Professional Documents

Culture Documents

S&P/TSX 60 Index Etf: Horizons

Uploaded by

LesterOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

S&P/TSX 60 Index Etf: Horizons

Uploaded by

LesterCopyright:

Available Formats

HORIZONS

S&P/TSX 60 INDEX ETF

TM

HXT $32.37 Ticker:

HXT

Eligibility:

All Registered and Non-Registered Accounts

CHANGE $-0.10 -0.31% Inception Date: Benchmark:

VOLUME1 495064 September 14, 2010 S&P/TSX 60™ Index (Total Return)

LAST CLOSE $32.47

Net Assets2: Bloomberg Index Ticker:

1,843,233,220 (as at 2018-11-16) TX60AR

Prices delayed by 15 minutes.

Last trade: Nov 19, 2018 05:15 PM Consolidated Prior Day Volume3: Management Fee:

767,237 (for 2018-11-16) 0.07% rebated by 0.04% to an effective

management fee of 0.03%, until at least

Average Daily Trading Volume Over A 12 September 30, 2019 (plus applicable sales tax)

Month Period4:

798,708 (as at 2018-10-31) Currency:

CAD

Exchange:

Toronto Stock Exchange Counterparty Exposure5:

-4.97% (as at 2018-10-31)

Investment Manager:

Horizons ETFs Management (Canada) Inc. LEI 6:

549300UV6MMK38353F61

Horizons - S&P/TSX 60™ Index ETF (Timestamp: November 20, 2018) 1 of 4

Investment Objective

Horizons HXT seeks to replicate, to the extent possible, the performance of the S&P/TSX 60™ Index (Total Return), net of PRICE AND NAV

expenses. The S&P/TSX 60™ Index (Total Return) is designed to measure the performance of the large-cap market segment of the as at November 16, 2018

Canadian equity market. Nav/Unit: $32.47230

Daily NAV (Since Inception) HXT Volume Price: $32.47

Premium Discount: $-0.00

Premium Discount Percentage: -0.01%

$30.00

Outstanding Shares: 56,763,310

$20.00

INDEX INVESTMENT METRICS

$10.00 as at October 31, 2018

Index 12-Month Trailing Yield7: 3.22

Current Index Yield8: 3.27

2011 2012 2013 2014 2015 2016 2017 2018

INDEX SECTOR ALLOCATION

The NAV chart above only shows the historical daily net asset value per unit (NAV) of the ETF, and identifies the various distributions made by the ETF, if as at September 30, 2018

any. The distributions are not treated as reinvested, and it does not take into account sales, redemption, distribution or optional charges or income taxes

payable by any securityholder. The NAV values do contemplate management fees and other fund expenses. The chart is not a performance chart and is not

indicative of future NAV values which will vary.

Growth Of 10K (1 Year)

$17.5k

$17k

Consumer Discretionary (4.18%)

$16.5k Consumer Staple (3.73%)

Energy (20.41%)

Financial (40.52%)

$16k

Health Care (0.60%)

Industrial (10.08%)

$15.5k Information Technology (3.55%)

Jan '18 Apr '18 Jul '18 Oct '18 Materials (8.78%)

Telecommunication (6.54%)

The Growth of 10K chart above is based on the historical daily net asset value per unit (NAV) of the ETF, and represents the value of an initial investment

into the ETF of $10,000 since its inception, on a total return basis. Distributions, if any, are treated as reinvested, and it does not take into account sales,

Utilities (1.61%)

redemption, distribution or optional charges or income taxes payable by any security holder. The NAV values do contemplate management fees and other

fund expenses where paid by the fund. The chart is not a performance chart and is not indicative of future value which will vary.

