Professional Documents

Culture Documents

Effect of Use of Knowledge and Skills On The Sutstainable Financial Performance of State Owned Sugar Companies in Kenya.

Uploaded by

OIRCOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Effect of Use of Knowledge and Skills On The Sutstainable Financial Performance of State Owned Sugar Companies in Kenya.

Uploaded by

OIRCCopyright:

Available Formats

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-43, October, 2018

www.oircjournals.org

Do Board Processes Affect Firm

Performance of State Owned Sugar

Companies in Kenya? Exploring the Role

of Use of Knowledge and Skills

1Simiyu

M. Peter & 2Mwengei K. B. Ombaba

1 MBA Student, Jomo Kenyatta University of Agriculture and

Technology

2Department of Business Management University of Eldoret

Type of the Paper: Research Paper.

Type of Review: Peer Reviewed.

Indexed in: worldwide web.

Google Scholar Citation: IJFAE

How to Cite this Paper:

Simiyu, P. M., and Ombaba, K B. M., (2018). Do Board Processes Affect Firm

Performance of State Owned Sugar Companies in Kenya? Exploring the Role of

Use of Knowledge and Skills. International Journal of Finance, Accounting and

Economics (IJFAE) 1 (3), 30-43.

International Journal of Finance, Accounting and Economics (IJFAE)

A Refereed International Journal of OIRC JOURNALS.

© Oirc Journals.

This work is licensed under a Creative Commons Attribution-Non Commercial 4.0

International License subject to proper citation to the publication source of the work.

Disclaimer: The scholarly papers as reviewed and published by the OIRC JOURNALS, are

the views and opinions of their respective authors and are not the views or opinions of the

OIRC JOURNALS. The OIRC JOURNALS disclaims of any harm or loss caused due to the

published content to any party.

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

Do Board Processes Affect Firm Performance of State

Owned Sugar Companies in Kenya? Exploring the

Role of Use of Knowledge and Skills

1Simiyu

E. Peter & 2Mwengei K. B. Ombaba

1 MBA Student, Jomo Kenyatta University of Agriculture and Technology

2Department of Business Management University of Eldoret

ARTICLE INFO Abstract

Firms with strong financial performance are able to

Received on 28th September, 2018 survive in the dynamic business environment.

th Financial stability of firms enables them to compete

Received in Revised Form 10 October,

globally. Corporate governance is plays a significant

2018 role on the financial stability of firms. Thus, state

Accepted 18th October, 2018 owned Sugar Companies in Kenya to financially

st

Published online 21 October, 2018 stable in order for the firms to beat competition from

both private firms and international inflow of sugar

Keywords: Board Processes, firm performance, State produce need effective boards. Therefore, this study

looked at the effect of use of knowledge and skills on

owned sugar companies, Use of Knowledge and Skills

financial performance of state owned sugar

companies in Kenya. The study was guided by Resource dependence theory. The study employed a descriptive

survey design that used both quantitative and qualitative approach. The target population was all the 38 board

members of state owned sugar companies in Kenya. The study used both primary and secondary data. The primary

data was collected using questionnaires while secondary data was collected using the data collection schedule.

Data was analyzed using both descriptive and inferential statistics. Descriptive statistics included frequencies,

mean, variances and standard deviation while inferential statistics included Pearson’s product moment of

correlation and multiple regression analysis. Tables and figures were used to present the analysis output.

Inferential statistical regression and correlation was done to establish the effect of board governance processes

on financial performance of state owned sugar companies in Kenya. The findings of the study established that use

of knowledge and skills positively and significantly affect financial performance (β=.280; p<0.05). The results of

the study is of great significance to policy making and practice since it will help to develop polices for the firms

to use to enhance corporate governance and therefore financial performance. The study will also be of help in

theory and literature by providing updated empirical literature regarding board processes from the developing

countries perspective on sugar industry in particular. Lastly, the study will form a basis for further studies on

corporate governance more so on board processes in future.

1.0 Introduction Dulewicz, MacMillan and Herbert (1995) defined

The board of directors is tasked with monitoring board process as the organizing and running of board

management and providing advice and counsel by which need to be performed so that the objectives of

facilitating access to information and other resources the board can be achieved. Board processes which

The monitoring role of boards has dominated have been identified as affecting board performance

research, the advising and counseling role remains include effort norms, cognitive conflict,

under researched (Hillman and Dalziel 2003, presence/use of knowledge & skills and

Tuggle, Schnatterly & Johnson 2010). Anderson and cohesiveness (Jehn & Mannix, 2001). Jehn &

Reep (2004) showed that board governance process Mannix (2001) therefore defined board processes as

relates to the healthy and rigorous discussion on the decision-making activities of directors of

corporate issues and problems so that decisions can companies. In general, board process refers mainly

be reached and supported.

pg. 31

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

to the decision-making activities of the board determined by board processes. Board of directors

(Zattoni, Gnan & Huse, 2012). are one of the governance measures which are in

The board has long been recognized as an important place for overseeing and monitoring the managers

corporate governance mechanism for aligning the and making sure that institutional goals are met

interests of managers and all stakeholders to a firm. accordingly. Literature on the board points out that

Researchers agree that boards of directors are board governance processes is an important

responsible for accomplishing two primary tasks determinant of its effectiveness and the financial

(Forbes & Milliken, 1999; Finkelstein & Mooney, performance of an organization (Dalton, Ellstrand &

2003) control tasks, that is, to safeguard Johnson, 2008).

shareholders’ and stakeholders interests through the

monitoring of top management’s behavior and the In Kenya, Capital markets Authority (CMA) a

control of company’s results, and strategy tasks, that number of measures to address issues of corporate

is, to provide some sort of support and counsel to the governance: for instance, it facilitated the enactment

management of the firm. Boards of directors of the corporate governance code, in the form of a

perform some important tasks and through them Sample Code of Best Practice of Corporate

influence firm performance (Zattoni et al., 2012). Governance in Kenya 2002, in order to strengthen

In these circumstances, board effectiveness is likely governance mechanisms among Kenya’s listed

to profoundly depend on socio-psychological firms (Tarus and Aime, 2014; Ombaba & Kosgei,

processes, particularly those relating to group 2017). Among the corporate governance structures

participation (effort norms), coordination (use of suggested, in order to improve the quality of

knowledge and skills), and open discussions decisions in the listed firms, was the composition of

(cognitive conflicts) (Finkelstein & Mooney, 2003; the board (The Capital Market Act, Cap. 485A,

Hambrick, Werder & Zajac, 2008). In their study 2002).

