Professional Documents

Culture Documents

Part-B. If More Questions Are Answered, The Last Extra Answers Will Be Ignored

Uploaded by

Raju ReddyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Part-B. If More Questions Are Answered, The Last Extra Answers Will Be Ignored

Uploaded by

Raju ReddyCopyright:

Available Formats

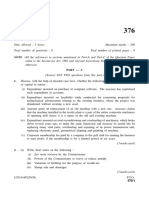

TRANSMISSION CORPORATION OF ANDHRA PRADESH LIMITED

ACCOUNT TEST FOR ASSISTANT ENGINEERS / ADDL. ASST. ENGINEERS

(ELECTRICAL, MECHANICAL AND TELE-COMMUNICATIONS)

PAPER – II (WITH BOOKS) :: JUNE 2005

Books Allowed:

1) A.P.Financial Code Volume-I & Volume-II.

2) A.P.Treasury Code Volume-I.

3) Accounts Code Volume-III.

4) APSEB Commercial Accounts Manual Part-II Stores Accounts.

5) Board Pension Rules including Liberalised Pension Rules & Family Pension Rules.

6) Workmen’s Compensation Act & Rules.

7) Factories Act & Rules

Note:- 1) Candidate should answer all Questions from Part-A & 5 (five) Questions from

Part-B. If more Questions are answered, the last extra answers will be ignored.

2) Parts of the same Questions should be answered together and must not be

interposed by answers to the other Questions.

3) Marks will be deducted for bad hand writing & overwriting on Numericals.

4) Authority to be quoted in support of answers wherever necessary.

PART - A

I) Write short notes on any 5 (five) of the following :- (10)

a) Travelling Allowance bill.

b) Temporary Advance account

c) Requisitions.

d) Recovery of amounts attached by court.

e) Joint liability of employers.

f) Execution of Agreement.

g) Time expired cheque.

h) Revolving Machinery.

i) Service Book.

j) Retiring Pension.

II) Explain about “Stock Verification” and as to how the differences are adjusted ? (10)

III) What are the amenities to be provided by the management of the factory to safeguard the

health of workers and explain briefly ? (10)

IV) Explain the procedure about “Distribution of Compensation to workman”. (10)

V) Describe the procedure to be followed for drawal of First pay and arrears bill of a Government

Servant. (10)

PART - B

VI) Write short notes on the following :- (10)

a) Imprest Stores.

b) Acceptance of Tenders.

c) Suspense Account.

d) Lapse of retirement Gratuity.

e) Cancelled cheque.

VII) What is the liability of Employer ? and explain as to when employer is not liable for payment of

Workmen’s Compensation. (10)

VIII) Explain about Fixing of percentage for Stores Transport, handling charges and pricing of

receipts in stores. (10)

IX) What are the welfare measures to be provided by the management in the factory ?

(10)

X) Explain the procedure for “Disbursement of Pay and Allowances” of a Government Servant ?

(10)

XI) Comment on “Control of Contingent expenditure against appropriation” (10)

XII) Calculate the Pension, Retirement Gratuity, Commuted Value and Family Pension admissible to

a employer of AP Transco as per particulars given below :- (10)

a) His date of birth - 01-01-1946

b) Date of joining - 28-04-1966

c) Date of Superannuation - 31-12-2004

d) Pay drawn as on 31-12-2004 was Rs.18,000/-

e) Commuted value Rs.125.52.

You might also like

- 2018 Acconts Paper TheoryDocument2 pages2018 Acconts Paper TheoryHmingsangliana HauhnarNo ratings yet

- Accounts 11th Class Sample PaperDocument8 pagesAccounts 11th Class Sample PaperVineet SinghNo ratings yet

- Economic and LabourDocument7 pagesEconomic and Labourmca_javaNo ratings yet

- AAO Paper 1 2022Document5 pagesAAO Paper 1 2022Baskar ANgadeNo ratings yet

- Inter P-5 New Dec-10 PaperDocument6 pagesInter P-5 New Dec-10 PaperBrowse PurposeNo ratings yet

- Accounting AndFinancial Management 2015-16Document4 pagesAccounting AndFinancial Management 2015-16Ashish AgarwalNo ratings yet

