Professional Documents

Culture Documents

Scope Ratings European Airlines 2019 - Jan

Uploaded by

TatianaOriginal Title

Copyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Scope Ratings European Airlines 2019 - Jan

Uploaded by

TatianaCopyright:

European

22 January 2019 airlines Corporates

EuropeanEurope’s top five airlines carried more than half of Europe’s passengers in

airlines

2018

Europe’s top five airlines carried more than

half of Europe’s passengers in 2018

Europe’s top five airlines crossed the 50% threshold in their combined share of the

region’s passenger traffic in 2018 as low prices and overcapacity put smaller

Analysts

carriers under intense financial pressure, often forcing them out of business.

Sebastian Zank, CFA

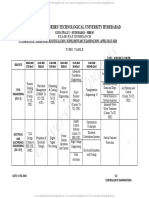

Figure 1: Overview of major consolidation activities of European airlines

+49 30 27891 225

F

s.zank@scoperatings.com

M

Werner Stäblein

?

+49 69 6677389 12

M A A A w.staeblein@scoperatings.com

Azza Chammem

+49 30 27891 240

a.chammem@scoperatings.com

A F F A

Media

Matthew Curtin

A F A

+33 6 22763078

m.curtin@scoperatings.com

A

A A B Related Research

Flight paths diverge as smaller

carriers face credit squeeze,

A A A A Nov 2018

Europe’s airlines brace for more

consolidation, Jun 2018

Trump Tax Reform to Spur

? Competition on Transatlantic

A

Routes, Feb 2018

European Airlines - Growing

A Need for Consolidation?,

Sep 2017

A

A A

Scope Ratings GmbH

Lennéstraße 5

10785 Berlin

Phone +49 30 27891 0

Fax +49 30 27891 100

info@scoperatings.com

www.scoperatings.com

2001 2003 2005 2007 2009 2011 2013 2015 2017 2019

Key A Acquisition M Merger B Breakup F Failed transaction Default Bloomberg: SCOP

Source: Scope Ratings based on market information

22 January 2019 1/4

European airlines

Europe’s top five airlines carried more than half of Europe’s passengers in

2018

Lufthansa leads gains in market share among large airlines

TOP5 airlines increased According to Scope’s calculations, Lufthansa Group (rated BBB-/Positive at Scope) has

European market share from taken the biggest extra slice of the market, growing its share by 1.6pp to an estimated

48% to 51%

12.3% in 2018 against 2016 (142m passengers in 2018), taking it ahead of Ryanair’s

12% share, International Consolidated Airlines Group’s 9.8%, Air France-KLM with 8.8%

and easyJet with 7.7%.

While the European airline sector remains fragmented – other airlines retain 49.4% of the

market – the larger carriers have filled the gaps left by the exit of the likes of Monarch,

Primera, Small Planet, Azur, Cobalt, VLM, PrivatAir among others in the past two years.

The near-collapse and rescue of budget airline Germania illustrates how smaller carriers

remain under pressure this year (see also Scope’s 2019 outlook on European airlines:

Flight paths diverge as smaller carriers face credit squeeze, Nov 2018).

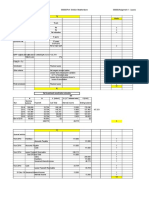

Figure 2: Market share gains of major European carriers

2016 Lufthansa 2018E

Lufthansa

Group Group

10.7% 12.3%

Ryanair

11.4% Ryanair

12.0%

Others

Others 49.4%

IAG

51.9%

9.8% IAG

9.8%

AF-KLM

9.1% AF-KLM

easyjet easyjet 8.8%

7.2% 7.7%

Source: companies, ACI Europe, Scope

Despite the fragmented nature, as measured by overall market share, some airlines still

benefit from favourable market structures. IATA reported in June 2018 that the number of

routes served by two and more airlines has increased to 30% between 2010 and 2017,

up 5 percentage points since 2010. At the first sight, this would point to increasing

competition but at the same time it confirms that 70% of all routes and connections are

still monopolistic/duopolistic with the resulting benefits for those carriers that serve these

connections.

