Professional Documents

Culture Documents

CIR Vs CTA and Smith Kline French Overseas Co

Uploaded by

Tom Lui EstrellaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CIR Vs CTA and Smith Kline French Overseas Co

Uploaded by

Tom Lui EstrellaCopyright:

Available Formats

CIR vs. CTA and Smith Kline & French Overseas Co.

(Philippine branch)

FACTS: Smith Kline and French Overseas Company, a multinational firm domiciled in Pennsylvania, is licensed to do

business in the Phils. It is engaged in the importation, manufacture, and sale of pharmaceutical drugs and chemicals.

In its original incomes tax return in 1971, Smith Kline declared a net taxable income of P1,489,277 and paid

P511,247 as tax due. Among the deductions claimed from gross income was P501,040 as its share of the head office

overhead expenses.

However, in its amended return in 1973, there was an overpayment of P324,255 “arising from underdeduction of

home office overhead.” It made a formal claim for refund of the alleged overpayment because it appears that sometime in

October 1972, Smith Kline received from its international independent auditors an authenticated certification to the effect

that the Philippine share in the unallocated overhead expenses of the main office for the year ended December 1971 was

actually P1,427,484, and that the allocation was made on the basis of the percentage of gross income in the Philippines to

gross income of the corporation as a whole. By reason of the new adjustment, Smith Kline’s tax liability was greatly reduced

from P511,247 to P186,992, resulting in an overpayment of P324,255.

The CTA rendered a decision in 1980 ordering the Commissioner to refund the overpayment or grant a tax credit to

Smith Kline. The Commissioner appealed.

ISSUE: Is Smith Kline’s share of the head office overhead expenses incurred outside the Philippines deductible?

HELD: YES. Smith Kline’s share of the head officer overhead expenses incurred outside the Philippines is deductible.

Section 37 of the old NIRC. Net Income from sources in the Philippines.

“From the items of gross income specified in subsection (a) of this section, there shall be deducted the expenses,

losses, and other deductions properly apportioned or allocated thereto and a ratable part of any expenses, losses, or other

deductions which cannot definitely be allocated to some item or class of gross income. The remained, if any, shall be included

in full as net income from sources within the Philippines.”

Section 160. Apportionment of deductions.

“…The ratable part is based upon the ration of gross income from sources within the Philippines to the total gross

income.”

EXAMPLE: A non-resident alien individual whose taxable year is the calendar year, derived gross income from all

sources for 1939 of P180,000, including therein:

Interest on bonds of a domestic corporation P9,000

Dividends on stock of a domestic corporation 4,000

Royalty for the use of patents within the Phils 12,000

Gain from sale of real property located in the Phils 11,000

TOTAL 36,000

That is, 1/5 of the total gross income was from sources within the Philippines. The remainder of the gross income was from

sources without the Philippines. The expenses of the taxpayer for the year amount to P78,000. Of these expenses, P8,000 is

properly allocated to income from sources within the Phils and P40,000 is from sources without the Phils. The remainder of

the expense, P30,000, cannot be definitely allocated to any class of income. A ratable part thereof, based upon the relation

of gross income from sources within the Phils to the total gross income shall be deducted in computing net income from

sources within the Phils. Thus, these are deducted from the P36,000 of gross income from sources within the Phils expenses

amounting to P14,000 (representing P8,000 properly apportioned to the income from sources within the Philippines and

P6,000, a ratable part (1/5) of the expenses which could not be allocated to any item or class of gross income). The

remainder of P22,000 is the net income from sources within the Phils.

From the foregoing provisions, it is manifest that where an expense is clearly related to the production of Philippine-

derived income or to Phil operations (e.g., salaries of Phil personnel, rental of office building in the Phils), that expense can

be deducted from the gross income acquired in the Phils without resorting to apportionment.

The overhead expenses incurred by the parent company in connection with finance, administration, and research

and development, all of which direct benefit its branches all over the world, including the Phils, fall under a different category

however. There are items which cannot be definitely allocated or identified with the operations of the Phil branch. For 1971,

the parent company of Smith Kline spent $1,077,739. Under Sec. 37, Smith Kline can claim as its deductible share a ratable

part of such expenses based upon the ration of the local branch’s gross income to the total gross income, worldwide, of the

multinational corporation. Smith Kline also presented ample evidence to support its claim for refund. We hold that Smith

Kline’s amended 1971 return is in conformity with the law and regulations. The Tax Court correctly held that the refund or

credit of the resulting overpayment is in order.

