Professional Documents

Culture Documents

LCCI Level 1 - Chapter 10 (Part II)

Uploaded by

KhinMgLwin0 ratings0% found this document useful (0 votes)

154 views4 pagesaccounting1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaccounting1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

154 views4 pagesLCCI Level 1 - Chapter 10 (Part II)

Uploaded by

KhinMgLwinaccounting1

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

GENIUS Business School

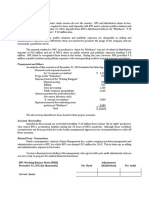

Exercise - 10.2 (P. 27)

Workings

(i) Wages and Salaries Account

$ $

• Bank 65,840 • SOPL 66,660

• Balance c/d 820

66,660 66,660

• Balance b/d 820

(ii) Rent Payable Account

$ $

• Bank 11,920 • SOPL 12,220

• Balance c/d 300

12,220 12,220

• Balance b/d 300

GENIUS Business School

Exercise - 10.2 (P. 27)

Workings

(iii) Height & Light Account

$ $

• Bank 2,840 • SOPL 2,760

• Balance c/d 80

2,840 2,840

• Balance b/d 80

(iv) Commission Receivable Account

$ $

• Bank 1,210

• SOPL 1,351 • Balance c/d 141

1,351 1,351

• Balance b/d 141

Exercise - 10.2 (P.27)

B Kouzalai

(a) Statement of Profit or Loss for the year ended

30 June 20X7

$ $

• Sales/Revenues 286,370

• Less: Cost of Goods Sold

• Opening Inventory 19,223

• Purchases 129,860

• Closing Inventory (13,980)

(135,103)

Gross Profit 151,267

Income

• Commission Receivable (1,210 + 141) 1,351

Expenses

• Wages and Salaries (65,840 + 820) 66,660

• Rent (11,920 + 300) 12,220

• Heat & Light (2,840 - 80) 2,760

• Stationery 3,650

• Motor Vehicle Expenses 1,620

(86,910)

Net Profit for the year 65,708

GENIUS Business School

(b) Statement of Financial Position (Extract) at

30 June 20X7

$ $

Current Assets

• Closing Inventory 13,980

• Trade Receivables 9,430

• Prepaid - Heat & Light 80

• Commission Receivable in arrears 141

Current Liabilities 23,631

• Trade Payables 7,620

• Accrued - W & S 820

• Accrued - Rent Payable 300

(8,740)

Working Capital (or) Net Current Assets 14,891

(c) Difference between Accruals & Prepayments

Accrual

An expense accrual is an amount owing for an accounting

period, which remains unpaid at the end of that period. Expense

accrual is also known as “accrued expense.”

Prepayment

An expense prepayment is an amount paid during the current

financial period to cover an expense for the next financial

period. Expense prepayment is also known as “prepaid expense”.

You might also like

- ACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2Document14 pagesACCT4110 Advanced Accounting PRACTICE Exam 2 KEY v2accounts 3 lifeNo ratings yet

- Palmer Limited Case Study AnalysisDocument9 pagesPalmer Limited Case Study AnalysisPrashil Raj MehtaNo ratings yet

- Consolidated Income and Balance Sheets 2009-2011Document16 pagesConsolidated Income and Balance Sheets 2009-2011Aman KumarNo ratings yet

- Assignment Questions - Suggested Answers (E3-7, E3-10, E3-11, P3-4, P3-6) E3-7. (Dollars in Millions)Document10 pagesAssignment Questions - Suggested Answers (E3-7, E3-10, E3-11, P3-4, P3-6) E3-7. (Dollars in Millions)Ivy KwokNo ratings yet

- Soal - Home Office Vs Branch (40%) : Total Informasi TambahanDocument2 pagesSoal - Home Office Vs Branch (40%) : Total Informasi Tambahanshani100% (1)

- 2019 Mid-Semester Mock Exam SolutionDocument11 pages2019 Mid-Semester Mock Exam SolutionMichael BobNo ratings yet

