Professional Documents

Culture Documents

FM

Uploaded by

Deepika vermaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM

Uploaded by

Deepika vermaCopyright:

Available Formats

CONTENT

Introduction

Business model

Business Segments

• Pharmaceutical

• Generics

• OTC

• Animal Health segment

Research and Development

Financial Analysis

Income Statement

Quarterly Results

• Balance Sheet

• Ratio Analysis

Novartis India Page 2

Introduction

The name Novartis is derived from the Latin "Novae Artes" which means new skills.

Novartis in India is a leading provider of innovative solutions to improve health and well-being

through products and services in the areas of pharmaceuticals, over-the-counter products,

nutrition, eye care and animal health.

The Group has a presence through three entities namely, Novartis India Limited, Novartis

Healthcare Private Limited and Sandoz Private Limited and employs more than 2000 people

across the country.

Sandoz Private Limited houses all the four manufacturing facilities which are located at Thane,

Kalwe, Turbhe and Mahad.

It is a 51% subsidiary of Swiss based Novartis AG. Novartis International AG is a multinational

pharmaceutical company based in Basel, Switzerland Novartis owns Sandoz, a large manufacturer

of generic drugs.

Business Model

Novartis India Page 3

Business Segments

The businesses comprise Pharmaceuticals, Generics, OTC and Animal Health. The

operational performance of the business is reviewed by the management based on such

segmentation.

(i) The Pharmaceuticals segment comprises a portfolio of prescription medicines which are

provided to patients through healthcare professionals. These are mainly products of original

research of the Novartis Group.

(ii) The Generics segment comprises Retail Generics products. The business unit primarily

focuses on the therapeutic segments such as Anti-TB, Anti-DUB (Gynaecology), Anti-

histamines, Antibiotics, Anti-ulcerants, Anti-diabetes and Cardiovascular.

(iii) The Animal Health segment has a presence primarily in the cattle, poultry and

aquaculture market segments.

(iv) The OTC segment is mainly in the VMS (vitamins, minerals and nutritional supplements)

and CoCoA (cough, cold and allergy) market segments.

1.Pharmaceutical

The Domestic pharmaceutical market is going through a transformation, led by strong underlying

growth drivers and has witnessed robust growth over the last couple of years. While this growth

was driven mainly by an increasing spend on healthcare, on account of rising disposable income,

increasing penetration of Health insurance and changing disease profile, regulatory reforms also

provided a significant boost.

Growth Drivers

• Strong economic growth

The rise in disposable income has a positive impact on healthcare spend. In 2005, 6.2 percent of

disposable income was spent on healthcare as compared to 2.8 percent in 1995.

• Improving healthcare infrastructure

At present, organized players account for a meagre 2 percent share of the pharma retail market. It

is expected that with the advent of modern retailing in India, increasing investments in this space

will multiply the availability and accessibility of pharma products.

• Increasing penetration of health insurance

Novartis India Page 4

At present, only 4 percent of the healthcare costs are borne by the insurers in India as against 80

percent in developed economies. With increasing health insurance penetration in India, this is set

to change and forward, a larger proportion of expenses will be paid by insurers and consumption

of sophisticated drugs is likely to become more affordable.

• Changing therapeutic mix

The existing therapy mix is tilted towards acute diseases. However, in the medium to long run the

domestic pharmaceutical market will be largely driven by the increasing prevalence of the chronic

segment. Increasing urbanization, changing lifestyles and ageing population will drive the growth

of this segment. In most cases, ailments in the chronic segment are recurring in nature, which

ensures regular consumption of medicines for the lifetime of the patient. Going forward, therapies

for treating cardiovascular diseases and diabetes are expected to have one of the highest growth

rates.

• Growth across regions

In terms of the geographical distribution of the Pharma market, 23 Metro cities account for

approximately a quarter of the market. Class I towns— comprising 300 towns altogether—

account for about one-third of the market. Rural markets which account for 21 percent of the total

market have been increasingly becoming an important market for big pharma companies.

• Government initiatives

The National Rural Health Mission (NRHM), introduced by the government to provide basic

healthcare amenities in the rural areas, is expected to increase the access to drugs in the rural

areas. In Budget 2007-08, the budgetary allocation to health was increased by 22 percent to INR 1,

52,910 million.

