Professional Documents

Culture Documents

FAQs Student

Uploaded by

Anchit JassalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAQs Student

Uploaded by

Anchit JassalCopyright:

Available Formats

Strengthening Corporate Governance

Amendments to Clause 49 of the Equity Listing Agreement

[revised on 31 October 2014]

© Grant Thornton India LLP. All rights reserved.

The Securities and Exchange Board of India (SEBI), months from the date they cease to meet the

vide its circulars dated 17 April 2014, had issued aforesaid criteria.

certain amendments to Clause 49 of the Listing • Companies whose equity shares capital is listed

Agreement. These amendments followed the exclusively on the SME and SME-ITP platforms.

overhaul in the corporate governance norms under

the Companies Act, 2013 and the related rules Further, for listed entities, which are not companies

notified on 27 March 2014 (together, the “2013 but body corporate, or are subject to regulations

Act”). These amendments are aimed at aligning the under other statutes (e.g. banks, financial

SEBI requirements with the provisions of the 2013 institutions, insurance companies etc.), the revised

Act and adopting best practices on corporate Clause 49 shall apply only to the extent it does not

governance. violate the respective statutes and guidelines or

directives issued by the relevant regulatory

The SEBI, subsequently, vide its circular dated 15 authorities. The revised Clause 49 is not applicable

September 2014, issued further amendments to to Mutual Funds.

Clause 49 to address the concerns and practical

difficulties raised by market participants and to This publication summarises the key amendments to

facilitate the listed companies to ensure compliance Clause 49 brought in by the aforesaid circulars dated

with the provisions of revised Clause 49 by also 17 April 2014 and 15 September 2014, respectively.

more closely aligning to the requirements of the

2013 Act. Grant Thornton fully

endorses the revisions to

To implement the corporate governance framework the listing agreement by the

effectively, the SEBI has also provided that the SEBI. We also appreciate

monitoring cell of the stock exchanges shall also the recent amendments and

monitor as to whether all listed companies were strongly believe that an

complying with the the provisions of the revised inclusive legislation by the

Clause 49 on corporate governance. The SEBI to address the

monitoring cell shall ascertain the adequacy and concerns expressed by the

accuracy of disclosures in the quarterly compliance industry would go a long

reports received from the companies and shall way in facilitating

submit a consolidated quarterly compliance report compliance and promoting

to the SEBI. highest standard of

corporate governance in

The revised Clause 49 is applicable to all listed India.

companies with effect from 1 October, 2014.

However, a temporary relaxation, for the time being, Nabeel Ahmed

has been provided to the following class of Partner

companies: Grant Thornton India LLP

• Companies with paid up equity capital not

exceeding INR 10 crore and net worth not

exceeding INR 25 crore as on the last day of the

previous financial year.

However, companies enjoying relaxation under

this criteria, shall be required to comply with the

provisions of the revised Clause 49 within six

© Grant Thornton India LLP. All rights reserved.

Principles of Corporate Governance Board of Directors

True to its objective, the revised Clause 49, for the Composition of Board of Directors

first time, has laid out the principles of corporate

governance. It also expressly states that in case of Woman director

any ambiguity, the provisions shall be interpreted

and applied in conformity with the said principles. With effect from 1 April 2015, the Board of

Following is a brief overview of the said principles: Directors of a listed company shall be required

1. The rights of shareholders to have at least one woman director.

a. The company should seek to protect and

facilitate the exercise of shareholders’ rights.

Minimum number of independent directors

b. The company should provide adequate and

timely information to shareholders.

The Clause 49 previously provided that if the

c. The company should ensure equitable

chairman of the Board of Directors is a non-

treatment of all shareholders, including

executive director, at least one-third of the Board

minority and foreign shareholders.

should comprise independent directors, and if the

2. Role of stakeholders in corporate governance

chairman of the Board is an executive director, at

a. The company should recognise the rights of

least half of the Board should comprise independent

stakeholders and encourage co-operation

directors. The revised Clause 49 has reworded the

between company and the stakeholders.

requirement to replace the reference to executive

3. Disclosure and transparency

director with regular non-executive director.

a. The company should ensure timely and

accurate disclosure on all material matters

The revised Clause 49 has further added that if the

including the financial situation,

chairman of the Board is a regular non-executive

performance, ownership, and governance of

director who is also a promoter of the company or is

the company.

related to any promoter or person occupying

4. Responsibilities of the Board of Directors

management positions at the Board level or at one

a. Disclosure of information

level below the Board, at least half of the Board

b. Key functions of the Board of Directors

should comprise of independent directors.

c. Other responsibilities

© Grant Thornton India LLP. All rights reserved.

