Professional Documents

Culture Documents

Today Gold Market Trend and News

Uploaded by

Rahul SolankiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Today Gold Market Trend and News

Uploaded by

Rahul SolankiCopyright:

Available Formats

Daily Market Reflection

27thDecember 2018

COMDEX

Market Outlook

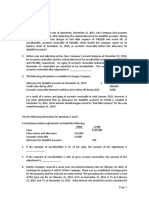

MCX Gold price begins today’s trading with clear positivity to

attack the correctional bullish channel’s resistance and

attempts to hold above it, oil price settles below 3120 barrel

after the decline that it witnessed in the previous sessions,

moving within bearish channel that supports the expectations

of continuing the bearish trend in the upcoming period,

MCX Copper price gained some firm momentum, to notice its Market

rally towards testing the broken support at 424, while the MCX Date Date % Chg

upcoming scenario depends on the stability of this barrier. 24-12-18 26-12-

18

GOLD 31460 31585 +0.40%

SILVER 37541 38274 +1.95%

Fundamental News COPPER 415.30 421.25 +1.43%

CRUDE 3077 3206 +4.19%

On Tuesday President Donald Trump said that a government ALUMINIUM 131.90 131.60 -0.23%

shutdown could last until his demand for funds to build a U.S.- LEAD 139.30 138.70 -0.43%

NICKEL 756.30 750.50 -0.77%

Mexico border is met.

ZINC 177.00 178.85 +1.05%

NATURALGAS 248.80 247.60 -0.48%

On Wednesday Crude Oil prices were mixed as the U.S.

COMEX Date Date % Chg

standard rebounded from steep losses in the previous session, 24-12-18 26-12-18

even though concern over the health of the global economy GOLD 1269.12 1270.97 +0.15%

continued to overshadow the market. SILVER 14.820 15.162 +2.31%

CRUDE 42.53 45.62 +7.19%

COPPER 2.661 2.701 +1.50%

$ INDEX 96.007 96.380 +0.39%

Important Data USDINR 70.1525 70.0700 -0.12%

-

Time Currenc Event Forecast Previou

y s OUR PREVIOUS CALLS UPDATE

10:30am JPY Housing Starts y/y -0.1% 0.3% Intraday super star

Date Commodity Entry Exit P/L

26/1 CHANA(S) 4340 4400 -6000

ECB Economic

2:30pm EUR 2

Bulletin

Multibagger

Unemployment Date Commodity Entry Exit P/L

7:00pm USD 220K 214K 26/1 NG(S) 245 235 12500

Claims

2

SCB Consumer Trifid special

8:30pm USD 133.0 135.7

Confidence Date Commodity Entry Exit P/L

26/1 GOLD(L) 31500 31700 20000

2

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Gold and Silver

GOLD COMEX GOLD

Gold showed sideways to bullish movement and found

PIVOT S1 S2 R1 R2

the major resistance level of 31740. Now if price

S

sustains on higher level then it will test next resistance

MCX 31470 31350 31740 31850

level of 31850. On other side 31470 will be major

COME 1270.81 1264.10 1278.89 1283.50 support level.

X

SILVER COMEX SILVER

PIVOTS S1 S2 R1 R2 Silver showed sideways to bullish movement and found

the major resistance level of 38500. Now if price

MCX 38100 37700 38500 38850 sustains on higher level then it will test next resistance

COMEX 14.77 14.50 15.15 15.30 level of 38850. On other side 38100 will be major

support level.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Crude and Copper

COMEX CRUDE

CRUDE

PIVOTS S1 S2 R1 R2 Crude oil showed sideways to bullish movement and

MCX 2959 2880 3259 3350 found the major resistance level of 3259. Now if price

sustains on higher level then it will test next resistance

COMEX 42.53 41.50 45.78 46.80 level of 3350. On other side 2959 will be major support

level.

