Professional Documents

Culture Documents

Group

Uploaded by

Saifullah MemonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Group

Uploaded by

Saifullah MemonCopyright:

Available Formats

2017

Performance Management

System at NBP

Group Members

SUKKUR INSTITUTE OF BUSINESS ADMINSITRTAION

Letter of Acknowledgement

We are writing this to pay our gratitude to our respected instructor Sir Qamaruddin Maitlo who

assigned us such a learning oriented project to compile the long report on performance management

system at NBP. This project has only been possible due to the continuous support, encouragement

and guidance of our respected instructor.

We would also like to thank Sukkur IBA who provided us the required resources and required facilities

to complete the project effectively.

We would also like to mention that the project is the fruit of mutual support and teamwork of the

members of the team.

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

Contents

Letter of Acknowledgement ................................................................................................................... 1

1.1 History of National Bank of Pakistan…………………………………………………………………………………………. 4

2.1 HR Values……………………………………………………………………………………………………………………………………5

2.2 Performance Management Objectives ............................................................................................. 5

3.1 Performance Management Review .................................................................................................. 8

3.1.1 Top-Down Review .......................................................................................................................... 8

3.1.2 Peer – Review Process .................................................................................................................. 8

3.1.3 360 Degree Feedback..................................................................................................................... 8

3.1.4 Self Assessment ............................................................................................................................. 9

4.1 Analyzing Performance Problem ...................................................................................................... 9

5.1 Performance Management System ................................................................................................ 11

5.1.1 NBP Improvement Plan ................................................................................................................ 11

5.1.2 Performance Planning.................................................................................................................. 13

5.1.3 Performance Execution ................................................................................................................ 13

5.1.4 Performance Review .................................................................................................................... 14

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

HR Mission

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

1.1 History of National Bank of Pakistan:

National Bank of Pakistan (the bank) was incorporated in Pakistan under the National Bank of

Pakistan Ordinance, 1949 and is listed on all the stock exchanges in Pakistan. It is registered

and head office is situated at I.I. Chundrigar Road, Karachi.

The bank is engaged in providing commercial banking and related services in Pakistan and

overseas. The bank also handles treasury transactions for the Government of Pakistan (GOP)

as an agent to the State Bank of Pakistan (SBP).

The bank operates 1,243 (2007: 1,232) branches in Pakistan and 22 (2007: 18) overseas

branches (including the Export Processing Zone branch, Karachi).

NBP (Formerly National Bank of Pakistan) has a solid foundation of over 63 years in Pakistan,

with a network of over 1349 branches, over 750 of which are Automated Branches, over 500

NBP ATMs in 41 cities nationwide and a network of over 12 banks on the MNET ATM Switch.

Overseas Branch Network:

Paris, Frankfurt, New York, Washington D.C., Tokyo, Osaka, Hong Kong, Kowloon, Seoul,

Bahrain, Dhaka, Chittagong, Ashgabat, Bishkek, Baku, Kabul, Jalalabad and KEPZ Offshore

Banking Unit

Nature of the Organization

National Bank of Pakistan is a Governmental Organization. It is functioning as an agent of

State Bank of Pakistan. It implements the policies of SBP. It basic objective was to extend

credit to the agriculture sector. It is the major business partner for the Government of Pakistan

with special emphasis on fostering Pakistan's economic growth through aggressive and

balanced lending policies, technologically oriented products and services offered through its

large network of branches. It deals all Govt Revenue, collection and payments of salaries,

pensions and Govt Treasury. It is a complete commercial, retail and corporate bank as well.

National Bank of Pakistan is naturally a Financial Organization, which deals with lending, and

borrowing and investing activities.

National Bank of Pakistan serving following product lines:

1. National Bank of Pakistan Saiban Scheme

2. NBP Advance Salary Scheme

3. National Bank Cash Gold Scheme

4. National Bank Kisan Dost Scheme

5. National Bank Premium Aamdani Certificate Scheme

6. NBP Karobar Scheme

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

Human resource Management at NBP

HR Mission:

Provide more talented Human Resource in all NBP functional areas in relation to competition

keep motivated all the employees and maintain total industrial harmony.

2.1 HR Values:

We believe that

People make the organization

People collectively yield results

People have ambitions and aspirations to be distinguished and rewarded

People form the human capital to be developed and invested in.

Performance Management Objectives:

The main objectives of performance management at NBP are discussed below:

To get agreement for achieving the objectives and organisation

To keep the employees toward the achievement of good performance at workplace.

