Professional Documents

Culture Documents

Agri Trade Web

Uploaded by

asdfasdfasdfCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agri Trade Web

Uploaded by

asdfasdfasdfCopyright:

Available Formats

Intensive Training Course | Limited Group Size | So Book Early!

Save With Our Group

Discount Plan!

Training

Agri Commodity

Trade and Price

Academy

Risk Management

23-24 June 2011 | Intercontinental Grand Stanford, Hong Kong

27-28 June 2011 | M Hotel, Singapore

Key Learning Outcomes Who Should Attend

• Build a solid understanding of the economics of key agri- • Agri commodity firms and trading houses (those

commodities working in operations, risk management,

• Appreciate what drives the price of these commodities in finance, and shipping)

international markets • Finance/banking professionals who work with

• Analyse the international trade finance environment and manage the agri commodities industry

risks in trade finance transactions • Traders / brokers, importers and exporters

• Understand chartering risks and the use of FFAs to manage • Analysts, Funds and Investors

risks • Government and regulatory bodies

• Know buyer and seller perspectives in trading and pricing

strategies

• Appreciate the key functions of commodity exchanges where

these commodities are traded

• Gain insight into the use of commodity derivatives

• Explore the various instruments available for hedging and

managing price risk

International Course Director

Professor Michael Tamvakis

Cass Business School, London

Michael has over 20 years experience in commodities,

Save up to Multiple Booking All participants derivatives, shipping, trade, and finance. He has lectured

40% with Inhouse Discount Price + receive a Course on international commodity trade, commodity derivatives

Training 4th Delegate Free Certificate and shipping economics. He is the Director of MSc in

Energy, Trade & Finance, and Professor of Commodity

Economics and Finance at the Cass Business School, City

Book and Pay Early and University London. He is also a Visiting Professor at the

HEC (Département des HautesÉtudesCommerciales) at

SAVE SGD200! the University of Geneva, where he teaches at the MA in

International Trading, Commodity Finance and Shipping.

Or register a team of 3 or more delegates and take

advantage of our Special Group Rate, PLUS – the Customer Service Hotline:

4th delegate attends for free! +65 6508 2401

www.ibc-asia.com/agritrade

What our Delegates Like

About Our Other Commodity

Agri Commodity Trade and

Courses Price Risk Management

“The knowledge gained is very useful and

will help me in my daily work.”

~ Guangxi

About the Course

“The course provided a lot of commodity Increasing global free trade, changes in agricultural and trade policies,

trading insights.” weather, and other market forces are increasing the price and production

~ Pepsico risks of agricultural commodities. As their variability increases, buyers,

sellers, and those in between are realizing the importance of risk management

“The course was enjoyable as I learned as an important component of their business strategies.

fundamental trading strategies. The topics

covered were areas I am involved in.” Agri Commodity Trade and Price Risk Management is an introductory

~ Mitr Phol course that provides a good understanding of the factors influencing agri

commodity demand, production, trade, and prices. The course will focus

“Topics are relevant to our company. The on the economics and commercial aspects including the risks faced by

speaker has a vast experience on the topics

players in the agri commodity value chain.

covered.”

~ Philex

The course will also focus on agri-commodity derivatives and how they

can be used to mitigate risks. Reference will also be made to the worldwide

seaborne transportation of agri commodities and how some of the freight

About the Course Director risks can be managed. The focus of the course will be on practical aspects

of derivative trading, simple hedging strategies (long, short, spreads) and

their uses by different market participants.

Michael Tamvakis

Through combination of lecture, discussion, group exercises, and case

studies, the course will provide a better appreciation of agri commodity

Professor, Commodity Economics & Finance trading and risk management strategies that can be used to improve your

Director, MSc in Energy, Trade & Finance

company’s bottom line.

Cass Business School, City University London

Visiting Professor

HEC, University of Geneva

Michael trained as an economist at the Athens

University of Economics and Business in Greece.

