Professional Documents

Culture Documents

Business Combination3

Uploaded by

sonly amatosaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Combination3

Uploaded by

sonly amatosaCopyright:

Available Formats

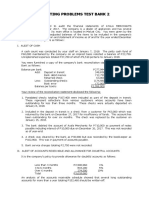

If the value implied by the purchase price of an acquired company exceeds the fair values of identifiable

net assets, the excess should be

a. allocated to reduce any previously recorded goodwill and classify any remainder as an

ordinary gain.

b. allocated to reduce current and long-lived assets.

c. allocated to reduce long-lived assets.

d. accounted for as goodwill.

18. P Co. issued 5,000 shares of its common stock, valued at $200,000, to the former shareholders of

S Company two years after S Company was acquired in an all-stock transaction. The additional

shares were issued because P Company agreed to issue additional shares of common stock if the

average post combination earnings over the next two years exceeded $500,000. P Company will

treat the issuance of the additional shares as a (decrease in)

a. consolidated retained earnings.

b. consolidated goodwill.

c. consolidated paid-in capital.

d. non-current liabilities of S Company assumed by P Company.

19. The fair value of assets and liabilities of the acquired entity is to be reflected in the financial

statements of the combined entity. When the acquisition takes place over a period of time rather

than all at once, at what time is the fair value of the assets and liabilities of the acquired entity

determined under SFAS 141R?

a. the date the interest in the acquiree was acquired.

b. the date the acquirer obtains control of the acquiree

c. the date of acquisition of the largest portion of the interest in the acquiree.

d. the date of the financial statements.

20. The first step in determining goodwill impairment involves comparing the

a. implied value of a reporting unit to its carrying amount (goodwill excluded).

b. fair value of a reporting unit to its carrying amount (goodwill excluded).

c. implied value of a reporting unit to its carrying amount (goodwill included).

d. fair value of a reporting unit to its carrying amount (goodwill included).

21. If an impairment loss is recorded on previously recognized goodwill due to the transitional

goodwill impairment test, the loss should be treated as a(n):

a. loss from a change in accounting principles.

b. extraordinary loss

c. loss from continuing operations.

d. loss from discontinuing operations.

22. P Company acquires all of the voting stock of S Company for $930,000 cash. The book values of

S Company’s assets are $800,000, but the fair values are $840,000 because land has a fair value

above its book value. Goodwill from the combination is computed as:

a. $130,000.

b. $90,000.

c. $40,000.

d. $0.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Plan Ahead Exponentially Portfolio Worksheet: Part 1: Dream Big!Document6 pagesPlan Ahead Exponentially Portfolio Worksheet: Part 1: Dream Big!Ritesh Singh100% (1)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Working Paper TemplatesDocument9 pagesWorking Paper TemplatesTroisNo ratings yet

- Business Combination2Document2 pagesBusiness Combination2sonly amatosaNo ratings yet

- Capital BudgetingDocument12 pagesCapital Budgetingjunhe898No ratings yet

- Business Combination2Document2 pagesBusiness Combination2sonly amatosaNo ratings yet

- Business CombinationDocument3 pagesBusiness Combinationsonly amatosaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Revenue Cycle Audit ObjectivesDocument2 pagesRevenue Cycle Audit ObjectivesRinokukun100% (1)

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Title 46 Professional and Occupational Standards Part XIX. Certified Public AccountantsDocument31 pagesTitle 46 Professional and Occupational Standards Part XIX. Certified Public Accountantssonly amatosaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- Adfina 3Document2 pagesAdfina 3sonly amatosaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Adfina 4Document1 pageAdfina 4sonly amatosaNo ratings yet

- 4 .P Acquires All of The Voting Shares of S by Issuing 500,000 Shares of P1 Par Common StockDocument1 page4 .P Acquires All of The Voting Shares of S by Issuing 500,000 Shares of P1 Par Common Stocksonly amatosaNo ratings yet

- Adfina 10Document1 pageAdfina 10sonly amatosaNo ratings yet

- Adfina 13Document1 pageAdfina 13sonly amatosaNo ratings yet

- 8.bats Inc, A New Corporation Formed and Organized Because of The Recent Consolidation of II Inc, and JJDocument1 page8.bats Inc, A New Corporation Formed and Organized Because of The Recent Consolidation of II Inc, and JJsonly amatosaNo ratings yet

- Fair Value Book ValueDocument2 pagesFair Value Book Valuesonly amatosaNo ratings yet

- Adfina 12Document1 pageAdfina 12sonly amatosaNo ratings yet

- Adfina 22Document1 pageAdfina 22sonly amatosaNo ratings yet

- Adfina 9Document1 pageAdfina 9sonly amatosaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- Adfina 11Document2 pagesAdfina 11sonly amatosa0% (1)