COPPER COMEX COPPER

PIVOTS S1 S2 R1 R2 Copper showed sideways to bullish movement and

found the major resistance level of 424.40. Now if price

MCX 411.80 408 424.40 428 sustains on higher level then it will test next resistance

COMEX 2.6317 2.6110 2.7172 2.7548 level of 428. On other side 411.80 will be major support

level.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Other Commodities

PIVOTS

COMMODITIE S1 S2 R1 R2 VOLUME OI TREND

S

ALUMINIUM 130.50 129 132.15 134 3068 2645 Bearish

LEAD 138.35 137 140.40 142 6221 2174 Bullish

NICKEL 735 720 757 770 18279 15129 Bearish

ZINC 175.50 174 179.40 181 13667 3785 Bullish

NATURAL GAS 233.90 226 251 257 51425 517 Bearish

LME INVENTORY

COMMODITIES 19/12/2018 20/12/2018 21/12/2018 24/12/2018 26/12/2018

ALUMINIUM +28600 -1800 +11125 +1325 -

Due to Summer Bank Holiday NO LME DATA TODA

COPPER +6350 -125 +1500 +1500 -

LEAD -175 -975 +0 -50 -

NICKEL -150 -486 -96 +150 -

ZINC +2925 +1500 -1950 +2450 -

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Agri Commodity Updates

GUARSEED

Guarseed showed bullish movement and found the

important resistance level of 4282. If price maintains

above 4300 level in next trading session then this

momentum can take prices to 4350 level. If it breaks

the support level of 4200 then 4150 will act as next

support level.

PIVOTS S1 S2 R1 R2

4150 4100 4250 4300

JEERA

Jeera showed bearish movement today and found

the support level of 17070. If prices maintains

above 17500 levels in next trading session then this

momentum can take prices to 17800 levels. If it

breaks the support level of 17000 then 16700 will

act as next support level.

PIVOTS S1 S2 R1 R2

17000 16700 17500 17800

SOYABEAN

Soyabean showed bullish movement and found the

important resistance level of 3373. If price maintains

below 3350 level in next trading session then this

bearish momentum can take prices to 3300 level. If

it breaks the resistance level of 3400 then 3450 will

act as next resistance level.

PIVOTS S1 S2 R1 R2

3350 3300 3400 3450

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Intraday Super Star

(Premium Section)

CALL: SELL DHANIYA JAN BELOW 6180 TARGETS 6140/6100 SL 6240.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Multibagger Call

(Premium Section)

CALL: BUY ZINC ABOVE 179.40 TARGETS 180.60/181.80 SL 178.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

Trifid Special

(Premium Section)

SS

CALL: SELL SILVER BELOW 38250 TARGETS 37950/37650 SL 38550.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

DISCLAIM ER

Trifid Research respects and values the Right to Policy of each and every individual. We are

esteemed by the relationship and by becoming our clients; you have a promise from our side

that we shall remain loyal to all our clients and non-clients whose information resides with us.

This Privacy Policy of Trifid Research applies to the current clients as well as former clients.

Below are the word by word credentials of our Privacy Policy:

1. Your information, whether public or private, will not be sold, rented, exchanged,

transferred or given to any company or individual for any reason without your consent.

2. The only use we will be bringing to your information will be for providing the services to

you for which you have subscribed to us.

3. Your information given to us represents your identity with us. If any changes are brought

in any of the fields of which you have provided us the information, you shall bring it to

our notice by either calling us or dropping a mail to us.

4. In addition to the service provided to you, your information (mobile number, E-mail ID

etc.) can be brought in use for sending you newsletters, surveys, contest information, or

information about any new services of the company which will be for your benefit and

while subscribing for our services, you agree that Trifid Research has the right to do so.

5. By subscribing to our services, you consent to our Privacy Policy and Terms of Use.

6. Trifid research does not guarantee or is responsible in any which way, for the trade

execution of our recommendations, this is the sole responsibility of the client.

7. Due to the market’s volatile nature, the trader may/ may not get appropriate opportunity

to execute the trades at the mentioned prices and Trifid Research hold’s no liability for

any profit/ loss incurred whatsoever in this case.

8. It is the responsibility of the client to view the report timely from our Premium member

section on our website: www.trifidresearch.com and the same will also be mailed to this

registered email id.

9. Trifid research does not hold any liability or responsibility of delay in mail delivery of

reports, as this depends on our mail service provider’s network infrastructure.

