Professional Documents

Culture Documents

151 Michigan Holdings v. City Treasurer of Makati

Uploaded by

Cheska VergaraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

151 Michigan Holdings v. City Treasurer of Makati

Uploaded by

Cheska VergaraCopyright:

Available Formats

LOCAL

TAXATION TAX

Michigan Holdings v. City Treasurer of other financial institutions. Section 131 (e) defines

“banks and other financial institutions,” which excludes

Makati

holding companies. Section 3.A.02(h) of the Revised

CTA EB No. 1093|June 17, 2015| RINGPIS-LIBAN, J.:

Local Taxation Makati Revenue Code imposes an LBT on the dividend

Local business tax on dividends received by Holding income of banks and other financial institutions.

companies Section 3.A.02(p), however, makes holding

companies, such as MHI, liable for the same

FACTS business tax. Section 3.A.02(p) of the Revised

Respondent City Treasurer of Makati assessed Makati Revenue Code violates the limit set by

Petitioner Michigan Holdings, Inc. (MHI) for alleged Section 133(a) of the LGC, which prohibits the

deficiency local business tax (LBT) on dividend income imposition of income tax except when levied on

earned for taxable year 2006. MHI protested the banks and other financial institutions.

deficiency LBT assessment, arguing that dividend

In addition to that, Section 27 (D) of the National

income is subject to income tax hence exempt from LBT

Internal Revenue Code deals with rates of tax on certain

under Section 133(a) of the Local Government Code

passive incomes. Subsection (4) thereof, covering

(LGC). As the City Treasurer did not act on its protest

intercorporate dividends, states that "Dividends

within the 60-day period, MHI filed a complaint before

received by a domestic corporation from another

the Makati Regional Trial Court (RTC) for the

cancellation of the LBT assessment. The RTC dismissed domestic corporation shall not be subject to tax" -

meaning corporate income tax. Dividends are instead

MHI’s appeal on the ground that it was directed at the

subject, under Section 27(D)(1), to "a final tax at the

validity of Section 3A.02(p) of the Revised Makati

Revenue Code, which should have been questioned rate of twenty percent (20%)

before the Secretary of Justice within 30 days from "Under Section 27(D)(4) of the Tax Code, dividends

effectivity of the said ordinance as prescribed by received by a domestic corporation from another

Section 187 of the LGC. MHI filed a Petition for Review corporation are not subject to the corporate income tax.

with the CTA. The CTA Second Division upheld the Such intracorporate dividends are some of the passive

ruling of the RTC. MHI elevated the case to the CTA En incomes that are subject to the 20% final tax, just like

Banc. interest on bank deposits. Intracorporate dividends,

being already subject to the final tax on income, no

ISSUE & HELD: longer form part of the bank's gross income under

Section 32 of the Tax Code for purposes of the

(1) Is MHI prohibited from questioning the legality corporate income tax.”

of the basis oft he LBT assessments?

Thus, Section 3A.02(p) in relation to Section 3A.02(h),

both of the Revised Makati Revenue Code, likewise

No. Section 195 of the LGC does not limit the grounds violates Section 27(D)(4) of the National Internal

for contesting an LBT assessment. Thus, an aggrieved Revenue Code. Section 3A.02(p) of the Revised

taxpayer is not barred from challenging the validity of a Makati Revenue Code is thus an ultra vires exercise

tax ordinance or a provision thereof upon which the of local taxing power, and cannot be given effect

assessment is based. There is nothing in Section 195 of without violating the principle that an ordinance

the LGC that requires a taxpayer who relies on this can neither amend nor repeal but must conform to

ground to first assail the validity of the ordinance a statute.

before the Secretary of Justice. Section 195 as a

taxpayer’s remedy against an assessment is separate,

distinct, and independent from Section 187 that

prescribes the procedure for contesting the

constitutionality of a tax ordinance.

