Professional Documents

Culture Documents

Ethical Fun9

Uploaded by

Nitish KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ethical Fun9

Uploaded by

Nitish KumarCopyright:

Available Formats

Tata Ethical Fund

(An open ended equity scheme following Shariah principles)

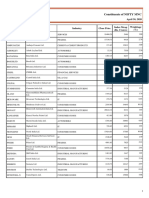

As on 30th November 2018 PORTFOLIO

INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of

An equity scheme which invests primarily in equities of Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets

Shariah compliant companies and other instrument if Equity & Equity Related Total 47768.14 91.42 Pesticides

allowed under Shariah principles. Auto Rallis India Ltd. 502000 812.24 1.55

Hero Motocorp Ltd. 31300 956.28 1.83 UPL Ltd. 85000 644.13 1.23

INVESTMENT OBJECTIVE Auto Ancillaries Petroleum Products

To provide medium to long- term capital gains by investing Wabco India Ltd. 20000 1353.80 2.59 Castrol India Ltd. 505000 762.55 1.46

in Shariah compliant equity and equity related instruments Amara Raja Batteries Ltd. 116849 828.75 1.59 Industrial Products

of well-researched value and growth - oriented companies. MRF Ltd. 1100 740.65 1.42 Carborundum Universal Ltd. 390000 1412.78 2.70

Cement Cummins India Ltd. 167186 1349.19 2.58

DATE OF ALLOTMENT Grasim Industries Ltd. 153000 1325.36 2.54 Schaeffler Ltd. 16000 844.59 1.62

May 24,1996 Ambuja Cements Ltd. 460000 1000.27 1.91 Mahindra Cie Automotive Ltd. 298000 771.08 1.48

Construction Project Finolex Cables Ltd. 161271 739.19 1.41

FUND MANAGER Voltas Ltd. 150000 830.93 1.59 Pharmaceuticals

Rupesh Patel (Managing Since 7-Sep-18 and overall Consumer Durables Alkem Laboratories Ltd. 94000 1797.89 3.44

experience of 18 years) Bata India Ltd. 158000 1648.41 3.15 IPCA Laboratories Ltd. 93750 746.67 1.43

Titan Company Ltd. 105000 973.46 1.86 Aurobindo Pharma Ltd. 80000 648.56 1.24

BENCHMARK Whirlpool Of India Ltd. 50400 705.05 1.35 Retailing

Nifty 500 Shariah TRI Havells India Ltd. 100000 684.70 1.31 Future Retail Ltd. 320000 1682.88 3.22

Consumer Non Durables Software

NAV Hindustan Unilever Ltd. 242000 4244.68 8.12 Tech Mahindra Ltd. 300000 2117.85 4.05

Direct - Growth : 161.6875 Britannia Industries Ltd. 77000 2440.71 4.67 Larsen & Toubro Infotech Ltd. 67000 1051.73 2.01

Direct - Dividend : 94.3977 Asian Paints (India) Ltd. 162000 2180.44 4.17 Textile Products

Reg - Growth : 153.3219 Tata Global Beverages Ltd. 420000 918.33 1.76 Mayur Uniquoters Ltd. 200000 808.20 1.55

Reg - Dividend : 68.2188 Nestle India Ltd. 7000 753.54 1.44

Gas

FUND SIZE Other Equities^ 4306.05 8.24

Gail ( India ) Ltd. 436666 1497.98 2.87

Rs. 522.49 (Rs. in Cr.) Portfolio Total 47768.14 91.42

Petronet Lng Ltd. 540000 1156.68 2.21

Cash / Net Current Asset 4480.52 8.58

Industrial Capital Goods

MONTHLY AVERAGE AUM Net Assets 52248.66 100.00

Siemens Ltd. 93000 884.10 1.69

Rs. 513.37 (Rs. in Cr.) Thermax Ltd. 81696 850.66 1.63 ^ Exposure less than 1% has been clubbed under Other Equities

