Professional Documents

Culture Documents

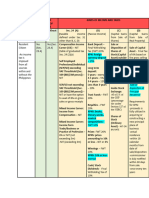

Impositions Taxpayer Tax Rate Tax Base Period of Applicability

Uploaded by

jpoy614940 ratings0% found this document useful (0 votes)

6 views1 pageJg

Original Title

Tax

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJg

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageImpositions Taxpayer Tax Rate Tax Base Period of Applicability

Uploaded by

jpoy61494Jg

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

IMPOSITIONS TAXPAYER TAX RATE TAX BASE PERIOD OF

APPLICABILITY

Sec. 29 Corporations 10% Taxable Start of every

(Improperly income calendar year

Accumulated (Improperly

Earnings Accumulated

Income Tax) earnings

Sec. 33 Employer 32% Grossed up From January

whether monetary 1, 2000

(Fringe Benefits

individual, GPP value & fringe onwards

Tax)

or benefit

Corporations

Sec. 49 ( c ) Individuals 6% Gross selling Commences

(Capital Gains price/current upon the

Tax - Sale of fair market realization of

Real Property value under sale

considered as Sec. 6 ( e ) of

Capital Asset this code

by Individual

You might also like

- Module 3 Tax On CorporationsDocument33 pagesModule 3 Tax On Corporationscha1150% (2)

- Cameroon - Country Key FeaturesDocument5 pagesCameroon - Country Key FeaturesTheo HendricksNo ratings yet

- Corporate Income Tax RateDocument3 pagesCorporate Income Tax RateJuliana ChengNo ratings yet

- Regular Income TaxationDocument6 pagesRegular Income TaxationAnabel Lajara AngelesNo ratings yet

- Regular Income TaxationDocument6 pagesRegular Income TaxationAnabel Lajara Angeles0% (1)

- Finals Reviewer Tax 1Document10 pagesFinals Reviewer Tax 1xtinxtin5432No ratings yet

- Transfer of Shares - Taxguru - inDocument4 pagesTransfer of Shares - Taxguru - inRamesh MandavaNo ratings yet

- Eopt Act Comparative SummaryDocument6 pagesEopt Act Comparative Summarybbc.moniqueNo ratings yet

- Nature of TaxesDocument3 pagesNature of TaxesCaliboso DaysieNo ratings yet

- Taxability of PartnershipDocument6 pagesTaxability of PartnershipPrincess Janine SyNo ratings yet

- Deduction Zimbabwe Revenue AuthorityDocument4 pagesDeduction Zimbabwe Revenue AuthorityRobinson ChinyerereNo ratings yet

- 2018 Tax Reform ChartDocument24 pages2018 Tax Reform ChartThomist AquinasNo ratings yet

- Calculation of Net Taxes Payable CCPCDocument1 pageCalculation of Net Taxes Payable CCPCdonnyed1479No ratings yet

- TAX Course OutlineDocument4 pagesTAX Course OutlineChe PuebloNo ratings yet

- Advanced Financial Reporting: Module 4: Final Accounts of Insurance CompaniesDocument23 pagesAdvanced Financial Reporting: Module 4: Final Accounts of Insurance CompaniesBijosh ThomasNo ratings yet

- Presumptive Tax: Table: PenaltiesDocument2 pagesPresumptive Tax: Table: PenaltiesKas MusNo ratings yet

- Comparative Matrix General Professional Partnership and General Partnership (Updated November 2020)Document2 pagesComparative Matrix General Professional Partnership and General Partnership (Updated November 2020)hellomynameisNo ratings yet

- All TaxesDocument9 pagesAll TaxesJv FerminNo ratings yet

- Rev 1Document18 pagesRev 1cypriancourageNo ratings yet

- Form REV 1 - Application For New Registration FormDocument18 pagesForm REV 1 - Application For New Registration FormMajaya JonasiNo ratings yet

- San Beda College of Law: 2005 C B O Annex B T R CDocument3 pagesSan Beda College of Law: 2005 C B O Annex B T R CRachel LeachonNo ratings yet

- TAXATION I - Income Tax (Word)Document24 pagesTAXATION I - Income Tax (Word)Jerald-Edz Tam AbonNo ratings yet

- AFAR 03.3 - Franchise and Installment SalesDocument2 pagesAFAR 03.3 - Franchise and Installment SalescheoreciNo ratings yet

- CREBA V Executive SecretaryDocument10 pagesCREBA V Executive SecretaryseentherellaaaNo ratings yet

- Notes On FranchiseDocument4 pagesNotes On FranchiseMia Monica ArestaNo ratings yet

