Professional Documents

Culture Documents

Answer To Practice Set I

Uploaded by

Din Rose GonzalesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Answer To Practice Set I

Uploaded by

Din Rose GonzalesCopyright:

Available Formats

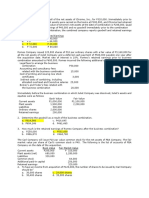

1.

Stain Corporation is an 80%-owned subsidiary of Paint of P Corporation and S Company for 2018 are as

Corporation. During 2017 Stain sold merchandise that follows:

cost P96,000 to Paint for P128,000. Paint's ending P Corporation S Company

inventory at December 31, 2017 contained unrealized Sales 633,600 350,400

profit of P6,400 from the intercompany sales. During Cost of Goods Sold 384,000 192,000

2018 Stain sold merchandise that cost P112,000 to Operating expenses 115,200 96,000

Paint for P152,000. One-half of this remained unsold Separate income from

by Paint at December 31, 2018 For 2018 Paint's own operations 134,400 62,400

separate income was P200,000 and Stain's reported

net income was P152,000. Intercompany sales from P to S for 2017 and 2018 are

The consolidated net income for 2018 will be: summarized as follows:

a. P302,000 c. P310,720 Cost Selling Unsold

b. P338,400 d. P274,500 Price at year-

end

2. P Company acquired a 90% interest in S Company in Intercompany sales

2016 at a time when S Company's book values and fair – 2017 240,000 374,400 30%

values were equal to one another. On January 1, 2018, Intercompany sales

S sold a machine with a P24,000 book value to P – 2018 168,000 264,000 40%

Company for P48,000. P depreciates the machine over

10 years using the straight line method. Separate 6. The 2018 consolidated income statement will show

incomes for P and S for 2018 are as follows: cost of goods sold of

P Co. S. Co. a. P 310,080 c. P 384,000

Sales P960,000 P560,000 b. P 576,000 d. P 192,000

Gain on sale of machinery 24,000

Cost of goods sold (400,000) (152,000) On January 1, 2018. P Corporation purchased 75% of the

Depreciation expense (240, 000) (72,000) common stock of S Company. Separate balance sheet data

Other expenses (96,000) (240,000) for the companies at the combination date are given

Separate incomes P224,000 P120,000 below:

P Corporation S Company

The consolidated net income for 2018 is: Cash P9,600 P82,400

a. P344,000 c. P310,400 Accounts receivable 57,600 10,400

b. P322,400 d. P312,560 Inventory 52,800 15,200

Land 31,200 12,800

3. On January 1, 2016, Subsidiary Company purchased a Plant assets 280,000 120,000

delivery truck with an expected useful life of 5 years Accumulated (96,000) (24,000)

and scrap value of P6,400. On January 1, 2018, depreciation

Subsidiary Company sold the truck to Parent Company Investment in Ucky 156,800 ________

and recorded the following entry: Total assets P492,000 P216,800

Debit Credit Accounts payable P82,400 P56,800

Cash 40,000 Capital stock 320,000 120,000

Accumulated depreciation 14,400 Retained earnings 89,600 40,000

Truck 42,400 Total equities P492,000 P216,800

Gain on sale of truck 12,000

At the date of combination the book values of S Company’s

Parent holds 60% of Subsidiary's voting shares. net assets was equal to the fair value of the net assets

Subsidiary reported net income of P44,000, and Parent except for S Company’s inventory which has a fair value of

reported separate net income of P78,400 for 2018. P24,000. Indicate in each of the questions what the

In preparing the consolidated financial statements for consolidated balance would be for the requested account,

2018, depreciation expense will be: assuming the amount assigned to NCI is the proportionate

a. debited for P12,000 in the elimination entries share in the fair value of net assets.

b. credited for P12,000 in the elimination entries

c. debited for P4,000 in the elimination entries 7. What amount of inventory will be reported

d. credited for P4,000 in the elimination entries. a. P52,800 c. P74,600

b. P68,000 d. P 76,800

4. The consolidated net income for 2018 will be:

a. P122,400 c. P100,000 8. What is the amount of the non-controlling interest?

