Professional Documents

Culture Documents

Adx

Uploaded by

Rishi BansalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adx

Uploaded by

Rishi BansalCopyright:

Available Formats

Stocks & Commodities V17:10 (433-439): How The Pros Use Average Directional Index by Barbara Star, Ph.D.

CLASSIC TECHNIQUES

How The Pros Use Average

Directional Index

Here’s how technicians Charles LeBeau, Paul Rabbitt, and

Linda Bradford Raschke integrate the average directional ADX above 30

index into their trading plans. Longer-term daily chart

by Barbara Star, Ph.D. Bollinger band

w/ 30-unit EMA

ow would you like to look over the shoulders of

METASTOCK (EQUIS INTERNATIONAL)

professional traders using one of your favorite

indicators? Here’s your chance. I spoke with

three well-known traders who put their own RSI

money at risk daily. I asked them to show me

what they do with the average directional index

(ADX), one of the longest-lived and most popu-

lar trend indicators around.

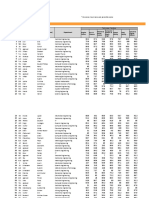

I asked Charles LeBeau, Paul Rabbitt, and FIGURE 1: RABBITT TEMPLATE, XOI OIL AND GAS INDEX. Paul Rabbitt’s screen

template shows both the overall price action and the indicators at the same time. The original

Linda Raschke how they integrate ADX into their own trading template consists of a black background, white price bars, and yellow trendlines. Those

analysis and trading tactics. Here, largely in their own words, colors were changed for this article to provide better contrast.

these traders explain the thinking that guides their decision-

making. Hopefully, some of their strategies might make you

think about how this indicator can improve your trading. surprises, or company developments to form the basis for

selecting buy or sell candidates. Then he looks at his technical

PAUL RABBITT tools. ADX helps determine entry and exit points on preselected

Paul Rabbitt is a well-known quantitative strategist. During securities. “ADX is the accelerator/decelerator in the trading

his 20-year affiliation with the Oppenheimer Co., he created process. ADX does not dictate whether I stay in or out of a

and ran their quantitative department. He also developed the trade,” he goes on to say. “ADX only postpones a sale or

“Q” stock ranking system, a 12-factor stock risk/return model. accelerates a sale or postpones a purchase or accelerates a

He was a senior portfolio strategist when he left the firm in purchase.

1998 to form his own company. Currently, he advises insti-

tutional clients and provides sector and industry forecasts.

Rabbitt’s analyses and investments include stocks, bonds,

ADX above 30

various financial indices, and Spyder sectors. Market com-

ments and quantitative rankings on individual stocks are

available on his Website. (For the URL, see “Related re-

sources” at the end of this article.)

Price down

Rabbitt uses a 14-unit ADX with end-of-day data as a rough trend

gauge of momentum. “I use a very simplistic interpretation of

➞

ADX. If I have a rising ADX, but it is only at the 15 or 20 level,

I consider it a weak momentum situation. If it is above 30, I

consider it a stronger momentum situation. Even if ADX

changes direction, as long as it remains above 30, I regard it

as a momentum situation. And the higher the level, the greater

the strength of the momentum. I don’ t try to refine ADX too

much,” he comments. FIGURE 2: 3COM CORP. ADX above its 30 level indicates a strong trend is in progress. In

this case, the trend is clearly down. Regardless of price direction, in a trending mode, Rabbitt

Entries and exits: Given his background, Rabbitt relies on focuses on the moving averages and disregards all other indicators until ADX moves below

fundamentals, such as earnings announcements, earnings 30. Once below, he would turn to the RSI and Bollinger bands to track price movement.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V17:10 (433-439): How The Pros Use Average Directional Index by Barbara Star, Ph.D.

“My goal is to invest rather than

trade, so I try to slow my activity as

much as I can and stay in situations

as long as I can,” he explains. “What

I am trying to do is create what I

call tax-efficient investment calls.

I am trying to create long-term

capital gains.”

The trading template: Along with

ADX, Rabbitt uses Bollinger bands

and the relative strength index (RSI).

He incorporates these indicators in

a template that offers both a broad

and specific view of the trading

situation (Figure 1).

