Professional Documents

Culture Documents

Sonata Software

Uploaded by

ADCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sonata Software

Uploaded by

ADCopyright:

Available Formats

Company Report

Industry: Information Technology

Sonata Software

Steady growth, Reasonable valuations

Madhu Babu (madhubabu@plindia.com)

+91-22-66322300

Sonata Software

Contents

Page No.

Niche competencies in select focused Verticals and Services ................................... 5

Key Investment thesis for the IT Services Business ........................................................................... 5

OPD for Independent Software Vendors (~29% of total IT services revenues) ................................. 6

Travel vertical (~27% of Total Revenues): Focus on Tour Operators ................................................ 7

Retail/CPG (Accounts for 26% of total revenues) : On a strong footing............................................ 8

Investing in Platformation within the focused verticals .................................................................... 9

Focus remains on new logo wins .............................................................................. 13

Strong Hiring in Senior management to aid traction ............................................... 15

Acquisitions aimed at improving IP competencies................................................... 17

Steady performance in Operating Metrics ...................................................................................... 17

Product Business (Reseller): Focus on margin expansion ........................................ 19

Growth and Margins fare well relative to Midcap peers ......................................... 21

Sonata enjoys steady EBITDA margin in the IT services business.................................................... 21

Challenges: Subscale and high client concentration ................................................ 22

High Client Concentration remains the biggest risk ........................................................................ 22

Financial Analysis ...................................................................................................... 23

Revenue growth: Expect Consolidated Revenue Growth CAGR of 13% over FY17-FY19E .............. 23

EBITDA margin expected to remain stable over FY17-FY19E .......................................................... 24

Steady FCF generation aids strong payout ratios ............................................................................ 25

Valuation and View ................................................................................................... 27

Company Background ............................................................................................... 29

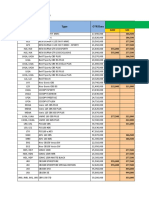

Quarterly Financials ......................................................................................................................... 30

Prabhudas Lilladher Pvt. Ltd. and/or its associates (the 'Firm') does and/or seeks to do business with companies covered in its research reports. As a result investors should be aware that

the Firm may have a conflict of interest that could affect the objectivity of the report. Investors should consider this report as only a single factor in making their investment decision.

Please refer to important disclosures and disclaimers at the end of the report

July 11, 2017 2

Company Report

July 11, 2017

Sonata Software

We initiate coverage on Sonata Software with a ‘BUY’ rating and a TP of Rs200/sh

Rating BUY (11.5x FY19E EPS). The IT services business (Revenues at US$122mn for FY17 and

Price Rs164 headcount of 3,350 employees) is on a transformational path with increased focus

Target Price Rs200 on IP and Platforms within its focused verticals (Travel, Retail, CPG). Over the past

Implied Upside 22.0% two years, Sonata has used both “Build and Buy” approach to develop IP and

Sensex 31,716 Platforms (Brick and Click, Retina, Rezopia, Halosys). Apart from own IP, Sonata

Nifty 9,771 enjoys expertise in delivering vertical specific solutions on third-party platforms

(Prices as on July 11, 2017) (Microsoft Dynamics AX, Hybris). Aided by this strategy, Sonata has seen strong

new client additions (10-15 accounts are scalable into large engagements),

especially within its focus verticals. IT services business of Sonata has grown at

18.5% CAGR (FY13-FY17). We expect IT services revenues to grow at 11.5% CAGR

Trading data

(FY17-FY19E) and reach revenues of US$150mn by FY19E. Traction in Digital, cross-

Market Cap. (Rs m) 17,236.4

selling and new logo wins are likely to aid growth. Valuations are reasonable (9.3x

Shares o/s (m) 105.1

FY19E EPS) and are at 35% discount to Mindtree. Steady revenue growth, robust

3M Avg. Daily value (Rs m) 43.6

balance sheet (net cash of Rs3.1bn, ~18% of Mcap) and superior dividend yield

(5.5% at CMP) are positives. We see favourable risk return. Initiate with ‘BUY’.

IT Services business is the value driver: Though IT services business accounts for

Major shareholders 32% of total revenues, it contributed to 78% of PAT for FY17. This is led by

Promoters 32.36% higher EBITDA margins of the IT services business (Adjusted EBITDA margin at

Foreign 14.32% 17.4% as on FY17). Key focus verticals are Offshore Product engineering for

Domestic Inst. 1.57% Independent Software vendors (29% of IT services revenues), Travel with focus

Public & Other 51.75% on Tour operators (27% of IT services revenues) and Retail and CPG (26% of IT

services Revenues). Among service offerings, Sonata enjoys strong competence

in delivering solutions on Microsoft Dynamics, SAP Hybris. Key clients include

Stock Performance Microsoft, TUI Travel, Johnson and Johnson. We expect the IT services business

(%) 1M 6M 12M to grow at 11.5% CAGR (FY17-FY19E) aided by mining new accounts.

Absolute 2.3 (17.2) (4.3) Management has guided for an aspirational goal of US$200mn revenues for IT

Relative 0.9 (35.1) (21.2) services business by FY20 (which implies 18% CAGR).

Contd...4

How we differ from Consensus Key financials (Y/e March) 2016 2017 2018E 2019E

EPS (Rs) PL Cons. % Diff. Revenues (Rs m) 19,404 25,211 28,229 32,079

2018 15.4 16.2 -4.7 Growth (%) 15.4 29.9 12.0 13.6

2019 17.5 19.2 -8.8 EBITDA (Rs m) 1,919 1,923 2,207 2,520

PAT (Rs m) 1,586 1,538 1,622 1,840

EPS (Rs) 15.1 14.6 15.4 17.5

Growth (%) 137.3 (3.1) 5.5 13.4

Price Performance (RIC: SOFT.BO, BB: SSOF IN)

Net DPS (Rs) 9.0 9.0 9.3 10.5

(Rs)

250

Profitability & Valuation 2016 2017 2018E 2019E

200 EBITDA margin (%) 9.9 7.6 7.8 7.9

150 RoE (%) 35.3 31.3 30.3 31.3

RoCE (%) 29.2 24.3 24.5 26.5

100

EV / sales (x) 0.8 0.6 0.6 0.5

50

EV / EBITDA (x) 8.3 8.0 7.1 6.1

0 PE (x) 10.9 11.2 10.6 9.4

Jul-17

Jul-16

Sep-16

Jan-17

May-17

Nov-16

Mar-17

P / BV (x) 3.7 3.4 3.1 2.8

Net dividend yield (%) 5.5 5.5 5.7 6.4

Source: Bloomberg Source: Company Data; PL Research

Sonata Software

Platformation strategy to enable client stickiness: In a bid to differentiate

within its focused verticals, Sonata has invested in developing IP and platforms.

This has enabled company maintain and consolidate its position within top

accounts as well as generate new logo wins. Top 10 clients contributed 70% to

total revenues as on Q4FY17. Company added 40 new logos wins over the past

two years and majority of the wins are in Retail & CPG and Travel vertical. Of

these, management indicated that ~10-15 clients can scale into larger

engagements. Sonata Software has also expanded senior management with new

additions over the past 18 months. This includes Mr Ranga Puranik, Mr Rajiv

Puri, Mr OmPrakash Subba Rao and Mr Tridip Saha who have joined Sonata

Software from various reputed organizations

(Persistent/Mindtree/Accenture/CSC respectively).

Products business (Re-seller of Licenses) enjoys high ROCE: Apart from IT

services, Sonata is involved in reselling of Licenses of Microsoft/Oracle/SAP in

India through its wholly-owned subsidiary (Sonata Information Technology

Limited). This business accounts for 68% of the total revenues, but has thin

EBITDA margins (~3% for FY17). Hence, this segment contributed to the

remaining 22% of the consolidated PAT for FY17. Management indicated that

products business has a very low capital employed as well as a negative working

capital cycle. Consequently, Sonata generates a high ROCE (~26% for FY17) in

this business and hence continues operating in this segment. We expect this IT

Products business to grow at 13% CAGR (FY17-FY19E) and model a margin

expansion led by SITL’s focus on value-added services like Cloud, System

Integration and Security Solutions.

Steady growth, Reasonable valuations: We expect Sonata Software

Consolidated Revenues/EBIDTA/APAT to grow at 12.8/14.2/12.2% CAGR (FY17-

FY19E). Valuations are reasonable with stock trading at 9.3x FY19E. Initiate

coverage with BUY and TP of Rs 200/sh (11.5x FY19E EPS).

July 11, 2017 4

Sonata Software

Niche competencies in select focused Verticals and Services

Key Investment thesis for the IT Services Business

The IT services business of Sonata Software has revenues of US$122mn for FY17. We

discuss the key sub segments of the IT services business which contributed to ~32%

of Sonata Services consolidated revenues and 78% of consolidated PAT for FY17.