Oil

TURN OVER

Oil & Natural Gas Co. 925000 1297.78 2.48

Portfolio Turnover (Total) 32.85%

Portfolio Turnover (Equity component only) 32.85%

EXPENSE RATIO**

SIP - If you had invested INR 10000 every month

Direct 1.53

Regular 2.68 1 Year 3 Year 5 Year 7 Year 10 Year Since Inception

**Note: The rates specified are actual month end expenses charged Total Amount Invested (Rs.) 1,20,000 3,60,000 6,00,000 8,40,000 12,00,000 26,70,000

as on Nov 30, 2018. The above ratio includes the Service tax on

Investment Management Fees. The above ratio excludes, Total Value as on Nov 30, 2018 (Rs.) 1,15,637 3,91,255 7,27,200 12,61,180 23,66,762 266,62,798

proportionate charge (out of maximum 30 bps on daily average net

assets allowed) in respect sales beyond T-30 cities assets, wherever Returns -6.68% 5.49% 7.63% 11.42% 13.03% 17.58%

applicable. Total Value of B: Nifty 500 Shariah TRI 1,15,343 4,14,434 7,97,688 13,76,820 24,44,201 72,95,772

VOLATILITY MEASURES^ FUND BENCHMARK B: Nifty 500 Shariah TRI -7.13% 9.37% 11.34% 13.87% 13.63% 8.20%

Std. Dev (Annualised) 13.15 14.19 Total Value of AB: Nifty 50 TRI 1,22,898 4,33,190 7,93,749 13,04,461 22,44,171 160,81,675

Sharpe Ratio 0.01 0.12 AB: Nifty 50 TRI 4.52% 12.41% 11.14% 12.36% 12.03% 14.00%

Portfolio Beta 0.89 1.00

R Squared 0.92 1.00 (Inception date :24-May-1996) (First Installment date : 01-Sep-1996)

Treynor 0.05 0.50 Past performance may or may not be sustained in the future. Returns greater than 1 year period are compounded annualized. Dividends are assumed to be

Jenson -0.39 NA reinvested and bonus is adjusted. Load is not taken in to consideration. For SIP returns, monthly investment of equal amounts invested on the 1st day of every

^Risk-free rate based on the FBIL Overnight MIBOR rate month has been considered.

of 6.55% as on Nov 30, 2018 For scheme performance refer pages 38 - 49.

*B: Benchmark, AB: Additional Benchmark

For calculation methodology please refer to Pg 49 Source: MFI Explorer

MINIMUM INVESTMENT/

MULTIPLES FOR NEW INVESTMENT

Rs. 5,000/- and in multiples of Re. 1/- thereafter.

Top 10 Holdings Equity Industry Allocation

ADDITIONAL INVESTMENT/ Issuer Name % to NAV Consumer Non Durables 20.17%

MULTIPLES FOR EXISTING INVESTORS Industrial Products 10.26%

Hindustan Unilever Ltd. 8.12 Consumer Durables 8.58%

Rs. 1,000/- and multiples of Re. 1/- thereafter. Britannia Industries Ltd. 4.67 Auto Ancillaries 7.18%

Software 7.17%

Asian Paints (india) Ltd. 4.17 Pharmaceuticals 6.11%

Cement 5.30%

LOAD STRUCTURE Tech Mahindra Ltd. 4.05 Gas 5.08%

Industrial Capital Goods 4.26%

Entry Load : Not Applicable Alkem Laboratories Ltd. 3.44 Retailing 3.22%

Future Retail Ltd. 3.22 Pesticides 2.79%

Exit Load : 1% of the applicable NAV, if redeemed on Construction Project 2.52%

or before 365 days from the date of Bata India Ltd. 3.15 Oil

Auto

2.48%

1.83%

allotment. (w.e.f. 6th April, 2015) Gail (india) Ltd. 2.87 Textile Products 1.55%

Petroleum Products 1.46%

Carborundum Universal Ltd. 2.70 Chemicals 0.93%

Please refer to our Tata Mutual Fund website for Wabco India Ltd. 2.59 Construction 0.52%

fundamental changes, wherever applicable

Total 38.98 0.00% 5.00% 10.00% 15.00% 20.00% 25.00%

Market Capitalisation wise Exposure NAV Movement

Tata Ethical Fund - Reg - Growth

Large Cap 50.03% 160 Nifty 500 Shariah TRI

Mid Cap 30.93% 146

132

Small Cap 19.04% 118

104

Market Capitalisation is as per list provided by AMFI.