- Finman ProblemDocument16 pagesFinman ProblemKatrizia FauniNo ratings yet

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- Affidavit of Universal Commercial Code 1 FINANCING STATEMENT LienDocument7 pagesAffidavit of Universal Commercial Code 1 FINANCING STATEMENT LienGloria Valichkofsky BeyNo ratings yet

- (AboutQL) PDFDocument8 pages(AboutQL) PDFJulie EastlakeNo ratings yet

- P 8-12 Valix 2015 Volume 1Document4 pagesP 8-12 Valix 2015 Volume 1blahblahblueNo ratings yet

- M - 30 S 2020 o ($'000) ($'000) ADocument10 pagesM - 30 S 2020 o ($'000) ($'000) AAmmar TahirNo ratings yet

- MHM 507 Midterm Exam OCTOBER 16, 2021: Answer The FollowingDocument3 pagesMHM 507 Midterm Exam OCTOBER 16, 2021: Answer The FollowingRenj CruzNo ratings yet

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- 8447809Document11 pages8447809blackghostNo ratings yet

- Financial Statement AdjustmentsDocument5 pagesFinancial Statement AdjustmentsHasan NajiNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Final Accounts From Single Entry NotesDocument5 pagesFinal Accounts From Single Entry NotesBamidele AdegboyeNo ratings yet

- Audit Report of CYGNUS COR 2020Document20 pagesAudit Report of CYGNUS COR 2020Friends Law ChamberNo ratings yet

- Jawaban Soal UTS Akuntansi Keu - MenengahDocument4 pagesJawaban Soal UTS Akuntansi Keu - MenengahJessinthaNo ratings yet

- Case - Chemlite (B)Document7 pagesCase - Chemlite (B)Vibhusha SinghNo ratings yet

- Exhibit 1 Sources and Uses of Funds, November 30, 1978-August 13, 1979 (Thousands of Dollars)Document4 pagesExhibit 1 Sources and Uses of Funds, November 30, 1978-August 13, 1979 (Thousands of Dollars)Japa SonNo ratings yet

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarNo ratings yet

- UAS PA 2020-2021 Ganjil - JawabanDocument27 pagesUAS PA 2020-2021 Ganjil - JawabanNuruddin AsyifaNo ratings yet

- 01 - Exercises Session 1 - EmptyDocument4 pages01 - Exercises Session 1 - EmptyAgustín RosalesNo ratings yet

- Unadjusted Trial BalanceDocument10 pagesUnadjusted Trial BalanceMingxNo ratings yet

- Introduction To Management Accounting 15th Edition Horngren Solutions ManualDocument46 pagesIntroduction To Management Accounting 15th Edition Horngren Solutions Manualcleopatrafreyane8c100% (19)

- Practice Questions For Ratio Analysis2Document13 pagesPractice Questions For Ratio Analysis2Crazy FootballNo ratings yet

- Afe 3582Document6 pagesAfe 3582sarah josephNo ratings yet

- FABM MID TERMS Exam PERFORMANCE TASKDocument3 pagesFABM MID TERMS Exam PERFORMANCE TASKRaymond RocoNo ratings yet

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- poa_2012_Jan_p.2.q.1_1Document4 pagespoa_2012_Jan_p.2.q.1_1RealGenius (Carl)No ratings yet

- Financial Accounting and Reporting: IFRS - 2021 December AKDocument15 pagesFinancial Accounting and Reporting: IFRS - 2021 December AKMarchella LukitoNo ratings yet

- PDE4232 Individual Coursework - 2023-24 UpdatedDocument5 pagesPDE4232 Individual Coursework - 2023-24 UpdatedTariq KhanNo ratings yet

- BUSI 2093 Exam Cover Sheet (Set C) : Professor Use OnlyDocument6 pagesBUSI 2093 Exam Cover Sheet (Set C) : Professor Use OnlySimranjeet KaurNo ratings yet