- Civil Audit & Service RulesDocument4 pagesCivil Audit & Service Rulesbosesamarpan1999No ratings yet

- Paper 6 Commercial and Industrial Laws Arnd AuditingDocument5 pagesPaper 6 Commercial and Industrial Laws Arnd AuditingVelayudham ThiyagarajanNo ratings yet

- BlueprintDocument6 pagesBlueprintYash GuptaNo ratings yet

- MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set1: Paper 6-Laws and EthicsDocument5 pagesMTP - Intermediate - Syllabus 2016 - Dec 2019 - Set1: Paper 6-Laws and EthicsvijaykumartaxNo ratings yet

- Law, EthicsDocument20 pagesLaw, EthicsG. DhanyaNo ratings yet

- Introduction to Taxation and IncomeDocument7 pagesIntroduction to Taxation and IncomeMonirul Islam MoniirrNo ratings yet

- PTP PP OS v0.2Document27 pagesPTP PP OS v0.2sanketpavi21No ratings yet

- Question Paper For Online Examination - Inter/P12-CAA/S1Document9 pagesQuestion Paper For Online Examination - Inter/P12-CAA/S1Hemmu sahuNo ratings yet

- The Chartered Insurance Institute Diploma April 2010 Examination PaperDocument8 pagesThe Chartered Insurance Institute Diploma April 2010 Examination PaperSultan AlrasheedNo ratings yet

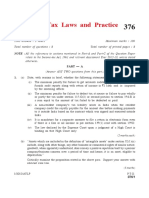

- Advanced Tax Laws and Practice 376Document8 pagesAdvanced Tax Laws and Practice 376sheena2saNo ratings yet

- Fin - Accounts Objective2Document3 pagesFin - Accounts Objective2Swarup MukherjeeNo ratings yet

- Delhi Public School Jodhpur: General InstructionsDocument4 pagesDelhi Public School Jodhpur: General Instructionssamyak patwaNo ratings yet

- Departmental Exams Himchal PradeshDocument3 pagesDepartmental Exams Himchal PradeshmadhaniasureshNo ratings yet

- Due Diligence and Corporate Compliance Management: NoteDocument5 pagesDue Diligence and Corporate Compliance Management: Notesks0865No ratings yet

- Adjustments:: B.Sc. Degree Examination, 2012Document3 pagesAdjustments:: B.Sc. Degree Examination, 2012Priyanka ChoudhuryNo ratings yet

- Due Diligence and Corporate Compliance Management: Roll No.........................Document5 pagesDue Diligence and Corporate Compliance Management: Roll No.........................sks0865No ratings yet

- Pakistan Institute of Public Finance Accountants Summer Exam-2018 Corporate Sector Business Laws and Cost AccountingDocument30 pagesPakistan Institute of Public Finance Accountants Summer Exam-2018 Corporate Sector Business Laws and Cost AccountingMohammad FaisalNo ratings yet

- Q.May19 Sem ExamDocument9 pagesQ.May19 Sem ExamSanvi NarayanNo ratings yet

- National Officers Academy: Mock Exams CSS-2022 April 2022 (Final Mock) Accountancy and Auditing, Paper-IiDocument2 pagesNational Officers Academy: Mock Exams CSS-2022 April 2022 (Final Mock) Accountancy and Auditing, Paper-IiAli KaziNo ratings yet

- Accountancy Sample PaperDocument6 pagesAccountancy Sample PaperDevansh BawejaNo ratings yet

- Company Accounts, Cost and Management CostsDocument8 pagesCompany Accounts, Cost and Management CostsMohit BhatnagarNo ratings yet

- Cma Question - r1 - Legal Environment of BusinessDocument12 pagesCma Question - r1 - Legal Environment of BusinessMuhammad Ziaul Haque100% (1)

- Secretarial Practice Relating To Economic Laws and Drafting & ConveyancingDocument4 pagesSecretarial Practice Relating To Economic Laws and Drafting & Conveyancingsks0865No ratings yet

- DBA7107Document21 pagesDBA7107Bhat MerajNo ratings yet

- Financial Accounting RecordsDocument7 pagesFinancial Accounting RecordsbangoangoNo ratings yet

