Professional Documents

Culture Documents

Reserve Bank of India

Uploaded by

Arvind ThakurOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentReserve Bank of India

Uploaded by

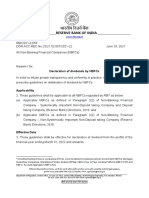

Arvind Thakurभारतीय �रजवर् ब�क

__________________RESERVE BANK OF INDIA _________________

www.rbi.org.in

RBI/2016-17/143

DBR.No.BP.BC.37/21.04.048/2016-17 November 21, 2016

All Entities Regulated by the Reserve Bank of India

Madam / Dear Sir,

Prudential Norms on Income Recognition, Asset Classification and

Provisioning pertaining to Advances

It has been represented to us that consequent upon withdrawal of the legal tender

status of the existing ` 500 and ` 1,000 notes (SBN) small borrowers may need

some more time to repay their loan dues. Taking these representations into

consideration, it has been decided to provide an additional 60 days beyond what is

applicable for the concerned regulated entity(RE) for recognition of a loan account

as substandard in the following cases:

(i) Running working capital accounts (OD/CC)/crop loans, with any bank,

the sanctioned limit whereof is ` 1 crore or less;

(ii) Term loans, whether business or personal, secured or otherwise, the

original sanctioned amount whereof is ` 1 crore or less, on the books of any

bank or any NBFC, including NBFC (MFI). This shall include housing loans

and agriculture loans.

Note: The limits at (i) and (ii) above are mutually exclusive limits

applicable to respective category of loans.

(iii) Loans sanctioned by banks to NBFC (MFI), NBFCs, Housing Finance

Companies, and PACs and by State Cooperative Banks to DCCBs.

(iv) The above guidelines will also be applicable to loans extended by

DCCBs.

2. The above dispensation will be subject to following conditions:

(i) It applies to dues payable between November 1, 2016 and December

31, 2016. REs shall note to ensure that this is a short-term deferment of

classification as substandard due to delay in payment of dues arising during

the period specified above and does not result in restructuring of the loans.

ब��कं ग �व�नयमन �वभाग, केन्द्र�यकायार्लय, 12वींमंिज़ल, शह�दभगत�संहमागर्, मुंबई – 400001

Department of Banking Regulation, Central Office, 12th Floor, Shahid Bhagat Singh Marg, Mumbai - 400001

Tel No: 22661602 Fax No: 22705691 Email ID: cgmicdbr@rbi.org.in

�हंद� आसान ह�, इसका प्रयोग बड़ाइए

2

(ii) Dues payable before November 1 and after December 31, 2016, will be

covered by the extant instruction for the respective regulated entity with

regard to recognition of NPAs.

(iii) The additional time given shall only apply to defer the classification of

an existing standard asset as substandard and not for delaying the migration

of an account across sub-categories of NPA.

3. All REs, including DCCBs, are advised to be guided by the above instructions.

Yours faithfully,

(S.S. Barik)

Chief General Manager-in-Charge

You might also like

- Blueprint To A BillionDocument20 pagesBlueprint To A Billionolumakin100% (1)

- Clarium Investment Commentary - The Wonderful Wizard of OzDocument15 pagesClarium Investment Commentary - The Wonderful Wizard of Ozmarketfolly.com100% (40)

- A.T. Biopower Rice Husk Power Project in PichitDocument9 pagesA.T. Biopower Rice Husk Power Project in PichitDidier SanonNo ratings yet

- Marketing Chapter NineDocument35 pagesMarketing Chapter Ninenupurk890% (1)

- Financing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesFrom EverandFinancing Small and Medium-Sized Enterprises in Asia and the Pacific: Credit Guarantee SchemesNo ratings yet

- Hindu Philosophy Life After DeathDocument144 pagesHindu Philosophy Life After Death4titude100% (1)

- Project Report PDFDocument13 pagesProject Report PDFAparnaNo ratings yet

- Bank Loan Classification and ProvisioningDocument19 pagesBank Loan Classification and ProvisioningsahhhhhhhNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Strategic Management of Amazon's DiversificationDocument13 pagesStrategic Management of Amazon's Diversificationrajesshpatel50% (2)

- Government of Himachal Pradesh notifies revised Financial RulesDocument70 pagesGovernment of Himachal Pradesh notifies revised Financial Ruleswiweksharma100% (1)