• Launch of patented drugs

After the product patent regime was introduced in India in 2005, the domestic pharma industry has

witnessed the launch of around 11 patented products by multinational companies. This number is

expected to grow, as MNC pharma companies are already planning significant patented launches

over the next few years. Various industry estimates suggest that by 2015, patented drugs will

account for 10-15 percent of the domestic pharma market.

Key considerations

• PPP

70 percent people in this country do not have access to modern medicine. 700 million people in a

population of 1 billion. That is a problem that the government needs to solve. There has to be a

public private partnership to reach medicines to these 700 people

• Spurious drugs

According to the Mashelkar committee report, the industry faces a loss of around INR 40 billion

due to substandard drugs and a WHO report suggests that 35 percent of spurious drugs of the

world are being produced in India. Spurious and counterfeit drugs are a major public health

hazard.

• Price control

Novartis India Page 5

Uncertainties regarding the Draft Pharmaceutical Policy 2006, which proposes to bring 354

essential drugs under the purview of Drug Price Control Order (DPCO) continues to be an area of

acute concern for the industry. The pharma industry feels that regulation should try to simulate the

"effects of competition" and price control should not be imposed on drugs where the "effects of

competition" already exist. The proposed policy would significantly increase DPCO’s span of

control from the existing 25 percent to approximately 50-60 percent of all medicines produced.

• High fragmentation

A report by the Institute for Studies in Industrial Development (ISID), a national level policy

research organization in the public domain, mentions that in 2000-01 there were approximately

2872 pharma units in India and out of these 91 percent were small manufacturing enterprises.

Challenges

• Uncertainty about price control regime looms Large

• Changes in regulatory environment e.g. VAT,MRP based Excise, Service Tax etc.

• Evolution and enforcement of IPR

• Continuing problem of counterfeit/spurious drugs

Planned Actions

• Market Access Initiatives

• Life cycle management initiatives

• In-licensing opportunities

• Likely consolidation in the highly fragmented industry

2007 2006

Segment Revenue 3,834,495 3,642,732

Segment Result 819,767 913,981

Segment Assets 1,047,613 939,521

Segment Liabilities 585,280 479,739

Capital Expenditure 20,132 27,953

Depreciation/Amortisation 15,341 5,748

• The Pharmaceuticals business registered a growth of 5% over the previous year with sales

of Rs 3835 million.

• Higher sales of the Voveran® range, the No. 1 Non-Steroidal Anti-Inflammatory drug in

India, due to the epidemics of chikungunya and dengue fever partially offset by a price

reduction in Tegrital™.

Novartis India Page 6

• An initiative branded ‘Project Orchid’ launched to build on Diversity and Inclusion

received Novartis Group recognition

New products and line extensions introduced during the period under review were:

– Pain & Inflammation , Voveran Plus

– Epilepsy ,Epitril MD

– Ophthalmology ,Vitalux Plus

The business continues to hold leadership position in major therapeutic areas such as:

– Gynaecology, Methergin and Syntocinon

– Transplantation & Immunology, Sandimmun Neoral

Novartis India Page 7

Generics

Indian companies are increasingly advancing beyond domestic boundaries and are aggressively

focusing on making their mark in the global generics space. In order to reduce their dependence

on the U.S. market, Indian pharma companies are now entering new and underserved generics

markets across different geographies such as Japan, South Africa, European and Commonwealth

of Independent States(CIS) countries and Latin America. While the global generics industry

continues to remain under severe pricing pressure, the Indian generic drug makers continue to

spread their wings across different international markets.

Growth Drivers

• Increasing use of generics

Globally, the generics industry is expected to grow at a Compound Annual Growth Rate

(CAGR) of 11 percent between 2006 and 2010 and touch USD 94 billion by 2010. At present,

India has only 10 percent market share in this industry.

• Regulated markets

U.S. - The world’s largest generics market, European Union (EU) – regulatory reforms to

drive growth and Japan – Low generics penetration and Government legislation to drive

growth

• Emerging markets

Emerging markets such as Russia and the CIS nations, Eastern Europe; Brazil and other Latin

American countries and South Africa are increasingly being viewed as highly remunerative

markets.