The left side of the template

consists of a price chart with three

years of daily data. This chart con-

tains support and resistance lines,

trendlines, and one or more mov-

ing averages. The right side con-

tains a tall window split into three

parts: ADX fills the upper portion,

Bollinger bands on price is in the

middle panel, and a 14-unit RSI

occupies the bottom portion. Each

panel on the right-hand side is based

on approximately 100 bars of daily

price data. The Bollinger bands are

formulated using two standard de-

viations above and below a 30-unit

exponential moving average.

“The bands and the RSI provide

a sense of a trading range, and the

large chart on the left gives me

information about both the trading

range and trend,” Rabbitt opines.

“I focus on the support and resis-

tance lines that coincide with the

Bollinger bands. If I can find

Bollinger bands that are close to

the support/resistance lines, I pay

a lot more attention to those.”

Trading with the ADX: Rabbitt

goes on to say, “If ADX is above

30 regardless of direction or be-

low 30 and rising, then I consider

this a trending situation and I am

going to disregard all trading tools.

I am just going to look at the trend

ANDREW VANDERKAAR

of the stock in terms of its rela-

tionship to the 200-day moving

average or some other series of

averages” (Figure 2).

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V17:10 (433-439): How The Pros Use Average Directional Index by Barbara Star, Ph.D.

If ADX is below its 30 level and either flat or declining,

Rabbitt deems price to be losing its momentum and moving Stay with the

strong trend

into a trading range. “That drives me down to the Bollinger Stay with

bands and the RSI and I would then range-trade the security. If the strong

price is at the top of the Bollinger band and I had thought about ADX trend

selling the stock for reasons based on my quantitative methods,

then this is a very comfortable sell. But if it is at the bottom of

the bands, I am not as comfortable about the sell,” he explains.

Let profits run: “One place that I have found the ADX to be

especially good is when a stock is screaming — really roaring

— and I am getting really nervous because it is just too

strong,” he adds. “I love to take profits on easy money, and

ADX is an objective way of getting through the excitement of

FIGURE 3: SPYDER BASIC INDUSTRIES. The April price breakout caused ADX to rise from

just wanting to reach out there and grab that profit. So if I have a low of 15 to over 50. While the temptation might be to take profits when ADX moves into

a 35 to 50 ADX and a stock that’s up 25% in the last 30 days, my ranges well above 30, sticking with the ascending ADX may prevent an early exit and gain

instinct is to say: ‘It can’t maintain this. Get out and take the extra profits.

profit!’ But staying with ADX will keep me in it.” (See Figure 3.)

“Over the last decade, what is now happening to the

Internet stocks occurred in other sectors. There have been charting screen to call attention to changes in market shifts

rotations into different sectors or industries that have had and market strength. When the ADX is above 30, it turns a

very strong momentum; the biotech stocks did that for a different color than when the ADX is between 20 and 30.

while, the gaming stocks did that as well. I refer to them as the “[Being above 30] signifies to me that there is a strong

tulip sectors†. ADX will keep you in a tulip stock a little trend on the time frame you are looking at. And if the ADX

longer. It probably is one of the best indicators to take the rises high enough, then any reaction should trigger a retest of

emotion out of a really strong stock.” sorts about 80% of the time. It comes from the generic

Rabbitt uses the ADX to signal whether he should be technical analysis principle that momentum precedes price.

trend trading with averages or range trading with RSI and If there is strong-enough momentum, the price extreme is still

Bollinger bands. Others, such as Linda Raschke, take a yet to come,” she opines. (See Figure 4.)

more classical approach. Trading momentum retracements is one of her favorite

strategies. “I like to enter as the price is retracing. For instance,

LINDA RASCHKE if price is in a downtrend and then price starts having a reaction

Linda Raschke, the president of the LBR Group, initially and begins to move up, I will sell while price is moving up

gained recognition for her professional trading prowess in rather than wait for it to top and turn down again,” she says.

Jack Schwager’s The New Market Wizards. Raschke trades

her own funds. She combines classic technical analysis with

tape-reading to trade all futures markets as well as futures

indices and stocks. To learn more about her trading style and

philosophy, visit her Website. (For the URL, see “Related

resources” at the end of this article.)

Consistent parameters: Raschke uses the 14-unit ADX with end-

of-day data. As with her other technical tools, she believes it

important to keep parameters the same for every market and every

time frame. “I have to be able to pull up a chart on the fly or sit down

for my nightly analysis and be able to approach the problem the

same way every time. It’s a consistency thing,” she explains.

