Professional Documents

Culture Documents

ENG102

Uploaded by

Mk Siv Sp0 ratings0% found this document useful (0 votes)

207 views2 pagesgoods

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentgoods

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

207 views2 pagesENG102

Uploaded by

Mk Siv Spgoods

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

TALLY FINAL TEST 3rd

Create a company name with castle pvt ltd. With your student code financial year 2017-18 address Buxipur Gorakhpur Pan No.

ASDFG1234A, TAN No. ASDF12345G, GSTIN NO. 09ASDFG1234A1Z5

1. Create the following ledger

Axis bank 720000, cash in hand 250000, capital - remaining balance

2. Pass the entry by the below document.

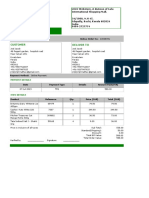

Invoice to: M/S MEHTA BROTHERS Bill no: Pur/001/17-18

Tirana road lal Ganj Lucknow Date: 1-7-20167

Castle pvt ltd. Email id mmb3214@gmail.com

Credit: 15days

Pin no. 374251

Buxipur Gorakhpur

SL. DESCRIPTION QTY RATE GST AMOUNT

1 MONITER 50 6500 18% 325000

2 PRINTER 25 8200 18% 205000

3 CPU 20 4200 12% 84000

Add: 52740

CGST 52740

SGST

INR six lack eighty-six thousand nine hundred twenty-five only TOTAL 686925

M/S Mehta Brothers

Accountant

3. Pass the entry by the below document.

Invoice to: Castle Pvt Ltd Bill no: Sal/001/17-18

Buxipur Gorakhpur

M/S Rahul Agency Email id cpl2345@gmail.com Date: 2-7-2017

Pin no. 273401

Kolkata, West Bengal

SL. DESCRIPTION QTY RATE AMOUNT

1 MONITER 10 9200 92000

2 PRINTER 5 10500 52500

3 CPU 5 6500 32500

Add:

29910

IGST

INR one lack eighty thousand five hundred forty only TOTAL 206910

Castle pvt ltd.

Accountant

4. Pass the entry by the below document

Nilanchal housing pvt ltd PAN No. ASFDR3241A

Tenants: - 15 prince Aditya road Date: 1-8-2017

Castle pvt ltd Betiyahata Gorakhpur MR No. MR/0132/17

Buxipur Gorakhpur Rent Receipt

Date Charge Description Amount

1-8-2017 Rent 01/01-2016 to 31/03/2016 215000.00

CGST @9% 20350.00

SGST @ 9% 20350.00

Gross Total 255700.00

Tds Deducted -21500.00

Net payment Received (Rounded off) 234200.00

Amount in word: - INR two lack thirty-Four thousand two hundred only

Payment Details: - Mode: - cheque, cheque no. 275469, Drawn on Axis For Nilanchal housing pvt ltd

Accountant

5. On 1-9-2017 company Tds amount paid to Govt. by cheque.

6. Pass the entry by the below document.

Mr. Annand Pandey

13, city hill, Hindustan park

Name: Castle pvt ltd Phone: +916854289756 Date: 2-9-2017

Address: Buxipur Gorakhpur Money Receipt MR No. ap/mr/001

Particular Amount

Professional fees 40000

Tds on professional fees (4000)

INR Thirty-six thousand only 36000

Note: - Pan available _______________

Through: Axis: Cheque no. 275684 Signature

7. Pass the entry by the below document.

Tax Invoice

Computer world pvt ltd

10b Shahi market Gorakhpur

To, Date: 01-10-2017

Castle pvt ltd

Buxipur Gorakhpur Invoice no. INV/0023/17

Sl No. Description of goods Unit price Unit Amount

1 Furniture 20000 12 240000

Add:

CGST @6% 14400

SGST @6% 14400

Installation charge 32000

CGST@9% 2880

SGST@9% 2880

Total 306560

INR three lack six thousand five hundred sixty only For COMPUTER WORLD PVT LTD

Signature

8. On 1-11-2016 company Tds amount paid to Govt. with late fine.

9. Pass the entry by the below document.

Invoice to: Castle pvt ltd Bill no: sale/003/17-18

Buxipur Gorakhpur

M/S Aditya pvt ltd Tax invoice Date: 2-10-2017

27, road kushinagar Credit: 30days

SL. DESCRIPTION QTY RATE GST AMOUNT

1 MONITER 40 9200 18% 368000.00

2 PRINTER 20 10500 18% 210000.00

3 CPU 15 6500 12% 97500.00

Add:

