Professional Documents

Culture Documents

Analyzing front-loaded earnings project NPV IRR

Uploaded by

Thùyy VyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analyzing front-loaded earnings project NPV IRR

Uploaded by

Thùyy VyCopyright:

Available Formats

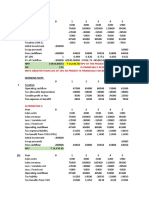

Exercise1:

ANALYZING A PROJECT WITH FRONT-LOADED EARNINGS

Wind Power Inc. builds and operates wind farms that generate electrical power using windmills.

The firm has wind farms throughout the Southwest, including Texas, New Mexico, and

Oklahoma. In the spring of 2015, the firm was considering an investment in a new monitoring

system that costs $6 million per wind farm to install. The new system is expected to contribute

to firm EBITDA via annual savings of $4.25 million in Year 1, $2.9 million in Year 2, and $1 million

in Year 3.

Wind Power’s chief financial officer is interested in investing in the new system but is concerned

that the savings from the system are such that the immediate impact of the project is so

accretive to the firm’s earnings that the individual unit managers will adopt the investment even

though it may not be expected to earn a positive NPV. Moreover, the firm has just moved to an

economic profit–based bonus system, and the CFO fears that the project may also make the

individual economic profits improve dramatically in the short term—a development that would

provide an added incentive for the wind-farm managers to take on the project.

a. Calculate the project’s expected NPV and IRR, assuming that the cost of capital for the project

is 15%, the firm faces a 30% marginal tax rate, it uses straight-line depreciation for the new

investment over a three-year project life, and it has a zero salvage value.

b. Calculate the annual economic profits for the investment for Years 1 through 3. What is the

present value of the annual economic profit measures discounted using the project’s cost of

capital? What potential problems do you see for the project?

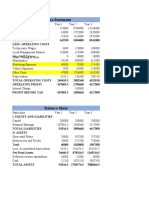

Excercise 2:

ECONOMIC PROFIT AND NPV

Steele Electronics is considering investing in a new component that requires a $100,000 investment in

new capital equipment, as well as additional net working capital. The investment is expected to

provide cash flows over the next five years. The anticipated earnings and project free cash flows for

the investment are found in the table below.

a. Assuming a project cost of capital of 11.24%, calculate the project’s NPV and IRR.

b. Steele is considering the adoption of economic profit as a performance evaluation tool. Calculate

the project’s annual economic profit using the invested capital figures found in the table. How are your

economic profit estimates related to project’s NPV?

c. How would your assessment of the project’s worth be affected if the economic profits in 2016

and 2017 were both negative? (No calculations required.)

Project pro-forma income statement

2016 2017 2018 2019 2020

Revenues 100000 105000 110250 115763 121551

Less: COGS -40000 -42000 -44100 -46305 -48620

Gross Profit 60000 63000 66150 69458 72930

Less: Oper. -20000 -21000 -22050 -23153 -24310

Exp

Less: Dep. -20000 -20000 -20000 -20000 -20000

Exp.

Net Oper. 20000 22000 24100 26305 28620

Income

Less: Int. Exp -3200 -3200 -3200 -3200 -3200

Earnings 16800 18800 20900 23105 25420

before tax

Less: tax -5040 -5640 -6270 -6932 -7626

Net income 11760 13160 14630 16173 17794

Project Free cash flows

2015 2016 2017 2018 2019 2020

Net Oper. 20000 22000 24100 26305 28620

Inc.