She believes that the fewer indicators or steps needed to

ASPEN GRAPHICS

make trading decisions, the better, especially during trading

hours. “You shouldn’t be using such a complex method that

you have to calculate numbers or comprehend something

during the trading day,” she asserts. “You need to reduce your FIGURE 4: ADX DISPLAY. Raschke color-codes the ADX on her charting screen to call

analysis to two or three indicators so you can make a judg- attention to changes in market shifts and market strength. When theADX is above 30, it turns

a different color than when the ADX is between 20 and 30. The original gray backgrounds

ment within a minute with a high confidence level.”

were changed for this article to provide better contrast.

Momentum retracement: Raschke color-codes ADX on her

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V17:10 (433-439): How The Pros Use Average Directional Index by Barbara Star, Ph.D.

Realizing that no entry strategy will be perfect all the time,

any retracement methodology can be used to help determine

where the pullback area might be — for example, a move

toward a trendline or a moving average. For Raschke, it is a 1 2

price move to its 20-unit exponentially smoothed moving

average. “I like to short price during a countertrend rally

when it is still rising. I need to have the confidence that even

➞

if I short it and it’s still a little bit too early, it will still turn and

come down. With experience and timing, you can minimize

the drawdown.”

But, she cautioned, always buy or sell in the direction of the

trend. “People get far too caught up looking for exact price

points. There’s not a perfect way to find the entry,” she points

out. “The moving average is a proxy for the entry window or

zone. Some aggressive traders might use a shorter moving

average length, such as a five-unit or 10 instead of a 20. They

will trade more often, but their net profit may not be as high.

The 20 moving average might miss a few trades, but average

net profit will be higher.”

Raschke has observed that the execution skill in placing a

trade accounts for 50% of any gain or loss. “The degree of FIGURE 5: UPSIDE HOLY GRAIL. This pattern takes advantage of retracements in a trend

hesitancy involved or the finesse in placing the order makes to make short-term trades once the retracement is over and the trend resumes. Here’s both

a big difference. I use market orders because I don’t want to a 20-unit EMA on the price chart and ADX in the lower panel. ADX located a strong trend in

the daily prices of the June 1999 dollar contract. ADX rose throughout February and into

miss the trade. For instance, there is always a 50-cent spread March before it made a peak and rolled over to the downside at point 1 on the price chart.

in the Standard & Poor’s 500, but I would rather pay that than At that point, price had begun to retrace or pull back to its moving average. The expectation

risk losing the trade.” is that price would retest the high that was made at point 1, which it did at price point 2.

Holy Grail: Momentum retracement forms the basis of the other method to trigger an entry,” she advises. “I have never

Holy Grail pattern, one of Raschke’s best-known methods, found an edge trading on the turn up of the ADX unless it is

and ADX plays a key part in setting it up. The trading rules for starting from a very low level. ADX contains too much

the Holy Grail are simple: smoothing, which causes it to lag.”

Using daily data, the frequency of retracement setups on any

1 The 14-unit ADX must be above its 30 level to signify given security may only occur once a quarter. “That’s why I look

that a strong trend is in progress. at several commodities and different time frames. An ADX setup

2 When ADX forms a top and begins to turn down, look would occur more often on a 60-minute chart — maybe three

for a retracement that causes price to move toward its

➞

20-unit exponential moving average (EMA).

3 In an uptrending market, look to buy when price falls to

or near the 20-unit EMA†. In a downtrending market,

look to sell when price rises to or near its 20-unit EMA.

4 In a countertrend decline of what had been an upward

➞

➞

trend, place a buy-stop just above the high of the last

declining bar. Use that to take you into the trade. In a

countertrend rally of what had been a downtrend, place

the sell-stop just below the low of the last bar and use 1 2

that to take you into the market.

5 The initial price target objective is a retest of the

previous high/low. At that point, it is necessary to gauge

market conditions and decide whether this was only a

simple retest or a continuation move in the direction of

the original trend. (See Figures 5 and 6.) FIGURE 6: DOWNWARD HOLY GRAIL. The retracement pattern works in any time frame,

as seen in this intraday five-minute S&P 500 chart. Price gapped down early on June 24 and

Raschke uses ADX to identify the initial condition — a remained in a downtrend until the afternoon. ADX rose as price declined and was above its

30 level when it peaked and rolled over shortly after noon. Price had stopped moving down

potential retracement pattern. “It does not function well as a at point 1 and made a rally up to its 20-unit moving average. A trader would have shorted

trigger. Price will always move faster than ADX, so use some at either of the two down arrows and profited as price moved down to point 2.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V17:10 (433-439): How The Pros Use Average Directional Index by Barbara Star, Ph.D.

