Professional Documents

Culture Documents

Derivatives Strategy

Uploaded by

Manoj ChauhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives Strategy

Uploaded by

Manoj ChauhanCopyright:

Available Formats

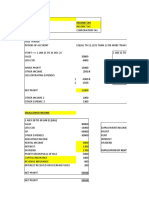

Nifty Spot : 4607

DERIVATIVE STRATEGIES AUGUST 24, 2009

ACTION STRIKE PREM. BREAKEVEN PT. AT EXPIRY Max. profit/loss

Strategy 1 Buy Sep call 4600 186 Profitable when nifty is above 4649 Max. profit: 2550

Mildly Bullish Sell Sep call 4700 137 Max. loss: 2450

Strategy 2 Buy Sep put 4500 140 Profitable when nifty is below 4464 Max. profit: 3200

Mildly Bearish Sell Sep put 4400 104 Max. loss: 1800

Strategy 3 Buy Sep call 4600 186 Profitable when nifty is above 4926 Max. profit: Unlimited

Volatile Buy Sep put 4500 140 Profitable when nifty is below 4174 Max. loss: 16300

Strategy 4 Sell Sep call 4800 98 Profitable when nifty is above 4124 Max. profit: 8800

Range Bound Sell Sep put 4300 78 Profitable when nifty is below 4976 Max. loss: Unlimited

Strategy 1 Nifty bull call spread

Strategy 1 - Payoff as on expiry

3000

View Mildly bullish on market.

2000

Profit/Loss

Buy Nifty Sep call 4600 at 186 1000

Action 0

Sell Nifty Sep call 4700 at 137

-1000

Premium (Higher premium minus lower -2000

49

difference premium) -3000

Total initial (premium difference x 50 lot

3100

3400

3700

4000

4300

4600

4900

5200

5500

2450

cost size)

Nifty Strikes

Breakeven pt. = Lower strike

Break-even pt. 4649

Plus premium difference

(difference bet. Two strikes)

Max. profit 2550 minus (premium difference) x SCENARIO – Strategy 1 (Bull call spread)

50 lot size POSSIBILITIES PROFIT/LOSS

Max. loss 2450 Limited to total initial cost closing < 4600 - difference paid

Do not execute strategy for 4600 < closing < 4700 (closing - 4600 ) - difference paid

Execution 59 more than given premium

difference 4700 < closing 100 - difference paid

Strategy 2 Nifty bear put spread

Strategy 2 - Payoff as on expiry

View Mildly bearish on market. 5000

Buy Nifty Sep put 4500 at 140 3000

Profit/Loss

Action

Sell Nifty Sep put 4400 at 104 1000

Premium (Higher premium minus lower

36 -1000

difference premium)

Total initial (premium difference x 50 lot -3000

1800

cost

3100

3400

3700

4000

4300

4600

4900

5200

5500

size)

Breakeven pt. = Higher strike Nifty Strikes

Break-even pt. 4464

minus premium difference

(difference bet. Two strikes)

Max. profit 3200 minus (premium difference) x

50 lot size SCENARIO – Strategy 2 (Bear put spread)

POSSIBILITIES PROFIT/LOSS

Max. loss 1800 Limited to total initial cost

closing < 4400 100 - difference paid

Do not execute strategy for

4400 < closing < 4500 (- closing + 4500 ) - difference paid

Execution 43 more than given premium

difference 4500 < closing - difference paid

Strategy 3 Nifty long strangle

Strategy 3 - Payoff as on expiry

Highly volatile market, expecting break 60000

View

out either side

40000

Profit/Loss

Buy Nifty Sep call 4600 at 186 20000

Action

Buy Nifty Sep put 4500 at 140

0

Premium paid 326 (sum of two premiums)

Total initial -20000

16300

3300

3600

3900

4200

4500

4800

5100

5400

5700

cost (premium paid x 50 lot size)

Profitable if nifty on expiry is Nifty Strikes

Break even pt. above upper break even or

below lower break even

Upper break Higher strike plus premium

4926

even paid

Lower break Lower strike minus premium

4174

even paid SCENARIO – Strategy 3 (Long strangle)

Max. profit Unlimited POSSIBILITIES PROFIT/LOSS

Max. loss 16300 Limited to total initial cost closing < 4500 (- closing + 4500 ) - premium paid

Do not execute strategy if 4500 < closing < 4600 - difference paid

Execution 342 premium received is more then

given total premium 4600 < closing (closing - 4600 ) - premium paid

Strategy 4 Nifty short strangle Strategy 4 - Payoff as on expiry

Range bound market, expecting Nifty to 20000

View 10000

remain in range.