- May 2021Document10 pagesMay 2021Ravi Shankar VermaNo ratings yet

- IDirect Banking SectorReport Jun19Document20 pagesIDirect Banking SectorReport Jun19RajeshNo ratings yet

- Rbi Circular Banning SDRDocument20 pagesRbi Circular Banning SDRRakesh SahuNo ratings yet

- Income Recognition and Asset Classification (IRAC) : Paper: Management of Financial InstitutionDocument15 pagesIncome Recognition and Asset Classification (IRAC) : Paper: Management of Financial InstitutionBabul YumkhamNo ratings yet

- IASbabas 60 Day Plan 2017 Day 22 MinDocument14 pagesIASbabas 60 Day Plan 2017 Day 22 MinsabirNo ratings yet

- 001.scale Based Regulation (SBR) A Revised Regulatory Framework For NBFCs DT Oct 22, 2021Document14 pages001.scale Based Regulation (SBR) A Revised Regulatory Framework For NBFCs DT Oct 22, 2021free2rhyme30No ratings yet

- RBI issues framework for resolution of stressed assetsDocument26 pagesRBI issues framework for resolution of stressed assetssgjatharNo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument16 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- News Magazine Jan 2022Document10 pagesNews Magazine Jan 2022kanarendranNo ratings yet

- Banking & Economy PDF - December 2022 by AffairsCloud 1Document119 pagesBanking & Economy PDF - December 2022 by AffairsCloud 1Maahi ThakorNo ratings yet

- Indian Banks Cut NPAs to Lowest Since 2016Document44 pagesIndian Banks Cut NPAs to Lowest Since 2016ParthNo ratings yet

- Risk RBI Circular Jan'22-Jun'22Document24 pagesRisk RBI Circular Jan'22-Jun'22Iris CoNo ratings yet

- NPA Recognition 12 Nov RBI CircularDocument30 pagesNPA Recognition 12 Nov RBI CircularNarayani TripathiNo ratings yet

- RBI Circulars Update Investments, PD Business, FCNR RatesDocument3 pagesRBI Circulars Update Investments, PD Business, FCNR RatesMakarand LonkarNo ratings yet

- Recovery Policy - 2012Document23 pagesRecovery Policy - 2012Dhawan SandeepNo ratings yet

- U Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingDocument10 pagesU Uu Uupdate Pdate Pdate Pdate Pdate: B BB Bbanking Anking Anking Anking AnkingAnjuRoseNo ratings yet

- Sample Phase I Ga NotesDocument8 pagesSample Phase I Ga NotesSAI CHARAN VNo ratings yet

- CCP Rbi Jul-Dec'23Document21 pagesCCP Rbi Jul-Dec'23RaviTuduNo ratings yet

- OTS FORMULA Agri Loans Upto 25 Lacs Cir 481 2023 Mobile VersionDocument7 pagesOTS FORMULA Agri Loans Upto 25 Lacs Cir 481 2023 Mobile VersionDigbalaya SamantarayNo ratings yet

- CCP - RBI - July-Dec 22Document19 pagesCCP - RBI - July-Dec 22P N rajuNo ratings yet

- LIQUIDITY COVERAGE RATION CIRCULAR BB Jan012015dos01eDocument9 pagesLIQUIDITY COVERAGE RATION CIRCULAR BB Jan012015dos01eJoynul AbedinNo ratings yet

- Bill Market SchemesDocument2 pagesBill Market SchemesLeslie DsouzaNo ratings yet

- GK Tornado Rbi Assist Main Exams 2020 English 87 PDFDocument171 pagesGK Tornado Rbi Assist Main Exams 2020 English 87 PDFSindhu ChandranNo ratings yet

- RBI GK Tornado for RBI Assistant Main Exam 2020Document171 pagesRBI GK Tornado for RBI Assistant Main Exam 2020Sunny Dara Rinnah SusanthNo ratings yet

- Warangal All Round Mentoring Sept 2021 (1) 20211015220020Document30 pagesWarangal All Round Mentoring Sept 2021 (1) 20211015220020Uday GopalNo ratings yet

- 02 07 21 PDFDocument13 pages02 07 21 PDFGeetanshi AgarwalNo ratings yet

- KPMG Ory - Insights - 27 - October - 2023 - Rbi - Issues - Master - Direction - Non - Banking - Company - Scale - Based - RegulationDocument27 pagesKPMG Ory - Insights - 27 - October - 2023 - Rbi - Issues - Master - Direction - Non - Banking - Company - Scale - Based - RegulationRangerNo ratings yet

