Professional Documents

Culture Documents

The Continuous Shift in the Global Economy's Center of Gravity Toward Asia

Uploaded by

Nischal ThapaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Continuous Shift in the Global Economy's Center of Gravity Toward Asia

Uploaded by

Nischal ThapaCopyright:

Available Formats

The A European insider

surveys the scene.

State of

Globalization

B Y J Ü R G E N S TA R K

W

hat has changed about the global economic struc-

ture since the early 1990s? An increasing pro-

portion of economic activity is

market-determined. Within a period of only fif-

teen years, major centrally planned economies

have turned into market economies and several

strongly regulated emerging market economies

have implemented radical reforms.

All of this has stimulated very strong and ongoing growth dynamics.

Consolidated and internationalized competitive conditions have ensued, continu-

ously requiring adjustment from all economies. This challenge is accompanied in

many advanced economies by demographic changes which require additional

efforts.

Under realistic assumptions, the United States and Asia will remain the cen-

ters of gravity of the global economy in the coming years. However, without

THE MAGAZINE OF

changes in the conduct of economic policy, this would also mean that the existing

INTERNATIONAL ECONOMIC POLICY

global current account imbalances would become even more pronounced, with

888 16th Street, N.W.

Suite 740 an increasing risk of sudden exchange rate and financial markets movements.

Washington, D.C. 20006 Moreover, enormous challenges increase the vulnerabilities connected with

Phone: 202-861-0791 current global imbalances. Changes in the global economic structures in the wake

Fax: 202-861-0790 of globalization are particularly important. Production processes can be regionally

www.international-economy.com

editor@international-economy.com Jürgen Stark is Deputy Governor of the Deutsche Bundesbank.

52 THE INTERNATIONAL ECONOMY SPRING 2005

S TA R K

fragmented to a greater extent than ever before. The

number of tradable goods has risen sharply and many

services have become tradable. The financial markets The continuous shift in the global

are closely integrated on a global scale. Economic

policies, but also tax systems and regulations, are

competing with one another internationally for capi- economy’s center of gravity toward

tal investment and savings.

The number of countries affected by today’s

globalization processes is far larger than the number Asia with its enormous labor

involved in earlier phases. This applies particularly to

the global economic integration of emerging markets

and developing countries. The shares which these reserves also means that the

countries have in the world’s goods markets, direct

investment flows, and portfolio inflows have

expanded considerably. employment prospects not only for

The increasing integration of large emerging

economies into the global economy means that the

volume of world trade and global growth prospects low-skilled but increasingly high-

will continue to rise. The so-called BRIC countries—

Brazil, Russia, India, and China—are arousing par-

ticular interest in this respect, with China and India skilled employees in the industrial

assuming a prominent role.

While China has established itself as the intra-

Asian platform for the production of labor-intensive nations will continue to deteriorate.

goods—especially for the United States—India’s strat-

egy is based on the export of services. However, China

and India import a considerable volume of goods from

other countries, particularly in Asia, and record only goods will offer the industrial countries tremendous

small current account deficits. export opportunities.

What obviously differentiates China and India If the countries which today are at the leading

from other emerging economies is their sheer size. edge of the global value-added chain maintain their

Their combined population is roughly 2.5 billion, advantages in the development and production of

representing more than one-third of the world’s pop- technology-intensive goods and services, they can

ulation. The global economy is therefore confronted but profit from the low-cost products from Asia. It is

with an adjustment process of a special type and not absolute but comparative cost advantages which

greater magnitude than those witnessed in the past. decide the pecking order of economies and regions

The growing range of goods and services from China in the context of the international division of labor.

and India, produced and supplied at low cost, will This adjustment process to the changes in the

lead to significant changes in global production pat- world economy will vary from country to country

terns, trade, and relative prices. and may result in economic and political tensions

The continuous shift in the global economy’s between the trading partners in these countries.

center of gravity toward Asia with its enormous labor Integration of the large emerging market economies

reserves also means that the employment prospects involves the risk of increasing protectionism.

not only for low-skilled but increasingly high-skilled Countries which see themselves as losers in the

employees in the industrial nations will continue to globalization process will resort to short-term iso-

deteriorate. On the other hand, developing the as-yet lation measures that endanger both the progress

inadequate infrastructure in these countries along already made and further progress in the global divi-

with their rising demand for high-quality industrial sion of labor.

