Professional Documents

Culture Documents

Order 5650318312901

Uploaded by

Subhan khan0 ratings0% found this document useful (0 votes)

40 views3 pagesTest

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTest

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

40 views3 pagesOrder 5650318312901

Uploaded by

Subhan khanTest

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

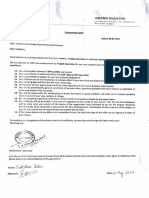

120 (Order to make Self assessment)

Name: SHAIKH SHARAB KHAN Registration No 5650318312901

Address: House No 01, Street No 01, Abdullah Shah Town Khan Tax Year : 2018

Dhak, Islamabad Islamabad Rural Period : 01-Jul-2017 - 30-Jun-2018

Medium : System

Contact No: 00923155088986 Due Date : 25-Oct-2018

Document Date 25-Oct-2018

Description Code Amount

Total Income 9000 322,000.00

Taxable Income 9100 322,000.00

This is not a valid evidence of being a "filer" for the purposes of clauses (23A) and (35C) of sections 2 and 181A.

Manufacturing / Trading Items

Amount

Exempt from Amount

Description Code Total Amount Tax / Subject Subject to

to Fixed / Normal Tax

Final Tax

Income / (Loss) from Business 3000 322,000.00 0.00 322,000.00

Other Revenues

Amount

Exempt from Amount

Description Code Total Amount Tax / Subject Subject to

to Fixed / Normal Tax

Final Tax

Other Revenues 3129 700,000.00 0.00 700,000.00

Others 3128 700,000.00 0.00 700,000.00

Management, Administrative, Selling & Financial Expenses

Amount

Exempt from Amount

Description Code Total Amount Tax / Subject Subject to

to Fixed / Normal Tax

Final Tax

Management, Administrative, Selling & Financial Expenses 3199 378,000.00 0.00 378,000.00

Other Indirect Expenses 3180 378,000.00 0.00 378,000.00

Accounting Profit / (Loss) 3200 322,000.00 0.00 322,000.00

Page 1 of 3 Printed on Tue, 30 Oct 2018 11:18:46

RTO ISLAMABAD, 20 KHAYABAN E SUHRAWARDY SERVICE ROAD SOUTH G-9 MOUVE AREA G-9/1 ISLAMABAD

120 (Order to make Self assessment)

Name: SHAIKH SHARAB KHAN Registration No 5650318312901

Address: House No 01, Street No 01, Abdullah Shah Town Khan Tax Year : 2018

Dhak, Islamabad Islamabad Rural Period : 01-Jul-2017 - 30-Jun-2018

Medium : System

Contact No: 00923155088986 Due Date : 25-Oct-2018

Document Date 25-Oct-2018

Inadmissible / Admissible Deductions

Amount

Exempt from Amount

Description Code Total Amount Tax / Subject Subject to

to Fixed / Normal Tax

Final Tax

Tax Amortization for Current Year 3247 0.00 0.00 0.00

Tax Depreciation / Initial Allowance for Current Year 3248 0.00 0.00 0.00

Adjustments

Amount

Exempt from Amount

Description Code Total Amount Tax / Subject Subject to

to Fixed / Normal Tax

Final Tax

Income / (Loss) from Business before adjustment of

Admissible Depreciation / Initial Allowance / Amortization 3270 0.00 0.00 322,000.00

for current / previous years

Business Assets / Equity / Liabilities

Description Code Amount

Total Equity / Liabilities 3399 0.00 0.00 0.00

Capital 3352 0.00 0.00 0.00

Computations

Amount

Exempt from Amount

Description Code Total Amount Tax / Subject Subject to

to Fixed / Normal Tax

Final Tax

Income / (Loss) from Business 3000 322,000.00 0.00 322,000.00

Total Income 9000 0.00 0.00 322,000.00

Taxable Income 9100 0.00 0.00 322,000.00

Attributes

Attribute Value

Decision Granted / Accepted

Business Sector-1 Other - Building Construction

Page 2 of 3 Printed on Tue, 30 Oct 2018 11:18:46

RTO ISLAMABAD, 20 KHAYABAN E SUHRAWARDY SERVICE ROAD SOUTH G-9 MOUVE AREA G-9/1 ISLAMABAD

120 (Order to make Self assessment)

Name: SHAIKH SHARAB KHAN Registration No 5650318312901

Address: House No 01, Street No 01, Abdullah Shah Town Khan Tax Year : 2018

Dhak, Islamabad Islamabad Rural Period : 01-Jul-2017 - 30-Jun-2018

Medium : System

Contact No: 00923155088986 Due Date : 25-Oct-2018

Document Date 25-Oct-2018

Muhammad Ashraf Khan

Assistant / Deputy Commissioner

Inland Revenue, Unit-V, Range-West, Zone-West

RTO ISLAMABAD, 20 KHAYABAN E SUHRAWARDY SERVICE ROAD SOUTH G-9 MOUVE AREA G-9/1

ISLAMABAD

Page 3 of 3 Printed on Tue, 30 Oct 2018 11:18:47

RTO ISLAMABAD, 20 KHAYABAN E SUHRAWARDY SERVICE ROAD SOUTH G-9 MOUVE AREA G-9/1 ISLAMABAD

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Essence of Success - Earl NightingaleDocument2 pagesThe Essence of Success - Earl NightingaleDegrace Ns40% (15)