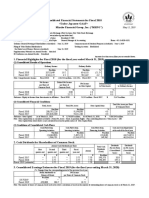

Annualized Performance*

1 Mo 3 Mo 6 Mo YTD 1 Yr 3 Yr 5 Yr SIR**

Horizons S&P/TSX 60™ Index ETF -5.73 -7.90 -1.37 -4.36 -2.60 7.20 6.21 5.95

S&P/TSX 60 Index Total Return -5.73 -7.89 -1.35 -4.33 -2.57 7.24 6.25 6.00

**Performance since inception on September 14, 2010, as at October 31, 2018

Calendar Year Performance*

2010 2011 2012 2013 2014 2015 2016 2017

ETF (HXT) -- -9.12 7.99 13.19 12.21 -7.80 21.32 9.75

S&P/TSX 60 Index Total Return -- -9.08 8.07 13.26 12.27 -7.76 21.36 9.78

Horizons - S&P/TSX 60™ Index ETF (Timestamp: November 20, 2018) 2 of 4

Morningstar Ratings

★ ★ ★ ★ 4 star Overall Morningstar Rating™1

★ ★ ★ ★ 4 star 5-Year Morningstar Rating™2

★ ★ ★ ★ 4 star 3-Year Morningstar Rating™1

1The above ratings are all based out of 445 funds in the Canadian Equity Morningstar category as at 31/10/2018.2The above ratings are all based out of 346

funds in the Canadian Equity Morningstar category as at 31/10/2018.

Morningstar, Inc. rates mutual funds and ETFs from 1 to 5 stars based on an objective mathematical evaluation of past performance (after adjusting for

risk and accounting for sales charges) in comparison to similar funds and ETFs. Every fund is rated versus its category peers over the following discrete

periods: three years, five years, and ten years (Morningstar, Inc. does not calculate one year ratings). The performance that corresponds to this (these)

rating(s) and rating period(s) is shown on this product page. Funds are rated on a curve, with the top 10% and bottom 10% of risk-adjusted performers in

each category receiving one star and five stars, respectively. The next 22.5% at each end of the scale receive two stars and four stars, respectively, whilst

the middle 35% receive three stars. The Overall Morningstar Rating is a weighted average of the ratings for all rated periods. The Overall Ratings view the

funds as long-term investment vehicles and therefore puts the most emphasis on longer time-periods. For a fund with 10 years of history, a 50% weight is

put on the 10-year rating period, a 30% weight on the five-year rating period, and a 20% weight on the three-year rating period. For a fund with five years of

history, a 60% weight is put on the five-year rating period, and a 40% weight on the three-year rating period. For a fund with 3 years of history, the Overall

Rating will have a 100% weight on the three-year rating period. Funds and ETFs are rated monthly and those with less than three years of history are not

rated. The ratings can change monthly and are a useful tool for identifying funds and ETFs worthy of further research, but should not be considered buy or

sell signals. For more information see www.morningstar.com. Past performance is no guarantee of future results.

Top 10 Index Holdings

as at October 31, 2018

Security Name Weight

ROYAL BANK OF CANADA 8.73%

TORONTO-DOMINION BANK/THE 8.44%

BANK OF NOVA SCOTIA/THE 5.50%

CANADIAN NATIONAL RAILWAY CO 5.22%

SUNCOR ENERGY INC 4.54%

ENBRIDGE INC 4.45%

BANK OF MONTREAL 3.98%

CANADIAN IMPERIAL BANK OF COMMERCE 3.18%

BROOKFIELD ASSET MANAGEMENT INC 2.96%

BCE INC 2.89%

For the complete list of index constituents, please click here:

S&P/TSX 60™ Index

Horizons - S&P/TSX 60™ Index ETF (Timestamp: November 20, 2018) 3 of 4

WWW.HORIZONSETFS.COM

1 Volume: Real-time volume on the Toronto Stock Exchange only.

2 Net Assets: The value of all assets, less the value of all liabilities, at a particular point in time. (Includes all classes of this ETF).

3 Consolidated

Prior Day Volume: The ETF’s aggregate volume traded on all Canadian exchanges.

4 Average

Daily Trading Volume over 12 Month Period: The ETF’s aggregate average daily trading volume over a 12 month period traded on all Canadian exchanges.

