Professional Documents

Culture Documents

Bonds - March 14 2019

Uploaded by

Tiso Blackstar Group0 ratings0% found this document useful (0 votes)

13 views3 pagesBonds - March 14 2019

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document0 ratings0% found this document useful (0 votes)

13 views3 pagesBonds - March 14 2019

Uploaded by

Tiso Blackstar GroupYou are on page 1of 3

Markets and Commodity figures

14 March 2019

Total Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Deals Nominal Consideration Deals Nominal Consideration

Current Day 1,124 40.54 bn Rbn 41.47 219 26.43 bn Rbn 28.22

Week to Date 4,164 147.38 bn Rbn 148.12 1,579 204.43 bn Rbn 199.90

Month to Date 10,543 343.68 bn Rbn 343.36 3,479 477.23 bn Rbn 464.71

Year to Date 54,853 1,816.47 bn Rbn 1,830.32 18,308 2,499.13 bn Rbn 2,399.69

Foreign Client Market Turnover Statistics

Standard Turnover REPO 1 Turnover

Party Deals Nominal Consideration Deals Nominal Consideration

Buy 66 4.24 bn Rbn 4.47 18 0.86 bn Rbn 0.81

Current Day Sell 77 4.33 bn Rbn 4.53 -0.11 bn Rbn -0.10

Net -11 -0.08 bn Rbn -0.06 18 0.97 bn Rbn 0.91

Buy 233 13.78 bn Rbn 14.04 77 15.13 bn Rbn 14.56

Week to Date Sell 223 13.55 bn Rbn 14.04 8 1.21 bn Rbn 1.28

Net 10 0.23 bn Rbn -0.00 69 13.92 bn Rbn 13.28

Buy 664 34.63 bn Rbn 35.15 192 35.60 bn Rbn 34.21

Month to Date Sell 595 38.10 bn Rbn 39.23 25 6.50 bn Rbn 6.89

Net 69 -3.48 bn Rbn -4.08 167 29.10 bn Rbn 27.33

Buy 3,853 229.07 bn Rbn 232.03 1,147 258.76 bn Rbn 244.06

Year to Date Sell 3,448 216.55 bn Rbn 221.87 156 56.30 bn Rbn 56.04

Net 405 12.52 bn Rbn 10.16 991 202.46 bn Rbn 188.03

Index Levels

Code Index Yield Index Previous Return MTD Return YTD

ALBI20 9.195%

All Bond Index Top 649.405

20 Composite 652.929 0.12% 2.57%

GOVI 9.304%Split - 642.934

ALBI20 Issuer Class GOVI 646.584 0.12% 2.60%

OTHI 8.775%

ALBI20 Issuer Class Split - 674.489

OTHI 677.496 0.10% 2.43%

CILI15 3.261%

Composite Inflation 256.063

Linked Index Top 15 256.390 -0.25% 1.02%

ICOR 4.061%

CILI15 Issuer Class 290.994

Split - ICOR 291.541 -0.50% 0.44%

IGOV 3.218%

CILI15 Issuer Class 254.464

Split - IGOV 254.782 -0.24% 1.05%

ISOE 4.045%

CILI15 Issuer Class 263.575

Split - ISOE 263.985 -0.43% 0.46%

MMI JSE Money Market Index

0 253.017 252.965 0.28% 1.50%

ALBI Constituent Bonds

Bond Issuer Maturity MTM Previous YTD Low YTD High

R159 REPUBLIC OF SOUTH

Sep 2020

AFRICA 8.315% 8.300% 8.11% 8.42%

R203 REPUBLIC OF SOUTH

Mar 2021

AFRICA 7.085% 7.070% 6.91% 7.19%

ES18 ESKOM HOLDINGSJanLIMITED

2023 9.035% 8.975% 8.88% 9.31%

R204 REPUBLIC OF SOUTH

Feb 2023

AFRICA 8.875% 8.815% 8.75% 9.22%

R207 REPUBLIC OF SOUTH

Feb 2023

AFRICA 7.875% 7.815% 7.72% 8.15%

R208 REPUBLIC OF SOUTH

Aug 2025

AFRICA 10.445% 10.380% 10.28% 10.64%

ES23 ESKOM HOLDINGSAprLIMITED

2026 9.985% 9.920% 9.83% 10.19%

DV23 DEVELOPMENT DecBANK

2026

OF SOUTHERN

8.745% AFRICA 8.680% 8.58% 8.94%

R2023 REPUBLIC OF SOUTH

Jan 2030

AFRICA 9.285% 9.205% 9.09% 9.47%

ES26 ESKOM HOLDINGSFebLIMITED

2031 9.400% 9.320% 9.21% 9.58%

R186 REPUBLIC OF SOUTH

Mar 2032

AFRICA 9.510% 9.425% 9.31% 9.69%

R2030 REPUBLIC OF SOUTH

