Professional Documents

Culture Documents

Fif, T n'1t : Q, o D.".-,". R, , 5-Il, L"!,' 2qC! 2) I Ti 2) JT

Uploaded by

CPAOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fif, T n'1t : Q, o D.".-,". R, , 5-Il, L"!,' 2qC! 2) I Ti 2) JT

Uploaded by

CPACopyright:

Available Formats

-&fA - 7L

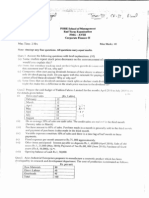

Q,*;o* 9,A,,,o{ ol d.".-,".;r^,*, MAS-12

F'INANCIAL STATEMENT ANAL YSIS

5- R.ELATIONSHIPS. Assume a 360-ciay year for each of tlre folkrwing independent cases:

Case A; The cr:rrent ratio is 2.5 to 1; the acid-test rol;o i:, 0.9 to 1; cash and receivabies are p 270/000.

l'he current aesets are conlro.spd of cash, rece,ivabks, and invenrory. Compute:

1) Current liabi[tjeq iL,l"!,' ( 2qC! l' . -t ,i

2) Inventory j<n .'

Case B: The age of receivatrles is 45 days. Annuai sales of P 900,000 are spread evenly throughouLthe

year. Inventory turnover is 4 tirnes. Compute:

1) Average accounts /l:', hi i ti .. ,;riir'i'

2) Operatirrg cycle leceivable

lilr . jt,,,, I 1 -v1.,, .f ... .,..,, :'

Case C: Net sales total P 100,000. Net profit margill ts L2o/o.Interest charges are earnecl-6,times.

1) How much is the earninqs before interests and taxes (tax rate: 4oo/o)? 'lL!'

2) Assunring that inventory age is 30 days aricl average annual amount of inventory is p 5,000,

how much is the company's operatirrg experrses? !'rl

Case D; Given the following:

' Return on sales is 5o,h.

.'

Return on assets is 10Yo.

.

Return on equity is 259b.

.

There is no preferred stock.

Determine the folk:winS u:ii,g Du Ponr technique: pf r ; i,'' 'll':. : ' j

i. t

,l fif,T lii,l"'"'q,u2'i

n'1t*;

u. ,,.) '1"\ !

3) ':i'rt; .;../U

Case E;

oent Lqrity ,ati['

^| l] , \

A company decided to go publrr At ttrht tidrie,'ridt income available fo common shareholders

anrounted to p 300,000. The number of common shares issued and outstancling is 125,000.

1) Assume that the pay-out ratto is 60o/c, how; r4uch of the total dividends shall a shareholder

owning 10,000 corlrmon shares rec-eive? l.t:

2) Assume that tFe pay-oul ratio is 60%r iinci,Uthe price per share is P 20, what is the dividerrd

'

Yielci? r-' 'r '

3) Assume that the price-earninrls !-at.io rr.,ili be set 12 times and 25,000 new shares wilf he

rssued:

34) l"iow much is the initial publit offering (iPO) per share of the 25,000 new shares,

38) How nruch is the nei proceeds frorn issuance if underwriter spread is Zola? {,1,

?q

l_

* '{l ';k

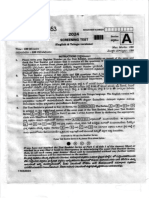

GROSS PROFIT VARIANCE ANALYSIS

The analysis of variation in gross profit is an ,r'rdispensable tool in evaluatinq operational perforrnance;

the adequacy or inadequacy of gross profit determins:s l-he final rr:sults of operalions (net income). Gross

profit must be adequate to cover operating and other expenses, along with a desirecJ amount of prr:fit.

Sales - Sales Volurne x Unit Selling price

I Cost of GoorJs Sold = Sales Volurne x Unit fjost

Gross Profit = Sales Volume x (Unit Selling prrce - Unit Cost)

GP variance rnay be analyzed though the following;

'. GP (Actual) vs. Gp (Budget)

GP (Current Period) vs. GP (Last period)

Gross profit variance * GP (Actual) "- Gp (Budget)

Favarable: If actual (current) Gp is greater ttran budgetecl (last year) Gp

unfavorable.' If actual (current) Gp is less than budgeted (last year) Gp.