Wan and Ong (2005), argued that effort norms make The corporate governance guidelines and

directors more aware and more willing to contribute regulations for intermediaries provided by (CMA)

to the performance of the board and a higher level of recommends that one third of board members should

cognitive conflicts, which are task-oriented, is likely be independent and the board should have at least

to make directors perform their roles better. With eight board members. The guidelines further require

more skills and knowledge within the board, there that the CEO and chairman positions should be held

should be more service and strategic planning by different persons. In addition, the guidelines

outcomes arising from board activities. The require that the board should have a balance of skills,

relevance of these three processes for the experience and background. Furthermore, outside

effectiveness of board strategic decision making has directorship held by board members should not be

been advanced theoretically by Forbes and Milliken more than five.

(1999) and supported empirically by some recent

studies focused on large companies (Zona & Zattoni, Despite of extensive regulatory reforms and

2007; Zattoni et al., 2012). measures undertaken to improve corporate

The effect of corporate boards on firm financial governance mechanism, Kenya is characterized by a

performance has received considerable attention in weak legal and regulatory framework (Gakeri, 2013;

Tarus, 2011) just like any other emerging economy.

the economic and finance literature in recent years.

For instance, in the past few years there have been a

Zona and Zattoni (2007) noted that board

number of corporate failures occasioned by financial

effectiveness has to depend on “good” internal

processes besides solid structure and substantive distress among listed firms. This phenomenon of

content. In terms of board processes, a strengthening financial difficulties in Kenyan public companies

has been witnessed by the increase delisting of

of effort norms will make directors more aware and

companies. Notable cases of corporate failure

more willing to contribute to the performance of the

include Kenya Bulk medical limited, A Baumann,

board that will lead to better financial performance.

Kenya Corporative Creameries, Uchumi

The board governance process has been found to

have influence on firm financial performance Supermarkets, and CMC Kenya Ltd., in 2012

(Forbes & Milliken, 2009). It is often assumed that among others (Ombaba & Kosgei, 2017). Although

CMA has enacted and implemented the corporate

a company's financial performance is mainly

governance guidelines, there remains a need to

pg. 32

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

determine whether board composition and a the years as consumption continues to outstrip

corporate governance mechanism enhance effective supply.

decision making in emerging economies such as

Kenya, particularly with regard to financial distress The main industry organ is the Kenya Sugar Board.

(Ombaba & Kosgei, 2017). Besides, the cooperate KSB was established to regulate, develop and

governance guidelines seem to applicable to listed promote the sugar industry; coordinate the activities

firms while the unlisted firms, where the state owned of individuals and organizations in the industry and;

sugar companies belong don’t seem to follow the facilitate equitable access to the benefits and

authority guideline. Hence, the motivation to resources of the industry by all interested parties.

conduct this research in order to determine whether KSB has 12 members and renewable tenure of three

board processes enhances financial performance. years. Another key player is the Minister of

Agriculture who imposes levies on domestic and

imported sugar, Special Development Levy (SDL),

Sugar Industry in Kenya makes the regulations and appoints the SAT

The sugar sector is mainly concentrated in the members in consultation with the Attorney General.

western part of Kenya. These include the populous The stakeholders in the industry include farmers, the

provinces of Nyanza, Western and parts of Rift government, sugar factories, and out-grower

valley. Shortly after independence in 1963 the institutions like the Kenya Sugarcane Growers

government set up Muhoroni (1966), previously Association (KESGA), Kenya Sugar Research

East African Sugar Company Ltd in 1961; Chemelil Foundation (KESREF), importers, financial

(1968); Mumias (1973); Nzoia (1978); South institutions, transporters, consumers and lobby

Nyanza (1979). Miwani Sugar, started in 1922 as groups like Sugar Campaign for Change (SUCAM).

private investment, was taken over in 1970. Private Unfortunately, not all of them have been involved in

investment include: West Kenya Sugar, Soin Sugar the due processes and most of them have not been

Company, Kibos Sugar and Allied Industries Ltd, represented. This has resulted in a small group

Butali Sugar Company and Busia Company. making decisions that affect the entire industry. This

is occasioned by political interference.

At present, both Miwani and Muhoroni are under

receivership; only the latter is operational. The performance of the sugar industry has continued

According to Kenya Sugar Board, the state stake to be quite dismal. Kenya therefore continues to live

holding in the industry is: Miwani Sugar (49%); off its legacy of being self-sufficient in terms of

Muhoroni (82.78%); Chemelil (97.64%); Nzoia sugar production. From the list of registered millers

(98.87%); South Nyanza (99.79%). The large and jaggeries provided by the KSB, Muhoroni and

government ownership makes the industry prone to Miwani Sugar Company are currently under

state and political interference (Sucam, 2003). The receivership. Muhoroni Sugar has been under

industry is one of the largest contributors to the receivership for the last four years Ramisi Sugar

agricultural Gross Domestic Product, directly and Factory collapsed in 1988 although plans are

indirectly supporting and estimated 6 million underway to revive it. According to the agricultural

Kenyans (20% of the Kenyan population), produces manager of the company sanctioned by the

over 500,000 metric tonnes of sugar for domestic government to revive Ramisi, commercial growing

consumption (saving the economy in excess of of cane at the Kiscol project, was expected to

US$250 million or Kshs. 20 billion in foreign commence by June 2010, while it was anticipated

exchange annually), GOK (2006). The prominence that the factory was to be fully operational by 2011.

of the sugar industry in Western Kenya has In terms of production arrangements, most Sugar

prompted the growth of regulatory and other companies typically have a factory, human

industry affiliated bodies. The government oversees resources, agriculture and finance department. The

the sub-sector principally through the Ministry of factory department has recently been split up into

Agriculture (MoA) and the Kenya Sugar Board quality control and engineering in a number of the

(KSB), the latter being made of representatives from factories such as Chemelil. The sugar companies

the state, sugar companies, farmers‟ organization also maintain nucleus estates to ensure there is

and general industry. Despite these investments, enough supply of cane. Out growers‟ scheme on the

self-sufficiency in sugar has remained elusive over other hand covers individuals or private sugar–cane

farmers. Despite the existence of nucleus estates,

pg. 33

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

sugar companies still complain of sugar cane performance of state owned sugar companies in

shortage a problem which has also contributed to the Kenya.

production gaps in the industry.