90

Nov-15 Nov-16 Nov-17 Nov-18

www.tatamutualfund.com TATA MUTUAL FUND 16

You might also like

- 4614 A Fact SheetDocument1 page4614 A Fact SheetAatish TNo ratings yet

- Mid Cap Growth FundDocument1 pageMid Cap Growth FundChromoNo ratings yet

- India Consumer Fund PortfolioDocument1 pageIndia Consumer Fund PortfolioNitish KumarNo ratings yet

- Small Cap Fun7Document1 pageSmall Cap Fun7kumarsaurabhprincyNo ratings yet

- April 30, 2020: Constituents of NIFTY MNCDocument2 pagesApril 30, 2020: Constituents of NIFTY MNCamitNo ratings yet

- Small Cap FundDocument1 pageSmall Cap Fundshailendra.goswamiNo ratings yet

- JM Midcap Oct 30Document1 pageJM Midcap Oct 30yugendhar janjiralaNo ratings yet

- April 30, 2020: Constituents of NIFTY India ConsumptionDocument2 pagesApril 30, 2020: Constituents of NIFTY India ConsumptionamitNo ratings yet

- NIFTY Next 50 Nov2020Document2 pagesNIFTY Next 50 Nov2020Games ZoneNo ratings yet

- Fiscf Franklin India Smaller Companies Fund: PortfolioDocument1 pageFiscf Franklin India Smaller Companies Fund: PortfolioRtsu PtNo ratings yet

- NIFTY Next 50 Apr2020Document2 pagesNIFTY Next 50 Apr2020amitNo ratings yet

- NIFTY50 Value 20 Apr2020Document1 pageNIFTY50 Value 20 Apr2020amitNo ratings yet

- NIFTY Midcap 100 Jan2022Document4 pagesNIFTY Midcap 100 Jan2022Arati DubeyNo ratings yet

- Tata Quant PortfolioDocument1 pageTata Quant PortfolioDeepanshu SatijaNo ratings yet

- NIFTY Midcap 150 Jan2022Document6 pagesNIFTY Midcap 150 Jan2022Arati DubeyNo ratings yet

- Nifty Next 50 Jan2022Document2 pagesNifty Next 50 Jan2022Arati DubeyNo ratings yet

- April 30, 2020: Constituents of NIFTY InfrastructureDocument2 pagesApril 30, 2020: Constituents of NIFTY InfrastructureamitNo ratings yet

- Construction of IndexDocument13 pagesConstruction of IndexNishi SharmaNo ratings yet

- NIFTY Dividend Opportunities 50 Apr2020Document2 pagesNIFTY Dividend Opportunities 50 Apr2020amitNo ratings yet

- April 30, 2020: Constituents of NIFTY 50Document2 pagesApril 30, 2020: Constituents of NIFTY 50amitNo ratings yet

- NIFTY 50 Nov2020Document2 pagesNIFTY 50 Nov2020Games ZoneNo ratings yet

- Tata Super Select Equity FundDocument1 pageTata Super Select Equity FundAbdulazeezNo ratings yet

- NIFTY Midcap 50 Apr2020Document2 pagesNIFTY Midcap 50 Apr2020amitNo ratings yet

- April 30, 2020: Constituents of NIFTY 100Document4 pagesApril 30, 2020: Constituents of NIFTY 100amitNo ratings yet

- InddisposedCategory16819 - Hazardous Waste ListDocument56 pagesInddisposedCategory16819 - Hazardous Waste ListzillionpplNo ratings yet

- NIFTY100 Liquid 15 Apr2020Document1 pageNIFTY100 Liquid 15 Apr2020amitNo ratings yet

- Portfolio Creation With Indian StocksDocument24 pagesPortfolio Creation With Indian StocksTILAK PAI 1827731No ratings yet

- April 30, 2020: Constituents of NIFTY Midcap 100Document4 pagesApril 30, 2020: Constituents of NIFTY Midcap 100amitNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

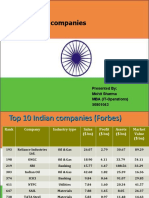

- Top 5 Indian Companies: Presented By: Mohit Sharma MBA (IT-Operations) 50801043Document18 pagesTop 5 Indian Companies: Presented By: Mohit Sharma MBA (IT-Operations) 50801043Manu SharmaNo ratings yet

- NIFTY Energy Apr2020Document1 pageNIFTY Energy Apr2020amitNo ratings yet

- January 31, 2022: Constituents of NIFTY 50Document2 pagesJanuary 31, 2022: Constituents of NIFTY 50nomihNo ratings yet