ADX setups a month. If I see one of those ADX-type trades on a

30- or 60-minute chart in any chart, I’ll trade it!”

Chart formation breakouts: Another ADX price pattern

favored by Raschke occurs when ADX drops below 18. This

often leads to sideways price patterns. A different ADX color

➞

appears on Raschke’s screen to signal a potential market

consolidation. “Price bars overlap, which causes ADX to drop

down very low. Whenever there is a lot of price bar overlap,

you start to see a sideways line, such as in classic point-and-

figure charting,” she comments. “Any sideways line will

show up as a classically recognized chart pattern, be it a

rectangle or flag. At that point, you also tend to find price

clustered around the moving averages.” That signifies basing

➞

action within a trading range from which it is possible to draw

support and resistance lines. FIGURE 7: CHART FORMATION BREAKOUT ON THE DAILY DJIA. In the chart formation

“According to classic technical analysis, the longer price breakout pattern, ADX lays well below its 20 level as it did with the DJIA throughout February

moves sideways, the more likely that the chart pattern will be a 1999 and into March. During that time, price was forming a sideways chart pattern. A

breakout from that pattern occurred as ADX began to rise, indicating the potential for a trend.

reversal pattern rather than a continuation pattern” (Figure 7).

The potential was realized as price soared from 9500 to 11000. The chart formation pattern

Raschke continues: “When ADX moves down that low, is a riskier trade.

you are in a breakout mode; once price breaks out, you could

be in a trend. So, draw your trendline and look for some type

of breakout method. You are probably coming into the end of Ready to respond to what the market shows, Linda Raschke

the consolidation and you could expect that the next price is a tape-reader and a classic technician, but the next ADX

move would be a real reversal. trader focuses on mechanical systems and tends to be more

“But,” she adds, “that isn’t always the case. You can’t comfortable with the raw numbers than with charts.

predict the direction of the breakout. As a trader, I try to be

prepared for a sharp price move in either direction. The CHARLES LEBEAU

sideways breakout (as in Figure 7) tells me that the market is Trader and writer Charles LeBeau has more than 30 years of

ready to pick up momentum again. An early entry means trading experience. He is president of a commodity advisory

more risk because there is less confirmation, but if the trade

is successful, you ultimately could receive a greater reward.” METASTOCK FORMULA

Risk management: Regardless of ADX method used, risk Here’s the MetaStock formula for the average directional

management is extremely important. “After entering the trade, index (ADX) with decimal point included:

the time frame and price volatility determines the appropriate

Periods:=Input(“Time Periods”,1,100,14);

risk I would be taking. On a five-minute chart of the S&P 500,

I wouldn’t want to risk more than five points from where I PlusDM:= If(H>Ref(H,-1) AND L>=Ref(L,-1),H-Ref(H,-1),

entered,” she says. “But the way the S&P has been trading lately, If(H>Ref(H,-1) AND L<Ref(L,-1) AND H-Ref(H,-1)>

if I were trading from a 60-minute bar chart, the more appropriate Ref(L,-1)-L,H-Ref(H,-1),0));

risk might be 10 points.”

The same criteria apply to stock trades. However, a stock trade DIPlus:= 100*Wilders(PlusDM,Periods)/ATR(periods);

may last two days to two weeks, depending on price volatility

and the trading time frame selected (that is, intraday, daily). MinusDM:= If(L<Ref(L,-1) AND H<=Ref(H,-1),Ref(L,-1)-

Raschke handles risk management of the chart formation L, If(H>Ref(H,-1) AND L<Ref(L,-1) AND H-Ref(H,-1)<

Ref(L,-1)-L,Ref(L,-1)-L,0));

breakouts differently. “I find this type of trade the most

difficult because you are still emerging from a low-volatility DIMinus:= 100*Wilders(MinusDM,Periods)/ATR(periods);

environment. It is often difficult to tell where the noise ends

and the real move begins,” she explains. “But the best DIDif:=Abs(DIPlus-DIMinus);

breakouts work right away. Volume confirms a breakout.”