b. P114,400 d. P 94,240 a. P 40,000 c. P 52,267

b. P 42,200 d. P 120,000

On January 1, 2018, P Company purchased 80% of S

Company’s outstanding stock for P2,000,000, an RICH Corporation paid P1,125,000 for an 80% interest in

amount equal to the book value of interest acquired. HARD Corporation on January 1, 2018 at a price P37,500

Appraisal of S Company’s net assets revealed that land in excess of underlying book value. The excess was

is undervalued by P80,000 while Plant Assets with allocated P15,000 to undervalued equipment with a ten-

remaining life of 5 years is overvalued by P200,000. year remaining useful life and P22,500 to goodwill which

Substantial portion of S Company’s inventories came was not impaired during the year. During 2018, HARD

from P Company. Summary of inter-company Corporation paid dividend of P60,000 to RICH Corporation.

shipments are given below: The income statements of RICH and HARD for 2018 are

Jan. 1 Merchandise costing P420,000 are given below:

shipped at 25% gross profit based on

cost. RICH HARD

May 1 Merchandise costing P660,000 are Sales P2,500,000 P1,000,000

shipped at the same gross profit rate Cost of sales (1,250,000) (500,000)

used on Jan.1 Depreciation

Nov. 1 Merchandise costing P209,600 are expense (250,000) (150,000)

shipped at the same gross profit rate Other expense (500,000) (225,000)

used on Jan.1 of which 1/5 is on hand at Net income P500,000 P125,000

December 31, 2018.

9. Consolidated net income for 2018 is

5. The amount of inter-company sales to be eliminated a. P632,125 c. P623,125

a. P 1,289,600 c. P 2,257,500 b. P263,125 d. P632,215

b. P 1,612,500 d. P 1,612,000

10. Non-controlling interest in net assets at December 31,

P Corporation acquired 70% of the voting common 2018.

stock of S Company at a time when S Company’s book a. P290,785 c. P270,985

values and fair values were equal. Separate incomes b. P209,785 d. P290,875

You might also like

- Equity Test BanksDocument34 pagesEquity Test BanksRez Pia92% (12)

- Tax 06-Tax On IndividualsDocument12 pagesTax 06-Tax On IndividualsDin Rose Gonzales80% (5)

- Advanced Accounting Part 1 Dayag 2015 Chapter 8Document5 pagesAdvanced Accounting Part 1 Dayag 2015 Chapter 8Killua Zoldyck67% (3)

- 6 Afar To Summary Quizzer 1 Solution Oct 2016Document44 pages6 Afar To Summary Quizzer 1 Solution Oct 2016Love Villa100% (1)

- JLR Bond Valuation - Adit - P41065Document7 pagesJLR Bond Valuation - Adit - P41065Adit Shah100% (2)

- AFARS14 General ReviewDocument15 pagesAFARS14 General ReviewBeatrice Teh100% (4)

- Pre Midterm AFAR PDFDocument12 pagesPre Midterm AFAR PDFDanielle Nicole Marquez100% (1)

- Multiple Choice QuestionsDocument8 pagesMultiple Choice QuestionsNicole Lin100% (1)

- Adjusting Entries Questions and AnswersDocument28 pagesAdjusting Entries Questions and AnswersAnonymous 17L3cj75% (20)

- FEU Quiz 2 Conso SYDocument6 pagesFEU Quiz 2 Conso SYclarissa paragas50% (2)

- Consolidated Problems TestbankDocument6 pagesConsolidated Problems TestbankIvy Salise0% (1)

- Ho BRDocument3 pagesHo BRSummer Star33% (3)

- Advnce - fin.Acc.&Repprac 2Document17 pagesAdvnce - fin.Acc.&Repprac 2Jerry Licayan0% (1)

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- Afar - Business Combinations - Mergers Ellery de Leon Far Eastern UniversityDocument3 pagesAfar - Business Combinations - Mergers Ellery de Leon Far Eastern UniversityRyan Joseph Agluba Dimacali50% (2)

- PB DifficultDocument20 pagesPB DifficultPaulo MiguelNo ratings yet

- AfarDocument11 pagesAfarWilsonNo ratings yet

- AFAR Quizzer 3 SolutionsDocument12 pagesAFAR Quizzer 3 SolutionsHazel Mae Lasay100% (1)

- T R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' EquityDocument12 pagesT R S A: Ap-200Q: Quizzer On Financing Cycle: Audit of Stockholders' Equityprincess sibugNo ratings yet

