Professional Documents

Culture Documents

OBN 9 - Bank of Utica - Issue 22

Uploaded by

Nate TobikCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

OBN 9 - Bank of Utica - Issue 22

Uploaded by

Nate TobikCopyright:

Available Formats

THE ODDBALL STOCKS NEWSLETTER | 4

alleging that Avalon is entitled to recover the profits that MintBroker made trading Avalon stock under

the short-swing profits rule (since MintBroker owned more than ten percent of the company and held

the stock for less than six months).

In its amended complaint filed on September 28 th, Avalon refers to Guy Gentile as an “experienced

securities market operator and connosseur of scams.” Michael Goode wrote about this on his website

Goode Trades: “The story of MintBroker International buying up large stakes in microcap companies

and quickly selling them continues.” Avalon claims that Gentile and MintBroker owe the company

$7.25 million for the short-swing profits made in their stock.

So here is a funny thought. If it is true that the profits on the trading were that high, it must represent

money that Gentile made at the expense of other participants in the marketplace – trend followers and

penny stock daytraders – and not from the company itself. Imagine if the company is successful at

recovering that amount: it would be $1.90 per share for a company that trades at $2.92. This could be

looked at as a speculative litigation play. (Perhaps the big problem here would be that Gentile has

operated out of foreign jurisdictions like Puerto Rico and Bahamas, which would make enforcing any

judgments against him much more difficult.)

Lost in this fracas, of course, has been the performance of Avalon as a business. The company also

announced a new acquisition earlier this year: “On March 7, 2018, Avalon, through a newly created

subsidiary, Avalon Mahoning Sports Center, Inc., completed the acquisition of the Boardman Tennis

Center facility in Boardman, Ohio for approximately $1.3 million in cash.”

As of the quarter ended June 30th, the Avalon shareholders' equity was $38.3 million – up very slightly

since Nate first wrote about it a little over a year ago. For the first six months of 2018, cash from

operations was $2.2 million versus $718k for the first six months of 2017. Besides the tennis center

acquisition there was $670k of capital expenditures, so at least recently there has been free cash flow.

(For the full years 2017 and 2016, there was $1.25 million and $2.6 million of cash from operations

versus $1.8 million and $3 million of capital expenditure, respectively.)

Hopefully the capital investments (which we understand have been for the tennis and resort side of the

business) will be drawing to a close. In Q2 the waste management revenues were up 21% year-over-

year while the resort side was up only 2% year-over-year.

Bank of Utica

We mentioned them in the March Issue (#19) of the Newsletter. At that time, the nonvoting shares of

the company (OTC:BKUTK) were trading at $550, which was 62% of book. We also calculated that

those shares were trading at 70% of “adjusted book,” which we defined as shareholder equity less

certain other items such as (primarily) the bank's $23 million of premises and equipment. (Someday we

will visit Utica and see how the bank spent $9,993,295 for purchases of premises and improvements in

2016 and another $6,923,822 in 2017.)

Since then, the BKUTK share price has declined 9% and is currently offered at about $500 per share.

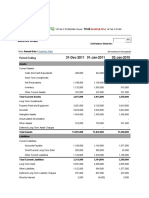

We took a look at their third quarter call report which was published on October 28 th. Interest income

(which almost all comes from line 1d3, “all other securities”) was $20.8 million for the first three

Copyright Oddball Media, LLC 2018

THE ODDBALL STOCKS NEWSLETTER | 5

months of the year, which annualizes to $27.7 million. That would be barely higher than the $27.5

million of interest income for the full year of 2017. Having interest income fail to grow with rising

rates would be an obvious consequence of having bought longer-term bonds for the fixed income

portfolio that comprises most of the bank's assets.

Meanwhile, Bank of Utica's interest expense was $6.7 million for the first three months of the year,

which annualizes to $8.9 million. That unfortunately is significantly higher than the $7.9 million for the

full year of 2017. The issue with falling net interest income is that Bank of Utica borrows short and

lends long, and even when bond yields were at record lows they did not seem to waver from that

strategy. Salaries look to be up a touch but other noninterest expense looks to be up 30% on an

estimated annualized basis. Another thing we noticed on the call report is that the company made $1.1

million in “donations” year-to-date in 2018 (this was $728k in 2017).