She advises trading with a degree of leverage (that is, the DISum:= DIPlus+DIMinus;

number of contracts used relative to your account size) that

fits the type of chart formation. Use fewer contracts (lower ADXFinal:= 100*Wilders(DIDif/DISum,Periods);

leverage) on a breakout from a rectangle because the stop

ADXFinal

point is farther away, then on a breakout of a flag formation

—Equis International

where the stop point is closer or more well-defined.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V17:10 (433-439): How The Pros Use Average Directional Index by Barbara Star, Ph.D.

and hedge fund company that manages money for both insti-

tutional and individual investors. He is well known for his

work in the development of trading systems. He trades futures

and futures indices. For more information, visit LeBeau’s

Website. (For the URL, see “Related resources” at the end of

this article.)

ADX as a measure of strength: LeBeau uses ADX with end-of-

TRADESTATION (OMEGA RESEARCH)

day data to measure the strength of trends. He and partner

➞

David Lucas have developed many systems that can be imple-

mented under almost any type of trading conditions. “ADX

helps me determine which system to execute. For instance,

when ADX indicates there isn’t a trend, that could point to a

➞

particular system designed to profit from those conditions,” he

explains. “But when ADX tells us there is a strong trend, we FIGURE 8: TRADING THE ADX FROM A LOW LEVEL. LeBeau finds that very good trades

would want to implement another system that would help us often emerge as ADX rises from levels below 20. The June 1999 crude oil chart shows that

stay with the trend.” He often uses 200-day databars or 50 to ADX spent several weeks below its 15 level as crude oil moved down in price. His system

100 weekly data bars to test the system. used the rising ADX in March to trigger an entry that got him into the trade early in what

proved to be a highly profitable trade.

LeBeau looks upon ADX as an indicator, rather than a

system. In his view, none of the parameters are sacred. His use

of ADX to measure trend is based on a combination of fluctu- Rate of change: LeBeau adds a rate of change element to the

ating factors that includes length, level, direction, and his own decision-making process. Rate of change pertains to speed.

added component, rate of change. Normally, it measures the difference between today’s price

and the price x days ago to tell how quickly price is, or has been,

Length: He sometimes adjusts the lookback length of the moving. The greater its speed, the greater its momentum.

indicator so it can provide better and more timely information. However, rather than compare price changes, LeBeau com-

A shorter length speeds up the indicator and makes it more pares ADX values.

sensitive to price movements. “Most of the time, I’m happy “The faster ADX is changing, the stronger the trend, regard-

with the default at 14. But for a faster signal, I have used ADX less of what level ADX is at. You are more likely to be getting

as short as 10 on daily bars and as short as seven on weekly bars. into a trend at a lower level rather than waiting until it reaches

Occasionally, I might optimize the ADX by twos up to 18 just a higher level. For example, if I want ADX one point higher than

to get an idea of whether a short length or longer one works it was yesterday, it’s better if that happens at 12 rather than

better. I’m not looking for any precise number,” he adds. when ADX is at 30. I will be catching the trend earlier,” he

“Optimizing doesn’t make as much difference as you’d concludes.

think. If you want to be more patient and have something more

reliable, you might increase ADX length. Stock traders have Trading rising and declining ADX: LeBeau discovered that

told me they have better results by lengthening it.” ADX can act as both a setup and a trigger in a trending market.

Level: The original ADX formulation calls for rounding ADX

value to a whole number. However, LeBeau finds it more

useful to include the fractional value in his type of system-

➞

based trading. Watching ADX values progress from 15.12 to

➞

15.26 to 15.33 alerts him to a potential trend sooner and,

conversely, a gradual drop from 15.12 to 14.63 warns of a

➞

continued loss of momentum. He suggests that traders carry

➞

ADX value out to three decimal places and then round it off to

two. (See sidebar for a MetaStock formula of an ADX with

decimal points.)

“The level of ADX tells you where you have been,” LeBeau

➞

says. “For example, we have one bond system designed to pick

bottoms; so we look at ADX to see if the bonds have been in a

➞

big downtrend. We want to trade the long side, but we want to

know where we have been. We have a minimum level that ADX FIGURE 9: ADX AND RSI. When the ADX stops rising as it did near the beginning of March,

must reach while the market is going down to show us there has a new trading strategy may be in order. A short four-unit RSI was added to capture profits

been a sufficient downtrend. Then we look for a turning point during both up and down price movements. A buy signal was generated when the RSI was

to go long.” below 25 and a sell short signal was produced when the RSI rose above its 80 level.