(2) Can the Makati City Treasurer levy LBT on MHI’s

dividend income? (SYLLABUS TOPIC)

No. Makati City has no authority to impose LBT on the

dividend income of MHI. Section 133(a) of the LGC

expressly provides that the taxing powers of provinces,

cities, municipalities, and barangays shall not extend to

the levy of income tax, except when levied on banks and

You might also like

- 9 TAXREV - Michigan Holdings v. City Treasurer of MakatiDocument1 page9 TAXREV - Michigan Holdings v. City Treasurer of MakatiRS SuyosaNo ratings yet

- 172 Michigan Holdings v. City Treasurer of MakatiDocument2 pages172 Michigan Holdings v. City Treasurer of MakatiKatrina Monica CajucomNo ratings yet

- DCCCO NOT LIABLE FOR TAXES ON MEMBER DEPOSITSDocument1 pageDCCCO NOT LIABLE FOR TAXES ON MEMBER DEPOSITSNichole LanuzaNo ratings yet

- Tax Chapter 3Document3 pagesTax Chapter 3lowienerNo ratings yet

- Citibank Nigeria Limited v. Lagos State Internal Revenue Service - Composition of Gross Income For Consolidated Relief Allowance - PedaboDocument3 pagesCitibank Nigeria Limited v. Lagos State Internal Revenue Service - Composition of Gross Income For Consolidated Relief Allowance - PedaboAkinloluwa TokedeNo ratings yet

- 2 CREBA Vs ROMULO INCOME TAXATIONDocument2 pages2 CREBA Vs ROMULO INCOME TAXATIONSu Kings AbetoNo ratings yet

- Dumaguete Cathedral Credit Coop VS CirDocument2 pagesDumaguete Cathedral Credit Coop VS CirJuris Formaran100% (2)

- TAX Digest 3Document2 pagesTAX Digest 3Barrymore Llegado Antonis IINo ratings yet

- Tax ADAM PDFDocument8 pagesTax ADAM PDFAdamNo ratings yet

- Philo Digested CasesDocument26 pagesPhilo Digested Casesm82s45jx4jNo ratings yet

- 100% CIR VS. SOLIDBANK - GR NO. 160756, 09 March 2010 (Validity of imposition of GRT on interest income subject to FWTDocument5 pages100% CIR VS. SOLIDBANK - GR NO. 160756, 09 March 2010 (Validity of imposition of GRT on interest income subject to FWTzaneNo ratings yet

- Due Process and MCITDocument3 pagesDue Process and MCITJean Jamailah TomugdanNo ratings yet

- SC Rules Condominium Corp Not Engaged in Business, Not Subject to Local Business TaxesDocument4 pagesSC Rules Condominium Corp Not Engaged in Business, Not Subject to Local Business TaxesleighsiazonNo ratings yet

- China Banking Corp V CIRDocument2 pagesChina Banking Corp V CIRWayne Michael NoveraNo ratings yet

- Chamber of Real Estate and Builders Associations Inc. vs. Romulo Et Al MinimDocument4 pagesChamber of Real Estate and Builders Associations Inc. vs. Romulo Et Al MinimRene ValentosNo ratings yet

- Yamane Vs LepantoDocument4 pagesYamane Vs LepantoAshley Candice100% (1)

- Digest 12 Deutsche Bank Vs CirDocument1 pageDigest 12 Deutsche Bank Vs CirPrincess Rosshien Hortal100% (1)

- PDIC Vs BIR DigestDocument3 pagesPDIC Vs BIR DigestRONPENo ratings yet

- #172 Dumaguete Coop Vs CIRDocument2 pages#172 Dumaguete Coop Vs CIRNisa Sango OpallaNo ratings yet

- NMIMS Taxation - Assignment Answers (Sem-III)Document6 pagesNMIMS Taxation - Assignment Answers (Sem-III)Udit JoshiNo ratings yet

- 142 CIR v. CitytrustDocument3 pages142 CIR v. CitytrustclarkorjaloNo ratings yet

- Tax Treaty Benefits Prevail Over RMO No. 1-2000Document7 pagesTax Treaty Benefits Prevail Over RMO No. 1-2000Jihan LlamesNo ratings yet

- Assignment 5 - TaxDocument99 pagesAssignment 5 - TaxLoNo ratings yet

- CREBA Vs RomuloDocument10 pagesCREBA Vs RomuloAndrea Peñas-ReyesNo ratings yet

- Dumaguete Cathedral Credit Cooperative VsDocument17 pagesDumaguete Cathedral Credit Cooperative VsAnonymous CWcXthhZgxNo ratings yet

- Cases Local Taxation FinalsDocument6 pagesCases Local Taxation FinalsSaySai Kalis SantosNo ratings yet

- finance-act-2021-major-highlightsDocument6 pagesfinance-act-2021-major-highlightsAyodeji BabatundeNo ratings yet

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutDocument4 pagesBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiNo ratings yet

