Professional Documents

Culture Documents

La Suerte V CA

Uploaded by

Mizelle AloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

La Suerte V CA

Uploaded by

Mizelle AloCopyright:

Available Formats

La Suerte v CA

Facts:

Th i s c a s e i n vo l v e s t h e t a x a b i l i t y o f s t e m me d l e a f t o b a c c o i mp o r t e d a n d l o c a l l ypurchased by La

S u e r t e C i g a r & C i g a r e t t e F a c t o r y f o r u s e a s r a w m a t e r i a l i n t h e manufacture of their cigarettes. Stemmed

leaf tobacco, as herein used means leaftobacco which has had the stem or midrib removed.O n J a n u a r y 1 2 , 1 9 9 0 , L a

S u e r t e p r o t e s t e d t h e e x c i s e t a x d e f i c i e n c y a s s e s s m e n t stressing that the BIR assessment was based solely on Section

141(b) of the Tax Code,“ p a r t i a l l y p r e p a r e d o r m a n u f a c t u r e d t o b a c c o i s s u b j e c t t o s p e c i f i c t a x . ”

W i t h o u t , however, applying Section 137 thereof, the more specific provision, which expresslyallows the sale of

stemmed leaf tobacco as raw material by one manufacturer directly toanother without payment of the excise tax. However, in a

letter, dated August 31, 1990,Commissioner Jose U. Ong denied La Suerte’s protest, insisting that stemmed

leaftobacco is subject to excise tax "unless there is an express grant of exemption from thepayment of tax."

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- RR No. 12-2018: New Consolidated RR on Estate Tax and Donor's TaxDocument20 pagesRR No. 12-2018: New Consolidated RR on Estate Tax and Donor's Taxjune Alvarez100% (1)

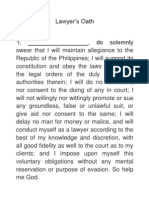

- Lawyer's OathDocument1 pageLawyer's OathKukoy PaktoyNo ratings yet

- Chavez V JBC DigestDocument1 pageChavez V JBC DigestMizelle AloNo ratings yet

- Criminal-Law BAR SYLLABUS 2020 - 2021Document3 pagesCriminal-Law BAR SYLLABUS 2020 - 2021Mizelle AloNo ratings yet

- Remedial-Law BAR SYLLABUS 2020 - 21Document19 pagesRemedial-Law BAR SYLLABUS 2020 - 21Mizelle AloNo ratings yet

- Crim Law Bar Q 2019Document7 pagesCrim Law Bar Q 2019Mizelle AloNo ratings yet

- Crimpro BQ 1Document1 pageCrimpro BQ 1Mizelle AloNo ratings yet

- Bar Exam Syllabus Guide for Political and International LawDocument9 pagesBar Exam Syllabus Guide for Political and International LawJerome BrusasNo ratings yet

- Political Law Bar Qs 2018Document8 pagesPolitical Law Bar Qs 2018Mizelle AloNo ratings yet

- Labor-Law BAR SYLLABUS 2020 - 21Document5 pagesLabor-Law BAR SYLLABUS 2020 - 21Mizelle AloNo ratings yet

- Taxation Law SyllabusDocument10 pagesTaxation Law SyllabusLost StudentNo ratings yet

- Methods of Interpreting The ConstitutionDocument1 pageMethods of Interpreting The ConstitutionMizelle AloNo ratings yet

- Tax 2 Case DigestDocument3 pagesTax 2 Case DigestMizelle AloNo ratings yet

- Manglapus and Pontejos DigestDocument1 pageManglapus and Pontejos DigestMizelle AloNo ratings yet

- Dimaporo Mitra Digest LegisDocument1 pageDimaporo Mitra Digest LegisMizelle AloNo ratings yet

- People V Jalosjos Digest LegisDocument1 pagePeople V Jalosjos Digest LegisMizelle AloNo ratings yet

- Jimenez V Cabangbang Digest LegisDocument1 pageJimenez V Cabangbang Digest LegisMizelle AloNo ratings yet

- Villanueva V JCB PDFDocument1 pageVillanueva V JCB PDFMizelle AloNo ratings yet

- Ocampo V Hret Digest LegisDocument1 pageOcampo V Hret Digest LegisMizelle AloNo ratings yet

- Locus Standi Denr V League of ProvincesDocument1 pageLocus Standi Denr V League of ProvincesMizelle AloNo ratings yet

- Pontejos V Ombudsman DigestDocument1 pagePontejos V Ombudsman DigestMizelle AloNo ratings yet

- Akbayan V Aquino Digest IIDocument1 pageAkbayan V Aquino Digest IIMizelle AloNo ratings yet

- Biraogo V Truth Commission DigestDocument1 pageBiraogo V Truth Commission DigestMizelle AloNo ratings yet

- Neri V Senate DigestDocument1 pageNeri V Senate DigestMizelle AloNo ratings yet

- Banda V Ermita DigestDocument1 pageBanda V Ermita DigestMizelle AloNo ratings yet

- 1) Transfield Philippines, Inc. vs. Luzon Hydro CorporationDocument32 pages1) Transfield Philippines, Inc. vs. Luzon Hydro CorporationresjudicataNo ratings yet

- Neri V Senate DigestDocument1 pageNeri V Senate DigestMizelle AloNo ratings yet

- 1 Marcos Vs Manglapus DigestDocument1 page1 Marcos Vs Manglapus DigestMizelle AloNo ratings yet

- Pontejos V Ombudsman DigestDocument1 pagePontejos V Ombudsman DigestMizelle AloNo ratings yet