Copyright (c) Technical Analysis Inc.

Stocks & Commodities V17:10 (433-439): How The Pros Use Average Directional Index by Barbara Star, Ph.D.

Initially, he used ADX mainly as a setup condition and moving ADX will start to decline showing an absence of trending

average crossovers as a trigger. direction, but the price does not have an absence of direction,

“It was good, but it left a lot on the table. Eventually, we it is moving down!

concluded that ADX was more reliable than the moving aver- “ADX shows that there isn’t a trend or a direction to the

age crossovers. Rather than wait for something else to confirm market and declines because the window of time it’s looking

a move, we were better off going into the trade as soon as ADX at includes both an up period and a down period,” LeBeau

started to rise. So we began using ADX as both a setup condition avers. “We have to wash all that rising data out of the time

and a trigger. It improved our results,” he says. period we are evaluating. I have observed that a 14-unit ADX,

He finds that an ADX rising somewhere between the 10 and with all its smoothing and other components, is really looking

20 level produces very good trades. (See Figure 8.) Trailing at more than 30 days of data. I think we may have a bigger

channel stops — that is, the lowest low of the last x number days window than we realize. If we wait until ADX starts moving up

— helps to preserve profit and limit losses. again indicating a strong down move, most of that move is

When ADX stops rising and begins to decline, look for price over. We wind up going short near the bottom of the move and

moves that are sideways to down. “I use ADX to identify get ourselves in trouble. So you can’t trade every time ADX

sideways markets and then implement a system that buys when rises; you have to take other things into consideration.”

oversold and sell when overbought. The ADX level on the June

Treasury bond triggered one of our ‘buy dips-sell rallies’ SUMMARY

systems. Three highly regarded market professionals approach the

“We have been trading both sides of the market for the past markets from very different perspectives — Charles LeBeau

two to three months now, based on the RSI and ADX saying it’s from systems development; Paul Rabbitt from quantitative

a sideways market. If the RSI goes above 75, I would be looking analysis; and Linda Raschke from tape-reading and classic

to sell; below 25, I would be looking to go long.” LeBeau varies technical analysis. Despite their differing mindsets and ap-

the length of the RSI between four and 20, depending on the proaches, all have found ways to incorporate ADX into their

length of his trading time frame. (See Figure 9.) trading frameworks during both its trending and nontrending

“I’ve also found that some of the best entries occur after a modes. With some examination, there may be a place for the

long price base. The long base brings ADX down to low levels. versatile ADX in your own trading future.

The signals that occur from the low levels lead into a trade

where I can catch that breakout. It is often a highly profitable Barbara Star, Ph.D., university professor and part-time trader,

trade,” he concludes. provides individual instruction and consultation to those inter-

ested in technical analysis. She leads a MetaStock users group

Exits and target objectives: ADX does not trigger an exit for and is a past vice president of the Market Analysts of Southern

LeBeau, but the ADX level does help with setting profit California.

objectives. LeBeau uses the average true range (ATR), a

measure of volatility, to set the actual profit targets. Depending RELATED READING AND RESOURCES

on market conditions, the number of ATRs may range from one Connors, Laurence A., and Linda Bradford Raschke [1995].

to 12. Smaller profits would be expected when ADX is at fairly Street Smarts: High Probability Trading Strategies for the

low levels (nontrending) or at extremely high levels (possible Futures and Equities Markets, M. Gordon Publishing

end of trend). “The juicy part is right in the middle; that gives Group, www.mgordonpub.com

the biggest profits. In one of our S&P systems, when we are at Evens, Stuart [1999]. “Directional Movement,” Technical Analy-

that [profitable] 15-30 midrange, we go for a profit objective sis of STOCKS & COMMODITIES, Volume 17: February.

that is four ATRs. But when we are on the tails of either side, Hartle, Thom [1993]. “The Discerning Trader: Linda Bradford

where the trend is about to end or hasn’t begun yet, we adjust Raschke,” interview, Technical Analysis of STOCKS &

our profit target to one ATR,” LeBeau explains. COMMODITIES, Volume 11: September.