- CREBA V Romulo (Tax Case)Document2 pagesCREBA V Romulo (Tax Case)Libay Villamor Ismael0% (1)

- Judicial Rulings BY ABHAY DESAIDocument27 pagesJudicial Rulings BY ABHAY DESAIPiyush PatelNo ratings yet

- CIR vs. Bank of Commerce (2005)Document16 pagesCIR vs. Bank of Commerce (2005)BenNo ratings yet

- BIR Ruling 013-2004Document8 pagesBIR Ruling 013-2004RNicolo BallesterosNo ratings yet

- CIR v. Citytrust Investment Phils., Inc. and Asiabank Corporation v. CIRDocument3 pagesCIR v. Citytrust Investment Phils., Inc. and Asiabank Corporation v. CIRAila Amp100% (1)

- CREBA DigestDocument2 pagesCREBA DigestAnaliza Tampad Sta MariaNo ratings yet

- The FactsDocument6 pagesThe FactsGarp BarrocaNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- RMO No. 42-2020Document2 pagesRMO No. 42-2020Miming BudoyNo ratings yet

- Creba vs. Romulo - Cir vs. LingayenDocument6 pagesCreba vs. Romulo - Cir vs. LingayenBea Dominique AbeNo ratings yet

- Bir Ruling No. 313-15Document4 pagesBir Ruling No. 313-15Stacy Lyn LiongNo ratings yet

- Trio 2 CD 1Document2 pagesTrio 2 CD 1Garp BarrocaNo ratings yet

- Dumaguete Cathedral Credit Cooperative vs. CIRDocument3 pagesDumaguete Cathedral Credit Cooperative vs. CIRrejine mondragonNo ratings yet

- Problem Exercises in TaxationDocument38 pagesProblem Exercises in TaxationSHeena MaRie ErAsmoNo ratings yet

- Commissioner - of - Internal - Revenue - v. - Citytrust20190606-5466-Rq5hc6 PDFDocument11 pagesCommissioner - of - Internal - Revenue - v. - Citytrust20190606-5466-Rq5hc6 PDFClarence ProtacioNo ratings yet

- Dumaguete Cathedral Credit Cooperative (Dccco) V. Commissioner of Internal RevenueDocument2 pagesDumaguete Cathedral Credit Cooperative (Dccco) V. Commissioner of Internal RevenuepaobnyNo ratings yet

- CIR Vs SolidbankDocument3 pagesCIR Vs SolidbankJoel MilanNo ratings yet

- NPC Vs City of CabanatuanDocument2 pagesNPC Vs City of Cabanatuan8111 aaa 1118100% (1)

- Tax Case DigestsDocument2 pagesTax Case DigestsJANNNo ratings yet

- General Principles CasesDocument294 pagesGeneral Principles CasesAnne OcampoNo ratings yet

- Decoding Indian Union Budget Finance Bil PDFDocument7 pagesDecoding Indian Union Budget Finance Bil PDFkumarNo ratings yet

- Tax Case Digests Challenge Constitutionality of Minimum Corporate Income TaxDocument36 pagesTax Case Digests Challenge Constitutionality of Minimum Corporate Income TaxRight CydNo ratings yet

- 2007 Bar Q&a TaxDocument5 pages2007 Bar Q&a TaxShantee Lasala0% (1)

- Finance Bill 2010Document51 pagesFinance Bill 2010riddhivakhariaNo ratings yet

- Additional Cases On Passive and Compensation Income-Tax 2Document10 pagesAdditional Cases On Passive and Compensation Income-Tax 2Brigid Marfe AbalosNo ratings yet

- CREATE Bill Lowers CIT and Provides Tax IncentivesDocument31 pagesCREATE Bill Lowers CIT and Provides Tax IncentivesJanet PaglingayenNo ratings yet

- Dumaguete Cathedral Credit Cooperative (Dccco) - Versus - Commissioner of Internal Revenue G.R. No. 182722 January 22, 2010Document4 pagesDumaguete Cathedral Credit Cooperative (Dccco) - Versus - Commissioner of Internal Revenue G.R. No. 182722 January 22, 2010Innah Agito-RamosNo ratings yet

- Summary of Significant CTA Decisions (February 2011)Document2 pagesSummary of Significant CTA Decisions (February 2011)ShaneBeriñaImperialNo ratings yet

- MCIT rules for domestic and foreign corporationsDocument3 pagesMCIT rules for domestic and foreign corporationsSBNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Revenue Administrative Order No. 8-95Document11 pagesRevenue Administrative Order No. 8-95Cheska VergaraNo ratings yet