IBC Training Academy

He then joined the International Centre for Upcoming Training Courses!

Shipping, Trade and Finance at the (then) City

University Business School; first as a student on • Coal Pricing

its MSc programme, and then as a member of 13-15 April 2011, Singapore

its academic staff, when he also received his

PhD. Between April 2003 and March 2009 he • Marine Insurance

was the Associate Dean for undergraduate 16-17 May 2011, Hong Kong

programmes at Cass. He lectures in international 19-20 May 2011, Singapore

commodity trade, commodity risk management

and shipping economics. His research interests • Iron Ore & Steel Trade Fundamentals

29-30 June 2011, Singapore

are in the areas of commodity economics, energy

derivatives and shipping economics. Finally, he

• Coal Market Fundamentals

has also been invited to give his opinion an

28-29 June 2011, Singapore

analysis on commodity and shipping topics on

BBC World, BBC Radio 4 and CNBC.

REGISTER TODAY! +65 6508 2401 +65 6508 2407 www.ibc-asia.com/agritrade

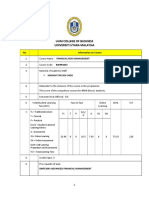

Two Day Course Outline

Course Registration: 8:00am Explanation of Timings: These times act as a guide and may modify slightly depending on the

depth of class discussion and whether assessments are being conducted.

Course Commencement: 9:00am

Course Programme: This program is a guide and may alter to better address participant

Course Conclusion: 5:00pm requirements on a consensus basis.

Agri-commodity market economics Group exercise: Managing fishhooks in trade finance transactions

• Supply / demand markets

• International trade flows Shipping and freight markets influence on the trading

• Market structure, and role of traders strategy

• Freight rates across the main trade routes

Factors influencing agri commodity prices • Understanding chartering risk

• Traditional Demand / Supply drivers • Use of Freight Forwarding Agreements

• Agricultural and trade policies

• Impact of Government to Government agreements Key elements of a trade risk management strategy

• Energy markets • Price volatility

• Role of speculators / funds • Counter party risk and defaults

• Buyer and seller perspectives in trading and pricing strategies

Understanding the international trade finance environment

• Transactional flow diagram of a typical transaction Group Exercise: Developing a risk management check-list

• Credit and payment flows Recap of day 1 and close

• Non documentary vs documentary settlements

• Letters of credit

• Incoterms

Agri-commodity exchanges Case Study: Transacting through Asian / European exchanges

• Using commodity exchange as a market place

• Key functions of exchanges Alternative scenarios for dealing with options

~ Price discovery, hedging, seller of last resort • Strategies available

~ Hedging, arbitrage and speculation • What works for importers vis a vis exporters

• Relationship with over-the-counter (OTC) markets • Do different strategies apply for different commodities?

• Main agri-commodity exchanges in US, Europe, and Asia Hedging strategies

~ Contracts traded • Long and short hedge

~ Sample specs and their meanings ~ Practical examples for a variety of commodities

Derivative instruments • Spreads (calendar, inter-commodity, crush, corn, dead)

• Definition ~ Definitions, functions, who uses them

• Function ~ Practical examples for a variety of commodities

• Uses • Options and futures combinations

• Risks involved and how to minimize them ~ Covered calls and puts

~ Caps, floors and collars

How the derivatives instruments and markets work

Case study: Sample strategies for Sugar, Coffee and Grains

• Forwards

trade

• Swaps

• Futures Commodity trading software selection

• Options • Understanding the softwareís ability to assist your trading

strategy

Agri-commodity futures

• Applications available

• Futures trade and price movements

• What features to look for?

