Professional Documents

Culture Documents

Microcogeneracion-Seguridad de Suministro, ND

Uploaded by

Nander Acosta OyarceCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Microcogeneracion-Seguridad de Suministro, ND

Uploaded by

Nander Acosta OyarceCopyright:

Available Formats

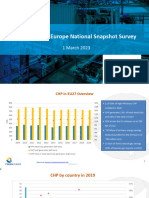

Cogeneration Country Fact Sheet

GERMANY

APRIL 2014

Possible Market Outlook 1. Policy environment

1.1 CHP a key technology in achieving Energiewende goals

*Some policy uncertainty

New German Coalition

Government committed to

promoting CHP.

2014 CHP Law Review to

tackle shortcomings of current

support levels.

Several drivers foster CHP growth in Germany: the dedicated CHP law and binding target focus on improving

2014 amendment to the energy efficiency in buildings, strong GHG emission reduction objectives, and the commitment to phase out

Renewable Energy Law (EEG), nuclear energy by 2022. The main support scheme consists of a feed-in premium and EU ETS bonus for fossil-fuel

with possible implications for CHP and a feed-in tariff offered to renewable-based CHP. In addition, micro-CHPs below 20 kWe benefit from a

the profitability of auto-

producer CHPs, which may have capital grant ranging between €1425-3325. In 2014 the CHP law will be reviewed to assess whether additional

to cover part of the EEG levy. support is necessary to achieve the 25% CHP target.

* Stabilisation of energy markets

1.2 Energy and climate targets: Clear objectives set on the pathway to 2050 (Energiewende)

ahead.

Spark spreads will

remain negative, but are

expected to stabilise in

2014-2015.

* Strengthening economy.

1.3 2013 EEG/KWK-G : Support levels for CHP

Exports are staying strong.

Domestic demand

Figure 1 Approximate level of subsidy for CHP plants

expected to pick up pace.

under the EEG and KWK-G in 2013

The German economy is set to

expand steadily in the next

few years, driven by expected

growth in domestic demand

and also good export

prospects. In the longer run, 2. CHP Sector Key Figures

the new German Coalition

Government formed at the end 2.1 Statistics : Steady but slow growth (2002-2011) CHP production has been increasing in the past

of 2013 is committed to energy few years, as a result of a favourable policy

efficiency and further support environment and Germany’s economy avoiding

for the CHP sector. As the

government goes ahead with the economic crisis to a certain extent. CHP

its Energiewende plans (i.e electricity production now represents

high share of renewables and approximately 17% of total electricity

phase-out of nuclear), CHP production.

technologies will have an

important role Figure 3 CHP fuel

to play in ensuring industrial

competitiveness, reducing

mix in Germany

energy costs for the residential (2011)

sector, introducing higher

flexibility into the system and

delivering CO2 emission

reductions. Figure 2 German CHP electricity and heat production (2002-2011)

Gas and coal represent three quarters of the fuel input to CHP plants in Germany, while

renewable fuels are on the rise in the German CHP fuel mix, amounting to up to 10% of the

total CHP fuel input.

2.2 CHP installations by size range

Sources Total installed capacity

reported to Eurostat by the

Figure 1: COGEN German government was

calculations based on 26.9 GWe in 2012, up by

KWK-G 2012 and EEG 2012 30% since 2005.

Between 2009 and 2013

Figures 2, 6, 7, 9 :

newly installed capacity

Prognos/BDEW, 2013

registred with the Federal

Figure 3 : Eurostat, 2013 Office of Economics and

Export Control (BAFA)

Figure 4: BAFA, 2014 Figure 4 Annually installed CHPs by plant size range (2009-2013) ranged between 0.5 -1 GWe.

Most of the newly installed capacity came from installations above 2 MWe. Total installed capacity from plants

Figure 5: CODE2 project,

smaller than 2 MWe has also been increasing. BAFA statistics show that the FiP and Incentive Programme gave a

2014

significant boost to micro-CHP below 2 kWe, as installed capacity in this category registered with BAFA

Figure 8 : EEX, 2014 increased ten fold between 2009-2013.