2.0 Theory and Hypothesis Development

Statement of the Problem

Firms with strong financial performance are able to Resource Dependence Theory

survive in the dynamic business environment. Sound The theory was founded by Pfeiffer and Salancik

financial stability of firms enables them to compete (1978). The two scholars opine that board

globally. Thus, state owned Sugar Companies in composition should be based on the need to “match”

Kenya need to be financially stable in order to beat the resources provided by the board with the needs

competition from both private firms and of the firm. The board exists as a provider of

international inflow of sugar produce. The stability resources to the executives in order to help them

of financial status will enable farmers, suppliers and achieve organizational goals (Hillman, Cannella, &

employees to be paid in good time. Paetzold, 2000; Hillman &Daziel, 2003). Boyd

(1995) suggests that in some environmental

The current financial position of all state owned conditions board size can be a hindrance, whereas

sugar companies’ is in a deplorable state (KSD, board interlocks (the number of other directorships

2017). All state owned sugar companies are in each director holds) are a benefit, suggesting that

financial distress and this is evidenced by non- resource-rich directors should be the focus of board

payment of long outstanding bills. The suppliers of composition. Thus, it’s not just the number, but the

raw materials are ever demonstrating, the type of directors on the board that matters. Directors

auctioneers bouncing on the companies’ vehicles for bring four benefits to organizations: information in

non-payment of supplies besides raw materials and the form of advice and counsel, access to channels

labour unrests in the firms due to delayed salaries of information between the firm and environmental

and wages (KSD, 2017). This trend allowed to contingencies, preferential access to resources and

continue will in the long run render thousands of legitimacy (Pfeiffer & Salancik, 1978). Significant

employees jobless when the firms eventually empirical evidence supports these proposed benefits,

collapse. More than two hundred and fifty thousand both generally and specifically.

farmers contracted to the firms may languish in

poverty for these have been their source of income. Firms that are able to attract and co-opt powerful

It is for this reason the study seeks to identify how members of the community onto their boards are

the board governance processes can enhance able to acquire critical resources from the

financial performance of the state owned sugar environment (Provan, 1989). More specifically,

firms. Studies have shown that it is the role of a Pfeffer and Salancik (1978) find that firms in

company’s board of directors to oversee corporate regulated industries may need more outsiders,

management in order to protect the interests of particularly those with relevant experience. Luoma

shareholders. Several corporate governance and Goodstein (2009) confirm this, finding that

problems have emerged due to accountability firms in highly regulated industries have a higher

remissful by the board of directors (Aguilera & proportion of stakeholder directors, whereas

Jackson, 2008). Johnson and Greening (1999) find that stakeholder

directors are more likely to improve corporate social

Considering several studies done outside and inside performance. Mizruchi and Stearns (1988) provide

Kenya, few studies done in most developed empirical support for the relationship between the

countries, no study done in Africa and Kenya on the firm’s need for financial resources and

board governance processes and its effect on representation of financial institutions on their

financial performance of firms. Despite all studies boards. Stearns & Mizruchi (1988) also find that the

done, many studies done were on other board types of financial institutions represented on a board

attributes other than board processes and this creates affect the financing the firms obtain, suggestive of

a big gap that needs to be filled. Therefore, this study Pfeffer and Salancik’s four benefits of boards.

intended to look inside the box on what happens in Support for these benefits is also found in recent

the board decision making process and also establish work by Kor and Misangyi (2008), who found a

the effect of board governance process on financial negative relationship, between top management’s

and the board’s collective levels of industry

pg. 34

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

experience. This suggests that the board general business knowledge (Bammens et. al.,

supplements top management with vital advice and 2011). Literature on group effectiveness shows that

counsel. There is need to change board composition two conditions can facilitate the use of knowledge

as the environment of the firm changes (Boeker & and skills available to boards of directors. First,

Goodstein, 1991; Lang & Lockhart, 1990). knowledge and skills of individual members are

more effectively used when group members are

In the context of China’s changing institutional more aware of each other’s competencies (Kearney

environment, Peng (2004) finds that resource-rich et. al., 2009; Zattoni et. al., 2012). Second, social

outside directors are likely to have a positive ties among board members enhance mutual trust and

influence on firm performance, whereas resource- respect and encourage the propensity of insiders to

poor outside directors are not, suggesting that when use knowledge and skills of outsiders (Westphal,

board composition is not changed to meet new 1999; Zattoni et.al., 2012).

environmental demands, performance suffers.

Hillman, Canella, and Paetz old (2000) create a Zona & Zattoni (2007) on their study beyond the

taxonomy of directors based on the RDT benefits Black Box of Demography: board processes and

that directors provide, exploring how specific types task effectiveness within Italian firms. According to

of directors may be more/less valuable as their findings with regards to board networking

environments change. They propose that directors performance, use of knowledge and skills they found

can be classified as “business experts,” “support positive influence on board task performance,

specialists,” and “community influential,” whereas they found only weak support for the

corresponding to the different types of resources hypothesized positive. They indicated that the

they bring to a board. Kroll, Walters, and Le (2007) higher the use of knowledge and skills, the higher

use Hillman and colleagues’ taxonomy, finding the level of board service, monitoring and

young post–initial public offering (IPO) firms networking task performance. On the contrary to

benefit from specific types of directors. Jones, their study, when it comes to board service and

Makri, and Gomez-Mejia (2008) observe that family monitoring performance, use of knowledge and

firms pursuing diversification similarly benefit from skills are positively associated with board

specific types of directors over others. The RDT performance. Moreover, it is worth noting that the

perspective on boards also has been important in the Use of knowledge and skills, such as the process by

study of organizational decline and bankruptcy which members’ contributions are coordinated, is

(Daily, 1998). This research suggests that directors’ positively associated with board task performances:

role as resource providers may be especially salient this finding seems to suggest that in episodic

during decline and bankruptcy because distressed decision-making groups facing complex tasks, such

firms often experience a reduction in their relative as boards of directors, a key factor determining

resource bases (Cameron, 2015). In support of RDT, board effectiveness is the way in which directors’

Daily (1998) finds that firms with a greater individual skills and expertise are integrated. Zona

proportion of outside directors were more likely to & Zattoni (2007) from their findings as supported by

successfully re-emerge from bankruptcy. Forbes and Milliken (1999); Pye and Pettigrew

(2005) maintained that board’s outcome may be less

The empirical literature confirms that financial than the sum of its parts if individual contributions

performance of firms depends on resourcefulness of are not well integrated.

the board members that is embodied in knowledge

and skills that they possess. These board members Zattoni et al, (2012) on how does Family

will be of significance in helping the firms to achieve Involvement Influence Firm Performance?

financial stability through the resources they bring Exploring the Mediating Effects of Board Processes

to the firm. and Tasks. Their results showed that board internal

processes do have a positive influence on board

Effect of Use of Knowledge and Skills on tasks performance. In particular, their results

Financial Performance. provide support for the relevance of effort norms and

The use of knowledge and skills available in the use of knowledge and skills as key antecedents of

board is particularly relevant, as the management board tasks performance. This is supported by

team has advantages in terms of firm-specific Tricker (2011) who shows that directors’ specific

knowledge but may be at disadvantage regarding knowledge of the complexity of the firm’s business

pg. 35

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

enables them to monitor and advice managers transferring wealth of other stockholders to

efficiently. The debate on the impact of board themselves (Beasly, 2005).

