Professional Documents

Culture Documents

Homework 4 Filip Hrastić, Bdib

Uploaded by

CalekaleOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homework 4 Filip Hrastić, Bdib

Uploaded by

CalekaleCopyright:

Available Formats

Homework 4

Filip Hrastić, BDiB

Suppose an investor wants to form a portfolio by investing into the video games industry. He

puts 60% of his money into stocks of Electronic Arts Inc. and 40% into Activision Blizzard Inc.

For the purpose of this homework, we shall take another combination of the shares of these

stocks: portfolio 2 shall have w1 of 25% and w2 of 75%. Our investor subsequently assumes

that expected returns will amount to 15% for Electronic Arts and 11% for Activision Blizzard.

Furthermore, the expected standard deviations are assumed to be 18% and 10% respectively.

We can thus isolate the following parameters for Portfolio 1:

𝒘𝟏 = 𝟎, 𝟔

𝒘𝟐 = 𝟎, 𝟒

𝑹𝟏 = 𝟎, 𝟏𝟓

𝑹𝟐 = 𝟎, 𝟏𝟏

𝝈𝟏 = 𝟎, 𝟏𝟖

𝝈𝟐 = 𝟎, 𝟏𝟎

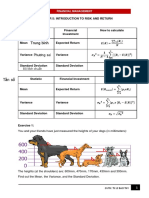

In order to calculate the expected return on Portfolio 1, we shall utilize the following formula:

𝑬(𝑹𝒑 ) = 𝒘𝟏 × 𝑬(𝑹𝟏 ) + 𝒘𝟐 × 𝑬(𝑹𝟐 )

After adding in the required figures for Portfolio 1, the expected returns are easily calculated:

𝑬(𝑹𝒑 ) = 𝟎, 𝟔 × 𝟎, 𝟏𝟓 + 𝟎, 𝟒 × 𝟎, 𝟏𝟏

= 𝟎, 𝟏𝟑𝟒

The standard deviations are 𝝈𝟏 = 𝟎, 𝟏𝟖 and 𝝈𝟐 = 𝟎, 𝟏𝟎, thus:

𝑽(𝑹𝒑 ) = 𝒘𝟐𝟏 𝝈𝟐𝟏 + 𝒘𝟐𝟐 𝝈𝟐𝟐 + 𝟐𝒘𝟏 𝒘𝟐 𝝆𝝈𝟏 𝝈𝟐

𝑽(𝑹𝒑 ) = (𝟎, 𝟔𝟐 )(𝟎, 𝟏𝟖𝟐 ) + (𝟎, 𝟒𝟐 )(𝟎, 𝟏𝟐 ) + 𝟐(𝟎, 𝟔)(𝟎, 𝟒)𝝆(𝟎, 𝟏𝟖)(𝟎, 𝟏𝟎)

𝑽(𝑹𝒑 ) = 𝟎, 𝟎𝟏𝟑𝟐𝟔𝟒 + 𝟎, 𝟎𝟎𝟖𝟔𝟒𝝆

When 𝝆 = 𝟏

𝑽(𝑹𝒑 ) = 𝟎, 𝟎𝟏𝟑𝟐𝟔𝟒 + 𝟎, 𝟎𝟎𝟖𝟔𝟒 × 𝟏 = 𝟎, 𝟎𝟐𝟏𝟗𝟎𝟒

When 𝝆 = 𝟎. 𝟐𝟗

𝑽(𝑹𝒑 ) = 𝟎, 𝟎𝟏𝟑𝟐𝟔𝟒 + 𝟎, 𝟎𝟎𝟖𝟔𝟒 × 𝟎, 𝟐𝟗 = 𝟎, 𝟎𝟏𝟓𝟕𝟔𝟗𝟔

When 𝝆 = 𝟎

(𝑹𝒑 ) = 𝟎, 𝟎𝟏𝟑𝟐𝟔𝟒 + 𝟎, 𝟎𝟎𝟖𝟔𝟒 × 𝟎 = 𝟎, 𝟎𝟏𝟑𝟐𝟔𝟒

We will perform the same calculations for the second portfolio. All parameters for Portfolio 2

are listed below:

𝒘𝟏 = 𝟎, 𝟐𝟓

𝒘𝟐 = 𝟎, 𝟕𝟓

𝑹𝟏 = 𝟎, 𝟏𝟓

𝑹𝟐 = 𝟎, 𝟏𝟏

𝝈𝟏 = 𝟎, 𝟏𝟖

𝝈𝟐 = 𝟎, 𝟏𝟎

Firstly, let us calculate the expected return on Portfolio 2 by using the same formula stated

beforehand in the paper:

𝑬(𝑹𝒑 ) = 𝟎, 𝟐𝟓 × 𝟎, 𝟏𝟓 + 𝟎, 𝟕𝟓 × 𝟎, 𝟏𝟏

= 𝟎, 𝟏𝟐

The standard deviations are the same as in the previous example. Let us proceed with the

calculation of the portfolio’s variance:

𝑽(𝑹𝒑 ) = 𝒘𝟐𝟏 𝝈𝟐𝟏 + 𝒘𝟐𝟐 𝝈𝟐𝟐 + 𝟐𝒘𝟏 𝒘𝟐 𝝆𝝈𝟏 𝝈𝟐

𝑽(𝑹𝒑 ) = (𝟎, 𝟐𝟓𝟐 )(𝟎, 𝟏𝟖𝟐 ) + (𝟎, 𝟕𝟓𝟐 )(𝟎, 𝟏𝟐 ) + 𝟐(𝟎, 𝟐𝟓)(𝟎, 𝟕𝟓)𝝆(𝟎, 𝟏𝟖)(𝟎, 𝟏𝟎)

𝑽(𝑹𝒑 ) = 𝟎, 𝟎𝟎𝟕𝟔𝟓 + 𝟎, 𝟎𝟎𝟔𝟕𝟓𝝆

When 𝝆 = 𝟏

𝑽(𝑹𝒑 ) = 𝟎, 𝟎𝟎𝟕𝟔𝟓 + 𝟎, 𝟎𝟎𝟔𝟕𝟓 × 𝟏 = 𝟎, 𝟎𝟏𝟒𝟒

When 𝝆 = 𝟎, 𝟐𝟗

𝑽(𝑹𝒑 ) = 𝟎, 𝟎𝟎𝟕𝟔𝟓 + 𝟎, 𝟎𝟎𝟔𝟕𝟓 × 𝟎, 𝟐𝟗 = 𝟎, 𝟎𝟎𝟗𝟔𝟎𝟕𝟓

When 𝝆 = 𝟎

𝑽(𝑹𝒑 ) = 𝟎, 𝟎𝟎𝟕𝟔𝟓 + 𝟎, 𝟎𝟎𝟔𝟕𝟓 × 𝟎, 𝟐𝟗 = 𝟎, 𝟎𝟎𝟕𝟔𝟓

In conclusion, Portfolio 1 offers a higher expected return, but at the same time it is also slightly

riskier than the alternative (as denoted by the portfolio’s variance). These differences are rather

small, however, thus I would opt for Portfolio 1 as it offers an overall higher expected return.

Filip Hrastić

_____________________________

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- FORMULA SHEET For Midterm ExamDocument4 pagesFORMULA SHEET For Midterm Examakshitak.2021No ratings yet

- Inverse Trigonometric Functions (Trigonometry) Mathematics Question BankFrom EverandInverse Trigonometric Functions (Trigonometry) Mathematics Question BankNo ratings yet

- Portfolio PDFDocument22 pagesPortfolio PDFShobhit BansalNo ratings yet

- DTSP - Compiled Content - Module 7 PDFDocument29 pagesDTSP - Compiled Content - Module 7 PDFvikrantNo ratings yet

- 3531 Midterm Formula SheetDocument3 pages3531 Midterm Formula Sheetanajagal87No ratings yet

- Formulas F O PDFDocument2 pagesFormulas F O PDFEliana MontagnaNo ratings yet

- IE54500 - Exam 3: 1. Static Game of Complete InformationDocument5 pagesIE54500 - Exam 3: 1. Static Game of Complete InformationM100% (1)

- Applied Oligopoly ModelsDocument9 pagesApplied Oligopoly Modelssuna leeNo ratings yet

- AJAZ-ECO204 Applied Oligopoly Models-FORMULASDocument3 pagesAJAZ-ECO204 Applied Oligopoly Models-FORMULASGrace IdreesNo ratings yet

- 2b FinInv Mean Var Multiple AssetsDocument18 pages2b FinInv Mean Var Multiple AssetsPrice RichardNo ratings yet

- Financial Economics Formulas 2014-10-19 11-33-13Document4 pagesFinancial Economics Formulas 2014-10-19 11-33-13Romain FarsatNo ratings yet