Independent Directors Performance evaluation of independent

directors

Definition of independent director

The revised Clause 49 has formalised the

The revised Clause 49 has expanded the performance evaluation of independent directors

disqualification criteria for independent directors, and specifies that the Nomination Committee shall

and thus, makes the definition more restrictive. Also, lay down the evaluation criteria for performance

the definition specifically excludes a nominee evaluation of independent directors. Such

director. performance evaluation shall be done by the Board

of Directors and shall form the basis for

Limit on number of directorships determination of reappointment of the independent

director. The company shall disclose the criteria for

The revised Clause 49 has introduced the limit on performance evaluation, as laid down by the

number of directorships and now specifies that an Nomination Committee, in its annual report.

individual shall not serve as an independent director

in more than seven listed companies. Further, any

Separate meetings of independent directors

individual who is also serving as a whole-time

director in any listed company shall not serve as an The revised Clause 49 has added a new requirement

independent director in more than three listed that the independent directors of the company shall

companies. hold at least one meeting in a year, without the

attendance of non-independent directors and

Maximum tenure of independent directors members of management. All the independent

directors of the company shall strive to be present at

The revised Clause 49 provides that the maximum such meeting. The independent directors in the

tenure of an independent director shall be in meeting shall:

accordance with the provisions of the 2013 Act and a. review the performance of non-independent

clarifications/ circulars issued by the Ministry of directors and the Board of Directors as a whole

Corporate Affairs from time to time. Under the b. review the performance of the Chairperson of

2013 Act, the maximum tenure of an independent the company, taking into account the views of

director in office is up to five consecutive years, executive directors and non-executive directors,

followed by a reappointment for another term of up and

to five consecutive years on passing of a special c. assess the quality, quantity and timeliness of

resolution by the company. On completion of the flow of information between the company

said maximum tenure of 10 years, an individual shall management and the Board that is necessary for

be eligible for appointment again as an independent the Board to effectively and reasonably perform

director in that company only after a cooling-off its duties.

period of three years. Further, the tenure already

served by an independent director in the past shall

not be considered, and for the purpose of

determining the maximum tenure, only future term

shall be considered.

© Grant Thornton India LLP. All rights reserved.

Familiarization program for independent Whistle Blower Policy

directors

The revised Clause 49 has formalised the whistle

The revised Clause 49 requires that the company blower policy requirements and mandates that the

shall familiarise the independent directors with the company shall establish a vigil mechanism for

company, their roles, rights, responsibilities in the directors and employees to report concerns about

company, nature of the industry in which the • unethical behavior,

company operates, business model of the company, • actual or suspected fraud, or

etc. through various programs. • violation of the company’s code of conduct or

ethics policy.

The company shall disclose the details of such

familiarisation programs on its website and also This mechanism should also provide for adequate

provide that web link in its annual report. safeguards against victimisation of individuals who

utilise such mechanism to report any concerns. The

Non-executive Directors’ compensation and details of establishment of such mechanism shall be

disclosures disclosed by the company on its website, and in the

report of Board of Directors.

The revised Clause 49 has inserted a prohibition and

specifically forbids the independent directors from

being entitled to any stock option.

Code of Conduct

The revised Clause 49 has inserted the requirement

that the code of conduct of the company shall

incorporate the duties of independent directors as

laid down in the Act. An independent director shall

be held liable in respect of acts by a company that

occur with his knowledge or if the independent

director does not act diligently with respect to the

requirements of the listing agreement.

The company shall disclose the code of conduct for

the Board of Directors and the senior management

on the website of the company.

© Grant Thornton India LLP. All rights reserved.