The other whopper on the income statement in the call report is that the company disclosed an

unrealized $12.1 million loss on equity securities not held for trading. (Remember this is a bank with

$231 million of capital.) The balance of equity securities at September 30 th was $79 million. The call

report also discloses that the equity securities had a cost of $28.7 million. The company has

consistently refused to disclose its equity or debt securities. All we know is that there are $461 million

of “other domestic debt securities” at fair value (down from $469 million cost) and $230 million of

“other foreign debt securities” at fair value (down from $235 million cost).

As we have observed before, this is a black box bond hedge fund or closed end fund that is a billion

dollar bond portfolio leveraged almost five to one on its equity. They actually did sell about $10 million

of three to five year paper and about $5 million of five through fifteen year paper. The bulk of assets

($405 million) are one year through three year debt securities.

Bank of Utica pays 1.1% on its deposits right now and is earning 2.8% (coupon yield) on its portfolio

of securities. Seems like a good trade to lever up five times right? But then you have $8.5 million in

annualized non-interest expense, which is actually just about as much as the interest expense. This is

something we have been mentioning in recent Newsletters: when you factor in the cost of running the

bank, banking is not normally that attractive of a business.

CIB Marine Bancshares, Inc.

We wrote about CIB Marine (OTC: CIBH) in Newsletter Issues 20 and 21. This is the small bank in the

Milwaukee suburbs with the fifteen year history of capital structure machinations that left the trust

preferred securities originally issued between 2000 and 2002 high and dry. Last time we wrote, the

company had completed a reverse tender dutch auction for its noncumulative preferred stocks on which

it has not been paying any dividends, but it was unclear exactly what price was paid or how accretive

the transaction was. However the third quarter financial release contained a little more detail:

Book and tangible book value per share of common stock improved to $2.34 and $2.71, respectively,

for September 30, 2018, compared to $2.04 and $2.53 at December 31, 2017.

During 2018, the carry value of preferred stock has declined $11.6 million due to repurchases of

preferred stock resulting in $1.8 million being transferred to additional paid in capital through

Copyright Oddball Media, LLC 2018

Subscribe to the Oddball Stocks Newsletter:

https://gumroad.com/l/oddball

The Oddball Stocks Newsletter and any excerpts therefrom (the “Content”) contained herein is

copyrighted and use of the Content is governed by the Oddball Media User Agreement. Please email

editor@oddballnewsletter.com for a copy.

In particular, please note that the User Agreement provides that:

The Content is not investment advice or recommendations or any other sort of professional advice

whatsoever, including but not limited to legal, tax, or accounting advice. If you desire investment,

legal, tax, accounting, or any other type of advice, you must obtain it for yourself from a qualified

professional. Before making any investment decision, you should carefully verify relevant facts for

yourself and discuss the decision with appropriate professional advisers who are familiar with your

specific situation and goals.

Some of the owners of Oddball Media, and some of the Newsletter's writers, guest writers,

interviewees, contributors, and editors (together the “Oddball Affiliates”) are or may be in business as

investment advisers or other types of professional advisers. However, the Oddball Affiliates still are not

your advisers nor are they providing any advice to you, unless you have contracted with any of them

separately. The Oddball Affiliates will have a variety of possible interests in any of the companies

mentioned in the Content These interests may conflict with yours if you own, purchase, or sell

securities of any of these companies. The Oddball Affiliates may buy or sell shares in any of the

companies, for themselves or for clients, either before or after the publication of a Newsletter.

The Content is not guaranteed to be accurate or complete and comes with no warranties of any kind.

You agree that any use by you of the Content is at your sole risk and acknowledge that it is provided

"AS IS" and that Oddball Media and the Oddball Affiliates disclaim all warranties of any kind, express

or implied, including, but not limited to, merchantability and fitness for a particular purpose or use.

Oddball Media and the Oddball Affiliates specifically disclaim any liability, whether based in contract,

tort, strict liability, or otherwise, for any direct, indirect, incidental, consequential, or special damages

arising out of or in any way connected with access to or use of the Content. In the event that any of the

foregoing limitations and disclaimers is ineffective, you agree that the maximum liability to you shall

be the total of the fees that you have paid to us. You agree that any dispute arising from, relating to, or

in any manner connected with your use of the Content shall be construed under and resolved in

accordance with the laws of the State of Arizona. Any such dispute shall be litigated only in the state or

federal courts of Maricopa County, Arizona, to the personal jurisdiction of which you hereby consent.