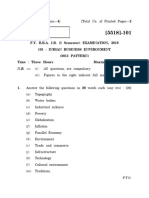

- NOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question PaperDocument8 pagesNOTE: All The References To Sections Mentioned in Part-A and Part-C of The Question Papersheena2saNo ratings yet

- Question Papers Supplementary Exam 2007Document24 pagesQuestion Papers Supplementary Exam 2007ce1978No ratings yet

- B.B.A (I.b) 2013 PatternDocument93 pagesB.B.A (I.b) 2013 PatternPRAJWAL JADHAVNo ratings yet

- Accounts - Full FledgedDocument5 pagesAccounts - Full FledgedSukhrut MNo ratings yet

- Test Dashy 2Document1 pageTest Dashy 2api-281193111No ratings yet

- Corporate Restructuring Tools and SchemesDocument4 pagesCorporate Restructuring Tools and SchemesBharat ThapaNo ratings yet

- Final Group III Test Papers (Revised July 2009)Document43 pagesFinal Group III Test Papers (Revised July 2009)Kishor SandageNo ratings yet

- Test Papers: FoundationDocument23 pagesTest Papers: FoundationUmesh TurankarNo ratings yet

- Code No.: BB-133: Online Annual Examination, 2022Document8 pagesCode No.: BB-133: Online Annual Examination, 2022Roshan ArjunkarNo ratings yet

- March 2010 Part 2 InsightDocument92 pagesMarch 2010 Part 2 InsightLegogie Moses AnoghenaNo ratings yet

- Intermediate Group I Test PapersDocument57 pagesIntermediate Group I Test Paperssantbaksmishra1261No ratings yet

- Accountancy Sample Paper Class 11 PDFDocument6 pagesAccountancy Sample Paper Class 11 PDFAnkit JhaNo ratings yet

- Intermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 6Document17 pagesIntermediate Examination: Suggested Answer - Syl12 - Dec2015 - Paper 6JOLLYNo ratings yet

- Test Series: October, 2021 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument10 pagesTest Series: October, 2021 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Clerical Officers Proficiency Exam Paper 701 Accounts PreparationDocument5 pagesClerical Officers Proficiency Exam Paper 701 Accounts PreparationM-mila Chepterit KenyNo ratings yet

- Consolidated Balance Sheet of H Ltd and S LtdDocument11 pagesConsolidated Balance Sheet of H Ltd and S LtdJesse SandersNo ratings yet

- Test Papers - Intermediate Group IDocument8 pagesTest Papers - Intermediate Group IRohan Jeckson RosarioNo ratings yet

- AccountancyDocument2 pagesAccountancyUmarmaharNo ratings yet

- Ba9207 - Legal Aspects of Business June 2010Document2 pagesBa9207 - Legal Aspects of Business June 2010Mridula MNo ratings yet

- Part ADocument7 pagesPart Asankarguru777No ratings yet

- Auditing AnalysisDocument13 pagesAuditing AnalysisAmmarah Rajput ParhiarNo ratings yet

- Bba 705Document2 pagesBba 705api-3782519No ratings yet

- March 2010 Part 1 InsightDocument63 pagesMarch 2010 Part 1 InsightSony AxleNo ratings yet

- Paper12 Set1 SolutionDocument17 pagesPaper12 Set1 SolutionMohamedThabrisNo ratings yet

- SuggestionsDocument2 pagesSuggestionsSudip chatterjeeNo ratings yet

- Thu Cs CostDocument31 pagesThu Cs CostthulasikNo ratings yet

- Study Mat1 AccountsDocument23 pagesStudy Mat1 Accountsinnovative studiesNo ratings yet

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Documents ViewDocument34 pagesDocuments ViewRaju ReddyNo ratings yet

- New Attestation FormDocument5 pagesNew Attestation FormRaju ReddyNo ratings yet

- 04-2-TS vOL-II, Sec-IV, FQP R1 PDFDocument20 pages04-2-TS vOL-II, Sec-IV, FQP R1 PDFsanjeevchhabraNo ratings yet

- Nu3-Ktrg: 1e/TG 4E/ "Document1 pageNu3-Ktrg: 1e/TG 4E/ "Raju ReddyNo ratings yet

