Professional Documents

Culture Documents

Costel Mitrofan, SA Tax Return 1

Uploaded by

Flutur Gavril0 ratings0% found this document useful (0 votes)

122 views2 pagesHave a good day and I hope you have a great evening

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHave a good day and I hope you have a great evening

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

122 views2 pagesCostel Mitrofan, SA Tax Return 1

Uploaded by

Flutur GavrilHave a good day and I hope you have a great evening

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

GOV.

UK

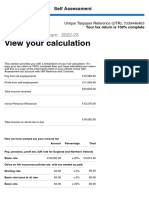

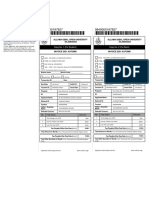

MITROFAN COSTEL's tax return 2017-18 Sign out

Unique Taxpayer Reference (UTR): 2384138207

Your tax return is 100% complete

View your calculation

This section provides you with a breakdown of your full calculation. If it says your tax return is 100% complete

then you have submitted your return and this is a copy of the information held on your official online Self

Assessment tax account with HM Revenue and Customs.

Profit from self-employment £21,526.00

Total income received £21,526.00

minus Personal Allowance £11,500.00

Total income on which tax is due £10,026.00

How we have worked out your income tax

Amount Percentage Total

Pay, pensions, profit etc. (UK rate for England, Wales and Northern Ireland)

Basic rate £10,026.00 x 20% £2,005.20

Starting rate £0.00 x 0% £0.00

Nil rate £0.00 x 0% £0.00

Basic rate £0.00 x 20% £0.00

Total income on which tax has been charged £10,026.00

Income Tax due £2,005.20

plus Class 4 National Insurance contributions £13,362.00 x 9% £1,202.58

plus Class 2 National Insurance contributions £148.20

Total Class 2 and Class 4 National Insurance contributions due £1,350.78

Income Tax, Class 2 and Class 4 National Insurance £3,355.98

contributions due

minus Tax deducted

CIS and trading income £7,027.00

Total tax deducted £7,027.00

Income Tax overpaid £3,671.02

Estimated overpayment at 31 January 2019

(Note: 2nd payment of £0.00 due 31 July 2019)

This calculation does not take into account any 2017-18 payments on account you may have already made or

tax due for earlier years

2017-18 balancing credit £3,671.02

Total overpaid at 31 January 2019 £3,671.02

Print your full calculation

You might also like

- Sa302 2021Document1 pageSa302 2021Umt KayaNo ratings yet

- A Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsDocument7 pagesA Guide To Our HMRC Tax Calculation & Tax Year Overview RequirementsbswaminaNo ratings yet

- Fit NoteDocument1 pageFit NoteSammy RobertsNo ratings yet

- Fit NoteDocument1 pageFit NoteSammy RobertsNo ratings yet

- Jose AbreuDocument39 pagesJose Abreueddy britoNo ratings yet

- ICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationDocument6 pagesICON College of Technology and Management Course: Btec HND in Business, Unit 12: TaxationmuhammadislamkhanNo ratings yet

- Notice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118Document2 pagesNotice of Assessment - Year Ended 30 June 2023: Miss Sheralie L Shadforth 8 Clabon ST Hillcrest QLD 4118shadforth1977No ratings yet

- 2022 T1 Form - CompletedDocument8 pages2022 T1 Form - CompletedARSH GROVERNo ratings yet

- 6.110907 29424343Document10 pages6.110907 29424343Christy JosephNo ratings yet

- Annexure 1B PDFDocument1 pageAnnexure 1B PDFFolaNo ratings yet

- Urusniaga Akaun/ /account TransactionsDocument2 pagesUrusniaga Akaun/ /account TransactionsLIM PEI YUN MoeNo ratings yet

- Statement of Benefits 30 04 2020Document10 pagesStatement of Benefits 30 04 2020Chris MillsNo ratings yet

