Professional Documents

Culture Documents

Final Bomb (Before Main Body)

Uploaded by

Mohammad helal uddin ChowdhuryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Bomb (Before Main Body)

Uploaded by

Mohammad helal uddin ChowdhuryCopyright:

Available Formats

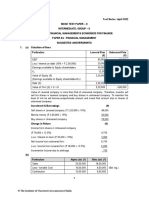

Solution: 1

Assessee Name: Ms. Naima Akter

Assessment year: 2014-2015

Income Year: 2013-2014

Computation of total income from salary (Section-21) :

Particular Taka Taka

Basic salary 3,60,000

Dearness allowance 1,20,000

Entertainment allowance 24,000

Employer’s contribution to provident fund (recognized) 60,000

Lunch allowance 24,000

School fee for children of the Naima 1,20,000

Utility allowance 72,000

Conveyance for full time use(5% of basic salary) 18,000

(+) Additional cash allowance 24,000 42,000

Fee for golf club 10,000

Medical allowance 72,000

(-) Actual expenditure 36,000 36,000

12,000

Employer’s contribution to Life insurance policy

60,000

Festival Bonus

Accommodation allowance:

25% of basic salary - 90,000

Or actual rental value Tk. -4,80,000 which is less 90,000

Servant salary 28,800

Total income from salary 10,58,800

Computation of income from house property (Section - 24):

Particular Taka Taka

Annual value of building:

Actual rental value (15,000×12×3×2) 10,80,000

Less: tenant expenses paid by owner 45,000

10,35,000

Add: owner expenses paid by tenant 15,000

10,50,000

6

Expected rent(14,40,000× ) 10,80,000

8

Annual value (higher one) 10,80,000

Add: Advance received 1,50,000

12,30,000

Admissible expenses:

Repair and maintenance (10,80,000×25%) 2,70,000

City corporation tax (1,30,000×6⁄8) 97,500

Insurance premium (22,000×6⁄8) 16,500

Land revenue paid (8,000×6⁄8) 6,000

Mortgage interest paid (8,000×6⁄8) 6,000

Legal expenses (12,000×6⁄8) 9,000

Uncollectible rent (10,80,000×1⁄6 × 1⁄12) 15,000

Vacancy allowance (10,80,000×1⁄6 × 2⁄12) 30,000

Refund of advance 60,000

5,10,000

Total income from house property: 7,20,000

Calculation of income from other sources (Section - 33):

Grossing –up:

31,500×100

1. Dividend from ICB unit fund = = 35,000

90

1,52,000×100

2. Interest on savings certificate = = 1,60,000

95

19,000×100

3. Interest on Paribar Sanchaypatra = = 20,000

95

36,000×100

4. Interest on post office savings bank = = 40,000

90

18,000×100

5. Fees for technical service = = 20,000

90

20,000×100

6. Prize of winning bond lottery = = 25,000

80

4,000×100

7. Income from copyright and royalty= = 4,444

90

Calculation of weighted commission expenditure:

1200

1. Collection of dividend from ICB unit fund= × 35,000 = 215

35,000+1,60,000

1,200

2. Collection of interest on savings certificate=35,000+1,60,000 × 1,60,000 = 985

Computation of income from other sources (Section- 33) :

Taka Taka

Particular

Dividend from ICB unit fund 35,000

(-) Commission 215

34,785

(-) interest

1,000

33,785

(-) Exemption up to 25,000 25,000

8,785

Interest on savings certificate 1,60,000

(-) Commission 985

1,59,015

Interest on post office savings Bank 40,000

Interest on paribar sanchaypatra 20,000

Fees for technical service from government 18,000

Prize of winning bond lottery 25,000

Income from copyright and royalty 4,444

Income from participating television talk show 2,000

5,000

Income from marriage anniversary

5,000

(-) Exemption (social custom) NiL

Income from license 2,000

(-) Renew fee 200

1,800

Total income from other sources 2,81,044

Computation of income from Agriculture sources (Section – 26 & 27) :

Taka Taka

Particular

Income from Agriculture (Section -26 & 27):

Income from sale of Jute (300×700) 2,10,000

Income from sale of Rice (225×550) 1,23,750

Income from lease of agriculture land 48,000

Income from tea garden (80,000×60%) 48,000

Income from sale of honey 20,000

Gain on sale of tractor 3,000

Gain on insurance compensation 4,000

4,56,750

Less: Admissible expenses:

1. Production cost 2,00,250

2. Land revenue paid 9,000

3. Union parisad tax 6,800

4. Crop insurance premium 11,500

5. Allowable depreciation 8,000

6. Interest on mortgage loan 4,750

7. Maintenance cost of irrigation plant 7,200

8. Loss due to discard of machine 3,500

2,51,000

Total income from source of Agriculture 2,05,750

Computation of total income Ms. Naima Akter:

1.Income from salary : 10,58,800

2.Income from house property : 7,20,000

3.Income from other sources : 2,81,044

4.Income from Agriculture : 2,05,750

Total income of Ms. Naima Akter = 22,65,594

Computation of Rebatable Investment:

1. Bangladesh Sanchoy patra : TK. 2,00,000

2. Prime minister’s relief fund : TK. 1,00,000

3. LIP(10% of sum assured) : TK. 60,000

4. Contribution of P.F(Self + Employer) : TK. 90,000

5. Purchase of share (IPO) : TK. 2,00,000

Total Rebatable Income = TK. 6,50,000

As per section 44 (3) of the ITO, allowable investment allowance comes to

30% 0f total income (excluding employer’s contribution to P.F ) =

(22,65,594-60,000)×30%= 6,61,678.

Calculation of Tax Liability:

1st TK. 2,75,000 Tax is Nil

For next 3,00,000 Tax @ 10% Tk.30,000

For next 4,00,000 Tax @ 15% TK. 60,000

For next 5,00,00 Tax @ 20% TK. 1,00,000

For next 7,90,594 Tax @ 25% Tk. 1,97,648

Gross Tax =TK. 3,87,648

(-)Tax Rebatable=(6,50,000×15%) =TK. 97,500

Total Tax payable =TK. 2,90,148

(-) AIT/ TDS = Tk. 23,944

Net Tax Payable =TK. 2,66,204

You might also like

- R2 TAX ML Solution CMA June 2020 Exam.Document6 pagesR2 TAX ML Solution CMA June 2020 Exam.Pavel DhakaNo ratings yet

- R2. TAX ML Solution CMA January 2022 ExaminationDocument6 pagesR2. TAX ML Solution CMA January 2022 ExaminationPavel DhakaNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For Corporations Prob 4Document3 pagesSol. Man. - Chapter 15 - Accounting For Corporations Prob 4ruth san joseNo ratings yet

- Tutorial 6 - Salaries TaxDocument5 pagesTutorial 6 - Salaries Tax周小荷No ratings yet

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDocument9 pagesSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsEinez B. CarilloNo ratings yet

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Answers - Chapter 4 - Provisions, Contingent Liab. & Contingent AssetsDocument2 pagesAnswers - Chapter 4 - Provisions, Contingent Liab. & Contingent AssetsLhica EsterasNo ratings yet

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- Income From Salary Presen TationDocument2 pagesIncome From Salary Presen TationJhuma haqueNo ratings yet

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDocument10 pagesSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsMiguel Amihan100% (1)

- Question Income From Salary Solved in ClassDocument4 pagesQuestion Income From Salary Solved in ClassFozle Rabby 182-11-5893No ratings yet

- Taxation Review June 16Document8 pagesTaxation Review June 16Shaiful Alam FCANo ratings yet

- AFA IIP.L III SolutionJune 2016Document4 pagesAFA IIP.L III SolutionJune 2016HossainNo ratings yet

- PremiumsDocument10 pagesPremiumsPhoebe Dayrit CunananNo ratings yet

- Chapter 22 - Teacher's Manual - Far Part 1bDocument13 pagesChapter 22 - Teacher's Manual - Far Part 1bPacifico HernandezNo ratings yet

- Perry - SolutionsDocument4 pagesPerry - SolutionsCharles TuazonNo ratings yet

- JournalDocument8 pagesJournalAmelia AndrianiNo ratings yet

- Corporate Finance Week 3 Slide SolutionsDocument6 pagesCorporate Finance Week 3 Slide SolutionsKate BNo ratings yet

- Solution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryDocument3 pagesSolution-Comprehensive Problem 1: A. Computation of Total Income: 1. Income From SalaryEmtiaz Ahmed AnikNo ratings yet

- Cbse Board Sample Paper-1: Accountancy SolutionDocument15 pagesCbse Board Sample Paper-1: Accountancy SolutionSAKSHI GOYALNo ratings yet

