Professional Documents

Culture Documents

LAB 3 - Analyzing Stock Investments

Uploaded by

Firda Zhafirah0 ratings0% found this document useful (0 votes)

19 views3 pagesThis document discusses a lab assignment on stock investments. It includes multiple choice questions, short essay questions, and a grand essay. The grand essay addresses allocating excess cost over book value of an investment to identifiable assets, calculating income from the investment, and the year-end balance of the investment account through journal entries. It provides examples of allocating excess cost to specific assets and liabilities acquired and recording amortization entries over their useful lives.

Original Description:

Solusi Latihan Stock Investment

Original Title

Solusi Latihan Stock Investment

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses a lab assignment on stock investments. It includes multiple choice questions, short essay questions, and a grand essay. The grand essay addresses allocating excess cost over book value of an investment to identifiable assets, calculating income from the investment, and the year-end balance of the investment account through journal entries. It provides examples of allocating excess cost to specific assets and liabilities acquired and recording amortization entries over their useful lives.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views3 pagesLAB 3 - Analyzing Stock Investments

Uploaded by

Firda ZhafirahThis document discusses a lab assignment on stock investments. It includes multiple choice questions, short essay questions, and a grand essay. The grand essay addresses allocating excess cost over book value of an investment to identifiable assets, calculating income from the investment, and the year-end balance of the investment account through journal entries. It provides examples of allocating excess cost to specific assets and liabilities acquired and recording amortization entries over their useful lives.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

LAB 3 – STOCK INVESTMENT FATA 2015

LAB 3

STOCK INVESTMENT

SOLUTION

I. Multiple Choice

1. d

2. d

3. b

4. b

5. b

II. Mini Essay

1.a

Total FATA Co. Common Stock’s after acquisition = 60.000 shares + 20.000 shares =

80.000 Shares

FITI Co. Percentage ownership = (20.000 shares/80.000 shares) × 100% = 25%

1.b

Goodwill = Investment Cost – Book Value of Equity

= $600.000 – (($1.200.000 + $600.000) × 25%)

= $600.000 - $450.000

= $150.000

2.a dan 2.b

2.a Fair Value/Cost Method 2.b Equity Method

To record investment

Investment in Moon Co $8.000 Investment in Moon Co $8.000

Cash $8.000 Cash $8.000

To record Dividend ($400.000 x 50%)

Cash $200.000 Cash $200.000

Dividend Income $200.000 Investment in Moon Co. $200.000

To recognize earnings ($800.000 x 50%)

Investment in Moon Co. $400.000

No entry

Income from Moon Co. $400.000

3. Income from Silver Co. for 2018

Net Income of Silver Co = Retained Earnings 2018 – Retained Earnings 2017 +

Dividend

= $625.000 – $500.000 + $125.000

= $250.000

Income from Silver Co. = $250.000 x 30% = $75.000

FAQIH – HANIFA – IRMAYANTI - JHOICE 1

LAB 3 – STOCK INVESTMENT FATA 2015

III. Grand Essay

1. Schedule to allocating excess of cost over book value (in $)

Investment in Tremor Co. 3,780,000

BV of interest acquired ($8.775.000 × 30%) 2.632.500

Total Excess of cost over BV 1.147.500

Assignment to identifiable net asset (in $000):

Net Asset FV BV % Acquired Amount

Inventories 2700 2250 135

Land 3.825 2.025 540

- × =

Buildings-net 4.500 3.375 30% 337,5

Equipment-net 1.125 2.700 (472,5)

Bonds Payable 2.475 2.250 (67.5)

Total assigned to net identifiable asset 472,5

Remainder assigned to goodwill 675

Total Excess od cost over book value acquired 1.147,5

2. FATA’s income from Tremor for 2018 (in $000)

Amount

Equity in Tremor reported income (2.700 x 30%) 810

Amortization of excess cost over BV:

Inventories (sold) (135)

Buildings-net (337.5/10 years) (33.75)

