Professional Documents

Culture Documents

Consolidated Balance Sheet Balance Sheet

Uploaded by

Marjuree Fuchsia QuibodOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consolidated Balance Sheet Balance Sheet

Uploaded by

Marjuree Fuchsia QuibodCopyright:

Available Formats

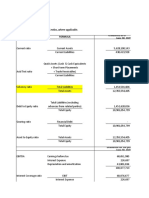

BALANCE SHEET CONSOLIDATED BALANCE SHEET

(Head Office and Branches) (Bank and Financial Subsidiaries)

As of December 31, 2015 As of December 31, 2015

Current Quarter Previous Quarter Current Quarter Previous Quarter

ASSETS ASSETS

Cash and Cash Items P 34,816,573,047.67 20,634,877,523.90 Cash and Cash Items P 35,701,114,433.50 21,348,560,290.69

Due from Bangko Sentral ng Pilipinas 174,370,372,872.94 171,668,196,260.03 Due from Bangko Sentral ng Pilipinas 214,959,993,900.79 204,046,400,318.52

Due from Other Banks 17,166,709,661.82 19,161,470,184.62 Due from Other Banks 21,156,647,266.80 21,950,931,872.19

Financial Assets at Fair Value through Profit or Loss 9,954,249,309.75 26,190,852,702.31 Financial Assets at Fair Value through Profit or Loss 12,602,786,955.62 29,856,372,224.26

Available-for-Sale Financial Assets-Net 36,305,904,478.16 30,785,659,307.34 Available-for-Sale Financial Assets-Net 41,606,996,875.58 36,380,294,672.33

Held-to-Maturity (HTM) Financial Assets-Net 221,696,398,101.49 218,228,238,263.66 Held-to-Maturity (HTM) Financial Assets-Net 241,078,848,023.02 238,204,181,240.62

Investments in Non-Marketable Equity Security-Net 59,671,870.43 56,268,248.31 Investments in Non-Marketable Equity Security-Net 255,380,084.37 249,287,249.70

Loans and Receivables-Net 666,099,020,861.82 592,578,395,282.44 Loans and Receivables-Net 880,567,435,576.00 792,586,561,666.71

Interbank Loans Receivable 6,159,675,871.87 7,122,334,506.15 Interbank Loans Receivable 7,519,806,039.18 8,545,165,143.99

Loans and Receivables-Others 667,548,487,755.88 583,518,945,049.75 Loans and Receivables-Others 876,479,178,779.90 782,861,375,191.95

Loans and Receivables Arising from RA/CA/PR/SLB - 8,560,000,000.00 Loans and Receivables Arising from RA/CA/PR/SLB 6,513,000,000.00 9,860,000,000.00

General Loan Loss Provision 7,609,142,765.93 6,622,884,273.46 General Loan Loss Provision 9,944,549,243.08 8,679,978,669.23

Other Financial Assets 6,372,373,189.81 5,087,006,204.30 Other Financial Assets 7,555,376,608.50 5,948,676,143.96

Equity Investment in Subsidiaries, Associates Equity Investment in Subsidiaries, Associates

and Joint Ventures-Net 47,252,696,659.88 45,616,520,038.95 and Joint Ventures-Net 8,474,741,246.94 8,362,366,471.96

Bank Premises, Furniture, Fixture and Equipment-Net 9,448,260,754.20 9,335,515,599.17 Bank Premises, Furniture, Fixture and Equipment-Net 10,584,505,270.89 10,447,083,272.12

Real and Other Properties Acquired-Net 1,603,679,289.45 1,607,625,859.95 Real and Other Properties Acquired-Net 3,686,157,626.56 3,676,796,308.35

Non-Current Assets Held for Sale - - Non-Current Assets Held for Sale 1,259,779.86 1,259,779.86

Other Assets-Net 16,508,384,050.96 17,568,536,233.01 Other Assets-Net 23,574,009,682.87 24,467,643,985.91