diversity in the corporate world has continued to

rage. The influence of the board members’ H02. There is no significant relationship between use

individual gender type and educational qualification of knowledge and skills and financial

on corporate performance is the main issue of performance of state owned Sugar

discussion. Scholars and practitioners as well as Company in Kenya

policy makers have for the last two decades debated Conceptual Framework

on the role of boards of directors as one of the key

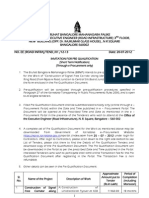

pillars of corporate governance (Monks & Minow, The conceptual framework looks at the effort norms,

2008; Tricker, 2011). Board composition has proven Cognitive conflict, use of Knowledge and skills and

to be critical in corporate performance especially in board Cohesiveness as independent variables of the

emerging and transition economies (Bhagat & board process and the effect on financial

Black, 2008). Dependent directors are also performance which will be measured by return on

important because they have insider knowledge of investments.

the organization which is not available to outside

directors, but they can misuse this knowledge by

Use of Knowledge and Skills Financial Performance

Presence of skill

Return on Investment

Usage of skills

Analytical thinking - Net earnings of the Firm

Strategic perception - Total Assets

=-- Result-oriented perspective

Independent Variables Dependent Variable

3.0 Methods operational. Thus, the accessible population was the

The study employed a census survey that will be to 38 board members from all the four state owned

obtain information that can be analysed for the sugar companies in Kenya which are in operation.

purpose of establishing a basis for making decisions. Data Collection Instruments

The census survey enables the researcher to collect The primary data was collected using questionnaires

data from the entire population. This design was and secondary data through data collection

suitable because it enables the researcher to schedules. The items in the questionnaire will be

formulate important principle of knowledge. measured on a 5-point Likert response scale ranging

from “strong disagree” to “strong agree” as guided

Target Population by prior studies. The questionnaire is preferred

A population is a group of objects, individuals or because it eliminates the subjectivity that is common

items from which samples are taken for with other data collection tools such as interviews.

measurement (Kombo and Tromp, 2011). Cooper The questionnaire also accords the respondents

and Schindler (2006) define population as the total adequate time to think or reflection before

collection of entities to whom the researcher seeks responding (Kothari, 2004).

to make inferences. Thus, population is the

collection of all entities that conform to a given Validity

study condition. The board members of the state Validity entails that the research instruments are

owned sugar companies in Kenya form the target measuring what they are purposed to measure

population. There are five state owned sugar (Cooper & Schindler, 2006). The research will

companies in Kenya. However, one is under employ content validity of research instruments by

receivership thus remaining with four which are thoroughly reviewing the relevant literature and

pg. 36

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

consultation with expert and supervisor to determine successfully filled and collected from the

whether the items in the measure have adequately respondents. This translates to 92.86% response

sampled the domain. rate. The response rate was accepted as it had exceed

the 70% response rate threshold (Nulty, 2008). The

Reliability main reasons that could be ascertained for non-

The study will use Cronbach’s alpha Coefficient to response included directors being overseas on

determine the reliability of its instrument. The business travel and unavailable to complete and

coefficient ranges from 0.00 to 1.0. However, a return the questionnaire in time.

Cronbach alpha of 0.7 and above was to be

indicative that the instruments are reliable Reliability Test Results

(Sreevidya & Sunitha, 2011). Reliability test was done by assessing the internal

consistency of the research questionnaire. This was

Regression Model done through the pilot test conducted on the board

Linear multiple regressions was used to establish the of directors of Mumias Sugar Company. The results

relationship between board governance processes of analysis are shown in Table 4.1.

and financial performance of state owned sugar

companies. The following model was used;

Table 4.1: Reliability of the Research

Y = α+β1X1+ε…………………….Equation 1 Questionnaire

Constructs Cronbach’s

Where: Alpha Coefficient Test Items

Y, represents dependent variable. Referring to Use of Knowledge and Skills 0.718 6

financial performance

Knowledge and skills had a Cronbach’s alpha

ɑ, regression constant. It is the value of Y when X1= coefficient (0.718). This implies that the research

=0 questionnaire was reliable as all the 6 constructs had

Cronbach’s alpha coefficients greater than the

β1 is change in Y with respect to a unit change in X1 threshold of 0.7

X2 use of Knowledge and Skills

ε is the error variable. Background Information

The study collected information in regards to age,

gender, academic qualifications, position in the

The inclusion of a random error, ε, is necessary board and tenure.

because other unspecified variables may also affect

the state owned sugar firm’s financial performance. Distribution of Respondents by Age

4.0 Findings and Discussions The study examined how respondents were

Response Rate distributed according to their age categories. Table

A total of 42 questionnaires were administered on 4.2 presents the results of analysis.

the respondents. Out of this number, 39 were

Table 4.2: Distribution of Respondents by Age

Frequency Percent

20 to 30 Years 3 7.69

31 to 40 Years 5 12.82

41 to 50 Years 9 23.08

51 to 60 Years 12 30.77

Above 60 Years 10 25.64

Total 39 100.0

It was found that 12 (30.77%) of the respondents 20 to 30 years were 3 (7.69%) while those between

were between 51 to 60 years. Respondents between 41 to 50 years were 9 (23.08%) and those between

pg. 37

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

31 to 40 years were 5 (23.08%). It was further Distribution of Respondent by Gender

established that 10 (25.64%) respondents was above This study analyzed how respondents were

60 years of age. The findings implied that most of distributed according to their gender. The results of

the members in sugar boards are of age 12 (51 to 60 the analysis are presented in Table 4.3.

years).

Table 4.3: Distribution of Respondents by Gender

Gender Frequency Percent

Male 31 78.48

Female 8 20.52

Total 39 100.0

It was noted that 31 (78.48) were male while 72 that men are the most board members in state owned

(20.52%) of the respondents were female. The sugar companies. This implies that despite the

findings shows that male are more than the female. agenda rule still women are sidelined in board

Thus, the gender of respondents could have positions.

influence on the findings of the study. This shows

Distribution of Respondents by Academic Qualifications

The study examined the distribution of respondents in regards to their academic qualifications. The results of

analysis are shown in Table 4.4

Table 4.4: Highest Educational Level of Respondents

Educational Level Frequency Percent

Post-secondary 4 10.26

Graduate 22 56.41

Post Graduate 13 33.33

Total 39 100.0

The findings of the study indicated that 22 (10.26%) post-secondary education. The findings

(56.41.8%) of the respondents who are members in indicates that members in sugar boards are educated

in boards of sugar companies had attained a bachelor hence are in a position to comprehend the issues

degree. It was also noted that 13 (33.33%) of the surrounding the sugar industry.