5 Counterparty Exposure: Represents a net amount owed to or owed from the ETF’s Bank Counterparty(ies), as a percentage of the total net assets of the ETF. If the figure is

negative, there is no counterparty risk as the ETF has more cash collateral than the net assets of the ETF and the ETF owes that net amount to its Bank Counterparty(ies). If the

figure is positive, there is counterparty risk for the net amount owed to the ETF by the Bank Counterparty(ies). Under National Instrument 81-102, the net amount owed to the ETF’s

Bank Counterparty(ies), which is also the positive mark-to-market value of the derivative instruments in the ETF, cannot generally exceed 10% of the net assets of the ETF, therefore

counterparty risk is limited to a maximum of 10% of the ETF’s net assets. Counterparty risk generally refers to the credit risk with respect to the amount an ETF expects to receive

from its Bank Counterparty(ies) to the financial instruments entered into by the ETF.

6 LEI: The Legal Entity Identifier (LEI) is the International ISO standard 17442. LEIs are identification codes that enable consistent and accurate identification of all legal entities that

are parties to financial transactions, including non-financial institutions.

7 Index

12-month trailing yield: Sum of the weighted trailing dividend yields of index constituent securities over the previous 12 months. The trailing yield is defined as the sum of

distribution per share amounts that have gone ex-dividend over the prior 12 months, divided by the stock price as at the close on the last business day of the last month end. Gross

or net dividend amounts are used based on the local market convention. All cash dividend types are included in this yield calculation.

8 Current

Index yield: Sum of the weighted dividend indicated yields of all index constituent securities. The dividend indicated yield is defined as the most recently announced

dividend amount, annualized based on the dividend frequency, then divided by the market price as at the close of the last business day of the last month end. Gross or net dividend

amount is used based on market convention.

Horizons ETFs is a Member of Mirae Asset Global Investments. Commissions, management fees and expenses all may be associated with an investment in exchange traded

products managed by Horizons ETFs Management (Canada) Inc. (the "Horizons Exchange Traded Products"). The Horizons Exchange Traded Products are not guaranteed, their

values change frequently and past performance may not be repeated. The prospectus contains important detailed information about the Horizons Exchange Traded Products.

Please read the prospectus before investing.

“Standard & Poor’s®” and “S&P®” are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”) and “TSX®” is a registered trademark of the TSX Inc. (“TSX”).

These marks have been licensed for use by Horizons ETFs Management (Canada) Inc. The ETF is not sponsored, endorsed, sold, or promoted by the S&P, TSX or their affiliated

companies and none of these parties make any representation, warranty or condition regarding the advisability of buying, selling or holding units/shares of the ETF.

*The indicated rates of return are the historical annual or annual compounded total returns (as indicated) including changes in per unit value and reinvestment of all dividends or

distributions and do not take into account sales, redemption, distribution or optional charges or income taxes payable by any securityholder that would have reduced returns. The

rates of return shown in the table are not intended to reflect future values of the ETF [the Index/Indices] or returns on investment in the ETF [the Index/Indices is not/are not directly

investable]. Only the returns for periods of one year or greater are annualized returns.

Horizons - S&P/TSX 60™ Index ETF (Timestamp: November 20, 2018) 4 of 4

You might also like

- Amex STMTDocument1 pageAmex STMTMark GalantyNo ratings yet

- Your Stock Plan Account Value:: German Horacio PersicoDocument8 pagesYour Stock Plan Account Value:: German Horacio PersicoGermanPersicoNo ratings yet

- M&a Primer Event Booklet - March 1 2011Document66 pagesM&a Primer Event Booklet - March 1 2011chirdhNo ratings yet

- S&P/TSX 60 Index Etf: HorizonsDocument4 pagesS&P/TSX 60 Index Etf: HorizonsCelestien LaperierreNo ratings yet

- S&P 500 Index Etf: HorizonsDocument4 pagesS&P 500 Index Etf: HorizonsChrisNo ratings yet

- S&P/TSX Capped Composite Index Etf: HorizonsDocument4 pagesS&P/TSX Capped Composite Index Etf: HorizonsCelestien LaperierreNo ratings yet

- Marijuana Life Sciences Index Etf: HorizonsDocument4 pagesMarijuana Life Sciences Index Etf: HorizonsAlex CajelaisNo ratings yet