Audit Committee down, and recommend their appointment and

removal

Role of Audit Committee d. recommend to the Board of Directors, the

policy for remuneration of the directors, key

The revised Clause 49 has enhanced the role of the managerial personnel and other employees; and

audit committee to also include: e. devising a policy on Board diversity

a. review and monitor the auditor’s independence

and performance, and effectiveness of audit The company shall disclose the remuneration policy

process and the evaluation criteria in its annual report.

b. approval or any subsequent modification of

transactions of the company with related parties; Subsidiary Companies

c. scrutiny of inter-corporate loans and

investments The revised Clause 49 has expanded the

d. valuation of undertakings or assets of the requirements for subsidiary companies, and

company, wherever it is necessary, and additionally requires that the company shall

e. evaluation of internal financial controls and risk formulate a policy for determining ‘material’

management systems subsidiaries, and the company shall disclose such

policy on its website and also provide that web link

Also, the meaning of ‘related party transactions’ shall in its annual report. The revised Clause 49 also

be determined by reference to the definitions given prescribes that at a minimum, a subsidiary shall be

in the revised Clause 49 (see below), and not the considered as material if the investment of the

definition contained in Accounting Standard 18. company in the subsidiary exceeds 20% of its

consolidated net worth as per the audited balance

Nomination and Remuneration Committee sheet of the previous financial year or if the

subsidiary has generated 20% of the consolidated

The revised Clause 49 has formalised the income of the company during the previous

remuneration committee and requires that a financial year.

company through its Board of Directors shall

constitute a ‘Nomination and Remuneration’ The revised Clause 49 mandates a special resolution,

committee which shall comprise at least three non- except in cases where a scheme or arrangement has

executive directors, half of which should also be been duly approved by a court/ tribunal, to dispose

independent. The chairman of the committee shall of shares in its material subsidiary which would

be an independent director. The chairperson of the reduce the shareholding to less than 50% or result in

company, even if an executive, can be appointed as a loss of control over the subsidiary. Further, selling,

member, but not as the chairman, of such disposing and leasing of assets amounting to more

committee. Such committee shall be responsible for: than 20% of the assets of the material subsidiary

a. formulation of the criteria for determining shall, except in cases where a scheme or

qualifications, positive attributes and arrangement has been duly approved by a court/

independence of a director tribunal, also require prior approval of shareholders

b. formulation of criteria for evaluation of by way of special resolution.

independent directors and the Board

c. identifying persons who are qualified to become The revised Clause 49 has also modified the

directors and who may be appointed in senior definition of a ‘material non-listed Indian subsidiary’,

management in accordance with the criteria laid and replaces the references to ‘turnover’ by ‘income’,

thus expanding the applicability of provisions for

material non-listed Indian subsidiary.

© Grant Thornton India LLP. All rights reserved.

Risk Management The revised Clause 49 also prescribes that a

company shall formulate a policy on materiality of

The revised Clause 49 has formalised the risk related party transactions, and also on dealing with

assessment and minimisation procedures and related party transactions. The revised Clause 49 also

requires that the Board of Directors shall be prescribes that at a minimum, a transaction with a

responsible for framing, implementing and related party shall be considered material if the

monitoring the risk management plan for the transaction(s), individually or taken together with

company. previous transactions during a financial year, exceed

10% of the annual turnover of the company as per

The revised Clause 49 has also inserted a new the last audited financial statements of the company.

requirement (for only top 100 listed companies by

market capitalisation as at the end of the immediate The revised Clause 49 mandates that all related party

previous financial year) that a company through its transactions shall require prior approval of the audit

Board of Directors shall constitute a Risk committee. The audit committee may grant an

Management Committee. The majority of the omnibus approval subject to the following

members, and the chairman, of such committee, conditions:

shall comprise the members of the Board. The a. the audit committee shall lay down the criteria

Board shall define the roles and responsibilities of for granting the omnibus approval in line with

the Risk Management Committee and may delegate the policy on Related Party Transactions of the

its said responsibilities to such committee. company and such approval shall be applicable

in respect of transactions which are repetitive in

Related Party Transactions nature

b. the audit committee shall satisfy itself about the

[These requirements are applicable to all prospective need for such omnibus approval and that such

transactions. All existing material related party approval is in the interest of the company

contracts or arrangements as on the date of the c. such omnibus approval shall specify (i) the

circular, which are likely to continue beyond 31 name/s of the related party, nature of