Less: taxes -6000 -6600 -7230 -7892 -8586

NOPAT 14000 15400 16870 18414 20034

Plus: 20000 20000 20000 20000 20000

depreciation

Less: CAPEX -100000

Less: change -5000 -250 -263 -276 -289 6078

in net

working

capital

Project free -105000 33750 35138 36594 38124 46112

cash flow

Invested 105000 85250 65513 45788 26078

capital

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Financial WorksheetDocument4 pagesFinancial WorksheetCarla GonçalvesNo ratings yet

- The Financial Model: InputDocument4 pagesThe Financial Model: InputCarla GonçalvesNo ratings yet

- Assignment 3-IndividualDocument5 pagesAssignment 3-IndividualAva MedNo ratings yet

- Income StatementDocument3 pagesIncome StatementBiswajit SarmaNo ratings yet

- Cmie Word FileDocument11 pagesCmie Word FileAniruddha ChakrabortyNo ratings yet

- Keith Corporation Generates Significant Positive Cash FlowsDocument24 pagesKeith Corporation Generates Significant Positive Cash FlowsMaiko KopadzeNo ratings yet

- Form 89(1) Relief CalculatorDocument8 pagesForm 89(1) Relief Calculatorsrinivasallam_259747No ratings yet

- Assignment N3Document12 pagesAssignment N3Maiko KopadzeNo ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- Sample Restaurant Training ProposalDocument7 pagesSample Restaurant Training ProposalSenami ZambaNo ratings yet

- Budgeted Income Statement AnalysisDocument3 pagesBudgeted Income Statement AnalysisAhmad Hafez100% (1)

- "Case Analysis-Cafés Monte Blanco: Building A Profit Plan": Managerial AccountingDocument8 pages"Case Analysis-Cafés Monte Blanco: Building A Profit Plan": Managerial Accountingvipul tutejaNo ratings yet

- Sunset Boards Financial Analysis and Statements for ExpansionDocument4 pagesSunset Boards Financial Analysis and Statements for ExpansionAhsan MubeenNo ratings yet

- NAC Machines: Paper Cup Making Business Start Up Projected Financial ReportDocument6 pagesNAC Machines: Paper Cup Making Business Start Up Projected Financial ReportrijusmitasaikiaNo ratings yet

- Financial ModelDocument6 pagesFinancial ModelMuneeb MateenNo ratings yet

- DocxDocument11 pagesDocxMikey MadRatNo ratings yet

- Load-Shedding CorporationDocument5 pagesLoad-Shedding CorporationSatish KannaujiyaNo ratings yet

- Financial PlanDocument20 pagesFinancial Planzhijaescosio25No ratings yet

- Aqua Pure Water Refilling Station Financial StatementsDocument22 pagesAqua Pure Water Refilling Station Financial StatementsCukeeNo ratings yet

- Bibek Pashu Tatha Machha PalanDocument44 pagesBibek Pashu Tatha Machha PalanBIBUTSAL BHATTARAINo ratings yet

- Alternative 1Document10 pagesAlternative 1Sreyas S KumarNo ratings yet

- Bishnu Pashu Tatha Machha FirmDocument238 pagesBishnu Pashu Tatha Machha FirmBIBUTSAL BHATTARAINo ratings yet

- ACT-202-Report North End PDFDocument11 pagesACT-202-Report North End PDFSoria Zoon HaiderNo ratings yet

- ASSIGNMENT NO.2 (Entrepreneurship)Document9 pagesASSIGNMENT NO.2 (Entrepreneurship)Malik Mughees AwanNo ratings yet

- Analyzing Financial Project Cash Flows and Depreciation Tax BenefitsDocument6 pagesAnalyzing Financial Project Cash Flows and Depreciation Tax BenefitsSpandana AchantaNo ratings yet

- Balance Sheet: With The Assumption We Can Use All The Plants and EquipmentDocument4 pagesBalance Sheet: With The Assumption We Can Use All The Plants and EquipmentPriadarshini Subramanyam DM21B093No ratings yet

- Urban Water PartnersDocument2 pagesUrban Water Partnersutskjdfsjkghfndbhdfn100% (2)

- PSBA REFRESHER TAXATION QUIZDocument10 pagesPSBA REFRESHER TAXATION QUIZEdnalyn CruzNo ratings yet

- Pantagon Beauty Parlor and Cosmetic Shop - FinalDocument14 pagesPantagon Beauty Parlor and Cosmetic Shop - FinalCA Manoj BoraNo ratings yet