3. Forecast

Figure 5 Possible paths of CHP power produc-tion &

Good Prospects on the path to 2030 share of total power production According to

Acknowledgements preliminary CODE2 results in the CHP Roadmap

for Germany, under the business-as-usual scenario,

COGEN Europe thanks which assumes no change to the current policy

B.KWK for their valuable

framework, CHP's share of electricity production

contribution to this fact

sheet. could reach 19% and 22% by 2020 and 2030

respectively. Under the more ambitious 'Roadmap

scenario', taking into account the 25% CHP target for

2020 and in line with the 50% target RES share in

total electricity production, CHP production could

reach up to 185 TWh in 2030, equivalent to roughly

one third of total electricity production.

Disclaimer

Figure 6 Growth scenarios for micro-CHP

This country fact sheet is

(2015 -2030)

based on the best publicly

available information at

The segment below 1 MW is also expected to expand

the time of publishing. The in the short to long term, with the total number of

views expressed here are micro-CHPs installed set to reach up to 260,000

those of the authors and units by 2020 and 1 million installed units by 2050.

do not necessarily reflect Small CHP installed capacity is also expected to

the official policy or increase, from 700 units installed today up to 2500

positions of those who and 3500 units by 2020 and 2050 respectively.

contributed to it.

COGEN Europe may not be

held responsible for the

use, to which information 4. Additionnal information

contained in this

publication may be put, or Profitability marred by unfavourable spark spreads and lower operating hours

for any errors which,

despite careful preparation

and checking, may appear.

© COGEN Europe

COGEN Europe

Avenue des Arts 3-4-5

B-1210 Brussels, Belgium

Tel: +32 2 772 82 90

Fax: +32 2 772 50 44 Figure 7 Number of profitable operating hours by type Figure 8 Average price for baseload power at

E-mail: info@cogeneurope.eu of CHP plant (2006-2012) EPEX spot/CHP Index (2000-2013)

Web: www.cogeneurope.eu

High gas prices/deteriorating spark spreads have put a strain on the CHP fleet in Germany, having

affected profit margins considerably since 2009. Investment in new gas plants has been hit

particularly hard. While the CHP law FiP does compensate for the negative clean spark spread to

some extent, in 2012 the number of hours was as low as 1426 and 395 for new and existing gas

CHP plants respectively. This situation is expected to be tackled during the ongoing CHP Law

review.

You might also like

- EU China Energy Magazine 2023 Summer Double Issue: 2023, #7From EverandEU China Energy Magazine 2023 Summer Double Issue: 2023, #7No ratings yet

- New Renewable Energy Policies in Germany and Their PerspectivesDocument20 pagesNew Renewable Energy Policies in Germany and Their Perspectivesadnan widyantaraNo ratings yet

- EU-China Energy Magazine 2020 Christmas Double Issue: 2020, #4From EverandEU-China Energy Magazine 2020 Christmas Double Issue: 2020, #4No ratings yet

- Sheeran e Zhu (2009) - Improving Energy EfficiencyDocument7 pagesSheeran e Zhu (2009) - Improving Energy Efficiencyvazzoleralex6884No ratings yet

- Renewable Energy and Power MarketDocument13 pagesRenewable Energy and Power Marketarihant.tiwari2021No ratings yet

- Infrastructure Report: A Study On Performance and FundingDocument12 pagesInfrastructure Report: A Study On Performance and FundingsafiNo ratings yet

- CountryReport2021 Germany FinalDocument22 pagesCountryReport2021 Germany FinalRudi SuwandiNo ratings yet

- Objectives:: German Policies BackgroundDocument2 pagesObjectives:: German Policies BackgroundSanjay JangraNo ratings yet

- 1 Intro To EOR23 - CSW - Rasmus - ENGDocument11 pages1 Intro To EOR23 - CSW - Rasmus - ENGremy.trungNo ratings yet

- Vietnam Energy Outlook Report 2019 ENDocument100 pagesVietnam Energy Outlook Report 2019 ENNguyen Thuy AnNo ratings yet

- Advanced Fuels Potential Germany Fact Sheet 20190916Document2 pagesAdvanced Fuels Potential Germany Fact Sheet 20190916The International Council on Clean TransportationNo ratings yet

- Energy Efficiency in Belgium Summary enDocument20 pagesEnergy Efficiency in Belgium Summary enanon_62910764No ratings yet