To support the employees in clearly identifying the required skills and competencies

that performs the job effectively and efficiently as it would keep employees to perform

the work on right time.

To increase the employee performance can commitment by encouraging employee

motivation, empowerment and implantation of a good performance management.

To create an environment of a two-way communication between employee and

immediate manager and clarifying the all expectations from the employees.

Identifying the hidden barriers that detract the employees from performing well and

help the employees by mentoring, coaching and developing to enhance the personality.

Strong support from the colleagues, managers and form the organizational culture itself

to grow the employees by giving the opportunities to make them productive

Set standards, criteria and indicators to make sure the employees performance in

aligning with the organizational goals and objective

Developing a basis for several strategic decision making, succession planning a

performance based pay system in the bank to ensure transparency and accountability.

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

To promote personal growth and career advancement to make them the valuable asset

for the motivated workforce.

Agree on feedback mechanism (formal or informal, use for administrative purpose)

To consider the personal vision and short term and long term goal of employees

3.1 Performance Management Review

Employee review process depends on the type of job description and how much the dealing

with the customer involve other than the management work so following are the employee

review process:

3.1.1 Top-Down Review

It is the most important is employee’s assessment from the top down approach because the

immediate supervisor is responsible for giving the direction to employee and provide the

opportunities for learning new skills and capabilities and asses training needs to be more

productive in performing job better to be competitive in organization and market as well.

Putting a direct supervisor in assessing employee performance is prevailing in assessing the

correct performance and identify the gap because immediate supervisor can provide true

feedback about performance lacking. The whole assessment depends on meeting the annual

objective of the bank and it vary with job to job and employee to employee because each person

varies with skills and capabilities.

3.1.2 Peer – Review Process

At this review, employee performance is assessed by it co-worker although its very effective

because peers are the major source of getting the information about the task and they can be

better aware about challenges of the task and required skills and capabilities for job and can

judge better than the person from the top down or any competent authority.

The problem is attach with this peer review is that it involves the biasness of employees and

make the rating poor because in competition employees are being jealous with each other.

3.1.3 360 Degree Feedback

In a 360-degree feedback employees are assessed by assessed by stakeholders from above,

below and side like peers, managers, subordinates and even from customers to analyse the

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

behaviour with customers either pleasant, rude or any other unavoidable behaviour. This type

of review is headed by the human resource department itself and input from all of the sources

are kept secret to maintain the privacy of employees and keep the motivated and productive.

The drawback of this review is that employee is being criticized by other stakeholders who

have no direct information regarding the performance or the can be biased while rating because

employees have right to rate so organization is unable to identify the intension behind the poor

rating or very rating of employees based on may be favouritism or personal relations among

employees.

3.1.4 Self-Assessment

It is also preferred in most of organization and can be used in conjunction with any another

review method listed above. Most of the companies are using this because it helps in identifying

the which employee need training and where they need guidance in career path. It also the

employee to receive some constructive feedback from the manager and supervisor.

The drawback of this review process is that employees sometime rate themselves very good

against the manager rating so it creates conflict among employee and manager.

4.1 Analyzing Performance Problem

1.Organizational and Job Factors

Organizational and job factors are outside the control of employee and create hindrance in

meeting the organizational objectives, in this situation manager is responsible for taking

corrective action for smooth running of operations. Some of these issues are defined below:

Poor leadership / role modelling

Lack of clarity in meeting expectational, roles and responsibilities and authority

delegation.

Inadequate resources to fulfil the tasks

Unrealistic goals and individual targets, policies and procedures

Uncomfortable work environment (harassment, discrimination, prejudice)

Lack of reward for good performance and leads to poor and ineffective performance

Lack of direct feedback from supervisor

2 Individual Factors

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

Some of the factors that affect employee performance are defines below:

Personal Circumstances (Magisterial or family problem, financial issues etc.)

Physical or emotional health problems (medical issues, depression, anxiety)

Insufficient knowledge or incompetent to meet the job requirements or unable to use

technology based resource

Mismatch to job, wrong person for the job

Don’t discuss with the immediate supervisor for achivwmnrt and hesitate in

Poor Performance Vs Misconduct

Most of the time manager are confused to identify the poor performance or misconduct of

employees and find in difficulty while assessing so distinguishing factors are defined below:

Poor Performance

Unable to fulfil task due to incompetency

Complaints from the manager for failing in learning new skills

Results in demotion

Not wilful

Misconduct

Breach of discipline

Wrong attitude rather than performing well

Wilful reject for instruction of competent authority

Grieve able and ad judicable behaviour

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

5.1 Performance Management System

The NBP has developed performance management system and widely followed for all

positions of organization, from OG-1 to OG-4. NBP have total 10 criteria performance

management, which truly predict the overall performance of an employee. It covers

Emotional intelligence part, discipline part and communication skills part.