- Sol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Teacher's Manual - Ia Part 1aYamateNo ratings yet

- Assign 4 Natividad BSA 2-13Document5 pagesAssign 4 Natividad BSA 2-13Natividad, Kered ZilyoNo ratings yet

- COST BEHAVIOR (Solution)Document5 pagesCOST BEHAVIOR (Solution)Mustafa ArshadNo ratings yet

- Assignment FARDocument2 pagesAssignment FARCykee Hanna Quizo LumongsodNo ratings yet

- IRA No. 4 Answer KeyDocument3 pagesIRA No. 4 Answer KeyProlen AcantoNo ratings yet

- BTDocument6 pagesBTthanhlong2692000No ratings yet

- Sol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aDocument7 pagesSol. Man. - Chapter 6 - Receivables Addtl Concept - Ia Part 1aJenny Joy Alcantara0% (1)

- Solution To Prob 3 On Provisions PP 189-192Document2 pagesSolution To Prob 3 On Provisions PP 189-192Martha MarieNo ratings yet

- FABULAR Intercompany DividendsDocument6 pagesFABULAR Intercompany DividendsRico, Jalaica B.No ratings yet

- Fair Value of Net AssetsDocument8 pagesFair Value of Net AssetsGanbilegBatnasanNo ratings yet

- Chap2 ProblemsDocument31 pagesChap2 Problemskyle GNo ratings yet

- Provisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseDocument6 pagesProvisions, Contingent Liabilities and Contingent Assets: Problem 1: True or FalseKim HanbinNo ratings yet

- Sol. Man. - Chapter 7 - Notes (Part 1)Document13 pagesSol. Man. - Chapter 7 - Notes (Part 1)natalie clyde matesNo ratings yet

- Rise School of Accountancy: Suggested Solution Test 08Document2 pagesRise School of Accountancy: Suggested Solution Test 08iamneonkingNo ratings yet

- Installment Method and Accounting Method Steven Richmon T GenerilloDocument4 pagesInstallment Method and Accounting Method Steven Richmon T GenerilloSteven RichmonNo ratings yet

- 5-Advanced Accounts Mock KeyDocument16 pages5-Advanced Accounts Mock Keydiyaj003No ratings yet

- Less: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaDocument16 pagesLess: Interest On Debt (10% × ' 2,00,000) : © The Institute of Chartered Accountants of IndiaGao YungNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- 1 2021 FAR FinalsDocument6 pages1 2021 FAR FinalsZatsumono YamamotoNo ratings yet

- Assignment1 BonutanHMDocument4 pagesAssignment1 BonutanHMmaegantrish543No ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- Model Solution: Page 1 of 6Document6 pagesModel Solution: Page 1 of 6ShuvonathNo ratings yet

- Taxation of Income of Partnership-1 - 034114Document6 pagesTaxation of Income of Partnership-1 - 034114temiladeadeyemi11No ratings yet

- F7 - Mock A - AnswersDocument6 pagesF7 - Mock A - AnswerspavishneNo ratings yet

- Income Taxation 2019 Chapter 13A 13C 14 BanggawanDocument8 pagesIncome Taxation 2019 Chapter 13A 13C 14 BanggawanEricka Einjhel Lachama100% (9)

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Solution Manual Chapter 13 B MC Problems 1Document3 pagesSolution Manual Chapter 13 B MC Problems 1Mallet S. GacadNo ratings yet

- Fin420.540 Jan 2018 Q2-5Document8 pagesFin420.540 Jan 2018 Q2-5Amar AzuanNo ratings yet

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocument13 pagesNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- RecFin AnswerKeySolutionsDocument3 pagesRecFin AnswerKeySolutionsHannah Jane UmbayNo ratings yet

- R&L Company: Assignment 1 Premium Liability, Warranty LiabilityDocument6 pagesR&L Company: Assignment 1 Premium Liability, Warranty Liabilityangelian bagadiongNo ratings yet

- MTP 10 16 Answers 1694780069Document13 pagesMTP 10 16 Answers 1694780069jiotv0050No ratings yet

- ORQUIA AssignmentDocument4 pagesORQUIA AssignmentClint RoblesNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- Ceramics 2Document3 pagesCeramics 2Mohammad helal uddin ChowdhuryNo ratings yet

- Ceramics 5Document3 pagesCeramics 5Mohammad helal uddin ChowdhuryNo ratings yet