- Income TaxDocument3 pagesIncome TaxTeodulo Jr CruzNo ratings yet

- BA 127 CorporationsDocument1 pageBA 127 CorporationscarlacauntayNo ratings yet

- Profession IncomeDocument6 pagesProfession IncomeOnkar BandichhodeNo ratings yet

- Corporate Taxation Lecture 2 3 4 5 6Document50 pagesCorporate Taxation Lecture 2 3 4 5 6Anastasia KosachNo ratings yet

- Cannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsDocument3 pagesCannot Be Used by Nra-Etb & Taxpayers Mandated To Use Itemized DeductionsAreel GalvanNo ratings yet

- PWC - 2023 Nigeria Tax Data Card 1Document43 pagesPWC - 2023 Nigeria Tax Data Card 1Adebola OguntayoNo ratings yet

- Tax LawsDocument7 pagesTax Lawsbesong marlonNo ratings yet

- Nigeria Tax Summaries 2022Document43 pagesNigeria Tax Summaries 2022NWACHUKWU OBANYENo ratings yet

- Week 1 - Key Areas To Review From ACTG4710 - ACTG4720-Post On Canvas-1Document29 pagesWeek 1 - Key Areas To Review From ACTG4710 - ACTG4720-Post On Canvas-1Mike RaitsinNo ratings yet

- Chapter 2Document7 pagesChapter 2cerayNo ratings yet

- Q - Tax Law Exam Last Minute Tips - Part 1Document11 pagesQ - Tax Law Exam Last Minute Tips - Part 1Chare MarcialNo ratings yet

- Test 7 SolutionDocument2 pagesTest 7 Solutionls786580302No ratings yet

- RR No. 11-18Document70 pagesRR No. 11-18Deen EnriquezNo ratings yet

- Pa Tax Brief - August 2018Document5 pagesPa Tax Brief - August 2018Teresita TibayanNo ratings yet

- Unit Iii:: Income Tax ON CorporationsDocument35 pagesUnit Iii:: Income Tax ON CorporationsElleNo ratings yet

- Train Law: Saliant Topics inDocument4 pagesTrain Law: Saliant Topics incrookshanksNo ratings yet

- BLT Business Income OnwardsDocument16 pagesBLT Business Income OnwardsAybern BawtistaNo ratings yet

- (A) in General: Sec. 27 - Rates of Income Tax On Domestic CorporationsDocument15 pages(A) in General: Sec. 27 - Rates of Income Tax On Domestic CorporationsdencamsNo ratings yet

- Taxation Garcia/Tamayo TX-602: Corporation (Income Tax Rates)Document2 pagesTaxation Garcia/Tamayo TX-602: Corporation (Income Tax Rates)Jun SaintNo ratings yet

- Form Rev 2 Change of Details Application For Additional Revenue Head - PDFDocument19 pagesForm Rev 2 Change of Details Application For Additional Revenue Head - PDFRumbidzai NyandoroNo ratings yet

- Rules, Required By: Intangible)Document5 pagesRules, Required By: Intangible)Iqra HayatNo ratings yet

- EA EA1 SU2 OutlineDocument23 pagesEA EA1 SU2 OutlineAashu AntilNo ratings yet

- Income Taxation (With Create Bill Application) Com-Ex ReviewerDocument4 pagesIncome Taxation (With Create Bill Application) Com-Ex Reviewerlonely ylenolNo ratings yet

- Income Taxation - PartnershipDocument4 pagesIncome Taxation - PartnershipJuan Dela CruzNo ratings yet

- For Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of ProfessionDocument17 pagesFor Individuals Earning Purely Compensation Income and Individuals Engaged in Business and Practice of Professionmustang_ladNo ratings yet

- Corporation Tax - AnnotatedDocument64 pagesCorporation Tax - AnnotatedDr SafaNo ratings yet

- Ch04 Taxation of CorporationsDocument13 pagesCh04 Taxation of CorporationsKyla ArcillaNo ratings yet

- Petroleum Fiscal System: (The Trends & The Challenges)Document44 pagesPetroleum Fiscal System: (The Trends & The Challenges)Lulav BarwaryNo ratings yet

- CREBA Vs RomuloDocument10 pagesCREBA Vs RomuloAndrea Peñas-ReyesNo ratings yet

- TAX-402 (Other Percentage Taxes - Part 2)Document5 pagesTAX-402 (Other Percentage Taxes - Part 2)lyndon delfinNo ratings yet

- Taxable IncomeDocument18 pagesTaxable Incomerav danoNo ratings yet

- Corporate Tax in Philippines TAXATION LAW REVIEWDocument7 pagesCorporate Tax in Philippines TAXATION LAW REVIEWferdie1278No ratings yet