You might also like

- OBN 6 - Boston Sand and Gravel - Issue 21Document4 pagesOBN 6 - Boston Sand and Gravel - Issue 21Nate Tobik100% (1)

- Rofo 2018 ArDocument18 pagesRofo 2018 ArNate TobikNo ratings yet

- SHLTR 490641Document1 pageSHLTR 490641Nate TobikNo ratings yet

- OBN - UNIF - Issue 33 (January 2021)Document1 pageOBN - UNIF - Issue 33 (January 2021)Nate TobikNo ratings yet

- Scion 2006 4q Rmbs Cds Primer and FaqDocument8 pagesScion 2006 4q Rmbs Cds Primer and FaqsabishiiNo ratings yet

- East Coast Asset Management (Q4 2009) Investor LetterDocument10 pagesEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comNo ratings yet

- Graham Doddsville - Issue 23 - FinalDocument43 pagesGraham Doddsville - Issue 23 - FinalCanadianValueNo ratings yet

- Michael Guichon Sohn Conference Presentation - Fiat Chrysler AutomobilesDocument49 pagesMichael Guichon Sohn Conference Presentation - Fiat Chrysler AutomobilesCanadianValueNo ratings yet

- Aig Best of Bernstein SlidesDocument50 pagesAig Best of Bernstein SlidesYA2301100% (1)

- Catahoula ExcerptDocument6 pagesCatahoula ExcerptNate TobikNo ratings yet

- The Beekeepers' Guide to Investing: Focusing on Business Fundamentals Over Emotions in Volatile MarketsDocument13 pagesThe Beekeepers' Guide to Investing: Focusing on Business Fundamentals Over Emotions in Volatile Marketscrees25No ratings yet

- Becton Dickinson BDX Thesis East Coast Asset MGMTDocument12 pagesBecton Dickinson BDX Thesis East Coast Asset MGMTWinstonNo ratings yet

- Mick McGuire Value Investing Congress Presentation Marcato Capital ManagementDocument70 pagesMick McGuire Value Investing Congress Presentation Marcato Capital Managementmarketfolly.comNo ratings yet

- Graham - Doddsville - Issue 40 - v19 PDFDocument61 pagesGraham - Doddsville - Issue 40 - v19 PDFRofiq 4 NugrohoNo ratings yet

- Eric Khrom of Khrom Capital 2013 Q1 LetterDocument4 pagesEric Khrom of Khrom Capital 2013 Q1 LetterallaboutvalueNo ratings yet

- Avoca LLC Annual Report 2018Document16 pagesAvoca LLC Annual Report 2018kdwcapitalNo ratings yet

- Friendly Hills BANK Story ...Document4 pagesFriendly Hills BANK Story ...Nate TobikNo ratings yet

- 2019 Pardee Annual Report - Low ResolutionDocument36 pages2019 Pardee Annual Report - Low ResolutionNate Tobik100% (2)

- Bridge With BuffetDocument12 pagesBridge With BuffetTraderCat SolarisNo ratings yet

- Kyle Bass - Subprime Credit Strategies Fund Power PointDocument53 pagesKyle Bass - Subprime Credit Strategies Fund Power PointbrmadragonNo ratings yet

- OBN - BKUTK - Issue 32 (November 2020)Document1 pageOBN - BKUTK - Issue 32 (November 2020)Nate TobikNo ratings yet

- Bloomberg Businessweek-Europe Edition - 14-20 March 2016Document88 pagesBloomberg Businessweek-Europe Edition - 14-20 March 2016Βασίλης ΣίνοςNo ratings yet

- NBFC Thematic On Securitisation - Spark - 25nov19Document35 pagesNBFC Thematic On Securitisation - Spark - 25nov19chetankvoraNo ratings yet

- Advanced Battery Technologies, Inc.: Here HereDocument35 pagesAdvanced Battery Technologies, Inc.: Here HerePrescienceIGNo ratings yet

- Letter About Carl IcahnDocument4 pagesLetter About Carl IcahnCNBC.com100% (1)

- ThirdPoint Q1 16Document9 pagesThirdPoint Q1 16marketfolly.comNo ratings yet

- There'S Something' Weird Going OnDocument33 pagesThere'S Something' Weird Going OnZerohedge100% (7)