• Working with a futures contract

• Important reporting tools required

• Strategies for exporters, importers and traders

IBC Training Academy IBC Training Academy In-House Training Solutions

IBC Training Academy is the Asian training division of IBC Asia, part of the Informa Make use of IBC Training Academy’s expertise in the training industry

Group and a public listed company in the UK. Informa’s main business is in the and have this course customised for your organisation – at a venue of

specialist information providing for global markets. We operate in 70 countries, 150 your choice – at a time convenient to you – at a cost attractive to you.

offices worldwide with over 7000 employees. We have over 25 years experience in Savings can be significant! For more information on IBC Training Academy

providing innovative, focused and high quality business information and training in-house training solutions please call Miki Kong at +65-6508 2477 or

products designed to help you improve the way your business is managed. email: inhousetraining@ibcasia.com.sg

REGISTER TODAY! +65 6508 2401 +65 6508 2407 www.ibc-asia.com/agritrade

If undelivered, please return to:

SAVE SGD200 with the

1 Grange Road,

#08-02 Orchard Building, Singapore 239693

Early Bird Rate!

Tel: +65 6508 2400 Fax: +65 6508 2407 Book by 13 May 2011

Agri Commodity Trade and Price Risk Management

ENJOY SUBSTANTIAL SAVINGS WITH

OUR MULTIPLE BOOKING DISCOUNT!

When 3 or more book into this course.

See pricing table for full details

5 EASY WAYS TO REGISTER

MAIL the attached registration form with your cheque to

IBC Asia (S) Pte Ltd

1 Grange Road, #08-02, Orchard Building, Singapore 239693

Customer Service Hotline Fax

+65 6508 2401 +65 6508 2407

This label contains your priority booking code. To expedite registration, please do not remove label. If you have Email Web

already received a copy of this brochure, we apologise. For reasons of confidentiality, your full particulars were not register@ibcasia.com.sg www.ibc-asia.com/agritrade

available to IBC Asia (S) Pte Ltd for deduplication prior to mail drop.

HOTEL INFORMATION

RESERVE YOUR PLACE TODAY!

InterContinental Grand Standford, Hong Kong

Yes! I/We Will Attend Agri Commodity Trade and Price Risk Management 70 Mody Road, Tsimshatsui East

❑ 23 – 24 June 2011, InterContinental Grand Stanford, Hong Kong ❑ 27 – 28 June 2011, M Hotel, Singapore Kowloon, Hong Kong, P. R. China

❑ I cannot attend this event but ❑ please include me in your mailing list. Tel: +852 2721 5161 | Fax: +852 2732 2233

Contact person: Joelle Chan

FEE PER DELEGATE

EARLY BIRD RATE NORMAL RATE Email: j.chan@grandstanford.com

Register and Pay on or before 13 May 2011 Register and Pay after 13 May 2011

Individuals SGD 2,795 (SAVE SGD 200) SGD 2,995 M Hotel, Singapore

81 Anson Road, Singapore 079908

Book a group of 3 or more delegates and pay per delegate

Multiple Bookings Discount Tel: +65 6224 1133 | Fax: +65 6226 3781

SGD 2,695 – SAVE SGD 300 PER DELEGATE!

Contact Person: Angeline Ng

In addition to the Multiple Bookings Discount Price, when you register 3 delegates you can send a 4th delegate for FREE! Email: angeline.ng@m-hotel.com

• Multiple Bookings Discount pricing is applicable to groups of 3 or more delegates from the same organisation registering for the same workshop, at the same time. Fee stated is

the discounted price PER DELEGATE. Only one discount price applies – either the early bird rate OR multiple bookings discount which includes 4th delegate free.

• All fees stated include luncheons, refreshments and complete set of documentation. It does not include the cost of accommodation and travel. A 7% Goods & Services Tax (GST)

PAYMENT TERMS

is applicable to all Singapore based companies for Singapore venue. Payment must be received 10 business days prior to the event. To

take advantage of discounts with an expiry cut-off date, registration

and payment must be received by the cut off date. All payments

Delegate 1 Details Delegate 2 Details should be made in Singapore dollars

• Payments by S$ bank draft or cheque should be made in favour

Name: Dr/Mr/Ms Name: Dr/Mr/Ms of “IBC Asia (S) Pte Ltd” payable in Singapore.

