Professional Documents

Culture Documents

Relevant Cost of Material HOT SPOT

Uploaded by

Usmän Mïrżä0 ratings0% found this document useful (0 votes)

10 views1 pagerelevant cost

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrelevant cost

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageRelevant Cost of Material HOT SPOT

Uploaded by

Usmän Mïrżärelevant cost

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

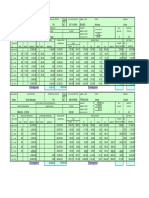

Relevant Cost of Material

Material In Stock No RC= Current purchase price

Material In stock Yes Regular Use Yes RC= Current purchase cost

Material In stock Yes No regular Use Alternative/Substitute use Yes RC = Higher of VIU or (Current

Price of another product less modification cost) or Scrap Value

Material In stock Yes No regular Use Alternative/Substitute Use No RC = Scrap/Disposal Value

Relevant Cost of Labour

Spare Capacity RC = Nil

Full Capacity Can hire externally Yes Take extra staff or pay overtime RC = Extra cost of labour

Full Capacity Can hire externally No RC = Opportunity Cost of diverting labour (Lost contribution + Extra Labour

Cost)

Typical Relevant Cash Flows

1. Purchase price of new machine

2. Sale proceed of old machine (opportunity benefit forgone)

3. Scrap/disposal proceeds on new asset bought

4. Take machinery from another department RC = lost Contribution from other dept

5. Hire machinery from outside RC = Extra cost of hire machine

Items that are not relevant

1. Depreciation is a sunk cost

2. Original Purchase cost is not relevant cost

3. NBV of existing machinery is not relevant cost

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Economic Substance NotificationDocument4 pagesEconomic Substance NotificationUsmän MïrżäNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Rahmat Daily Tasks of Erie-54Document10 pagesRahmat Daily Tasks of Erie-54Usmän MïrżäNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Flixier SubtitlesDocument1 pageFlixier SubtitlesUsmän MïrżäNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- AMEXDocument2 pagesAMEXUsmän MïrżäNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Minimalist Business LetterheadDocument1 pageMinimalist Business LetterheadUsmän MïrżäNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Travel CertificateDocument4 pagesTravel CertificateUsmän MïrżäNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Daily Journal 080723Document2 pagesDaily Journal 080723Usmän MïrżäNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Assignment 1Document2 pagesAssignment 1Usmän MïrżäNo ratings yet

- Sleepworld International, LLC: Customer DetailDocument1 pageSleepworld International, LLC: Customer DetailUsmän MïrżäNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Daily Bank and Cash - 080723Document1 pageDaily Bank and Cash - 080723Usmän MïrżäNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Decision TreeDocument1 pageDecision TreeUsmän MïrżäNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Job Description of Position of Project Manager For Digital Marketing ProjectDocument3 pagesJob Description of Position of Project Manager For Digital Marketing ProjectUsmän MïrżäNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Banking Regulations and LawDocument5 pagesBanking Regulations and LawUsmän MïrżäNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Abdul Wahab InvestmentDocument7 pagesAbdul Wahab InvestmentUsmän MïrżäNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- A Minimization of The Cost of Transportation: M. L. Aliyu, U. Usman, Z. Babayaro, M. K. AminuDocument7 pagesA Minimization of The Cost of Transportation: M. L. Aliyu, U. Usman, Z. Babayaro, M. K. AminuUsmän MïrżäNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- November Purchase ReportDocument63 pagesNovember Purchase ReportUsmän MïrżäNo ratings yet

- STReturn With Annexures 74131613Document22 pagesSTReturn With Annexures 74131613Usmän MïrżäNo ratings yet

- ACTB212F Introduction To Accounting 2. (1) DocxDocument18 pagesACTB212F Introduction To Accounting 2. (1) DocxUsmän MïrżäNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- English Name & Dose Quantity Form PriceDocument2 pagesEnglish Name & Dose Quantity Form PriceUsmän MïrżäNo ratings yet

- Sregister PartyDocument1 pageSregister PartyUsmän MïrżäNo ratings yet

- PM - Assignment 3 Indv Spring 2019-20Document5 pagesPM - Assignment 3 Indv Spring 2019-20Usmän MïrżäNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- CHP 12Document59 pagesCHP 12Usmän Mïrżä100% (1)

- Appendix ADocument29 pagesAppendix AUsmän Mïrżä11% (9)

- News Letter: December, 2019 - March, 2020Document2 pagesNews Letter: December, 2019 - March, 2020Usmän MïrżäNo ratings yet

- Billet Summary August 2019Document1 pageBillet Summary August 2019Usmän MïrżäNo ratings yet

- Payroll Project PDFDocument39 pagesPayroll Project PDFUsmän Mïrżä100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- (A) Managing Director Pricing StrategyDocument2 pages(A) Managing Director Pricing StrategyUsmän MïrżäNo ratings yet

- Muhammad Usman SaleemDocument2 pagesMuhammad Usman SaleemUsmän MïrżäNo ratings yet

- Gatepass PDFDocument1 pageGatepass PDFUsmän MïrżäNo ratings yet

- Buff & Pack Report - Copy of Sheet1Document1 pageBuff & Pack Report - Copy of Sheet1Usmän MïrżäNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)