Fate of Flybe, Alitalia and Adria Some medium-sized airlines have also succumbed to market pressures, again to the

Airways still uncertain benefit of larger airlines. Lufthansa Group and easyjet picked up the assets of insolvent

Air Berlin (2016 market share of 2.8%). IAG has already acquired landing slots from

Britain’s Flybe, the regional carrier which is up for sale. It remains to be seen whether

Flybe will eventually be sold to the newly formed consortium of Virgin Atlantic, Stobart

Group and Cyrus Capital under the name Connect Airways. The future of Slovenia’s

Adria Airways remains in the hands of the Civil Aviation Agency. And the fate of Alitalia,

Italy’s bankrupt flag carrier, might soon be decided too as the airline looks for a suitor. On

numerous occasions, Lufthansa has communicated not to be interested in Alitalia if the

Italian carrier was to become a (partly) government-owned entity. The most recent of the

many rumours that were spread over the past two year around the fate of Alitalia is an

alleged interest of Delta Airlines Alitalia’s long-haul business.

22 January 2019 2/4

European airlines

Europe’s top five airlines carried more than half of Europe’s passengers in

2018

Some player can afford it to play Scope believes that the shake-out will continue as long as interest rates remain cheap

the game tougher than others and the larger – more creditworthy – airlines can benefit from their better cost profiles and

the financial strength to fund the buyout of bankrupt entities. Small airlines cannot pass

on increased costs – from rising jet-fuel prices, US dollar appreciation, higher wages

costs, airport charges and passenger reimbursements – as easily as the large carriers.

Dominating airlines may not fully What becomes an existential question for some smaller airlines may only be a temporary

pass on increased cost base sacrifice of profitability for the larger operators such as Ryanair, Wizzair, easyjet or

Lufthansa which can easily afford to give up some percentage points in profitability by not

raising air fares for customers, thereby securing a competitive edge. Ryanair, for

example, has reported a reduction in its EBITDAR margin to a still healthy 36% -

excluding the negative effect from Laudamotion – in the first half of its business year

2018/19 against 41% in the period a year earlier, at an unchanged passenger load factor

and even reduced average air fares. This one reason why we believe the gap in the

creditworthiness of larger airline operators and smaller carriers is set to widen further.

22 January 2019 3/4

European airlines

Europe’s top five airlines carried more than half of Europe’s passengers in

2018

Scope Ratings GmbH

Headquarters Berlin Frankfurt am Main Paris

Lennéstraße 5 Neue Mainzer Straße 66-68 1 Cour du Havre

D-10785 Berlin D-60311 Frankfurt am Main F-75008 Paris

Phone +49 30 27891 0 Phone +49 69 66 77 389 0 Phone +33 1 8288 5557

London Madrid Milan

Suite 301 Paseo de la Castellana 95 Via Paleocapa 7

2 Angel Square Edificio Torre Europa IT-20121 Milan

London EC1V 1NY E-28046 Madrid

Phone +44 203-457 0 4444 Phone +34 914 186 973 Phone +39 02 30315 814

Oslo

Haakon VII's gate 6

N-0161 Oslo

Phone +47 21 62 31 42

info@scoperatings.com

www.scoperatings.com

Disclaimer

© 2019 Scope SE & Co. KGaA and all its subsidiaries including Scope Ratings GmbH, Scope Analysis, Scope Investor Services

GmbH (collectively, Scope). All rights reserved. The information and data supporting Scope’s ratings, rating reports, rating

opinions and related research and credit opinions originate from sources Scope considers to be reliable and accurate. Scope

cannot, however, independently verify the reliability and accuracy of the information and data. Scope’s ratings, rating reports,

rating opinions, or related research and credit opinions are provided “as is” without any representation or warranty of any kind. In

no circumstance shall Scope or its directors, officers, employees and other representatives be liable to any party for any direct,

indirect, incidental or otherwise damages, expenses of any kind, or losses arising from any use of Scope’s ratings, rating

reports, rating opinions, related research or credit opinions. Ratings and other related credit opinions issued by Scope are, and

have to be viewed by any party, as opinions on relative credit risk and not as a statement of fact or recommendation to

purchase, hold or sell securities. Past performance does not necessarily predict future results. Any report issued by Scope is not

a prospectus or similar document related to a debt security or issuing entity. Scope issues credit ratings and related research

and opinions with the understanding and expectation that parties using them will assess independently the suitability of each

security for investment or transaction purposes. Scope’s credit ratings address relative credit risk, they do not address other

risks such as market, liquidity, legal, or volatility. The information and data included herein is protected by copyright and other

laws. To reproduce, transmit, transfer, disseminate, translate, resell, or store for subsequent use for any such purpose the

information and data contained herein, contact Scope Ratings GmbH at Lennéstraße 5, D-10785 Berlin.