Job Title: Job Title: • Payment by telegraphic transfer in S$ must be made to:

IBC Asia (S) Pte Ltd

Department Department A/C No.: 147-059513-001 (SGD)

Tel: Tel: The Hongkong and Shanghai

Banking Corporation Limited

Mobile No.: Mobile No.: 21 Collyer Quay, HSBC Building,

Singapore 049320

Email: Email: Bank Swift Code: HSBCSGSG

Bank Code: 7232

Delegate 3 Details Delegate 4 Details • Payments by S$ bank draft or cheque should be made in favour

of “IBC Asia (S) Pte Ltd” and mailed to:

Name: Dr/Mr/Ms Name: Dr/Mr/Ms IBC Asia (S) Pte Ltd

c/o Informa Regional Business Services

OU P

Job Title: Job Title:

NT

111 Somerset Road, TripleOne Somerset #10-06

SC OU

Department Department Singapore 238164

E

Attn: The Accounts Receivable Team

DI GR

Tel: Tel:

FR

• Payment by Credit Card (AMEX, VISA or MASTERCARD).

Mobile No.: Mobile No.: Please provide your Card Number, Name of Cardholder, Expiry

Date and your Signature and send it by fax to +65 6508 2407.

Email: Email:

Please photocopy for additional delegates CANCELLATIONS / SUBSTITUTION

Who is Head of your Department? Should you be unable to attend, a substitute delegate is welcome

at no extra charge. Cancellations must be received in writing at

Who is Head of Training? least 10 business days before the start of the event, to receive a

refund less 10% processing fee per registration. The company

Company Information regrets that no refund will be made available for cancellation

notifications received less than 10 business days before the event.

Company Name: Main Business/Activity:

Address: Postal Code: IMPORTANT NOTE

Please quote the name of the delegate, event title and invoice

P50016/P50017WEB number on the advice when remitting payment. Bank charges are

to be deducted from participating organisations own accounts.

Please fax your payment details (copy of remittance advice, cheque

Payment Method (Please tick:) ❑ I enclose my Cheque/Draft payable to IBC Asia (S) Pte Ltd or draft to +65 6508 2407.

❑ I am paying by bank transfer (copy attached) Attendance will only be permitted upon receipt of full payment.

❑ Payment by Credit Card: ❑ Visa ❑ Mastercard ❑ Amex Participants wishing to register at the door are responsible to ensure

all details are as published. IBC Asia will not be responsible for

any event re-scheduled or cancelled.

DATA PROTECTION

REG NO. 200108203N

Card Holder’s Name: Signature: The personal information entered during your registration/order,

or provided by you, will be held on a database and may be shared

with companies in the Informa Group in the UK and internationally.

Card Number: Expiry Date: (mm/yy) Sometimes your details may be obtained from or shared with

(Please provide photocopy of front & back of your Credit Card)

external companies for marketing purposes. If you do not wish

your details to be used for this purpose, please contact Winnie

Seah (Database) on winnie.seah@ibcasia.com.sg Tel: +65

REGISTER NOW! FAX BACK TO +65 6508 2407 6508 2468 or Fax: +65 6508 2408.

You might also like

- 4FI3 F19 Siam 1Document9 pages4FI3 F19 Siam 1Arash MojahedNo ratings yet

- DerivativesDocument3 pagesDerivativesAditya SukhijaNo ratings yet

- Investment Analysis and Portfolio Management Course ObjectiveDocument5 pagesInvestment Analysis and Portfolio Management Course ObjectiveNishantNo ratings yet

- BudgetingDocument52 pagesBudgetingSewale AbateNo ratings yet

- Master in International Business: International Trade - Global AffairsDocument4 pagesMaster in International Business: International Trade - Global AffairsAbhishek_Majum_5454No ratings yet

- Syllabus - Master in International Trade PDFDocument7 pagesSyllabus - Master in International Trade PDFVin BamNo ratings yet