Analysis:

Sales price variance = AQ x A Sp

Cost price variance = AQ x A Unit Cost

Volume variance * AQ x Budgetecl r,Jr-rit. Gp

I

F Sales volume varlance = A e x Burlgeted Sp

L-9, Cost volume variance - A Qx l}_rdgeted Unit Cost

.Lesen"dl

AQ - Actual quantity SP - Selling price per unit .i1

Alternative analysis:

sares varan.n { 3:l:: 3:,,:;'j}:X::." r il:::Xl;:ih;i}lT;X;;t*9lJff"",:"T:J",

variance

Cost varian.u *.[] Cost price = currerlt CGS * currentlolunre (0 buclgeted unit cost

Cost volume variail/:e -: crri'rer)l

'",olrirne (d bLrdgeted unit cost - bLrdqeted CGS

i)a,.:t. : .. i :. r;ti

You might also like

- The Process of Capitalist Production as a Whole (Capital Vol. III)From EverandThe Process of Capitalist Production as a Whole (Capital Vol. III)No ratings yet

- Review Capital BudgetingDocument22 pagesReview Capital BudgetingJamesno LumbNo ratings yet

- Engineering Economics (18HS1T02) - End-Term Exam - 2019-2020Document3 pagesEngineering Economics (18HS1T02) - End-Term Exam - 2019-2020sahu.tukun003No ratings yet

- Accountin - , I.t,: ,., ResaDocument1 pageAccountin - , I.t,: ,., ResaRyan PelitoNo ratings yet

- Esti. Project CFsDocument3 pagesEsti. Project CFsMinu kumariNo ratings yet

- Econ Art 1Document19 pagesEcon Art 1Misganaw MarewNo ratings yet

- MS Quiz 4Document2 pagesMS Quiz 4nikNo ratings yet

- Anthonyhepworthm 1050 MortgageprjctDocument5 pagesAnthonyhepworthm 1050 Mortgageprjctapi-289280166No ratings yet

- NPV Irr ArrDocument16 pagesNPV Irr ArrAnjaliNo ratings yet

- Increasing Returl/S, Monopolistic Competition, A1'D Inteirnatiol/ Al TradeDocument11 pagesIncreasing Returl/S, Monopolistic Competition, A1'D Inteirnatiol/ Al TradeA lazzaroNo ratings yet

- B.A. (Programme) Principles of Macroeconomics - I sem-III (5195)Document3 pagesB.A. (Programme) Principles of Macroeconomics - I sem-III (5195)Gauri GaherwarNo ratings yet

- SC431 Lecture No. 5Document58 pagesSC431 Lecture No. 5Joseph BaruhiyeNo ratings yet

- Advanced Accounting Adc Bcom Part 2 Solved Past Paper 2020Document2 pagesAdvanced Accounting Adc Bcom Part 2 Solved Past Paper 2020usman haiderNo ratings yet

- Firm Heterogeneity, Endogenous Markups, and Factor EndowmentsDocument24 pagesFirm Heterogeneity, Endogenous Markups, and Factor EndowmentsHector Perez SaizNo ratings yet

- Sol Q6Document4 pagesSol Q6yen c aNo ratings yet

- MS 3412-8Document1 pageMS 3412-8CPANo ratings yet

- DMSSF ACC003 Topic 4 Additional HandoutsDocument2 pagesDMSSF ACC003 Topic 4 Additional HandoutsJosh lamNo ratings yet

- Financial Lislrorting The of Bcfore For Realized: Gross ..,.... ,... '.......... 'P 2,040 37'800Document1 pageFinancial Lislrorting The of Bcfore For Realized: Gross ..,.... ,... '.......... 'P 2,040 37'800John Francis Raspado AnchetaNo ratings yet

- Accountant Sample PaperDocument10 pagesAccountant Sample PaperAgastya KarnwalNo ratings yet

- Toa 334-3Document1 pageToa 334-3CPANo ratings yet

- MS 3412-3Document1 pageMS 3412-3CPANo ratings yet

- JP Hansen 2Document32 pagesJP Hansen 2jose manuelNo ratings yet

- I.,Qi) ' LL, /L: Al N+1 ?y" N-L Yl''Document2 pagesI.,Qi) ' LL, /L: Al N+1 ?y" N-L Yl''Mandar Priya PhatakNo ratings yet

- Amalgamation Illustration PDFDocument25 pagesAmalgamation Illustration PDFyash nawariyaNo ratings yet

- Errors and Accounting ChangesDocument8 pagesErrors and Accounting ChangesAndrew Benedict PardilloNo ratings yet