- S&P 500 Index Etf: HorizonsDocument4 pagesS&P 500 Index Etf: HorizonsCelestien LaperierreNo ratings yet

- CDN High Dividend Index Etf: HorizonsDocument4 pagesCDN High Dividend Index Etf: HorizonsCAT CYLINDERNo ratings yet

- Marijuana Life Sciences Index Etf: HorizonsDocument4 pagesMarijuana Life Sciences Index Etf: HorizonsstonerhinoNo ratings yet

- UBS (Lux) Equity SICAV - All China: Fund Description Performance (Share Class P-Acc Basis USD, Net of Fees)Document2 pagesUBS (Lux) Equity SICAV - All China: Fund Description Performance (Share Class P-Acc Basis USD, Net of Fees)J. BangjakNo ratings yet

- HXX - FactSheet EN - 2023 07 13 - 12 58pmDocument11 pagesHXX - FactSheet EN - 2023 07 13 - 12 58pmTHE LEGEND INDIANo ratings yet

- Kotak Standard Multicap Fund (G)Document4 pagesKotak Standard Multicap Fund (G)Rudhra MoorthyNo ratings yet

- 4 Assignment 4 PDFDocument2 pages4 Assignment 4 PDFasmelash gideyNo ratings yet

- Crude Oil 2X Daily Bull Etf: BetaproDocument4 pagesCrude Oil 2X Daily Bull Etf: BetaproHelen ZhangNo ratings yet

- CDN Select Universe Bond Etf: HorizonsDocument4 pagesCDN Select Universe Bond Etf: HorizonsCelestien LaperierreNo ratings yet

- L&T India Value FundDocument1 pageL&T India Value Fundjaspreet AnandNo ratings yet

- Affin Holdings Berhad: Low Allowance For Impairment of Loans Helps Beat Estimates - 23/08/2010Document6 pagesAffin Holdings Berhad: Low Allowance For Impairment of Loans Helps Beat Estimates - 23/08/2010Rhb InvestNo ratings yet

- Tally Bill The Perfect 1Document1 pageTally Bill The Perfect 1Unnat aggarwalNo ratings yet

- BMO Balanced ETF Portfolio - Advisor: Reasons To Invest in The Fund Fund DetailsDocument2 pagesBMO Balanced ETF Portfolio - Advisor: Reasons To Invest in The Fund Fund DetailsJasonJin93No ratings yet

- Alliance Financial Group Berhad: Boosted by Low Impairment Allowance For Loans - 23/08/2010Document5 pagesAlliance Financial Group Berhad: Boosted by Low Impairment Allowance For Loans - 23/08/2010Rhb InvestNo ratings yet

- VT PDFDocument6 pagesVT PDFSRGNo ratings yet

- What Is Mutual FundDocument6 pagesWhat Is Mutual Fund2K19/EE/116 ISH MISHRANo ratings yet

- IPO Diary January'2021Document19 pagesIPO Diary January'2021Rakshan ShahNo ratings yet

- Vanguard VTIDocument110 pagesVanguard VTIRaka AryawanNo ratings yet

- Keywords Asia Private Limited: PayslipDocument1 pageKeywords Asia Private Limited: PayslipAaronn RaphaaNo ratings yet

- Annual Report of IOCL 117Document1 pageAnnual Report of IOCL 117Nikunj ParmarNo ratings yet

- Franklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchDocument1 pageFranklin India Smaller Companies Fund Regular Plan Mutual Fund Value ResearchAbhishek GinodiaNo ratings yet

- AngelBrokingResearch L&TTechnologyServices IPONote 090916Document18 pagesAngelBrokingResearch L&TTechnologyServices IPONote 090916durgasainathNo ratings yet

- Psychedelic Stock Index Etf: HorizonsDocument4 pagesPsychedelic Stock Index Etf: HorizonsananNo ratings yet