Equipment-net (472.5/7 years) 67.5

Bonds Payable (67.5/5 years) 13.5

Income from Tremor 722.25

3. Investment in Tremor balance December 31, 2108 (in$000)

Amount

Investment Cost 3,780

Add : Income from Tremor 722.25

Less : Dividends ($1.350.000 x 30%) 405

Investment in Tremor December 31, 2018 4.097.25

4. Journal Entries

Journal to record investment in Tremor

Investment in Tremor $3.780.000

Cash $3.780.000

Journal to record dividend

Cash $405.000

Investment in Tremor $405.000

FAQIH – HANIFA – IRMAYANTI - JHOICE 2

LAB 3 – STOCK INVESTMENT FATA 2015

Journal to record income from Tremor

Investment in Tremor $810.000

Income from Tremor $810.000

Journal to record writte-off of excess allocated to Inventory

Income from Tremor $135.000

Investment in Tremor $135.000

Journal to record depreciation or excess allocated to undervalued buildings with

10 years remaining useful life

Income from Tremor $33.750

Investment in Tremor $33.750

Journal to record depreciation or excess allocated to overvalued equipment with

10 years remaining useful life

Investment in Tremor $67.500

Income from Tremor $67.500

Journal to record amortization of bonds payable

Investment in Tremor $13.500

Income from Tremor $13.500

FAQIH – HANIFA – IRMAYANTI - JHOICE 3

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Tugas 10Document3 pagesTugas 10Reyhan ArioNo ratings yet

- Get Rich with Dividends: A Proven System for Earning Double-Digit ReturnsFrom EverandGet Rich with Dividends: A Proven System for Earning Double-Digit ReturnsNo ratings yet

- BKM 10e Chap014Document8 pagesBKM 10e Chap014jl123123No ratings yet

- Advanced Accounting ProblemsDocument6 pagesAdvanced Accounting ProblemsAgatha de CastroNo ratings yet

- Wealth of Experience: Real Investors on What Works and What Doesn'tFrom EverandWealth of Experience: Real Investors on What Works and What Doesn'tNo ratings yet

- Jawaban Review Uts Inter 2 - FixDocument8 pagesJawaban Review Uts Inter 2 - FixCaratmelonaNo ratings yet

- Invest Like a Fox... Not Like a Hedgehog: How You Can Earn Higher Returns With Less RiskFrom EverandInvest Like a Fox... Not Like a Hedgehog: How You Can Earn Higher Returns With Less RiskNo ratings yet

- Tugas AKL 1 TM 9Document8 pagesTugas AKL 1 TM 9Dila PujiNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Final Test - AnswersDocument6 pagesFinal Test - Answersnguyễn hiềnNo ratings yet

- MGMT AssignmentDocument79 pagesMGMT AssignmentLuleseged Gebre100% (1)

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- Problem 8-9 Akl 2Document4 pagesProblem 8-9 Akl 2andi nanaNo ratings yet

- Tutorial 6 For Instructor PDFDocument5 pagesTutorial 6 For Instructor PDFsherynNo ratings yet

- Advance Financial Accounting and ReportingDocument25 pagesAdvance Financial Accounting and ReportingEmma Mariz GarciaNo ratings yet

- A. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CDocument23 pagesA. Corporate Reorganization: 1.A 6.B 11.D 16.A 2.C 7.C 12.C 17.C 3.D 8.D 13.C 18.B 4.B 9.B 14.C 19.D 5.A 10.D 15.A 20.CHilario, Jana Rizzette C.No ratings yet

- Tugas Akm Ii Pertemuan 10Document5 pagesTugas Akm Ii Pertemuan 10Alisya UmariNo ratings yet

- Online Ass Advance Acc NEWDocument6 pagesOnline Ass Advance Acc NEWRara Rarara30No ratings yet

- Ch.2 Stock Investments: Investor Accounting and ReportingDocument29 pagesCh.2 Stock Investments: Investor Accounting and ReportingAdrian ChrisceydiNo ratings yet

- Investments in Equity Securities Problems (Victoria Corporation) Year 1Document12 pagesInvestments in Equity Securities Problems (Victoria Corporation) Year 1Xyza Faye Regalado100% (2)

- Chapter17 BuenaventuraDocument8 pagesChapter17 BuenaventuraAnonnNo ratings yet

- Chapter 4Document6 pagesChapter 4HelloWorldNowNo ratings yet

- Advance Financial Accounting Solutions - Chapter 2Document6 pagesAdvance Financial Accounting Solutions - Chapter 2haidaNo ratings yet

- Intermediate Accounting Unit4 - Topic4Document8 pagesIntermediate Accounting Unit4 - Topic4Lea Polinar100% (1)

- Date Account Titles & Explanation Debit Credit: A. Prepare EntriesDocument4 pagesDate Account Titles & Explanation Debit Credit: A. Prepare Entriesyogi fetriansyahNo ratings yet