- Activity For Finals TermDocument6 pagesActivity For Finals TermRhegee Irene RosarioNo ratings yet

- 09 Additional NotesDocument4 pages09 Additional NotesMelody GumbaNo ratings yet

- Bfjpia Cup 3 - Practical Accounting 2 Easy: Page 1 of 10Document10 pagesBfjpia Cup 3 - Practical Accounting 2 Easy: Page 1 of 10Arah OpalecNo ratings yet

- AFAR Answer-KeyDocument8 pagesAFAR Answer-KeyShirliz Jane Benitez100% (1)

- Test AfarDocument24 pagesTest AfarZyrelle Delgado100% (3)

- AFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSDocument7 pagesAFAR.2906 - SEPARATE and CONSOLIDATED STATEMENTSRonna Mae Mendoza100% (1)

- ConstDocument15 pagesConstJemson YandugNo ratings yet

- Batohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossDocument7 pagesBatohinog, Tricia Jean B. 1: Name Block: Write Your Final Answers in The Table Provided. Indicate If Gain or LossivankingbachoNo ratings yet

- CRC ACE Final PreboardDocument10 pagesCRC ACE Final PreboardrochielanciolaNo ratings yet

- 1st PB TAX AnsDocument24 pages1st PB TAX AnsDin Rose Gonzales50% (2)

- Apollo Food Holdings BerhadDocument21 pagesApollo Food Holdings BerhadAzilah UsmanNo ratings yet

- AFAR - BC TwoDocument3 pagesAFAR - BC TwoJoanna Rose DeciarNo ratings yet

- Final Exam - ADV ACCTG 2 - 2nd Sem2011-2012Document26 pagesFinal Exam - ADV ACCTG 2 - 2nd Sem2011-2012R De GuzmanNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- AfarDocument14 pagesAfarKenneth RobledoNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyKim Fernandez50% (2)

- Installment Sales Multiple QuestionsDocument36 pagesInstallment Sales Multiple QuestionsTrixie CapisosNo ratings yet

- FL AfarDocument20 pagesFL AfarKenneth Robledo50% (2)

- CPA Board Examination Operation - Advance Accounting: Page 1 of 11Document11 pagesCPA Board Examination Operation - Advance Accounting: Page 1 of 11Janella Patrizia0% (1)

- Jointly Operations Point of ViewDocument1 pageJointly Operations Point of ViewMarjorie100% (1)

- Afar.2905 Business Combination Mergers PDFDocument5 pagesAfar.2905 Business Combination Mergers PDFCyrille Keith FranciscoNo ratings yet

- Exercises Corpo and Inst. SalesDocument1 pageExercises Corpo and Inst. SalesGanda MoNo ratings yet

- Installment, Home-Branch, Liquidation, LT Constn ContractsDocument47 pagesInstallment, Home-Branch, Liquidation, LT Constn ContractsArianne Llorente83% (6)

- Nfjpia Nmbe Afar 2017 AnsDocument10 pagesNfjpia Nmbe Afar 2017 AnshyosungloverNo ratings yet

- 2018cpapassers PDFDocument4 pages2018cpapassers PDFBryan Bryan BacarisasNo ratings yet

- Measurement of Inventory and Inventory Shortage5Document3 pagesMeasurement of Inventory and Inventory Shortage5CJ alandyNo ratings yet

- Ho Branch Quiz 3 2016Document9 pagesHo Branch Quiz 3 2016shampaloc100% (2)

- ConstructiveDocument5 pagesConstructiveLobotNo ratings yet

- Business Combi - AcquisitionDocument6 pagesBusiness Combi - Acquisitionnaser20% (5)

- CPAR PreweekDocument20 pagesCPAR Preweekrochielanciola100% (1)

- Afar QuestionsDocument16 pagesAfar Questionspopsie tulalianNo ratings yet

- MidtermQ2 - Home Office Branch Accounting Billing Above CostDocument7 pagesMidtermQ2 - Home Office Branch Accounting Billing Above Costsarahbee33% (3)

- Business CombinationDocument10 pagesBusiness CombinationCloudKielGuiang0% (1)

- Practical Accounting 2 - RMYCDocument10 pagesPractical Accounting 2 - RMYCZadharie Abby Gail BurataNo ratings yet