CRITERIA PERFORMANCE MANAGEMENT

Devotion Discipline and punctuality

Initiative and drive

Team spirit

Intelligence

Honesty

Interpersonal relationship skills

Creativity and innovations

Flexibility

Loyalty and

Fitness

The NBP have also five broad performance factor that which are sign of a large

organization having well organized and systematic performance management system.

PERFORMANCE FACTOR

Professional knowledge

Improving corporate culture

Decision making ability

Ability to visualize and plan

Ability to act on emergent situation

5.1.1 NBP Improvement Plan

In this stage, crisp arrangement of objectives is set up for a worker and new due date is

accommodated finishing those destinations. The representative is obviously imparted about the

zones in which the worker is relied upon to enhance and a stipulated due date is likewise

allocated inside which the representative must demonstrate this change. This arrangement is

together created by the evaluate and the appraiser and is commonly affirmed

As every organization have its own performance management system that depict how careful

and serious attitude they are possessing for appraising and performance management of

employees. The NBP have its own step by step performance management system. PMS of

NBP almost following same step by step which we read in our book.

Prerequisite

Performance planning

Performance execution

Collecting and sharing performance data

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

Performance assessment

Preparing for performance reviews

Prerequisite

Knowledge of Knowledge of job

mission and goals in question

Behaviour

Performance Planning

Improvement plan

Performance Performance

Execution Assessment

Performance Review

Model of Performance Management in NBP

Association Practice

NATIONAL BANK OF PAKISTAN incompletely takes after Graphic Rating Scale technique.

Here every individual has diverse arrangement for assessing. Practically junior to senior

workers have comparative configuration to fill in however there is some exemption for the

senior level. The arrangement is outlined in the way like Fist page must be topped off by the

workers without anyone else yet they need to sign in every one of the pages. There is point

framework for assessing representatives.

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

Prerequisites

Knowledge of the organization’s mission and strategic goals

Knowledge of Organization is important to implement prerequisites step of

performance management system. This knowledge helps in doing strategic planning

process which takes place after collecting organization mission and goals. As strategic

planning process clearly define its purpose or reason for existing.

Knowledge of the job in question

Then comes what job position is taken for performance management. All position

across organization is consider under each factor and criteria of performance

management. After taken a position, knowledge is acquired by appraiser to evaluate

this. NBP is one of organization in Pakistan, which has organized and well developed

records of knowledge of each position. Which position should possess number of

leaves, what roles and responsibilities are necessary, merit and benefit salary

increased annually.

5.1.2 Performance Planning

Results

In NAP, goal and competencies are set by a mutual agreement between appraiser and

appraise. Results are measured based on competency. There are two types core

competencies (mandatory for all), role specific and function specific.

Behaviours

Behaviours are carefully considering and evaluated through trait, knowledge and

skills approach. NBP as a finance company give more important to knowledge based

approach for evaluating serious attitude of employees, higher serious attitude means

higher knowledge of employee.

Improvement Plan

After the outcomes are measured, preparing need are recognized in discussion with the

appraiser. The appraiser is your quick supervisor and the analyst will be the individual

next in the chain of command. For instance, for OG-2, OG-3 and OG-4 the appraiser is

divisional head and the analyst is HOOD/Director

5.1.3 Performance Execution

As arranging contributing much significance, execution is likewise well contributing in

compelling execution of execution administration.

These are progressing execution input and instructing: he ought to request the input on

fulfilment of assignment .it is very suggesting for the appraisers and appraisers both to

make utilization of STAR shape (connected) to record achievements/basic occasions

all through year and utilize it at the season of evaluation. In NAP, STAR Model is taken

after, STAR remains for circumstance, activities and results

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

Correspondence with boss

The idea of worker engagement is worked exceptionally well in NAP. Every single

Junior representative are solace with their quick administrator. Every single junior

worker and their chief are settled on one page. like when leaves and unlucky

deficiencies are concerned, assess, appraiser and commentator are altogether

encouraged to stay away from nonattendances from work and timetable their leaves and

authority assignments as needs be empowering us to settle the PMS evaluation stage

and consequent process well in time.