- Indian Institute of Foreign Trade Course Outline - International Financial ManagementDocument3 pagesIndian Institute of Foreign Trade Course Outline - International Financial ManagementAMITaXWINo ratings yet

- 209 Wittenborg University Bachelor IBA International Trade&Logistics PDFDocument2 pages209 Wittenborg University Bachelor IBA International Trade&Logistics PDFmonikaNo ratings yet

- SPECIALIZATIONSDocument36 pagesSPECIALIZATIONSNishant ShekharNo ratings yet

- Swaps and Swap TradingDocument2 pagesSwaps and Swap TradingUbaid NiazNo ratings yet

- International BusinessDocument158 pagesInternational BusinessG GautamNo ratings yet

- Crisis Management & Business Continuity Planning: Andrew HilesDocument6 pagesCrisis Management & Business Continuity Planning: Andrew HilesJuvy Macapagal100% (1)

- Volatility Trading InsightsDocument5 pagesVolatility Trading Insightspyrole1100% (1)

- Valuation For Non-ValuationDocument2 pagesValuation For Non-ValuationEnp Gus AgostoNo ratings yet

- Foreign Exchange Risk Management Using Derivatives: Master of Business AdministrationDocument10 pagesForeign Exchange Risk Management Using Derivatives: Master of Business AdministrationAshish GumberNo ratings yet

- Mpa Epm Handbook 2019Document14 pagesMpa Epm Handbook 2019mohit sharmaNo ratings yet

- Amsterdam Business School - Executive Master in International FinanceDocument6 pagesAmsterdam Business School - Executive Master in International FinanceJM KoffiNo ratings yet

- Proposal For SamaveshDocument6 pagesProposal For Samaveshpranav nijhawanNo ratings yet

- Euromed MBA & Maritime Management Track 2012Document10 pagesEuromed MBA & Maritime Management Track 2012caroline_flochNo ratings yet

- Birla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionDocument6 pagesBirla Institute of Technology and Science, Pilani Pilani Campus AUGS/ AGSR DivisionArchak SinghNo ratings yet

- International Finance Course Covers Global MarketsDocument2 pagesInternational Finance Course Covers Global MarketsmolapauNo ratings yet

- IFID BrochureDocument6 pagesIFID BrochurePrabhakar SharmaNo ratings yet

- Shipping Investment & Finance: Program ContentDocument3 pagesShipping Investment & Finance: Program ContentIsaias Castro ArmendarizNo ratings yet

- FRM Syllabus of AUDocument9 pagesFRM Syllabus of AUMeer Mazhar AliNo ratings yet

- Risk Management in DerivativesDocument3 pagesRisk Management in DerivativessuryaprakashNo ratings yet

- Winter SchoolDocument32 pagesWinter SchoolAbhishek BansalNo ratings yet

- MGMT 3053 Course OutlineDocument4 pagesMGMT 3053 Course OutlineStephen M. NeilNo ratings yet

- Amplify University TrainingDocument11 pagesAmplify University Trainingshariz500100% (1)

- MBA in Global Management Bremen University of Applied Sciences - BremenDocument9 pagesMBA in Global Management Bremen University of Applied Sciences - BremenHieu NguyenNo ratings yet

- Moodys CdmsDocument2 pagesMoodys CdmssaurabhanandsuccessNo ratings yet

- HEC Lieà - Ge - Management - Banking & AssetDocument2 pagesHEC Lieà - Ge - Management - Banking & AssetyaserabatorabNo ratings yet

- Course Outline On Managerial EconomicsDocument5 pagesCourse Outline On Managerial EconomicsAbhishek ModakNo ratings yet

- Brochure AM in Quantitative Finance PDFDocument6 pagesBrochure AM in Quantitative Finance PDFqueue2010No ratings yet

- 2013 MARSH ERM IRMSA BrochureDocument5 pages2013 MARSH ERM IRMSA Brochurewdr80No ratings yet