- UNIOILDocument2 pagesUNIOILsteventanco1977No ratings yet

- Invoice No.002Document1 pageInvoice No.002sarthakNo ratings yet

- Portfolio ValuationDocument1 pagePortfolio ValuationAnkit ThakreNo ratings yet

- Absa Dividend Income FundDocument2 pagesAbsa Dividend Income FundGontse SitholeNo ratings yet

- CapitalGainDocument2 pagesCapitalGainYuvaNo ratings yet

- Performance As of October 31, 2020 Holdings by Company Size: Institutional ClassDocument1 pagePerformance As of October 31, 2020 Holdings by Company Size: Institutional ClassLjubisa MaticNo ratings yet

- Vanguard VEADocument114 pagesVanguard VEARaka AryawanNo ratings yet

- Schroder Dana Prestasi Plus: Fund FactsheetDocument1 pageSchroder Dana Prestasi Plus: Fund FactsheetGiovanno HermawanNo ratings yet

- IDEA One PagerDocument6 pagesIDEA One PagerdidwaniasNo ratings yet

- Agnc R 2017Document12 pagesAgnc R 2017Alejandro MNo ratings yet

- Sgov Ishares 0 3 Month Treasury Bond Etf Fund Fact Sheet en UsDocument3 pagesSgov Ishares 0 3 Month Treasury Bond Etf Fund Fact Sheet en UsVandy SilvaNo ratings yet

- Hiap Teck Venture Berhad :2QFY07/10 Net Profit Dips QoQ - 31/03/2010Document3 pagesHiap Teck Venture Berhad :2QFY07/10 Net Profit Dips QoQ - 31/03/2010Rhb InvestNo ratings yet

- Lecture 04Document17 pagesLecture 04Suman KunduNo ratings yet

- Exxon Mobil CorpDocument2 pagesExxon Mobil CorpBhubaneshwari Roy MNo ratings yet

- Ta Ann Holdings Berhad: Earnings Expected To Pick Up From 2QFY12/10 - 31/5/2010Document4 pagesTa Ann Holdings Berhad: Earnings Expected To Pick Up From 2QFY12/10 - 31/5/2010Rhb InvestNo ratings yet

- Company Profile Comparative Business Analysis Sales Analysis Price Analysis Earnings and Dividends AnalysisDocument14 pagesCompany Profile Comparative Business Analysis Sales Analysis Price Analysis Earnings and Dividends AnalysispradeepganwaniNo ratings yet

- BH Macro Limited: Monthly Shareholder ReportDocument6 pagesBH Macro Limited: Monthly Shareholder ReportdanehalNo ratings yet

- Target Corporation - Equity Value and Enterprise ValueDocument3 pagesTarget Corporation - Equity Value and Enterprise Valuemerag76668No ratings yet

- Eq - Uitf - Bpi Peif - Oct 2018Document3 pagesEq - Uitf - Bpi Peif - Oct 2018Darren ValienteNo ratings yet

- ValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Document4 pagesValueResearchFundcard TataRetirementSavingsFund ModeratePlan DirectPlan 2019jul15Ankit ShuklaNo ratings yet

- Otter Creek Long/Short Opportunity Fund: Investment Strategy ProcessDocument3 pagesOtter Creek Long/Short Opportunity Fund: Investment Strategy Processtcwalling2No ratings yet

- Assignment Print View13.4Document3 pagesAssignment Print View13.4alexie aurelioNo ratings yet

- Factsheet For Fidelity Mutual FundDocument2 pagesFactsheet For Fidelity Mutual FundewaidaebaaNo ratings yet

- ARKA - Arkha Jayanti Persada TBK.: RTI AnalyticsDocument1 pageARKA - Arkha Jayanti Persada TBK.: RTI AnalyticsfarialNo ratings yet

- Account Satement93320190702005003Document1 pageAccount Satement93320190702005003RJ Akash DevNo ratings yet

- COSCO - PH Cosco Capital Inc. Financial Statements - WSJDocument1 pageCOSCO - PH Cosco Capital Inc. Financial Statements - WSJjannahaaliyahdNo ratings yet

- Ngwata Friends Self Help GroupDocument8 pagesNgwata Friends Self Help Grouprobert mogakaNo ratings yet