TOTAL ASSETS P 1,241,654,294,148.38 1,158,519,161,707.99 TOTAL ASSETS P 1,501,805,253,331.30 1,397,526,415,497.18

LIABILITIES LIABILITIES

Financial Liabilities at Fair Value through Profit or Loss P 3,215,364,571.51 3,623,729,881.30 Financial Liabilities at Fair Value through Profit or Loss P 3,216,282,595.03 3,625,501,958.56

Deposit Liabilities 1,033,608,615,755.08 961,702,954,921.63 Deposit Liabilities 1,277,346,380,182.49 1,185,287,583,917.63

Due to Other Banks 164,019,951.21 169,617,473.44 Due to Other Banks 164,019,951.21 169,617,473.44

Bills Payable 12,826,134,333.19 7,658,945,184.08 Bills Payable 18,740,945,186.40 13,079,630,785.93

a) BSP (Rediscounting and Other Advances) - - a) BSP (Rediscounting and Other Advances) 12,615,234.96 15,782,821.40

b) Interbank Loans Payable 12,706,200,000.00 7,478,400,000.00 b) Interbank Loans Payable 13,888,763,681.00 8,413,795,843.20

c) Other Deposit Substitute - 41,895,450.88 c) Other Deposit Substitute - 41,895,450.88

d) Others 119,934,333.19 138,649,733.20 d) Others 4,839,566,270.44 4,608,156,670.45

Other Financial Liabilities 11,827,764,051.42 11,250,943,180.97 Other Financial Liabilities 14,426,054,770.45 13,635,160,371.38

Other Liabilities 34,243,722,085.29 28,589,633,706.74 Other Liabilities 40,665,760,026.19 34,691,285,960.73

TOTAL LIABILITIES P 1,095,885,620,747.70 1,012,995,824,348.16 TOTAL LIABILITIES P 1,354,559,442,711.77 1,250,488,780,467.67

STOCKHOLDERS' EQUITY STOCKHOLDERS' EQUITY

Capital Stock P 68,643,660,607.58 68,618,402,342.50 Capital Stock P 68,643,660,607.58 68,618,402,342.50

Other Capital Accounts 12,615,152,429.07 8,871,083,534.07 Other Capital Accounts 12,615,152,429.07 8,871,083,534.07

Retained Earnings 64,509,860,364.03 68,033,851,483.26 Retained Earnings 64,589,788,276.44 68,122,317,846.88

Minority Interest in Subsidiaries 1,397,209,306.44 1,425,831,306.06

TOTAL STOCKHOLDERS' EQUITY P 145,768,673,400.68 145,523,337,359.83 TOTAL STOCKHOLDERS' EQUITY P 147,245,810,619.53 147,037,635,029.51

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY P 1,241,654,294,148.38 1,158,519,161,707.99 TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY P 1,501,805,253,331.30 1,397,526,415,497.18

CONTINGENT ACCOUNTS CONTINGENT ACCOUNTS

Guarantees Issued P 245,009,848.40 247,208,023.28 Guarantees Issued P 245,009,848.40 247,208,023.28

Financial Standby Letters of Credit 2,949,671,522.09 2,769,761,609.79 Financial Standby Letters of Credit 2,949,671,522.09 2,769,761,609.79

Performance Standby Letters of Credit 1,393,469,000.90 1,383,353,723.14 Performance Standby Letters of Credit 1,393,469,000.90 1,383,353,723.14

Commercial Letters of Credit 6,603,877,593.88 5,682,756,792.31 Commercial Letters of Credit 6,603,877,593.88 5,682,756,792.31

Trade Related Guarantees 697,884,278.20 842,224,997.56 Trade Related Guarantees 697,884,278.20 842,224,997.56

Commitments 78,774,252,568.93 80,579,480,415.35 Commitments 79,980,680,162.06 81,678,444,017.69

Spot Foreign Exchange Contracts 3,122,306,617.59 20,018,468,922.38 Spot Foreign Exchange Contracts 3,122,306,617.59 20,018,468,922.38

Trust Department Accounts 539,832,193,311.71 538,284,706,051.16 Trust Department Accounts 539,832,193,311.71 538,284,706,051.16

a) Trust and Other Fiduciary Accounts 382,425,796,407.87 382,930,375,618.20 a) Trust and Other Fiduciary Accounts 382,425,796,407.87 382,930,375,618.20

b) Agency Accounts 157,406,396,903.84 155,354,330,432.96 b) Agency Accounts 157,406,396,903.84 155,354,330,432.96