- Master of Management in Finance & Investment: NasdaqDocument8 pagesMaster of Management in Finance & Investment: NasdaqTino MatsvayiNo ratings yet

- Research Paper On Foreign Exchange Risk ManagementDocument4 pagesResearch Paper On Foreign Exchange Risk ManagementafmcmuugoNo ratings yet

- Subject Outline Financial Risk ManagementDocument6 pagesSubject Outline Financial Risk ManagementDamien KohNo ratings yet

- Treasury ManagementDocument6 pagesTreasury ManagementMeeroButt100% (1)

- ACCM01B Costing and Pricing-1Document3 pagesACCM01B Costing and Pricing-1Lylanie Gustilo AlcantaraNo ratings yet

- Summer Internship Project Report-FOREX Inner Matter With Page NumberDocument63 pagesSummer Internship Project Report-FOREX Inner Matter With Page NumberJyoti SinghNo ratings yet

- Chin TanDocument4 pagesChin TanDanielNo ratings yet

- Cmpma - 3 IMP PDFDocument5 pagesCmpma - 3 IMP PDFtusharholey90No ratings yet

- BTRM BrochureDocument27 pagesBTRM BrochureSibabrata PanigrahiNo ratings yet

- Subjects EconfinDocument4 pagesSubjects EconfinGenoveva Erika HengNo ratings yet

- Credit Derivatives BrochureDocument3 pagesCredit Derivatives BrochureAileen AraoNo ratings yet

- CPEM Brochure II of 2017Document11 pagesCPEM Brochure II of 2017Aryan WinnerNo ratings yet

- FIN4224Document2 pagesFIN4224garbage DumpNo ratings yet

- EPAT Brochure PDFDocument16 pagesEPAT Brochure PDFcancelthis0035994No ratings yet

- International MarketingDocument440 pagesInternational MarketingHari Krishna67% (3)

- Counselling LaboratoryDocument22 pagesCounselling LaboratoryAnubhuti TripathiNo ratings yet

- Short Courses - MBSDocument5 pagesShort Courses - MBSMyu Wai ShinNo ratings yet

- International Oil Trader Academy Winter School - Virtual DeliveryDocument6 pagesInternational Oil Trader Academy Winter School - Virtual DeliveryMuslim NasirNo ratings yet

- 1.1. Identification of ProblemDocument45 pages1.1. Identification of ProblemAditya AgarwalNo ratings yet

- CGB 2016Document6 pagesCGB 2016GETAHUN ASSEFA ALEMUNo ratings yet

- CBFS-MODULE NO. 2-Globe-Intl TradeDocument4 pagesCBFS-MODULE NO. 2-Globe-Intl TradeDA YenNo ratings yet

- Irmsa Training - IntroductioDocument3 pagesIrmsa Training - IntroductiobharatNo ratings yet

- Uum College of Business Universiti Utara MalaysiaDocument7 pagesUum College of Business Universiti Utara MalaysiaSyai GenjNo ratings yet

- Engineering Investment Process: Making Value Creation RepeatableFrom EverandEngineering Investment Process: Making Value Creation RepeatableNo ratings yet

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsFrom EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsNo ratings yet

- Investment Management: A Modern Guide to Security Analysis and Stock SelectionFrom EverandInvestment Management: A Modern Guide to Security Analysis and Stock SelectionNo ratings yet

- What Is Game TheoryDocument4 pagesWhat Is Game TheoryssafihiNo ratings yet

- Finlatics Financial Markets Experience Program Brief Deck-MinDocument18 pagesFinlatics Financial Markets Experience Program Brief Deck-MinIshan Ratnakar100% (1)

- 2014 GregoryDocument26 pages2014 GregoryKiều Lê Nhật ĐôngNo ratings yet

- 10U/101/26 Set No: (1) : I To Be Filled Up by The Candidate by Blue! Black Ball-Point Pen) Roll NoDocument43 pages10U/101/26 Set No: (1) : I To Be Filled Up by The Candidate by Blue! Black Ball-Point Pen) Roll NoAditi BazajNo ratings yet