0

Profit/Loss

Sell Nifty Sep call 4800 at 98 -10000

Action

Sell Nifty Sep put 4300 at 78 -20000

Premium rec 176 (sum of two premiums) -30000

-40000

Total initial -50000

8800

credit (premium paid x 50 lot size)

3300

3600

3900

4200

4500

4800

5100

5400

5700

Profitable if nifty on expiry is

Break even pt. between upper break even & Nifty Strikes

lower break even

Upper break

4976 Higher strike plus premium rec.

even

Lower break Lower strike minus premium SCENARIO – Strategy 4 (Short strangle)

4124

even rec. POSSIBILITIES PROFIT/LOSS

Max. profit 8800 Limited to total initial cost closing < 4300 (closing - 4300 ) + premium rec

Max. loss Unlimited beyond breakeven pts < closing

4300 < 4800 + Premium rec

Do not execute strategy if (- closing

Execution 167 premium received is less then 4800 < closing + 4800 ) + premium rec

given total premium

NOTE:

(* All the above mentioned strategies are just for easy referral for different market views mentioned. One can also opt for strikes other than mentioned

in these strategies)

* All calculations are as per Premium price/premium difference given in the example and it may vary according to change in premium price/premium

difference

* Selling/writing an Option would attract margin requirement, for further details refer FAQ)

ICICIdirect.com Derivatives Desk

ICICI Securities Limited,

7th Floor, Akruti Centre Point,

MIDC Main Road, Marol Naka

Andheri (East)

Mumbai – 400 093

research@icicidirect.com

DISCLAIMER: The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or

distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written consent of ICICI Securities Limited. "The author of the report does not

hold any investment/open position in any of the companies mentioned in this report. ICICI Securities Services Ltd (I-Sec) may be holding a small number of shares/ an open position in the

above referred companies as on the date of release of this report." This report is based on information obtained from public sources and sources believed to be reliable, but no

independent verification has been made nor is its accuracy or completeness guaranteed. This report and information herein is solely for informational purpose and may not be used or

considered as an offer document or solicitation of offer to buy or sell or subscribe for securities or other financial instruments. Nothing in this report constitutes investment, legal,

accounting and tax advice or a representation that any investment or strategy is suitable or appropriate to your specific circumstances. The securities discussed and opinions expressed in

this report may not be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and needs of specific

recipient. This may not be taken in substitution for the exercise of independent judgment by any recipient. The recipient should independently evaluate the investment risks. ICICI

Securities Ltd and affiliates accept no liabilities for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily a guide to future performance.

Actual results may differ materially from those set forth in projections. ICICI Securities Ltd may have issued other reports that are inconsistent with and reach different conclusion from the

information presented in this report. This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state,

country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities Ltd and affiliates to any

registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors.

Persons in whose possession this document may come are required to inform themselves of and to observe such restriction.

You might also like

- CostingDocument56 pagesCostingKartNo ratings yet

- Bull Call SpreadDocument2 pagesBull Call SpreadAKSHAYA AKSHAYANo ratings yet

- Marco SADocument4 pagesMarco SAДенис ЗаславскийNo ratings yet

- Depreciation (Building) 538000 Depreciation (Equipment) 386000Document6 pagesDepreciation (Building) 538000 Depreciation (Equipment) 386000Shubham MaheshwariNo ratings yet

- Put BackspreadDocument2 pagesPut BackspreadAKSHAYA AKSHAYANo ratings yet

- Payoff Schedule Payoff Chart: Nifty at Expiry Net PayoffDocument2 pagesPayoff Schedule Payoff Chart: Nifty at Expiry Net PayoffAKSHAYA AKSHAYANo ratings yet

- 40 PDFDocument2 pages40 PDFAKSHAYA AKSHAYANo ratings yet

- Income Statement 1 Year1Document1 pageIncome Statement 1 Year1Gobe JamNo ratings yet

- Intangile Asset - IFRS 15 25 - 03 - 2021Document8 pagesIntangile Asset - IFRS 15 25 - 03 - 2021Huệ LêNo ratings yet

- Marwa Year 1 Using Marginal Costing ApproachDocument6 pagesMarwa Year 1 Using Marginal Costing ApproachMak PussNo ratings yet

- Long Put LadderDocument2 pagesLong Put LadderAKSHAYA AKSHAYANo ratings yet

- Promo PricelistDocument1 pagePromo PricelistHindi ka NakilalaNo ratings yet

- Question 2 Income StatementDocument2 pagesQuestion 2 Income Statementhamsmith1876No ratings yet

- Finance Booklet For StudentsDocument7 pagesFinance Booklet For StudentsMohamedNo ratings yet

- Call BackspreadDocument2 pagesCall BackspreadAKSHAYA AKSHAYANo ratings yet

- Payoff Schedule Payoff Chart: NIFTY at Expiry Net PayoffDocument2 pagesPayoff Schedule Payoff Chart: NIFTY at Expiry Net PayoffAKSHAYA AKSHAYANo ratings yet