Sonata Software focuses on three major industry verticals in the IT services business:

Offshore Product engineering for Independent Software vendors (OPD), Travel

vertical with focus on Tour operators, Retail & Consumer Packaged Goods. The

vertical mix of revenues of the IT services business is shown below.

Exhibit 1: Vertical mix of IT Services revenues as on Q4FY17 (%)

Others Offshore

18 Product

Engineering (ISV)

29

Retail/ CPG

26

Travel

27

Source: Company Data, PL Research

Exhibit 2: Vertical Mix of IT services revenues (%)

Verticals (%) 1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17

OPD ( ISV) 34 31 29 28 30 31 30 29

Travel 32 31 33 31 29 28 26 27

Retail & CPG 16 19 21 24 24 23 27 26

Others 18 19 17 17 17 17 17 18

Source: Company Data, PL Research

July 11, 2017 5

Sonata Software

Exhibit 3: Key Focus areas within the verticals

Source: Company Data, PL Research

OPD for Independent Software Vendors (~29% of total IT services

revenues)

Sonata has a strong footprint in Product engineering with marquee clients which

include leading global ISVs. Sonata’s services in offshore product Engineering spans

include Testing, Performance Engineering, Cloud Engineering, Mobile Engineering

and Analytics Integration. Sonata is seeing traction in enabling enterprise software

product companies to evolve into cloud-based SaaS & PaaS models. Apart from

Product Engineering, Sonata extends product support and professional services to

strategic partners. The OPD business has annual revenues of US$36.4mn and

delivered 0% CAGR over FY15-FY17. The slower growth was on account of ramp-

down of a European client (A midsized Accounting ERP software provider) owing to

Technology shift. Hence, the OPD vertical revenues declined by 9% YoY in FY16.

However, this unit has bounced back in FY17 delivering 11% USD revenue growth.

Exhibit 4: Select projects for the ISV Clients

Client Nature of Offerings

Strategic partnership with ISV product team to design solution, develop, customize, deploy it as

A Leading Supply Chain Solution company

part of releases, and provide maintenance support to customers across various releases

A Mobility Platform Vendor Strategic partnership spanning professional services and go-to-market

Source: Company Data, PL Research

Exhibit 5: Offerings in Product Engineering

Source: Company Data, PL Research

July 11, 2017 6

Sonata Software

Microsoft is the largest account in the OPD vertical and also happens to be the

second largest client of the company. Sonata has hired Mr Ranga Puranik effective

May 2016 as the Chief Growth Officer. In his earlier role, Mr Ranga Puranik was the

Head of Sales at Persistent Systems, a much larger midsized IT company focused on

Product Engineering for ISVs. We believe Mr Ranga Puranik addition can help Sonata

Software expand its footing in the OPD segment. Sonata Software has ~20 clients in

the OPD vertical and we believe that ramp-up of the next set of accounts is a key

growth driver. We model the OPD business revenues to grow at 9% CAGR over

FY17-FY19E predominantly driven by mining new accounts.

Travel vertical (~27% of Total Revenues): Focus on Tour Operators

In the Travel vertical, Sonata is predominantly focused on tour operators, corporate

travel and online travel companies. The largest client in Travel vertical is TUI UK

which is a large luxury tour operator based in Europe. TUI is the largest client of

Sonata Software as on FY17.We note that a large share of revenues from Travel

Vertical are from TUI account. Management indicated that relationship with TUI has

been for more than 10 years and Sonata has high stickiness with the account. Sonata

also has in-depth understanding of the core IT application landscape of the company.

Sonata also works within multiple departments in TUI with relationships at multiple

levels. Hence, Sonata does not see any major risk from vendor consolidation in this

account. Management indicated that it is currently focusing on diversifying its client

base in Travel vertical with focus on new client additions.

Exhibit 6: Select projects of Sonata in Travel vertical

Client Solution

Re-platforming the customer system which helped reduces operating costs. The project involved Reverse-engineered

A Leading European Travel

legacy mainframe customer system, identified and refined core functionalities, and moved to Cloud-based

Company

infrastructure for scalability and costs

Provided a Workforce management solution. Sonata provided solutions for crew-centric functions: Simple Search,

A Large Asian Airline

Crew Notes, Crew Profile & Advanced Crew Search, Crew Alerts & Trends, Return to Base, and Crew Tracking System

Source: Company Data, PL Research

Sonata acquired Rezopia, a Cloud-based Platform focused on Travel vertical in

August 2014. The IP-based solution strengthened Sonata’s position in cloud-based

offerings for tour operators and online travel companies. Sonata has built on

additional features on the Rezopia platform and has substantially upgraded it over

the past three years. Rezopia platform has enabled expand Sonata client base in the

Travel vertical with key wins which includes a large Australian Rail Travel company as

well as multiple midsized tour operators. As on Q4FY17, Sonata Software has ~12

accounts within the Travel vertical and a majority of them are Tour and Luxury

operators.

Travel vertical revenues for FY17 came at US$33.4mn and have grown at 7% CAGR

over FY15-FY17 aiding new logo additions. Sonata offers a variety of solutions which

include Business Intelligence, Mobility Solutions, Omni-Channel Commerce, etc.

Sonata also has strong expertise in SAP Hybris competency for the Travel vertical.

We expect the Travel vertical revenues to grow at 9% CAGR over FY17-FY19E

predominantly driven by mining new accounts.

July 11, 2017 7

Sonata Software

Retail/CPG (Accounts for 26% of total revenues) : On a strong footing

Sonata has a strong presence in Retail vertical with specialization in Omni-Channel

Commerce, Mobility and Analytics. Sonata has a track record of powering Brick-and-

Click-led business transformation initiatives for some of the most well-known Retail

enterprises. Marquee clients in Retail and CPG include Johnson & Johnson, Pepsi,

etc. Sonata’s offerings to this vertical predominantly include providing customised

vertical specific solutions on ERP packages like Hybris, Microsoft Dynamics AX and

Oracle Apps. Retail/CPG vertical revenues came at US$30.3mn and delivered 40%

CAGR over FY15-FY17. The strong growth in this vertical was also driven by

acquisition of IBIS. Excluding IBIS acquisition, organic growth in the vertical was

19% CAGR over FY15-FY17. Sonata Software has ~35 clients in Retail and CPG

vertical as on 4QFY17. This vertical has seen the maximum new client additions

overs the past two years aided by Sonata’s competency in offering vertical specific

solutions in Microsoft Dynamics and SAP Hybris. Owing to traction in Sonata’s core

offerings, we expect this vertical revenue to grow at 18% CAGR over FY17-FY19E.

Exhibit 7: Case studies in Retail vertical

Digital enabablement for Fashion Retailer

...For a retailer who has multiple independently running legacy systems and non-

integrated IT environment. Sonata Digital commerce solution has seamlessly

integrated and extended back-end system, logistics and loyalty programs to

online channels. Sonata solution is providing superior customer experience &

optimized business operation resulting in more than 3000 orders everyday

Enabling mobile first strategy for a Health & Beauty Retailer in

record time

...For a leading Asian retailer with more than 1000 brick and mortar stores.

Sonata Digital commerce has defined & delivered a mobile first engagaement

and commerce solution comprising responsive mobile, web & mobile app for

android and I-phone devices. Sonata launched the solution in record time of 6

weeks significantly reducing the costs by up to 40%

e-Commerce solution for Emerging Online Retailer

Asia based emerging retailer having various systems and vendor systems.

Looking for a solution that can enhance order process and enrich customer

experience . Sonata provided accurate inventory solution to help in committing

correct delivery dates. Fulfilment cycle process time reduced to few minutes,

hence a big boost in the operational bottomline confidence.

Source: Company Data, PL Research

July 11, 2017 8

Sonata Software

Investing in Platformation within the focused verticals

Sonata has focused on ‘Platformation’ and IP-led offering and has made substantial

investments on this front over the past two years. In the analyst meet held on May

31, 2017, Management classified its IP strategy in three buckets.

Sonata-Ready: This is company’s own IP-based end-to-end solutions developed

by Sonata Software for its focused verticals (Brick and Click Platform for Retail

vertical, Retina for Retail vertical).

Sonata Accelerate: Within this, company deploys and manages the platforms

from technology partners like Microsoft and SAP for customers and businesses.

Sonata Custom: A completely custom-built solution based on either company’s

own platforms which customers can white label or source code the license and

build on top. (Client can take the base platform from Sonata and built custom

offerings on the top).

Sonata has boosted its Platformation’ journey over the past two years with both

organic initiatives as well as acquisitions. This acquisition done by Sonata on the IP

front include Halosys (enterprise mobility management platform), IBIS (supply chain

platform running on Dynamics AX solution) and Rezopia (cloud-based travel industry

software platform).

We discuss some of the IP-led Solutions:

Brick and Click Platform (An IP for Retail vertical): Brick & Click enables traditional

retailers to take the leap to the digital by getting the best of store & online retail on

one seamless platform.