respondents had post a graduate degree while 4

Distribution of Respondents by Tenure of Service

The study also examined how respondents were distributed according to the tenure of service in as the board

member. The results are shown in Table 4.5

Table 4.5: Tenure of Service

Frequency Percent

Less than 1 year 3 7.69

2 years 5 12.82

3 years 4 10.25

4 years 7 17.95

5 years 9 23.08

Above 5 years 11 28.20

Total 39 100.0

pg. 38

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

The findings of the study showed that 3 (7.69%) of Descriptive Findings and Discussions

the respondents have been members less than 1 year. The study examined the views of the sampled board

Members who have been serving as the directors for members on board governance processes and

2 year and 3 years are 9 (13.07%) respondents. financial performance of state owned sugar

Board of directors who have been in service for 5 companies in Kenya. The results are in line with a 5-

years were 9 (23.08%), while those members that point Likert scale where integers 5 to 1 represent

have been in the board for 4 years are 7 (17.95%) In strongly agree to strongly disagree respectively.

addition 11 (28.20%) had been in service for over 5

years. The findings indicate that the respondents Use of Knowledge and Skills

have been in the board for long and therefore have The study also analyzed the views of respondents’

understood the effort norms of the boards. on use of knowledge and skills. The results are

indicated in Table 4.8.

Table 4.6: Descriptive Statistics for Use of Knowledge and Skills

N Min Max Mean Std.

Dev

i. People on the board are aware of each-others areas of 39 1 5 2.49 1.31

expertise

ii. Task delegation on this board represents a good match 39 1 5 3.24 1.27

between knowledge and responsibilities

iii. Board members adopt/use analytical thinking 39 5 3.83 0.97

iv. Our board makes best use of board members knowledge and 39 1 5 4.21 0.82

skills

v. When an issue is discussed, the most knowledgeable people 39 1 5 4.21 0.82

generally have the most influence.

vi. The board members understand the activities of the company. 39 1 5 4.30 0.85

It was agreed that board members understand the Inferential Analysis

activities of the company (mean= 4.30; std In this section the relationship between independent

dev=0.85). There was agreement that the boards variables and the dependent variable and also the

make best use of their members’ knowledge and influence of the independent variable on the

skills (mean=4.21; std dev=0.82). In addition, there dependent variable was discussed. Thus, the section

was an agreement that when an issue isd being presents the results of both correlation and multiple

discussed the most knowledgeable persons have the regression analysis.

most influence on it (mean=4.20; std dev=0.84).

There was also an agreement that board members Relationship between Use of Knowledge and

use analytical thinking (mean=3.83; std dev=0.97). Skills and Financial Performance

However, it was unclear whether task delegation of The study further assessed the relationship between

the board represents a good match between use of knowledge and skills and financial

knowledge and responsibilities (mean=3.24; std performance of state owned sugar companies in

dev=1.27). The findings were also indifferent on Kenya. The correlation analysis results are as shown

whether people on the board are aware of each other in Table 4.9.

area of expertise (mean=2.49; std. dev=1.305).

pg. 39

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

Table 4.7: Correlation Analysis for Financial Regulations Strategies

Financial Performance

of State Owned Sugar Companies

Use of Knowledge and Skills Pearson Correlation .137*

Sig. (2-tailed) .036

* Correlation is significant at the 0.05 level (2- tailed).

The study established that there exists a positive and Regression Analysis for Overall Model

statistically significant relationship between use of The study examined the combined effect of effort

knowledge and skills and financial performance of norms, cognitive conflict, use of knowledge and

state owned sugar companies (r=0.237; p<0.05). Use skills and board cohesiveness on financial

of knowledge and skills significantly influence performance of state owned sugar companies. Table

financial performance. The results implies that 4.8 presents the results of multiple regression

boards’ effectiveness is enhanced when boards make analysis.

greater use of their knowledge and skills. The

findings of this study supports earlier findings by

(Zona & Zattoni (2007).

Table 4.8: Multiple Regression Model Summary

R R Square Adjusted R Square Std. Error of the Estimate

.623 .328 .325 .485

a. Predictors: (Constant), effort norms, cognitive conflict, use of knowledge and skills and board cohesiveness

b. Dependent Variable: financial performance

The findings as shown in Table 4.16 indicated a performance can be accounted for by the four

positive effect between board processes and independent variables in the study while 67.5% of

financial performance (R2 = 0.328). Findings the financial performance can be accounted by other

indicate that 32.8% of the variation in financial factors not included in the study

4.8.2 Regression Coefficients

The study also conducted t-test of statistical significance of each individual regression coefficient. Table 4.9

presents the results.

Table 4.9: Significant Test for Overall Model

Results Unstandardized Standardized t Sig.

Coefficients Coefficients

B Std. Error Beta

(Constant) .957 .311 3.071 .024

Use of Knowledge

and Skills .272 .077 .280 3.555 .019

a. Dependent Variable: Financial performance of State owned sugar companies

The null hypothesis H01 suggested that there is no This implies that board have the ability to utilise the

significant effect of use of knowledge and skills on knowledge and skills available to it and then to apply

financial performance of state owned sugar such knowledge and skills to required board tasks

companies. The study established that financial ultimately enhancing financial performance of state

regulation strategies significantly predicts owned Sugar Companies in Kenya.

sustainability (β=.280; p< 0.05). Therefore, the null This finding is supported by previous studies of

hypothesis was rejected at significance level of 5%. (Wan & Ong, 2005; Zona & Zattoni (2007) that

pg. 40

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

boards’ effectiveness is enhanced when boards make performance. This findings support resource

greater use of their knowledge and skills. Forbes & dependency theory that boards can utilize the

Milliken (1999) also agree that for boards to perform resources of the directors to enhance financial

their tasks effectively, they must combine and apply performance.

their knowledge this in return will enhance the

performance of the firms. A board’s usage of its Conclusions

management skills and result-oriented perspective There are several conclusions that were made in

has allowed effective monitoring of company respect of the study findings. The conclusions are in

From the t-test results of individual regression line with the study objective.

coefficients, the three independent variables were From the findings of the study, it was concluded

included in the regression equation as they were from the findings of the study that usage of

significant (p<0.05). The study results is shown in knowledge and skills enhance financial performance

regression equation 4.1 of sugar companies. Board of directors should make

use of the skills and expertise of it board members

Y= 0.957+ 0.241X1+ ……………..….Equation 4.1 when making decisions affecting the firms. This

shows that board members should possess certain

The study noted that by improving use of knowledge skills and knowledge to enhance firm performance.

and skills by 1 unit it will enhance financial This support the argument of resource dependence

performance by 0.280 units. From the equation 4.1 theory that advocates for resourcefulness among the

above it implies that if state owned sugar companies directors so as to be able to think analytically.