• India’s competitive position

In order to remain competitive and maintain their dominance, Indian players have realigned

and restructured their operating paradigms reflected in lean cost structures, vertically

integrated models, geographically diversified presence, vast product baskets and increasing

presence in niche segments.

• Enhanced focus of niche specialities

• Consolidations

Today, the top 10 global generics companies collectively have a market share of over 50

percent of the global generics market. This is likely to have a positive effect and reduce

pricing pressure in the global generics market, to some extent.

Key consideration

• Pricing pressure

Novartis India Page 8

the generics market will expand. It is a growing market and opportunities still exist. The

severe pricing pressure will continue and eventually it will become a volume game. The key

factors that will become very important to succeed in the generics business will be the ability

to differentiate oneself in terms of technological development and cost optimization.

• Multiple markets

The success of companies in these markets will depend on factors such as:

• Entry strategy

• Ability to comply with regulatory complexities

• Building product portfolio based on disease profile of each country.

• China competition

China is emerging as a strong competitor on the back of its cost competitiveness, strong

government support (in the form of incentives), implementation of GMP norms, aggressive

focus on exports and the soaring consolidation drive to build large Chinese pharma giants

• Integration problems

Some of the key concerns of the integration process involve people management, managing

cultural differences and aligning the goals and ambitions of the staff members with the vision

of the merged company.

Challenges

• Anti-TB business continues to move towards tender

• Government imposed price reduction of Anti-TB products

Planned Actions

• Restructured Field Force to improve Productivity

• Promotional plan to keep loyal customers

• Use initiatives like ‘JEET’ to differentiate

• Special promotional thrust for REGESTRONE

2007 2006

Segment Revenue 432,834 551,629

Segment Result 117,646 176,488

Segment Assets 148,995 162,341

Segment Liabilities 72,612 98,328

Capital Expenditure 0 13

Depreciation/Amortisation 3,188 -1,848

The business continues to operate in a challenging environment.

Novartis India Page 9

• The business recorded sales of Rs 433 million decline of 22% over the previous

comparable period.

• The business decided not to participate in the tender business due to

– very low margins.

– lower volumes in certain products due to competitive pressures

– de-stocking in certain States due to impending VAT regime

• The TB segment witnessed a marginal growth of 4% as compared to the previous year.

Top Products

• Foristal

• PZA CibaÒ

• Regestrone

Novartis India Page 10

OTC

Challenges

• Announcement of a Government policy for the OTC segment continues to be delayed

• Sustained investment in brand building

Planned Actions

• New global brands to be introduced in India

• Continue to grow business faster than market

• New variants in Calcium range

2007 2006

Segment Revenue 795,750 720,649

Segment Result 111,052 93,871

Segment Assets 177,337 146,656

Segment Liabilities 116,091 105,082

Capital Expenditure 1,874 816

Depreciation/Amortisation 3,570 2,974

• The OTC business registered sales of Rs 796 million with a growth of 10%.

• The Calcium Sandoz® range of products consolidated its position as the leading OTC

brand in Calcium with significant growth by

– Calcium Sandoz® Softchews

– Calcium Sandoz® Woman

• Otrivin®, which enjoys a leadership position in the Nasal Decongestant category

maintained its market share under intense competitive pressure.

• The T-minic™ range of products in the CoCoA (Cough, Cold and Allergy) category

posted good growth albeit on a small base.

• Segment profits were up primarily because of

– higher sales

– Adoption of effective cost control initiatives.

New products and line extensions introduced during the period under review were:

• Gastrointestinal

Novartis India Page 11

– Gascidity® powder, liquid and tablets

Animal Health

Challenges

• Volatility of poultry industry

– Bird flu

– Price sensitivity

• Unorganised Dairy business with heavy dependence on Monsoon

• Cheaper imports & generics dominated market

Planned Actions

• Tiamutin Leadership Marketing

• Shift of focus to Cattle segment

• Sales Force Optimisation project

• Customer and Consumer Excellence initiatives to continue

2007 2006

Segment Revenue 359,291 344,206

Segment Result 30,771 46,393

Segment Assets 180,774 157,258

Segment Liabilities 63,383 45,164

Capital Expenditure 1,576 1,553

Depreciation/Amortisation 2,102 188

• Animal Health business achieved sales of Rs 359 million with a 4% growth over the

comparable previous period despite bird flu which impacted our key poultry brands.

