Professional Documents

Culture Documents

REVENUE REGULATIONS NO. 14-2000 Issued December 29, 2000 Amends Sections 3 (2), 3 and 6 of RR No

Uploaded by

Dessa Ruth ReyesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

REVENUE REGULATIONS NO. 14-2000 Issued December 29, 2000 Amends Sections 3 (2), 3 and 6 of RR No

Uploaded by

Dessa Ruth ReyesCopyright:

Available Formats

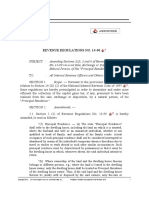

REVENUE REGULATIONS NO. 14-2000 issued December 29, 2000 amends Sections 3(2), 3 and 6 of RR No.

13-99 relative to the sale, exchange or disposition by a natural person of his "principal residence".

The residential address shown in the latest income tax return filed by the vendor/transferor immediately

preceding the date of sale of said real property shall be treated, for purposes of these Regulations, as a

conclusive presumption about his true residential address, the certification of the Barangay Chairman, or

Building Administrator (in case of condominium unit), to the contrary notwithstanding, in accordance with

the doctrine of admission against interest or the principle of estoppel.

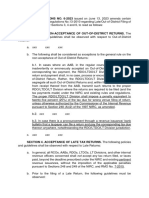

The seller/transferor's compliance with the preliminary conditions for exemption from the 6% capital

gains tax under Sec. 3(1) and (2) of the Regulations will be sufficient basis for the RDO to approve and

issue the Certificate Authorizing Registration (CAR) or Tax Clearance Certificate (TCC) of the principal

residence sold, exchanged or disposed by the aforesaid taxpayer. Said CAR or TCC shall state that the said

sale, exchange or disposition of the taxpayer's principal residence is exempt from capital gains tax

pursuant to Sec. 24 (D)(2) of the Tax Code, but subject to compliance with the post-reporting

requirements imposed under Sec. 3(3) of the Regulations.

You might also like

- AMENDED MORTGAGEDocument5 pagesAMENDED MORTGAGEManny SandichoNo ratings yet

- Tax Exemption Rulings RequirementsDocument7 pagesTax Exemption Rulings RequirementsArjam B. BonsucanNo ratings yet

- Revocable vs. Irrevocable Trust AgreementDocument3 pagesRevocable vs. Irrevocable Trust AgreementJfm A DazlacNo ratings yet

- RR 8-98Document3 pagesRR 8-98matinikkiNo ratings yet

- Capital Gains TaxDocument5 pagesCapital Gains TaxJAYAR MENDZNo ratings yet

- Motion to Postpone Court HearingDocument2 pagesMotion to Postpone Court HearingDominic M. CerbitoNo ratings yet

- Spouses Carlos Vs TolentinoDocument3 pagesSpouses Carlos Vs Tolentinojovifactor100% (2)

- City Gov't of San Pablo Laguna Vs ReyesDocument6 pagesCity Gov't of San Pablo Laguna Vs ReyesKristine NavaltaNo ratings yet

- BIR Ruling No 039-2002Document2 pagesBIR Ruling No 039-2002Ton Ton Cananea100% (1)

- Agpalo Notes 2003Document84 pagesAgpalo Notes 2003ducati99d395% (19)

- IT - RR 12-2011 LESSOR Reportorial Requirements PDFDocument5 pagesIT - RR 12-2011 LESSOR Reportorial Requirements PDFMark Lord Morales BumagatNo ratings yet

- BIR RR 14-00 and 13-99Document22 pagesBIR RR 14-00 and 13-99Sophia Martinez100% (1)

- Santos vs. BeltranDocument7 pagesSantos vs. BeltranAdrianne BenignoNo ratings yet

- Revenue Regulations No. 14-00Document7 pagesRevenue Regulations No. 14-00Peggy SalazarNo ratings yet

- RR 4-99Document3 pagesRR 4-99matinikkiNo ratings yet

- Tobias v. Abalos, 239 SCRA 106Document4 pagesTobias v. Abalos, 239 SCRA 106zatarra_12No ratings yet

- League of Cities Vs ComelecDocument4 pagesLeague of Cities Vs ComelecKim EsmeñaNo ratings yet

- Regional Trial Court: Republic of The PhilippinesDocument3 pagesRegional Trial Court: Republic of The PhilippinesDessa Ruth ReyesNo ratings yet

- Pre-Trial-Brief-ProsecutionDocument2 pagesPre-Trial-Brief-ProsecutionJuris Formaran100% (2)

- RR 14-2000Document10 pagesRR 14-2000LouNo ratings yet

- Capital Gains Tax Exemption for Principal Home SalesDocument10 pagesCapital Gains Tax Exemption for Principal Home SalesmatinikkiNo ratings yet