- FIN441 Homework 2 FL16 SolutionDocument10 pagesFIN441 Homework 2 FL16 SolutionMatthewLiuNo ratings yet

- Lab-5 21BAI1664Document8 pagesLab-5 21BAI1664Akshat KumarNo ratings yet

- Pca Portfolio SelectionDocument18 pagesPca Portfolio Selectionluli_kbreraNo ratings yet

- 2.lines of Best Fit PDFDocument6 pages2.lines of Best Fit PDFgeorges khairallahNo ratings yet

- IE54500 - Problem Set 4: 1. Pure and Mixed Nash EquilibriaDocument5 pagesIE54500 - Problem Set 4: 1. Pure and Mixed Nash EquilibriaM100% (1)

- BFW2140 - Past Year Final Exam QuestionsDocument9 pagesBFW2140 - Past Year Final Exam Questionsvnfhjc jNo ratings yet

- General Mathematics - Grade 11 Fair Market Value and Deferred AnnuityDocument13 pagesGeneral Mathematics - Grade 11 Fair Market Value and Deferred AnnuityMaxine ReyesNo ratings yet

- Pricing Approaches For Credit DerivativesDocument24 pagesPricing Approaches For Credit DerivativesTheodor MunteanuNo ratings yet

- Derivada Direccional Jespinoza Arevalo24Document17 pagesDerivada Direccional Jespinoza Arevalo240512022031No ratings yet

- ETF5930 AssignmentDocument22 pagesETF5930 Assignment王勃伟No ratings yet

- Audit Strategy - VoiceDocument20 pagesAudit Strategy - VoiceKaushiki SenguptaNo ratings yet

- Smithrobert000123456Medi1111-We01: May/June 2020 - W E 0Document11 pagesSmithrobert000123456Medi1111-We01: May/June 2020 - W E 0AdamNo ratings yet

- The Value ChainDocument6 pagesThe Value ChainFabio Hernan TorresNo ratings yet

- Lecture 5Document34 pagesLecture 5ceyda.duztasNo ratings yet

- School of Finance and Applied EconomicsDocument14 pagesSchool of Finance and Applied EconomicsJoyNo ratings yet

- Capital Asset Pricing Model in Mathcad PDFDocument13 pagesCapital Asset Pricing Model in Mathcad PDFOleg PashininNo ratings yet

- Stat Notes Sem5Document7 pagesStat Notes Sem5Ps PsNo ratings yet

- Engineering Economy Presentation 4 AnnuitiesDocument38 pagesEngineering Economy Presentation 4 AnnuitiesQwertyuiop QwertyuiopNo ratings yet

- Interest FormulaDocument1 pageInterest FormulaTimbas, Raizel DeeNo ratings yet

- Mundell FlemingDocument8 pagesMundell FlemingIftikhar AhmedNo ratings yet

- MScFE 620 DTSP Compiled Notes M5Document16 pagesMScFE 620 DTSP Compiled Notes M5sudokuxNo ratings yet

- Prestress Concrete: University of Thi-Qar Civil Engineering DepartementDocument13 pagesPrestress Concrete: University of Thi-Qar Civil Engineering DepartementMalak ShatiNo ratings yet

- Chapter 5 Bài tậpDocument4 pagesChapter 5 Bài tậpVõ Hoàng Bảo TrânNo ratings yet

- FNCE Cheat SheetDocument1 pageFNCE Cheat SheetRia UppalapatiNo ratings yet

- Principles of Finance Risk and Return: Instructor: Xiaomeng LuDocument78 pagesPrinciples of Finance Risk and Return: Instructor: Xiaomeng LuLinaceroNo ratings yet

- Solow Model FinalDocument8 pagesSolow Model FinalgodussopnakamaNo ratings yet

- IE54500 - Exam 1: Dr. David Johnson Fall 2020Document7 pagesIE54500 - Exam 1: Dr. David Johnson Fall 2020MNo ratings yet

- Problem Set N+1 Solutions: 1 Local Non SatiationDocument7 pagesProblem Set N+1 Solutions: 1 Local Non SatiationciustucNo ratings yet

- Aggregate Expenditures Model (AE)Document7 pagesAggregate Expenditures Model (AE)souhad.abouzakiNo ratings yet

- C 1906634 U226385 s977868Document50 pagesC 1906634 U226385 s977868royalNo ratings yet