• This growth was mainly in a product Natuzyme, an enzyme used in feed.

• Tiamutin® was also another contributor to growth through

– successful implementation of the Tiamutin Leadership marketing initiative

– upgradation of technical skills of the field force

– provision of technical services to farmers.

• The growth in the cattle segment was primarily due to higher sales of the Calcium range

of products.

New product introduced during the year was:

Novartis India Page 12

– Antibiotic to treat bacterial infections in cattle , Petromox™

Novartis India Page 13

Research And Development

1. Specific areas in which R&D is carried out by the Company:

The scope of activities covers process development in Drugs and Pharmaceutical formulations.

2. Benefits derived from R&D:

• Productivity and quality improvements

• Improved process performance and better cost management

• Enhancement of safety and better environmental protection

3. Future plan of action:

Relevant R&D activity in the areas of business operations of the Company will continue with a

view to adapt products and processes to improve performance and better meet the end user’s

needs.

4. Expenditure on R&D:

1. Efforts in brief made towards technology absorption, adaptation and innovation:

Novartis AG, Switzerland continues to provide basic technology and technical know-how for

introduction of new products and formulation development. These are adapted, wherever

necessary, to local conditions.

2. Benefits derived as a result of the above efforts:

New product development, productivity and quality improvements, enhanced safety and

environmental protection measures and conservation of energy are the benefits derived.

3. Technology Imported:

Novartis AG, Switzerland has provided technical know-how and technology relevant to the areas

of business of the Company, as and when required, relating to products, quality, marketing and so

on. This on-going process involves visits by employees of both companies to each other’s office

sites for discussions and training. Novartis is considered to have one of the best pipelines in

Pharma sector.

Novartis India Page 14

Financial Analysis

Income Statement

Income Mar Mar Mar Mar Mar Mar’08

'03 '04 '05 '06 '07

Sales Turnover 478.85 511.58 478.35 529.16 548.38 563.85

Excise Duty 6.8 5.79 5.86 2.9 7.32 7.53

Net Sales 472.05 505.79 472.49 526.26 541.06 556.32

Other Income 37.44 38.12 33.52 54.32 47.17 60.61

Stock Adjustments 17.49 -23.17 14.62 2.33 5.24 5

Total Income 526.98 520.74 520.63 582.91 593.47 65.61

Expenditure Mar Mar Mar Mar Mar Mar

'03 '04 '05 '06 '07 ‘08

Raw Materials 266.59 240.32 243.2 260.85 249.25 250

Power & Fuel Cost 12.08 11.01 11.85 1.89 1.87 1.88

Employee Cost 43.62 43.77 44.51 50.15 55.18 57

Other Manufacturing 2.39 2.22 2.83 8.01 9.1 9.3

Expenses

Selling and Admin 75.27 80.35 83.79 85.53 100.47 100

Expenses

Miscellaneous 30.3 32.72 32.43 34.68 47.88 45

Expenses

Preoperative Exp -3.72 -4 -4.62 -1.02 -6.47 -4

Capitalised

Total Expenses 426.53 406.39 413.99 440.09 457.28 459.18

The overall sales figures areon a growing trend and shall grow at a fasterpace

in the coming years. with the reduction in excise duties , income should

Novartis India Page 15

improve considerably. But the expenses which have been more or less

constant. The sharp decrease in power and fuel expense is due to sale of

assets in 2006.

Novartis India Page 16

Quarterly Results

Dec Mar Jun Sep Dec Mar

'06 '07 '07 '07 '07 ’08

Sales Turnover 148.72 123.86 138.83 147.88 136.18 140.96

Other Income 9.79 20.78 12.11 16.09 16.41 16.00

Total Income 158.51 144.64 150.94 163.97 152.59 156.96

Total Expenses 124.85 109.02 114.86 114.23 116.15 115.08

Operating Profit 23.87 14.84 23.97 33.65 20.03 25.88

Gross Profit 33.66 35.62 36.08 49.74 36.44 41.88

Interest 0.15 0.2 0.14 0.14 0.24 0.24

PBDT 33.51 35.42 35.94 49.6 36.2 41.64

Depreciation 0.65 0.66 0.68 0.71 0.73 0.71

PBT 32.86 34.76 35.26 48.89 35.47 40.93

Tax 11.79 10.89 12.42 18.5 13 15.16

Net Profit 21.07 23.87 22.84 30.39 22.47 25.77

sales have recovered after march last year and also other income has come

in.the quarter 3 showed lesser sales due to animal health segment being hit.