- Avalanche Corporation - EXAM - With Production ProcessDocument18 pagesAvalanche Corporation - EXAM - With Production ProcessawsNo ratings yet

- 8 PDFDocument2 pages8 PDFAKSHAYA AKSHAYANo ratings yet

- Health: Is WealthDocument88 pagesHealth: Is WealthSimon Joseph SantosNo ratings yet

- Problem 7.2Document4 pagesProblem 7.2Ayesha SidiqNo ratings yet

- Bull Put SpreadDocument2 pagesBull Put SpreadAKSHAYA AKSHAYANo ratings yet

- Option Trading StrategiesDocument2 pagesOption Trading StrategiesAKSHAYA AKSHAYANo ratings yet

- Long ComboDocument2 pagesLong ComboAKSHAYA AKSHAYANo ratings yet

- Additional StorageDocument1 pageAdditional StoragedenyNo ratings yet

- Mark Scheme (Results) Summer 2015: Pearson Edexcel IAL Accounting (WAC01/01) Unit 1 The Accounting System and CostingDocument18 pagesMark Scheme (Results) Summer 2015: Pearson Edexcel IAL Accounting (WAC01/01) Unit 1 The Accounting System and CostingRafid Ibne KhaledNo ratings yet

- EAST ASIA DISTRIBUTORS - Income StatementDocument1 pageEAST ASIA DISTRIBUTORS - Income Statementrachelprincess.monteroso23No ratings yet

- Issue of Shares Questions With SolutionsDocument4 pagesIssue of Shares Questions With SolutionsSumiran BansalNo ratings yet

- Capital Gains For CompaniesDocument3 pagesCapital Gains For CompaniesWajih RehmanNo ratings yet

- Statement of Comprehensive Income RM RMDocument11 pagesStatement of Comprehensive Income RM RMKashveena BathmanathanNo ratings yet

- Tutorial 12Document15 pagesTutorial 12lkaixin 02No ratings yet

- Buy StraddleDocument2 pagesBuy StraddleAKSHAYA AKSHAYANo ratings yet

- Payoff & ExplanationDocument2 pagesPayoff & Explanationmahender2012No ratings yet

- Types of CostsDocument3 pagesTypes of CostsHaris AhnedNo ratings yet

- Document Titl1Document2 pagesDocument Titl1Gobe JamNo ratings yet

- ConsolidatedDocument12 pagesConsolidatedjaitwitsNo ratings yet

- Household SizeDocument4 pagesHousehold SizeSsarifaNo ratings yet

- Unit - 4Document26 pagesUnit - 4MOHAIDEEN THARIQ MNo ratings yet

- Intraday Winning System by Paisa To BanegaDocument7 pagesIntraday Winning System by Paisa To BanegaSumeet Gupta40% (5)

- Trading ProfitDocument9 pagesTrading ProfitEhsan KhanNo ratings yet

- LESSON10Document6 pagesLESSON10Carl Daniel DoromalNo ratings yet

- TBDocument1 pageTBtengku rilNo ratings yet

- BusinessDocument9 pagesBusinessMuhammad Luqman Arif AbdurrahmanNo ratings yet

- Long StrangleDocument2 pagesLong StrangleAKSHAYA AKSHAYANo ratings yet

- Payoff Schedule Payoff Chart: NIFTY at Expiry Net PayoffDocument2 pagesPayoff Schedule Payoff Chart: NIFTY at Expiry Net PayoffAKSHAYA AKSHAYANo ratings yet

- Long SyntheticDocument2 pagesLong SyntheticAKSHAYA AKSHAYANo ratings yet

- Kls B Seri 1&2Document39 pagesKls B Seri 1&2Apri ZdenkNo ratings yet

- Maf201 Chapter 2 Process Costing Part 5 JP BP Test Iq7Document12 pagesMaf201 Chapter 2 Process Costing Part 5 JP BP Test Iq7Wan NurdeenaNo ratings yet

- Answer of Kieso TM9 P5-5 5-1Document5 pagesAnswer of Kieso TM9 P5-5 5-1M BrighittaNo ratings yet

- Strategic Profit ModelDocument1 pageStrategic Profit ModelSumit LohiaNo ratings yet

- 36 PDFDocument2 pages36 PDFAKSHAYA AKSHAYANo ratings yet

- Payoff Schedule Payoff Chart: Nifty at Expiry Net PayoffDocument2 pagesPayoff Schedule Payoff Chart: Nifty at Expiry Net PayoffAKSHAYA AKSHAYANo ratings yet

- Assiment Salman KhanDocument6 pagesAssiment Salman Khanakber khan khanNo ratings yet

- Bullish Strategies: Long Call Short Put Bull Call Spread Ratio Call Spread Stock Repair Strategy NextDocument17 pagesBullish Strategies: Long Call Short Put Bull Call Spread Ratio Call Spread Stock Repair Strategy NextmeetwithsanjayNo ratings yet