You might also like

- Practice Court I Midterms ReviewerDocument20 pagesPractice Court I Midterms ReviewerDoo100% (9)

- 11 20 18-Torts-FtDocument26 pages11 20 18-Torts-FtTom Lui EstrellaNo ratings yet

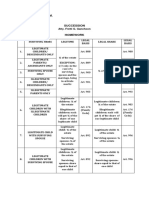

- Succession heirs legal shares basisDocument3 pagesSuccession heirs legal shares basisTom Lui EstrellaNo ratings yet

- Corpo Week 2Document26 pagesCorpo Week 2Tom Lui EstrellaNo ratings yet

- Local Legislation and Administrative Investigation WRITTEN REPORT GROUP 2Document61 pagesLocal Legislation and Administrative Investigation WRITTEN REPORT GROUP 2Tom Lui EstrellaNo ratings yet

- Diaz Vs IAC (1990)Document2 pagesDiaz Vs IAC (1990)Stephanie Valentine50% (2)

- Abl 6 Minigames ManualDocument3 pagesAbl 6 Minigames ManualTom Lui EstrellaNo ratings yet

- CIVPRODocument13 pagesCIVPROTom Lui EstrellaNo ratings yet

- Pakiusap!: Isang Pindot Lang Sa Doorbell. Papunta Na Yung Magtitinda. SalamatDocument2 pagesPakiusap!: Isang Pindot Lang Sa Doorbell. Papunta Na Yung Magtitinda. SalamatTom Lui EstrellaNo ratings yet

- Casting and Counting of VotesDocument3 pagesCasting and Counting of VotesTom Lui EstrellaNo ratings yet

- QaswedrftyDocument2 pagesQaswedrftyTom Lui EstrellaNo ratings yet

- Easments 2.0Document10 pagesEasments 2.0Tom Lui EstrellaNo ratings yet

- Fisher V TrinidadDocument2 pagesFisher V TrinidadEva Marie Gutierrez Cantero100% (1)

- 17 Umil V Ramos 1991 BunoDocument1 page17 Umil V Ramos 1991 BunoTom Lui EstrellaNo ratings yet

- Garcia v. LacuestaDocument1 pageGarcia v. LacuestaTom Lui EstrellaNo ratings yet

- 92 CIR Vs Pilipinas ShellDocument3 pages92 CIR Vs Pilipinas ShellTom Lui EstrellaNo ratings yet

- Dizon V Court of Tax Appeals BriesDocument2 pagesDizon V Court of Tax Appeals BriesTom Lui EstrellaNo ratings yet

- PNB V. Picornell FACTS: Bartolome Picornell, Following Instruction Hyndman, Tavera &Document6 pagesPNB V. Picornell FACTS: Bartolome Picornell, Following Instruction Hyndman, Tavera &Tom Lui EstrellaNo ratings yet

- Nego Finals 1Document11 pagesNego Finals 1Tom Lui EstrellaNo ratings yet

- Rabadilla V CA.Document1 pageRabadilla V CA.Karla EspinosaNo ratings yet

- CIR V Isabela Cultural Corporation DIGESTDocument4 pagesCIR V Isabela Cultural Corporation DIGESTsilosgr100% (1)

- G.R. Nos. 138874-75Document20 pagesG.R. Nos. 138874-75Ronald FloresNo ratings yet

- Delpher Trades Corporation Vs IACDocument1 pageDelpher Trades Corporation Vs IACTom Lui EstrellaNo ratings yet

- Vda. de Ramos vs. Court of AppealsDocument2 pagesVda. de Ramos vs. Court of AppealsKaye Mendoza100% (2)

- 345 RtuyiuoipojklhkjghfdDocument3 pages345 RtuyiuoipojklhkjghfdTom Lui EstrellaNo ratings yet

- 345 RtuyiuoipojklhkjghfdDocument3 pages345 RtuyiuoipojklhkjghfdTom Lui EstrellaNo ratings yet

- Online Digests - Warehouse Receipts LawDocument9 pagesOnline Digests - Warehouse Receipts LawMaria Reylan Garcia100% (2)

- Assoc. Bank v. Tan DigestDocument1 pageAssoc. Bank v. Tan Digestpaparonnie100% (1)

- Fisher V TrinidadDocument2 pagesFisher V TrinidadEva Marie Gutierrez Cantero100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Accounting 2Document35 pagesAccounting 2Yousaf JamalNo ratings yet