But considering the renewed focus on cattle, this segment will be able to

catch up and a profit will be observed.

Novartis India Page 17

Balance Sheet

Mar Mar Mar Mar Mar Mar ’08

'03 '04 '05 '06 '07

Sources Of Funds

Total Share Capital 15.98 15.98 15.98 15.98 15.98 15.98

Reserves 227.6 239.8 268.39 321.62 372.6 461.19

Net worth 243.58 255.78 284.37 337.6 388.58 509.13

Secured Loans 5.51 2.01 2.99 2.41 4.5 4.5

Unsecured Loans 3.22 4.06 3.91 3.9 4.7 4.7

Total Debt 8.73 6.07 6.9 6.31 9.2 9.2

Total Liabilities 252.31 261.85 291.27 343.91 397.78 527.57

Application Of Funds

Gross Block 155.49 155.55 152.76 22.41 23.17 23.17

Less: Accum. 53.46 129.79 131.17 12.55 13.53 13.53

Depreciation

Net Block 102.03 25.76 21.59 9.86 9.64 9.64

Capital Work in 0.45 0.57 0.39 0.21 0.03 0

Progress

Investments 36.88 106.4 47.53 7.08 3.77 16.52

Inventories 71.98 50.79 65.86 61.32 67.4 70

Sundry Debtors 47.59 68.67 41.59 39.61 42.42 52

Cash and Bank 32.19 8.58 6.16 4.4 2.9 3

Balance

Total Current Assets 151.76 128.04 113.61 105.33 112.72 125

Loans and Advances 76.43 109.63 167.47 232.88 359.43 460

Fixed Deposits 12.7 0.09 58.59 121.46 2.41 2.41

Total CA, Loans & 240.89 237.76 339.67 459.67 474.56 577.41

Advances

Current Liabilities 95.28 66.11 74.67 69.28 68.2 68

Provisions 32.67 42.53 43.24 63.64 22.01 22

Total CL & Provisions 127.95 108.64 117.91 132.92 90.21 90

Net Current Assets 112.94 129.12 221.76 326.75 384.35 501.41

Total Assets 252.3 261.85 291.27 343.9 397.79 527.57

Novartis India Page 18

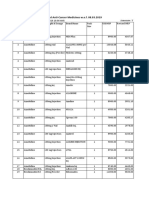

Ratio Analysis

Liquidity

Dr Reddy`s Glenmark Matrix Sun

Laboratori Pharmaceuti Laboratori Novartis Pharmaceutic

es cal es India al

‘0 ‘0 ‘0 ‘0 ‘0 ‘0 ‘0 ‘0

Year 7 6 5 ‘07 ‘06 ‘05 7 6 05 7 6 5 ‘07 ‘06 ‘05

Curren 4. 3. 3. 1. 1. 1. 5. 3. 3.

t Ratio 6 5 7 4.0 5.3 5.1 6 7 9 3 5 3 6.5 6.0 7.7

The current ratio for top pharmaceutical companies is high due to high

current assets in the form of inventories and high loans and advances. The

sudden leap in Novartis India’s current ratio is due to reduction in current

liabilities by approximately 55% in ’07.

Leverage

Dr Reddy`s Glenmark Matrix Sun

Laboratori Pharmaceuti Laboratori Novartis Pharmaceutic

es cal es India al

‘0 ‘0 ‘0 ‘0 ‘0 ‘0 ‘0 ‘0

Year 7 6 5 ‘07 ‘06 ‘05 7 6 05 7 6 5 ‘07 ‘06 ‘05

0. 0. 0. 0. 0. 0. 0. 0. 0.

Debt/Equit 1 4 1 2.1 2.7 1.8 2 2 1 0 0 0 0.4 1.2 1.7

y

0. 0. 0. 0. 0. 0. 0. 0. 0. 16.