- Schedule Examination 27122018Document1 pageSchedule Examination 27122018TopRankersNo ratings yet

- Transmission Line IEE Checklist Instructions PDFDocument20 pagesTransmission Line IEE Checklist Instructions PDFRaju ReddyNo ratings yet

- Esmf 04052017 PDFDocument265 pagesEsmf 04052017 PDFRaju ReddyNo ratings yet

- APTRANSCO Electrical PaperDocument20 pagesAPTRANSCO Electrical PaperAnonymous sENwj8nwqNo ratings yet

- CDP to VGA flight ticket booking confirmationDocument2 pagesCDP to VGA flight ticket booking confirmationRaju ReddyNo ratings yet

- For Class - IV For Others: Maximum Monthly Installments For Recovery ofDocument4 pagesFor Class - IV For Others: Maximum Monthly Installments For Recovery ofRaju ReddyNo ratings yet

- Concrete Mix Design Comparison Between BIS and ACIDocument7 pagesConcrete Mix Design Comparison Between BIS and ACIPraveen JainNo ratings yet

- 132kV TNS tower BOMDocument2 pages132kV TNS tower BOMRaju ReddyNo ratings yet

- Water Heater Leaflet - FDocument3 pagesWater Heater Leaflet - FRaju ReddyNo ratings yet

- Extra Questions in Each Part Will Be IgnoredDocument3 pagesExtra Questions in Each Part Will Be IgnoredRaju ReddyNo ratings yet

- Tower M Stub TemplateDocument1 pageTower M Stub TemplateRaju ReddyNo ratings yet

- DAHandbook SectionDocument20 pagesDAHandbook SectionbpchimeraNo ratings yet

- APTRANSCO Holiday ListDocument4 pagesAPTRANSCO Holiday ListRaju ReddyNo ratings yet

- PDFDocument13 pagesPDFRaju ReddyNo ratings yet

- The Art & Science of Protective Relaying - C. Russell Mason - GEDocument357 pagesThe Art & Science of Protective Relaying - C. Russell Mason - GEAasim MallickNo ratings yet

- Grohe Bathbook enDocument294 pagesGrohe Bathbook enRaju ReddyNo ratings yet

- Powertransmissionguide PDFDocument3 pagesPowertransmissionguide PDFRaju ReddyNo ratings yet

- Transfers List PDFDocument12 pagesTransfers List PDFRaju ReddyNo ratings yet

- Employees' Provident Fund Organization: Declaration FormDocument3 pagesEmployees' Provident Fund Organization: Declaration FormroseNo ratings yet

- Cards Schedule ChargesDocument1 pageCards Schedule ChargesRaju ReddyNo ratings yet

- ANSI Codes PDFDocument3 pagesANSI Codes PDFelectrical_1012000100% (2)

- AP Si Mains Paperiv QPDocument62 pagesAP Si Mains Paperiv QPRaju ReddyNo ratings yet

- APSEBDocument9 pagesAPSEBRaju ReddyNo ratings yet

- AP ECET EEE QP KeyDocument61 pagesAP ECET EEE QP KeyRaju ReddyNo ratings yet

- 312017Document30 pages312017Sharath AndeNo ratings yet

- Medicard PH VAT liability on amounts paid to medical providersDocument2 pagesMedicard PH VAT liability on amounts paid to medical providersVon Lee De LunaNo ratings yet

- VOL. 354, MARCH 14, 2001 339 People vs. Go: - First DivisionDocument15 pagesVOL. 354, MARCH 14, 2001 339 People vs. Go: - First DivisionMichelle Joy ItableNo ratings yet

- Andres Vs CabreraDocument6 pagesAndres Vs CabreraNarciso Javelosa III100% (1)

- Villavicencio v. Lukban, G.R. No. L-14639Document12 pagesVillavicencio v. Lukban, G.R. No. L-14639Daryl CruzNo ratings yet

- Chapter Seventeen: Website Development and Maintenance Agreements Form 2.17.1 Website Development and Maintenance AgreementDocument19 pagesChapter Seventeen: Website Development and Maintenance Agreements Form 2.17.1 Website Development and Maintenance AgreementRambabu ChowdaryNo ratings yet