March 2015, shall be placed for approval of the transaction, period of transaction, maximum

shareholders in the first general meeting subsequent amount of transaction that can be entered into,

to 1 October 2014. However, a company may (ii) the indicative base price / current contracted

choose to get such contracts approved by the price and the formula for variation in the price if

shareholders even before 1 October 2014.] any and (iii) such other conditions as the Audit

Committee may deem fit. However, where the

The revised Clause 49 has added a detailed new need for related party transaction cannot be

section on related party transactions. This section foreseen and aforesaid details are not available,

describes what related party transactions are, and

also defines the term ‘related party’. This definition

of related party comprises the definition of related

party provided in, both, the 2013 Act as well as the

applicable accounting standards.

© Grant Thornton India LLP. All rights reserved.

Audit Committee may grant omnibus approval Following transactions shall be exempt from the

for such transactions subject to their value not aforesaid approvals of the audit committee and the

exceeding INR 1 crore per transaction shareholders, respectively:

d. audit committee shall review, at least on a a. transactions entered into between two

quarterly basis, the details of related party government companies, or

transactions entered into by the company b. transactions entered into between a holding

pursuant to each of the omnibus approval given company and its wholly-owned subsidiary

e. such omnibus approvals shall be valid for a whose accounts are consolidated with such

period not exceeding one year and shall require holding company and placed before the

fresh approvals after the expiry of one year. shareholders at the general meeting for approval

Further, all material related party transactions shall The details of all material transactions with related

require approval of the shareholders through a parties shall be disclosed quarterly along with the

special resolution and all related parties shall abstain compliance report on corporate governance. The

from voting on such resolutions. company shall also disclose the policy on dealing

with related party transactions on its website and

also provide that web link in the annual report.

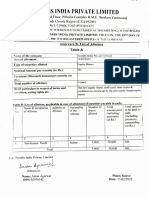

Particulars Revised Clause 49 2013 Act

Limit on number of Revised Clause 49 is more restrictive on the limit The 2013 Act provides overall limits on number of

directorships for on number of directorships for independent directorships by an individual i.e. maximum 20

independent directors directors i.e. maximum seven listed companies. companies (including 10 public companies).

Also, the revised Clause 49 shall have to be Further, the 2013 Act provides transition period of

complied with effect from 1 October 2014. one year to comply with the requirements.

Definition of related party Definition of related party in revised Clause 49 is -

broader than that under the 2013 Act and also

includes definition under the applicable

accounting standards.

Approval of related party The revised Clause 49 mandates that all related The 2013 Act also requires that all related party

transactions party transactions shall require prior approval of transactions shall require prior approval of audit

the audit committee. The audit committee may committee. Additionally, all related party

also grant an omnibus approval subject to the transactions, which are not in the ordinary course

certain conditions. All material related party of business or not at arm’s length basis, should

transactions shall require approval of the also be approved by the Board and shareholders.

shareholders through special resolution and all However, shareholders’ approval is required for

related parties shall abstain from voting on such only certain transactions with the criteria for such

resolutions. The revised Clause 49 provides approval defined differently.

exemption from approval requirements for

transactions entered into between two

government companies, and transactions entered

into between a holding company and its wholly-

owned subsidiary whose accounts are

consolidated with such holding company and

placed before the shareholders at the general

meeting for approval.

© Grant Thornton India LLP. All rights reserved.

Particulars Revised Clause 49 2013 Act

Risk Management The revised Clause 49 has inserted a new The 2013 Act does not contain similar

Committee requirement (for only top 100 listed companies by requirements.

market capitalisation as at the end of the

immediate previous financial year) that a

company shall also constitute a Risk

Management Committee.

Sale of a material The revised Clause 49 mandates a special The 2013 Act mandates a special resolution to

subsidiary resolution to dispose of shares in its material sell, lease or otherwise dispose of the whole or

subsidiary which would reduce the shareholding substantially the whole of the undertaking of the

to less than 50% or result in loss of control over company. The term ‘undertaking’ means an

the subsidiary. Further, selling, disposing of and undertaking in which the investment of the

leasing of assets amounting to more than 20% of company exceeds 20% of its net worth as per

the assets of the material subsidiary shall also previous audited balance sheet or an undertaking

require prior approval of shareholders by way of which generates 20% of the total income of the

special resolution. The meaning of the ‘material company during the previous financial year.

subsidiary’ is similar to the term ‘undertaking’ as

defined under the 2013 Act. Cases where a

scheme or arrangement has been duly approved

by a court/ tribunal are exempt from aforesaid

requirements.