0 0 0 1.1 1.9 0.4 0 0 0 0 0 0 0.4 1.2 4

LTD/NW

The debt/equity ratio is low because of comparatively low debt of these

companies. most of their debt is long term secured loans. the ratio for

Novartis tends towards 0 due to a very low debt. But there has been an

upward trend in the last 3 years.

Company Industry Sector S&P 500

Quick Ratio (MRQ) 1.32 1.47 2.16 1.18

Current Ratio (MRQ) 1.65 2.06 2.88 1.7

LT Debt to Equity (MRQ) 0.01 0.24 0.33 0.47

Total Debt to Equity 0.12 0.34 0.41 0.57

(MRQ)

By comparing the financial strength of Novartis with others we realise that, as

the ratios are low there is potential to increase current assets and also to

raise debt.

Novartis India Page 19

Novartis India Page 20

Profitability

Glenmark Sun

Dr Reddy`s Matrix Novartis

Pharmaceutic Pharmaceutic

Laboratories Laboratories India

al al

% ‘07 ‘06 ‘05 ‘07 ‘06 ‘05 ‘07 ‘06 05 ‘07 ‘06 ‘05 ‘07 ‘06 ‘05

27. 31. 23. 25. 10. 21. 20. 22. 32. 22. 25. 32. 28.

RONW 1 9.5 3.2 2 9 6 2 0 9 8 0 9 9 0 3

12. 18. 23. 35. 28. 31.

Tax/PB

T 8 8.9 0.0 4.7 9.7 4 1.8 7.1 8 5 3 5 1.1 1.8 2.1

39. 16. 11. 28. 20. 25. 19. 34. 29. 17. 21. 16. 25. 26. 29.

Gross

Profit 9 1 7 0 1 2 5 0 1 9 0 4 8 5 2

31. 10. 17. 12. 13. 13. 27. 20. 16. 20. 13. 28. 28. 26.

Net

Profit 1 5 4.2 2 5 7 3 3 5 3 5 8 7 1 3

Profitability improved in ’06 but slumped in ’07 due to Animal Health division

affected by bird flu and change in employee benefits policy in ’07. the Tax

margin is affecting the bottom line. Lower R&D and depreciated assets have

resulted in higher tax.

Company Industry Sector S&P 500

Gross Margin (TTM) 71.67 71.28 67.32 44.14

EBITD Margin (TTM) 22.18 28.24 24.15 23.2

Operating Margin (TTM) 17.41 21.95 19.37 19.48

Pre-Tax Margin (TTM) 19.22 21.92 19.04 17.89

Net Profit Margin (TTM) 16.79 16.95 13.93 13.18

High non operating income and low depreciation are the peculiarities seen in

Novartis India.

Activity

Dr Reddy`s Glenmark Matrix

Novartis Sun

Laboratorie Pharmaceuti Laboratorie

India Pharmaceutical

s cal s

‘0 ‘0 ‘0

Days ‘07 ‘06 ‘05 ‘07 ‘06 ‘05 ‘07 ‘06 05 ‘07 ‘06 ‘05

7 6 5

15 23 21 19 15 17 16 - -

RM Inv 250 216 149 7 6 14

4 8 6 6 4 3 0 1580 2341

FG Inv 10 18 19 38 35 50 5 10 13 50 47 50 19 17 19

Novartis India Page 21

10 10 10

Recv. 99 94 189 174 131 75 28 27 32 50 55 71

1 0 7

11 10

Creditor 88 92 80 62 58 97 73 42 41 47 15 23 36

s 2 7

The very low inventories of raw materials is due to actual production being

done in subsidiaries abroad, which also causes higher Finished goods

inventory considering longer lead times. Low receivables and creditors reflect

the efficiency of the staff.

Company Industry Sector S&P 500

Revenue/Employee 396,609 444,977 588,984 922,822

(TTM)

Net Income/Employee 66,599 75,343 96,608 115,491

(TTM)

Receivable Turnover 6.08 6.09 7.06 10.3

(TTM)

Inventory Turnover 2.22 2.87 4.05 12.15

(TTM)

Asset Turnover (TTM) 0.54 0.64 0.78 0.96

The turnover ratios are low reflecting the efficiency but the per employee

ratios are reflecting low productivity. It seems that excess employees are

affecting the turnover ratios.