- RBI - Dividend by NBFCs 24062021Document8 pagesRBI - Dividend by NBFCs 24062021Nimesh KumarNo ratings yet

- Income Recognition, Asset Classification and Provisioning Norms For The Urban Cooperat Ive BanksDocument10 pagesIncome Recognition, Asset Classification and Provisioning Norms For The Urban Cooperat Ive Banksramsundar_99No ratings yet

- Statutory Audit of Bank Branches (Certain Aspects)Document43 pagesStatutory Audit of Bank Branches (Certain Aspects)Nivedita SharmaNo ratings yet

- Sale of Stressed Asset GuidelinesDocument6 pagesSale of Stressed Asset GuidelinesRashi JainNo ratings yet

- Master Direction - Reserve Bank of India (Transfer of Loan Exposures)Document33 pagesMaster Direction - Reserve Bank of India (Transfer of Loan Exposures)Sarim FazliNo ratings yet

- OSCB Banking Assistant Previous Paper with Solution PDFDocument62 pagesOSCB Banking Assistant Previous Paper with Solution PDFRupeshNo ratings yet

- Prudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesDocument47 pagesPrudential Norms On Income Recognition, Asset Classification & Provisioning of AdvancesRAJESH MAHTO 2058No ratings yet

- RBI Master CircularDocument13 pagesRBI Master Circularnaina.kim2427No ratings yet

- Revised Framework For Resolution of Stressed AssetsDocument4 pagesRevised Framework For Resolution of Stressed AssetsAyush RampuriaNo ratings yet

- BB Loan Classification and ProvisioningDocument16 pagesBB Loan Classification and ProvisioningMuhammad Ali Jinnah100% (1)

- Cbi So Model Paper 2022Document37 pagesCbi So Model Paper 2022himanshu agrawalNo ratings yet

- Credit Authorizatio N Scheme: Presented By:-Sheenu AroraDocument18 pagesCredit Authorizatio N Scheme: Presented By:-Sheenu AroraSheenu AroraNo ratings yet

- COVID Resolution Framework FAQsDocument5 pagesCOVID Resolution Framework FAQskgvnktshNo ratings yet

- Banking Law Final DraftDocument21 pagesBanking Law Final DraftKeerti SinghNo ratings yet

- 503acf260214f PDFDocument16 pages503acf260214f PDFSiddhi KudalkarNo ratings yet

- Audit of AdvancesDocument29 pagesAudit of AdvancesHemanshu SolankiNo ratings yet

- Policy Framework For Lending To MSE (Micro and Small Enterprises)Document7 pagesPolicy Framework For Lending To MSE (Micro and Small Enterprises)Pabitra Kumar PrustyNo ratings yet

- D1 - 2023 Matters Related To The NSFRDocument4 pagesD1 - 2023 Matters Related To The NSFRtendai rwodziNo ratings yet

- GK Tornado Lic Assistant Main Exams 2019 Eng 18Document203 pagesGK Tornado Lic Assistant Main Exams 2019 Eng 18Sakshi GuptaNo ratings yet

- Wilful DefaultersDocument41 pagesWilful DefaultersNikhil Das SharmaNo ratings yet

- Policy On Co-Lending by Bank and NBFC/HFC To Priority SectorDocument7 pagesPolicy On Co-Lending by Bank and NBFC/HFC To Priority Sectorpatruni sureshkumarNo ratings yet

- Reserve Bank of India: Systemically Important Core Investment CompaniesDocument19 pagesReserve Bank of India: Systemically Important Core Investment CompaniesBhanu prasanna kumarNo ratings yet

- NPAs in Indian State Co-op BanksDocument9 pagesNPAs in Indian State Co-op BankskumardattNo ratings yet

- Regulators Regulations Dec 2021Document44 pagesRegulators Regulations Dec 2021Ravi Shankar VermaNo ratings yet

- GK Tornado Ibps Clerk Main Exams 2019 Eng 80 PDFDocument110 pagesGK Tornado Ibps Clerk Main Exams 2019 Eng 80 PDFShivani ChandelNo ratings yet

- BRPD Circular No. 04 Large Loan Restructuring - 29.01.15Document5 pagesBRPD Circular No. 04 Large Loan Restructuring - 29.01.15M Tariqul Islam MishuNo ratings yet