- AmortizationDocument2 pagesAmortizationBuenaventura, Elijah B.No ratings yet

- Akuntansi Keuangan Lanjutan 2Document6 pagesAkuntansi Keuangan Lanjutan 2Marselinus Aditya Hartanto TjungadiNo ratings yet

- For Classroom Discussion: SolutionDocument4 pagesFor Classroom Discussion: SolutionMisherene MagpileNo ratings yet

- Excel Academy Financial StatementsDocument5 pagesExcel Academy Financial Statementsfaith olaNo ratings yet

- B326 MTA Fall 2017-2018 MGLDocument7 pagesB326 MTA Fall 2017-2018 MGLmjlNo ratings yet

- Materi Lab 3 - Stock Investment PDFDocument4 pagesMateri Lab 3 - Stock Investment PDFPUTRI YANINo ratings yet

- Chapter16 BuenaventuraDocument11 pagesChapter16 BuenaventuraAnonn100% (1)

- Investments in Financial Instruments CompleteDocument34 pagesInvestments in Financial Instruments CompleteDenise CruzNo ratings yet

- Consolidation Q74Document4 pagesConsolidation Q74johny SahaNo ratings yet

- Chapter 14 AssociatesDocument15 pagesChapter 14 AssociatesChristian James RiveraNo ratings yet

- Solution Test 2 (1) June 19Document5 pagesSolution Test 2 (1) June 19Nur Dina AbsbNo ratings yet

- Dr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Document3 pagesDr. ($) Cr. ($) Dr. ($) Cr. ($) Dr. ($) Cr. ($)Ishrat Jahan PapiyaNo ratings yet

- Hospitality Financial Accounting 2Nd Edition Weygandt Solutions Manual Full Chapter PDFDocument33 pagesHospitality Financial Accounting 2Nd Edition Weygandt Solutions Manual Full Chapter PDFJeremyMitchellkgaxp100% (10)

- Hospitality Financial Accounting 2nd Edition Weygandt Solutions ManualDocument12 pagesHospitality Financial Accounting 2nd Edition Weygandt Solutions Manualasbestinepalama3rzc6100% (21)

- Ass 4Document14 pagesAss 4Beza AbrNo ratings yet

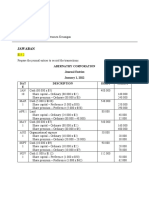

- Jawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditDocument6 pagesJawaban: Abernathy Corporation Journal Entries January 1, 2022 DAT E Description Debit CreditChupa HesNo ratings yet

- Quiz Advanced Accounting 2 - Anggelina Ariresta 008201900008Document4 pagesQuiz Advanced Accounting 2 - Anggelina Ariresta 008201900008anggelina arirestaNo ratings yet

- BACC1 Group Work-Fafa and BlewuDocument3 pagesBACC1 Group Work-Fafa and Blewuisaacbediako82No ratings yet

- ACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2Document14 pagesACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2accounts 3 lifeNo ratings yet

- Tugas Chapter 6 - Sandra Hanania - 120110180024Document4 pagesTugas Chapter 6 - Sandra Hanania - 120110180024Sandra Hanania PasaribuNo ratings yet

- Dollar Amounts in Thousands: Balance SheetDocument1 pageDollar Amounts in Thousands: Balance SheetJai Bhushan BharmouriaNo ratings yet

- Solutions For Notes and Loans ReceivableDocument4 pagesSolutions For Notes and Loans ReceivableKenaniah SanchezNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (60)

- Fath Abdul Azis - A031211044Document6 pagesFath Abdul Azis - A031211044Fath Abdul AzisNo ratings yet

- Principles of Accounting 12th Edition Needles Solutions ManualDocument26 pagesPrinciples of Accounting 12th Edition Needles Solutions Manualmodelerdativelygb7100% (30)

- Acct 3533 F'19 CH 3 Class Ex Equity Method W - SolutionDocument8 pagesAcct 3533 F'19 CH 3 Class Ex Equity Method W - SolutionFiona TaNo ratings yet

- Aa2 - Chapter 3 Suggested Answers: Exercises Exercise 3 - 1Document14 pagesAa2 - Chapter 3 Suggested Answers: Exercises Exercise 3 - 1Mary Joy BalangcadNo ratings yet