SPRING 2005 THE INTERNATIONAL ECONOMY 53

S TA R K

rather improbable. This is due partly to the

diverging levels of economic performance,

and partly to the lack of strong political insti-

tutions in Asia.

In fact, the various regional organiza-

tions in Asia are much less institutionalized

than those in the European Union. Their cho-

sen mode of interaction is intergovernmental.

The established bodies have nothing more

than an advisory function.

However, there is good reason to

assume that regional integration will deepen

in Asia. This leads to the interesting ques-

tion: Who will be the main driving force of

this process?

To cope with the challenges posed by

globalization, a high degree of adaptability

The ASEAN Headquarters in Jakarta. In previous years, east Asian will be needed. The United States, with its flexi-

countries, in particular the ASEAN member states, have intensified their ble economy, comparatively favorable demo-

cooperation. As a whole, the ASEAN region comprises a market of no graphics, and high degree of penetration of the

less than 500 million people, which is a sizeable entity also for foreign economy with information and communications

investors. In addition, these countries have distinguished themselves as technology, has every chance of successfully

investment locations with attractive business conditions. overcoming the challenges described. However,

—J. Stark the U.S. current account deficit is a clear indica-

tion that there is a need for structural adjustment,

too. The need to finance around 5.5 percent of

U.S. GDP externally in 2004 has made the United

T

he shift in the global economic focus toward States the biggest “debtor” in the world. This credit-

east and southeast Asia also raises the question financed “overconsumption” cannot be sustained in

of economic cooperation within Asia and its the long term, not even by the United States. A grad-

possible political implications—including the shift in ual adjustment process, which includes not only

the balance of power.

One has to bear in mind that rising regionalism is

a global phenomenon because countries—large and

small alike—have used this to respond to global chal- Huge internal imbalances in

lenges and developments. They integrate because they

do not want to lose out in the global competition for

export markets and foreign direct investments. And the leading Asian emerging

because of the dynamics in multilateral trade negoti-

ations, small nations resort to regionalism in order to

enhance their bargaining leverage and to gain some economies may absorb much of the

degree of international political influence.

In previous years, east Asian countries, in par-

ticular the ASEAN member states, have intensified political energy in order to contain

their cooperation. As a whole, the ASEAN region

comprises a market of no less than 500 million peo-

ple, which is a sizeable entity also for foreign potential regional and social

investors. In addition, these countries have distin-

guished themselves as investment locations with

attractive business conditions. tensions and conflicts.

In spite of the dynamic developments in Asian

economic cooperation, integration along EU lines is

54 THE INTERNATIONAL ECONOMY SPRING 2005

S TA R K

owned enterprises have hitherto been responsible as

well as a framework for a market-oriented fiscal and

Small nations resort to regionalism monetary policy.

in order to enhance their bargaining

I

n Europe, the process of structural reforms must

continue. Europe has problems. The most pressing

include high unemployment, a lack of economic

leverage and to gain some degree of flexibility, and an aging population. However, one

should not overlook the fact that more than ten million

jobs have been created since 1997. That is two million

international political influence. more than in the United States. There has also been a

maturing awareness of the need for reform. Reforms

have now been introduced in the labor markets and

social security systems. Following the accession of ten

exchange rate changes and internal adjustment, but also new members last year, the European Union now has a

higher growth rates outside the United States, would large single market which unites the purchasing power

be desirable. of 450 million citizens.

A crucial requirement if the U.S. current account However, in view of its possibilities, the euro area’s

deficit is to be reduced is that U.S. national savings growth potential is low. The OECD estimates it to be

must increase. The International Monetary Fund, the about 2 percent per year; by comparison, the U.S.

U.S. Federal Reserve, and also the G7 are therefore growth potential is estimated at over 3 percent. These

emphatically calling for reduction in government bud- growth differentials are to a large extent attributable to

get deficits. different rates of population growth. Even so, I am opti-

Despite the progress that Japan has made in mistic. With increasingly flexible economies, greater

removing structural rigidities, there is still a need for efforts in research and development, and greater will-

reform if it wants to restrengthen its economic role in ingness to be innovative and work longer hours, Europe

the region. Structural rigidities in the domestic market is on the way to becoming an economically more

and, in particular, the age structure of the Japanese pop- dynamic region. Don’t forget—the European Union has

ulation are restricting its economic potential. This is

also a reason why the OECD estimates Japan’s annual

potential growth at only just over 1 percent. The situ-

ation is compounded by the precarious state of public The euro area’s

finances with the government debt level at almost 170

percent of GDP.