- Chapter 6-Problems (Scanned Copy)Document5 pagesChapter 6-Problems (Scanned Copy)codebreaker911No ratings yet

- Sample Exam CAT Level 1 - Dec 2018Document10 pagesSample Exam CAT Level 1 - Dec 2018April Joy InductaNo ratings yet

- Itel.: Accountancy & 734-3989Document1 pageItel.: Accountancy & 734-3989Jims Leñar CezarNo ratings yet

- Math 1010 ProjectDocument5 pagesMath 1010 Projectapi-340040831No ratings yet

- Jnu 2012Document11 pagesJnu 2012Vikram SharmaNo ratings yet

- Portfolio Insurance Strategies - OBPI Versus CPPIDocument16 pagesPortfolio Insurance Strategies - OBPI Versus CPPIKaushal ShahNo ratings yet

- P1 3402-2 PDFDocument1 pageP1 3402-2 PDFRyan PelitoNo ratings yet

- Basic Accounting TermsDocument22 pagesBasic Accounting TermsAastha SharmaNo ratings yet

- Cvp-Analysis PDFDocument11 pagesCvp-Analysis PDFanon_901038567No ratings yet

- Capital Budgeting TechniquesDocument11 pagesCapital Budgeting TechniquesDip KunduNo ratings yet

- Amortized AnalysisDocument35 pagesAmortized Analysisapi-3844034No ratings yet

- MC B105 PDFDocument4 pagesMC B105 PDFShivam KumarNo ratings yet

- Acct 385 Blocher El1-33Document14 pagesAcct 385 Blocher El1-33Queen Jean MielNo ratings yet

- Various Topics in MANAGEMENT ACCOUNTING (RESA)Document2 pagesVarious Topics in MANAGEMENT ACCOUNTING (RESA)Denise ChristinaNo ratings yet

- Project Finance: Valuing Unlevered ProjectsDocument32 pagesProject Finance: Valuing Unlevered ProjectsKelsey GaoNo ratings yet

- CBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Document4 pagesCBCSS March 2018 Sixth Sem Accounting For Managerial Decisions QUESTION PAPER Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill75% (4)

- Flttion: Definition: (Nflation CountrDocument12 pagesFlttion: Definition: (Nflation CountrSofwan MohamedNo ratings yet

- Manual - Cost Theory ExercisesDocument4 pagesManual - Cost Theory ExercisesSarah M'dinNo ratings yet

- WP012 PDFDocument24 pagesWP012 PDFSurajNo ratings yet

- Ccfylv: Ch. 2 Practice QuizDocument11 pagesCcfylv: Ch. 2 Practice QuizFrank LovettNo ratings yet

- Krugman 1979Document11 pagesKrugman 1979Blanca MecinaNo ratings yet

- PS4 SolutionsDocument18 pagesPS4 SolutionsAVERILLNo ratings yet

- Liabilities QuizDocument13 pagesLiabilities QuizRizia Feh Eustaquio100% (1)

- Income ApproachDocument25 pagesIncome ApproachaghnimaulaniNo ratings yet

- Appendix To "Determinants of Mining Investment: A Case Study of Zimbabwe"Document6 pagesAppendix To "Determinants of Mining Investment: A Case Study of Zimbabwe"Umang VoraNo ratings yet

- 2011 MT1Document2 pages2011 MT1adamNo ratings yet

- (WWW - Entrance Exam - Net) Ma Economics Entrance Question Paper 1Document15 pages(WWW - Entrance Exam - Net) Ma Economics Entrance Question Paper 1Ziaul KainNo ratings yet

- 10 HomeworkDocument4 pages10 Homeworknikaabesadze0No ratings yet

- MS 34PB2ND-7Document1 pageMS 34PB2ND-7sunshineNo ratings yet

- Book NotationDocument9 pagesBook NotationJesse MoraNo ratings yet

- Equity EvaluationDocument20 pagesEquity EvaluationRavi SistaNo ratings yet

- Tybaf Sem5 Fa-Vi Nov19Document6 pagesTybaf Sem5 Fa-Vi Nov19Hasan ShahNo ratings yet

- Homework #5: Inputs and Oil Drilling in UtopiaDocument2 pagesHomework #5: Inputs and Oil Drilling in UtopiaSukayna AmeenNo ratings yet