10. The clients can call us for any query related to buying/selling the securities, based on

our recommendations.

www.trifidresearch.com | Email id: info@trifidresearch.com | Toll Free: 1800-270-1410

You might also like

- Today Commodity Gold Trading Tips and News UpdatesDocument9 pagesToday Commodity Gold Trading Tips and News UpdatesRahul SolankiNo ratings yet

- Free Indian Commodity MArket Report 1st Sept 2017Document9 pagesFree Indian Commodity MArket Report 1st Sept 2017Rahul SolankiNo ratings yet

- Real Time Market News and DataDocument9 pagesReal Time Market News and DataRahul SolankiNo ratings yet

- Free Commodity Tips and News AlertsDocument9 pagesFree Commodity Tips and News AlertsRahul SolankiNo ratings yet

- Free Indian Commodity Market Data and Charts For Trading PDFDocument9 pagesFree Indian Commodity Market Data and Charts For Trading PDFRahul SolankiNo ratings yet

- Free Online Commodity Gold Market NewsDocument9 pagesFree Online Commodity Gold Market NewsRahul SolankiNo ratings yet

- Live MCX Gold Market News 29 Aug 2017Document9 pagesLive MCX Gold Market News 29 Aug 2017Rahul SolankiNo ratings yet

- Free Commodity Trading Tips Via Experts AdviserDocument9 pagesFree Commodity Trading Tips Via Experts AdviserRahul SolankiNo ratings yet

- Free Indian Commodity Market Report Via ResearcherDocument9 pagesFree Indian Commodity Market Report Via ResearcherRahul SolankiNo ratings yet

- Daily Indian Commodity Market Report 24 Aug 2017Document9 pagesDaily Indian Commodity Market Report 24 Aug 2017Rahul SolankiNo ratings yet

- Free Online Commodity Trading Tips Via Market ExpertsDocument9 pagesFree Online Commodity Trading Tips Via Market ExpertsRahul SolankiNo ratings yet

- Commodity Trading Tips Via Share Market ExpertsDocument9 pagesCommodity Trading Tips Via Share Market ExpertsRahul SolankiNo ratings yet

- Live Commodity Trading Tips and Experts ViewDocument9 pagesLive Commodity Trading Tips and Experts ViewRahul SolankiNo ratings yet

- Free Online Commodity Trading Tips and NewsDocument9 pagesFree Online Commodity Trading Tips and NewsRahul SolankiNo ratings yet

- Commodity Market Live Charts For TradingDocument9 pagesCommodity Market Live Charts For TradingRahul SolankiNo ratings yet

- Commodity Trading Tips and Live ChartsDocument9 pagesCommodity Trading Tips and Live ChartsRahul SolankiNo ratings yet

- Daily News Report For Commodity MarketDocument9 pagesDaily News Report For Commodity MarketRahul SolankiNo ratings yet

- New Commodity Trading Data For TradingDocument9 pagesNew Commodity Trading Data For TradingRahul SolankiNo ratings yet

- Commodity Market Premium UpdatesDocument9 pagesCommodity Market Premium UpdatesRahul SolankiNo ratings yet

- Free Indian Commodity Market Reprot and Tips PDFDocument9 pagesFree Indian Commodity Market Reprot and Tips PDFRahul SolankiNo ratings yet

- Free Indian Commodity Market Reprot and Tips PDFDocument9 pagesFree Indian Commodity Market Reprot and Tips PDFRahul SolankiNo ratings yet

- Weekly Trend of Commodity Market 8th Aug 2017Document8 pagesWeekly Trend of Commodity Market 8th Aug 2017Rahul SolankiNo ratings yet

- Live Commodity Market Trading Tips and Market NewsDocument9 pagesLive Commodity Market Trading Tips and Market NewsRahul SolankiNo ratings yet

- Premium Commodity Tips For New InvestorsDocument9 pagesPremium Commodity Tips For New InvestorsRahul SolankiNo ratings yet

- Trade in Commodity Via Market ExpertsDocument9 pagesTrade in Commodity Via Market ExpertsRahul SolankiNo ratings yet

- Premium Commodity Trading Tips and News UpdatesDocument9 pagesPremium Commodity Trading Tips and News UpdatesRahul SolankiNo ratings yet

- Real Time Commodity Market Data, Calls and ChatrsDocument9 pagesReal Time Commodity Market Data, Calls and ChatrsRahul SolankiNo ratings yet

- Commodity-Premium Report 31ST July 147426655844145Document9 pagesCommodity-Premium Report 31ST July 147426655844145Rahul SolankiNo ratings yet

- Commodity Market Trend and News PortalDocument9 pagesCommodity Market Trend and News PortalRahul SolankiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IndusInd BankDocument67 pagesIndusInd BankCHITRANSH SINGHNo ratings yet

- 2010 CMA Part 2 Section B: Corporate FinanceDocument326 pages2010 CMA Part 2 Section B: Corporate FinanceAhmed Magdi0% (1)