Scope Ratings GmbH, Lennéstraße 5, 10785 Berlin, District Court for Berlin (Charlottenburg) HRB 192993 B, Managing

Director: Torsten Hinrichs.

22 January 2019 4/4

You might also like

- Hamriyah Independent Power Plant (IPP) Project: Stakeholder Engagement Plan (SEP)Document28 pagesHamriyah Independent Power Plant (IPP) Project: Stakeholder Engagement Plan (SEP)FAREEDNo ratings yet

- Global Airlines: Procurement Partnerships Coming CloserDocument14 pagesGlobal Airlines: Procurement Partnerships Coming CloserSangwoo KimNo ratings yet

- MAS Restructuring: Airline Needs Tough Decisions to Survive, Including Section 176 Bankruptcy ProtectionDocument2 pagesMAS Restructuring: Airline Needs Tough Decisions to Survive, Including Section 176 Bankruptcy ProtectionRinder SidhuNo ratings yet

- Business Plan Proposal For Launch of Airline Business-KSDocument37 pagesBusiness Plan Proposal For Launch of Airline Business-KSshahzaibNo ratings yet

- TheSun 2008-11-24 Page17 Slump in Europe Spreads WiderDocument1 pageTheSun 2008-11-24 Page17 Slump in Europe Spreads WiderImpulsive collectorNo ratings yet

- Companies PHDocument22 pagesCompanies PHMicah SevillaNo ratings yet

- Sector Update India Cement April 2018Document120 pagesSector Update India Cement April 2018Vivek PatidarNo ratings yet

- CS-2 Standards Battle - Which Automotive Technology Will WinDocument2 pagesCS-2 Standards Battle - Which Automotive Technology Will Winemail bukaNo ratings yet

- Samsung Motors - Case Study by Woonghee Lee and Nam S. LeeDocument17 pagesSamsung Motors - Case Study by Woonghee Lee and Nam S. Leenaikintu9818No ratings yet

- Political Correction: Top Areas of Concern Regarding Geopolitical RiskDocument1 pagePolitical Correction: Top Areas of Concern Regarding Geopolitical RiskcoloradoresourcesNo ratings yet

- Research 060918 PDFDocument32 pagesResearch 060918 PDFAnonymous oZ3csfNo ratings yet

- Merger Market League Tables Financial Advisers Q3 2009 (Read in "Fullscreen")Document37 pagesMerger Market League Tables Financial Advisers Q3 2009 (Read in "Fullscreen")DealBook100% (2)

- Samsung Motors - CaseDocument17 pagesSamsung Motors - Casenaikintu9818No ratings yet

- SAIC Case PresentationDocument5 pagesSAIC Case PresentationRichard HudsonNo ratings yet

- Untitled NotebookDocument3 pagesUntitled Notebookelatalu7No ratings yet

- University Updates: Jawaharlal Nehru Technological University HyderabadDocument11 pagesUniversity Updates: Jawaharlal Nehru Technological University HyderabadSandeep Reddy SamaNo ratings yet

- Midnapore College (Autonomous) (Affiliated To Vidyasagar University) Result of Ese of Semester-Iii, 2019 (Ug) Subject - Chemistry (Hons.)Document3 pagesMidnapore College (Autonomous) (Affiliated To Vidyasagar University) Result of Ese of Semester-Iii, 2019 (Ug) Subject - Chemistry (Hons.)MaitraNo ratings yet

- Asia Business Jet Fleet Report 2020Document60 pagesAsia Business Jet Fleet Report 2020Atiesh MishraNo ratings yet

- Asia Business Jet Fleet Report 2019Document60 pagesAsia Business Jet Fleet Report 2019Atiesh MishraNo ratings yet

- Best Available Technology (BAT) Report: Hamriyah IPP Sharjah UAEDocument21 pagesBest Available Technology (BAT) Report: Hamriyah IPP Sharjah UAE1hass1No ratings yet