- Bir Memorandum: August 8, 2011Document2 pagesBir Memorandum: August 8, 2011Cheska VergaraNo ratings yet

- Streamlining Treaty ReliefDocument13 pagesStreamlining Treaty ReliefCarloAysonNo ratings yet

- Streamlining Treaty ReliefDocument13 pagesStreamlining Treaty ReliefCarloAysonNo ratings yet

- Iatf Reso 94 RRDDocument6 pagesIatf Reso 94 RRDJoseph Raymund BautistaNo ratings yet

- 111 Republic V CaguioaDocument2 pages111 Republic V CaguioaCheska VergaraNo ratings yet

- Nngress Fqe Jqilip-P-Ines: Uh!ii: 11f F4e J4ilippiue11Document39 pagesNngress Fqe Jqilip-P-Ines: Uh!ii: 11f F4e J4ilippiue11Cheska VergaraNo ratings yet

- 24347-2005-Adopting The Revised Makati Revenue Code20210505-11-1ovgmqdDocument134 pages24347-2005-Adopting The Revised Makati Revenue Code20210505-11-1ovgmqdCheska VergaraNo ratings yet

- Schedule and Procedure For The Filing of Annual Financial Statements, General Information Sheet and Other Covered ReportsDocument11 pagesSchedule and Procedure For The Filing of Annual Financial Statements, General Information Sheet and Other Covered ReportsRoderick RiveraNo ratings yet

- Streamlining Treaty ReliefDocument13 pagesStreamlining Treaty ReliefCarloAysonNo ratings yet

- BIR RR 07-2003Document8 pagesBIR RR 07-2003Brian BaldwinNo ratings yet

- RR No. 13-2018 CorrectedDocument20 pagesRR No. 13-2018 CorrectedRap BaguioNo ratings yet

- Republic v. ManaloDocument42 pagesRepublic v. ManaloFatima Blanca SolisNo ratings yet

- Wassmer v. VelezDocument4 pagesWassmer v. VelezJanine OlivaNo ratings yet

- Revenue Memorandum Order No. 01-90 PDFDocument9 pagesRevenue Memorandum Order No. 01-90 PDFCheska VergaraNo ratings yet

- Revenue Memorandum Order No. 01-90 PDFDocument9 pagesRevenue Memorandum Order No. 01-90 PDFCheska VergaraNo ratings yet

- Validity of Manila Tax OrdinanceDocument2 pagesValidity of Manila Tax OrdinanceCheska VergaraNo ratings yet

- Publication Requirement for Laws to Ensure Due ProcessDocument6 pagesPublication Requirement for Laws to Ensure Due ProcessElieNo ratings yet

- 143 Palma Development Corp. v. Municipality of MalangasDocument2 pages143 Palma Development Corp. v. Municipality of MalangasCheska VergaraNo ratings yet

- 149 Ericsson V PasigDocument2 pages149 Ericsson V PasigCheska VergaraNo ratings yet

- 12 United Airlines Vs CIRDocument11 pages12 United Airlines Vs CIREMNo ratings yet

- 140 - City of Manila v. Coca-ColaDocument2 pages140 - City of Manila v. Coca-ColaCheska VergaraNo ratings yet

- Sincere Villanueva vs. Marlyn Nite - GR 148211Document4 pagesSincere Villanueva vs. Marlyn Nite - GR 148211Krister VallenteNo ratings yet

- 83PLDT Vs City of DavaoDocument1 page83PLDT Vs City of DavaoKaye LambinoNo ratings yet

- 50 - Traders Royal Bank v. Radio Philippines NetworkDocument8 pages50 - Traders Royal Bank v. Radio Philippines NetworkCheska VergaraNo ratings yet

- 04 BdoDocument43 pages04 BdoCheska VergaraNo ratings yet

- 138 Manila Toledo Santiago V NazarioDocument2 pages138 Manila Toledo Santiago V NazarioCheska VergaraNo ratings yet

- Firestone Tire Rubber Company of TheDocument6 pagesFirestone Tire Rubber Company of Thebrandon dawisNo ratings yet

- 001 - Magallona v. Ermita - GR 187167 - August 16 2011 PDFDocument16 pages001 - Magallona v. Ermita - GR 187167 - August 16 2011 PDFCheska VergaraNo ratings yet