Performance Assessment

Evaluation and advising is given a considerable measure of significance in the

execution administration handle. This is the phase in which the representative gets

mindfulness from the appraiser about the regions of changes and furthermore data on

whether the worker is contributing the normal levels.

5.1.4 Performance Review

Employer measure real execution of representatives with predefined gauges. Real

accomplishments are composed against objectives and behavioural cases against skills .an

examination meeting is led and the appraisals of objectives and abilities are settled. There are

5 evaluations level for objectives (Outstanding, estimable, equipped, negligible and

inadmissibly) and 5 levels for abilities (constantly powerful, normally successful, every so

often viable, once in a while viable, never compelling).

Planning for execution audits

Regularly performed twice in a year in an association as mid surveys and yearly audits

which is held toward the finish of the monetary year. assess first offers the self-topped

off evaluations in the self-examination shape and furthermore depicts his/her

accomplishments over a timeframe in quantifiable terms.

Submitted to: Respected Sir Qamaruddin Maitlo Performance Management

You might also like

- Ational Ank of Akistan: BC080401631, G SDocument37 pagesAtional Ank of Akistan: BC080401631, G SLubna TajNo ratings yet

- Internship Report ZTBL, Hailey CollegeDocument109 pagesInternship Report ZTBL, Hailey CollegeAdnan80% (10)

- MDG 2014 English WebDocument59 pagesMDG 2014 English Webmillian0987No ratings yet

- 1 Aliia-Zainullina PDFDocument3 pages1 Aliia-Zainullina PDFSaifullah MemonNo ratings yet

- Painting A Picture For Africa PDFDocument26 pagesPainting A Picture For Africa PDFSaifullah MemonNo ratings yet

- MCQS Pak AffairsDocument8 pagesMCQS Pak AffairsKhuleedShaikhNo ratings yet

- List of Institutes With Foreign Collaboration-17!04!2017Document14 pagesList of Institutes With Foreign Collaboration-17!04!2017Sagar KumarNo ratings yet

- 1 (Com) Custom Inspector All Batches Test MCQ's - 1Document12 pages1 (Com) Custom Inspector All Batches Test MCQ's - 1awais khanNo ratings yet

- Pronlems Nad Chllenges in HRMDocument11 pagesPronlems Nad Chllenges in HRMSaifullah MemonNo ratings yet

- CSS Recommended Book List by 45th Common PDFDocument8 pagesCSS Recommended Book List by 45th Common PDFShahid KamalNo ratings yet

- Custom Inspector FPSC Past PapersDocument9 pagesCustom Inspector FPSC Past PapersNoorullah NoonariNo ratings yet

- 19 PDFDocument20 pages19 PDFAdnan MunirNo ratings yet

- 5 Surprising Habits of Toppers PDFDocument2 pages5 Surprising Habits of Toppers PDFSaifullah MemonNo ratings yet

- CSS Beginners Guide (2017-18) PDFDocument66 pagesCSS Beginners Guide (2017-18) PDFSaad Ahsan100% (1)

- Recruitment DefinedDocument4 pagesRecruitment DefinedSaifullah MemonNo ratings yet

- HRM MCQ Sem IDocument24 pagesHRM MCQ Sem ISuren Koundal71% (52)

- GAT Analytical ReasoningDocument272 pagesGAT Analytical ReasoningMuzaffar Iqbal90% (10)

- Relevance of Kissan Relief PackageDocument2 pagesRelevance of Kissan Relief PackageSaifullah MemonNo ratings yet

- HRM PPT13Document30 pagesHRM PPT13Saifullah MemonNo ratings yet

- Assgt 1 MacroDocument2 pagesAssgt 1 MacroSaifullah MemonNo ratings yet

- Principles of Agribusiness Management-BBA & MBA Course Outline Fall 2015Document16 pagesPrinciples of Agribusiness Management-BBA & MBA Course Outline Fall 2015Saifullah MemonNo ratings yet

- New Microsoft Word DocumentDocument3 pagesNew Microsoft Word DocumentSaifullah MemonNo ratings yet

- HRM Report Final 111Document7 pagesHRM Report Final 111Saifullah MemonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Aquinas Five Ways To Prove That God Exists - The ArgumentsDocument2 pagesAquinas Five Ways To Prove That God Exists - The ArgumentsAbhinav AnandNo ratings yet