In the case of the emerging economies in East Asia, growth potential is low.

what matters is not the adjustment of existing struc-

tures, but rather the creation of new ones. The Asian

countries must overcome the prevailing bilateralism to

be able to benefit from the international division of been an extraordinary success in terms of stabilizing the

labor more than has been the case thus far. This includes continent politically. Despite occasional setbacks, inte-

establishing an institutional framework for their gration has made continuous advances and has culmi-

regional cooperation. nated in a single currency.

China’s political and economic development will

depend largely on how the country deals with its grow-

T

ing internal imbalances such as the tension between oday, globalization is by some argued to be mostly

urban and rural areas. In China, the most pressing a triadization. The process of integration is at its

reform project is the creation of a well-functioning most intense among the three regions that contain

financial system able to channel national savings toward most of the world’s developed market economies: North

efficient uses and as an important step toward more America, Western Europe, and East Asia. But we should

exchange rate flexibility. Furthermore, it is necessary also not forget South America and Africa.

to create a social security system for which the state- Continued on page 70

SPRING 2005 THE INTERNATIONAL ECONOMY 55

S TA R K

Continued from page 55

Europe has problems. The most pressing include high unemployment,

a lack of economic flexibility, and an aging population.

However, one should not overlook the fact that more than

ten million jobs have been created since 1997.

That is two million more than in the United States.

On the one hand, the United States and the With the appearance of new economic players on

European Union continue to be the “traditional” driving the international scene, the global economic structure is

forces of the global economy, accounting for more than changing. The relevance of Japan, Europe, and the

half of global trade and investment. United States might be affected. What might be the

At the same time, the most dynamic growth region impact on the regional and global balance of power?

is non-Japan Asia. With globalized markets and increas- One important aspect in this context are the huge

ing competition, the integration of large emerging mar- internal imbalances in the leading Asian emerging

kets is giving rise to structural adjustments in the global economies. These imbalances may absorb much of the

economy. political energy in order to contain potential regional and

Forces of globalization and competitive markets are social tensions and conflicts.

driving Americans, Europeans, and Asians together, not Thus, the United States is most likely—if not for

apart. This represents a major challenge since geo- sure—to remain the only economic, political, and mili-

economics and geopolitics are deeply intertwined. To tary power. However, it is desirable that the United States

rise to this challenge, a sound international framework remains open to international cooperation and multilat-

must be in place in which all parties involved commit eralism. Isolationism and unilateralism should not be real

themselves to a multilateral approach. The integration political options.

of large emerging markets into the global economy can- What is most likely to change globally are alliances

not be allowed to lead to increased protectionism. Its and relationships. New alliances and altering relation-

consequences would have to be borne by all parties ships might affect the global role of individual countries.

involved. What about Europe? Europe has the potential to

become internationally more relevant again, economi-

cally and politically. Since the early 1990s, Europe has

primarily dealt with its domestic problems in a rather

Economic policies, but also tax systems inward-looking attitude. The Berlin Wall and the Iron cur-

tain fell in 1989–90, and the former communist states in

central and eastern Europe were transformed politically

and regulations, are competing with and economically. The path to EMU was prepared in the

second half of the 1990s. The European Union was

enlarged by ten new member states in 2004. Structural

one another internationally for capital reforms were begun in the late 1990s.

The future international role of the European Union

will depend on the speed and the results of the adjust-

investment and savings. ment and reform process. To deepen political integra-

tion and to have a vision about Europe’s future role are

key. ◆

70 THE INTERNATIONAL ECONOMY SPRING 2005

You might also like

- Test Bank For International Marketing 16th Edition CateoraDocument118 pagesTest Bank For International Marketing 16th Edition Cateoraa2820622510% (1)

- A New Look at The: Development AgendaDocument12 pagesA New Look at The: Development AgendaIsraelNo ratings yet

- Uk in Guide To Emerging MarketsDocument16 pagesUk in Guide To Emerging MarketsgammaslideNo ratings yet

- A New Growth Strategy For Developing NationsDocument16 pagesA New Growth Strategy For Developing NationsmumoshitakeshiNo ratings yet

- Think Piece SUPAPODocument5 pagesThink Piece SUPAPOKenneth Dela cruzNo ratings yet