- Moodys - Sample Questions 1Document12 pagesMoodys - Sample Questions 1iva100% (2)

- Barangay Budget Preparation Form 2ADocument4 pagesBarangay Budget Preparation Form 2Aaldren cedamon100% (8)

- Ae 112 Prelim Assessment 1Document7 pagesAe 112 Prelim Assessment 1Chelssy ParadoNo ratings yet

- 1 Winkler OutlinesDocument500 pages1 Winkler OutlinesDRNo ratings yet

- Systems Understanding AidDocument12 pagesSystems Understanding AidPayton CraigNo ratings yet

- Comp ExamsDocument28 pagesComp ExamsTomoko KatoNo ratings yet

- Financial Statement As of February 2018Document12 pagesFinancial Statement As of February 2018Jaijai Travel and ToursNo ratings yet

- 3 Decision MakingDocument6 pages3 Decision MakingAnushka DharangaonkarNo ratings yet

- Types of Major AccountsDocument3 pagesTypes of Major AccountsRomeo Cayog PonsicaNo ratings yet

- FIMA 30013 FS Analysis Premium Notes P1Document5 pagesFIMA 30013 FS Analysis Premium Notes P1dcdeguzman.pup.pulilanNo ratings yet

- Valencia CF Business Plan and Financial Valuation: Facultad de Ciencias EconomicasDocument45 pagesValencia CF Business Plan and Financial Valuation: Facultad de Ciencias EconomicasHarsh BhatNo ratings yet

- Money MattersDocument20 pagesMoney MattersGaurang PatelNo ratings yet

- Acp and CPG QuizDocument6 pagesAcp and CPG QuizCarina Mae Valdez Valencia0% (1)

- DT Volume 2 Dec 21 CS Executive CA Saumil Manglani UpdatedDocument180 pagesDT Volume 2 Dec 21 CS Executive CA Saumil Manglani UpdatedSouvik MukherjeeNo ratings yet

- Intermediate Accounting II - Chapter 10 Study GuideDocument13 pagesIntermediate Accounting II - Chapter 10 Study GuideCoco Tucker100% (4)

- Business Income Sell Sheet 12.08Document2 pagesBusiness Income Sell Sheet 12.08Abdullah AljammalNo ratings yet

- Declare BoB/Flexi Benefits in SSC PortalDocument7 pagesDeclare BoB/Flexi Benefits in SSC PortalNupoor DeshpandeNo ratings yet

- Income Tax Part ADocument23 pagesIncome Tax Part AVishwas AgarwalNo ratings yet

- Activity 1 Finman 1Document6 pagesActivity 1 Finman 1lykaNo ratings yet

- Res AccountingDocument33 pagesRes Accountingsunanda88No ratings yet

- Real Estate Investment Financial AnalysisDocument11 pagesReal Estate Investment Financial AnalysisSourabh Chiprikar100% (1)

- Hyperion FDM Data FlowDocument25 pagesHyperion FDM Data Flowvijayreddy1258652No ratings yet

- Basic Spreadsheet Concepts Exercise 2 Type in The - 5aadb1aa1723dda4b37e82edDocument6 pagesBasic Spreadsheet Concepts Exercise 2 Type in The - 5aadb1aa1723dda4b37e82edAlthimese AndersonNo ratings yet

- Genre Analysis FinalDocument8 pagesGenre Analysis Finalsnessl94No ratings yet

- Chapter 29 Machinery Capital Expenditures and Revenue Expenditures PDF FreeDocument9 pagesChapter 29 Machinery Capital Expenditures and Revenue Expenditures PDF FreeSherri BonquinNo ratings yet

- Updated Production Costs and Returns For Selected Agricultural Commodities Part II - Other Commodities, 2016-2018Document65 pagesUpdated Production Costs and Returns For Selected Agricultural Commodities Part II - Other Commodities, 2016-2018RuthieNo ratings yet

- Indian Eyewear Retail Industry ReportDocument40 pagesIndian Eyewear Retail Industry ReportReevolv Advisory Services Private Limited100% (1)

- Detailed Project Report On How To Start A Hotel in BhopalDocument39 pagesDetailed Project Report On How To Start A Hotel in BhopalChaitany JoshiNo ratings yet

- dt7 PDFDocument215 pagesdt7 PDFAnkitaNo ratings yet