- Driving Volkswagen AG into the future: Strategy 2025Document164 pagesDriving Volkswagen AG into the future: Strategy 2025Achmad Rifaie de JongNo ratings yet

- SMP N 2 Satu Atap Salak Daftar Hadir Guru September 2017Document139 pagesSMP N 2 Satu Atap Salak Daftar Hadir Guru September 2017Mawar AprilNo ratings yet

- Wallstreetjournaleurope 20151224 The Wall Street Journal EuropeDocument20 pagesWallstreetjournaleurope 20151224 The Wall Street Journal EuropestefanoNo ratings yet

- Economic Contribution of The Automotive Industry To The U.S. Economy - An UpdateDocument47 pagesEconomic Contribution of The Automotive Industry To The U.S. Economy - An Updatemohamedthameem6316No ratings yet

- 3M Equity ResearchDocument63 pages3M Equity ResearchKai YangNo ratings yet

- 2 Kasus SouthwestDocument9 pages2 Kasus SouthwestFitri AriantiNo ratings yet

- Paper 21Document7 pagesPaper 21Mai ZhangNo ratings yet

- A Level Exam Practice Case StudiesDocument5 pagesA Level Exam Practice Case Studiesmudassir karnolwalNo ratings yet

- The Future of Chemical Engineering: Where is the Industry HeadedDocument4 pagesThe Future of Chemical Engineering: Where is the Industry HeadedElma RodriguesNo ratings yet

- Car MarketDocument2 pagesCar MarketArundev RaviNo ratings yet

- Procurement Management Process for IBM Sirena 3 ProjectDocument7 pagesProcurement Management Process for IBM Sirena 3 ProjectPhilip CorsanoNo ratings yet

- 52605-02 Ingilizce 1 Property Classes of Special Service FastenersDocument7 pages52605-02 Ingilizce 1 Property Classes of Special Service FastenersEmir AkçayNo ratings yet

- Schiphol Group Annual Report 2015: Connecting the Netherlands through Value CreationDocument222 pagesSchiphol Group Annual Report 2015: Connecting the Netherlands through Value Creationיּיּ יּיּNo ratings yet

- Case 4 Singapore International AirlinesDocument19 pagesCase 4 Singapore International Airlinesantarctica809No ratings yet

- Training Stress Testing and Scenario AnalysisDocument7 pagesTraining Stress Testing and Scenario AnalysisUshal VeeriahNo ratings yet

- CS-11000Document17 pagesCS-11000Engenharia APedro100% (1)

- METALS WATCH: Car Sales Set to Unwind From Recent SlumpDocument4 pagesMETALS WATCH: Car Sales Set to Unwind From Recent SlumpcesarNo ratings yet

- FM Notes 2022 StudentsDocument121 pagesFM Notes 2022 StudentsAnjani veluNo ratings yet

- YJCCI Directory 2018-19Document52 pagesYJCCI Directory 2018-19S K SinghNo ratings yet

- 4 Malaysia PDFDocument14 pages4 Malaysia PDFluthfi190No ratings yet

- Wiring Diagram CB 500 KV UnindoDocument33 pagesWiring Diagram CB 500 KV UnindoGITET GratiNo ratings yet

- UNWTO Barometer 2022 - 04 July ExcerptDocument6 pagesUNWTO Barometer 2022 - 04 July ExcerptTatianaNo ratings yet

- 06 2022 EuropeanDocument1 page06 2022 EuropeanTatianaNo ratings yet

- Παρουσίαση American AirlinesDocument9 pagesΠαρουσίαση American AirlinesTatianaNo ratings yet

- 2021 Black Representation in Hospitality Industry Leadership FinalDocument20 pages2021 Black Representation in Hospitality Industry Leadership FinalTatianaNo ratings yet

- Premium Comfort FactsheetDocument2 pagesPremium Comfort FactsheetTatianaNo ratings yet

- HAMA Spring 2021 Outlook SurveyDocument16 pagesHAMA Spring 2021 Outlook SurveyTatianaNo ratings yet

- Thomas Cook Greece PresentationDocument12 pagesThomas Cook Greece PresentationTatianaNo ratings yet