- Trimester 3Document14 pagesTrimester 3Tanya MalikNo ratings yet

- J "0 A. N,", o ,: UnitDocument1 pageJ "0 A. N,", o ,: UnitCPANo ratings yet

- Cpar AuditingDocument10 pagesCpar AuditingCPANo ratings yet

- LeadDocument46 pagesLeadCPANo ratings yet

- Afarq 2 Corporate LiquidationDocument4 pagesAfarq 2 Corporate LiquidationCPANo ratings yet

- MS 3412-8Document1 pageMS 3412-8CPANo ratings yet

- Learning Advancement Cpa Review Center: Revenue From Contracts With CustomersDocument4 pagesLearning Advancement Cpa Review Center: Revenue From Contracts With CustomersCPANo ratings yet

- Toa 334-3Document1 pageToa 334-3CPANo ratings yet

- MS 3412-3Document1 pageMS 3412-3CPANo ratings yet

- Rurnover: '.::::"" ':'U ' O, .-Ffhsffihr"ODocument1 pageRurnover: '.::::"" ':'U ' O, .-Ffhsffihr"OCPANo ratings yet

- Financial: " " 1" 2. 3. 4. 5. RetiosDocument1 pageFinancial: " " 1" 2. 3. 4. 5. RetiosCPANo ratings yet

- Iht#I T:,Ffi, I:Trri ,:FFJLLLJ H:!:Iiiff: at ofDocument1 pageIht#I T:,Ffi, I:Trri ,:FFJLLLJ H:!:Iiiff: at ofCPANo ratings yet

- RFBT Handout 4Document5 pagesRFBT Handout 4CPANo ratings yet

- MS 3412-2Document1 pageMS 3412-2CPANo ratings yet

- Toa 334-1 PDFDocument1 pageToa 334-1 PDFCPANo ratings yet

- RFBT 34new-2Document1 pageRFBT 34new-2CPANo ratings yet

- Toa 333-3 PDFDocument1 pageToa 333-3 PDFCPANo ratings yet

- Toa 334-2Document1 pageToa 334-2CPANo ratings yet

- 1.3. Sales: Regulatory Framework For Business Transactions MadbolivarDocument9 pages1.3. Sales: Regulatory Framework For Business Transactions MadbolivarJims Leñar CezarNo ratings yet

- Regulatory Framework For Business Transactions Madbolivar: Quiz 2-ContractsDocument2 pagesRegulatory Framework For Business Transactions Madbolivar: Quiz 2-ContractsCPANo ratings yet

- Toa 333-1Document1 pageToa 333-1CPANo ratings yet

- RFBT 34new-1Document1 pageRFBT 34new-1CPANo ratings yet

- Financial Accounting and Reporting MsvegaDocument2 pagesFinancial Accounting and Reporting MsvegaCPANo ratings yet

- RFBT 34new-3Document1 pageRFBT 34new-3CPANo ratings yet

- Toa 333-2 PDFDocument1 pageToa 333-2 PDFCPANo ratings yet

- RFBT Handout 4Document5 pagesRFBT Handout 4CPANo ratings yet

- C. D. A. B. C. It D.: Il', I:TjrDocument1 pageC. D. A. B. C. It D.: Il', I:TjrCPANo ratings yet

- Toa 34B-2Document1 pageToa 34B-2CPANo ratings yet

- Handouts ConsolidationIntercompany Sale of Plant AssetsDocument3 pagesHandouts ConsolidationIntercompany Sale of Plant AssetsCPANo ratings yet

- Toa 34B-1Document1 pageToa 34B-1CPANo ratings yet

- APPSC GR I Initial Key Paper IIDocument52 pagesAPPSC GR I Initial Key Paper IIdarimaduguNo ratings yet

- Law MCQ 25Document3 pagesLaw MCQ 25nonoNo ratings yet

- Python PyDocument19 pagesPython Pyakhilesh kr bhagatNo ratings yet

- Applied Social Research A Tool For The Human Services 9th Edition Monette Test Bank 1Document36 pagesApplied Social Research A Tool For The Human Services 9th Edition Monette Test Bank 1wesleyvasquezmeoapcjtrb100% (25)

- Tesla - Electric Railway SystemDocument3 pagesTesla - Electric Railway SystemMihai CroitoruNo ratings yet

- Material List Summary-WaptechDocument5 pagesMaterial List Summary-WaptechMarko AnticNo ratings yet