- Dripto Bakshi - Lecture Slides - Constrained OptimizationDocument58 pagesDripto Bakshi - Lecture Slides - Constrained OptimizationRupinder GoyalNo ratings yet

- Financial Management FormulaeDocument15 pagesFinancial Management FormulaeAsAd MehƏiNo ratings yet

- Modeling Change With Difference EquationsDocument20 pagesModeling Change With Difference EquationsManik AsylumNo ratings yet

- Credibility, Mahler & Dean (AutoRecovered)Document4 pagesCredibility, Mahler & Dean (AutoRecovered)Selly SalsabilaNo ratings yet

- Artikel Materi Skripsi - Qurrotu Aini-2Document13 pagesArtikel Materi Skripsi - Qurrotu Aini-2Qurrotu AiniNo ratings yet

- IS-LM MultipliersDocument16 pagesIS-LM MultipliersCamilla ANo ratings yet

- Ef4484 PS2Document8 pagesEf4484 PS2Ziyan CaoNo ratings yet

- MScFE 610 ECON - Compiled - Notes - M6Document29 pagesMScFE 610 ECON - Compiled - Notes - M6sadiqpmpNo ratings yet

- Formulae All in OneDocument18 pagesFormulae All in Onemysteriousmbj20No ratings yet

- Lec13 Pred Semantics SolDocument36 pagesLec13 Pred Semantics SolKarus InsaniaNo ratings yet

- ENGGECON Prelim FormulaDocument8 pagesENGGECON Prelim FormulaSan Jose, Kyla Mae M.No ratings yet

- FM1 - 15Document15 pagesFM1 - 15Namitha ShajanNo ratings yet

- How To Conduct Today AmamotoDocument4 pagesHow To Conduct Today AmamotoAlok TiwariNo ratings yet

- FE 8507 Lecture 2 More On Dynamic Security Markets StudentsDocument52 pagesFE 8507 Lecture 2 More On Dynamic Security Markets Studentsseng0022No ratings yet

- Macroeconomics Profit Maximization of Firm in 2 Period ModelDocument38 pagesMacroeconomics Profit Maximization of Firm in 2 Period ModelJoeyNo ratings yet

- 1A SumsandproductsDocument33 pages1A SumsandproductsSanderM0904No ratings yet

- Tutorial 5 Sol S21920Document10 pagesTutorial 5 Sol S21920Zhenjie YueNo ratings yet

- DataStage Interview QuestionsDocument3 pagesDataStage Interview QuestionsvrkesariNo ratings yet

- Limitations of The Study - Docx EMDocument1 pageLimitations of The Study - Docx EMthreeNo ratings yet

- Report Swtich Cisco Pass DNSDocument91 pagesReport Swtich Cisco Pass DNSDenis Syst Laime LópezNo ratings yet

- Chapter 12 My Nursing Test BanksDocument10 pagesChapter 12 My Nursing Test Banksنمر نصار100% (1)

- B.tech - Non Credit Courses For 2nd Year StudentsDocument4 pagesB.tech - Non Credit Courses For 2nd Year StudentsNishant MishraNo ratings yet

- Compiled H.W - Class 10th-1Document3 pagesCompiled H.W - Class 10th-1Sree KalaNo ratings yet

- Spirolab IIIDocument1 pageSpirolab IIIDzenan DelijaNo ratings yet

- JAIM InstructionsDocument11 pagesJAIM InstructionsAlphaRaj Mekapogu100% (1)

- OS Lab ManualDocument47 pagesOS Lab ManualNivedhithaVNo ratings yet

- JavaScript ArraysDocument5 pagesJavaScript Arraysursu_padure_scrNo ratings yet

- Agents SocializationDocument4 pagesAgents Socializationinstinct920% (1)

- Types of Dance Steps and Positions PDFDocument11 pagesTypes of Dance Steps and Positions PDFRather NotNo ratings yet

- Kolkata City Accident Report - 2018Document48 pagesKolkata City Accident Report - 2018anon_109699702No ratings yet

- DSpace Configuration PDFDocument1 pageDSpace Configuration PDFArshad SanwalNo ratings yet

- L53 & L54 Environmental Impact Assessment (Eng) - WebDocument31 pagesL53 & L54 Environmental Impact Assessment (Eng) - WebplyanaNo ratings yet