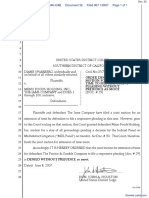

- Swarberg v. Menu Foods Holding Inc Et Al - Document No. 32Document1 pageSwarberg v. Menu Foods Holding Inc Et Al - Document No. 32Justia.comNo ratings yet

- ICJ Rules on Vienna Convention Violations by US in Avena CaseDocument20 pagesICJ Rules on Vienna Convention Violations by US in Avena CasegiezeldaNo ratings yet

- Academic Research Paper OutlineDocument2 pagesAcademic Research Paper OutlineRicci SerafinoNo ratings yet

- Report of Multiple Sale or Other Disposition of Certain RiflesDocument2 pagesReport of Multiple Sale or Other Disposition of Certain RiflesreiNo ratings yet

- 1 Carbajal Vs GsisDocument7 pages1 Carbajal Vs GsisJan Niño JugadoraNo ratings yet

- D..Fu 1A J +:JRLLFJ: Federal Negarit GazetaDocument7 pagesD..Fu 1A J +:JRLLFJ: Federal Negarit GazetaTWWNo ratings yet

- 08 - Chapter 3 PDFDocument128 pages08 - Chapter 3 PDFAnonymous VXnKfXZ2PNo ratings yet

- MyviDocument2 pagesMyviamran5973No ratings yet

- Notice To Court and All Court OfficersDocument27 pagesNotice To Court and All Court OfficersMisory96% (113)

- People v. SumayoDocument7 pagesPeople v. SumayoJohn Kayle BorjaNo ratings yet

- Ganzon Vs CA - G.R. No. 93252. November 8, 1991Document7 pagesGanzon Vs CA - G.R. No. 93252. November 8, 1991Ebbe DyNo ratings yet

- Daclison V BaytionDocument2 pagesDaclison V BaytionEmma Guanco100% (1)

- Betz: MEGACHURCHES AND PRIVATE INUREMENTDocument29 pagesBetz: MEGACHURCHES AND PRIVATE INUREMENTNew England Law Review100% (1)

- Pollution Adjudication Board v. Court of Appeals (195 SCRA 112)Document1 pagePollution Adjudication Board v. Court of Appeals (195 SCRA 112)MaeBartolomeNo ratings yet

- Magestrado vs. People, 527 SCRA 125, July 10, 2007Document18 pagesMagestrado vs. People, 527 SCRA 125, July 10, 2007TNVTRLNo ratings yet

- Durban Apartments Liable for Lost VehicleDocument2 pagesDurban Apartments Liable for Lost VehicleNivra Lyn EmpialesNo ratings yet

- Government Regulation No 58 On PPH 21 (Wef 1 Jan 2024)Document5 pagesGovernment Regulation No 58 On PPH 21 (Wef 1 Jan 2024)pokcayNo ratings yet

- Magallona, Et Al v. Ermita, Et Al., GR No. 187167, Aug. 16, 2011Document7 pagesMagallona, Et Al v. Ermita, Et Al., GR No. 187167, Aug. 16, 2011Ciara NavarroNo ratings yet

- A Project Report On Strict Liabilty: University Institute of Legal StudiesDocument4 pagesA Project Report On Strict Liabilty: University Institute of Legal StudiesDishant MittalNo ratings yet

- H 1973Document60 pagesH 1973Hal ShurtleffNo ratings yet

- B - Instructions For Documents Needed For Online Review PDFDocument20 pagesB - Instructions For Documents Needed For Online Review PDFNimaNo ratings yet

- Third Party Due Diligence QuestionnaireDocument1 pageThird Party Due Diligence QuestionnaireEdelmanNo ratings yet

- Letter Complaint - MeralcoDocument2 pagesLetter Complaint - MeralcoJazz TraceyNo ratings yet

- Maternity Benefit ActDocument9 pagesMaternity Benefit Acthimanshu kumarNo ratings yet

- Filipino Merchants Insurance Vs CADocument2 pagesFilipino Merchants Insurance Vs CAAngela Marie AlmalbisNo ratings yet