- Czosnyka 2018Document6 pagesCzosnyka 2018Serge KewouNo ratings yet

- European Summary Report On CHP Support SchemesDocument33 pagesEuropean Summary Report On CHP Support SchemesioanitescumihaiNo ratings yet

- Agora Understanding The Energiewende PDFDocument60 pagesAgora Understanding The Energiewende PDFArmin ZaimovićNo ratings yet

- Wezco Infra Nijamoddin Shaikh THDocument12 pagesWezco Infra Nijamoddin Shaikh THsafiNo ratings yet

- Mind The Energy Performance GapDocument28 pagesMind The Energy Performance GapKahkashanNo ratings yet

- Accounting For Greenhouse Gas Emissions in Energy-Related ProjectsDocument44 pagesAccounting For Greenhouse Gas Emissions in Energy-Related Projectsrrlan77No ratings yet

- EN EN: European CommissionDocument14 pagesEN EN: European CommissionLim ChintakNo ratings yet

- Annual Market Update 2020 0Document63 pagesAnnual Market Update 2020 0jlskdfjNo ratings yet

- Europe: Status of Integrating Renewable Electricity Production Into The GridDocument30 pagesEurope: Status of Integrating Renewable Electricity Production Into The GriddanielraqueNo ratings yet

- Energy Price Inflation - This Time Is DifferentDocument12 pagesEnergy Price Inflation - This Time Is DifferentMiseon LeeNo ratings yet

- Agora CP Germany Web PDFDocument48 pagesAgora CP Germany Web PDFSuad SalijuNo ratings yet

- Ec - Bharti Airtel Limited IndiaDocument6 pagesEc - Bharti Airtel Limited IndiaSiddhardh VarmaNo ratings yet

- The Application of MCADocument21 pagesThe Application of MCACamilaNo ratings yet

- ENS Part 2Document70 pagesENS Part 2maazdixitNo ratings yet

- Japan Power: Renewables To Embrace More Competition: October 2021Document6 pagesJapan Power: Renewables To Embrace More Competition: October 2021MartaNo ratings yet

- Europe Lcoe Sensitivity Analysis Report - PRDocument88 pagesEurope Lcoe Sensitivity Analysis Report - PRoperation.nreNo ratings yet

- 10 BC CopenhagueDocument4 pages10 BC CopenhaguemmNo ratings yet

- Brosch - Biogas 2013 en Web PDFDocument44 pagesBrosch - Biogas 2013 en Web PDFRafael GarciaNo ratings yet

- ECF Europes Leap To Heat Pumps Report - FINAL - April 2023Document22 pagesECF Europes Leap To Heat Pumps Report - FINAL - April 2023gurkanxNo ratings yet

- Comparison of Synthetic Natural Gas Production Pathways For The Storage of Renewable EnergyDocument24 pagesComparison of Synthetic Natural Gas Production Pathways For The Storage of Renewable EnergySohail AzharNo ratings yet

- EndgameDocument1 pageEndgamevarshithaNo ratings yet

- Abania Progress Reports - 2017Document20 pagesAbania Progress Reports - 2017Mian Muhammad YounusNo ratings yet

- Version 2.0 (Oct. 2016) : Derisking Renewable Energy Investment Finance Case StudyDocument9 pagesVersion 2.0 (Oct. 2016) : Derisking Renewable Energy Investment Finance Case StudyGiannina BassiNo ratings yet

- MITRE - Meeting The Targets & Putting Renewables To WorkDocument4 pagesMITRE - Meeting The Targets & Putting Renewables To WorkCognosferaNo ratings yet

- Energy Efficiency NetherlandsDocument20 pagesEnergy Efficiency NetherlandsJean Briham Pardo BaqueroNo ratings yet

- Decarbonising Our To Meet Our Climate Goals: Energy SystemDocument4 pagesDecarbonising Our To Meet Our Climate Goals: Energy SystemMihaelaZavoianuNo ratings yet

- Energies: Current Status of Energy Production From Solid Biomass in Southern ItalyDocument21 pagesEnergies: Current Status of Energy Production From Solid Biomass in Southern Italyshiva19892006No ratings yet