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- Solution Key To Problem Set 1Document6 pagesSolution Key To Problem Set 1Ayush RaiNo ratings yet

- December 2010 TC1ADocument10 pagesDecember 2010 TC1AkalowekamoNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Fa July2023-Far210-StudentDocument9 pagesFa July2023-Far210-Student2022613976No ratings yet

- FINANCIAL ACCOUNTING FUNDAMENTALSDocument7 pagesFINANCIAL ACCOUNTING FUNDAMENTALSabhaymvyas1144No ratings yet

- Xtreme ToysDocument4 pagesXtreme ToysJakkam RajeshNo ratings yet

- Reconciliation Statement MathDocument6 pagesReconciliation Statement MathRajibNo ratings yet

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision QuestionskelvinmunashenyamutumbaNo ratings yet

- Prelim Exam Part 2 SolutionsDocument4 pagesPrelim Exam Part 2 SolutionseaeNo ratings yet

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwaneNo ratings yet

- Tobias Co. Problem AssignmentDocument2 pagesTobias Co. Problem AssignmentMiss MegzzNo ratings yet

- Prepare Financial StatementsDocument16 pagesPrepare Financial StatementsDayaan ANo ratings yet

- Onen Diane Alheri Vu-Bcs-1909-0032 Coursework 3Document5 pagesOnen Diane Alheri Vu-Bcs-1909-0032 Coursework 3diane alheriNo ratings yet

- Complete Financial ModelDocument47 pagesComplete Financial ModelArrush AhujaNo ratings yet

- MBA-Quiz-10-on-Income StatementDocument2 pagesMBA-Quiz-10-on-Income StatementJonah Gregory GregoryNo ratings yet

- Accounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusDocument18 pagesAccounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusAung Zaw HtweNo ratings yet

- Excel Karna Krishna1Document37 pagesExcel Karna Krishna1Krishna KumarNo ratings yet

- CH 4 - HomeworkDocument5 pagesCH 4 - HomeworkAxel OngNo ratings yet

- Assignment 5 - AnswerDocument3 pagesAssignment 5 - AnswerSyahidatul FatimyNo ratings yet

- Chapter 7. Student CH 7-14 Build A Model: AssetsDocument5 pagesChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNo ratings yet

- ACCT10002 Tutorial 2 Exercises, 2020 SM1Document6 pagesACCT10002 Tutorial 2 Exercises, 2020 SM1JING NIENo ratings yet

- Tutorial 4B : Excel: More Applications in AccountingDocument7 pagesTutorial 4B : Excel: More Applications in Accountingasdsad dsadsaNo ratings yet

- Nguyen My Khanh - 25 - Mc1802Document6 pagesNguyen My Khanh - 25 - Mc1802Biên KimNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Pearson LCCI Tuesday 12 January 2021: Certificate in Advanced Business CalculationsDocument20 pagesPearson LCCI Tuesday 12 January 2021: Certificate in Advanced Business CalculationsKhinMgLwinNo ratings yet

- Level 12 Text Update June 20211Document110 pagesLevel 12 Text Update June 20211Swe Zin Thet100% (2)

- Certificate in Advanced Business Calculations: Pearson LCCIDocument12 pagesCertificate in Advanced Business Calculations: Pearson LCCIKhinMgLwinNo ratings yet

- Accounting for Irrecoverable Debt and DepreciationDocument105 pagesAccounting for Irrecoverable Debt and DepreciationKhinMgLwin100% (1)

- ACCA F3 (Chapter 11 - Kaplan MCQS)Document8 pagesACCA F3 (Chapter 11 - Kaplan MCQS)KhinMgLwinNo ratings yet

- လက္ေတြ႕႐ူပေဗဒအတြဲ ၁ (MyanmarLibrary)Document20 pagesလက္ေတြ႕႐ူပေဗဒအတြဲ ၁ (MyanmarLibrary)KhinMgLwinNo ratings yet