Exhibit 8: Offerings of the Brick and Click Platform

Smart Multi-Channel

Superior Customer Experience Next Gen Technology

Operations

Connected Web, Mobile & Store Single view of customer, Seamless Digital- Omni-channel,

shopping- Search, buy, fulfil inventory & operations mobile, analytics, cloud-ready

Faster scalable deployment- Pre-

Personalization-Cross/up- Flexible fulfilment &

built cloud platform and

sell,Offers, Promotions, Loyalty delivery

components

Turnkey solution- customize,

Digital In store experience Supply chain efficiency

implement, support

Source: Company Data, PL Research

Rezopia – IP led offering for Travel Vertical: Sonata acquired IP platform Rezopia, a

leading cloud-based travel ERP system provider in Aug 2014. Rezopia offers a

complete end-to-end reservation, contract management, operations and distribution

system. It enables travel providers to scale revenues, reduce costs and better serve

customers via the web, social networks, mobile devices and traditional call centres.

The focused segment for Rezopia Platform include Tour operators, Online travel

agencies offering dynamic packages, Travel suppliers such as rail, activity provider

and hotels.

July 11, 2017 9

Sonata Software

Exhibit 9: Functionalities of Rezopia Platform

Source: Company Data, PL Research

Halosys (An Enterprise Mobility Platform): Halosys provides a single Unified

Enterprise Mobile Enablement platform that enables businesses to build,

secure, manage and deploy an enterprise wide mobile applications portfolio.

Management guided that IP-led offerings currently account to 14% of total

revenues as on FY17. However, Sonata indicated that while IP can help gain

inroads into accounts, Sonata further mines these accounts with additional

services. Company classifies the whole revenues from these accounts (wherein

Sonata made inroads with IP) as IP led revenues. We believe that this method

of classification has inflated the proportion of revenues from IP.

In our view, IP led strategy would aid Sonata improve its positioning in focused

verticals and drive new wins. However, Sonata’s mettle would be tested in its

ability to mine the new accounts won over from IP led strategy by cross-selling

other service lines.

“We are saying we will do it by building Digital-ready platforms. The way to

approaching this is three ways – one is by keeping people our own IP led platforms;

two is deploy global lead popular platforms like Dynamics or Hybris or Power BI or

Cortana or Azure kind of stuff; and the third is to create world-class platforms.

There we are saying that the fact that today we have really Cloud products of our

own with the domain skills and running large critical businesses. We are able to

then add value and be able to create solutions for enterprises which are scalable

and which are Cloud-ready and which will help them what we call “Go the digital

way” through adoption of platform.” Sonata Software CEO in Concall.

July 11, 2017 10

Sonata Software

Niche Competencies in Key Service Lines

Sonata has strong competency in select technologies which include SAP hybrid

Omni-Channel Commerce, Microsoft Dynamics AX ERP, Microsoft Azure Cloud and

JDA supply chain. The company offers customisation, implementation as well as up-

gradation services to clients. Sonata‘s strength in these service offerings (Hybris,

Dynamics AX) is the key enabler for new account wins.

Exhibit 10: Areas of Competency within Verticals

Source: Company Data, PL Research

Microsoft Dynamics AX: Sonata has strong relationship with Microsoft extending

over two decades. The company developed strong skills across Microsoft

technologies and has efficiently deployed them on customer engagements. Some of

Sonata’s key offerings on Microsoft stack include Enterprise Solutions on MS

Dynamics AX and CRM, Cloud solutions on Windows Azure and Office 365. Sonata's

capability to build solutions around Dynamics AX has made it a partner of choice for

many Fortune 500 ISVs and enterprises. Sonata has developed an array of solution

accelerators around Dynamics AX that help faster turnaround time and cost savings.

Hybris: Sonata has a dedicated team of consultants specialised in Hybris (E-

commerce and Omni-Channel Solution). Sonata offers customised solutions in

technologies such as Travel e-Commerce Framework on Hybris, Hybris B2B & B2C

accelerators etc. Apart from Hybris, Sonata has competency in SAP business All-in-

One implementation and is positioned as a key player in providing technology

services and solutions around SAP Mobility and SAP BI Stack.

July 11, 2017 11

Sonata Software

Exhibit 11: Service line mix of IT services revenues (%)

1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17

ADM 26 26 24 23 25 26 24 25

Test 19 19 18 18 15 16 17 17

AX 15 14 13 15 16 15 15 15

ERP 5 6 3 4 4 4 5 5

IMS 10 12 12 15 16 18 19 19

BI 6 7 9 9 9 9 9 8

E-commerce 9 9 10 9 7 6 6 6

Mobility 4 2 4 2 2 2 2 1

Cloud 3 3 5 4 6 3 4 4

Source: Company Data, PL Research

Sonata indicated a strong traction in Digital Services which currently accounts for

31% of total revenues. Management guided that while projects tend be smaller in

size, it benefits from providing adjacent services like Integrating Digital with legacy

applications, etc.

“Yeah absolutely, I think, while digital is a great way to enter, there is obviously

there are a lot of scope for cross-selling other services and that's really the strategy

for us. It's not just enter through digital and stay digital, but then to see at least

get one or two service lines additional into an account and that's what we are

doing and then again actually we are investing a lot more on that in terms of more

dedicated kind of a client champion and how do we want to get in, what can we do

with these accounts, so that's something we are focusing on a lot more now this

quarter onwards” Mr Srikar Reddy in Q1FY16 concall.

July 11, 2017 12

Sonata Software

Focus remains on new logo wins

As with the case of small and midsized vendors, Sonata Software derives a higher

proportion of revenues from top 10 clients. As on Q4FY17, revenues from top 10

clients contributed 70% to the total revenues. Management indicated cross-selling

additional services to top 10 accounts to improve revenue stability. Revenues from

Top 10 accounts have grown at 9.4% CAGR over FY15-FY17. Key clients which are

within the Top 10 accounts are TUI, Microsoft, PennyMac etc.

Exhibit 12: % of revenues derived from top 10 clients for the IT services business

76 75

74 73 73

72 72 72

72 71

70 70 70 70

70

68 67

66

64

62

2QFY15

3QFY15

4QFY15

2QFY16

3QFY16

1QFY17

2QFY17

3QFY17

1QFY15

1QFY16

4QFY16

4QFY17

Source: Company Data, PL Research

Sonata has seen a steady rise in number of accounts contributing to annual revenues

of US$1mn per year (21 accounts in Q4FY17). We believe that further client mining

initiatives in these accounts would be aiding incremental growth. Management

indicated of beefing client partners to focus on these key accounts.

Exhibit 13: Number of clients contributing to US$1mn per year

21.5 21 21 21 21 21

21

20.5 20 20 20

20

19.5 19 19

19

18.5 18 18

18

17.5

17

16.5

1QFY15

2QFY15

3QFY15

3QFY16

4QFY16

1QFY17

2QFY17

3QFY17

4QFY17

4QFY15

1QFY16

2QFY16

Source: Company Data, PL Research

July 11, 2017 13

Sonata Software

Aided by expansion in the sales team, Sonata has seen strong new client addition as

well. Management guided that a majority of new client wins are led by Digital

Offering (80% of our new clients wins). Sonata’s competency in IP led solutions as

well as strengths in its focus areas (Microsoft Dynamicx and SAP Hybris) are also

driving new client wins. Over the past two years, company added over 40 new

clients. While new client additions might remain strong, Sonata might also see

attrition at the tail accounts as some of the new accounts won might be for project

specific work. Management guided that over 10-15 new accounts can scale into

larger engagements. We believe mining the new accounts is the key metric to watch

over FY18-FY20 as this would aid in lowering client concentration. Our interaction

with the management indicates that Sonata’s initiatives are also focused on the

same.

Led by its focus on Digital offerings for Exhibit 14: New account additions over the past few quarters

Travel & Retail clients, Sonata software has 12

seen steady new account wins over the 10

10

past few quarters 8 8

8 7

6 6 6

6 5

4

4 3

2

2 1

0

2QFY15

3QFY15

4QFY15

2QFY16

3QFY16

1QFY17

2QFY17

3QFY17

1QFY15

1QFY16

4QFY16

4QFY17

Source: Company Data, PL Research

July 11, 2017 14

Sonata Software

Strong Hiring in Senior management to aid traction

Exhibit 15: IT Services revenues (USD mn) and YoY Growth (%)

Revenues Growth (%)

160.0 150.7 40.0%

140.0 29.5% 133.6

23.0% 121.4 30.0%

120.0 107.8

98.3 12.8% 20.0%

100.0

9.0% 79.9 12.6%

80.0 9.7% 10.0%

56.6 61.7

60.0 10.0% 0.0%

40.0

-10.2% -10.0%

20.0

0.0 -20.0%

FY12 FY13 FY14 FY15 FY16 FY17 FY18E FY19E

Source: Company Data, PL Research

Mr Srikar Reddy has been the CEO of Sonata Software had seen major internal management restructuring in FY12 with Mr

Sonata Software for over six years. Most of Palem Srikar Reddy, a veteran in the company taking over as the CEO. Mr Srikar has

the turnaround in IT services business has been with Sonata since 1986, handling various functions during his tenure

been driven under his leadership (Operations, Delivery, and HR). His last role in the company was that of Chief

Operating Officer (COO) before taking over as CEO. Mr Srikar is an engineer from

REC, Tiruchirappalli, and post graduate in management from IIM, Calcutta.