- BIR CGT RequirementsDocument3 pagesBIR CGT RequirementsGerald MesinaNo ratings yet

- Revenue Regulation 14-2000 amends RR 13-99 on principal residence capital gains taxDocument1 pageRevenue Regulation 14-2000 amends RR 13-99 on principal residence capital gains taxJoyce VillanuevaNo ratings yet

- Revenue Regulations No. 14-00Document6 pagesRevenue Regulations No. 14-00Ben DhekenzNo ratings yet

- RR 2000Document76 pagesRR 2000Maisie Rose VilladolidNo ratings yet

- Revenue Regulation 14-2000 Amends RR 13-99Document10 pagesRevenue Regulation 14-2000 Amends RR 13-99Nombs NomNo ratings yet

- 309 Repayment of Security Deposits To Tenants: 14 DCMR 309Document2 pages309 Repayment of Security Deposits To Tenants: 14 DCMR 309AauNo ratings yet

- Updated RR 2-98 Sec 2.57.1 (A) (6) Individual CGT On Real PropertyDocument2 pagesUpdated RR 2-98 Sec 2.57.1 (A) (6) Individual CGT On Real PropertyJaymar DetoitoNo ratings yet

- RR 17-03Document15 pagesRR 17-03firstdummyNo ratings yet

- Source: Revenue Regulations 2-2003Document3 pagesSource: Revenue Regulations 2-2003Jennylyn Biltz AlbanoNo ratings yet

- Digest RMC 40-2012Document1 pageDigest RMC 40-2012Jm CruzNo ratings yet

- NJ Eviction Law GuideDocument45 pagesNJ Eviction Law GuideJeffrey NewtonNo ratings yet

- RR 05-09 (Sale of RP)Document7 pagesRR 05-09 (Sale of RP)joefieNo ratings yet

- Village of Islandia Taxpayer Relief AgreementDocument11 pagesVillage of Islandia Taxpayer Relief AgreementNewsday EditorNo ratings yet

- BIR Ruling 27-2002 July 3, 2002Document5 pagesBIR Ruling 27-2002 July 3, 2002Raiya AngelaNo ratings yet

- 2 Year Redemption PeriodDocument3 pages2 Year Redemption PeriodremNo ratings yet

- BIR Rulings (2017 - 2018)Document2,631 pagesBIR Rulings (2017 - 2018)Jerwin DaveNo ratings yet

- Tax-RegulationsDocument12 pagesTax-RegulationsMichelle Jude TinioNo ratings yet

- Notification Under Registration Act, 1908 - Opposed To Public PolicyDocument5 pagesNotification Under Registration Act, 1908 - Opposed To Public PolicyanirudhmbNo ratings yet

- City of Government of Caloocan vs. DavidDocument10 pagesCity of Government of Caloocan vs. DavidCharmaine GraceNo ratings yet

- BIR EscrowDocument20 pagesBIR Escrowlorkan19No ratings yet

- BIR RR 12-2011 Reportorial Requirements For Commercial Leasing BusinessesDocument5 pagesBIR RR 12-2011 Reportorial Requirements For Commercial Leasing BusinessesPilosopo LiveNo ratings yet

- BIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawDocument3 pagesBIR RULING (DA - (I-036) 395-08) : Nitura Malabanan Lagunilla Mendoza & Gaddi Attorneys-at-LawCarlo AlfonsoNo ratings yet

- RR 04-08 (Sale of RP)Document7 pagesRR 04-08 (Sale of RP)joefieNo ratings yet

- Initial Due Diligence Report - Banawa PropertyDocument3 pagesInitial Due Diligence Report - Banawa PropertyJeffrey DiazNo ratings yet

- BIR Ruling No. 634-19Document5 pagesBIR Ruling No. 634-19SGNo ratings yet

- LGU Taxation Case Analyzes Franchise Tax Exemption of Electric CompanyDocument6 pagesLGU Taxation Case Analyzes Franchise Tax Exemption of Electric CompanyAnonymous CWcXthhZgxNo ratings yet

- RR 04-99 PDFDocument3 pagesRR 04-99 PDFPeter Joshua OrtegaNo ratings yet

- Amendment Ot RR2-98 Providing Additional Transactions Subject To Creditable Withholding Tax Re-Establishing Policy On Capital Gain Tax (RR 17-2003) PDFDocument12 pagesAmendment Ot RR2-98 Providing Additional Transactions Subject To Creditable Withholding Tax Re-Establishing Policy On Capital Gain Tax (RR 17-2003) PDFRomer LesondatoNo ratings yet

- RR 18-01Document7 pagesRR 18-01JvsticeNickNo ratings yet

- 088-City Government of San Pablo v. Reyes, March 25, 1999Document7 pages088-City Government of San Pablo v. Reyes, March 25, 1999Jopan SJNo ratings yet