- Case 1 Is Coca-Cola A Perfect Business PDFDocument2 pagesCase 1 Is Coca-Cola A Perfect Business PDFJasmine Maala50% (2)

- Marketing Strategies of BSNLDocument5 pagesMarketing Strategies of BSNLRanjeet Pandit50% (2)

- Greek Labour LawDocument3 pagesGreek Labour LawSerban MihaelaNo ratings yet

- SupermarketsDocument20 pagesSupermarketsVikram Sean RoseNo ratings yet

- Disputed Invoice CreationDocument13 pagesDisputed Invoice CreationSrinivas Girnala100% (1)

- Kasneb Entrepreneurship and Communication For More Free Past Papers Visit May 2014 Section 1 Question OneDocument1 pageKasneb Entrepreneurship and Communication For More Free Past Papers Visit May 2014 Section 1 Question OneTimo PaulNo ratings yet

- BBA Syllabus - 1Document39 pagesBBA Syllabus - 1Gaurav SaurabhNo ratings yet

- Casino PowerpointDocument23 pagesCasino Powerpointmanami11No ratings yet

- Merritt's BakeryDocument1 pageMerritt's BakeryNardine Farag0% (1)

- DESIGNER BASKETS Vs Air Sea TransportDocument1 pageDESIGNER BASKETS Vs Air Sea TransportMarco CervantesNo ratings yet

- KFC Case Study by MR OtakuDocument36 pagesKFC Case Study by MR OtakuSajan Razzak Akon100% (1)

- Operations and Supply Chain Management B PDFDocument15 pagesOperations and Supply Chain Management B PDFAnonymous sMqylHNo ratings yet

- Some Information About The Exam (Version 2023-2024 Groep T)Document17 pagesSome Information About The Exam (Version 2023-2024 Groep T)mawiya1535No ratings yet

- Sesi 14 - Pemodelan Berbasis Agen - 2Document20 pagesSesi 14 - Pemodelan Berbasis Agen - 2nimah tsabitahNo ratings yet

- JKGKJDocument2 pagesJKGKJYing LiuNo ratings yet

- Exam 500895 - PPMC - Senior Capstone - Excel SpreadsheetDocument7 pagesExam 500895 - PPMC - Senior Capstone - Excel Spreadsheetshags100% (6)

- Isaca Cisa CoursewareDocument223 pagesIsaca Cisa Coursewareer_bhargeshNo ratings yet

- Exam Review: Market Equilibrium and ExternalitiesDocument24 pagesExam Review: Market Equilibrium and ExternalitiesDavid LimNo ratings yet

- List of 50 Cheapest Proofreading Services: Are You Looking For TheDocument5 pagesList of 50 Cheapest Proofreading Services: Are You Looking For TheCheapestProofreadingSNo ratings yet

- Marketing Mix and PricingDocument11 pagesMarketing Mix and PricingDiveshDuttNo ratings yet

- Abdulghany Mohamed CVDocument4 pagesAbdulghany Mohamed CVAbdulghany SulehriaNo ratings yet

- Salim Ivomas Pratama TBK Bilingual 30 June 2019 Final Director StatementDocument124 pagesSalim Ivomas Pratama TBK Bilingual 30 June 2019 Final Director Statementilham pakpahanNo ratings yet

- Ackoff Systems ThinkingDocument2 pagesAckoff Systems ThinkingLuiz S.No ratings yet

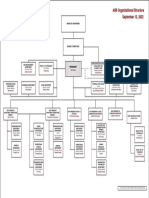

- AIIB Organizational StructureDocument1 pageAIIB Organizational StructureHenintsoa RaNo ratings yet

- Forex Signals Success PDF - Forex Trading Lab (PDFDrive)Document30 pagesForex Signals Success PDF - Forex Trading Lab (PDFDrive)scorp nxNo ratings yet

- LA Chief Procurement OfficerDocument3 pagesLA Chief Procurement OfficerJason ShuehNo ratings yet

- Account Payable Tables in R12Document8 pagesAccount Payable Tables in R12anchauhanNo ratings yet

- Executive SummaryDocument32 pagesExecutive SummaryMuhammad ZainNo ratings yet

- Fundamental RulesDocument18 pagesFundamental RulesrakeshNo ratings yet

- Kennedy Geographic Consulting Market Outlook 2014 Latin America SummaryDocument8 pagesKennedy Geographic Consulting Market Outlook 2014 Latin America SummaryD50% (2)