- Case study solution: Water company financial projectionsDocument15 pagesCase study solution: Water company financial projectionsRahul Tiwari100% (2)

- Sales and Cost Plan (Income Statement)Document4 pagesSales and Cost Plan (Income Statement)Ramira EdquilaNo ratings yet

- Pre F.chap.5 NewDocument9 pagesPre F.chap.5 NewVee Gabiana GoNo ratings yet

- Delta Project and Repco AnalysisDocument9 pagesDelta Project and Repco AnalysisvarunjajooNo ratings yet

- Analysis: Calculation of Total Sales of The ProjectDocument7 pagesAnalysis: Calculation of Total Sales of The ProjectShailesh Kumar BaldodiaNo ratings yet

- FAM Assignment - Rupasree Dey - 01-20-108Document10 pagesFAM Assignment - Rupasree Dey - 01-20-108Rupasree DeyNo ratings yet

- Market Size: Investment/Major DevelopmentDocument3 pagesMarket Size: Investment/Major DevelopmentManishNo ratings yet

- Urban Water Partners Group ADocument5 pagesUrban Water Partners Group AAman jhaNo ratings yet

- Lab Chapter 17Document5 pagesLab Chapter 17Tran Kim Tram PhanNo ratings yet

- Chapt 17-18 Suyanto - DDocument8 pagesChapt 17-18 Suyanto - DZephyrNo ratings yet

- Beauty Parlour FinalDocument16 pagesBeauty Parlour FinalAbdul Hakim ShaikhNo ratings yet

- Capital Budjeting TechniquesDocument15 pagesCapital Budjeting Techniquesashwin balajiNo ratings yet

- Peony Coffee - Clc62a-V6Document9 pagesPeony Coffee - Clc62a-V6Thuy Duong DONo ratings yet

- Final Assignment ValuationDocument5 pagesFinal Assignment ValuationSamin ChowdhuryNo ratings yet

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument17 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- Profolis Technologies MCS Project, Cost Estimate Sl/No. Discription Up To Dec 2019 Jan-20 Feb-20Document4 pagesProfolis Technologies MCS Project, Cost Estimate Sl/No. Discription Up To Dec 2019 Jan-20 Feb-20Gangadhar BhiwmickNo ratings yet

- Assignment 6.1Document9 pagesAssignment 6.1Abigail ConstantinoNo ratings yet

- SABV Topic 5 QuestionsDocument5 pagesSABV Topic 5 QuestionsNgoc Hoang Ngan NgoNo ratings yet

- FINANCE COMPARISONDocument7 pagesFINANCE COMPARISONNienke OzingaNo ratings yet

- Finance II Cours 8 2021Document53 pagesFinance II Cours 8 2021Fiveer FreelancerNo ratings yet

- Capital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallyDocument14 pagesCapital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallybhaskkarNo ratings yet

- 10-ZamboangaCityWD2018 Part2-Observations and RecommDocument45 pages10-ZamboangaCityWD2018 Part2-Observations and RecommBaliv MozamNo ratings yet

- After-Tax Salvage Value CalculationDocument20 pagesAfter-Tax Salvage Value CalculationSaadNo ratings yet

- Data Analysis of Balance Sheet and Profit & Loss Statement of Bindal Duplex Paper LtdDocument24 pagesData Analysis of Balance Sheet and Profit & Loss Statement of Bindal Duplex Paper LtdSarthakNo ratings yet

- PET E 411 Work Session Oil Field Development Project Sensitivity AnalysisDocument14 pagesPET E 411 Work Session Oil Field Development Project Sensitivity AnalysistwofortheNo ratings yet

- Business Plan: Pfs 3233 - EntreprenuershipDocument19 pagesBusiness Plan: Pfs 3233 - EntreprenuershipAre DamNo ratings yet

- Bsbfim601 Manage Finances Prepare BudgetsDocument9 pagesBsbfim601 Manage Finances Prepare BudgetsAli Butt100% (4)