About Grant Thornton in India

Grant Thornton in India is one of the largest With shorter decision-making chains, more senior

assurance, tax, and advisory firms in India. With personnel involvement, and empowered client service

over 2,000 professional staff across 13 offices, the teams, the firm is able to operate in a coordinated way

firm provides robust compliance services and and respond with agility.

growth navigation solutions on complex business Over the years, Grant Thornton in India has added

and financial matters through focused practice lateral talent across service lines and has developed a

groups. The firm has extensive experience across a host of specialist services such as Corporate Finance,

range of industries, market segments, and Governance, Risk & Operations, and Forensic &

geographical corridors. It is on a fast-track to Investigation. The firm's strong Subject Matter

becoming the best growth advisor to dynamic Expertise (SME) focus not only enhances the reach

Indian businesses with global ambitions. but also helps deliver bespoke solutions tailored to

the needs of its clients.

© Grant Thornton India LLP. All rights reserved.

Contact us

NEW DELHI AHMEDABAD BENGALURU CHANDIGARH

National Office BSQUARE Managed “Wings”, 1st floor SCO 17

Outer Circle Offices, 7th Floor, Shree 16/1 Cambridge Road 2nd floor

L 41 Connaught Circus Krishna Center, Above Ulsoor Sector 17 E

New Delhi 110 001 Crossword, Bengaluru 560 008 Chandigarh 160 017

T +91 11 4278 7070 Nr. Mithakali Six Roads, T +91 80 4243 0700 T +91 172 4338 000

Navrangpura,

Ahmedabad 380009

T - +91 9825 073080

CHENNAI GURGAON HYDERABAD KOCHI

Arihant Nitco Park, 6th 21st floor, DLF Square 7th floor, Block III 7th Floor, Modayil Centre

floor Jacaranda Marg White House point,

No.90, Dr. Radhakrishnan DLF Phase II Kundan Bagh, Begumpet Warriam road junction,

Salai Gurgaon 122 002 Hyderabad 500 016 M.G.Road,

Mylapore T +91 124 462 8000 T +91 40 6630 8200 Kochi 682016

Chennai 600 004 T +91 9901755773

T +91 44 4294 0000

KOLKATA MUMBAI MUMBAI NOIDA

10C Hungerford Street 16th floor, Tower II 9th Floor, Classic Plot No. 19A, 7th Floor

5th floor Indiabulls Finance Centre Pentagon, Sector – 16A,

Kolkata 700 017 SB Marg, Elphinstone Nr Bisleri, Western Express Noida – 201301

T +91 33 4050 8000 (W) Highway, Andheri (E) T +91 120 7109001

Mumbai 400 013 Mumbai 400 099

T +91 22 6626 2600 T +91 22 6626 2600

PUNE

401 Century Arcade

Narangi Baug Road

Off Boat Club Road

Pune 411 001

T +91 20 4105 7000

Grant Thornton India LLP (formerly Grant Thornton India) is registered with limited liability with identity

number AAA-7677 and its registered office at

L-41 Connaught Circus, New Delhi, 110001

Grant Thornton India LLP is a member firm within Grant Thornton International Ltd (‘Grant Thornton

International’).

Grant Thornton International and the member firms are not a worldwide partnership.

Services are delivered by the member firms independently.