- Nova Scotia's Child Youth Vital Signs 2014Document64 pagesNova Scotia's Child Youth Vital Signs 2014Global HalifaxNo ratings yet

- Acfe NotesDocument12 pagesAcfe NotesIshmael OneyaNo ratings yet

- Law On Business Organizations ReviewerDocument51 pagesLaw On Business Organizations ReviewerAriana Regio100% (2)

- Sources of Finance for BusinessesDocument16 pagesSources of Finance for BusinessestekleyNo ratings yet

- Complete guide to OWWA membership, benefits and services for OFWsDocument15 pagesComplete guide to OWWA membership, benefits and services for OFWsChristian UrbinaNo ratings yet

- Agcaoili LTD PDFDocument32 pagesAgcaoili LTD PDFruss8dikoNo ratings yet

- Internal Assignment Applicable For June 2017 Examination: Course: Commercial Banking System and Role of RBIDocument2 pagesInternal Assignment Applicable For June 2017 Examination: Course: Commercial Banking System and Role of RBInbala.iyerNo ratings yet

- Bank Account EnglishDocument6 pagesBank Account EnglishNgang Wei HanNo ratings yet

- Villanueva v. IAC - MONESDocument1 pageVillanueva v. IAC - MONESVince Llamazares LupangoNo ratings yet

- De La Merced vs. GSIS DigestDocument4 pagesDe La Merced vs. GSIS DigestXyrus BucaoNo ratings yet

- Quiz BowlDocument3 pagesQuiz BowljayrjoshuavillapandoNo ratings yet

- F1-Student Visa Application StepsDocument1 pageF1-Student Visa Application Stepsjfernandez303No ratings yet

- E - Portfolio Assignment MacroDocument8 pagesE - Portfolio Assignment Macroapi-316969642No ratings yet

- Managala Marine Exim India Pvt. LTDDocument50 pagesManagala Marine Exim India Pvt. LTDnineeshkkNo ratings yet

- BillionaireDocument7 pagesBillionaireanestesista100% (1)

- Chapter 01 Solutions - FMTDocument7 pagesChapter 01 Solutions - FMTOscar Neira CuadraNo ratings yet

- Case Study-501 On ITR-5 DR SB Rathore, Associate Professor, Shyam Lal CollegeDocument5 pagesCase Study-501 On ITR-5 DR SB Rathore, Associate Professor, Shyam Lal Collegeshreya126No ratings yet

- 46 - SERVICEWIDE SPECIALISTS v. CA DigestDocument1 page46 - SERVICEWIDE SPECIALISTS v. CA DigestChiic-chiic SalamidaNo ratings yet

- First Quiz in Prac 1Document10 pagesFirst Quiz in Prac 1ai shiNo ratings yet

- Chapter 6 - The Theory of CostDocument11 pagesChapter 6 - The Theory of Costjcguru2013No ratings yet

- Business Standard 9th Nov 18Document14 pagesBusiness Standard 9th Nov 18Kalai ArasiNo ratings yet

- OPERATION AND MAINTENANCEDocument132 pagesOPERATION AND MAINTENANCEgavallapalliNo ratings yet

- Bajaj Finance Digital Strategy Executive SummaryDocument5 pagesBajaj Finance Digital Strategy Executive Summarypunya.trivedi2003No ratings yet

- Criminal Complaint Against Borrower for Violation of BP 22Document2 pagesCriminal Complaint Against Borrower for Violation of BP 22Ramil Dominguez OrtizoNo ratings yet

- Understanding the evolution and functions of banksDocument3 pagesUnderstanding the evolution and functions of banksCorolla SedanNo ratings yet

- A Group GameDocument41 pagesA Group GameHenryNo ratings yet

- Group 7 - Legal AspectsDocument3 pagesGroup 7 - Legal AspectsPevi Anne Bañaga FetalveroNo ratings yet