- Proof of Balance Report: Jasmine Petrovski 5/71 Pine Street Reservoir Vic 3073 Australia Account BalancesDocument1 pageProof of Balance Report: Jasmine Petrovski 5/71 Pine Street Reservoir Vic 3073 Australia Account BalancesgeorgiaNo ratings yet

- 2023 08 31 - Statement 1Document2 pages2023 08 31 - Statement 1ranielysilvaukNo ratings yet

- FitNote - 3Document1 pageFitNote - 3Arindella AllenNo ratings yet

- Preview 26Document15 pagesPreview 26kakabadzebaiaNo ratings yet

- Statement 2020 03 10Document3 pagesStatement 2020 03 10BrendaNo ratings yet

- PayslipDocument1 pagePayslipmoriyambugam1No ratings yet

- Monzo Bank Statement 2024 01 01 2024 03 31 40 1Document10 pagesMonzo Bank Statement 2024 01 01 2024 03 31 40 1tsundereadamsNo ratings yet

- SCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - RedactedDocument1 pageSCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - Redactedlarry-612445No ratings yet

- Notice of Assessment 2019 04 29 02 32 21 264865Document4 pagesNotice of Assessment 2019 04 29 02 32 21 264865Dennis EnnsNo ratings yet

- Ita34 1058123249Document3 pagesIta34 1058123249Bahlakoana NtsasaNo ratings yet

- Your Statement: Platinum Rewards VISA® Page 1 of 2Document3 pagesYour Statement: Platinum Rewards VISA® Page 1 of 2Leonardo GonzalezNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- Pay SlipDocument1 pagePay Slipraj Kumar Thapa chhetriNo ratings yet

- Statement: Your Current Details Period 30 Dec 2022 To 27 Jan 2023Document4 pagesStatement: Your Current Details Period 30 Dec 2022 To 27 Jan 2023tevisthomas205No ratings yet

- Noa-Iit Ob2620150425142233zb4 PDFDocument1 pageNoa-Iit Ob2620150425142233zb4 PDFKanza KhanNo ratings yet

- Bill Enquiries Branch Number Customer Number: Statement Month: OCTOBER 2021 Balance As At: 30/9/2021 $435.21Document2 pagesBill Enquiries Branch Number Customer Number: Statement Month: OCTOBER 2021 Balance As At: 30/9/2021 $435.21David JamiesonNo ratings yet

- EstatementDocument7 pagesEstatementdennisNo ratings yet

- Account Statement - : February 2014Document2 pagesAccount Statement - : February 2014Fernando BatesNo ratings yet

- Agent Appointment FormDocument2 pagesAgent Appointment FormSatyen ChikhliaNo ratings yet

- Get NoticeDocument3 pagesGet NoticeLetsoai MalesaNo ratings yet

- Maury UtilityDocument4 pagesMaury Utilityyusufosoba51No ratings yet

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- PreviewDocument3 pagesPreviewvi6205552No ratings yet

- Account Statement - 2024 03 30Document1 pageAccount Statement - 2024 03 30tsundereadamsNo ratings yet

- Ambulance: VictoriaDocument2 pagesAmbulance: VictoriaJames WearneNo ratings yet

- Get NoticeDocument3 pagesGet NoticeJo anne Jo anneNo ratings yet

- SCC Comunicados Ed 02ef11fc44216a3910a0c93714358Document4 pagesSCC Comunicados Ed 02ef11fc44216a3910a0c93714358srikanth829No ratings yet

- ClearDocument3 pagesClearOleg DaffNo ratings yet

- Adonis Brooks 3379 Fernview DR Lawrenceville Ga, 30044: Checking SummaryDocument1 pageAdonis Brooks 3379 Fernview DR Lawrenceville Ga, 30044: Checking Summaryjkelle24No ratings yet

- Your Account Summary BalanceDocument1 pageYour Account Summary BalanceВиктория ГринькоNo ratings yet