For more information or for any queries, write to us at contact@in.gt.com

www.grantthornton.in

© Grant Thornton India LLP. All rights reserved.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2018 NFHS Soccer Exam Part 1Document17 pages2018 NFHS Soccer Exam Part 1MOEDNo ratings yet

- Supreme Court of India Page 1 of 9Document9 pagesSupreme Court of India Page 1 of 9Anchit JassalNo ratings yet

- Bail Sitharam MaharashtraDocument79 pagesBail Sitharam MaharashtraAnchit JassalNo ratings yet

- Global Business Skills Workshop S22Document5 pagesGlobal Business Skills Workshop S22Anchit JassalNo ratings yet

- CG in India, UK & USADocument50 pagesCG in India, UK & USAAnchit JassalNo ratings yet

- A. Steps For Initiation of Criminal Machinery: 1. Cases in Which PCR Call Was MadeDocument4 pagesA. Steps For Initiation of Criminal Machinery: 1. Cases in Which PCR Call Was MadeAnchit Jassal100% (1)

- Board CommitteesDocument33 pagesBoard CommitteesAnchit JassalNo ratings yet

- Corporate Governance & Finance: Theories of CGDocument36 pagesCorporate Governance & Finance: Theories of CGAnchit JassalNo ratings yet

- Quality CircleDocument8 pagesQuality CircleAnchit JassalNo ratings yet

- Human Resources and Total Quality Management: Academic Year 2017-18 Semester IV Teaching PlanDocument18 pagesHuman Resources and Total Quality Management: Academic Year 2017-18 Semester IV Teaching PlanAnchit JassalNo ratings yet

- Capital Budgeting - SolutionDocument5 pagesCapital Budgeting - SolutionAnchit JassalNo ratings yet

- Job Analysis: Introduction, Importance, Methods EtcDocument18 pagesJob Analysis: Introduction, Importance, Methods EtcAnchit JassalNo ratings yet

- E-Supply Chain 12th FebDocument17 pagesE-Supply Chain 12th FebAnchit JassalNo ratings yet

- Frequently Asked Questions (Faqs) : Directorate of Student ServicesDocument26 pagesFrequently Asked Questions (Faqs) : Directorate of Student ServicesAnchit JassalNo ratings yet

- Scanned by CamscannerDocument3 pagesScanned by CamscannerAnchit JassalNo ratings yet

- 27th Jan E-Business - Arch - Design - Issues 2251Document6 pages27th Jan E-Business - Arch - Design - Issues 2251Anchit JassalNo ratings yet

- Paper On SurrogacyDocument14 pagesPaper On SurrogacyAnchit JassalNo ratings yet

- Environmental History and British ColonialismDocument19 pagesEnvironmental History and British ColonialismAnchit JassalNo ratings yet

- Clarification About The Formatting of The Project: Word LimitDocument3 pagesClarification About The Formatting of The Project: Word LimitAnchit JassalNo ratings yet

- Chapter-V: Lease Section 105-117Document24 pagesChapter-V: Lease Section 105-117Anchit Jassal100% (1)

- Indian Financial MarketsDocument1 pageIndian Financial MarketsAnchit JassalNo ratings yet

- Certification: Barangay Development Council Functionality Assessment FYDocument2 pagesCertification: Barangay Development Council Functionality Assessment FYbrgy.sabang lipa city100% (4)

- Clado-Reyes V LimpeDocument2 pagesClado-Reyes V LimpeJL A H-DimaculanganNo ratings yet

- (Azizi Ali) Lesson Learnt From Tun Daim E-BookDocument26 pages(Azizi Ali) Lesson Learnt From Tun Daim E-BookgabanheroNo ratings yet

- Complaint On Tamil GenocideDocument67 pagesComplaint On Tamil GenocideNandhi VarmanNo ratings yet

- ISLAMIC MISREPRESENTATION - Draft CheckedDocument19 pagesISLAMIC MISREPRESENTATION - Draft CheckedNajmi NasirNo ratings yet

- Tectabs Private: IndiaDocument1 pageTectabs Private: IndiaTanya sheetalNo ratings yet

- Shrimp Specialists V Fuji-TriumphDocument2 pagesShrimp Specialists V Fuji-TriumphDeaNo ratings yet

- Types and Concept of IncomeDocument5 pagesTypes and Concept of IncomeMariecris MartinezNo ratings yet

- Advantage: A Health Cover For at The Cost of Your Monthly Internet BillDocument4 pagesAdvantage: A Health Cover For at The Cost of Your Monthly Internet BillAmitabh WaghmareNo ratings yet

- Internship Report For Accounting Major - English VerDocument45 pagesInternship Report For Accounting Major - English VerDieu AnhNo ratings yet