- Association For Asian Studies The Journal of Asian StudiesDocument25 pagesAssociation For Asian Studies The Journal of Asian Studiesmonster_newinNo ratings yet

- Globalisation, Growth and Justice: ErspectivesDocument7 pagesGlobalisation, Growth and Justice: Erspectivesyash tyagiNo ratings yet

- Transitioning To A New U.S. International Economic PolicyDocument42 pagesTransitioning To A New U.S. International Economic PolicyjiheegoNo ratings yet

- Replacing Obsolete Institutions and Business Models: Adjusting To Brics in Glass HousesDocument18 pagesReplacing Obsolete Institutions and Business Models: Adjusting To Brics in Glass HousesDhaval ShethiaNo ratings yet

- Management Discussions and AnalysisDocument12 pagesManagement Discussions and AnalysisMohanapriya JayakumarNo ratings yet

- Globalization: Curse or Cure? Policies To Harness Global Economic Integration To Solve Our Economic Challenge, Cato Policy Analysis No. 659Document24 pagesGlobalization: Curse or Cure? Policies To Harness Global Economic Integration To Solve Our Economic Challenge, Cato Policy Analysis No. 659Cato InstituteNo ratings yet

- F.-AGUSTIN-GEC-005-MODULE-7-12Document28 pagesF.-AGUSTIN-GEC-005-MODULE-7-12Aldrin MarianoNo ratings yet

- PWC Connectivity Growth PDFDocument48 pagesPWC Connectivity Growth PDFcristinamartin853643No ratings yet

- GCR Chapter1.1 2012-13 PDFDocument46 pagesGCR Chapter1.1 2012-13 PDFErnesto GuiñazuNo ratings yet

- ECONDEV-1Document9 pagesECONDEV-1Jasmine MaghirangNo ratings yet

- Technological Upgrading in GlobalDocument49 pagesTechnological Upgrading in GlobalAskederin MusahNo ratings yet

- Emerging Market Economies Leading Global Growth: - Duvvuri SubbaraoDocument12 pagesEmerging Market Economies Leading Global Growth: - Duvvuri SubbaraoBanajit DekaNo ratings yet

- ANZ Insight 5 Final Report CleanDocument35 pagesANZ Insight 5 Final Report Cleanm76507084No ratings yet

- India Dream RunDocument13 pagesIndia Dream RunNAMYA ARORANo ratings yet

- Solow Growth Model in The Economies of USA and ChinaDocument10 pagesSolow Growth Model in The Economies of USA and ChinaFedrick BuenaventuraNo ratings yet

- ADBI News: Volume 3 Number 2 (2009)Document8 pagesADBI News: Volume 3 Number 2 (2009)ADBI PublicationsNo ratings yet

- Microsoft Word - LETTER HEADDocument6 pagesMicrosoft Word - LETTER HEADVikram BhaveNo ratings yet

- Decoupling A Fresh PerspectiveDocument3 pagesDecoupling A Fresh PerspectiveSovid GuptaNo ratings yet

- Overview PDFDocument10 pagesOverview PDFBig LitresNo ratings yet

- Stiglitz 1994 Role of StateDocument133 pagesStiglitz 1994 Role of StatePandan ArumNo ratings yet

- Rise-Middle-Class-Asian-Emerging-Markets-2012-KPMGDocument5 pagesRise-Middle-Class-Asian-Emerging-Markets-2012-KPMGsingerngoctrinh657No ratings yet

- Overview of Pak EconomyDocument22 pagesOverview of Pak EconomyheadandtailNo ratings yet

- Bicol University Graduate School Document Analyzes Lewis and Chenery Models of Economic DevelopmentDocument3 pagesBicol University Graduate School Document Analyzes Lewis and Chenery Models of Economic DevelopmentGrace Revilla CamposNo ratings yet

- Crescimento Acelerado SpenceDocument12 pagesCrescimento Acelerado SpenceJoss DeeNo ratings yet

- Ear Executive Summary 080421Document8 pagesEar Executive Summary 080421Lie MarNo ratings yet

- Índices de Mercados Emergentes (EMI) Do HSBC Terceiro Trimestre de 2009Document13 pagesÍndices de Mercados Emergentes (EMI) Do HSBC Terceiro Trimestre de 2009Marc SaundersNo ratings yet