ATR is a moving target. “You might have one target when _____ [1993]. “A Statistical Scholar: Paul Rabbitt Of OpCo,”

you put on the trade and then once you have been in the trade interview, Technical Analysis of STOCKS & COMMODI-

for a few days, the market has changed. Sometimes, a market TIES, Volume 11: May.

gets more volatile and you’ll reach what was the profit target Herera, Sue [1997]. Women Of The Street, John Wiley & Sons.

on the very day that you entered the trade. But now, because the LeBeau, Charles, and David Lucas [1992]. Computer Analy-

ranges are expanding, it’s telling you that you ought to hold out sis Of The Futures Markets, Business One-Irwin.

for a bigger profit so you increase the number of ATRs.” LeBeau, Charles.Internet: http://www.traderclub.com

Rabbitt, Paul. Internet: http://www.rabbittanalytics.com.

Limits of ADX: Every indicator has its weaknesses, and ADX is Raschke, Linda. Internet: http://www.mrci.com/lbr

no exception. “Imagine that we have a nice long base. We jump Schwager, Jack D. [1992]. The New Market Wizards: Con-

on board when ADX starts rising from a low level. We success- versations With America’s Top Traders, HarperBusiness.

fully carry this trade all the way up to a high ADX level,

somewhere above 30, and then the market turns down. The †See Traders’ Glossary for definition S&C

Copyright (c) Technical Analysis Inc.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- ADANIPDocument7 pagesADANIPRishi BansalNo ratings yet

- CXFXVXDocument7 pagesCXFXVXRishi BansalNo ratings yet

- BbcdbbbsDocument7 pagesBbcdbbbsRishi BansalNo ratings yet

- BCBCBCBCDocument7 pagesBCBCBCBCRishi BansalNo ratings yet

- GDDDDGGDocument7 pagesGDDDDGGRishi BansalNo ratings yet

- KKKDocument7 pagesKKKRishi BansalNo ratings yet

- SdfsdfsfsfsDocument7 pagesSdfsdfsfsfsRishi BansalNo ratings yet

- MNMVNMVDocument7 pagesMNMVNMVRishi BansalNo ratings yet

- MHJHGJDocument30 pagesMHJHGJRishi BansalNo ratings yet

- ArvindDocument7 pagesArvindRishi BansalNo ratings yet

- MHJHGJDocument30 pagesMHJHGJRishi BansalNo ratings yet

- Bharti Art LDocument7 pagesBharti Art LRishi BansalNo ratings yet

- MHJHGJDocument30 pagesMHJHGJRishi BansalNo ratings yet

- AccDocument7 pagesAccRishi BansalNo ratings yet

- 2012 02 27nse NDXDocument1 page2012 02 27nse NDXRishi BansalNo ratings yet

- AccDocument7 pagesAccRishi BansalNo ratings yet

- PACE CDSL Individual PDFDocument21 pagesPACE CDSL Individual PDFRishi BansalNo ratings yet

- 5PAISADocument1 page5PAISARishi BansalNo ratings yet

- Astrology CheatsheetDocument15 pagesAstrology CheatsheetAnonymous 7QjNuvoCpI97% (30)

- 2012 02 27nse NDXDocument1 page2012 02 27nse NDXRishi BansalNo ratings yet

- 63 MoonsDocument3 pages63 MoonsRishi BansalNo ratings yet

- 3IINFOTECHDocument48 pages3IINFOTECHRishi BansalNo ratings yet

- 2019 01 22nse EqDocument28 pages2019 01 22nse EqRishi BansalNo ratings yet

- 2019 01 25nse EqDocument28 pages2019 01 25nse EqRishi BansalNo ratings yet

- 2012 02 27nse NDXDocument1 page2012 02 27nse NDXRishi BansalNo ratings yet

- 2016 04 05 Nse EqDocument26 pages2016 04 05 Nse EqRishi BansalNo ratings yet

- 2012 02 27nse NDXDocument1 page2012 02 27nse NDXRishi BansalNo ratings yet

- 2019 01 17nse EqDocument28 pages2019 01 17nse EqRishi BansalNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Informal and Formal Letter Writing X E Sem II 2018 - 2019Document15 pagesInformal and Formal Letter Writing X E Sem II 2018 - 2019Oana Nedelcu0% (1)