CGST 57870.00

SGST 57870.00

INR Seven lack ninety thousand seven hundred forty only TOTAL 790740.00

Castle pvt ltd

Accountant

10. On 1-11-2017 company paid gst amount to govt.

11. Create the following employee with the details given.

Name Group Basic DA Overtime CA Pf

Vijay Account 15000 40% 225/hr. 2200 Computed

Sahil Sales 12000 40% 200/hr. 2000 Computed

Satyam Marketing 6500 40% 175/hr. 2500 Computed

12. Pass the attendance entry on 1-12-2017 Vijay & satyam was present 27 & 28 days and sahil & Vijay done overtime 155 min.

& 220 min.

13. On 2-12-2017 pass salary due processing entry and pf payble.

14. On 1-1-2018 salary amount paid by cheque.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- TMV Ba Tally Erp-9Document30 pagesTMV Ba Tally Erp-9Rajat PatelNo ratings yet

- Practical IllustrationDocument4 pagesPractical IllustrationMk Siv SpNo ratings yet

- CONVERSACIONDocument1 pageCONVERSACIONMk Siv SpNo ratings yet

- Kendriya Vidyalaya English WorksheetDocument2 pagesKendriya Vidyalaya English WorksheetMk Siv SpNo ratings yet

- 10) Inter Caste Marriage FormDocument2 pages10) Inter Caste Marriage FormMk Siv SpNo ratings yet

- Hand Writing TipsDocument1 pageHand Writing TipsMk Siv SpNo ratings yet

- English GGDocument1 pageEnglish GGMk Siv SpNo ratings yet

- Adjectives in Spanish: Adjective EndingsDocument10 pagesAdjectives in Spanish: Adjective Endingsev komNo ratings yet

- VaniDocument1 pageVaniMk Siv SpNo ratings yet

- Narayana StotramDocument1 pageNarayana StotramMk Siv SpNo ratings yet

- 10) Inter Caste Marriage - Form PDFDocument1 page10) Inter Caste Marriage - Form PDFSenthil Velu PNo ratings yet

- Cursive WritingDocument1 pageCursive WritingMk Siv SpNo ratings yet

- Vedic MathsDocument1 pageVedic MathsMk Siv SpNo ratings yet

- EswarDocument1 pageEswarMk Siv SpNo ratings yet

- CHGCGHCHCG JKBKJBJBJMBJM NMNBBNMBMNBMNBN VJHVJVJJJJHVNCCFGCFCFGCGFCGF FXFGXGFXGXGFXXGXDocument1 pageCHGCGHCHCG JKBKJBJBJMBJM NMNBBNMBMNBMNBN VJHVJVJJJJHVNCCFGCFCFGCGFCGF FXFGXGFXGXGFXXGXMk Siv SpNo ratings yet

- C' Language: Answer Any Five QuestionsDocument1 pageC' Language: Answer Any Five QuestionsMk Siv SpNo ratings yet

- Job WorkDocument6 pagesJob WorkMk Siv SpNo ratings yet

- Mythri Ojas Institute Tally Erp 9 Exam: Name of The Student: Batch TimeDocument12 pagesMythri Ojas Institute Tally Erp 9 Exam: Name of The Student: Batch TimeMk Siv SpNo ratings yet

- Using Nouns in SentencesDocument26 pagesUsing Nouns in SentencesLiu InnNo ratings yet

- TESTDocument2 pagesTESTMk Siv SpNo ratings yet

- C Question PaperDocument106 pagesC Question PaperMk Siv SpNo ratings yet

- Work Book SpanishDocument1 pageWork Book SpanishMk Siv SpNo ratings yet

- C' Language: Answer Any Five QuestionsDocument1 pageC' Language: Answer Any Five QuestionsMk Siv SpNo ratings yet

- Mythri Ojas Institute Tally Erp 9 Exam: Name of The Student: Batch TimeDocument12 pagesMythri Ojas Institute Tally Erp 9 Exam: Name of The Student: Batch TimeMk Siv SpNo ratings yet