Valuation

Glenmark Sun

Dr Reddy`s Matrix

Pharmaceuti Novartis India Pharmaceutic

Laboratories Laboratories

cal al

% ‘07 ‘06 ‘05 ‘07 ‘06 ‘05 ‘07 ‘06 05 ‘07 ‘06 ‘05 ‘07 ‘06 ‘05

EPS 70 27 8 11 5 5 6 11 8 27 33 20 32 24 16

10. 15. 10.

Div

/share 3.8 5.0 5.0 0.8 0.7 0.8 0.0 1.2 1.2 0 0 0 6.7 5.5 3.8

Book 259 289 267 36 23 20 63 56 41 121 105 89 125 77 58

Value

Book Value and EPS are at considerably good in contrast to others. the payout

ratio is high for Novartis and they had announced 200% dividend in the past 2

years.

Novartis India Page 22

Company Industry Sector S&P 500

P/E Ratio (TTM) 18.21 22.74 25.17 19.72

Beta 0.49 0.61 0.77 1

This reflects the security of investing in the firm and the potential for P/E to

increase.

Novartis India Page 23

The way ahead

Considering that Novartis was unsuccessful in getting patent for Glivec , it was

a setback for them. They are now reconsidering their decision about setting

up research infrastructure in India. They may now concentrate on gurgoun

instead. The 500 Cr Hyderabad campus shows the importance Novartis is

giving India as an emerging country.

The pharmaceutical companies are expecting an excise duty cut from 16% to

8%. This will be beneficial to the consumer and organizations. Also the patent

regulations should be sorted in India soon for MNC companies to develop their

products in India.

Consolidation of Indian firms and high number of unregulated players in this

sector is a threat to Novartis in the future. Also CRAMS is going to be a threat

to subsidiaries like Novartis India. But the fact remains that Novartis has one

of the best pipelines, which shows their commitment towards research. This

also implies their future potential in releasing new drugs.

Novartis India Page 24

You might also like

- MIB For IPDocument210 pagesMIB For IPaditya_kpl588% (8)

- Process of E-CommerceDocument7 pagesProcess of E-CommerceDeepika vermaNo ratings yet

- Advertising Impact Airtel & VodafoneDocument42 pagesAdvertising Impact Airtel & VodafoneDeepika verma80% (5)

- Horizontal Marketing SystemDocument4 pagesHorizontal Marketing SystemDeepika vermaNo ratings yet

- Punching Card SystemDocument11 pagesPunching Card SystemDeepika verma100% (1)

- Dissertation Report On Mutual Funds Industry in IndiaDocument12 pagesDissertation Report On Mutual Funds Industry in IndiaDeepika verma88% (8)

- Psycho Graphic SegmentationDocument31 pagesPsycho Graphic SegmentationDeepika verma100% (1)

- of InsuranceDocument18 pagesof InsuranceDeepika verma100% (4)

- Definition of Shoulder DislocationDocument66 pagesDefinition of Shoulder DislocationDeepika verma100% (1)

- HTACPLDocument14 pagesHTACPLDeepika verma100% (1)

- Ratio AnalysisDocument16 pagesRatio AnalysisDeepika vermaNo ratings yet

- Motivation in Public OrganizationDocument15 pagesMotivation in Public OrganizationKhadim Jan89% (9)

- HTACPLDocument14 pagesHTACPLDeepika vermaNo ratings yet

- Hypothesis FormulationDocument28 pagesHypothesis FormulationDeepika verma80% (5)

- Technology MGMTDocument43 pagesTechnology MGMTDeepika verma100% (4)

- Punching Card SystemDocument5 pagesPunching Card SystemDeepika vermaNo ratings yet

- Job Enrichment Should Be Distinguished From Enlargement Job Enlargement Attempts To Make A Job More Varied by Removing The Dullness Associated With Performing Repetitive OperationsDocument3 pagesJob Enrichment Should Be Distinguished From Enlargement Job Enlargement Attempts To Make A Job More Varied by Removing The Dullness Associated With Performing Repetitive OperationsDeepika vermaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Rasaprakashasudhakar Chapter 1Document42 pagesRasaprakashasudhakar Chapter 1NCSASTRO100% (1)