- UlipDocument1 pageUlipsanu091No ratings yet

- Nifty50 Value 20 Jan2022Document1 pageNifty50 Value 20 Jan2022Arati DubeyNo ratings yet

- Isha Excel Anand 123Document162 pagesIsha Excel Anand 123ISHA AGGARWALNo ratings yet

- April 30, 2020: Constituents of NIFTY Midcap 150Document6 pagesApril 30, 2020: Constituents of NIFTY Midcap 150amitNo ratings yet

- Portfolio Assingment Arbitrage Fund 2Document9 pagesPortfolio Assingment Arbitrage Fund 2Mayank AggarwalNo ratings yet

- UTIFLEXICAPFUNDDocument2 pagesUTIFLEXICAPFUNDmeghaNo ratings yet

- Company Analysis Report On (Hindustan Oil Exploration Company LTD)Document33 pagesCompany Analysis Report On (Hindustan Oil Exploration Company LTD)balaji bysaniNo ratings yet

- April 30, 2020: Constituents of NIFTY Smallcap 100Document4 pagesApril 30, 2020: Constituents of NIFTY Smallcap 100amitNo ratings yet

- Nifty FMCG Jan2022Document1 pageNifty FMCG Jan2022Arati DubeyNo ratings yet

- Template Portfolio Disclosure - February 2018-DerivativeDocument1 pageTemplate Portfolio Disclosure - February 2018-DerivativeReedos LucknowNo ratings yet

- Portfolio Management Report - FEB Module-2 - Mikhlesh EkkaDocument18 pagesPortfolio Management Report - FEB Module-2 - Mikhlesh EkkaSai PavanNo ratings yet

- Tata India Consumption FundDocument1 pageTata India Consumption FundJeremiah SolomonNo ratings yet

- Assignment No. 1Document4 pagesAssignment No. 1priye250No ratings yet

- Portfolio 28022018-09-March-2018-1160956717Document54 pagesPortfolio 28022018-09-March-2018-1160956717Reedos LucknowNo ratings yet

- 01-04-2020 Bse 200 52LDocument18 pages01-04-2020 Bse 200 52LSach PaNo ratings yet

- NIFTY Midcap Liquid 15 Apr2020Document1 pageNIFTY Midcap Liquid 15 Apr2020amitNo ratings yet

- April 30, 2020: Constituents of NIFTY PSEDocument1 pageApril 30, 2020: Constituents of NIFTY PSEamitNo ratings yet

- NIFTY Smallcap 100 Jan2022Document4 pagesNIFTY Smallcap 100 Jan2022Arati DubeyNo ratings yet

- Comparision of HPCL, BPCL & IOCLDocument57 pagesComparision of HPCL, BPCL & IOCLpushpa patel54% (13)

- Model Portfolio Performance - 15th May 2020Document4 pagesModel Portfolio Performance - 15th May 2020FACTS- WORLDNo ratings yet

- Debt Free CompaniesDocument43 pagesDebt Free CompaniesWajid KNo ratings yet

- Nature of BusinessDocument10 pagesNature of BusinessRudolph MakwanaNo ratings yet

- Ambit PortfolioDocument2 pagesAmbit PortfolioPearl MotwaniNo ratings yet

- NIFTY Aditya Birla Group Apr2020Document1 pageNIFTY Aditya Birla Group Apr2020amitNo ratings yet

- Utivalueopportunitiesfund 193Document2 pagesUtivalueopportunitiesfund 193201 TVNo ratings yet

- Ind AS 38Document51 pagesInd AS 38rajan tiwariNo ratings yet

- NIFTY Midcap Select Jan2022Document1 pageNIFTY Midcap Select Jan2022Arati DubeyNo ratings yet

- 3 CH 2Document20 pages3 CH 2Mary HarrisonNo ratings yet

- Main Turbine Lub. Oil System: Prepared byDocument44 pagesMain Turbine Lub. Oil System: Prepared byNitish Kumar100% (1)

- ME Power-Plant FinalDocument11 pagesME Power-Plant Finalk l mandalNo ratings yet

- Akshya BoilerDocument19 pagesAkshya BoilerNitish KumarNo ratings yet

- Two Wheeler Package PolicyDocument17 pagesTwo Wheeler Package PolicyChandra SuryaNo ratings yet