- Gr. 10 Persuasive EssayDocument22 pagesGr. 10 Persuasive EssayZephania JandayanNo ratings yet

- Evolution DBQDocument4 pagesEvolution DBQCharles JordanNo ratings yet

- Kimura K.K. (KKK) : Can This Customer Be Saved? - Group D13Document6 pagesKimura K.K. (KKK) : Can This Customer Be Saved? - Group D13Mayuresh GaikarNo ratings yet

- R67068.0002 2 HB Profibus-Schnittstelle en KueblerDocument42 pagesR67068.0002 2 HB Profibus-Schnittstelle en KueblerSabari StunnerNo ratings yet

- DAB Submersible PumpsDocument24 pagesDAB Submersible PumpsMohamed MamdouhNo ratings yet

- Plane TrigonometryDocument545 pagesPlane Trigonometrygnavya680No ratings yet

- Manual - Rapid Literacy AssessmentDocument16 pagesManual - Rapid Literacy AssessmentBaldeo PreciousNo ratings yet

- ITP - Plaster WorkDocument1 pageITP - Plaster Workmahmoud ghanemNo ratings yet

- Pedagogical Leadership. Baird - CoughlinDocument5 pagesPedagogical Leadership. Baird - CoughlinChyta AnindhytaNo ratings yet

- Grimm (2015) WisdomDocument17 pagesGrimm (2015) WisdomBruce WayneNo ratings yet

- Apps Android StudioDocument12 pagesApps Android StudioDaniel AlcocerNo ratings yet

- Help SIMARIS Project 3.1 enDocument61 pagesHelp SIMARIS Project 3.1 enVictor VignolaNo ratings yet

- IVISOR Mentor IVISOR Mentor QVGADocument2 pagesIVISOR Mentor IVISOR Mentor QVGAwoulkanNo ratings yet

- Time Table & Instruction For Candidate - Faculty of Sci & TechDocument3 pagesTime Table & Instruction For Candidate - Faculty of Sci & TechDeepshikha Mehta joshiNo ratings yet

- Dady - Piernas LargasDocument12 pagesDady - Piernas LargasSarha NietoNo ratings yet

- AIF User Guide PDFDocument631 pagesAIF User Guide PDFÖzgün Alkın ŞensoyNo ratings yet

- ER288 090714 5082 CV OKP (089) Method Statement For Plate Baring TestDocument3 pagesER288 090714 5082 CV OKP (089) Method Statement For Plate Baring TestWr ArNo ratings yet

- Lifecycle of A Butterfly Unit Lesson PlanDocument11 pagesLifecycle of A Butterfly Unit Lesson Planapi-645067057No ratings yet

- Jungles & SavannasDocument80 pagesJungles & SavannasJessica100% (1)

- Information Brochure: (Special Rounds)Document35 pagesInformation Brochure: (Special Rounds)Praveen KumarNo ratings yet

- Formula Renault20 Mod00Document68 pagesFormula Renault20 Mod00Scuderia MalatestaNo ratings yet

- ZH210LC 5BDocument24 pagesZH210LC 5BPHÁT NGUYỄN THẾ0% (1)

- 22-28 August 2009Document16 pages22-28 August 2009pratidinNo ratings yet

- Chapter 07Document16 pagesChapter 07Elmarie RecorbaNo ratings yet

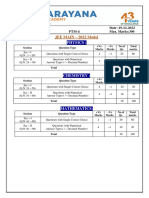

- Xii - STD - Iit - B1 - QP (19-12-2022) - 221221 - 102558Document13 pagesXii - STD - Iit - B1 - QP (19-12-2022) - 221221 - 102558Stephen SatwikNo ratings yet

- Phase DiagramDocument3 pagesPhase DiagramTing TCNo ratings yet

- SR# Call Type A-Party B-Party Date & Time Duration Cell ID ImeiDocument12 pagesSR# Call Type A-Party B-Party Date & Time Duration Cell ID ImeiSaifullah BalochNo ratings yet

- The Practice Book - Doing Passivation ProcessDocument22 pagesThe Practice Book - Doing Passivation ProcessNikos VrettakosNo ratings yet

- Graduate Macro Theory II: The Real Business Cycle Model: Eric Sims University of Notre Dame Spring 2017Document25 pagesGraduate Macro Theory II: The Real Business Cycle Model: Eric Sims University of Notre Dame Spring 2017Joab Dan Valdivia CoriaNo ratings yet