- AE Vs EMDocument3 pagesAE Vs EMASIF KHANNo ratings yet

- Development Unchained - Trade and Industrialization in The Era of International ProductionDocument12 pagesDevelopment Unchained - Trade and Industrialization in The Era of International ProductionSafaeNkhNo ratings yet

- Areo 0415 C 2 PDFDocument20 pagesAreo 0415 C 2 PDFNehaNo ratings yet

- China's Economic Rise-Fact and FictionDocument16 pagesChina's Economic Rise-Fact and FictionCarnegie Endowment for International Peace100% (2)

- Making Slow But Undeniable ProgressDocument1 pageMaking Slow But Undeniable ProgressAmerican Century InvestmentsNo ratings yet

- Shaping the Future of the Global Economy After COVID-19Document13 pagesShaping the Future of the Global Economy After COVID-19ĐiênĐiênNo ratings yet

- The Impact of Structural Adjustment On The PoorDocument12 pagesThe Impact of Structural Adjustment On The PoorShania AlexanderNo ratings yet

- Unit 7 International Monetary System and Currency Markets: StructureDocument0 pagesUnit 7 International Monetary System and Currency Markets: StructureJohn ArthurNo ratings yet

- The Macroeconomic Framework and Financial Sector DevelopmentDocument27 pagesThe Macroeconomic Framework and Financial Sector Developmentpn_santoshNo ratings yet

- MiddleIncomeTransition SpenceDocument2 pagesMiddleIncomeTransition Spencenguyenminh76No ratings yet

- Understanding The Global EnvironmentDocument9 pagesUnderstanding The Global EnvironmentAiperi MatyevaNo ratings yet

- DE Group 03Document32 pagesDE Group 03Pasindu DilshanNo ratings yet

- Economic Crisis & ReformsDocument5 pagesEconomic Crisis & Reformsnandini11No ratings yet

- The Service Sector in The Chinese Economy: A Geographic AppraisalDocument27 pagesThe Service Sector in The Chinese Economy: A Geographic AppraisalMuciñoHectorNo ratings yet

- Enterprises, Industry and Innovation in the People's Republic of China: Questioning Socialism from Deng to the Trade and Tech WarFrom EverandEnterprises, Industry and Innovation in the People's Republic of China: Questioning Socialism from Deng to the Trade and Tech WarNo ratings yet

- African Economic Development in A Comparative Perspective: Yilmaz Akyüz and Charles GoreDocument24 pagesAfrican Economic Development in A Comparative Perspective: Yilmaz Akyüz and Charles GoreTassia Gazé HolguinNo ratings yet

- Assignment 1stDocument9 pagesAssignment 1stZia Ur RehmanNo ratings yet

- Global Productivity Chapter 2Document56 pagesGlobal Productivity Chapter 2Sofa Zuhad MNo ratings yet

- Accumulation Strategies and Human Development in India: Jayati GhoshDocument22 pagesAccumulation Strategies and Human Development in India: Jayati GhoshBernard AlvesNo ratings yet

- Regions and Markets in Latin AmericaDocument6 pagesRegions and Markets in Latin AmericajjjjjjjjjjjjjjjNo ratings yet

- IMF Programs Consistently Restructure EconomiesDocument31 pagesIMF Programs Consistently Restructure EconomiesSonia HasNo ratings yet

- Yasheng Huang - How Did China Take OffDocument25 pagesYasheng Huang - How Did China Take OffJun QianNo ratings yet

- Literature Summary TableDocument15 pagesLiterature Summary TableOluwatosin RotimiNo ratings yet

- Drivers of Developing Asia's Growth: Past and FutureDocument35 pagesDrivers of Developing Asia's Growth: Past and FutureAsian Development BankNo ratings yet

- China 2010Document12 pagesChina 2010Olea RoscaNo ratings yet

- Endogenous Growth Theories and New Strategies For DevelopmentDocument8 pagesEndogenous Growth Theories and New Strategies For DevelopmenthendraxyzxyzNo ratings yet

- Asia and Policymaking For The Global Economy - Highlights VersionDocument10 pagesAsia and Policymaking For The Global Economy - Highlights VersionADBI PublicationsNo ratings yet

- Tdr2023ch1 enDocument31 pagesTdr2023ch1 enSuhrobNo ratings yet

- 6 PDFDocument10 pages6 PDFNalin KarunarathneNo ratings yet

- Trade Restrictions in RussiaDocument15 pagesTrade Restrictions in Russiasayalipatil1196No ratings yet