Derivatives 699,741,384,554.89 712,331,567,553.09 Derivatives 700,816,169,826.32 713,400,292,671.69

Others 17,760,907,860.56 19,193,486,157.46 Others 117,792,671,675.72 123,585,528,578.58

TOTAL CONTINGENT ACCOUNTS P 1,351,120,957,157.15 1,381,333,014,245.52 TOTAL CONTINGENT ACCOUNTS P 1,453,433,933,836.87 1,487,892,745,387.58

ADDITIONAL INFORMATION ADDITIONAL INFORMATION

Gross total loan portfolio (TLP) P 679,123,982,460.24 605,260,728,459.28 1. List of Financial Allied Subsidiaries (excluding Subsidiary Insurance Companies)

Specific allowance for credit losses on the TLP 5,415,818,832.49 6,059,448,903.38 a) BPI Family Savings Bank, Inc.

Non-Performing Loans (NPLs) b) BPI Capital Corporation

a. Gross NPLs 8,088,920,117.06 8,764,642,869.60 c) BPI Direct Savings Bank, Inc.

b. Ratio of gross NPLs to gross TLP 1.19% 1.45% d) BPI Century Tokyo Lease & Finance Corporation

c. Net NPLs 2,673,101,284.57 2,705,193,966.22 e) BPI Card Finance Corporation

d. Ratio of Net NPLs to gross TLP 0.39% 0.45% f) BPI Express Remittance Corporation

Classified Loans & Other Risk Assets, g) BPI Foreign Exchange Corporation

gross of allowance for credit losses 15,686,434,491.48 17,361,842,610.24 h) BPI International Finance Limited

DOSRI Loans and receivables, i) BPI Europe, PLC.

gross of allowance for credit losses 15,519,554,587.97 15,514,907,340.23 j) BPI Globe BanKO

Ratio of DOSRI loans and receivables, k) BPI Investment Management Inc.

gross of allowance for credit losses, to gross TLP 2.29% 2.56%

Gross non-performing DOSRI loans and receivables 342,814.41 796,408.81 2. List of Subsidiary Insurance Companies

Percent Compliance with Magna Carta a) BPI/MS Insurance Corporation

a. 8% for Micro and Small Enterprises 5.32% 5.19% b) FGU Insurance Corporation

b. 2% for Medium Entreprises 8.63% 8.18% c) Ayala Plans, Inc.

Return on Equity (ROE) 12.79% 13.05%

Capital Adequacy Ratio (CAR) on Solo Basis, 3. Capital Adequacy Ratio (CAR) on Consolidated Basis,

as prescribed under existing regulations as prescribed under existing regulations

a. Total CAR 12.02% 13.48% a. Total CAR 13.59% 14.86%

b. Tier 1 Ratio 11.13% 12.61% b. Tier 1 Ratio 12.71% 13.99%

c. Common Equity Tier 1 Ratio 1/ 11.13% 12.61% c. Common Equity Tier 1 Ratio 1/ 12.71% 13.99%

1/ 1/

Common Equity Tier 1 is only applicable to all Universal and Commercial Banks and their subsidiary banks. Common Equity Tier 1 is only applicable to all Universal and Commercial Banks and their subsidiary banks.

REPUBLIC OF THE PHILIPPINES) REPUBLIC OF THE PHILIPPINES)

City of Makati……………… .... ) S.S. City of Makati……………… .... ) S.S.

We, CEZAR P. CONSING and JOSEPH ALBERT L. GOTUACO, of the above-mentioned bank, do solemnly swear that We, CEZAR P. CONSING and JOSEPH ALBERT L. GOTUACO, of the above-mentioned bank, do solemnly swear that all

all matters set forth in the above Balance Sheet are true and correct to the best of our knowledge and belief. matters set forth in the above Balance Sheet are true and correct to the best of our knowledge and belief.