- Test2 AfarDocument24 pagesTest2 AfarZyrelle DelgadoNo ratings yet

- Practical Accounting 2Document4 pagesPractical Accounting 2RajkumariNo ratings yet

- Audit of Inventories - STDocument7 pagesAudit of Inventories - STFrancine Holler0% (2)

- Level 2 AfarDocument7 pagesLevel 2 AfarDarelle Hannah MarquezNo ratings yet

- Accounting 101Document7 pagesAccounting 101Jan ryanNo ratings yet

- Set ADocument5 pagesSet ASomersNo ratings yet

- Quiz Conso FSDocument3 pagesQuiz Conso FSMark Joshua SalongaNo ratings yet

- Final ExaminationDocument3 pagesFinal ExaminationCezanne Pi-ay EckmanNo ratings yet

- 1617 2ndS 3rde JonaldBDocument11 pages1617 2ndS 3rde JonaldBAlyssa Andrea SabinoNo ratings yet

- Assignment Business CombinationDocument2 pagesAssignment Business CombinationZarah H. LeongNo ratings yet

- M36 - Quizzer 4Document5 pagesM36 - Quizzer 4Joshua DaarolNo ratings yet

- FAR - RQ - Investment in AssociatesDocument2 pagesFAR - RQ - Investment in AssociatesKriane Kei50% (2)

- 2013 2014 2015 2016 2017 2018 2019 CparDocument2 pages2013 2014 2015 2016 2017 2018 2019 CparDin Rose GonzalesNo ratings yet

- Long Quiz 1 Part IDocument1 pageLong Quiz 1 Part IDin Rose GonzalesNo ratings yet

- Room Assignment Studio 3 ROOM 305Document1 pageRoom Assignment Studio 3 ROOM 305Din Rose GonzalesNo ratings yet

- Room Assignment Studio 3 ROOM 305Document1 pageRoom Assignment Studio 3 ROOM 305Din Rose GonzalesNo ratings yet

- Long Quiz 1 Part IIDocument1 pageLong Quiz 1 Part IIDin Rose GonzalesNo ratings yet

- Accounting Sample TestDocument6 pagesAccounting Sample TestDin Rose GonzalesNo ratings yet

- CbaDocument1 pageCbaDin Rose GonzalesNo ratings yet

- Part 1-FinObj MCQDocument21 pagesPart 1-FinObj MCQHồng DiệpNo ratings yet

- Part 1-FinObj MCQDocument21 pagesPart 1-FinObj MCQHồng DiệpNo ratings yet

- Part 1-FinObj MCQDocument21 pagesPart 1-FinObj MCQHồng DiệpNo ratings yet

- Insight: Examiners General CommentsDocument84 pagesInsight: Examiners General CommentskmillatNo ratings yet

- 340 Exam 1 F 01Document7 pages340 Exam 1 F 01Din Rose GonzalesNo ratings yet

- Tax 01-General PrinciplesDocument9 pagesTax 01-General PrinciplesDin Rose Gonzales0% (1)

- Insight: Examiners General CommentsDocument84 pagesInsight: Examiners General CommentskmillatNo ratings yet

- S36BW 418092310210Document3 pagesS36BW 418092310210Din Rose GonzalesNo ratings yet

- Income Tax On CorporationDocument12 pagesIncome Tax On CorporationDin Rose GonzalesNo ratings yet

- Review - Atty Dante O. Dela Cruz 12-28-17Document1 pageReview - Atty Dante O. Dela Cruz 12-28-17Din Rose GonzalesNo ratings yet

- S36BW 418122018181Document8 pagesS36BW 418122018181Din Rose GonzalesNo ratings yet

- Estate TaxDocument16 pagesEstate TaxDin Rose GonzalesNo ratings yet

- Tax 06-Tax On IndividualsDocument9 pagesTax 06-Tax On IndividualsDin Rose GonzalesNo ratings yet

- Quiz For PrintingDocument6 pagesQuiz For PrintingDin Rose GonzalesNo ratings yet

- RMC No 1-2018Document3 pagesRMC No 1-2018Din Rose GonzalesNo ratings yet

- The Problem and Its SettingDocument27 pagesThe Problem and Its SettingDin Rose GonzalesNo ratings yet