- Acc 2112: Accounting Theory and Practice Assignment (February 2021)Document6 pagesAcc 2112: Accounting Theory and Practice Assignment (February 2021)Ranson MerciecaNo ratings yet

- Income Statement Format (KTV) To Ediiiiittttttt DarleneDocument25 pagesIncome Statement Format (KTV) To Ediiiiittttttt DarleneDarlene Jade Butic VillanuevaNo ratings yet

- Analyzing front-loaded earnings project NPV IRRDocument3 pagesAnalyzing front-loaded earnings project NPV IRRThùyy Vy0% (1)

- Key Note For MidDocument8 pagesKey Note For MidThùyy VyNo ratings yet

- BC Essays Group HDocument14 pagesBC Essays Group HThùyy VyNo ratings yet

- Annual Report Highlights Vietnam Fund PerformanceDocument19 pagesAnnual Report Highlights Vietnam Fund PerformanceThùyy VyNo ratings yet

- Regression ExamDocument2 pagesRegression ExamAlexandre GumNo ratings yet

- Frequency Distribution, Cross-Tabulation, and Hypothesis TestingDocument4 pagesFrequency Distribution, Cross-Tabulation, and Hypothesis TestingThùyy VyNo ratings yet

- Đề Thi Mẫu Tiếng Anh - HSBCDocument5 pagesĐề Thi Mẫu Tiếng Anh - HSBCThùyy VyNo ratings yet

- 1081 CFAEXAMlv 1Document0 pages1081 CFAEXAMlv 1Hoang VinhNo ratings yet

- Answers To End-Of-Chapter Questions: 2222222 (1) in Your Own Words, Define Multivariate AnalysisDocument9 pagesAnswers To End-Of-Chapter Questions: 2222222 (1) in Your Own Words, Define Multivariate AnalysisThùyy VyNo ratings yet

- Multivariate Data Analysis Chapter 18 MCQDocument7 pagesMultivariate Data Analysis Chapter 18 MCQThùyy VyNo ratings yet

- Session 7 + 8: Correlation and Regression Product Moment Correlation (R) : Measure The Strength of Association BetweenDocument3 pagesSession 7 + 8: Correlation and Regression Product Moment Correlation (R) : Measure The Strength of Association BetweenThùyy VyNo ratings yet

- Bài TậpDocument7 pagesBài TậpThùyy VyNo ratings yet

- Malhotra16 TifDocument11 pagesMalhotra16 TifIsabella MehnazNo ratings yet

- Chapter 15 - Data Preparation and Analysis Strategy: Multiple ChoiceDocument9 pagesChapter 15 - Data Preparation and Analysis Strategy: Multiple ChoiceThùyy VyNo ratings yet

- Answers To End-Of-Chapter Questions: 2222222 (1) in Your Own Words, Define Multivariate AnalysisDocument9 pagesAnswers To End-Of-Chapter Questions: 2222222 (1) in Your Own Words, Define Multivariate AnalysisThùyy VyNo ratings yet

- Note For MidtermDocument2 pagesNote For MidtermThùyy VyNo ratings yet

- Hiếu HiếuDocument2 pagesHiếu HiếuThùyy VyNo ratings yet

- Frequency Distribution, Cross-Tabulation, and Hypothesis TestingDocument4 pagesFrequency Distribution, Cross-Tabulation, and Hypothesis TestingThùyy VyNo ratings yet

- IELTS Writing Task 1 - Bài Mẫu IELTS FighterDocument39 pagesIELTS Writing Task 1 - Bài Mẫu IELTS FighterThùyy VyNo ratings yet

- ChildBook Mother Is Gold Father Is Glass Gender An - Lorelle D Semley PDFDocument257 pagesChildBook Mother Is Gold Father Is Glass Gender An - Lorelle D Semley PDFTristan Pan100% (1)

- An Introduction To TeluguDocument5 pagesAn Introduction To TeluguAnonymous 86cyUE2No ratings yet

