Professional Documents

Culture Documents

Portfolio Update - November 2018

Uploaded by

FinnCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Portfolio Update - November 2018

Uploaded by

FinnCopyright:

Available Formats

Portfolio Update

November 2018

Author: Aman Regmi

December 10th, 2018

York Trading Club Page !1 of !5

Important Information

This report is a monthly update on the performance of York Trading Club’s Long Equity Fund. York

Trading Club is a ratified student club at York University. We prepared this document to offer

investment insights and promote awareness in the fields of finance and investments.

Investing in the types of equities referred to in this report involves various types of risks, including

loss of capital, illiquidity, lack of dividends, and dilution. For more information on the risks of

investing, please read our disclaimer.

The performance statistics stated in this report refer to the past, and past performance is not a

reliable indicator of future results. All of our returns reflect returns from our paper trading activities,

which means that while they show the notional performance of investments based on market activity,

they do not necessarily reflect the cash returns that could be achieved if the relevant financial

instruments were traded.

All tax treatment referred to in this report depends on individual circumstances and may be subject

to change in the future.

York Trading Club does not provide legal, financial, or tax advice of any kind, and this particular report

is for informational and educational purposes only. This update does not intend and should not serve

as legal, financial, or tax advice. If you have any questions with respect to legal, financial or tax

matters, you should consult a professional advisor.

York Trading Club Page !2 of !5

Investment Overview &

Performance

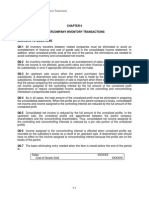

Company Market Price (Nov Price (Nov

Symbol Exchange Sector P/L % P/L $

Name Value 1) 30)

Loblaw

L Compani TSX Food- $12,258.00 $52.90 $61.29 15.86% $1678.00

es Ltd. Retail

Retail-

BBY Best Buy NYSE Consum $4,426.35 $72.99 $64.15 (12.11%) ($609.96)

Inc. er

Internati Paper

IP onal NYSE and $4,942.33 $46.48 $46.19 (0.62%) ($31.03)

Papers Related

Products

Floor &

FND Decor NYSE Consum $6,626.00 $32.93 $33.13 0.61% $40.00

Holdings er

S&P 500

SPY ETF NYSE ETF $38,596.60 $280.48 $275.69 (1.71%) ($670.60)

Cash $33,557.13

Total Portfolio Value $100,406.41 Monthly Return 0.41%

Portfolio Profit/Loss $406.41 Annualized Return 5.03%

This past of November was a crucial month for the

financial markets. With market corrections

throughout October, an overall weak earnings

season, and Fed rate hikes scheduled for 2019, the

market dropped significantly. In fact, the correction

###

was the largest of its kind since 2016.

Our long equity fund went live on November 1, 2018;

thus, this is the first month of testing for our

investing strategy. Our strategy is to focus on a

short-term trading horizon, thus we trade based on

event-driven plays and earnings. Over the past

month, our fund has accumulated a total gain of

0.41%. This provides an annualized return of 5.03%.

Over the month of November, the S&P 500 has lost

close to 1% translating to our fund outperforming

the market by 1.6%.

York Trading Club Page !3 of !5

Our fund’s strong performance through a very dreading month in the markets can be credited to the

performance of Loblaw Companies Limited (TSX: L) which has gained 16% within November only.

Loblaw appreciated on strong earnings, and its guidance was increased by management for the

holiday season. Additionally, a delayed but successful spin-off of Loblaw’s Choice Properties REIT

(TSX: CHP-UN) contributed to the appreciation in Loblaw’s stock price. The spin-off is seen as a

catalyst for the company as it provides tax benefits to both investors and the parent company George

Weston Limited. Loblaw has a portfolio allocation of 12% (See new positions’ table). Best Buy Co.

(NYSE: BBY) on the other hand is our least profitable position sitting at a 12% loss.