- 05 2022 AthensDocument1 page05 2022 AthensTatianaNo ratings yet

- Overall Performance of The Attica Hotel IndustryDocument1 pageOverall Performance of The Attica Hotel IndustryTatianaNo ratings yet

- COVID-19 Destination Protocol 18-04-2022Document7 pagesCOVID-19 Destination Protocol 18-04-2022TatianaNo ratings yet

- Increasing The Value of Tax Free Shopping For EU Destination EconomiesDocument5 pagesIncreasing The Value of Tax Free Shopping For EU Destination EconomiesTatianaNo ratings yet

- Increasing The Value of Tax Free Shopping For EU Destination EconomiesDocument5 pagesIncreasing The Value of Tax Free Shopping For EU Destination EconomiesTatianaNo ratings yet

- DHR White Paper - Hospitality ReturnsDocument76 pagesDHR White Paper - Hospitality ReturnsTatianaNo ratings yet

- Passenger Covid 19 CharterDocument15 pagesPassenger Covid 19 CharterTatianaNo ratings yet

- Full February Air Passenger Market AnalysisDocument4 pagesFull February Air Passenger Market AnalysisTatianaNo ratings yet

- Greece: 2021 Annual Research: Key HighlightsDocument2 pagesGreece: 2021 Annual Research: Key HighlightsTatianaNo ratings yet

- AX Europe Airport Industry Connectivity Report 2020Document19 pagesAX Europe Airport Industry Connectivity Report 2020TatianaNo ratings yet

- DHR White Paper - Hospitality ReturnsDocument76 pagesDHR White Paper - Hospitality ReturnsTatianaNo ratings yet

- European Benchmark: Year To Date July 2020Document1 pageEuropean Benchmark: Year To Date July 2020TatianaNo ratings yet

- Overall Performance of The Attica Hotel IndustryDocument1 pageOverall Performance of The Attica Hotel IndustryTatianaNo ratings yet

- EUROSTAT - Tourism TripsDocument4 pagesEUROSTAT - Tourism TripsTatianaNo ratings yet

- Resulticks Report FINAL PDFDocument12 pagesResulticks Report FINAL PDFTatianaNo ratings yet

- Fraport Greece YTD 04 Traffic 2019vs2018Document2 pagesFraport Greece YTD 04 Traffic 2019vs2018TatianaNo ratings yet

- Local Passport PresentationDocument8 pagesLocal Passport PresentationTatianaNo ratings yet

- Global Survey On The Perception of Residents Towards City Tourism: Impact and MeasuresDocument24 pagesGlobal Survey On The Perception of Residents Towards City Tourism: Impact and MeasuresTatianaNo ratings yet

- Fraport Greece - YTD 03 Traffic 2019 Vs 2018Document2 pagesFraport Greece - YTD 03 Traffic 2019 Vs 2018TatianaNo ratings yet

- Eyeota EyeOnTravel Full ReportDocument14 pagesEyeota EyeOnTravel Full ReportTatianaNo ratings yet

- And Lufthansa: A Long Lasting Relationship !: Athens International AirportDocument8 pagesAnd Lufthansa: A Long Lasting Relationship !: Athens International AirportTatianaNo ratings yet

- Fraport Greece - Επιβατική Κίνηση Μαρτίου 2019Document2 pagesFraport Greece - Επιβατική Κίνηση Μαρτίου 2019TatianaNo ratings yet

- Overall Performance of the Attica Hotel Industry - Μάρτιος 2019 Έναντι Μαρτίου 2018Document1 pageOverall Performance of the Attica Hotel Industry - Μάρτιος 2019 Έναντι Μαρτίου 2018TatianaNo ratings yet

- Entrepreneurship HandoutDocument2 pagesEntrepreneurship HandoutMerben AlmioNo ratings yet

- CH 12 Hull Fundamentals 8 The DDocument25 pagesCH 12 Hull Fundamentals 8 The DjlosamNo ratings yet

- Adjudication Order in Respect of Shri Bikramjit Ahluwalia and Others in The Matter of Ahlcon Parenterals (India) Ltd.Document9 pagesAdjudication Order in Respect of Shri Bikramjit Ahluwalia and Others in The Matter of Ahlcon Parenterals (India) Ltd.Shyam SunderNo ratings yet