(Sgd) JOSEPH ALBERT L. GOTUACO (Sgd) CEZAR P. CONSING (Sgd) JOSEPH ALBERT L. GOTUACO (Sgd) CEZAR P. CONSING

Chief Financial Officer President Chief Financial Officer President

SUBSCRIBED AND SWORN TO BEFORE ME this February 02, 2016 at Makati City, Metro Manila affiants exhibiting to SUBSCRIBED AND SWORN TO BEFORE ME this February 02, 2016 at Makati City, Metro Manila affiants exhibiting to

me their Passport No. EB9284966 issued at HongKong on October 02, 2013 and Passport No. EC2373461 issued at me their Passport No. EB9284966 issued at HongKong on October 02, 2013 and Passport No. EC2373461 issued at

DFA Manila on October 10, 2014, repectively. DFA Manila on October 10, 2014, repectively.

Doc. No. 63 (SGD) BUENAVENTURA U. MENDOZA Doc. No. 64 (SGD) BUENAVENTURA U. MENDOZA

Page No. 14 Notary Public Page No. 14 Notary Public for Makati City

Book No. 76 Until December 31, 2016 Book No. 76 Until December 31, 2016

Series of 2016 PTR No. 5323698 Makati City - 1/04/16 Series of 2016 PTR No. 5323698 Makati City-1/04/16

IBP No. 975446 10-15-14 Roll No. 31206 IBP No.975446 10-15-14 Roll No.31206

500-A Madrigal Bldg., Ayala Avenue, Makati City 500-A Madrigal Bldg., Ayala Ave. Makati City

Member: Philippine Deposit Insurance Corporation. Maximum deposit insurance for each depositor is P500,000.

You might also like

- A Study of Best Performing Scripts of Nifty in Last 5 Year in Banking SectorDocument84 pagesA Study of Best Performing Scripts of Nifty in Last 5 Year in Banking SectorKathiravan Cse0% (2)

- A Manager's Guide To Financial Analysis 6eDocument252 pagesA Manager's Guide To Financial Analysis 6eAq Rma100% (3)

- Personal Computers Inc.Document4 pagesPersonal Computers Inc.nazishNo ratings yet

- Contract of Lease 23B TRION 3 MADELAINE MATEODocument7 pagesContract of Lease 23B TRION 3 MADELAINE MATEOChad VillaverdeNo ratings yet

- Henkel 2016 Annual ReportDocument202 pagesHenkel 2016 Annual ReportjonnyNo ratings yet

- Bpisoloconso 122022 v2Document1 pageBpisoloconso 122022 v2Ricalyn VillaneaNo ratings yet

- BPI Balance Sheet 2019Document1 pageBPI Balance Sheet 2019Marwin AceNo ratings yet

- 14-DFA2022 Part4-Annex CDocument15 pages14-DFA2022 Part4-Annex CjoevincentgrisolaNo ratings yet

- Unaudited Second Quarter 2022 - 23Document42 pagesUnaudited Second Quarter 2022 - 23Mahan KhanalNo ratings yet

- Balance Sheet As of Dec - 31, 2020Document1 pageBalance Sheet As of Dec - 31, 2020Charlen Relos GermanNo ratings yet

- AVB - EXAM QUESTIONS - 2021-2022 (Calculations)Document6 pagesAVB - EXAM QUESTIONS - 2021-2022 (Calculations)Dean ErlanggaNo ratings yet

- Company: Agriculture Development Bank Limited (ADBL)Document2 pagesCompany: Agriculture Development Bank Limited (ADBL)Nijan JyakhwoNo ratings yet

- Interim Financial Statements As On Chaitra End 2075Document30 pagesInterim Financial Statements As On Chaitra End 2075Mendel AbiNo ratings yet

- SFPOSDocument1 pageSFPOSShaira May Dela CruzNo ratings yet

- Abott LabDocument6 pagesAbott LabRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintAbhay Kumar SinghNo ratings yet

- Reshma Deep Boaring 767Document7 pagesReshma Deep Boaring 767Abishek AdhikariNo ratings yet

- Financial in WebsiteDocument38 pagesFinancial in WebsiteJay prakash ChaudharyNo ratings yet

- Rastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Document3 pagesRastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Sagar ThakurNo ratings yet

- City of Malolos Combined Statement of Cash Flows For The Period December 31, 2015Document11 pagesCity of Malolos Combined Statement of Cash Flows For The Period December 31, 2015Carl Joseph MoredoNo ratings yet

- Global Auto PartsDocument33 pagesGlobal Auto Partssantosh pandeyNo ratings yet

- Current Assets: See Accompanying Notes To Financial StatementsDocument5 pagesCurrent Assets: See Accompanying Notes To Financial StatementsAlicia NhsNo ratings yet

- See Accompanying Notes To Financial StatementsDocument9 pagesSee Accompanying Notes To Financial StatementsEG ReyesNo ratings yet

- FS - Baltazar, Fatima S. 2020Document50 pagesFS - Baltazar, Fatima S. 2020Ma Teresa B. CerezoNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintSamil MusthafaNo ratings yet

- 02-Anda2015 FSDocument7 pages02-Anda2015 FSoabeljeanmoniqueNo ratings yet

- Tab D - Detailed Financial StatementsDocument13 pagesTab D - Detailed Financial Statementsarellano lawschoolNo ratings yet

- LBP2016 Part1 Financial PositionsDocument1 pageLBP2016 Part1 Financial PositionsSerje Anthony BualNo ratings yet

- Consolidated Statement of Financial Position: (With Comparative Figures For CY 2016)Document7 pagesConsolidated Statement of Financial Position: (With Comparative Figures For CY 2016)Alicia NhsNo ratings yet

- Financial StatementsDocument14 pagesFinancial Statementsthenal kulandaianNo ratings yet

- Financial Statements For China CNR Corp LTD - Google Finance CFDocument1 pageFinancial Statements For China CNR Corp LTD - Google Finance CFethandanfordNo ratings yet

- 2nd LinkDocument8 pages2nd Linktechsagadme.109No ratings yet

- Fourth Quater Financial Report 2075-76-2Document27 pagesFourth Quater Financial Report 2075-76-2Manish BhandariNo ratings yet

- 7 Ifmis Cash Flow Statement - National ConsolidatedDocument1 page7 Ifmis Cash Flow Statement - National ConsolidatedNagesso BesayeNo ratings yet

- Marico BSDocument2 pagesMarico BSAbhay Kumar SinghNo ratings yet

- FINANCIAL POSITION June302017Document10 pagesFINANCIAL POSITION June302017Reginald ValenciaNo ratings yet

- 08-WVSU2021 Part1-Financial StatementsDocument15 pages08-WVSU2021 Part1-Financial StatementsMiss_AccountantNo ratings yet

- PLDTDocument16 pagesPLDTPrince PerezNo ratings yet

- See Accompanying Notes To Financial Statements.Document6 pagesSee Accompanying Notes To Financial Statements.Lemuel De MesaNo ratings yet

- Quarterly Highlights 2nd Quarter FY 2079-80 (Published)Document5 pagesQuarterly Highlights 2nd Quarter FY 2079-80 (Published)baijumuskan417No ratings yet

- RBB Report at End of Ashadh 2080Document4 pagesRBB Report at End of Ashadh 2080ashurajsah123No ratings yet

- Interim Financial StatementsDocument22 pagesInterim Financial StatementsShivam KarnNo ratings yet

- Ormoc City Comparative Statements of Financial Position: Total Current AssetsDocument6 pagesOrmoc City Comparative Statements of Financial Position: Total Current Assetssandra bolokNo ratings yet

- Third QTR Report 207980Document44 pagesThird QTR Report 207980Manita KunwarNo ratings yet

- Cma. Cia. 3Document37 pagesCma. Cia. 3Usha KarkiNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsSpuran RamtejaNo ratings yet

- This Statement Should Be Read in Conjunction With The Accompanying NotesDocument4 pagesThis Statement Should Be Read in Conjunction With The Accompanying NotesKim Patrick VictoriaNo ratings yet

- Balance SheetDocument2 pagesBalance SheetSachin SinghNo ratings yet

- Ashok Leyland Balane SheetDocument2 pagesAshok Leyland Balane SheetNaresh Kumar NareshNo ratings yet