- Mean Mean : X N FX FDocument3 pagesMean Mean : X N FX FMohammad helal uddin ChowdhuryNo ratings yet

- ElementsDocument1 pageElementsMohammad helal uddin ChowdhuryNo ratings yet

- In Partnership With The University of Suffolk BABS AssignmentDocument8 pagesIn Partnership With The University of Suffolk BABS AssignmentMohammad helal uddin ChowdhuryNo ratings yet

- Ceramics 4Document3 pagesCeramics 4Mohammad helal uddin ChowdhuryNo ratings yet

- Ceramics 3Document3 pagesCeramics 3Mohammad helal uddin ChowdhuryNo ratings yet

- Organizations. 29 (5), pp.938Document4 pagesOrganizations. 29 (5), pp.938Mohammad helal uddin ChowdhuryNo ratings yet

- Define HRM - Human Resource Management Based Functions Are Mainly Related To TheDocument21 pagesDefine HRM - Human Resource Management Based Functions Are Mainly Related To TheMohammad helal uddin ChowdhuryNo ratings yet

- HNBS 332 Business StrategyDocument8 pagesHNBS 332 Business StrategyMohammad helal uddin ChowdhuryNo ratings yet

- Bus. Ethics, CSRDocument14 pagesBus. Ethics, CSRMohammad helal uddin ChowdhuryNo ratings yet

- 2.3 Sources of Mistakes Giving Rise To ComplaintsDocument2 pages2.3 Sources of Mistakes Giving Rise To ComplaintsMohammad helal uddin ChowdhuryNo ratings yet

- Case Study ReviewDocument10 pagesCase Study ReviewMohammad helal uddin ChowdhuryNo ratings yet

- Case Study ReviewDocument10 pagesCase Study ReviewMohammad helal uddin ChowdhuryNo ratings yet

- 2.9 What Is Adjustment Letter?Document2 pages2.9 What Is Adjustment Letter?Mohammad helal uddin ChowdhuryNo ratings yet

- Claim LetterDocument1 pageClaim LetterMohammad helal uddin ChowdhuryNo ratings yet

- 204 Main FinalDocument61 pages204 Main FinalMohammad helal uddin Chowdhury100% (1)

- 3.1 Sajeeb CorporationDocument1 page3.1 Sajeeb CorporationMohammad helal uddin ChowdhuryNo ratings yet

- ch16 Mish11ge EmbfmDocument29 pagesch16 Mish11ge EmbfmLazaros KarapouNo ratings yet

- 3.1 Sajeeb CorporationDocument1 page3.1 Sajeeb CorporationMohammad helal uddin ChowdhuryNo ratings yet

- Claim LetterDocument1 pageClaim LetterMohammad helal uddin ChowdhuryNo ratings yet

- CGDF-Junior Auditor - 2019 (IBA) - Math Part Solution by Khairul AlamDocument8 pagesCGDF-Junior Auditor - 2019 (IBA) - Math Part Solution by Khairul AlamMohammad helal uddin ChowdhuryNo ratings yet

- 2.3 Sources of Mistakes Giving Rise To ComplaintsDocument2 pages2.3 Sources of Mistakes Giving Rise To ComplaintsMohammad helal uddin ChowdhuryNo ratings yet

- ch17 Mish11ge EmbfmDocument26 pagesch17 Mish11ge EmbfmMohammad helal uddin ChowdhuryNo ratings yet

- Commercial Paper Risks and Mitigants in Context of Bangladesh PDFDocument14 pagesCommercial Paper Risks and Mitigants in Context of Bangladesh PDFMohammad helal uddin ChowdhuryNo ratings yet

- Draft Prospectus-Bdpl (26.12.19)Document300 pagesDraft Prospectus-Bdpl (26.12.19)Mohammad helal uddin ChowdhuryNo ratings yet

- ch03 Mish11ge EmbfmDocument18 pagesch03 Mish11ge EmbfmLazaros KarapouNo ratings yet

- ch05 Mish11ge EmbfmDocument33 pagesch05 Mish11ge EmbfmMohammad helal uddin ChowdhuryNo ratings yet

- Bergen Edu ELRC Guidemxtnsex HTMLDocument3 pagesBergen Edu ELRC Guidemxtnsex HTMLMohammad helal uddin ChowdhuryNo ratings yet

- Investment Banking, Bank, Scope and Future in BangladeshDocument42 pagesInvestment Banking, Bank, Scope and Future in BangladeshMehedi HassanNo ratings yet