Despite beating earnings after we entered this position, Best Buy’s stock has received negativity due

to the uncertain retail environment and increased competition in the e-commerce business from

Amazon. Going forward, it is important to note that Amazon alone cannot fill the demand of the

consumer electronics sector. With 18% higher Black Friday foot traffic, Best Buy is signalling a bullish

case. Our position in International Papers (NYSE: IP) has not experienced much volatility, sitting at a

0.62% loss for the month. We also have a large position in the S&P 500 ETF (NYSE: SPY) and a small

position in Floor and Decor Holdings (NYSE:FND) which have been stagnant.

Closed Positions

Company Market Entry

Symbol Exchange Sector Exit Price P/L % P/L $

Name Value Price

Arrowhe Medical

ad -

ARWR Pharmac NASDAQ Biomedi $2,770.00 $14.61 $13.85 (5.20%) ($76.00)

enticals cal

Genetics

On the other hand, we exited our position in Arrowhead Pharmaceuticals (NASDAQ:ARWR) during this

month. The reason for the exit was that a stop-loss was triggered. This position intended to profit

from Arrowhead’s announcement on its liver medication trial results. The trial was successful as

expected; however, due to the timing of the trial in the midst of market corrections and panicked

investors, the stock saw a temporary decline. Going into this trade, our investments team was firm on

a 5% stop loss to ensure a proper risk management protocol. Due to the risks involved in this trading

strategy, we only dedicated 3% of our portfolio into this trade, and therefore have successfully

generated alpha for the month of November.

York Trading Club Page !4 of !5

New Positions

Company Portfolio

Symbol Exchange Sector Market Value Entry Price

Name Allocation

Loblaw

L Companies TSX Food - Retail $12,258.00 $52.90 12.21%

Ltd.

Best Buy Retail -

BBY Inc. NYSE Consumer $4,426.35 $72.99 4.41%

Paper and

IP International NYSE related $4,942.33 $46.48 4.92%

Papers products

Arrowhead Medical -

ARWR Pharmacenti NASDAQ Biomedical $2,770.00 $14.61 2.76%

cals Genetics

Floor &

FND Decor NYSE Consumer $6,626.00 $32.93 6.60%

Holdings

SPY S&P 500 ETF NYSE ETF $38,596.00 $280.48 38.44%

November being our equity fund’s first month of trading, we opened several new positions

throughout the month. After a downtrend throughout October in the stock price of Loblaw

Companies Ltd. (TSE:L), we decided to open a long position in the retail giant. We simply believe that

the market had an overreaction over Loblaw’s failed attempt to spin off its Choice Properties REIT

followed by an analyst downgrade. Further, we opened a long position in Arrowhead Pharmaceuticals

(NASDAQ:ARWR). We carefully analyzed pending patents of ARWR under careful review from the FDA

which were due for announcements in late November. As mentioned earlier, this position has been

closed. Our associate team also pitched several other investment ideas including Best Buy Co.

(NYSE:BBY), International Papers (NYSE:IP) and Floor and Decor Holdings (FND) which were added to

the portfolio.

Disclaimer: all information present in this report is for educational and informational purpose only and without warranty of any kind. All

information present in this report represents only the opinion of the writers, which may be influenced by various factors. You are advised to

conduct your independent research and invest responsibly. Investing in markets may not be suitable for all investors, and investing in the

stock market has risks, with the possibility in which you could lose all your investment. Before making your investment decision, please

consult with your financial advisor. York Trading Club is not responsible for your losses, financial or otherwise, as a result of making

investment decisions.

Charts produced with TradingView. York Trading Club © 2018, All Rights Reserved.

Follow York Trading Club on Facebook for the latest updates.