- Final PPT FsssDocument22 pagesFinal PPT FsssNitish KumarNo ratings yet

- 5309 PDFDocument14 pages5309 PDFNitish KumarNo ratings yet

- Compressor TypesDocument35 pagesCompressor TypesSaju SebastianNo ratings yet

- Air Valves ValmaticDocument28 pagesAir Valves Valmaticnimm1962100% (1)

- CompressorDocument37 pagesCompressorNitish Kumar100% (1)

- Analysis of Axial & Centrifugal Compressors: To Be Selected As Per Specific Speed of ApplicationsDocument31 pagesAnalysis of Axial & Centrifugal Compressors: To Be Selected As Per Specific Speed of ApplicationsNitish KumarNo ratings yet

- Emhp Bu01 0518 Lo ResDocument4 pagesEmhp Bu01 0518 Lo ResNitish KumarNo ratings yet

- Air in Pipes ManualDocument60 pagesAir in Pipes ManualelcivilengNo ratings yet

- GEARS FUNdaMENTALS of Design Topic 6 PDFDocument62 pagesGEARS FUNdaMENTALS of Design Topic 6 PDFCristina Andreea CrissyNo ratings yet

- Testing and Maintenance of High-Voltage BushingsDocument10 pagesTesting and Maintenance of High-Voltage BushingsNoé Rafael Colorado SósolNo ratings yet

- Generalized Theory of Electrical MachinesDocument16 pagesGeneralized Theory of Electrical MachinesNitish KumarNo ratings yet

- Electrical Machines..Document11 pagesElectrical Machines..GautamNo ratings yet

- TR TASC Unit Selection GuideDocument6 pagesTR TASC Unit Selection GuideNitish Kumar0% (1)

- Hazards When Purging Hydrogen Gas-Cooled Electric GeneratorsDocument5 pagesHazards When Purging Hydrogen Gas-Cooled Electric GeneratorsNitish KumarNo ratings yet

- Massachusetts Institute of TechnologyDocument12 pagesMassachusetts Institute of TechnologyPrakhar PandeyNo ratings yet

- ABB - 52kV To 550kV - OIP Bushing (En)Document12 pagesABB - 52kV To 550kV - OIP Bushing (En)Nitish KumarNo ratings yet

- Inuence of External Factors on Results of Bushing tan δ and Capacitance MeasurementsDocument5 pagesInuence of External Factors on Results of Bushing tan δ and Capacitance MeasurementsNitish KumarNo ratings yet

- Notice Inviting Open Tender (Through E-Tendering Process Only)Document41 pagesNotice Inviting Open Tender (Through E-Tendering Process Only)Nitish KumarNo ratings yet

- Massachusetts Institute of TechnologyDocument12 pagesMassachusetts Institute of TechnologyPrakhar PandeyNo ratings yet

- Transformer BushingDocument6 pagesTransformer BushingNitish KumarNo ratings yet

- Flyash: Characteristics, Problems and Possible Utilization Rupnarayan SettDocument19 pagesFlyash: Characteristics, Problems and Possible Utilization Rupnarayan SettNitish KumarNo ratings yet

- M Onendra MillsDocument37 pagesM Onendra MillsNitish KumarNo ratings yet

- EOI On R and D CollaborationDocument5 pagesEOI On R and D CollaborationNitish KumarNo ratings yet

- Fuels and CombustionDocument28 pagesFuels and CombustionDrupad PatelNo ratings yet

- 334.00-11 The Turning Gear PDFDocument3 pages334.00-11 The Turning Gear PDFOleg ShkolnikNo ratings yet

- Introduction To Password Cracking Part 1Document8 pagesIntroduction To Password Cracking Part 1Tibyan MuhammedNo ratings yet

- ET4254 Communications and Networking 1 - Tutorial Sheet 3 Short QuestionsDocument5 pagesET4254 Communications and Networking 1 - Tutorial Sheet 3 Short QuestionsMichael LeungNo ratings yet

- Gastroesophagea L of Reflux Disease (GERD)Document34 pagesGastroesophagea L of Reflux Disease (GERD)Alyda Choirunnissa SudiratnaNo ratings yet

- Pedagogy MCQS 03Document54 pagesPedagogy MCQS 03Nawab Ali MalikNo ratings yet

- Hw10 SolutionsDocument4 pagesHw10 Solutionsbernandaz123No ratings yet

- Positive Psychology in The WorkplaceDocument12 pagesPositive Psychology in The Workplacemlenita264No ratings yet