- Pharmacy Management SynopsisDocument7 pagesPharmacy Management SynopsisHariom75% (4)

- Acetaminophen (Paracetamol)Document2 pagesAcetaminophen (Paracetamol)Joshua KellyNo ratings yet

- Glucosami̇ne and Chondroi̇ti̇n SulfateDocument4 pagesGlucosami̇ne and Chondroi̇ti̇n Sulfatetaner_soysurenNo ratings yet

- Cito 27Document58 pagesCito 27dewakusumaNo ratings yet

- Routes of Drug AdministrationDocument24 pagesRoutes of Drug AdministrationLaurie BurtonNo ratings yet

- CRESO Pharma Press ReleaseDocument6 pagesCRESO Pharma Press Releasejenn_hoeggNo ratings yet

- Zanthoxylum Fruit Extracts Boost Immune Activity in RatsDocument1 pageZanthoxylum Fruit Extracts Boost Immune Activity in RatsM Fzn LbsNo ratings yet

- Good Faith Dispensing GuidelinesDocument3 pagesGood Faith Dispensing GuidelinesKerriNo ratings yet

- At A Glance - Drug Distribution in The Body.Document10 pagesAt A Glance - Drug Distribution in The Body.Ismail Hossain Siragee100% (1)

- Peracetic Acid Assay MerckDocument73 pagesPeracetic Acid Assay MerckCientificamenteSaraNo ratings yet

- List Obat Dead Stock Di If Rawat Jalan Lantai 1: Abbotic Ds 30MlDocument18 pagesList Obat Dead Stock Di If Rawat Jalan Lantai 1: Abbotic Ds 30MlTriyoko Septio MNo ratings yet

- Revised MRP of Non-Scheduled Anti-Cancer MedicinesDocument23 pagesRevised MRP of Non-Scheduled Anti-Cancer Medicinessampath seshadri100% (1)

- Finish Poster DM TMFDocument1 pageFinish Poster DM TMFpratika wardaniNo ratings yet

- Sanofi Annual Report 2016Document340 pagesSanofi Annual Report 2016Ojo-publico.comNo ratings yet

- Rptabstracts in Presentation Order 2013 PDFDocument283 pagesRptabstracts in Presentation Order 2013 PDFgod4alllNo ratings yet

- Consumer Rights in IndiaDocument3 pagesConsumer Rights in IndiaShiraz KhanNo ratings yet

- Guidance on medicinal product registration in Singapore checklistDocument17 pagesGuidance on medicinal product registration in Singapore checklistWilliam ChandraNo ratings yet

- LIST OF REGISTERED DRUGS As of December 2012: DR No Generic Brand Strength Form CompanyDocument33 pagesLIST OF REGISTERED DRUGS As of December 2012: DR No Generic Brand Strength Form CompanyBenjamin Tantiansu50% (2)

- Medication Administration TimesDocument3 pagesMedication Administration TimesBenjel AndayaNo ratings yet

- Intraoperative Vasoplegia: Methylene Blue To The Rescue!: ReviewDocument7 pagesIntraoperative Vasoplegia: Methylene Blue To The Rescue!: ReviewSandra GarGarNo ratings yet

- No. 167, Vol.2, No.4, 9720980, RJC-499Document9 pagesNo. 167, Vol.2, No.4, 9720980, RJC-499Salih OzerNo ratings yet

- Administering Intramuscular InjectionDocument7 pagesAdministering Intramuscular Injectionthanuja mathew100% (1)

- Profiles of Drug Substances Vol 05Document556 pagesProfiles of Drug Substances Vol 05Binhnguyen Nguyen100% (3)

- Formularium Ifrs MMB TerbaruDocument33 pagesFormularium Ifrs MMB TerbaruDesitrisnasariNo ratings yet

- Thesis English 4Document21 pagesThesis English 4Hermiie Joii Galang MaglaquiiNo ratings yet

- Kalbe FarmaDocument5 pagesKalbe FarmaRafi WardanaNo ratings yet

- Importer Chemicals Pharma Pat ImpexDocument27 pagesImporter Chemicals Pharma Pat ImpexTejasParikhNo ratings yet

- Square StrategyDocument11 pagesSquare StrategyAshwin TattapureNo ratings yet