- 3rd Yr 2nd Sem Export Marketing Prefinals ExamDocument9 pages3rd Yr 2nd Sem Export Marketing Prefinals ExamAlfie Jaicten SyNo ratings yet

- MGT 212 - Mid 1 - LT 3 - Global ManagementDocument31 pagesMGT 212 - Mid 1 - LT 3 - Global ManagementNajmus Rahman Sakib 1931937630No ratings yet

- Bangladesh Case StudyDocument42 pagesBangladesh Case StudyTasmiaNo ratings yet

- Coo Inv 06 BHATTDocument2 pagesCoo Inv 06 BHATTIpons Ponaryo100% (1)

- Turkish Lira Crisis 2018Document7 pagesTurkish Lira Crisis 2018Akhil BaghlaNo ratings yet

- Question Bank Globalisation and The Indian EconomyDocument4 pagesQuestion Bank Globalisation and The Indian EconomyThe Unleashed LegendNo ratings yet

- WTO Promotes Free Trade GloballyDocument3 pagesWTO Promotes Free Trade Globallykobeadjordan0% (1)

- International Trade QuotationDocument1 pageInternational Trade QuotationNazmul Hasan NahidNo ratings yet

- Duties of Buyer/Seller according to Incoterms 2010Document1 pageDuties of Buyer/Seller according to Incoterms 2010Prince PrinceNo ratings yet

- MBA Sem-II Geopolitics & World Economic Systems MCQsDocument9 pagesMBA Sem-II Geopolitics & World Economic Systems MCQsSAURABH PATILNo ratings yet

- Transfer Pricing and Tax HavensDocument83 pagesTransfer Pricing and Tax HavensMartin TørnqvistNo ratings yet

- Globalisation and The Indian Economy Day 17 2024Document2 pagesGlobalisation and The Indian Economy Day 17 2024justpeppezzNo ratings yet

- Forex RulesDocument1 pageForex RulesKuiba TonetNo ratings yet

- International Trade and Finance CrosswordInternational Trade and Finance Crossword - WordMint QuestıonsDocument2 pagesInternational Trade and Finance CrosswordInternational Trade and Finance Crossword - WordMint QuestıonsSandy SaddlerNo ratings yet

- China in Global Finance: Sandra HeepDocument171 pagesChina in Global Finance: Sandra Heepislam k rabeeNo ratings yet

- Rate Rises As Hopes For Easing Uk Social Distancing Rules Grow 48118Document4 pagesRate Rises As Hopes For Easing Uk Social Distancing Rules Grow 48118Pratik ChourasiaNo ratings yet

- 1the Globalization of Economic Relations (1-6)Document6 pages1the Globalization of Economic Relations (1-6)Tam Gerald CalzadoNo ratings yet

- Chapter 3Document9 pagesChapter 3Safitri Eka LestariNo ratings yet

- The Balance of Payment of IndiaDocument6 pagesThe Balance of Payment of IndiaAby Abdul Rabb100% (1)

- 2Document11 pages2Erik JNo ratings yet

- Selling: Janata Bank LimitedDocument1 pageSelling: Janata Bank Limitedsalam ahmedNo ratings yet

- Foreign Trade Law: The Agreement On Trade-Related Investment Measures (Trims)Document15 pagesForeign Trade Law: The Agreement On Trade-Related Investment Measures (Trims)TanuNo ratings yet

- IBO 01 June 2019 - RemovedDocument4 pagesIBO 01 June 2019 - RemovedJay PatelNo ratings yet

- Sessions 12-15 Political Economy of International TradeDocument11 pagesSessions 12-15 Political Economy of International TradeMohan MahatoNo ratings yet

- The Rise of Globalization and the Evolution of International BusinessDocument9 pagesThe Rise of Globalization and the Evolution of International BusinessKleiam ChumzyNo ratings yet

- Question Exercise 1 26102020Document2 pagesQuestion Exercise 1 26102020azwanni zulkarnainNo ratings yet

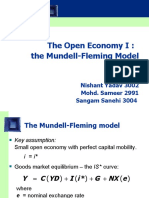

- The Mundell-Fleming ModelDocument22 pagesThe Mundell-Fleming ModelNishant YadavNo ratings yet

- Exchange Rates & Balance of Payments ExplainedDocument8 pagesExchange Rates & Balance of Payments Explainedwidya615No ratings yet