- Chemistry Chemical EngineeringDocument124 pagesChemistry Chemical Engineeringjrobs314No ratings yet

- BC TEAL Keynote Address 20140502Document6 pagesBC TEAL Keynote Address 20140502Siva Sankara Narayanan SubramanianNo ratings yet

- Costing of Oil and Gas Projects For Efficient Management and SustainabilityDocument15 pagesCosting of Oil and Gas Projects For Efficient Management and SustainabilityMohammed M. Mohammed67% (3)

- IMS - General MBA - Interview QuestionsDocument2 pagesIMS - General MBA - Interview QuestionsRahulSatputeNo ratings yet

- Tropical Rainforest Newsletter TemplateDocument92 pagesTropical Rainforest Newsletter TemplatedoyoungNo ratings yet

- Labacha CatalogueDocument282 pagesLabacha CatalogueChaitanya KrishnaNo ratings yet

- STIers Meeting Industry ProfessionalsDocument4 pagesSTIers Meeting Industry ProfessionalsAdrian Reloj VillanuevaNo ratings yet

- Cerita BugisDocument14 pagesCerita BugisI'dris M11No ratings yet

- AP HUG - Urban Developing ModelsDocument5 pagesAP HUG - Urban Developing ModelsMaria ThompsonNo ratings yet

- Manual de Servicio CX 350B 84355067-Dmc Site OnlyDocument127 pagesManual de Servicio CX 350B 84355067-Dmc Site Onlyabel jairo santos cabello100% (2)

- A New Approach To Economic Development in NunavutDocument26 pagesA New Approach To Economic Development in NunavutNunatsiaqNewsNo ratings yet

- API DevDocument274 pagesAPI Devruggedboy0% (1)

- Retail Analysis WalmartDocument18 pagesRetail Analysis WalmartNavin MathadNo ratings yet

- A Practical Guide To Geostatistical - HenglDocument165 pagesA Practical Guide To Geostatistical - HenglJorge D. MarquesNo ratings yet

- Design of Power Converters For Renewable Energy Sources and Electric Vehicles ChargingDocument6 pagesDesign of Power Converters For Renewable Energy Sources and Electric Vehicles ChargingRay Aavanged IINo ratings yet

- A Brief About Chandrayaan 1Document3 pagesA Brief About Chandrayaan 1DebasisBarikNo ratings yet

- How To Build TelescopeDocument50 pagesHow To Build TelescopeSachin VermaNo ratings yet

- Paranthropology Vol 3 No 3Document70 pagesParanthropology Vol 3 No 3George ZafeiriouNo ratings yet

- T3904-390-02 SG-Ins Exc EN PDFDocument89 pagesT3904-390-02 SG-Ins Exc EN PDFBrunoPanutoNo ratings yet

- ABAP Performance Tuning Tips and TricksDocument4 pagesABAP Performance Tuning Tips and TricksEmilSNo ratings yet

- Finding The Right Place On The Map: Central and Eastern European Media Change in A Global PerspectiveDocument306 pagesFinding The Right Place On The Map: Central and Eastern European Media Change in A Global PerspectiveIntellect BooksNo ratings yet

- Physics Sample Problems With SolutionsDocument10 pagesPhysics Sample Problems With SolutionsMichaelAnthonyNo ratings yet

- TOS Physical ScienceDocument1 pageTOS Physical ScienceSuzette De Leon0% (1)

- Ashley Skrinjar ResumeDocument2 pagesAshley Skrinjar Resumeapi-282513842No ratings yet

- Innoventure List of Short Listed CandidatesDocument69 pagesInnoventure List of Short Listed CandidatesgovindmalhotraNo ratings yet

- DS - en 1991-1-7 DK Na - 2007 eDocument6 pagesDS - en 1991-1-7 DK Na - 2007 ep_meulendijks108No ratings yet

- 17. ĐỀ SỐ 17 HSG ANH 9 HUYỆNDocument9 pages17. ĐỀ SỐ 17 HSG ANH 9 HUYỆNHồng Hoàn NguyễnNo ratings yet

- Pasig Transparency OrdinanceDocument9 pagesPasig Transparency OrdinanceVico Sotto100% (3)

- 432 HZ - Unearthing The Truth Behind Nature's FrequencyDocument6 pages432 HZ - Unearthing The Truth Behind Nature's FrequencyShiv KeskarNo ratings yet