- Acco 20133 - Unit Iii & Iv - CreateDocument35 pagesAcco 20133 - Unit Iii & Iv - CreateHarvey AguilarNo ratings yet

- Chapter 5: Corporate Tax Learning ObjectivesDocument19 pagesChapter 5: Corporate Tax Learning ObjectivesLogaa UthyasuriyanNo ratings yet

- 103 (HHH) Bank of The Philippine Islands v. Amador Domingo - SAGURAN, June Paolo C.Document2 pages103 (HHH) Bank of The Philippine Islands v. Amador Domingo - SAGURAN, June Paolo C.jpoy61494No ratings yet

- Formal Offer of Evidence Prosecution Murder - Bill Kadagan - RDocument4 pagesFormal Offer of Evidence Prosecution Murder - Bill Kadagan - Rjpoy61494No ratings yet

- University of San Jose - Recolletos College of LawDocument3 pagesUniversity of San Jose - Recolletos College of Lawjpoy61494No ratings yet

- (Q) Mamaril Vs Boy Scouts of The PhilippinesDocument1 page(Q) Mamaril Vs Boy Scouts of The Philippinesjpoy61494No ratings yet

- W03-05 Case DigestsDocument51 pagesW03-05 Case Digestsjpoy61494No ratings yet

- IV.c.1.a Wenphil vs. Abing - Full TextDocument8 pagesIV.c.1.a Wenphil vs. Abing - Full Textjpoy61494No ratings yet

- Formal Offer of Evidence Prosecution Murder - Bill Kadagan - RDocument4 pagesFormal Offer of Evidence Prosecution Murder - Bill Kadagan - Rjpoy61494No ratings yet

- Succession - Civil Law Review Final PDFDocument33 pagesSuccession - Civil Law Review Final PDFjpoy61494No ratings yet

- History of The PhilippinesDocument2 pagesHistory of The Philippinesjpoy61494No ratings yet

- History of AmericaDocument2 pagesHistory of Americajpoy61494No ratings yet

- From The Ashes of World War II: United Nations 74th Session of Its Annual General AssemblyDocument3 pagesFrom The Ashes of World War II: United Nations 74th Session of Its Annual General Assemblyjpoy61494No ratings yet

- History of CanadaDocument1 pageHistory of Canadajpoy61494No ratings yet

- W03-05 Case DigestsDocument51 pagesW03-05 Case Digestsjpoy61494No ratings yet

- QwerrtDocument1 pageQwerrtjpoy61494No ratings yet

- Antonio Iran Vs NLRC - GR No. 121927 - April 22, 1998Document5 pagesAntonio Iran Vs NLRC - GR No. 121927 - April 22, 1998BerniceAnneAseñas-ElmacoNo ratings yet

- Part 2Document3 pagesPart 2jpoy61494No ratings yet

- Activity 1Document1 pageActivity 1jpoy61494No ratings yet

- Re: Request Letter To Allow Vehicle To Park Inside The USJR Main CampusDocument1 pageRe: Request Letter To Allow Vehicle To Park Inside The USJR Main Campusjpoy61494No ratings yet

- The Benefits of Knowing A Foreign LanguageDocument2 pagesThe Benefits of Knowing A Foreign Languagejpoy61494No ratings yet

- IV.c.1.a Wenphil vs. Abing - Full TextDocument8 pagesIV.c.1.a Wenphil vs. Abing - Full Textjpoy61494No ratings yet

- E20Document1 pageE20jpoy61494No ratings yet

- Paris Party and EventsDocument1 pageParis Party and Eventsjpoy61494No ratings yet

- English UgmaDocument5 pagesEnglish Ugmajpoy61494No ratings yet

- PORTFOLIO of WRITTEN OUTPUTSDocument1 pagePORTFOLIO of WRITTEN OUTPUTSjpoy61494No ratings yet

- Navia Et. Al. vs. PardicoDocument5 pagesNavia Et. Al. vs. PardicomichelleNo ratings yet

- E20Document1 pageE20jpoy61494No ratings yet

- Activity 1Document1 pageActivity 1jpoy61494No ratings yet

- Re: Request Letter To Allow Vehicle To Park Inside The USJR Main CampusDocument1 pageRe: Request Letter To Allow Vehicle To Park Inside The USJR Main Campusjpoy61494No ratings yet

- WEEK 9 (Madrigal-Napa)Document10 pagesWEEK 9 (Madrigal-Napa)jpoy61494No ratings yet

- Support Pendente Lite Week7 DIGESTDocument21 pagesSupport Pendente Lite Week7 DIGESTjpoy61494No ratings yet