- East Coast Q1 2015 MR Market RevisitedDocument17 pagesEast Coast Q1 2015 MR Market RevisitedCanadianValue0% (1)

- Value Investing Congress NY 2010 AshtonDocument26 pagesValue Investing Congress NY 2010 Ashtonbrian4877No ratings yet

- Lazard Secondary Market Report 2022Document23 pagesLazard Secondary Market Report 2022Marcel LimNo ratings yet

- Physical Precious Metals and The Individual InvestorDocument12 pagesPhysical Precious Metals and The Individual InvestorSomaSorrowNo ratings yet

- OBN - Small Bank Snapshot - Issue 31Document6 pagesOBN - Small Bank Snapshot - Issue 31Nate TobikNo ratings yet

- Bloomberg Businessweek - July 28 2014Document72 pagesBloomberg Businessweek - July 28 2014Sunil Kumar100% (1)

- The Optimist - Bill Ackman - Portfolio - 05-2009Document10 pagesThe Optimist - Bill Ackman - Portfolio - 05-2009KuJungNo ratings yet

- Third Point Q2 15Document10 pagesThird Point Q2 15marketfolly.comNo ratings yet

- Eagle Capital Management PresentationDocument23 pagesEagle Capital Management Presentationturnbj75No ratings yet

- Sequoia Ann 14Document36 pagesSequoia Ann 14CanadianValueNo ratings yet

- Ackman Realty Income ShortDocument35 pagesAckman Realty Income Shortmarketfolly.com100% (1)

- Graham & Doddsville - Issue 20 - Winter 2014 - FinalDocument68 pagesGraham & Doddsville - Issue 20 - Winter 2014 - Finalbpd3kNo ratings yet

- Cadbury Trian LetterDocument14 pagesCadbury Trian Letterbillroberts981No ratings yet

- Beautiful Investment AnalysisDocument10 pagesBeautiful Investment AnalysisJohnetoreNo ratings yet

- LICOA Investment Schedule 12 31 2021Document32 pagesLICOA Investment Schedule 12 31 2021Nate TobikNo ratings yet

- Creighton Value Investing PanelDocument9 pagesCreighton Value Investing PanelbenclaremonNo ratings yet

- Value Investing Congress Presentation-Tilson-10!1!12Document93 pagesValue Investing Congress Presentation-Tilson-10!1!12VALUEWALK LLCNo ratings yet

- 1 L I LL I: WWW EscDocument4 pages1 L I LL I: WWW EscforexmastertanNo ratings yet

- Analysis of Berkshire Hathaway's Growth and ValuationDocument19 pagesAnalysis of Berkshire Hathaway's Growth and Valuationmacarthur1980No ratings yet

- Financial Fine Print: Uncovering a Company's True ValueFrom EverandFinancial Fine Print: Uncovering a Company's True ValueRating: 3 out of 5 stars3/5 (3)

- Investing in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketFrom EverandInvesting in Credit Hedge Funds: An In-Depth Guide to Building Your Portfolio and Profiting from the Credit MarketNo ratings yet

- Bruce Packard's Weekly Commentary on Spectra Systems and SomeroDocument8 pagesBruce Packard's Weekly Commentary on Spectra Systems and Somerobruce packardNo ratings yet

- Einhorn q2 2019Document7 pagesEinhorn q2 2019Zerohedge100% (2)

- Notes receivable allowance aging methodsDocument10 pagesNotes receivable allowance aging methodsppate110No ratings yet

- CB Chapter 16Document4 pagesCB Chapter 16Sim Pei YingNo ratings yet

- Fixed Income BulletinDocument12 pagesFixed Income BulletinfaiyazadamNo ratings yet

- Radar 05 2014 1117 DeepDive Red Tape in OzDocument3 pagesRadar 05 2014 1117 DeepDive Red Tape in OzzeronomicsNo ratings yet

- Accounting Textbook Solutions - 67Document19 pagesAccounting Textbook Solutions - 67acc-expertNo ratings yet

- WEEK 4 Inggris THE SABBATH CONTAINER COMPANYDocument3 pagesWEEK 4 Inggris THE SABBATH CONTAINER COMPANYRennya Lily KharismaNo ratings yet