in Kenya fail to implement board governance

processes, financial performance will be constant at Recommendations

0.957 units. A number of important recommendations were

made in respect of study findings. The

The findings from the multiple regressions analysis recommendations were also in line with objectives

are in agreement with the preposition of the theories of the study. There are recommendations for policy

that underpinned the study. The primary goal of the and practice, Theory and Literature and further

monitoring functions of the board is the obligation studies.

to ensure that management operates in the interests

of shareholders an obligation that is met by scrutiny, Recommendations for Policy and Practice

evaluation, and regulation of the actions of top The study recommends that government should put

management by the board (Hillman and Dalziel, in place policies and regulations that will compel

2003). This implies that management cannot be board of directors to have certain skills and

trusted, thereby calling for strict monitoring and knowledge. The government should come up with

supervision by the board in order to protect training programs to sensitize board of directors on

shareholders’ interest. This theory is supported by governance policies. The study also recommends

positive and significant effect of use of knowledge boards to put in place policy and guidelines on board

and skills and cognitive conflict of financial meetings processes this is to enable board members

performance. follow the procedures.

5.0 Summary, Conclusions and

Recommendation Recommendations for Theories

The objective was to examine the effect of use of The study recommends that the use of knowledge

knowledge and skills on financial performance of and skills enhance board effectiveness and thus firm

state owned sugar companies. The findings showed performance. Therefore, this study upholds the

a positive and significant effect on financial tenets of resource dependency theory by providing

performance. Thus, the findings revealed that board updated empirical literature from the developing

directors make use of knowledge and skills of the county perspective. The study therefore has boosted

board members when conducting meetings. The the existing literature on board processes and

study established that there exist a positive and financial performance which provide a reference

significant correlation between use of knowledge point for academic discourse and future reference.

and skills and financial performance. Therefore, use

of knowledge and skills enhances financial Suggestions for Further Studies

pg. 41

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

The following suggestions were made for further performance. The study further recommends need to

research based on the findings of this study; conduct research on the listed firms in Nairobi

securities market because they give a different

The study recommends that to take research to the perspective on governance. There need of

next level the study recommends that future research conducting further studies on role of board processes

to undertake a study on mediated-moderated on financial performance of family owned or private

relationships on board processes and financial owned sugar companies.

References

Aguilera, R. V., & Jackson, G. (2008). An Organizational Approach to Comparative Corporate

Governance; Costs, Contingencies, and Complementarities. Organization science 19(3), 475-494

Anderson, R. C., & Reeb, D. M. (2004). Board Composition, Balancing Family influence in S & P 500 Firms.

Administration science Quarterly 49(2), 209-237.

Bhagat, S. Bolton, B. (2008). Corporate Governance and Firm Performance. Journal of Corporate Finance, 14,

257-273.

Boyd, B. K. (1995). CEO Duality and Firm performance: A contingency Model. Strategic Management Journal,

16(4), 301-312.

Brennan, N., (2006). Boards of Directors and Firm Performance: Is There an Expectations Gap? Corporate

Governance: An International Review, 14 (6), 577-593

Cameron, S. (2015). Econometrics. New York; the McGraw-Hill.

Cooper, D. R., & Schindler, P. S., (2006). Business research methods (Vol. 9). New York: McGraw-Hill.

Daily, C. and Dalton, D (1998). Compensation Committee Composition as a Determinant of CEO Compensation.

Academy of Management journal, 41(2), 209-210.

Finkelstein, S., & Mooney, A. C. (2003). Not the Usual Suspects: How to Use Board Process to Make Boards

Better. Academy of Management Executive, 17(2): 101-113

Forbes D. P and Milliken F. J., (1999); Cognition and Corporate Governance: Understanding Boards of Directors

as Strategic Decision-Making Groups: The Academy of Management Review, Vol. 24, (3) 489-505.

Hambrick, D. C., Werder, A. V., & Zajac, E. J. (2008). New Directions in Corporate Governance. Organization

Science, 19: (4) 381-385.

Hillman, A. J., & Dalziel, T. 2003. Boards of Directors and Firm Performance: Integrating Agency and Resource

Dependence Perspectives. Academy of Management Review, 28: (4) 383-396.

Hillman, A, J., Canella, A. A., & Paetzold, R. L. (2000). The Resource Dependency Role of Corporate Directors:

Strategic Adaptation of Board Composition in Response to Environmental Change. Journal on Management

Studies, 37(2), 235-255.

Kombo, D. K., & Tromp, D. L. (2011). Proposal and Thesis Writing. An Introduction. Nairobi; Paulines

Publications, Africa.

Kothari, C. R. (2004). Research Methodology: methods and techniques. Mumbai: New Age International.

KSD, (2017). Privatization of state owned sugar factories. Business Journal on Sugar Production In Kenya,

4, 34-38.

Huse, M. (2005) Accountability and creating accountability: a framework for exploring behavioural

perspectives of corporate governance, British Journal of Management, 16, S65-S79

Huse, M. (2007) Boards, governance, and value creation, Cambridge: Cambridge University Presstragroup

Conflict, Administrative Science Quarterly, 40, 256–282.

Jehn, K. and Mannix, E. (2001). The Dynamic Nature of Conflict: A Longitudinal Study of Intragroup Conflict

and Group Performance, Academy of Management Journal, 4, 238– 251.

Kroll, M., Walters, B. A., & Wright, P. 2008. Board vigilance, director experience, and corporate outcomes.

Strategic Management Journal, 29: 363-382

Monks, R. A & Minnow, N. (2004). Corporate Governance. Malden, MA: Blackwell Publishers.

Mizruchi, M. S. (1988). A Longitudinal Study of the Formation of Interlocking Directorates. Administrative

Sciences Quaterly, 33(2), 194-210

Peng, M. (2004), Outside Directors and Firm Performance during Institutional Transitions. Strategic Management

Journal, Vol.25, (5),. 453-471.

pg. 42

Simiyu and Ombaba (2018) www.oircjournals.org

International Journal of Finance, Accounting and Economics

(IJFAE) ISSN: 2617-135X Vol. 1 (3) 30-42, October, 2018

www.oircjournals.org

Polit, D. & Beck, C. (2003). Nursing Research; principles and methods, (7th ed.), United States of America;

Lippincott, Williams and Wilkins.

Pfeiffer, J., & Salancik, G. (1978). The External Control of Organizations. A Resource Dependence Perspective.

New York: Harper and Row.

Sreevidya, U., & Sunitha, K. (2011). Business research methods. Retrieved from

htt://www.universityofcalcut.info/SDE/business research methods.pdf.

Tricker, B. (2011). Re-Inventing the Limited Liability Company. Corporate Governance: An International

Review, 19(4), 384-393.