- Differential AnalysisDocument1 pageDifferential AnalysisKoko LaineNo ratings yet

- 2018 - Final Exam123key To StudentsDocument3 pages2018 - Final Exam123key To StudentsMinh ThưNo ratings yet

- 30 PDFDocument2 pages30 PDFAKSHAYA AKSHAYANo ratings yet

- Short StrangleDocument2 pagesShort StrangleAKSHAYA AKSHAYANo ratings yet

- Gabuya, Christine EDocument4 pagesGabuya, Christine Echristine gabuyaNo ratings yet

- Payoff Schedule Payoff Chart: Nifty at Expiry Net PayoffDocument2 pagesPayoff Schedule Payoff Chart: Nifty at Expiry Net PayoffAKSHAYA AKSHAYANo ratings yet

- Compliance Management: A Holistic ApproachDocument7 pagesCompliance Management: A Holistic Approachjbascribd100% (1)

- Housing Manual 2012 EnglishDocument83 pagesHousing Manual 2012 EnglishVivekanandan MVNo ratings yet

- EO EncounterDocument12 pagesEO EncounterMJ YaconNo ratings yet

- Financial & Managerial Accounting Mbas: Oanhnguyenth231Document64 pagesFinancial & Managerial Accounting Mbas: Oanhnguyenth231Hồng LongNo ratings yet

- 7 Depreciation, Deplbtion, Amortization, and Cash FlowDocument52 pages7 Depreciation, Deplbtion, Amortization, and Cash FlowRiswan Riswan100% (1)

- Session 2-2019Document13 pagesSession 2-2019pankaj tiwariNo ratings yet

- What Is Clause 49Document3 pagesWhat Is Clause 49Kaushik ShahNo ratings yet

- ToshibaDocument8 pagesToshibaMoon LightNo ratings yet

- SP Group CentreDocument5 pagesSP Group CentreNachiket HanmantgadNo ratings yet

- Executive SummaryDocument64 pagesExecutive SummaryRuishabh RunwalNo ratings yet

- (Deloitte) Entrance Test & AnswerDocument36 pages(Deloitte) Entrance Test & AnswerLê Quang Trung75% (4)

- 2 Notes Lecture Audit of Cash 2021Document1 page2 Notes Lecture Audit of Cash 2021JoyluxxiNo ratings yet

- IRCA Application Form 2015Document7 pagesIRCA Application Form 2015shaistaNo ratings yet

- CH 7Document6 pagesCH 7Mendoza KlariseNo ratings yet

- Adb Bihar PKG 3-1Document21 pagesAdb Bihar PKG 3-1AtulNo ratings yet

- Purchase OrdersDocument9 pagesPurchase OrderslulughoshNo ratings yet

- 3ATDocument3 pages3ATPaula Mae Dacanay0% (1)

- Service TaxDocument24 pagesService TaxkalaswamiNo ratings yet

- The Companies (General Provisions and Forms) Rules, 1985 (As Amended Upto 30.5.16)Document28 pagesThe Companies (General Provisions and Forms) Rules, 1985 (As Amended Upto 30.5.16)Syed HunainNo ratings yet

- Rfjpia 28TH Arc Acad Irr PDFDocument18 pagesRfjpia 28TH Arc Acad Irr PDFDaenerys TargaryenNo ratings yet

- The Guidance of Filling The Halal Internal AuditDocument19 pagesThe Guidance of Filling The Halal Internal AuditEmmy RindaNo ratings yet

- Sample Board Agenda & MaterialsDocument17 pagesSample Board Agenda & MaterialsStartup Tool Kit100% (3)

- 02-Pimentel v. Aguirre G.R. No. 132988 July 19, 2000 PDFDocument16 pages02-Pimentel v. Aguirre G.R. No. 132988 July 19, 2000 PDFlilnightrainNo ratings yet

- Managing RisksDocument42 pagesManaging RisksMena HamdNo ratings yet

- IDPDocument9 pagesIDPpoojavsingh11No ratings yet

- Total Time in Minutes (For Regular Tasks)Document7 pagesTotal Time in Minutes (For Regular Tasks)Salah UddinNo ratings yet

- EG LH讲义-上Document42 pagesEG LH讲义-上winningpiggodNo ratings yet

- Ust Global Welfare Foundation Guidelines For Ussociates in IndiaDocument10 pagesUst Global Welfare Foundation Guidelines For Ussociates in IndiaZenk itNo ratings yet

- Red Clay School District - Special Investigations ReportDocument26 pagesRed Clay School District - Special Investigations ReportJohn AllisonNo ratings yet

- Aquino & Opog. 3.00-4.30TthDocument13 pagesAquino & Opog. 3.00-4.30TthZzaza OppNo ratings yet