- 2 Simple-Present PDFDocument6 pages2 Simple-Present PDFAnnie AzNo ratings yet

- Artices ExercisesDocument2 pagesArtices ExercisesMk Siv SpNo ratings yet

- 1 - Basics, GenerationDocument43 pages1 - Basics, GenerationMk Siv SpNo ratings yet

- KOREANDocument2 pagesKOREANMk Siv SpNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Guide to SAP Tables by ModuleDocument19 pagesGuide to SAP Tables by ModuleRavindra Sadar JoshiNo ratings yet

- Tax Bulletin 55 PDFDocument48 pagesTax Bulletin 55 PDFABC 123No ratings yet

- MRL Tyres Limited Tax InvoiceDocument1 pageMRL Tyres Limited Tax InvoiceramanNo ratings yet

- Steps in Closing SPDocument2 pagesSteps in Closing SPphilip william altaresNo ratings yet

- FreshBooks Accounting Software ReviewDocument16 pagesFreshBooks Accounting Software ReviewAngela GalloNo ratings yet

- VAT Reconcilation Forein (3) 2Document28 pagesVAT Reconcilation Forein (3) 2Bani SinghNo ratings yet

- DD 1Document2 pagesDD 1Rebecca CooperNo ratings yet

- Qip ERPDocument113 pagesQip ERPPuja MazumdarNo ratings yet

- Trade and Cash Discount NotesDocument3 pagesTrade and Cash Discount NotesAyushNo ratings yet

- InvoiceReports PDFDocument1 pageInvoiceReports PDFJoel Mathew JacobNo ratings yet

- PIT and Estate Tax Updates 2018Document16 pagesPIT and Estate Tax Updates 2018Niel Edar BallezaNo ratings yet

- Meru Trip Report SummaryDocument1 pageMeru Trip Report SummaryvenspalNo ratings yet

- Accounts Sample Paper 04 0253b13ec1bb2Document48 pagesAccounts Sample Paper 04 0253b13ec1bb2opNo ratings yet

- Billing Report Test ScriptDocument4 pagesBilling Report Test ScriptSergio ArtinanoNo ratings yet

- Answers - Business Taxation - Input Vat (Chapter 9)Document2 pagesAnswers - Business Taxation - Input Vat (Chapter 9)Gino CajoloNo ratings yet

- планDocument13 pagesпланAngelaDamjanovaNo ratings yet

- Tax Invoice for Coffee Condiment OrganizerDocument1 pageTax Invoice for Coffee Condiment OrganizerSUNIL PATELNo ratings yet

- Gicici Bank: Discounting-WorkingDocument8 pagesGicici Bank: Discounting-WorkingManav SinghNo ratings yet

- Sales ContractDocument5 pagesSales ContractDemoBriliyanto0% (1)

- COD orders for stainless steel water bottlesDocument588 pagesCOD orders for stainless steel water bottlessattar khanNo ratings yet

- Using Project Revenue and BillingDocument122 pagesUsing Project Revenue and BillingAbbas khanNo ratings yet

- Value Added Tax Get The MaxDocument23 pagesValue Added Tax Get The MaxSubhash SahuNo ratings yet

- BioScan10 IriMagic 1000BK InvoiceDocument1 pageBioScan10 IriMagic 1000BK InvoiceAsterism TechPro RajasthanNo ratings yet

- Vendor API FAQsDocument14 pagesVendor API FAQsMehul ThakkarNo ratings yet

- (Emerson) Lead Magnet - CompressedDocument4 pages(Emerson) Lead Magnet - CompressedJohn BuenviajeNo ratings yet

- Cash vs Accrual Accounting: Key Differences ExplainedDocument3 pagesCash vs Accrual Accounting: Key Differences ExplainedAllen Jade PateñaNo ratings yet

- In60107 PDFDocument11 pagesIn60107 PDFMajda MohamadNo ratings yet

- Service Tax Abatement Rate Chart 01.04.2015 PDFDocument11 pagesService Tax Abatement Rate Chart 01.04.2015 PDFkumar45caNo ratings yet

- Peachtree Accounting Software GuideDocument10 pagesPeachtree Accounting Software Guidegemu custodioNo ratings yet

- 111 Tax GuideDocument81 pages111 Tax Guideavelito bautistaNo ratings yet