Tuggle, C. S., Sirmon, D. G., Reutzel, C. R., & Bierman, L. (2010). Commanding Board of Director Attention:

Investigating How Organizational Performance and CEO Duality Affect Board Members’ Attention To

Monitoring. Strategic Management Journal, 31: (7) 946-968.

Van Ees, H., Van der Laan, G., & Postma, T. 2008. Effective board’s behavior in the Netherlands. European

Management Journal, 26: 84–93.

Wan, D. & Ong, C. H. (2005); Board structure, Process, and Performance: Evidence from Public- listed

Companies in Singapore. Corporate Governance: An International Review, 13: (5) 277– 290.

Westphal, J. D. 1999. Collaboration in the Boardroom: Behavioral and Performance Consequences of CEO-Board

Social Ties. Academy of Management Journal, 42: 7-24.

Zattoni, A., Gnan, L. & Huse, M. (2012) Does Family Involvement Influence Firm Performance? Exploring the

Mediating Effects of Board Processes and Tasks

Zona, F. & Zattoni, A. (2007). Beyond the Black Box of Demography: Board processes and task Effectiveness

within Italian Firms. Corporate Governance: An International Review, 15 (6) 852–864.

pg. 43

Simiyu and Ombaba (2018) www.oircjournals.org

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Evaluation of English Language Teaching SyllabusesDocument10 pagesEvaluation of English Language Teaching SyllabusesOIRCNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Call For Papers 4th Eldoret Conference On Sustainable DevelopmentDocument4 pagesCall For Papers 4th Eldoret Conference On Sustainable DevelopmentOIRCNo ratings yet

- Language Teachers' Cognition and Classroom Practice A Study of Teaching English Vocabulary in Busia County, KenyaDocument12 pagesLanguage Teachers' Cognition and Classroom Practice A Study of Teaching English Vocabulary in Busia County, KenyaOIRCNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Rapid Review of Social Protection A Gender PerspectiveDocument8 pagesRapid Review of Social Protection A Gender PerspectiveOIRCNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Factors Influencing Gender Equality Among Multi-Sectoral Workers in Meru County, Kenya.Document7 pagesFactors Influencing Gender Equality Among Multi-Sectoral Workers in Meru County, Kenya.OIRCNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- CV FinalDocument9 pagesCV FinalOIRCNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Intervention of Media in Determining Acceptance of Alternative Rite of Passage (ARP) Among Girls and Women in The Maasai Community of Kenya PDFDocument14 pagesThe Intervention of Media in Determining Acceptance of Alternative Rite of Passage (ARP) Among Girls and Women in The Maasai Community of Kenya PDFOIRCNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Effect of Use of Knowledge and Skills On The Sutstainable Financial Performance of State Owned Sugar Companies in Kenya.Document14 pagesEffect of Use of Knowledge and Skills On The Sutstainable Financial Performance of State Owned Sugar Companies in Kenya.OIRCNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Enhancing Participation of Women Groups in Economic Empowerment A Survey of Selected Women Groups in Kisii County, KenyaDocument6 pagesEnhancing Participation of Women Groups in Economic Empowerment A Survey of Selected Women Groups in Kisii County, KenyaOIRCNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Effect of Use of Knowledge and Skills On The Sutstainable Financial Performance of State Owned Sugar Companies in Kenya.Document14 pagesEffect of Use of Knowledge and Skills On The Sutstainable Financial Performance of State Owned Sugar Companies in Kenya.OIRCNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Rapid Review of Social Protection A Gender PerspectiveDocument8 pagesRapid Review of Social Protection A Gender PerspectiveOIRCNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Effect of Non-Performing Loans On Financial Performance of Commercial Banks in KenyaDocument14 pagesEffect of Non-Performing Loans On Financial Performance of Commercial Banks in KenyaOIRCNo ratings yet

- Financial Expertise and Capital StructureDocument13 pagesFinancial Expertise and Capital StructureOasis International Consulting LtdNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- An Investigation Into The Level of Expertise of The Staff in Implementing Policy On The Management of Public Early Childhood Development Education Centres in Elgeyo Marakwet County, KenyaDocument9 pagesAn Investigation Into The Level of Expertise of The Staff in Implementing Policy On The Management of Public Early Childhood Development Education Centres in Elgeyo Marakwet County, KenyaOIRCNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Establishing The Effectiveness of Market Ratios in Predicting Financial Distress of Listed Firms in Nairobi Security Exchange MarketDocument13 pagesEstablishing The Effectiveness of Market Ratios in Predicting Financial Distress of Listed Firms in Nairobi Security Exchange MarketOIRCNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Utilization of Media Resources Policy and Its Effect On Management of Public Early Childhood Development Education Centers in Elgeyo-Marakwet County PDFDocument11 pagesUtilization of Media Resources Policy and Its Effect On Management of Public Early Childhood Development Education Centers in Elgeyo-Marakwet County PDFOIRCNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Monitoring Intensity and Procurement Performance. Emprical Evidence From Elgeyo Marakwet County, Kenya.Document12 pagesMonitoring Intensity and Procurement Performance. Emprical Evidence From Elgeyo Marakwet County, Kenya.OIRCNo ratings yet

- Determining The Extent of Financial Planning and Performance of Small Scale Enterprises (SSEs) in Kisii Town, Kenya (Repaired)Document12 pagesDetermining The Extent of Financial Planning and Performance of Small Scale Enterprises (SSEs) in Kisii Town, Kenya (Repaired)OIRCNo ratings yet

- An Investigation Into The Level of Expertise of The Staff in Implementing Policy On The Management of Public Early Childhood Development Education Centres in Elgeyo Marakwet County, KenyaDocument9 pagesAn Investigation Into The Level of Expertise of The Staff in Implementing Policy On The Management of Public Early Childhood Development Education Centres in Elgeyo Marakwet County, KenyaOIRCNo ratings yet

- The Intervention of Media in Determining Acceptance of Alternative Rite of Passage (ARP) Among Girls and Women in The Maasai Community of Kenya PDFDocument14 pagesThe Intervention of Media in Determining Acceptance of Alternative Rite of Passage (ARP) Among Girls and Women in The Maasai Community of Kenya PDFOIRCNo ratings yet

- Financial Expertise and Capital StructureDocument13 pagesFinancial Expertise and Capital StructureOasis International Consulting LtdNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Enterprise Resource Planning On Quality of Financial Reports of Public Universities in Uasin Gishu CountyDocument17 pagesEnterprise Resource Planning On Quality of Financial Reports of Public Universities in Uasin Gishu CountyOIRCNo ratings yet