- Third Point Q2'09 Investor LetterDocument8 pagesThird Point Q2'09 Investor Lettermarketfolly.com100% (1)

- UntitledDocument13 pagesUntitledJocelyn GiselleNo ratings yet

- An Overview of Financial MarketsDocument22 pagesAn Overview of Financial MarketsChihYing TiffNo ratings yet

- Money MarketDocument12 pagesMoney MarketkulkarnipradnyapvpitNo ratings yet

- Feature: Q&A With Sam Haskell of Colarion PartnersDocument7 pagesFeature: Q&A With Sam Haskell of Colarion PartnersNate TobikNo ratings yet

- Hanover Fiscal Q2 2022Document7 pagesHanover Fiscal Q2 2022Nate TobikNo ratings yet

- LICOA Order OrderDocument2 pagesLICOA Order OrderNate TobikNo ratings yet

- Berkshire's Performance vs. The S&P 500Document11 pagesBerkshire's Performance vs. The S&P 500Joseph AdinolfiNo ratings yet

- LICOA Annual Statement 12 31 2021Document61 pagesLICOA Annual Statement 12 31 2021Nate TobikNo ratings yet

- AFBA - Merger Agreement and Fairness Opinion - March 2022Document114 pagesAFBA - Merger Agreement and Fairness Opinion - March 2022Nate Tobik100% (1)

- LICOA Investment Schedule 12 31 2021Document32 pagesLICOA Investment Schedule 12 31 2021Nate TobikNo ratings yet

- Rockford Corporation - Notice of Special MeetingDocument28 pagesRockford Corporation - Notice of Special MeetingNate TobikNo ratings yet

- Obn - Gwox - Issue 34 (March 2021)Document1 pageObn - Gwox - Issue 34 (March 2021)Nate TobikNo ratings yet

- Bank of Utica (BKUTK) - Shareholder Letter - 02 01 2022Document5 pagesBank of Utica (BKUTK) - Shareholder Letter - 02 01 2022Nate TobikNo ratings yet

- OBN - Paired Comparisons of OTC and NASDAQ-Listed Banks - Issue 35 (June 2021)Document3 pagesOBN - Paired Comparisons of OTC and NASDAQ-Listed Banks - Issue 35 (June 2021)Nate TobikNo ratings yet

- Bank of Utica (BKUTK) - Annual Report - FY 2021Document35 pagesBank of Utica (BKUTK) - Annual Report - FY 2021Nate TobikNo ratings yet

- PARF - Final Liquidating Distribution - December 2021Document1 pagePARF - Final Liquidating Distribution - December 2021Nate TobikNo ratings yet

- OBN - BKUTK - Issue 32 (November 2020)Document1 pageOBN - BKUTK - Issue 32 (November 2020)Nate TobikNo ratings yet

- OBN - AFBA - Issue 36 (August 2021)Document1 pageOBN - AFBA - Issue 36 (August 2021)Nate TobikNo ratings yet

- OBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Document2 pagesOBN - Small Banks and The OTC Discount - Issue 34 (March 2021)Nate TobikNo ratings yet

- Hanover Foods Corp 2021 Annual ReportDocument31 pagesHanover Foods Corp 2021 Annual ReportNate TobikNo ratings yet

- OBN - Delaware Chancery Corner - Issue 33 (January 2021)Document1 pageOBN - Delaware Chancery Corner - Issue 33 (January 2021)Nate TobikNo ratings yet

- Catahoula Pages From Oddball Newsletter Issue 36Document6 pagesCatahoula Pages From Oddball Newsletter Issue 36Nate TobikNo ratings yet

- Hanover Fiscal Q1 2022 EarningsDocument7 pagesHanover Fiscal Q1 2022 EarningsNate TobikNo ratings yet

- Company Updates: Allied First BankDocument1 pageCompany Updates: Allied First BankNate TobikNo ratings yet

- OBN - Small Banks - Issue 32 (November 2020)Document2 pagesOBN - Small Banks - Issue 32 (November 2020)Nate TobikNo ratings yet

- OBN - Small Bank Snapshot - Issue 31Document6 pagesOBN - Small Bank Snapshot - Issue 31Nate TobikNo ratings yet

- LICOA Quarterly Statement Q3 2021Document36 pagesLICOA Quarterly Statement Q3 2021Nate TobikNo ratings yet