Mr Srikar has undertaken various measures to revive the growth momentum.

The first major restructuring on the operations front was the exit from TUI JV in

October 2012. For FY12, TUI JV contributed 31.5% to the company’s total

revenues. The JV had a lower EBITDA margin (~5% for FY12) owing to the higher

onsite effort and onsite costs. The JV was making losses at the net level in FY12.

Sonata Software’s exit from the JV has helped improve the overall profitability.

This was visible with the steep improvement in consolidated PAT in FY13.

However, TUI Travel continues to remain a large client for the company as of

date.

Sonata ramped up its sales functions by hiring various senior resources with

strong credentials. Sonata has aggressively bolstered the front-end onsite Sales

team, Pre-Sales team and Hunters. We present some of the recent hires of

Sonata Software over the past 18 months.

July 11, 2017 15

Sonata Software

Exhibit 16: Recruits under Mr Srikar Reddy

Recruit Designation Earlier Experience Joining

Mr Om Prakash Subba Rao Head of Digital He was earlier with Accenture Feb- 2016

Mr Ranga Puranik Chief Growth Officer Head of Sales at Persistent Systems. May 2016

Mr Rajiv Puri Head of US Sales He was earlier with Mindtree in Sales Aug- 2016

Mr Tridip Saha Head of Europe Region He was earlier with CSC and Mindtree Dec- 2016

Source: Company Data, PL Research

Sonata has also increased investments in participation in Industry conferences,

events to improve its positioning and Branding. The results are visible with the

company showing a strong acceleration in IT services business. Revenues from IT

services came in at US$122mn for FY17 and registered 18.4% CAGR (FY13-FY17).

Company has set an internal target to reach revenue of US$200mn by FY20. We

believe that this is an aspirational target as it requires 18% CAGR over FY17-FY20.

July 11, 2017 16

Sonata Software

Acquisitions aimed at improving IP competencies

Sonata’s acquisition strategy has been predominantly focused on building IP and

platforms. Over the past three years, the company has done three acquisitions and

all the acquisitions were centred on boosting IP competency. With a net cash of

Rs3.1bn as on 4QFY17, we see scope for Sonata to further pursue acquisitions

targeting companies with annual revenues of US$10-15mn with niche competencies.

Exhibit 17: Acquisitions done by Sonata

Acquisition Number of

Amount Paid Annual Revenue Rationale

period employees

Strengthens the Cloud 75

Rezopia ~US$2mn ~US$3.5mn Aug-14 based Platform

offering

US$5mn 20

(US$2mn is Strengthens the

Halosys < US$1mn Aug-15

fixed and Rest Mobility offerings

is earn out)

Strengthen Microsoft ~60

IBIS US$14mn US$12mn Oct-2015 Dynamics AX IP

offerings

Source: Company Data, PL Research

Steady performance in Operating Metrics

Sonata Software has shown a solid turnaround in operating performance under the

leadership of Mr Srikar Reddy. We note that Sonata Software’s IT services segment

revenues have grown at 2.6% CQGR over the past eleven quarters. Considering the

low revenue base, we believe that Sonata has the potential to deliver accelerated

growth over FY18-FY20.

Exhibit 18: QoQ USD revenue growth of IT Services (%) Exhibit 19: IT Services EBIDTA Margins (Adjusted and reported)

8.0% 7.4% 6.8% Reoprted EBIDTA Margin Adjusted EBITDA Margins

6.0% 5.2% 5.4%

3.6% 4.0% 27.0%

4.0% 2.9% 2.5%

2.0% 1.3% 23.3%

22.0% 21.6%

0.0%0.4%

0.0% 21.7% 21.7%

17.0% 20.3% 18.4% 20.1% 18.7%

-2.0% 16.7%

18.0%

15.2% 17.4%

-4.0% -2.9% 12.0%

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

1QFY17

2QFY17

3QFY17

4QFY17

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

1QFY17

2QFY17

3QFY17

4QFY17

Source: Company Data, PL Research* Acquisitions aided growth in Source: Company Data, PL Research

3QFY16 and 4QFY16

July 11, 2017 17

Sonata Software

Exhibit 20: USD revenues of IT services business

Fig in USD mn FY12 FY13 FY14 FY15 FY16 FY17 FY18E FY19E

Revenues 56.6 61.7 79.9 98.3 107.8 121.4 133.6 150.7

Growth (%) (10.2) 9.0 29.5 23.0 9.7 12.6 10.0 12.8

Adjusted EBITDA margin (%) NA NA 16.0 21.3 19.9 17.4 17.0 17.5

Source: Company Data, PL Research

Sonata Software’s management has guided for an ambitious target of US$200mn in

revenues for IT services business by FY20. We believe that achieving this is an uphill

task at it requires 18% CAGR. However, we believe that company can comfortably

deliver 11-13% USD revenue growth over the next two- three years considering its

smaller revenue base and niche positioning.

We analyze the key competencies of Sonata which could aid revenue growth

Traction in its Niche Services (Dynamics AX, Hybris): We see Sonata’s strong

position in these service offerings aiding client recall. With demand for Omni-

Channel Commerce in Travel and Retail verticals, Sonata could enjoy new

business opportunities in developing customised solutions on Dynamics and

Hybris.

Mining the next set of accounts: Sonata has shown steady results in client

mining over the past eight quarters. Company currently has 21 accounts which

contribute to annual revenue of US$1m as of Q4FY17 (v/s 13 accounts in

Q1FY14). We note that company has strong potential for further account

mining.

Further acceleration in S&M Investments: Management indicated of continued

expansion in Sales and Marketing efforts. Sonata has increased participation in

Marketing Events for Travel and Retail verticals over the past few quarters.

IP-Led offerings and competencies in digital technologies: Sonata has invested

substantially in IP within its focused verticals both organically as well as

acquisitions. Management guided that Digital accounts for 31% of total

revenues and is seeing steady traction.

We estimate 11.5% USD revenue growth CAGR over FY17-19E as compared to 18.5%

CAGR (FY13-17). The IT Services business accounts to 32% of Sonata Software’s

revenues but contributes to 78% of PAT owing to higher EBITDA margins. We model

IT services adjusted EBIDTA margin at 17/17.4% for FY18/FY19E ( vs 17.4% for FY17).

July 11, 2017 18

Sonata Software

Product Business (Reseller): Focus on margin expansion

Sonata, through its subsidiary Sonata Information Technology (SITL) operates as a

value-added distributor for a broad range of software products and services. This

business accounts for 68% of total revenues, 27% of EBITDA and 22% of PAT for

FY17. SITL has been providing end-to-end services which include software licensing,

support, installation and implementation. Sonata has been in this business since

1986, and hence enjoys strong position in the domestic market. SITL offers services

to enterprises across verticals such as Manufacturing, Banking, Financial Services &

Insurances, Telecommunications, IT/ITES, Government, Retail and Hospitality.

Sonata increased focus on new technologies and products and has grown

substantially in the area of Cloud, Social and Analytics. Sonata has strategic

partnerships with leading technology providers which include Microsoft, SAP, Oracle

and Appcelerator. These relationships also serve as an advantage in accessing

emerging technology solutions for the company. Management indicated that despite

thin margins, the segment has a high RoCE of ~26% for FY17.

Sonata is able to garner a strong Exhibit 21: Major products distributed by Sonata Software

relationship with product companies like

Microsoft, IBM and Oracle owing to the

third party re-selling business. This helps

the company stay ahead on the technology

Source: Company Data, PL Research

Exhibit 22: Domestic products business (Revenues and Margins)

Fig in Rs mn FY11 FY12 FY13 FY14 FY15 FY16 FY17

Revenues 6,020 7,940 9,780 10,850 10,930 12,501 17,342

Growth (%) 20.4 31.9 23.1 10.9 0.7 14.4 38.7

EBITDA 175 30 223 351* 413 584 584

EBITDA Margin (%) 2.9 0.4 2.3 3.2* 3.8* 4.7 3.4

Source: Company Data, PL Research * FY14 and FY15 EBITDA for Products business includes interest on Income tax of Rs68.3mn and Rs31mn,

respectively. If we exclude this, EBITDA margins for the IT products business would be 2.6% and 3.5% respectively.

July 11, 2017 19

Sonata Software

Sonata Software’s headcount in the products business stands at 153 employees. We

note that the products business has delivered growth of 17% CAGR (FY12-FY17).