- All SBR Topics Overview PDFDocument245 pagesAll SBR Topics Overview PDFRone garciaNo ratings yet

- Solutions Manual To Accompany Investment 8th Edition 9780073382371Document9 pagesSolutions Manual To Accompany Investment 8th Edition 9780073382371JamieBerrypdey100% (36)

- Equity Investments As of October 19, 2021Document25 pagesEquity Investments As of October 19, 2021Almirah's iCPA ReviewNo ratings yet

- Financial Performance and Ratio Analysis of Bharati AirtelDocument63 pagesFinancial Performance and Ratio Analysis of Bharati AirtelJayaprabhu PrabhuNo ratings yet

- C6 C7 C8 Answers SolutionsDocument16 pagesC6 C7 C8 Answers Solutionsjhela18No ratings yet

- Earnings Per ShareDocument15 pagesEarnings Per ShareMuhammad SajidNo ratings yet

- Lehman Brothers Kerkhof Inflation Derivatives Explained Markets Products and PricingDocument81 pagesLehman Brothers Kerkhof Inflation Derivatives Explained Markets Products and Pricingvolcom808No ratings yet

- Solution To Assignment 1 Winter 2017 ADM 4348Document19 pagesSolution To Assignment 1 Winter 2017 ADM 4348CodyzqzeaniLombNo ratings yet

- 2022-04-13 The Cost of CapitalDocument30 pages2022-04-13 The Cost of Capitalleonmpgl162No ratings yet

- Key Terms in BankingDocument12 pagesKey Terms in BankingsagortemenosNo ratings yet

- Summer Training Project ReportDocument48 pagesSummer Training Project Reportanil_batra44100% (1)

- Audit Trading Securities Problem 1Document1 pageAudit Trading Securities Problem 1Lourdios EdullantesNo ratings yet

- Icfai P.A. IiDocument11 pagesIcfai P.A. Iiapi-3757629No ratings yet

- THE COMPANIES ACT, 2017 (XIX of 2017) : Memorandum OF Association OFDocument5 pagesTHE COMPANIES ACT, 2017 (XIX of 2017) : Memorandum OF Association OFZainab IshaqNo ratings yet

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- A Process View of Organizational Knowledge: Athens, Greece, April 5th-6th, 2002Document16 pagesA Process View of Organizational Knowledge: Athens, Greece, April 5th-6th, 2002Akm EngidaNo ratings yet

- China - Rising Foreign Demand Amid DeleveragingDocument62 pagesChina - Rising Foreign Demand Amid DeleveragingbondbondNo ratings yet

- Corporate Finance: The Core Chapter 5 Interest RatesDocument207 pagesCorporate Finance: The Core Chapter 5 Interest Ratesedgargallego6260% (1)

- Unit-3: Corporate Parenting, Bcg-Matrix and Porter's DiamondDocument36 pagesUnit-3: Corporate Parenting, Bcg-Matrix and Porter's DiamondAnkur RastogiNo ratings yet

- Primer On DebenturesDocument14 pagesPrimer On DebenturesShakeel AhamedNo ratings yet

- Corporate Reporting Manual Part 2 - Up To 2018Document774 pagesCorporate Reporting Manual Part 2 - Up To 2018Masum GaziNo ratings yet

- Contract To Sell, Right To Mortgage The Property by The Owner - PNB v. DEEDocument4 pagesContract To Sell, Right To Mortgage The Property by The Owner - PNB v. DEEKatrinaCassandraNgSyNo ratings yet

- Manual de ResseguroDocument148 pagesManual de ResseguroDjonDiasNo ratings yet

- Offering Memo First HY Chilean Bond in 2011Document528 pagesOffering Memo First HY Chilean Bond in 2011AlfNo ratings yet

- Check List For Sub Division of Shares - CA ViswaDocument3 pagesCheck List For Sub Division of Shares - CA ViswaRahul JainNo ratings yet

- Strategic Buyers Vs Private EquityDocument20 pagesStrategic Buyers Vs Private EquityGaboNo ratings yet

- NRB Directives To Microfinance FIs, - 2074Document104 pagesNRB Directives To Microfinance FIs, - 2074NarayanPrajapatiNo ratings yet