- Agricultural Development Bank Limited: Interim Financial Statements As On Chaitra End 2077Document25 pagesAgricultural Development Bank Limited: Interim Financial Statements As On Chaitra End 2077Shubhash ShresthaNo ratings yet

- 12 KalingaProvince2018 Part4 AnnexesDocument19 pages12 KalingaProvince2018 Part4 AnnexesMarcus SalvateroNo ratings yet

- (With Comparative Figures For CY 2016) : Consolidated Statement of Financial PositionDocument6 pages(With Comparative Figures For CY 2016) : Consolidated Statement of Financial PositionAlicia NhsNo ratings yet

- Reliance CommunicationsDocument117 pagesReliance Communicationsrahul m dNo ratings yet

- Calculation Group 10Document12 pagesCalculation Group 10HM FarhanNo ratings yet

- Brothers Maharjan Itta & Tile Udhayog Pvt. LTD.: Balance SheetDocument36 pagesBrothers Maharjan Itta & Tile Udhayog Pvt. LTD.: Balance SheetMenuka SiwaNo ratings yet

- Fin464.dhaka Vs MercantileDocument22 pagesFin464.dhaka Vs Mercantiletanvir.ahammad01688No ratings yet

- Foreign Institutional Investors (FII) : Shareholders (As of 31 December 2015) Promoter Group (HDFC)Document10 pagesForeign Institutional Investors (FII) : Shareholders (As of 31 December 2015) Promoter Group (HDFC)Vinod KananiNo ratings yet

- Seven Heaven Corporation Statement of Financial Position As of December 31, 2019 AssetsDocument16 pagesSeven Heaven Corporation Statement of Financial Position As of December 31, 2019 AssetsRolyn BonghanoyNo ratings yet

- Quarter Report May 12Document27 pagesQuarter Report May 12Babita neupaneNo ratings yet

- Financial Ratios TemplateDocument4 pagesFinancial Ratios TemplateAlex Ochinang Jr.No ratings yet

- 18 - Tesla IncDocument8 pages18 - Tesla IncKobir HossainNo ratings yet

- 07 MalabonCity2018 - Part1 FSDocument8 pages07 MalabonCity2018 - Part1 FSJuan Uriel CruzNo ratings yet

- HCL BalancesheetDocument2 pagesHCL BalancesheetTharunyaNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Read Each Item Carefully Circle One Number For Each ItemDocument6 pagesRead Each Item Carefully Circle One Number For Each ItemMarjuree Fuchsia QuibodNo ratings yet

- Developing Organizational Creativity and InnovationDocument2 pagesDeveloping Organizational Creativity and InnovationMarjuree Fuchsia QuibodNo ratings yet

- V. Marketing PlanDocument4 pagesV. Marketing PlanMarjuree Fuchsia QuibodNo ratings yet

- Reference ListDocument3 pagesReference ListMarjuree Fuchsia QuibodNo ratings yet

- ME12 Ch. 5 (Recovered)Document19 pagesME12 Ch. 5 (Recovered)Marjuree Fuchsia QuibodNo ratings yet

- Preparing For A Job InterviewDocument30 pagesPreparing For A Job InterviewMarjuree Fuchsia QuibodNo ratings yet

- SyndromesDocument11 pagesSyndromesMarjuree Fuchsia QuibodNo ratings yet

- Republic Acts: Click Here For The Latest Philippine Laws, Statutes & CodesDocument71 pagesRepublic Acts: Click Here For The Latest Philippine Laws, Statutes & CodesMarjuree Fuchsia QuibodNo ratings yet

- Parts of The Plants and Their FunctionsDocument1 pageParts of The Plants and Their FunctionsMarjuree Fuchsia QuibodNo ratings yet

- Application LetterDocument14 pagesApplication LetterMarjuree Fuchsia Quibod80% (10)

- Republic Acts: Click Here For The Latest Philippine Laws, Statutes & CodesDocument71 pagesRepublic Acts: Click Here For The Latest Philippine Laws, Statutes & CodesMarjuree Fuchsia QuibodNo ratings yet