- Biaya PembangkitanDocument28 pagesBiaya PembangkitanblackzenyNo ratings yet

- MDR Eurupen CommısonDocument32 pagesMDR Eurupen CommısonserdalNo ratings yet

- Renewable Power Remains Cost-Competitive Amid Fossil Fuel CrisisDocument2 pagesRenewable Power Remains Cost-Competitive Amid Fossil Fuel CrisisBel NochuNo ratings yet

- 2017 - USAID RALI Project - Colombia Clean Energy Program Case StudyDocument4 pages2017 - USAID RALI Project - Colombia Clean Energy Program Case StudyMayette Rose SarrozaNo ratings yet

- 1 s2.0 S1755008422000540 MainDocument17 pages1 s2.0 S1755008422000540 MainWilbert ACNo ratings yet

- CHP SpreadsheetDocument7 pagesCHP SpreadsheetSuyitno YitnoNo ratings yet

- Vietnam Power Development Plan Rev 7 2020 - 2030 PDFDocument9 pagesVietnam Power Development Plan Rev 7 2020 - 2030 PDFMohd FazlanNo ratings yet

- 5thEED AnnualReport 072021 NMDocument13 pages5thEED AnnualReport 072021 NMmirkomakNo ratings yet

- RUEN - 23022021-CompressedDocument48 pagesRUEN - 23022021-CompressedIrwan SukmaNo ratings yet

- Impact Assessment 2Document114 pagesImpact Assessment 2rocosanaNo ratings yet

- Dena-Grid Study SummaryDocument23 pagesDena-Grid Study Summarythermosol5416No ratings yet

- Unlocking The Value of The Balancing Mechanism For Renewable Energy ProjectsDocument8 pagesUnlocking The Value of The Balancing Mechanism For Renewable Energy ProjectsAlasdair MacleodNo ratings yet

- PB 06 2023 - 4Document30 pagesPB 06 2023 - 4SandraNo ratings yet

- Germanys-Energy-Transition-At-A-Crossroads - Pflugmann Et All.2019Document8 pagesGermanys-Energy-Transition-At-A-Crossroads - Pflugmann Et All.2019TakwaNo ratings yet

- Electricity Generation Cost 2023Document35 pagesElectricity Generation Cost 2023taigerasNo ratings yet

- COGEN Europe Snapshot Survey 2022 Results OverviewDocument12 pagesCOGEN Europe Snapshot Survey 2022 Results Overviewomid20000No ratings yet

- Pat CycleDocument4 pagesPat CyclekgmaheswaranNo ratings yet

- Europe S Clean Technology RVDocument9 pagesEurope S Clean Technology RVBruegelNo ratings yet

- CCC Chapter 5Document12 pagesCCC Chapter 584fab48No ratings yet

- Tackling The European Energy CrisisDocument28 pagesTackling The European Energy CrisisTran Thanh ThaoNo ratings yet

- Early Decarbonisation of The European Energy System Pays OffDocument47 pagesEarly Decarbonisation of The European Energy System Pays OffJessica BecerrilNo ratings yet

- Description of Wind SystemsDocument10 pagesDescription of Wind SystemsNander Acosta OyarceNo ratings yet

- Bioenergy Student: Acosta Oyarce Nander Code: 1227210084 Subject: Technical English IDocument6 pagesBioenergy Student: Acosta Oyarce Nander Code: 1227210084 Subject: Technical English INander Acosta OyarceNo ratings yet

- Ingles Ii TraduciendoDocument24 pagesIngles Ii TraduciendoNander Acosta OyarceNo ratings yet

- Microcogeneracion-Potenciando A Los Consumidores de Energía, 2015Document4 pagesMicrocogeneracion-Potenciando A Los Consumidores de Energía, 2015Nander Acosta OyarceNo ratings yet

- RYA CHP (Göteborg Energi) : Case Study Factsheet Europe, SwedenDocument1 pageRYA CHP (Göteborg Energi) : Case Study Factsheet Europe, SwedenNander Acosta OyarceNo ratings yet

- Caso de Estudio - Hotel Crowne Plaza Bruselas, 2010Document1 pageCaso de Estudio - Hotel Crowne Plaza Bruselas, 2010Nander Acosta OyarceNo ratings yet