EBITDA margins for this business are at ~3% for FY17. Going forward, management

believes that focus in this segment would remain margin expansion. Management

indicated that the business is strategic in nature despite lower margin profile.

Sonata has relationship with CIOs of over 1000 firms in India due to its presence in

this business. The business also complements the OPD business of the Sonata

Software. We note that large chunk of the IT products business is from Microsoft

Products and Microsoft is also the largest client for Sonata in the OPD segment.

Exhibit 23: Number of employees on the IT product business

160 156

155 153 153

150 147

145 142

140 140

140

135

130

130

125

120

115

1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17

Source: Company Data, PL Research

We estimate the IT products business to grow at 13% CAGR over FY17-FY19E. We

also see scope for margin expansion in this business which would remain the key

focus of the management. We model EBITDA margin of the business at 3.5/3.5% for

FY18/FY19E (v/s 3% delivered in FY17).

July 11, 2017 20

Sonata Software

Growth and Margins fare well relative to Midcap peers

Exhibit 24: Organic USD revenue growth (%) of small and mid-sized IT vendors

Sonata Software Mindtree Hexaware NIIT Tech

35.0%

29.5%

30.0%

25.0% 23.0%

20.0%

15.1% 15.8% 13.2% 14.9%

15.0%

8.9% 9.0% 8.3%

10.0% 6.4% 6.0%

3.4% 4.5%

5.0% 1.5% 0.8%

0.0%

-5.0% FY14 FY15 -1.2% FY16 FY17

Source: Company Data, PL Research, Hexaware revenue growth is for CY13/CY14/CY15/CY16.

We have only mentioned the organic USD revenue growth of the companies.

Under the leadership of Mr Srikar Reddy, Sonata has delivered solid growth in FY14

and FY15 which is ahead of other midsized IT peers. However, Sonata has seen

slowdown in growth in FY16 owing to challenges in one of its large ISV client.

Hence, organic revenues for FY16 grew by a modest 6% YoY. Revenue growth

remained modest in FY17 as well with Sonata delivering ~9% organic USD Revenue

growth (~12% constant currency revenue growth) led by slowdown in Travel vertical.

We have modeled company to deliver 10/12.5% USD revenue growth in FY18/FY19

with mining of new accounts as the key driver for incremental growth.

Sonata enjoys steady EBITDA margin in the IT services business

Sonata’s Adjusted EBITDA margin for the IT services business is at ~17.4% for FY17

and is comparable with other mid-sized peers in the sector. We believe that Sonata

Software’s EBITDA margins could remain in a stable band over the next two years.

Exhibit 25: EBITDA Margins of mid-sized IT Vendors

Sonata Software Mindtree Hexaware NIIT Tech

22.4%

21.3%

24.0%

20.1%

19.9%

19.6%

22.0%

18.5%

17.8%

17.7%

17.6%

17.4%

17.4%

20.0%

17.0%

16.5%

18.0%

15.2%

14.6%

13.70%

16.0%

14.0%

12.0%

10.0%

FY14 FY15 FY16 FY17

Source: Company Data, PL Research * NIIT Tech reports hedge gains in Revenue line and hence

boosting its reported EBIDTA margin.

July 11, 2017 21

Sonata Software

Challenges: Subscale and high client concentration

Sonata’s IT services business is much smaller compared to other midsized IT vendors.

Hence, the company is subscale with competencies limited to niche offerings in

select verticals and service lines. Headcount of the company stands at ~3,350

employees as on FY17.

Exhibit 26: USD Revenues (mn) as of FY17 Exhibit 27: IT services headcount as on Q4FY17

900 18,000 16,470

780

800 16,000

700 600 14,000 12,734

600 12,000

500 411 10,000 8,853

400 8,000

300 6,000

3,366

200 121.4 4,000

100 2,000

0 -

Sonata Mindtree Hexaware NIIT Tech Sonata Mindtree Hexaware NIIT Tech

Software Software

Source: Company Data, PL Research* Hexaware revenues are for CY17E Source: Company Data, PL Research

High Client Concentration remains the biggest risk

Midsized IT vendors have a higher client concentration as compared to Tier 1 IT

vendors which derive 20-25% of their revenues from top 10 accounts. Among

Midsized IT vendors, Mindtree/Hexaware /NIIT Tech derive 45-55% of total revenues

from top 10 clients. Sonata being a smaller IT vendor has a much higher client

concentration with top 10 clients accounting to 70% of total revenues as on

Q4FY17.We believe high client concentration is the biggest risk for Sonata Software.

Exhibit 28: Revenue contribution from top 10 accounts

80%

70%

70%

60% 57%

50% 46%

42%

40%

30%

20%

10%

0%

Sonata Software Mindtree Hexaware NIIT Tech

Source: Company Data, PL Research

July 11, 2017 22

Sonata Software

Financial Analysis

Revenue growth: Expect Consolidated Revenue Growth CAGR of 13% over FY17-FY19E

Exhibit 29: Summary of revenue and revenue growth for Sonata

Rs mn FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18E FY19E

Services 2,250 2,986 2,800 3,353 4,835 6,068 7,068 8,153 8,816 9,944

Growth (%) (0.8) 32.7 (6.2) 19.8 44.2 25.5 16.5 15.4 8.1 12.8

Products 5,000 6,021 7,940 9,777 10,847 10,926 12,501 17,342 19,389 22,136

Growth (21.7) 20.4 31.9 23.1 10.9 0.7 14.4 38.7 11.8 14.2

TUI 6,680 5,039 4,948

Growth (9.4) (24.6) (1.8)

Total Revenues 13,930 14,046 15,688 13,130 15,682 16,994 19,569 25,495 28,205 32,079

Growth (13.0) 0.8 11.7 (16.3) 19.4 8.4 15.2 30.3 10.6 13.7

As a % of revenues

Services 16.2 21.3 17.8 25.5 30.8 35.7 36.1 32.0 31.3 31.0

Products 35.9 42.9 50.6 74.5 69.2 64.3 63.9 68.0 68.7 69.0

TUI 48.0 35.9 31.5 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Source: Company Data, PL Research

Exit from TUI JV in FY12 was a strategic positive move: In FY06, Sonata Software

entered into JV with TUI by paying Euro18mn to buy 50.01% stake in TUI Info Tek.

TUI Info Tek was a subsidiary of TUI AG, a Germany-based Leisure Travel group. TUI

Info Tek provided IT services to the parent company as well as other clients in the

Travel sector. However, owing to the higher onsite effort, the JV’s performance has

been volatile on the revenue as well as margins. Sonata Software exited TUI Info Tek

JV in October 2012 by selling its 50.01% stake to TUI Travel PLC. Although the JV

contributed 31.5% to total revenues in FY12, it was making losses at the net level in

FY12. Sonata has taken a hit of Rs580mn which led to the company reporting an

overall loss in FY13.

Steady growth over FY17-FY19E: Post this exit, Sonata Software streamlined its

focus on International IT services which led to steady acceleration in the segment’s

growth. We expect IT services to continue contributing ~30-32% to the company’s

total revenues. We model revenues from IT services USD revenues to grow at 11.5%

CAGR over FY17-FY19E. Domestic IT products business currently accounts for the

lion’s share of revenues (~68% for FY17). We expect this division to show moderate

growth (13% CAGR over FY17-FY19E). Management guided that for the products

business, the focus would be on operating metrics like EBITDA margin, working

capital cycle and ROCE. We expect overall consolidated revenues to grow at 13%

CAGR over FY17-FY19E.

July 11, 2017 23

Sonata Software

EBITDA margin expected to remain stable over FY17-FY19E

Sonata’s adjusted EBITDA Margin for IT Exhibit 30: IT Services EBITDA Margins (Reported and Adjusted)

service segment is ~17.5% for FY17. This is

Reoprted EBIDTA Margin Adjusted EBITDA Margins

in line with select Midcap vendors

26.5%

26.9%

25.5%

26.3%

29.0%

25.4%

24.4%

24.2%

23.9%

23.3%

27.0%

23.2%

23.3%

22.5%

21.8%

21.7%

21.6%

21.7%

25.0%

20.3%

20.1%

23.0%

18.7%

18.0%

18.4%

17.4%

21.0%

16.7%

19.0%

15.2%

17.0%

15.0%

13.0%

1QFY15

3QFY15

4QFY15

1QFY16

2QFY16

4QFY16

1QFY17

2QFY17

3QFY17

2QFY15

3QFY16

4QFY17

Source: Company Data, PL Research

IT services:. Though reported EBITDA margins stand at ~22.7% for the IT services

business, we note that adjusted EBITDA margin stands at 17.4% for FY17. The higher

reported segmental EBITDA margin for IT services is owing to company reporting

interest income and Forex gains from hedging in the IT Services segmental margin.

Domestic products: Due to the trading nature of this business, Sonata has muted

EBITDA margins in the products business. As of FY17, the domestic products business

has ~3.5% EBITDA margin. Management guided that focus would remain on gradual

margin expansion in this business as well. This would be driven by focussing on new

technologies like cloud, security offerings etc.