- Special Educational Needs, Inclusion and DiversityDocument665 pagesSpecial Educational Needs, Inclusion and DiversityAndrej Hodonj100% (1)

- Narrative On Parents OrientationDocument2 pagesNarrative On Parents Orientationydieh donaNo ratings yet

- Vodafone service grievance unresolvedDocument2 pagesVodafone service grievance unresolvedSojan PaulNo ratings yet

- Vas Ifrs Event enDocument2 pagesVas Ifrs Event enDexie Cabañelez ManahanNo ratings yet

- Housing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodDocument4 pagesHousing Backlog: An Assessment of The Practicality of A Proposed Plan or MethodJoey AlbertNo ratings yet

- PÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Document33 pagesPÉREZ MORALES, E. - Manumission On The Land, Slaves, Masters, and Magistrates in Eighteenth-Century Mompox (Colombia)Mario Davi BarbosaNo ratings yet

- Ola Ride Receipt March 25Document3 pagesOla Ride Receipt March 25Nachiappan PlNo ratings yet

- Asset To LiabDocument25 pagesAsset To LiabHavanaNo ratings yet

- Quicho - Civil Procedure DoctrinesDocument73 pagesQuicho - Civil Procedure DoctrinesDeanne ViNo ratings yet

- Social media types for media literacyDocument28 pagesSocial media types for media literacyMa. Shantel CamposanoNo ratings yet

- Vivarium - Vol 37, Nos. 1-2, 1999Document306 pagesVivarium - Vol 37, Nos. 1-2, 1999Manticora VenerabilisNo ratings yet

- Forest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Document2 pagesForest Economics: Question 1. What Are The Limitations of Applications of Economic Principles in Forestry?Nikhil AgrawalNo ratings yet

- Ngo Burca Vs RP DigestDocument1 pageNgo Burca Vs RP DigestIvy Paz100% (1)

- The Bogey BeastDocument4 pagesThe Bogey BeastMosor VladNo ratings yet

- Pascal, Francine - SVH M 12 The Patmans of Sweet ValleyDocument140 pagesPascal, Francine - SVH M 12 The Patmans of Sweet ValleyClair100% (2)

- Godbolt RulingDocument84 pagesGodbolt RulingAnthony WarrenNo ratings yet

- Mobile Pixels v. Schedule A - Complaint (D. Mass.)Document156 pagesMobile Pixels v. Schedule A - Complaint (D. Mass.)Sarah BursteinNo ratings yet

- Intrepid Group Annual Report 2018Document53 pagesIntrepid Group Annual Report 2018Andre Febrima100% (1)

- Emanel Et - Al Informed Consent Form EnglishDocument6 pagesEmanel Et - Al Informed Consent Form English4w5jpvb9jhNo ratings yet

- Bernardo Motion For ReconsiderationDocument8 pagesBernardo Motion For ReconsiderationFelice Juleanne Lador-EscalanteNo ratings yet

- Alcovy Prom General Information 2018Document2 pagesAlcovy Prom General Information 2018Matthew Anthony PinoNo ratings yet

- WADVDocument2 pagesWADVANNA MARY GINTORONo ratings yet

- 50 Simple Interest Problems With SolutionsDocument46 pages50 Simple Interest Problems With SolutionsArnel MedinaNo ratings yet

- Journalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesDocument24 pagesJournalism of Courage: Wednesday, January 11, 2023, New Delhi, Late City, 24 PagesVarsha YenareNo ratings yet

- Frankfurt Show Daily Day 1: October 16, 2019Document76 pagesFrankfurt Show Daily Day 1: October 16, 2019Publishers WeeklyNo ratings yet

- Rubric for Evaluating Doodle NotesDocument1 pageRubric for Evaluating Doodle NotesMa. Socorro HilarioNo ratings yet

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Document6 pagesBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Doughty IncNo ratings yet

- Surface Chemistry Literature List: Literature On The SubjectDocument5 pagesSurface Chemistry Literature List: Literature On The SubjectMasih SuryanaNo ratings yet