- Genergia Pinerolo: Case Study Factsheet South Western Europe, ITALYDocument1 pageGenergia Pinerolo: Case Study Factsheet South Western Europe, ITALYNander Acosta OyarceNo ratings yet

- Caso de Estudio - Cervecería Warsteiner, 2009Document1 pageCaso de Estudio - Cervecería Warsteiner, 2009Nander Acosta OyarceNo ratings yet

- 11 AppendixDocument5 pages11 AppendixkkkkNo ratings yet

- Thermal Ice Storage Application & Design GuideDocument68 pagesThermal Ice Storage Application & Design GuideJosh Garcia100% (1)

- Plant DesignDocument151 pagesPlant DesignAbdul Wahab100% (1)

- Renewable Energy Sources For Fuels and ElectricityDocument15 pagesRenewable Energy Sources For Fuels and ElectricityshojaeizadehehsanNo ratings yet

- Patent 7 Claims MT KESHE, FREE ENERGYDocument29 pagesPatent 7 Claims MT KESHE, FREE ENERGYTruth Press MediaNo ratings yet

- Urban Planning Portfolio 1Document1 pageUrban Planning Portfolio 1api-525985532No ratings yet

- Assignment 1Document6 pagesAssignment 1TommyVercettiNo ratings yet

- LNG Journal 2018 01 January0Document36 pagesLNG Journal 2018 01 January0Karima BelbraikNo ratings yet

- Biomass Combustion DevicesDocument33 pagesBiomass Combustion DevicesHeiro KeystrifeNo ratings yet

- Complex Engineering Problem: Submitted To Sir Umer Hamid Submitted by Hassan (04) Danish (14) SumamaDocument14 pagesComplex Engineering Problem: Submitted To Sir Umer Hamid Submitted by Hassan (04) Danish (14) SumamaUmar HamidNo ratings yet

- ScoreDocument2 pagesScoreEdgar HuancaNo ratings yet

- 2013 7 3 Weiss Air Liquide LurgiDocument21 pages2013 7 3 Weiss Air Liquide LurgiAdi Gunawan PrasetiaNo ratings yet

- Combustion EjeciciosDocument13 pagesCombustion EjeciciosHectorRdzNo ratings yet

- Bacem Laporan Combustion EngineDocument38 pagesBacem Laporan Combustion EngineRizky FajarNo ratings yet

- Gujarat Technological University: W.E.F. AY 2018-19Document3 pagesGujarat Technological University: W.E.F. AY 2018-19AkashNo ratings yet

- SLK G9-Q4wk8 Mongcopa (Refined)Document13 pagesSLK G9-Q4wk8 Mongcopa (Refined)Jeson GaiteraNo ratings yet

- Japon Sistema Electrico 2020Document20 pagesJapon Sistema Electrico 2020Marcelo GonzalezNo ratings yet

- Thermoelectric ApplicationsDocument10 pagesThermoelectric ApplicationsVenkat AlluNo ratings yet

- Functional AnalysisDocument16 pagesFunctional AnalysisyerasijNo ratings yet

- Cafterial SDB Electrical PLanDocument1 pageCafterial SDB Electrical PLanAmos KormeNo ratings yet

- ANSYS Advantage Multiphysics AA V8 I2Document60 pagesANSYS Advantage Multiphysics AA V8 I2j_c_garcia_dNo ratings yet

- Capacitor CatalogueDocument4 pagesCapacitor Cataloguerajveer kumarNo ratings yet

- 800kV Standard ParametersDocument17 pages800kV Standard ParametersnicesreekanthNo ratings yet

- MTU Gas GS400-6SDocument4 pagesMTU Gas GS400-6Shector1653No ratings yet

- 193 227 PDFDocument35 pages193 227 PDFRicardo Morán SilvaNo ratings yet

- Analysing Partial Shading of PV Modules by Circuit ModellingDocument4 pagesAnalysing Partial Shading of PV Modules by Circuit ModellingHimal ChaulagainNo ratings yet

- 3731.three Phase Rectifier PresentationDocument48 pages3731.three Phase Rectifier PresentationMithunMNo ratings yet

- Gpu 3Document13 pagesGpu 3MarioNo ratings yet

- G23002.18 03-IncomerDocument35 pagesG23002.18 03-IncomermaxvanmaxNo ratings yet