- Gold Business Account 82Document1 pageGold Business Account 82nicole.philippsNo ratings yet

- Statement PDFDocument1 pageStatement PDFTakunda MuchuchuNo ratings yet

- Next Steps: You Need To Write Your Customer Reference Number On Every Document You Send UsDocument8 pagesNext Steps: You Need To Write Your Customer Reference Number On Every Document You Send UsPaul FlorinNo ratings yet

- Preview 29Document16 pagesPreview 29kakabadzebaiaNo ratings yet

- MYOB Payslip TemplateDocument1 pageMYOB Payslip Templatejack smith100% (1)

- IndividualCustomerStatement 2019-12-26Document4 pagesIndividualCustomerStatement 2019-12-26TFAL TEAMNo ratings yet

- Noa-Iit Ob212020062419132485y PDFDocument1 pageNoa-Iit Ob212020062419132485y PDFilamahizhNo ratings yet

- Tax Credit Certificate 2023 9552312947779Document2 pagesTax Credit Certificate 2023 9552312947779Toni rogers CardosoNo ratings yet

- Payslip EPay 20231026Document1 pagePayslip EPay 20231026jacksparrow2023mayNo ratings yet

- Dent Eimear LindaDocument4 pagesDent Eimear LindaITNo ratings yet

- Attachment PDFDocument1 pageAttachment PDFmuhammad arhum aishNo ratings yet

- E0800J3WXBDocument2 pagesE0800J3WXBAhmed Al AdawiNo ratings yet

- Xapo Bank Statement - 2022-01-01-To-2022-12-31Document1 pageXapo Bank Statement - 2022-01-01-To-2022-12-31Raja Hermansyah0% (1)

- Fit NoteDocument1 pageFit Noteamandawood1967No ratings yet

- StatusOutcome 04 February 2020Document6 pagesStatusOutcome 04 February 2020Takacs Marcel100% (1)

- Sa302 2021-22Document2 pagesSa302 2021-22Viktoria VasevaNo ratings yet

- Tax Return Rauol Moraru 22 23Document2 pagesTax Return Rauol Moraru 22 23severinco2017No ratings yet

- 3G Basic PDFDocument29 pages3G Basic PDFJOHNNY5377No ratings yet

- C5I3HS Soldan PDFDocument1 pageC5I3HS Soldan PDFFlutur GavrilNo ratings yet

- RS9868943218Document3 pagesRS9868943218Flutur GavrilNo ratings yet

- CIS Subcontractors Payment StatementDocument3 pagesCIS Subcontractors Payment StatementmalefiCNo ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- BoardingCard 180120468 LTN SCVDocument1 pageBoardingCard 180120468 LTN SCVFlutur GavrilNo ratings yet

- RS9868943218Document3 pagesRS9868943218Flutur GavrilNo ratings yet

- PIB F R Prepaid Produkte DATA 1GB 20072017Document1 pagePIB F R Prepaid Produkte DATA 1GB 20072017Flutur GavrilNo ratings yet

- Inventory Castle SkyDocument2 pagesInventory Castle SkyFlutur GavrilNo ratings yet

- Standard Ticket Gavril Flutur 1Document1 pageStandard Ticket Gavril Flutur 1Flutur GavrilNo ratings yet

- BN46 00682A EngDocument50 pagesBN46 00682A EngFlutur GavrilNo ratings yet

- BoardingCard InfosDocument1 pageBoardingCard InfosFlutur GavrilNo ratings yet

- Milan Bergamo: MR Simion Soldan (ADT)Document1 pageMilan Bergamo: MR Simion Soldan (ADT)Flutur GavrilNo ratings yet

- Ingenico iWL250 QRG PDFDocument10 pagesIngenico iWL250 QRG PDFZen Eulalio TalubanNo ratings yet

- Sap Bank ReconcilationDocument39 pagesSap Bank ReconcilationRajathPreethamH100% (1)