- Intermediate Accounting Testbank 2Document419 pagesIntermediate Accounting Testbank 2SOPHIA97% (30)

- Leyte Geothermal v. PNOCDocument3 pagesLeyte Geothermal v. PNOCAllen Windel BernabeNo ratings yet

- Financial ManagementDocument21 pagesFinancial ManagementsumanNo ratings yet

- SC invalidates Ordinance allowing oil depots in Pandacan due to population densityDocument2 pagesSC invalidates Ordinance allowing oil depots in Pandacan due to population densityMigs Raymundo100% (1)

- 1 Regions Region - Id Number 22 N P: Column - Id Table - Name Column - Name Data - Type Data - Length Null KEYDocument1 page1 Regions Region - Id Number 22 N P: Column - Id Table - Name Column - Name Data - Type Data - Length Null KEYSubhan khanNo ratings yet

- Ogden 2018 IPP ToneShift VoRDocument21 pagesOgden 2018 IPP ToneShift VoRSubhan khanNo ratings yet

- Ogden 2018 IPP ToneShift VoRDocument21 pagesOgden 2018 IPP ToneShift VoRSubhan khanNo ratings yet

- Ogden 2018 IPP ToneShift VoRDocument21 pagesOgden 2018 IPP ToneShift VoRSubhan khanNo ratings yet

- Current AFfairs MCQs 2018Document39 pagesCurrent AFfairs MCQs 2018Subhan khanNo ratings yet

- VBScriptDocument120 pagesVBScriptdhanaji jondhaleNo ratings yet

- 702190-Free PowerPoint Template AmazonDocument1 page702190-Free PowerPoint Template AmazonnazNo ratings yet

- AssDocument9 pagesAssJane SalvanNo ratings yet

- Company Profi Le: IHC HytopDocument13 pagesCompany Profi Le: IHC HytopHanzil HakeemNo ratings yet

- Unit 13 AminesDocument3 pagesUnit 13 AminesArinath DeepaNo ratings yet

- Using The Marketing Mix Reading Comprenhension TaskDocument17 pagesUsing The Marketing Mix Reading Comprenhension TaskMonica GalvisNo ratings yet

- PDS-1st PageDocument1 pagePDS-1st PageElmer LucreciaNo ratings yet

- Bolsas Transfer FKDocument7 pagesBolsas Transfer FKBelèn Caridad Nelly Pajuelo YaipènNo ratings yet

- Tutorial Manual Safi PDFDocument53 pagesTutorial Manual Safi PDFrustamriyadiNo ratings yet

- Market Participants in Securities MarketDocument11 pagesMarket Participants in Securities MarketSandra PhilipNo ratings yet

- Nmea Components: NMEA 2000® Signal Supply Cable NMEA 2000® Gauges, Gauge Kits, HarnessesDocument2 pagesNmea Components: NMEA 2000® Signal Supply Cable NMEA 2000® Gauges, Gauge Kits, HarnessesNuty IonutNo ratings yet

- 10 Appendix RS Means Assemblies Cost EstimationDocument12 pages10 Appendix RS Means Assemblies Cost Estimationshahbazi.amir15No ratings yet

- Telangana Budget 2014-2015 Full TextDocument28 pagesTelangana Budget 2014-2015 Full TextRavi Krishna MettaNo ratings yet

- Final Project Report: Uop, LLCDocument165 pagesFinal Project Report: Uop, LLCSiddharth KishanNo ratings yet

- ETP Research Proposal Group7 NewDocument12 pagesETP Research Proposal Group7 NewlohNo ratings yet

- Factors Affecting Employee Turnover and Job Satisfaction A Case Study of Amari Hotels and Resorts Boondarig Ronra and Assoc. Prof. Manat ChaisawatDocument26 pagesFactors Affecting Employee Turnover and Job Satisfaction A Case Study of Amari Hotels and Resorts Boondarig Ronra and Assoc. Prof. Manat ChaisawathumeragillNo ratings yet

- Spain Price List With VatDocument3 pagesSpain Price List With Vatsanti647No ratings yet

- Iqvia PDFDocument1 pageIqvia PDFSaksham DabasNo ratings yet

- Stage 1 Isolating Boiler Feed Pump 1. PurposeDocument3 pagesStage 1 Isolating Boiler Feed Pump 1. Purposejoseph kamwendoNo ratings yet

- Philippines Taxation Scope and ReformsDocument4 pagesPhilippines Taxation Scope and ReformsAngie Olpos Boreros BaritugoNo ratings yet

- AB InBev Code of Business Conduct PDFDocument10 pagesAB InBev Code of Business Conduct PDFcristian quelmis vilca huarachiNo ratings yet

- Top Machine Learning ToolsDocument9 pagesTop Machine Learning ToolsMaria LavanyaNo ratings yet

- Vitamin D3 5GDocument7 pagesVitamin D3 5GLuis SuescumNo ratings yet

- Career Guidance Activity Sheet For Grade IiDocument5 pagesCareer Guidance Activity Sheet For Grade IiJayson Escoto100% (1)

- Bajaj 100bDocument3 pagesBajaj 100brmlstoreNo ratings yet