- Morgan's Point Resort Bill 2014Document20 pagesMorgan's Point Resort Bill 2014patburchall6278No ratings yet

- Agreement For Sale - TripartyDocument15 pagesAgreement For Sale - TripartyKamaluddin SyedNo ratings yet

- PD 816Document2 pagesPD 816Leo Archival ImperialNo ratings yet

- RR 6-2023Document2 pagesRR 6-2023Akld D LerioNo ratings yet

- Extending Estate Tax AmnestyDocument2 pagesExtending Estate Tax AmnestyRandy1028No ratings yet

- HBT6336Document5 pagesHBT6336Mr. DooWeENo ratings yet

- Rr98 08 - DigestDocument1 pageRr98 08 - DigestCinNo ratings yet

- PLDT Vs Davao 2001Document4 pagesPLDT Vs Davao 2001Kenmar NoganNo ratings yet

- Guidelines for Determining Capital vs Ordinary Real Estate AssetsDocument6 pagesGuidelines for Determining Capital vs Ordinary Real Estate AssetsJames Estrada CastroNo ratings yet

- 59293rr11 12Document1 page59293rr11 12Elenita IglesiaNo ratings yet

- Republic of The Philippines Manila: CREBA, Inc. v. Romulo G.R. No. 160756Document18 pagesRepublic of The Philippines Manila: CREBA, Inc. v. Romulo G.R. No. 160756Jopan SJNo ratings yet

- BIR Ruling 091-99 PDFDocument6 pagesBIR Ruling 091-99 PDFleahtabsNo ratings yet

- Documentary Requirements: Estate TaxDocument19 pagesDocumentary Requirements: Estate TaxAubrey CaballeroNo ratings yet

- Paris V AveriaDocument11 pagesParis V AveriaMeeJeeNo ratings yet

- Bayan V Zamora PDFDocument17 pagesBayan V Zamora PDFNori LolaNo ratings yet

- Estrada vs. EscritorDocument59 pagesEstrada vs. EscritorDessa Ruth ReyesNo ratings yet

- Datu Kida Vs SenateDocument44 pagesDatu Kida Vs SenateDessa Ruth ReyesNo ratings yet

- Kilosbayan V MoratoDocument21 pagesKilosbayan V MoratoDessa Ruth ReyesNo ratings yet

- Co Vs HretDocument50 pagesCo Vs HretRowela DescallarNo ratings yet

- Artiaga v. VillanuevaDocument11 pagesArtiaga v. VillanuevaN.V.No ratings yet

- FELICITO BASBACIO vs. OFFICE OF THE SECRETARY, DEPARTMENT OF JUSTICE, FRANKLIN DRILONDocument5 pagesFELICITO BASBACIO vs. OFFICE OF THE SECRETARY, DEPARTMENT OF JUSTICE, FRANKLIN DRILONAnonymous 96BXHnSziNo ratings yet

- Bagong Bayani-Ofw v. ComelecDocument19 pagesBagong Bayani-Ofw v. ComelecDessa Ruth ReyesNo ratings yet

- Ladlad Vs ComelecDocument28 pagesLadlad Vs ComelecJojo LaroaNo ratings yet

- Defensor vs. ComelecDocument27 pagesDefensor vs. ComelecAngie DouglasNo ratings yet

- Liberal Interpretation of "Practice of LawDocument25 pagesLiberal Interpretation of "Practice of LawrjeroshieNo ratings yet

- PNB Vs CIRDocument4 pagesPNB Vs CIRMariaNo ratings yet

- Republic Vs SandovalDocument7 pagesRepublic Vs SandovalTracy MarchanNo ratings yet

- G.R. No. 76180 October 24, 1986Document3 pagesG.R. No. 76180 October 24, 1986Inter_vivosNo ratings yet

- FINALS Civil Law Review CasesDocument59 pagesFINALS Civil Law Review CasesDessa Ruth ReyesNo ratings yet

- 2nd Batch Tax Cases1Document113 pages2nd Batch Tax Cases1Dessa Ruth ReyesNo ratings yet

- General Audit Procedures and Documentation-BirDocument3 pagesGeneral Audit Procedures and Documentation-BirAnalyn BanzuelaNo ratings yet

- Title Seven Revised Penal Code. Crimes Committed by Public OfficersDocument10 pagesTitle Seven Revised Penal Code. Crimes Committed by Public OfficersDessa Ruth ReyesNo ratings yet

- LEGAL COMMUNICATION DigestsDocument2 pagesLEGAL COMMUNICATION DigestsDessa Ruth ReyesNo ratings yet

- Sunlife Vs CADocument4 pagesSunlife Vs CADessa Ruth ReyesNo ratings yet

- Notice of AppealDocument2 pagesNotice of AppealDessa Ruth ReyesNo ratings yet