- CG Covid Risk Assessment - Hirers - Nov 2021Document8 pagesCG Covid Risk Assessment - Hirers - Nov 2021hibaNo ratings yet

- Posting and Preparation of Trial Balance 1Document33 pagesPosting and Preparation of Trial Balance 1iTs jEnInONo ratings yet

- ANNEX A-Final For Ustad InputDocument15 pagesANNEX A-Final For Ustad Inputwafiullah sayedNo ratings yet

- United States v. Guiseppe Gambino, Francesco Gambino, Lorenzo Mannino, Matto Romano, Salvatore Lobuglio, Salvatore Rina, Guiseppe D'amico, Salvatore D'amico, Francesco Cipriano, Pietro Candela, Salvatore Candela, Francesco Inzerillo, Joseph Larosa, Paolo D'amico, Rocco Launi, Fabrizio Tesi, Vittorio Barletta, Carmelo Guarnera, Sasha (Lnu), Giovanni Zarbano, Rosario Naimo, Emanuele Adamita and Giovanni Gambino, Salvatore Lobuglio and Salvatore D'Amico, 951 F.2d 498, 2d Cir. (1991)Document9 pagesUnited States v. Guiseppe Gambino, Francesco Gambino, Lorenzo Mannino, Matto Romano, Salvatore Lobuglio, Salvatore Rina, Guiseppe D'amico, Salvatore D'amico, Francesco Cipriano, Pietro Candela, Salvatore Candela, Francesco Inzerillo, Joseph Larosa, Paolo D'amico, Rocco Launi, Fabrizio Tesi, Vittorio Barletta, Carmelo Guarnera, Sasha (Lnu), Giovanni Zarbano, Rosario Naimo, Emanuele Adamita and Giovanni Gambino, Salvatore Lobuglio and Salvatore D'Amico, 951 F.2d 498, 2d Cir. (1991)Scribd Government DocsNo ratings yet

- Adelfa V CADocument3 pagesAdelfa V CAEd Karell GamboaNo ratings yet

- Republica Italiana Annual ReportDocument413 pagesRepublica Italiana Annual ReportVincenzo BrunoNo ratings yet

- Sydeco Vs PeopleDocument2 pagesSydeco Vs PeopleJenu OrosNo ratings yet

- The Oecd Principles of Corporate GovernanceDocument8 pagesThe Oecd Principles of Corporate GovernanceNazifaNo ratings yet

- Form - 28Document2 pagesForm - 28Manoj GuruNo ratings yet

- Improving Indonesia's Competitiveness: Case Study of Textile and Farmed Shrimp IndustriesDocument81 pagesImproving Indonesia's Competitiveness: Case Study of Textile and Farmed Shrimp IndustriesadjipramNo ratings yet

- Aguirre Vs Judge BelmonteDocument2 pagesAguirre Vs Judge BelmonteGulf StreamNo ratings yet

- The Following Payments and Receipts Are Related To Land Land 115625Document1 pageThe Following Payments and Receipts Are Related To Land Land 115625M Bilal SaleemNo ratings yet

- Ioana Ramona JurcaDocument1 pageIoana Ramona JurcaDaia SorinNo ratings yet

- Tax Invoice UP1222304 AA46663Document1 pageTax Invoice UP1222304 AA46663Siddhartha SrivastavaNo ratings yet

- PhillhpeDocument14 pagesPhillhpeMonica MartinezNo ratings yet

- K12-14 (FGD) Baase - Henry - GoF5e - Ch9 Professional Ethics and ResponsibilityDocument32 pagesK12-14 (FGD) Baase - Henry - GoF5e - Ch9 Professional Ethics and ResponsibilityirgiNo ratings yet

- Separation of PowersDocument23 pagesSeparation of PowersLubna Iftikhar 4506-FSL/LLB/F15No ratings yet

- Individual Performance Commitment and Review Form (Ipcrf) : To Be Filled in During PlanningDocument6 pagesIndividual Performance Commitment and Review Form (Ipcrf) : To Be Filled in During PlanningChris21JinkyNo ratings yet

- Arnold Emergency Motion 22cv41008 Joseph Et AlDocument13 pagesArnold Emergency Motion 22cv41008 Joseph Et AlKaitlin AthertonNo ratings yet