- Assignment of Management of Working Capital On Chore CommitteeDocument4 pagesAssignment of Management of Working Capital On Chore CommitteeShubhamNo ratings yet

- RBI Master CircularDocument42 pagesRBI Master CircularDeep Singh PariharNo ratings yet

- Reserve Bank of India issues revised regulatory framework for Urban Co-operative BanksDocument5 pagesReserve Bank of India issues revised regulatory framework for Urban Co-operative BanksJay SharmaNo ratings yet

- 1710-Dda 31.05.17Document53 pages1710-Dda 31.05.17sunilNo ratings yet

- Doodh Ganga Yojana - EditedDocument10 pagesDoodh Ganga Yojana - EditedDheeraj VermaNo ratings yet

- MantrasDocument2 pagesMantrasVenoo GoopalNo ratings yet

- Facts of RamayanaDocument39 pagesFacts of RamayananatanuNo ratings yet

- Project Proposal TemplateDocument4 pagesProject Proposal TemplateArvind ThakurNo ratings yet

- Road Safety: We Share The RoadDocument28 pagesRoad Safety: We Share The RoadArvind ThakurNo ratings yet

- PreferenceShares - March 27 2018Document1 pagePreferenceShares - March 27 2018Tiso Blackstar GroupNo ratings yet

- Cash Flow ForecastingDocument3 pagesCash Flow Forecastingrohit_kumraNo ratings yet

- Questionnaire: Respected Sir/MadamDocument4 pagesQuestionnaire: Respected Sir/MadamhunnyNo ratings yet

- Tanzania'S Oil and Gas Contract Regime, Investments and MarketsDocument45 pagesTanzania'S Oil and Gas Contract Regime, Investments and Marketssamwel danielNo ratings yet

- Abl 2009 PDFDocument125 pagesAbl 2009 PDFAli SyedNo ratings yet

- Minister Gigaba's Response To The Guptas' NaturalisationDocument22 pagesMinister Gigaba's Response To The Guptas' NaturalisationTiso Blackstar GroupNo ratings yet

- Why businesses tend to grow or remain smallDocument10 pagesWhy businesses tend to grow or remain smallAnuvrat ShankerNo ratings yet

- GE MatrixDocument6 pagesGE Matrixmax_dcosta0% (2)

- Trade AND Capital MovementsDocument16 pagesTrade AND Capital MovementsVert ResterioNo ratings yet

- CEOs of Life Insurers Cap on Charges CircularDocument1 pageCEOs of Life Insurers Cap on Charges CircularKushal AgarwalNo ratings yet

- The Value Line Contest: A Test of the Predictability of Stock Price ChangesDocument20 pagesThe Value Line Contest: A Test of the Predictability of Stock Price ChangescarminatNo ratings yet

- Revista AbbDocument84 pagesRevista Abbenrique zamoraNo ratings yet

- GL 003 14 Code of Good Practice For Life InsuranceDocument19 pagesGL 003 14 Code of Good Practice For Life InsuranceAdrian BehNo ratings yet

- Instructions for Principal, Associates, and Checklists for DiscussionsDocument20 pagesInstructions for Principal, Associates, and Checklists for DiscussionsAnoushka GuptaNo ratings yet

- Group AssignmentDocument4 pagesGroup AssignmentLinh Le Thi ThuyNo ratings yet

- Financial and Management Accounting-1 PDFDocument108 pagesFinancial and Management Accounting-1 PDFAugastusBwalyaLombeNo ratings yet

- Personal Income Tax in Poland 2010Document21 pagesPersonal Income Tax in Poland 2010Agnieszka GryskaNo ratings yet

- Relative ValuationDocument26 pagesRelative ValuationRAKESH SINGHNo ratings yet

- GFM Mock QuestionsDocument13 pagesGFM Mock QuestionsBhanu TejaNo ratings yet

- Chapter 15 28-36Document2 pagesChapter 15 28-36Angelica AnneNo ratings yet

- PW, FW, Aw: Shreyam PokharelDocument14 pagesPW, FW, Aw: Shreyam PokharelLuna Insorita100% (1)

- Bank of Punjab Internship UOGDocument36 pagesBank of Punjab Internship UOGAhsanNo ratings yet

- Bond Valuation 1Document37 pagesBond Valuation 1Nitesh SolankiNo ratings yet

- Managerial Economics ExplainedDocument7 pagesManagerial Economics ExplainedRaghu RallapalliNo ratings yet