Exhibit 31: EBITDA margins of Sonata Software

Adjusted EBITDA ( Rs mn) FY14 FY15 FY16 FY17 FY18E FY19E

IT Services 773 1,294 1,406 1,415 1,491 1,697

IT Products 280 383 547 517 679 775

Total Adjusted EBITDA 1,053 1,677 1,954 1,931 2,170 2,471

Adjusted IT services EBITDA margin (%) 16.0% 21.3% 19.9% 17.4% 17.0% 17.5%

Adjusted IT products EBITDA margin (%) 2.6% 3.5% 4.4% 3.0% 3.5% 3.5%

Overall EBITDA margin (%) 6.7% 9.9% 10.0% 7.6% 7.7% 7.7%

Source: Company Data, PL Research

We expect consolidated EBIDTA margin to remain in a narrow band and model

overall consolidated EBIDTA margin at 7.7/7.7% for FY18/FY19E ( vs 7.6% in FY17)

July 11, 2017 24

Sonata Software

Steady FCF generation aids strong payout ratios

Sonata Software’s cash flow generation remained volatile owing to fluctuations in

working capital cycle as well as capital expenditure. The company had negative free

cash flow in FY12 due to higher capital expenditure. Over the past few years, the

company has shifted to a leased model which has substantially reduced the capital

expenditure. Hence, company has shown steady improvement in free cash flow

trajectory over the past few years.

Exhibit 32: Consolidated Cash Flow

Fig in Rs mn FY12 FY13 FY14 FY15 FY16 FY17P FY18E FY19E

Operating Cash Flow 374 458 1269 768 1581 1479 848 1457

Capex 681.4 19 39 59 144 250 150 200

Acquisition 82 704

Capex+ Acquisitions 681.4 19.3 39.4 140.1 848 250 150 200

FCF (307) 439 1,229 627 733 1,229 698 1,257

FCF/EBITDA -63.2% 82.3% 117.9% 37.4% 37.5% 63.6% 32.0% 49.9%

Net Cash on Balance sheet 799 1405 2387 2375 1600 2131 1946 2189

Net cash per share 7.6 13.4 22.7 22.6 15.2 20.3 18.5 20.8

Net cash per share as a % of Mcap 5.1% 8.9% 15.1% 15.1% 10.1% 13.5% 12.3% 13.9%

ROE(%) 6.5% 8.4% 19.7% 32.5% 34.5% 31.3% 30.3% 31.3%

Source: Company Data, PL Research

Sonata Software has delivered a steady dividend payout ratio over the past six years.

For FY17, the company paid a total dividend of Rs9/sh (5.5% dividend yield).

Management guided for intent to maintain the pay-out ratio at ~50% of profits. The

company has a strong cash position, with net cash of Rs3.1bn on the balance sheet

as on Q4FY17. Debtor days remain moderate which is another key positive. Aided by

improvement in margins as well as strong dividend payout ratio, Sonata Software

has shown steady expansion in RoE, which is a key positive.

July 11, 2017 25

Sonata Software

Exhibit 33: DPS of Sonata (Rs) Exhibit 34: Dividend payout ratio (%) ( Excluding dividend tax)

12.0 64.0%

10.5

10.0 9.0 9.0 9.3 62.0% 61.3% 61.0% 61.5%

60.0% 60.0%

60.0%

8.0 7.0

58.0% 56.4%

6.0 55.9%

3.7 56.0%

4.0

54.0%

1.8

2.0 0.8 52.0%

0.0 50.0%

FY12 FY13 FY14 FY15 FY16 FY17 FY18E FY19E FY13 FY14 FY15 FY16 FY17 FY18E FY19E

Source: Company Data, PL Research Source: Company Data, PL Research

Exhibit 35: Debtor days

DSO 1QFY15 2QFY15 3QFY15 4QFY15 1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17

International Services 71 59 56 61 55 58 52 55 60 60 48 53

Domestic Products 40 85 82 79 76 101 65 62 59 102 90 73

Total Debtor Days 51 76 74 72 70 84 61 60 60 85 77 68

Source: Company Data, PL Research

July 11, 2017 26

Sonata Software

Valuation and View

Sonata Software IT services revenues came in at US$122m for FY17, delivering 18.4%

CAGR (FY13-17). We expect IT services revenues to grow at 11.5% CAGR (FY17-19E),

aided by strong traction in emerging services (Digital) as well as steady new account

wins. Owing to strong growth trajectory, steady margin and dividend, Sonata

Software can trade a respectable P/E multiples.

We study the possible target price scenarios based on sum of the parts valuation.

We assign higher P/E to the IT services earnings (11.5x FY19E EPS) and a relatively

lower P/E (7.5x FY19 EPS) to the IT products business due to the trading nature of

business and lower margins. The sum of parts yields a target price of Rs190/sh.

Exhibit 36: Sum of part valuation for Sonata (P/E multiple)

Sum of the parts FY19E Target multiple Value

IT services PAT 1,472

IT Services EPS 14.0 11.5 161.0

IT Products ( Reseller) PAT 368

IT products EPS 3.5 8.0 28

Total Target Price 190

Source: Company Data, PL Research

We have also done an EV/EBITDA-based valuation for each business (services and

products) separately. We have assigned 7.5x EV/EBITDA for the IT services business

and 5x EV/EBITDA for the IT products business. The sum of parts results in an implied

target price of Rs185/sh.

Exhibit 37: Sum of part valuation for Sonata (EV/EBITDA)

Sum of the parts ( EV/EBITDA) FY19E Target Multiple Value

IT Services Adjusted EBITDA 1,746 7.5 13,092

IT products EBITDA 775 5.5 4,261

Implied EV 17,353

Net Cash as on FY19E 2,131

Implied Mcap 19,484

Target Price 185

Source: Company Data, PL Research

July 11, 2017 27

Sonata Software

Sonata Software currently trades at 9.3x FY19E EPS. Superior dividend yield (5.5% at

CMP), Net cash of Rs 3.1bn on balance sheet (18% of Mcap), superior return ratios

(~31% for FY17) and moderate valuations lead us to initiate coverage with a ‘BUY’

with a target price of Rs200/sh (11.5x FY19E EPS).

Exhibit 38: Sonata Software’s one-year forward P/E Exhibit 39: Sonata v/s Mindtree (Discount/premium)

18 0.0%

15 -10.0%

12 -20.0%

9 -30.0%

6 -40.0%

3 -50.0%

0 -60.0%

-70.0%

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Nov-13

Nov-14

Nov-15

Nov-16

Mar-14

Mar-15

Mar-16

Mar-17

-80.0%

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Nov-13

Nov-14

Nov-15

Nov-16

Mar-14

Mar-15

Mar-16

Mar-17

P/E Mean

Mean + Std Dev Mean - Std Dev

Source: Company Data, PL Research Source: Company Data, PL Research

July 11, 2017 28

Sonata Software

Company Background

Sonata Software is a global IT services company headquartered in Bengaluru, with

presence across major markets (US, UK, Europe, APAC and Middle East). The

company operates in two major business units: International IT Services and

Domestic Products. Within International IT Services (Contributes to ~32/73/79% of

Revenues/EBIDTA/PAT for FY17), the company caters to Travel, Retail, CPG and

Product Engineering services. Sonata’s offerings span across service lines, which

include consulting, application development, testing, maintenance and

infrastructure support. Sonata, through its subsidiary, resells software products in

India. The major software products sold by the company include Microsoft, SAP,

Oracle, Abode, IBM, HP and TIBCO. This Products business accounts for 68/27/21%

of the revenues/EBIDTA/PAT. The company is co-promoted by Raheja Group, which

owns 29% stake. The company is currently headed by Mr Palem Srikar Reddy who

took over as the CEO in February 2012.

Exhibit 40: Board of Directors

Mr Pradip Shah is a non-executive Independent Director and Chairman of

Sonata. He assisted in founding HDFC in 1977 and was the founder

Chairman Managing Director of CRISIL, India’s first and largest credit rating agency.

He is also Director in BASF India Ltd., Godrej & Boyce Mfg. Ltd., Hardy Oil &

Gas Ltd. [U.K.], Kansai Nerolac Paints Ltd., Pfizer Ltd.

Mr Srikar Reddy is the MD and CEO and a Member of the Board of

Managing

Directors of Sonata Software. Srikar has an Engineering degree from REC,

Director and CEO

Tiruchirappalli and is a Post Graduate in Management from IIM Kolkata.

S. N. Talwar is a Director of Sonata. He is Director/Alternate Director of the

following public limited companies: Biocon Ltd., Blue Star Infotech Ltd.,

Director Elantas Beck India Ltd., FCI OEN Connectors Ltd., Merck Ltd., Shrenuj & Co

Ltd., Samson Maritime Ltd.He is Chairman of the Audit Committee of FCI

OEN Connectors Ltd., Merck Ltd. and Sandvik Asia Private Ltd.