- Axiata Group Berhad: Improvements Gaining Momentum - 31/5/2010Document5 pagesAxiata Group Berhad: Improvements Gaining Momentum - 31/5/2010Rhb InvestNo ratings yet

- Data18 FyDocument66 pagesData18 FyYessica LidiaNo ratings yet

- Statement 4597116Document1 pageStatement 4597116Thalia Pajares ArangurenNo ratings yet

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.From EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.No ratings yet

- CorporationsDocument9 pagesCorporationsimtinanNo ratings yet

- Introduction To Corporate Finance: True / False QuestionsDocument89 pagesIntroduction To Corporate Finance: True / False QuestionsBet NaroNo ratings yet

- Investor Presentation: March 2017Document32 pagesInvestor Presentation: March 2017Jenny QuachNo ratings yet

- Cityam 2011-02-09bookDocument32 pagesCityam 2011-02-09bookCity A.M.No ratings yet

- The Value of A Millisecond - Full StudyDocument46 pagesThe Value of A Millisecond - Full StudytabbforumNo ratings yet

- Tda Nam PDFDocument7 pagesTda Nam PDFAnonymous xsXqL6uhTNo ratings yet

- Banking Acronyms and AbbreviationsDocument14 pagesBanking Acronyms and Abbreviationssayan_shuvoNo ratings yet

- Cibc 5-Year GicDocument3 pagesCibc 5-Year GicSalimah ArabNo ratings yet

- 12 Global Indices INDEXDocument31 pages12 Global Indices INDEXjudas1432No ratings yet

- TSXe ReviewDocument290 pagesTSXe ReviewexsarafNo ratings yet

- Test Bank For Corporate Finance 2nd Canadian Edition BerkDocument14 pagesTest Bank For Corporate Finance 2nd Canadian Edition BerkmessiphatwtpwNo ratings yet

- PricelistDocument162 pagesPricelistNIT TEKSTILNo ratings yet

- Active FacilityDocument716 pagesActive FacilitytayyabemeNo ratings yet

- Energy Companies Listed On TSX and TSXV 2021 05 21 enDocument55 pagesEnergy Companies Listed On TSX and TSXV 2021 05 21 enAnanthakumarNo ratings yet

- RjgoldDocument26 pagesRjgoldSahaj Goel 576643No ratings yet

- Homburg Invest Inc.-2007Document78 pagesHomburg Invest Inc.-2007Southey CapitalNo ratings yet

- NBF Industry - Report 2022 01 04T06 - 50 - 56 05 - 00Document7 pagesNBF Industry - Report 2022 01 04T06 - 50 - 56 05 - 00robNo ratings yet

- Contoh Financial Report PDFDocument106 pagesContoh Financial Report PDFSandi Utama S0% (1)

- Drilling Companies in CanadaDocument5 pagesDrilling Companies in CanadaEngineer AlviNo ratings yet

- Currency ExchangeDocument18 pagesCurrency ExchangeJenny QuachNo ratings yet

- Mda CibcDocument12 pagesMda CibcAlexandertheviNo ratings yet

- 03 Oct - SedarDocument2 pages03 Oct - SedarDhirendra Pratap SinghNo ratings yet

- Comparing Algo Trading Advances in Canada & Globally - 20080506Document33 pagesComparing Algo Trading Advances in Canada & Globally - 20080506MuralidharNo ratings yet

- CIBC: Demographics and SMEsDocument3 pagesCIBC: Demographics and SMEsEquicapita Income TrustNo ratings yet

- Drillers and Dealers May 2011Document34 pagesDrillers and Dealers May 2011rossstewartcampbellNo ratings yet

- Report On Business February 2010Document14 pagesReport On Business February 2010investingthesisNo ratings yet

- Lse PDFDocument28 pagesLse PDFEmil AzhibayevNo ratings yet

- SP Indices Tickers ETFDocument41 pagesSP Indices Tickers ETFBrian ClarkNo ratings yet

- Global Electronic TradingDocument3 pagesGlobal Electronic Tradingzara20132013No ratings yet