- BA 114.1 - Module2 - Receivables - Exercise 1 PDFDocument4 pagesBA 114.1 - Module2 - Receivables - Exercise 1 PDFKurt Orfanel0% (1)

- Qo M Pass White PaperDocument40 pagesQo M Pass White Papersaurav.iseNo ratings yet

- 09-PCSO2019 Part2-Observations and RecommDocument40 pages09-PCSO2019 Part2-Observations and RecommdemosreaNo ratings yet

- Samsung C&T AuditDocument104 pagesSamsung C&T AuditkevalNo ratings yet

- Mutual Fund Management. Sybim-Sem-3 Faculty - Khyati Ma'am Co-Ordinator - Sheetal Ma'am Hinduja College of CommerceDocument24 pagesMutual Fund Management. Sybim-Sem-3 Faculty - Khyati Ma'am Co-Ordinator - Sheetal Ma'am Hinduja College of CommerceMonish jainNo ratings yet

- Msme Question PDFDocument9 pagesMsme Question PDFNiranjan ReddyNo ratings yet

- APC308 Financial Management (SL 1636)Document16 pagesAPC308 Financial Management (SL 1636)MD. SHAKILNo ratings yet

- Arbitrage Pricing TheoryDocument16 pagesArbitrage Pricing Theorya_karimNo ratings yet

- Revenue Memo Ruling 02-2002Document20 pagesRevenue Memo Ruling 02-2002Annie SibayanNo ratings yet

- Financial System and Financial MarketDocument10 pagesFinancial System and Financial MarketPulkit PareekNo ratings yet

- BV2018 - MFRS 4Document41 pagesBV2018 - MFRS 4Tok DalangNo ratings yet

- ST TH: Ordinance No. 28, Series of 2017Document20 pagesST TH: Ordinance No. 28, Series of 2017Marites TaniegraNo ratings yet

- Opsdog - KPI-Encyclopedia Consumer-Finance Preview 5 PgsDocument5 pagesOpsdog - KPI-Encyclopedia Consumer-Finance Preview 5 PgsJohn CheekanalNo ratings yet

- Hedge Fund Structures PDFDocument9 pagesHedge Fund Structures PDFStanley MunodawafaNo ratings yet

- Time Table Internal Audit SMK3 PT Ubs (2022)Document1 pageTime Table Internal Audit SMK3 PT Ubs (2022)Javiero Isroj WilnadiNo ratings yet

- CSR&SD 0118 l1 Intro To CSRDocument27 pagesCSR&SD 0118 l1 Intro To CSRUditNo ratings yet

- Brunei Darussalam TINDocument6 pagesBrunei Darussalam TINAyman MehassebNo ratings yet

- Steve Advanced Courses Part 3Document16 pagesSteve Advanced Courses Part 3Manuel NadeauNo ratings yet

- Internship Report On General Banking of Janata Bank LimitedDocument35 pagesInternship Report On General Banking of Janata Bank LimitedMd. Tareq AzizNo ratings yet

- PRIDE INTERNATIONAL INC 10-K (Annual Reports) 2009-02-25Document142 pagesPRIDE INTERNATIONAL INC 10-K (Annual Reports) 2009-02-25http://secwatch.com100% (5)

- Advanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFDocument60 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual Full Chapter PDFanwalteru32x100% (13)

- The California Fire Chronicles First EditionDocument109 pagesThe California Fire Chronicles First EditioneskawitzNo ratings yet

- MACS - Assignment 3 - Question PaperDocument8 pagesMACS - Assignment 3 - Question PaperAudrey KhwinanaNo ratings yet

- Ketan RathodDocument92 pagesKetan RathodKetan RathodNo ratings yet

- Global Cities and Developmental StatesDocument29 pagesGlobal Cities and Developmental StatesmayaNo ratings yet

- Sri Lalitha Nissima MahimaDocument56 pagesSri Lalitha Nissima MahimaPrathap Vimarsha100% (1)

- BUSS 207 - Fall 2021: Quiz 5 (Chapter 5) Solution: Investment Rate CompoundingDocument3 pagesBUSS 207 - Fall 2021: Quiz 5 (Chapter 5) Solution: Investment Rate Compoundingtom dussekNo ratings yet

- Hw5 Mfe Au14 SolutionDocument8 pagesHw5 Mfe Au14 SolutionWenn Zhang100% (2)