Mr Brijendra Syngal is a Director of Sonata. He also sits on the Board and

Director

Committees of several listed and unlisted companies in the ICT sector.

Mr S.B. Ghia is a non-executive Promoter Director of Sonata Software. He

Non-Executive is an industrialist with interests in a variety of fields including Chemicals

Director and Consumer Food products. He is also Director in the following public

companies: Alkyl Amines Chemicals Ltd., AVT Natural Products Ltd.

Mr Viren Raheja is a non-executive Promoter Director of Sonata. He is

Non-Executive Director/Alternate Director of several companies: Asianet Satellite

promoter director Communications Ltd., Innovassynth Technologies (India) Ltd., Hathway

Cable & Datacom Ltd. and Supreme Petrochem Ltd. etc.

Non-Executive Mr Radhika Rajan is a Non-Executive Independent Director of Sonata

Independent Software. She is the Executive Vice President, DSP Investments and heads

director DSP Investments.

Source: Company Data, PL Research

July 11, 2017 29

Sonata Software

Quarterly Financials

Exhibit 41: Headcount details

Headcount 1QFY15 2QFY15 3QFY15 4QFY15 1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17

IT Services 2,575 2,746 2,837 2,896 2,889 2,908 3,139 3,111 3,144 3,147 3,161 3,213

Products 111 110 114 122 130 142 140 140 147 156 153 153

Total 2,686 2,856 2,951 3,018 3,019 3,050 3,279 3,251 3,291 3,303 3,314 3,366

Source: Company Data, PL Research

Exhibit 42: Geography Mix by revenues (%)

Geographical Mix (%) 1QFY15 2QFY15 3QFY15 4QFY15 1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17

USA 53 56 55 52 51 55 56 60 61 59 60 60

Europe incl UK 35 35 31 34 34 31 31 26 26 26 24 24

ROW 11 9 15 14 15 14 13 14 13 15 15 16

Source: Company Data, PL Research

Exhibit 43: Revenues by Delivery centers (%)

Delivery Mix (%) 1QFY16 2QFY16 3QFY16 4QFY16 1QFY17 2QFY17 3QFY17 4QFY17

Onsite 34 38 42 43 42 45 40 43

Offshore 66 62 58 57 58 55 60 57

Source: Company Data, PL Research

July 11, 2017 30

Sonata Software

Exhibit 44: Consolidated Financial model of Sonata Software

FY14 FY15 FY16 FY17P FY18E FY19E

USD revenues of IT services (USD mn) 79.9 98.3 107.8 121.4 133.6 150.7

Growth (%) 29.5% 23.0% 9.7% 12.6% 10.0% 12.8%

Average Rate (USD vs INR) 60.5 61.7 65.6 67.2 66.0 66.0

IT services Revenues (Rs mn) 4835 6068 7067.8 8153 8816 9944

Growth (%) 44.2% 25.5% 16.5% 15.4% 8.1% 12.8%

IT Products Revenues (Rs mn) 10847 10926 12501 17342 19389 22136

Growth (%) 10.9% 0.7% 14.4% 38.7% 11.8% 14.2%

Consolidated Revenues (Rs mn) 15,659 16,821 19,404 25,211 28,229 32,079

Growth (%) 19.4% 7.4% 15.4% 29.9% 12.0% 13.6%

Mix of Revenues ( As a % of Revenues)

IT Services 31% 36% 36% 32% 31% 31%

Products (Reseller of Licenses) 69% 65% 64% 69% 69% 69%

EBITDA (Rs mn)

IT Services 773 1294 1406 1415 1505 1746

IT Products 280 383 547 517 679 775

Total Adjusted EBITDA 1053 1677 1954 1931 2183 2520

Adjusted IT services EBITDA margin (%) 16.0% 21.3% 19.9% 17.4% 17.1% 17.6%

Adjusted IT products EBITDA margin (%) 2.6% 3.5% 4.4% 3.0% 3.5% 3.5%

EBITDA margin 6.7% 10.0% 9.9% 7.6% 7.8% 7.9%

PAT (Rs mn) 777 1337 1586 1537 1621 1839

APAT (Rs mn) 706 1305 1549 1460 1621 1839

Adjusted EPS 6.7 12.4 14.7 13.9 15.4 17.5

Growth (%) 135.3% 84.9% 18.7% -5.8% 11.0% 13.4%

P/E 24.0 13.0 11.3 11.1 10.5 9.3

DPS 3.7 7.0 9.0 9.0 9.3 10.5

Dividend Payout Ratio 55.8% 56.4% 62.5% 64.7% 60.0% 60.0%

Dividend Yield (%) 2.5% 4.3% 5.6% 5.6% 5.7% 6.5%

ROE (%) 19.7% 32.5% 34.5% 31.3% 30.3% 31.3%

Consolidated Balance sheet (Rs mn)

Net cash on Balance sheet 2387 2375 1600 2131 1946 2189

Net Cash per Share 22.7 22.6 15.2 20.3 18.5 20.8

Net Cash per share/Mcap 15.1% 15.1% 10.1% 13.5% 12.3% 13.9%

Consolidated cash flows (Rs mn)

Cash Flow from Operations 1269 768 1581 1479 848 1457

Capex+ Acquisition 39 140 848 250 150 200

FCF 1229 627 733 1229 698 1257

FCF/EBITDA 117.9% 37.4% 38.2% 63.9% 31.6% 49.9%

Headcount 2445 3018 3251 3366 3666 3966

Source: Company Data, PL Research

July 11, 2017 31

Sonata Software

Income Statement (Rs m) Balance Sheet Abstract (Rs m)

Y/e March 2016 2017 2018E 2019E Y/e March 2016 2017 2018E 2019E

Net Revenue 19,404 25,211 28,229 32,079 Shareholder's Funds 4,710 5,113 5,596 6,144

Software Dev. Exp. 11,600 16,477 18,152 20,256 Total Debt 1,712 1,312 1,112 912

Gross Profit 7,805 8,734 10,077 11,823 Other Liabilities 161 161 161 161

Employee Cost 4,097 4,555 5,540 6,416 Total Liabilities 6,583 6,586 6,869 7,217

Other Expenses 1,788 2,256 2,330 2,887 Net Fixed Assets 291 448 485 557

EBITDA 1,919 1,923 2,207 2,520 Goodwill 910 910 910 910

Depr. & Amortization 62 93 113 128 Investments 522 522 522 522

Net Interest (231) (201) (236) (236) Net Current Assets 4,722 4,568 4,814 5,090

Other Income 420 403 300 280 Cash & Equivalents 2,951 3,081 2,697 2,739

Profit before Tax 2,216 2,143 2,350 2,628 Other Current Assets 5,103 5,973 6,964 7,818

Total Tax 666 682 729 788 Current Liabilities 3,332 4,487 4,847 5,467

Profit after Tax 1,549 1,461 1,622 1,840 Other Assets 138 138 138 138

Ex-Od items / Min. Int. 37 77 — — Total Assets 6,583 6,586 6,869 7,217

Adj. PAT 1,586 1,538 1,622 1,840

Avg. Shares O/S (m) 105.1 105.1 105.1 105.1

EPS (Rs.) 15.1 14.6 15.4 17.5

Cash Flow Abstract (Rs m) Quarterly Financials (Rs m)

Y/e March 2016 2017 2018E 2019E Y/e March Q1FY17 Q2FY17 Q3FY17 Q4FY17

C/F from Operations 1,581 1,479 848 1,457 Net Revenue 6,778 5,224 6,126 7,083

C/F from Investing (1,319) (100) 50 20 EBITDA 439 506 536 441

C/F from Financing (297) (1,325) (1,282) (1,435) % of revenue 6.5 9.7 8.7 6.2

Inc. / Dec. in Cash (35) 54 (384) 42 Depr. & Amortization 20 22 23 29

Net Interest 42 13 24 11

Other Income 125 83 86 110

Profit before Tax 501 555 575 511

Total Tax 154 176 189 163

Profit after Tax 368 379 387 405

Adj. PAT 368 379 387 405

Source: Company Data, PL Research.

Key Financial Metrics

Y/e March 2016 2017 2018E 2019E

Growth

Revenue (%) 15.4 29.9 12.0 13.6

EBITDA (%) 14.5 0.2 14.8 14.2

PAT (%) 18.6 (3.1) 5.5 13.4

EPS (%) 137.3 (3.1) 5.5 13.4

Profitability

EBITDA Margin (%) 9.9 7.6 7.8 7.9

PAT Margin (%) 8.2 6.1 5.7 5.7

RoCE (%) 29.2 24.3 24.5 26.5

RoE (%) 35.3 31.3 30.3 31.3

Balance Sheet

Net Debt : Equity (0.3) (0.3) (0.3) (0.3)

Valuation

PER (x) 10.9 11.2 10.6 9.4

P / B (x) 3.7 3.4 3.1 2.8

EV / EBITDA (x) 8.3 8.0 7.1 6.1

EV / Sales (x) 0.8 0.6 0.6 0.5

Earnings Quality

Eff. Tax Rate 30.1 31.8 31.0 30.0

Other Inc / PBT 18.9 18.8 12.8 10.7

Source: Company Data, PL Research.