- Kumplan Kuiz Mis ChatrinDocument28 pagesKumplan Kuiz Mis ChatrinRizki PurbaNo ratings yet

- The Republic of Zambia: Public Service Capacity Building ProjectDocument182 pagesThe Republic of Zambia: Public Service Capacity Building ProjectGEORGE LUKONGANo ratings yet

- Pharmacy SrsDocument38 pagesPharmacy SrsJohn Son47% (19)

- Income Under The Head Salary2 PDFDocument142 pagesIncome Under The Head Salary2 PDFswati0% (1)

- SingaporeDocument8 pagesSingaporeazertyuiopppNo ratings yet

- DOPT O.M Dated 27.03.2009Document4 pagesDOPT O.M Dated 27.03.2009DeepamBora100% (1)

- Presented by Radhika Notwani: Year (Ca)Document20 pagesPresented by Radhika Notwani: Year (Ca)google driiveNo ratings yet

- Hotel TerminologyDocument15 pagesHotel TerminologyJoko Haryono100% (1)

- Life in SwitzerlandDocument18 pagesLife in SwitzerlandЭрик ГригорянNo ratings yet

- Legal Memorandum (Labor-Company Loans and Car Plans) PDFDocument8 pagesLegal Memorandum (Labor-Company Loans and Car Plans) PDFRon QuintoNo ratings yet

- Dinshaw RAWDocument51 pagesDinshaw RAWJaykrishnan ChembakaseriNo ratings yet

- Magna Carta of Public Health WorkersDocument31 pagesMagna Carta of Public Health Workersinvictus0446100% (6)

- Wage or Compensation DifferentialsDocument28 pagesWage or Compensation DifferentialsdollyguptaNo ratings yet

- De Chart of Acounts SKR 03 - EN - 2011Document12 pagesDe Chart of Acounts SKR 03 - EN - 2011Ana CristescuNo ratings yet

- Case Quantum MeruitDocument12 pagesCase Quantum MeruitYgh E SargeNo ratings yet

- CBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Document16 pagesCBDT - E-Filing - ITR 4 - Validation Rules - V 1.0Kuldeep JatNo ratings yet

- Case Title: Esalyn Chavez Vs Hon. Edna Bonto-Perez Et. Al (GR 109808)Document4 pagesCase Title: Esalyn Chavez Vs Hon. Edna Bonto-Perez Et. Al (GR 109808)ladyvickyNo ratings yet

- Question Paper Organizational Behavior and HRM (MB251) : July 2005Document13 pagesQuestion Paper Organizational Behavior and HRM (MB251) : July 2005Henoke Man100% (1)

- Expates GuideDocument36 pagesExpates GuideDaniela Luncan CalinescuNo ratings yet

- Metro Motorcycle Company Internship ReportDocument40 pagesMetro Motorcycle Company Internship Reportbbaahmad89No ratings yet

- Methods of Compensation Uap Doc 210Document5 pagesMethods of Compensation Uap Doc 210Ronielle Mercado100% (1)

- Synopsis On Balance Between Workin and Personal Life of Indian WomenDocument16 pagesSynopsis On Balance Between Workin and Personal Life of Indian WomenAdan HoodaNo ratings yet

- Rural Marketing ProcessDocument24 pagesRural Marketing ProcessakanshatakNo ratings yet

- Review Letter - Oct 19 - Chandan TatiDocument2 pagesReview Letter - Oct 19 - Chandan Tatimadali sivareddyNo ratings yet

- Human Resource Practices in Entertainment Industry A Cinema Scope CasestudyDocument7 pagesHuman Resource Practices in Entertainment Industry A Cinema Scope CasestudyGina Margasiu100% (1)

- International Industrial RelationsDocument11 pagesInternational Industrial RelationsMartina Dubey50% (2)

- Compensation Policy - Chapter 02 Compensation Administration Process Principles of Administration of CompensationDocument6 pagesCompensation Policy - Chapter 02 Compensation Administration Process Principles of Administration of CompensationSanam PathanNo ratings yet

- 17 - HR Analytics - CIPDDocument18 pages17 - HR Analytics - CIPDSimone SegattoNo ratings yet

- IinterviewDocument5 pagesIinterviewsobirinNo ratings yet

- Compiled Research ArticalsDocument314 pagesCompiled Research Articalshyder nawaz100% (1)