- SavannahHarbor5R Restoration Plan 11 10 2015Document119 pagesSavannahHarbor5R Restoration Plan 11 10 2015siamak dadashzadeNo ratings yet

- RSC Article Template-Mss - DaltonDocument15 pagesRSC Article Template-Mss - DaltonIon BadeaNo ratings yet

- DN102-R0-GPJ-Design of Substructure & Foundation 28m+28m Span, 19.6m Width, 22m Height PDFDocument64 pagesDN102-R0-GPJ-Design of Substructure & Foundation 28m+28m Span, 19.6m Width, 22m Height PDFravichandraNo ratings yet

- Omnitron CatalogDocument180 pagesOmnitron Catalogjamal AlawsuNo ratings yet

- Guided-Discovery Learning Strategy and Senior School Students Performance in Mathematics in Ejigbo, NigeriaDocument9 pagesGuided-Discovery Learning Strategy and Senior School Students Performance in Mathematics in Ejigbo, NigeriaAlexander DeckerNo ratings yet

- Fire Prevention Plan Template - FINAL 5-30-08Document5 pagesFire Prevention Plan Template - FINAL 5-30-08Peter GeorgeNo ratings yet

- Presenters: Horace M. Estrella Jay Mart A. Lazana Princess Camille R. HipolitoDocument23 pagesPresenters: Horace M. Estrella Jay Mart A. Lazana Princess Camille R. HipolitoHorace EstrellaNo ratings yet

- LPS 1131-Issue 1.2-Requirements and Testing Methods For Pumps For Automatic Sprinkler Installation Pump Sets PDFDocument19 pagesLPS 1131-Issue 1.2-Requirements and Testing Methods For Pumps For Automatic Sprinkler Installation Pump Sets PDFHazem HabibNo ratings yet

- Plain English Part 2Document18 pagesPlain English Part 2ابو ريمNo ratings yet

- Backwards Design - Jessica W Maddison CDocument20 pagesBackwards Design - Jessica W Maddison Capi-451306299100% (1)

- GCP Vol 2 PDF (2022 Edition)Document548 pagesGCP Vol 2 PDF (2022 Edition)Sergio AlvaradoNo ratings yet

- Muscles of The Dog 2: 2012 Martin Cake, Murdoch UniversityDocument11 pagesMuscles of The Dog 2: 2012 Martin Cake, Murdoch UniversityPiereNo ratings yet

- Lesson 1 Q3 Figure Life DrawingDocument10 pagesLesson 1 Q3 Figure Life DrawingCAHAPNo ratings yet

- DR S GurusamyDocument15 pagesDR S Gurusamybhanu.chanduNo ratings yet

- KCG-2001I Service ManualDocument5 pagesKCG-2001I Service ManualPatrick BouffardNo ratings yet

- Accounting Students' Perceptions On Employment OpportunitiesDocument7 pagesAccounting Students' Perceptions On Employment OpportunitiesAquila Kate ReyesNo ratings yet

- B. Pengenalan Kepada Pengawal Mikro 1. Mengenali Sistem Yang Berasaskan Pengawal MikroDocument4 pagesB. Pengenalan Kepada Pengawal Mikro 1. Mengenali Sistem Yang Berasaskan Pengawal MikroSyamsul IsmailNo ratings yet

- Multimedia System DesignDocument95 pagesMultimedia System DesignRishi Aeri100% (1)

- PetrifiedDocument13 pagesPetrifiedMarta GortNo ratings yet

- Fortigate Firewall Version 4 OSDocument122 pagesFortigate Firewall Version 4 OSSam Mani Jacob DNo ratings yet

- DCN Dte-Dce and ModemsDocument5 pagesDCN Dte-Dce and ModemsSathish BabuNo ratings yet

- Ethical Conflicts in Psychology PDF DownloadDocument2 pagesEthical Conflicts in Psychology PDF DownloadAvory0% (2)

- Academic Socialization and Its Effects On Academic SuccessDocument2 pagesAcademic Socialization and Its Effects On Academic SuccessJustin LargoNo ratings yet

- Lancru hzj105 DieselDocument2 pagesLancru hzj105 DieselMuhammad MasdukiNo ratings yet