- Document Filing Is An Important Role Done by A SecretaryDocument1 pageDocument Filing Is An Important Role Done by A SecretaryMarjuree Fuchsia QuibodNo ratings yet

- List of AccommodationsDocument1 pageList of AccommodationsMarjuree Fuchsia QuibodNo ratings yet

- Parts of The Plants and Their FunctionsDocument1 pageParts of The Plants and Their FunctionsMarjuree Fuchsia QuibodNo ratings yet

- Audit Testbank PDFDocument76 pagesAudit Testbank PDFEdison L. ChuNo ratings yet

- 8 Powerpoint Guided NotesDocument79 pages8 Powerpoint Guided Notesapi-173610472No ratings yet

- Certificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisDocument19 pagesCertificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisGurvinder SinghNo ratings yet

- 998 Portage RD - BrochureDocument12 pages998 Portage RD - BrochurePatrick EganNo ratings yet

- Ten Percent Rule To Build Wealth PDFDocument6 pagesTen Percent Rule To Build Wealth PDFAtharvaNo ratings yet

- ProposalDocument12 pagesProposalapil subediNo ratings yet

- Assignment: Introduction-State Bank of IndiaDocument2 pagesAssignment: Introduction-State Bank of IndiaSarayu BhardwajNo ratings yet

- Ibis HotelDocument2 pagesIbis Hoteldaveb100100% (1)

- Pakistan M Edical Commission Pakistan M Edical Commission Pakistan M Edical CommissionDocument1 pagePakistan M Edical Commission Pakistan M Edical Commission Pakistan M Edical CommissionAdil ShahzadNo ratings yet

- Partnership PDFDocument28 pagesPartnership PDFBasant OjhaNo ratings yet

- Financial ManagementDocument34 pagesFinancial ManagementAbisellyNo ratings yet

- ABP Annual Report 2021Document257 pagesABP Annual Report 2021nit hingongNo ratings yet

- ISO 20022 Data Source Schemes (DSS)Document15 pagesISO 20022 Data Source Schemes (DSS)aNo ratings yet

- Zakon o Potvrdjivanju Finansijskog Ugovora (Istrazivanje I Razvoj U Javnom Sektoru) Izmedju Republike Srbije I Evropske Investicione BankeDocument83 pagesZakon o Potvrdjivanju Finansijskog Ugovora (Istrazivanje I Razvoj U Javnom Sektoru) Izmedju Republike Srbije I Evropske Investicione BankeamomimusNo ratings yet

- Unioniank: Unionbank Plal.A Meralco An!Nue Onyx Sapphire Roads, Onigas CenlerDocument7 pagesUnioniank: Unionbank Plal.A Meralco An!Nue Onyx Sapphire Roads, Onigas CenlerEdgar LayNo ratings yet

- AdesDocument1,128 pagesAdesattilzmax100% (2)

- KASNEB-fa-may-2015 Teacher - Co .KeDocument7 pagesKASNEB-fa-may-2015 Teacher - Co .KeTimo PaulNo ratings yet

- 23Document2 pages23Heaven HeartNo ratings yet

- Chap3 - Stock ValuationDocument46 pagesChap3 - Stock ValuationAina KhairunnisaNo ratings yet

- Investigation 2024 GR 12Document6 pagesInvestigation 2024 GR 12koekoeorefileNo ratings yet

- Pakistan Stock Exchange Named Best Performing in AsiaDocument2 pagesPakistan Stock Exchange Named Best Performing in AsiaAqib SheikhNo ratings yet

- Macy's Store Closings News ReleaseDocument6 pagesMacy's Store Closings News ReleaseJim KinneyNo ratings yet

- Stock Market - A Complete Guide BookDocument43 pagesStock Market - A Complete Guide BookParag Saxena100% (1)

- Accounting Project Level IVDocument80 pagesAccounting Project Level IVEdom60% (5)

- 1569974603267g4SdkiBXnw22cLKZ PDFDocument4 pages1569974603267g4SdkiBXnw22cLKZ PDFSelvarathnam MuniratnamNo ratings yet