- Quiz - For PrintingDocument9 pagesQuiz - For PrintingDin Rose Gonzales100% (1)

- Far First PB 1017Document25 pagesFar First PB 1017Din Rose Gonzales100% (1)

- RMC No 1-2018Document4 pagesRMC No 1-2018Dione GuevaraNo ratings yet

- PEODocument2 pagesPEODin Rose GonzalesNo ratings yet

- FCFE ValuationDocument27 pagesFCFE ValuationTaleya FatimaNo ratings yet

- Wikler Case Competition PowerpointDocument16 pagesWikler Case Competition Powerpointbtlala0% (1)

- Daftar PustakaDocument3 pagesDaftar Pustakathescribd94No ratings yet

- Pal Corporation and Subdinary Consolidation Workpaper Fo The Year Ended Des 31, 2011Document8 pagesPal Corporation and Subdinary Consolidation Workpaper Fo The Year Ended Des 31, 2011ATIKA ZAHRAHNo ratings yet

- UGBA 120B Discussion Section 7 10 12 12Document18 pagesUGBA 120B Discussion Section 7 10 12 12jennyz365No ratings yet

- CM&SLDocument554 pagesCM&SLeducational797No ratings yet

- Larson Chap 1 Prob Set ADocument17 pagesLarson Chap 1 Prob Set AJack ThuanNo ratings yet

- Speech (Business Proposal)Document8 pagesSpeech (Business Proposal)Filza MaryamNo ratings yet

- This Study Resource Was: Correct!Document5 pagesThis Study Resource Was: Correct!Angelie De LeonNo ratings yet

- MFSA Newsletter July 2011Document8 pagesMFSA Newsletter July 2011Andrea DG Markt TraineeNo ratings yet

- GBM Mexico Strategy 2024Document34 pagesGBM Mexico Strategy 2024Mario LuisNo ratings yet

- CROCI Focus Intellectual CapitalDocument35 pagesCROCI Focus Intellectual CapitalcarminatNo ratings yet

- Atc MM Combined Kiids Rda PtaDocument12 pagesAtc MM Combined Kiids Rda PtaronNo ratings yet

- Determinants of Credit Risk in Ethiopian Private Commercial BanksDocument1 pageDeterminants of Credit Risk in Ethiopian Private Commercial BanksAtakelt HailuNo ratings yet

- Inbt Finals ReviewerDocument11 pagesInbt Finals ReviewerQuenie SagunNo ratings yet

- Other Concepts and Valuation Techniques MA 05.24.23Document4 pagesOther Concepts and Valuation Techniques MA 05.24.23Ivan Jay E. EsminoNo ratings yet

- Google 10k 2015Document3 pagesGoogle 10k 2015EliasNo ratings yet

- Multiple Choice Answers and Solutions: Reorganization and Troubled Debt Restructuring 135Document9 pagesMultiple Choice Answers and Solutions: Reorganization and Troubled Debt Restructuring 135Nelia Mae S. VillenaNo ratings yet

- Annexure A Operational Guidelines For Offer To Buy (OTB) WindowDocument38 pagesAnnexure A Operational Guidelines For Offer To Buy (OTB) WindowMaminul IslamNo ratings yet

- School District Notes To Financial Statements Year Ended June 30, 2021Document34 pagesSchool District Notes To Financial Statements Year Ended June 30, 2021Jam SurdivillaNo ratings yet

- Chapter 08Document6 pagesChapter 08Sankalan GhoshNo ratings yet

- Ignacio Vinke - Investments Homework 1Document19 pagesIgnacio Vinke - Investments Homework 1Ignacio Andrés VinkeNo ratings yet

- The Magic of MarketDocument7 pagesThe Magic of MarketRadu DragoşNo ratings yet

- Commodity Market and DerivativesDocument20 pagesCommodity Market and DerivativesMonish jainNo ratings yet

- Ceat Tyres LTD.: Fsa AssignmentDocument37 pagesCeat Tyres LTD.: Fsa AssignmentSourajit SanyalNo ratings yet

- Stratim Capital Announces First Closing of Stratim Cloud Fund, LPDocument3 pagesStratim Capital Announces First Closing of Stratim Cloud Fund, LPPR.comNo ratings yet

- Future of Trading - RefinitivDocument8 pagesFuture of Trading - Refinitivryan sharmaNo ratings yet