- Business Analysis & ValuationDocument50 pagesBusiness Analysis & ValuationAimee EemiaNo ratings yet

- Introduction To The OVIDocument13 pagesIntroduction To The OVIwinstoncomNo ratings yet

- GarnierDocument16 pagesGarnierViraj MulkiNo ratings yet

- SalesDocument19 pagesSalesjericho sarmientoNo ratings yet

- Economic Schools of ThoughtDocument14 pagesEconomic Schools of ThoughtRena DianaNo ratings yet

- IFAS - Presentation - S2Document21 pagesIFAS - Presentation - S2Abinash BiswalNo ratings yet

- AE 18 Sep 1999Document29 pagesAE 18 Sep 1999omair.latifNo ratings yet

- Chapt-5 Exclude From Gross IncomeDocument4 pagesChapt-5 Exclude From Gross IncomehumnarviosNo ratings yet

- 2018 Practice Case PDFDocument11 pages2018 Practice Case PDFStanley ChangNo ratings yet

- DHL Company PortraitDocument28 pagesDHL Company PortraitIsmail Hossain TusharNo ratings yet

- Module 4 - ImpairmentDocument5 pagesModule 4 - ImpairmentLuiNo ratings yet

- Adjudication Order Against Moneybee Securities Pvt. LTD, Dhiren Shah (HUF) and Yogesh Laxman Rege in The Matter of Trading in The Scrip of New Horizon Leasing and Finance LTDDocument17 pagesAdjudication Order Against Moneybee Securities Pvt. LTD, Dhiren Shah (HUF) and Yogesh Laxman Rege in The Matter of Trading in The Scrip of New Horizon Leasing and Finance LTDShyam SunderNo ratings yet

- Agriculture Marketing - Transportation - TechnologyDocument29 pagesAgriculture Marketing - Transportation - Technologyajay kumar sainiNo ratings yet

- Grp. 8 Case Study 2Document2 pagesGrp. 8 Case Study 2Raymond Baldelovar100% (1)

- Econ Systems and MethodologyDocument9 pagesEcon Systems and Methodologylucy havenworthNo ratings yet

- Amalgamation, Absorption Etc PDFDocument21 pagesAmalgamation, Absorption Etc PDFYashodhan MithareNo ratings yet

- 1.2 Variables and ExpressionsDocument3 pages1.2 Variables and ExpressionsSovanrany MengNo ratings yet

- Mfrs 116 PpeDocument41 pagesMfrs 116 PpeDINIE RUZAINI BINTI MOH ZAINUDIN0% (1)

- ENGINEERING ECONOMY IN 40Document14 pagesENGINEERING ECONOMY IN 40Levi CloverioNo ratings yet

- G 014 027 NWDocument28 pagesG 014 027 NWArmin MnNo ratings yet

- Solutions For Bubble and BeeDocument12 pagesSolutions For Bubble and BeeMavin Jerald100% (6)

- H&M Ch09 Standard CostingDocument37 pagesH&M Ch09 Standard Costingagungwibowo89No ratings yet

- Connect The Dots - Become Successful Options ScalperDocument12 pagesConnect The Dots - Become Successful Options Scalperlambaz50% (2)

- LCCI L3 Financial Accounting ASE20097 Dec 2016Document20 pagesLCCI L3 Financial Accounting ASE20097 Dec 2016chee pin wongNo ratings yet

- Nevine Corporation Owns and Manages A Small10 Store Shopping CentreDocument1 pageNevine Corporation Owns and Manages A Small10 Store Shopping CentreHassan JanNo ratings yet

- Just The Faqs:: Answers Common Questions About Reverse MortgagesDocument16 pagesJust The Faqs:: Answers Common Questions About Reverse MortgagesValerie VanBooven RN BSNNo ratings yet