- Quest Circuits 2 KeyDocument4 pagesQuest Circuits 2 KeyCarlos OrtizNo ratings yet

- The Ancestor's Tale: A Pilgrimage to the Dawn of EvolutionFrom EverandThe Ancestor's Tale: A Pilgrimage to the Dawn of EvolutionRating: 4 out of 5 stars4/5 (812)

- When You Find Out the World Is Against You: And Other Funny Memories About Awful MomentsFrom EverandWhen You Find Out the World Is Against You: And Other Funny Memories About Awful MomentsRating: 3.5 out of 5 stars3.5/5 (13)

- Dark Matter and the Dinosaurs: The Astounding Interconnectedness of the UniverseFrom EverandDark Matter and the Dinosaurs: The Astounding Interconnectedness of the UniverseRating: 3.5 out of 5 stars3.5/5 (69)

- Alex & Me: How a Scientist and a Parrot Discovered a Hidden World of Animal Intelligence—and Formed a Deep Bond in the ProcessFrom EverandAlex & Me: How a Scientist and a Parrot Discovered a Hidden World of Animal Intelligence—and Formed a Deep Bond in the ProcessNo ratings yet

- The Rise and Fall of the Dinosaurs: A New History of a Lost WorldFrom EverandThe Rise and Fall of the Dinosaurs: A New History of a Lost WorldRating: 4 out of 5 stars4/5 (595)

- Fire Season: Field Notes from a Wilderness LookoutFrom EverandFire Season: Field Notes from a Wilderness LookoutRating: 4 out of 5 stars4/5 (142)

- The Lives of Bees: The Untold Story of the Honey Bee in the WildFrom EverandThe Lives of Bees: The Untold Story of the Honey Bee in the WildRating: 4.5 out of 5 stars4.5/5 (44)

- The Other End of the Leash: Why We Do What We Do Around DogsFrom EverandThe Other End of the Leash: Why We Do What We Do Around DogsRating: 5 out of 5 stars5/5 (65)

- Spoiled Rotten America: Outrages of Everyday LifeFrom EverandSpoiled Rotten America: Outrages of Everyday LifeRating: 3 out of 5 stars3/5 (19)

- Roxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingFrom EverandRoxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingRating: 3.5 out of 5 stars3.5/5 (35)

- Come Back, Como: Winning the Heart of a Reluctant DogFrom EverandCome Back, Como: Winning the Heart of a Reluctant DogRating: 3.5 out of 5 stars3.5/5 (10)

- Roxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingFrom EverandRoxane Gay & Everand Originals: My Year of Psychedelics: Lessons on Better LivingRating: 5 out of 5 stars5/5 (5)

- World of Wonders: In Praise of Fireflies, Whale Sharks, and Other AstonishmentsFrom EverandWorld of Wonders: In Praise of Fireflies, Whale Sharks, and Other AstonishmentsRating: 4 out of 5 stars4/5 (223)

- The Revolutionary Genius of Plants: A New Understanding of Plant Intelligence and BehaviorFrom EverandThe Revolutionary Genius of Plants: A New Understanding of Plant Intelligence and BehaviorRating: 4.5 out of 5 stars4.5/5 (137)

- Wayfinding: The Science and Mystery of How Humans Navigate the WorldFrom EverandWayfinding: The Science and Mystery of How Humans Navigate the WorldRating: 4.5 out of 5 stars4.5/5 (18)

- Eels: An Exploration, from New Zealand to the Sargasso, of the World's Most Mysterious FishFrom EverandEels: An Exploration, from New Zealand to the Sargasso, of the World's Most Mysterious FishRating: 4 out of 5 stars4/5 (30)

- Microscopy of Numerology: Numerology SimplifiedFrom EverandMicroscopy of Numerology: Numerology SimplifiedRating: 5 out of 5 stars5/5 (2)

- The Hidden Life of Trees: What They Feel, How They CommunicateFrom EverandThe Hidden Life of Trees: What They Feel, How They CommunicateRating: 4 out of 5 stars4/5 (1003)

- The Mind of Plants: Narratives of Vegetal IntelligenceFrom EverandThe Mind of Plants: Narratives of Vegetal IntelligenceRating: 4.5 out of 5 stars4.5/5 (11)