- Lembar Kerja Spreadsheet 3Document7 pagesLembar Kerja Spreadsheet 3NanaNo ratings yet

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDocument1 pageImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadMuhammad Sohail0% (1)

- RTGSDocument14 pagesRTGSAbirami ThevarNo ratings yet

- Invoice: Invoice From Invoice To Customer InformationDocument1 pageInvoice: Invoice From Invoice To Customer Informationsarala deviNo ratings yet

- Form 16: Wipro LimitedDocument6 pagesForm 16: Wipro LimitedSanjay RamuNo ratings yet

- Private Individual and Registered Farms Product and Service Price ListDocument17 pagesPrivate Individual and Registered Farms Product and Service Price ListZoran LjepojaNo ratings yet

- 2.0 Technology Used in BankingDocument70 pages2.0 Technology Used in BankingSarang DewdeNo ratings yet

- Mail Clerk Test V2 NewDocument4 pagesMail Clerk Test V2 NewDustin Neil SlomainyNo ratings yet

- IRCTC E-Ticketing ServiceDocument3 pagesIRCTC E-Ticketing ServiceSubhash NaikNo ratings yet

- Daily Grind Day 1 With Suggested AnswerDocument2 pagesDaily Grind Day 1 With Suggested AnswerBulandos ChroniclesNo ratings yet

- Vanapalli Sumalatha Account StatementDocument2 pagesVanapalli Sumalatha Account StatementSumalatha VanapalliNo ratings yet

- OpTransactionHistory09 06 2022Document4 pagesOpTransactionHistory09 06 2022vasant ugaleNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)AK TRIPATHINo ratings yet

- Credit Card StatementDocument1 pageCredit Card Statementcharlene carter100% (2)

- Rf100 VehicleDocument2 pagesRf100 VehicleMaria KellyNo ratings yet

- 6 nhiều đcDocument11 pages6 nhiều đchanhNo ratings yet

- Bank Statment Wells FargoDocument7 pagesBank Statment Wells FargoYu ShilohNo ratings yet

- Money and Banking Class 12 ProjectDocument2 pagesMoney and Banking Class 12 ProjectRocking Rahul55% (11)

- Problem 1 - Dallas CorporationDocument6 pagesProblem 1 - Dallas CorporationKatherine Cabading InocandoNo ratings yet

- PWC Tax GuideDocument30 pagesPWC Tax Guideshikhagupta3288No ratings yet

- GSC SelfPrint TicketDocument2 pagesGSC SelfPrint TicketNik Mohd BazliNo ratings yet

- No. (A) Customer Activty (B) Denr Action (C) Office/Person Responsible/ Location (D) Duration (E) Documentary Requirements (F) Amount of Fees (G)Document3 pagesNo. (A) Customer Activty (B) Denr Action (C) Office/Person Responsible/ Location (D) Duration (E) Documentary Requirements (F) Amount of Fees (G)Kevin Haji Ferraren AguinaldoNo ratings yet

- Planning Designing and Analysis of Bus Stand With Special FeaturesDocument21 pagesPlanning Designing and Analysis of Bus Stand With Special FeaturesThamilarasanNo ratings yet

- Universitas Negeri Malang: Attn.: I Kadek Suartama Malang IndonesiaDocument1 pageUniversitas Negeri Malang: Attn.: I Kadek Suartama Malang IndonesiaI Kadek SuartamaNo ratings yet

- Barclay BillDocument3 pagesBarclay Billafish110No ratings yet

- Telephone No Amount Payable Due Date: Bill Mail Service Tax InvoiceDocument3 pagesTelephone No Amount Payable Due Date: Bill Mail Service Tax InvoiceMannknowz JaredaNo ratings yet

- Tax Invoice KA1181906 AL33621Document1 pageTax Invoice KA1181906 AL33621Nitesh Kumar DasNo ratings yet