July 11, 2017 32

Sonata Software

Notes:

July 11, 2017 33

Sonata Software

Notes:

July 11, 2017 34

Sonata Software

Notes:

July 11, 2017 35

Sonata Software

Prabhudas Lilladher Pvt. Ltd.

3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai-400 018, India

Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209

Rating Distribution of Research Coverage PL’s Recommendation Nomenclature

50% BUY : Over 15% Outperformance to Sensex over 12-months

44.3%

37.7% Accumulate : Outperformance to Sensex over 12-months

40%

% of Total Coverage

Reduce : Underperformance to Sensex over 12-months

30% Sell : Over 15% underperformance to Sensex over 12-months

18.0%

20% Trading Buy : Over 10% absolute upside in 1-month

10% Trading Sell : Over 10% absolute decline in 1-month

0.0% Not Rated (NR) : No specific call on the stock

0%

BUY Accumulate Reduce Sell Under Review (UR) : Rating likely to change shortly

DISCLAIMER/DISCLOSURES

ANALYST CERTIFICATION

We/I, Mr. Madhu Babu, BTech & PG MBA, Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about the

subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

Terms & conditions and other disclosures:

Prabhudas Lilladher Pvt. Ltd, Mumbai, India (hereinafter referred to as “PL”) is engaged in the business of Stock Broking, Portfolio Manager, Depository Participant and distribution for third party financial products. PL is a

subsidiary of Prabhudas Lilladher Advisory Services Pvt Ltd. which has its various subsidiaries engaged in business of commodity broking, investment banking, financial services (margin funding) and distribution of third

party financial/other products, details in respect of which are available at www.plindia.com

This document has been prepared by the Research Division of PL and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported or copied or made available to

others without prior permission of PL. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security.

The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or completeness of the same. Neither PL nor any of its

affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made available or expressed herein or for any omission therein.

Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or otherwise of any investments will depend

upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor.

Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions of securities of companies

referred to in this report and they may have used the research material prior to publication.

PL may from time to time solicit or perform investment banking or other services for any company mentioned in this document.

PL is in the process of applying for certificate of registration as Research Analyst under Securities and Exchange Board of India (Research Analysts) Regulations, 2014

PL submits that no material disciplinary action has been taken on us by any Regulatory Authority impacting Equity Research Analysis activities.

PL or its research analysts or its associates or his relatives do not have any financial interest in the subject company.

PL or its research analysts or its associates or his relatives do not have actual/beneficial ownership of one per cent or more securities of the subject company at the end of the month immediately preceding the date of

publication of the research report.

PL or its research analysts or its associates or his relatives do not have any material conflict of interest at the time of publication of the research report.

PL or its associates might have received compensation from the subject company in the past twelve months.

PL or its associates might have managed or co-managed public offering of securities for the subject company in the past twelve months or mandated by the subject company for any other assignment in the past twelve

months.

PL or its associates might have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

PL or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve months

PL or its associates might have received any compensation or other benefits from the subject company or third party in connection with the research report.

PL encourages independence in research report preparation and strives to minimize conflict in preparation of research report. PL or its analysts did not receive any compensation or other benefits from the subject

Company or third party in connection with the preparation of the research report. PL or its Research Analysts do not have any material conflict of interest at the time of publication of this report.

It is confirmed that Mr. Madhu Babu, BTech & PG MBA, Research Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

The Research analysts for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its or their securities, and no part of his

or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report.

The research analysts for this report has not served as an officer, director or employee of the subject company PL or its research analysts have not engaged in market making activity for the subject company

Our sales people, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary to the opinions expressed herein,

and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all o

the foregoing, among other things, may give rise to real or potential conflicts of interest.

PL and its associates, their directors and employees may (a) from time to time, have a long or short position in, and buy or sell the securities of the subject company or (b) be engaged in any other transaction involving

such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company or act as an advisor or lender/borrower to the subject company or may have any

other potential conflict of interests with respect to any recommendation and other related information and opinions.

DISCLAIMER/DISCLOSURES (FOR US CLIENTS)

ANALYST CERTIFICATION

The research analysts, with respect to each issuer and its securities covered by them in this research report, certify that: All of the views expressed in this research report accurately reflect his or her or their personal

views about all of the issuers and their securities; and No part of his or her or their compensation was, is or will be directly related to the specific recommendation or views expressed in this research report

Terms & conditions and other disclosures:

This research report is a product of Prabhudas Lilladher Pvt. Ltd., which is the employer of the research analyst(s) who has prepared the research report. The research analyst(s) preparing the research report is/are

resident outside the United States (U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are not subject to supervision by a U.S. broker-dealer, and is/are not required to

satisfy the regulatory licensing requirements of FINRA or required to otherwise comply with U.S. rules or regulations regarding, among other things, communications with a subject company, public appearances and

trading securities held by a research analyst account.

This report is intended for distribution by Prabhudas Lilladher Pvt. Ltd. only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S. Securities and Exchange Act, 1934 (the Exchange Act) and

interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major Institutional Investor as specified above, then it should not act upon

this report and return the same to the sender. Further, this report may not be copied, duplicated and/or transmitted onward to any U.S. person, which is not the Major Institutional Investor.

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct certain business with Major Institutional Investors, Prabhudas

Lilladher Pvt. Ltd. has entered into an agreement with a U.S. registered broker-dealer, Marco Polo Securities Inc. ("Marco Polo").

Transactions in securities discussed in this research report should be effected through Marco Polo or another U.S. registered broker dealer.

Digitally signed by RADHAKRISHNAN SREESANKAR

July 11, 2017 RADHAKRISHNA DN: c=IN, o=Personal, cn=RADHAKRISHNAN

SREESANKAR,

serialNumber=8859da2df03122989b585ad520865a4f

36

N SREESANKAR 59be69fbc1b7ba2c5315941f987f41de,

postalCode=400104, st=MAHARASHTRA

Date: 2017.07.11 13:19:28 +05'30'

You might also like

- Relaxo Footwears Stock Update: Growth Momentum to SustainDocument3 pagesRelaxo Footwears Stock Update: Growth Momentum to SustainADNo ratings yet

- ICICI Bank Q4FY2019 Result UpdateDocument7 pagesICICI Bank Q4FY2019 Result UpdateADNo ratings yet

- Viewpoint: Natco PharmaDocument3 pagesViewpoint: Natco PharmaADNo ratings yet

- Top Equity Fund Picks for 2020Document4 pagesTop Equity Fund Picks for 2020ADNo ratings yet

- Apcotex Industries 230817 PDFDocument7 pagesApcotex Industries 230817 PDFADNo ratings yet

- Stock Update: Bajaj Finance Remains Strong PickDocument3 pagesStock Update: Bajaj Finance Remains Strong PickADNo ratings yet

- Icici Bank LTD: Operating Performance On TrackDocument6 pagesIcici Bank LTD: Operating Performance On TrackADNo ratings yet

- TTKH Angel PDFDocument14 pagesTTKH Angel PDFADNo ratings yet

- Gulf Oil Lubricants India LTD: Index DetailsDocument13 pagesGulf Oil Lubricants India LTD: Index DetailsADNo ratings yet

- Aurobindo - Pharma MOSL 261119Document6 pagesAurobindo - Pharma MOSL 261119ADNo ratings yet

- ICICI Bank Results Review Indicates Continued ProgressDocument13 pagesICICI Bank Results Review Indicates Continued ProgressPuneet367No ratings yet

- Cummins India (KKC IN) : Analyst Meet UpdateDocument5 pagesCummins India (KKC IN) : Analyst Meet UpdateADNo ratings yet

- DHFL Geo PDFDocument3 pagesDHFL Geo PDFADNo ratings yet

- Viewpoint: Godrej Agrovet (GAVL)Document3 pagesViewpoint: Godrej Agrovet (GAVL)ADNo ratings yet

- E I L (EIL) : Ngineers Ndia TDDocument8 pagesE I L (EIL) : Ngineers Ndia TDADNo ratings yet

- EngineersIndia SushilDocument23 pagesEngineersIndia SushilADNo ratings yet

- Godrej Agrovet: An Agri Giant in the MakingDocument38 pagesGodrej Agrovet: An Agri Giant in the MakingADNo ratings yet

- Godrej Agrovet: Agri Behemoth in The MakingDocument38 pagesGodrej Agrovet: Agri Behemoth in The MakingADNo ratings yet

- Cyient LTD.: Q1FY20: Weak Quarter, Lack VisibilityDocument7 pagesCyient LTD.: Q1FY20: Weak Quarter, Lack VisibilityADNo ratings yet