- Dave Chapter 9Document11 pagesDave Chapter 9Mark Dave SambranoNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Chapter 15 Part 2Document8 pagesChapter 15 Part 2Mauren putri SalendaNo ratings yet

- CH 11 - CF Estimation Mini Case Sols Excel 14edDocument36 pagesCH 11 - CF Estimation Mini Case Sols Excel 14edأثير مخوNo ratings yet

- Alternative Investments Angus Cartwright, JR Case AnalysisDocument9 pagesAlternative Investments Angus Cartwright, JR Case Analysissharanya86No ratings yet

- Consolidation - Cost vs. Equity MethodDocument8 pagesConsolidation - Cost vs. Equity MethodzaounxosakubNo ratings yet

- Currency Future & Option For StudentsDocument8 pagesCurrency Future & Option For StudentsAmit SinhaNo ratings yet

- Darden Resumes BookDocument48 pagesDarden Resumes BookSaurabh KhatriNo ratings yet

- Mahindra Finance Annual Report 2018 19 PDFDocument347 pagesMahindra Finance Annual Report 2018 19 PDFadoniscalNo ratings yet

- Chapter 6 Slides - Orange Coloured Slides Slide 1Document7 pagesChapter 6 Slides - Orange Coloured Slides Slide 1MartinNo ratings yet

- Business Plan LengkapDocument85 pagesBusiness Plan Lengkapzul_zamoska69100% (2)

- Multinational CorporationsDocument8 pagesMultinational Corporationsmanindersingh949No ratings yet

- Income Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Document1 pageIncome Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Star RamirezNo ratings yet

- Group 10-Mexican Peso CrisisDocument10 pagesGroup 10-Mexican Peso CrisisTianqi LiNo ratings yet

- Homework 5 SolutionDocument3 pagesHomework 5 SolutionalstonetNo ratings yet

- Tough LekkaluDocument42 pagesTough Lekkaludeviprasad03No ratings yet

- D9Document11 pagesD9Saida MolinaNo ratings yet

- Other Long Term InvestmentsDocument1 pageOther Long Term InvestmentsShaira MaguddayaoNo ratings yet

- Research Paper Small and Medium Scale BusinessDocument16 pagesResearch Paper Small and Medium Scale BusinessMusa0% (1)

- Syllabus Wealth ManagementDocument4 pagesSyllabus Wealth Managementsachin choudharyNo ratings yet

- Tax Nirc PDFDocument93 pagesTax Nirc PDFHeber BacolodNo ratings yet

- Orchard Projections (Imperial Units)Document11 pagesOrchard Projections (Imperial Units)Chandler OrchardsNo ratings yet

- Global Securities Operations - An IntroductionDocument2 pagesGlobal Securities Operations - An IntroductionMd Zahid HussainNo ratings yet

- Portfolio SelectionDocument6 pagesPortfolio SelectionAssfaw KebedeNo ratings yet

- Questions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyDocument22 pagesQuestions 1 - 6 Pertain To The Case Study Each Question Should Be Answered IndependentlyNoura ShamseddineNo ratings yet

- The Multiplier Model ExplainedDocument35 pagesThe Multiplier Model ExplainedannsaralondeNo ratings yet

- Hospital Services Market IndiaDocument3 pagesHospital Services Market IndiaVidhi BuchNo ratings yet

- Real Estate Marketplace - July 2015Document44 pagesReal Estate Marketplace - July 2015The Lima NewsNo ratings yet

- National Income EquilibriumDocument14 pagesNational Income EquilibriumAli zizoNo ratings yet

- Cost of Sales Narrative: Inventory PurchaseDocument3 pagesCost of Sales Narrative: Inventory PurchaseCaterina De LucaNo ratings yet

- MIASSEIDocument14 pagesMIASSEICrystal HillNo ratings yet

- Tax CodeDocument160 pagesTax CodeMark Anthony ManuelNo ratings yet

- Ca2016 GR8Document113 pagesCa2016 GR8Rajesh KarNo ratings yet

- DemonstraDocument104 pagesDemonstraJBS RINo ratings yet

- Financial Accounting Fundamentals: John J. Wild 2009 EditionDocument39 pagesFinancial Accounting Fundamentals: John J. Wild 2009 EditionKhvichaKopinadze100% (1)

- NVP, Arr, MNPVDocument64 pagesNVP, Arr, MNPVSaad Bin AslamNo ratings yet