- Corporate Governance and Financial Performance of Savings and Credit Co-Operatives in Embu County, KenyaDocument11 pagesCorporate Governance and Financial Performance of Savings and Credit Co-Operatives in Embu County, KenyaOIRCNo ratings yet

- Utilization of Media Resources Policy and Its Effect On Management of Public Early Childhood Development Education Centers in Elgeyo-Marakwet County PDFDocument11 pagesUtilization of Media Resources Policy and Its Effect On Management of Public Early Childhood Development Education Centers in Elgeyo-Marakwet County PDFOIRCNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Determining The Extent of Financial Planning and Performance of Small Scale Enterprises (SSEs) in Kisii Town, Kenya (Repaired)Document12 pagesDetermining The Extent of Financial Planning and Performance of Small Scale Enterprises (SSEs) in Kisii Town, Kenya (Repaired)OIRCNo ratings yet

- Influence of Teacher Preparedness On Mother Tongue Usage in Classroom Instruction Among The Rural ECDE Centres in Nandi County 1Document19 pagesInfluence of Teacher Preparedness On Mother Tongue Usage in Classroom Instruction Among The Rural ECDE Centres in Nandi County 1OIRCNo ratings yet

- Does Environmental Responsibility Affect Business Performance Evidence From Insurance Sector KenyaDocument16 pagesDoes Environmental Responsibility Affect Business Performance Evidence From Insurance Sector KenyaOasis International Consulting LtdNo ratings yet

- Mainstreaming Gender in Teacher Education Programme For Sustainable Development in Modern Africa The Kenyan CaseDocument10 pagesMainstreaming Gender in Teacher Education Programme For Sustainable Development in Modern Africa The Kenyan CaseOasis International Consulting LtdNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Effect of Product Creation Strategy On Performance of Small and Medium Enterprises in Eldoret TownDocument17 pagesEffect of Product Creation Strategy On Performance of Small and Medium Enterprises in Eldoret TownOasis International Consulting LtdNo ratings yet

- SWOT Pengembangan Udang WinduDocument9 pagesSWOT Pengembangan Udang WinduSiska AmeliaNo ratings yet

- 134 Banking LJ547Document4 pages134 Banking LJ547AyushNo ratings yet

- IO Model Vs Resource Based Model - Two Approaches To StrategyDocument14 pagesIO Model Vs Resource Based Model - Two Approaches To StrategyM ManjunathNo ratings yet

- Midterm ManaccDocument13 pagesMidterm ManaccTheodora YenneferNo ratings yet

- Accounting For Trust and ControlDocument19 pagesAccounting For Trust and ControlJuan David Arias SuárezNo ratings yet

- Compensation of General Partners of Private Equity FundsDocument6 pagesCompensation of General Partners of Private Equity FundsManu Midha100% (1)

- Construction Sectors and Roles For Chartered Quantity SurveyorsDocument33 pagesConstruction Sectors and Roles For Chartered Quantity Surveyorspdkprabhath_66619207No ratings yet

- Session 26 - Income TaxDocument23 pagesSession 26 - Income TaxUnnati RawatNo ratings yet

- MEDCLAIM - Docx 80 DDocument1 pageMEDCLAIM - Docx 80 DNani krishnaNo ratings yet

- DIM2183 Exam Jan 2024 Set 1Document4 pagesDIM2183 Exam Jan 2024 Set 1Yus LindaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Effects of Business Ethics and Corporate Social Responsibility On Intellectual Capital Voluntary DisclosureDocument23 pagesThe Effects of Business Ethics and Corporate Social Responsibility On Intellectual Capital Voluntary DisclosureCase HandphoneNo ratings yet

- ch15 Non-Current LiabilitiesDocument66 pagesch15 Non-Current LiabilitiesDesain KPPN KPHNo ratings yet

- Lead Bank SchemeDocument8 pagesLead Bank Schemebistamaster100% (2)

- MBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersDocument20 pagesMBA and MBA (Banking & Finance) : Mmpc-004: Accounting For ManagersAvijit GuinNo ratings yet

- Answer of Integrative Case 1 (Track Software, LTD)Document2 pagesAnswer of Integrative Case 1 (Track Software, LTD)Mrito Manob67% (3)

- Exercises Topic 2 With AnswersDocument2 pagesExercises Topic 2 With AnswersfatehahNo ratings yet

- Ee Roadinfra Tend 01Document3 pagesEe Roadinfra Tend 01Prasanna VswamyNo ratings yet

- CityAM 08/01/2010Document20 pagesCityAM 08/01/2010City A.M.No ratings yet

- Case Studies EdM404 - TecsonNoesonB.Document15 pagesCase Studies EdM404 - TecsonNoesonB.Noeson TecsonNo ratings yet

- UNICART2 YaynDocument13 pagesUNICART2 YaynMohammad BibarsNo ratings yet

- Brand Strategy Road MapDocument2 pagesBrand Strategy Road MapOwais AhmedNo ratings yet

- Ford Motor CompanyDocument22 pagesFord Motor CompanyAngel WhuyoNo ratings yet

- Macro and Micro Economics of MalaysiaDocument13 pagesMacro and Micro Economics of MalaysiaGreyGordonNo ratings yet

- Needs VS WantsDocument2 pagesNeeds VS WantsMhie RelatorNo ratings yet

- VOLUNTARY RETIREMENT SCHEME FinalDocument70 pagesVOLUNTARY RETIREMENT SCHEME FinalDishangi50% (4)

- History and Background of The Steel IndustryDocument12 pagesHistory and Background of The Steel IndustryMario R. Ramírez BasoraNo ratings yet

- Asisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Document5 pagesAsisgn. 1 Mod 2 - NCA HELD FOR SALE & DISCONTINUED OPNS.Kristine Vertucio0% (1)

- HDA Quick NotesDocument5 pagesHDA Quick NotesRidha Razak100% (1)

- Wall Street Self Defense Manual PreviewDocument18 pagesWall Street Self Defense Manual PreviewCharlene Dabon100% (1)

- Case Study Measuring ROI in Interactive SkillsDocument18 pagesCase Study Measuring ROI in Interactive SkillsAbhay KumarNo ratings yet

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4 out of 5 stars4/5 (2)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (88)

- $100M Leads: How to Get Strangers to Want to Buy Your StuffFrom Everand$100M Leads: How to Get Strangers to Want to Buy Your StuffRating: 5 out of 5 stars5/5 (18)

- $100M Offers: How to Make Offers So Good People Feel Stupid Saying NoFrom Everand$100M Offers: How to Make Offers So Good People Feel Stupid Saying NoRating: 5 out of 5 stars5/5 (21)

- Summary of Noah Kagan's Million Dollar WeekendFrom EverandSummary of Noah Kagan's Million Dollar WeekendRating: 5 out of 5 stars5/5 (1)