York Trading Club Page !5 of !5

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Fair Value MeasurementDocument2 pagesFair Value Measurementbkoi buildersNo ratings yet

- Investing For Beginners: How To Read A Stock Chart: Chris MullerDocument54 pagesInvesting For Beginners: How To Read A Stock Chart: Chris MullerPANKAJ SHUKLA100% (2)

- Advanced Accounting Hoyle 12th Edition Test BankDocument8 pagesAdvanced Accounting Hoyle 12th Edition Test BankNicholas Becerra100% (33)

- ICAP CMA Paper March 2016Document5 pagesICAP CMA Paper March 2016CA Instructor100% (1)

- Multinational Accounting: Foreign Currency Transactions and Financial InstrumentsDocument88 pagesMultinational Accounting: Foreign Currency Transactions and Financial InstrumentsVitaNo ratings yet

- Solvency Ratios: Solvency Ratios Come in A Variety of FormsDocument3 pagesSolvency Ratios: Solvency Ratios Come in A Variety of FormssanskritiNo ratings yet

- Class 5 - JournalDocument17 pagesClass 5 - Journal04shubhgoelNo ratings yet

- Week 4 PDF FreeDocument5 pagesWeek 4 PDF FreeM. Gibran KhalilNo ratings yet

- Flash Memory, IncDocument16 pagesFlash Memory, Inckiller drama67% (3)

- Asset ValuationDocument3 pagesAsset ValuationHassanRana0% (1)

- Ppt-W7-S11-Finc6046-Cost of Capital-R0Document34 pagesPpt-W7-S11-Finc6046-Cost of Capital-R0Atikah LiviaNo ratings yet

- E-Cell 2022-23Document8 pagesE-Cell 2022-23divyansh thakreNo ratings yet

- Annual Report - 2020 - Linde Bangladesh BOCDocument90 pagesAnnual Report - 2020 - Linde Bangladesh BOCAtiqul islamNo ratings yet

- 9706 Accounts Nov 08 p4Document8 pages9706 Accounts Nov 08 p4hiraashrafNo ratings yet

- Chapter 1Document95 pagesChapter 1Quỳnh Chi NguyễnNo ratings yet

- Akuntansi Keuangan Lanjutan - Chap 011Document38 pagesAkuntansi Keuangan Lanjutan - Chap 011Gugat jelang romadhonNo ratings yet

- Ch11 P18 Build A ModelDocument10 pagesCh11 P18 Build A ModelAshish Bhalla0% (4)

- Benefit-Cost Analysis: Financial and Economic Appraisal Using SpreadsheetsDocument6 pagesBenefit-Cost Analysis: Financial and Economic Appraisal Using SpreadsheetsrodskogjNo ratings yet

- HDFC Small Cap Fund - Presentation - April 23Document30 pagesHDFC Small Cap Fund - Presentation - April 23Niks MystryNo ratings yet

- 676254Document89 pages676254Shofiana IfadaNo ratings yet

- The Buffettology WorkbookDocument6 pagesThe Buffettology WorkbookSimon and Schuster25% (4)

- Transaction AssumptionsDocument21 pagesTransaction AssumptionsSuresh PandaNo ratings yet

- MKTG 6th Edition Lamb Solutions ManualDocument35 pagesMKTG 6th Edition Lamb Solutions Manualscumberuncle3e1jw2100% (22)

- Business Management: Chapter 5Document24 pagesBusiness Management: Chapter 5Javier BallesterosNo ratings yet

- Review 105 - Day 4 Theory of AccountsDocument13 pagesReview 105 - Day 4 Theory of Accountschristine anglaNo ratings yet

- Chap5 Cost of CapitalDocument38 pagesChap5 Cost of CapitalIzzy BNo ratings yet

- Mining Finance Interview QuestionsDocument17 pagesMining Finance Interview QuestionsIshanSaneNo ratings yet

- Mark 0n Mark Up Mark Down BUS - Math WEEK5 Q1Document43 pagesMark 0n Mark Up Mark Down BUS - Math WEEK5 Q1seanraye.baldaenNo ratings yet

- Unit 6 Venture CapitalDocument39 pagesUnit 6 Venture CapitalNtinginya Iddi rajabuNo ratings yet

- PT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsDocument2 pagesPT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsAgil MahendraNo ratings yet