- Eric Speron Pages From Oddball - Newsletter - Issue - 36Document7 pagesEric Speron Pages From Oddball - Newsletter - Issue - 36Nate Tobik100% (1)

- Catahoula ExcerptDocument6 pagesCatahoula ExcerptNate TobikNo ratings yet

- SEC Rule 15c2-11restricted Securities: New AmendmentsDocument162 pagesSEC Rule 15c2-11restricted Securities: New AmendmentsNate TobikNo ratings yet

- Chapter 10Document28 pagesChapter 10YourMotherNo ratings yet

- Inflation AccountingDocument32 pagesInflation Accountingmanchana100% (9)

- Wahed FTSE USA Shariah ETF: FactsheetDocument4 pagesWahed FTSE USA Shariah ETF: FactsheetNajmi IshakNo ratings yet

- MBA 4th Sem IM Unit I Probs On Risk and ReturnDocument5 pagesMBA 4th Sem IM Unit I Probs On Risk and ReturnMoheed UddinNo ratings yet

- Madoff ScandalDocument7 pagesMadoff ScandalRohit GoyalNo ratings yet

- Business Studies Grade 10 (English Medium)Document14 pagesBusiness Studies Grade 10 (English Medium)Nipuni PereraNo ratings yet

- ACBDocument64 pagesACBPrakash GowdaNo ratings yet

- Finama Sir MarayaDocument16 pagesFinama Sir MarayaYander Marl BautistaNo ratings yet

- Enterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13Document20 pagesEnterprenuership Project For Garments Sticthing Unit Financail Section - Xls 2012, 13KabeerMalikNo ratings yet

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- The Andrew Keene PlaybookDocument13 pagesThe Andrew Keene Playbookszali9230% (1)

- T-Bills in BangladeshDocument2 pagesT-Bills in BangladeshH.R. RobinNo ratings yet

- Alternative Investments AssignmentDocument8 pagesAlternative Investments AssignmentYashwanth YashasNo ratings yet

- 8 - Operating and Financial LeverageDocument15 pages8 - Operating and Financial LeverageClariz VelasquezNo ratings yet

- Chapter1-Focusondecisionmaking Man. Acc.Document188 pagesChapter1-Focusondecisionmaking Man. Acc.eltonNo ratings yet

- Medical Research Corporation Is Expanding Its Research and Production CapacityDocument1 pageMedical Research Corporation Is Expanding Its Research and Production CapacityAmit PandeyNo ratings yet

- Adjust trial balance and complete financial statementsDocument4 pagesAdjust trial balance and complete financial statementsAiman KhanNo ratings yet

- Math - Day 1Document20 pagesMath - Day 1Elmer John BallonNo ratings yet

- Leverage & Risk AnalysisDocument11 pagesLeverage & Risk AnalysisAnkush ChoudharyNo ratings yet

- Commercial Mortgage Alert For 09 11 09Document16 pagesCommercial Mortgage Alert For 09 11 09levittjNo ratings yet

- Digimap EPPDocument8 pagesDigimap EPPTeam NurosoftNo ratings yet

- Financial Report Unilever 1Document8 pagesFinancial Report Unilever 1Dora MahayaniNo ratings yet

- JPM 2015 Equity Derivati 2014-12-15 1578141 PDFDocument76 pagesJPM 2015 Equity Derivati 2014-12-15 1578141 PDFfu jiNo ratings yet

- AP Equity 4Document3 pagesAP Equity 4Mark Michael LegaspiNo ratings yet

- Inner Circle Trader - High Probability Price PatternsDocument10 pagesInner Circle Trader - High Probability Price PatternsAleepha LelanaNo ratings yet

- Hoba Icare Answer KeysDocument15 pagesHoba Icare Answer KeysMark Gelo WinchesterNo ratings yet

- Assignment 3Document7 pagesAssignment 3Engene :LiftNo ratings yet

- Urban Water Partners Group ADocument5 pagesUrban Water Partners Group AAman jhaNo ratings yet

- Foundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsDocument18 pagesFoundations of Multinational Financial Management: Alan Shapiro John Wiley & SonsHamis Rabiam MagundaNo ratings yet

- Accounting ChangesDocument35 pagesAccounting ChangesIkhsan RamadhanNo ratings yet