- Role of Wickability On The Critical Heat Flux of Structured Superhydrophilic SurfacesDocument10 pagesRole of Wickability On The Critical Heat Flux of Structured Superhydrophilic Surfacesavi0341No ratings yet

- Integrated Cost and Risk Analysis Using Monte Carlo Simulation of A CPM ModelDocument4 pagesIntegrated Cost and Risk Analysis Using Monte Carlo Simulation of A CPM ModelPavlos Vardoulakis0% (1)

- Assignment 2: Question 1: Predator-Prey ModelDocument2 pagesAssignment 2: Question 1: Predator-Prey ModelKhan Mohd SaalimNo ratings yet

- Purposive Comm. Group 6 PPT Concise Vers.Document77 pagesPurposive Comm. Group 6 PPT Concise Vers.rovicrosales1No ratings yet

- Capillary PressureDocument12 pagesCapillary PressureamahaminerNo ratings yet

- Policy Analysis ReportDocument16 pagesPolicy Analysis ReportGhelvin Auriele AguirreNo ratings yet

- Strong PasswordDocument2 pagesStrong PasswordluciangeNo ratings yet

- Joshi C M, Vyas Y - Extensions of Certain Classical Integrals of Erdélyi For Gauss Hypergeometric Functions - J. Comput. and Appl. Mat. 160 (2003) 125-138Document14 pagesJoshi C M, Vyas Y - Extensions of Certain Classical Integrals of Erdélyi For Gauss Hypergeometric Functions - J. Comput. and Appl. Mat. 160 (2003) 125-138Renee BravoNo ratings yet

- EgoismDocument3 pagesEgoism123014stephenNo ratings yet

- Control Panel Manual 1v4Document52 pagesControl Panel Manual 1v4Gustavo HidalgoNo ratings yet

- Mutants & Masterminds 1st Ed Character Generater (Xls Spreadsheet)Document89 pagesMutants & Masterminds 1st Ed Character Generater (Xls Spreadsheet)WesleyNo ratings yet

- Gear Whine Prediction With CAE For AAMDocument6 pagesGear Whine Prediction With CAE For AAMSanjay DeshpandeNo ratings yet

- 1 BN Sintax SemanticsDocument10 pages1 BN Sintax SemanticsJackNo ratings yet

- 009 Installation of Pumps Risk AssessmentDocument2 pages009 Installation of Pumps Risk Assessmentgangadharan000100% (13)

- AFDD 1-1 (2006) - Leadership and Force DevelopmentDocument82 pagesAFDD 1-1 (2006) - Leadership and Force Developmentncore_scribd100% (1)

- CATIA V5-6R2015 Basics - Part I : Getting Started and Sketcher WorkbenchFrom EverandCATIA V5-6R2015 Basics - Part I : Getting Started and Sketcher WorkbenchRating: 4 out of 5 stars4/5 (10)

- SketchUp Success for Woodworkers: Four Simple Rules to Create 3D Drawings Quickly and AccuratelyFrom EverandSketchUp Success for Woodworkers: Four Simple Rules to Create 3D Drawings Quickly and AccuratelyRating: 1.5 out of 5 stars1.5/5 (2)

- From Vision to Version - Step by step guide for crafting and aligning your product vision, strategy and roadmap: Strategy Framework for Digital Product Management RockstarsFrom EverandFrom Vision to Version - Step by step guide for crafting and aligning your product vision, strategy and roadmap: Strategy Framework for Digital Product Management RockstarsNo ratings yet

- AutoCAD 2010 Tutorial Series: Drawing Dimensions, Elevations and SectionsFrom EverandAutoCAD 2010 Tutorial Series: Drawing Dimensions, Elevations and SectionsNo ratings yet

- Autodesk Fusion 360: A Power Guide for Beginners and Intermediate Users (3rd Edition)From EverandAutodesk Fusion 360: A Power Guide for Beginners and Intermediate Users (3rd Edition)Rating: 5 out of 5 stars5/5 (2)

- Certified Solidworks Professional Advanced Surface Modeling Exam PreparationFrom EverandCertified Solidworks Professional Advanced Surface Modeling Exam PreparationRating: 5 out of 5 stars5/5 (1)

- FreeCAD | Step by Step: Learn how to easily create 3D objects, assemblies, and technical drawingsFrom EverandFreeCAD | Step by Step: Learn how to easily create 3D objects, assemblies, and technical drawingsRating: 5 out of 5 stars5/5 (1)