- Flyweis Services Pvt. LTDDocument11 pagesFlyweis Services Pvt. LTDFlyweis TechnologyNo ratings yet

- Chapter-4 Conditional and Iterative Statements in PythonDocument30 pagesChapter-4 Conditional and Iterative Statements in Pythonashishiet100% (1)

- 12 Layer PCB Manufacturing and Stack Up OptionsDocument12 pages12 Layer PCB Manufacturing and Stack Up OptionsjackNo ratings yet

- PTEG Spoken OfficialSampleTest L5 17mar11Document8 pagesPTEG Spoken OfficialSampleTest L5 17mar11Katia LeliakhNo ratings yet

- John Paul Jackson Prophecies of The FutureDocument15 pagesJohn Paul Jackson Prophecies of The FutureMeranda Devan100% (9)

- Multidimensional Scaling Groenen Velden 2004 PDFDocument14 pagesMultidimensional Scaling Groenen Velden 2004 PDFjoséNo ratings yet

- Atmosphere Study Guide 2013Document4 pagesAtmosphere Study Guide 2013api-205313794No ratings yet

- Topic 3 Module 2 Simple Annuity (Savings Annuity and Payout Annuity)Document8 pagesTopic 3 Module 2 Simple Annuity (Savings Annuity and Payout Annuity)millerNo ratings yet

- RRC & RabDocument14 pagesRRC & RabSyed Waqas AhmedNo ratings yet

- Trading Book - AGDocument7 pagesTrading Book - AGAnilkumarGopinathanNairNo ratings yet

- Minimization Z Z Z Z Maximization Z Z : LP IPDocument13 pagesMinimization Z Z Z Z Maximization Z Z : LP IPSandeep Kumar JhaNo ratings yet

- Esp-2000 BSDocument6 pagesEsp-2000 BSByron LopezNo ratings yet

- What Is A Timer?Document12 pagesWhat Is A Timer?Hemraj Singh Rautela100% (1)

- Put Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsDocument2 pagesPut Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsNithya SweetieNo ratings yet

- Brain Alchemy Masterclass PsychotacticsDocument87 pagesBrain Alchemy Masterclass Psychotacticskscmain83% (6)

- Toeic VocabularyDocument10 pagesToeic VocabularyBrian Niblo80% (5)

- I. Ifugao and Its TribeDocument8 pagesI. Ifugao and Its TribeGerard EscandaNo ratings yet

- Topics For AssignmentDocument2 pagesTopics For AssignmentniharaNo ratings yet

- Rubber DamDocument78 pagesRubber DamDevanshi Sharma100% (1)

- A Modified Linear Programming Method For Distribution System ReconfigurationDocument6 pagesA Modified Linear Programming Method For Distribution System Reconfigurationapi-3697505No ratings yet

- SAP IAG Admin GuideDocument182 pagesSAP IAG Admin GuidegadesigerNo ratings yet

- The Accreditation Committee Cityland Development CorporationDocument5 pagesThe Accreditation Committee Cityland Development Corporationthe apprenticeNo ratings yet

- Copy - of - Commonlit - Meet The Fearless Cook Who Secretly Fed and Funded The Civil Rights Movement - StudentDocument6 pagesCopy - of - Commonlit - Meet The Fearless Cook Who Secretly Fed and Funded The Civil Rights Movement - Studentlilywright08No ratings yet

- CCBA Exam: Questions & Answers (Demo Version - Limited Content)Document11 pagesCCBA Exam: Questions & Answers (Demo Version - Limited Content)begisep202No ratings yet

- How to Estimate with RSMeans Data: Basic Skills for Building ConstructionFrom EverandHow to Estimate with RSMeans Data: Basic Skills for Building ConstructionRating: 4.5 out of 5 stars4.5/5 (2)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- A Place of My Own: The Architecture of DaydreamsFrom EverandA Place of My Own: The Architecture of DaydreamsRating: 4 out of 5 stars4/5 (242)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- The Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseFrom EverandThe Complete Guide to Building Your Own Home and Saving Thousands on Your New HouseRating: 5 out of 5 stars5/5 (3)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Pressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedFrom EverandPressure Vessels: Design, Formulas, Codes, and Interview Questions & Answers ExplainedRating: 5 out of 5 stars5/5 (1)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Building Construction Technology: A Useful Guide - Part 1From EverandBuilding Construction Technology: A Useful Guide - Part 1Rating: 4 out of 5 stars4/5 (3)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)