- Adfina 12Document1 pageAdfina 12sonly amatosaNo ratings yet

- Test Bank Advanced Accounting 5th Edition Jeter PDFDocument17 pagesTest Bank Advanced Accounting 5th Edition Jeter PDFSyra SorianoNo ratings yet

- At-5906 Audit ReportDocument10 pagesAt-5906 Audit Reportshambiruar100% (4)

- CparDocument6 pagesCparmxviolet100% (4)

- JulianDocument4 pagesJulianBhavesh GelaniNo ratings yet

- Overconfidence and Investment Decisions in Nepalese Stock MarketDocument10 pagesOverconfidence and Investment Decisions in Nepalese Stock MarketMgc RyustailbNo ratings yet

- Hecht v. Malley, 265 U.S. 144 (1924)Document15 pagesHecht v. Malley, 265 U.S. 144 (1924)Scribd Government DocsNo ratings yet

- Finlatics Investment Banking Experience Program Project 4: - Nischal SinghalDocument4 pagesFinlatics Investment Banking Experience Program Project 4: - Nischal SinghalNischal Singhal ce18b045No ratings yet

- Human Resource AccountingDocument14 pagesHuman Resource AccountingsumitruNo ratings yet

- LiveDocument31 pagesLivebkaaljdaelvNo ratings yet

- Lesson 4 Partnership DissolutionDocument17 pagesLesson 4 Partnership DissolutionheyheyNo ratings yet

- Finsight 1april2012Document10 pagesFinsight 1april2012Archish GuptaNo ratings yet

- Financial AspectDocument16 pagesFinancial AspectJezeree DichosoNo ratings yet

- #15 Negotiate, EvalVCTermsDocument1 page#15 Negotiate, EvalVCTermsSeth RogersNo ratings yet

- Customer SatisfactionDocument88 pagesCustomer Satisfactionmd jabir hussain73% (11)

- Valu TraderDocument16 pagesValu TraderRichard SuttmeierNo ratings yet

- Comparison and Contrast of Share Capital and Loan Capital in Financing of A CompanyDocument5 pagesComparison and Contrast of Share Capital and Loan Capital in Financing of A Companyalinafe kandionNo ratings yet

- Hyper-Urbanization in IndonesiaDocument48 pagesHyper-Urbanization in Indonesiawt_alkatiriNo ratings yet

- Tatasteel Inclass DiscusionDocument6 pagesTatasteel Inclass DiscusionADAMYA VARSHNEYNo ratings yet

- Lecture 11 International Equity MarketDocument29 pagesLecture 11 International Equity MarketYogesh DevmoreNo ratings yet

- Business Finance Module 8Document21 pagesBusiness Finance Module 8Junkyu Koala100% (2)

- Africa Fintech Rising SummitDocument15 pagesAfrica Fintech Rising Summitace187No ratings yet

- Present A Current Critical Strategic Analysis of One Business Unit Within General ElectricDocument12 pagesPresent A Current Critical Strategic Analysis of One Business Unit Within General Electricokey obiNo ratings yet

- Risk and Portfolio Management Similarities Between Joel Greenblatt and Stanley Druckenmiller - Base Hit InvestingDocument7 pagesRisk and Portfolio Management Similarities Between Joel Greenblatt and Stanley Druckenmiller - Base Hit InvestingnabsNo ratings yet

- GKEDC Open Letter To Pen Argyl Area ResidentsDocument3 pagesGKEDC Open Letter To Pen Argyl Area ResidentsAnonymous arnc2g2N100% (1)

- Venture Pulse q4 2021Document94 pagesVenture Pulse q4 2021Stathis MetsovitisNo ratings yet

- AFAR - Corp L, JA, HBODocument6 pagesAFAR - Corp L, JA, HBOJoanna Rose DeciarNo ratings yet

- Introduction To Finance Zeeshan Notes Cost of CapitalDocument12 pagesIntroduction To Finance Zeeshan Notes Cost of CapitalZeeshan SardarNo ratings yet

- (GR) San Miguel Corp. V Semillano (2010)Document12 pages(GR) San Miguel Corp. V Semillano (2010)Jackie CanlasNo ratings yet

- INDIAN RAILWAYS - Source of Finance BudgetaryDocument12 pagesINDIAN RAILWAYS - Source of Finance Budgetaryjeya chandranNo ratings yet

- PIMM Panama PostDocument3 pagesPIMM Panama PostPIMM100% (2)

- All About Form 3CEB Specified Domestic Transaction + International TransactionDocument3 pagesAll About Form 3CEB Specified Domestic Transaction + International TransactionKirti SanghaviNo ratings yet

- Mortgage Backed SecuritiesDocument13 pagesMortgage Backed SecuritiessaranNo ratings yet