Sep 2033

AFRICA 10.920% 10.840% 10.74% 11.10%

R213 REPUBLIC OF SOUTH

Feb 2035

AFRICA 9.670% 9.590% 9.48% 9.84%

R2032 REPUBLIC OF SOUTH

Mar 2036

AFRICA 9.620% 9.540% 9.43% 9.80%

ES33 ESKOM HOLDINGSJanLIMITED

2037 9.745% 9.670% 9.55% 9.92%

R209 REPUBLIC OF SOUTH

Jan 2040

AFRICA 9.835% 9.755% 9.62% 10.00%

R2037 REPUBLIC OF SOUTH

Feb 2041

AFRICA 9.805% 9.725% 9.60% 9.98%

R214 REPUBLIC OF SOUTH

Apr 2042

AFRICA 11.175% 11.095% 10.97% 11.35%

R2044 REPUBLIC OF SOUTH

Jan 2044

AFRICA 9.835% 9.750% 9.64% 10.02%

R2048 REPUBLIC OF SOUTH

Feb 2048

AFRICA 9.805% 9.720% 9.62% 9.99%

Other Rates

Code Description Rate Previous YTD Low YTD High

SAFEX SAFEX Overnight Deposit Rate6.590% 6.590% 6.59% 6.60%

JIBAR1 JIBAR 1 Month 6.975% 6.975% 6.96% 6.98%

JIBAR3 JIBAR 3 Month 7.150% 7.150% 7.15% 7.15%

JIBAR6 JIBAR 6 Month 7.725% 7.725% 7.70% 7.75%

RSA 2 year retail bond 7.75% 0 0 0

RSA 3 year retail bond 8.00% 0 0 0

RSA 5 year retail bond 8.50% 0 0 0

RSA 3 year inflation linked retail

3.50%

bond 0 0 0

RSA 5 year inflation linked retail

3.75%

bond 0 0 0

RSA 10 year inflation linked retail

4.00%

bond 0 0 0

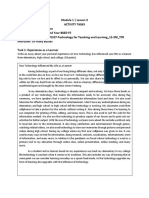

Nominal Bond Curves (NACS)

9.62

9.12

8.62

8.12

7.62

7.12 Zero

6.62 Par/Swap

6.12

5.62

5.12

4.62

2015 2020 2026 2031 2037 2042 2048 2053 2059

DATA DISCLAIMER

To the extent allowed by law, JSE Limited (the JSE) does not (expressly, tacitly or implicitly) guarantee or warrant the availability,

sequence, accuracy, completeness, reliability or any other aspect of any of the data (Data), or that any Data is up to date.

To the extent allowed by law, neither the JSE nor any of its directors, officers, employees, contractors, agents or representatives are

liable in any way to the reader or to any other natural or juristic person (Person) for any loss or damage as a result of (i) the display

of any Data in this bulltetin, or (ii) any Data being unavailable in this bulletin at any time and for any reason, or (iii) any delay,

inaccuracy, error, or omission in relation to any Data, or (iv) any actions taken or not taken by or on behalf of any Person in reliance

on any Data. The JSE is entitled to terminate the production of any Data at any time, without notice and without liability to any Person.

These figures are supplied by parties external to Business Day. Business Day will not warrant the accuracy of the figures.

You might also like

- Bonds - March 19 2019Document3 pagesBonds - March 19 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 21 2019Document3 pagesBonds - March 21 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 28 2019Document3 pagesBonds - March 28 2019Tiso Blackstar GroupNo ratings yet

- Bonds - February 6 2019Document3 pagesBonds - February 6 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 22 2019Document3 pagesBonds - May 22 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 5 2020Document3 pagesBonds - May 5 2020Lisle Daverin BlythNo ratings yet

- Bonds - May 4 2020Document3 pagesBonds - May 4 2020Lisle Daverin BlythNo ratings yet

- Bonds - May 7 2020Document3 pagesBonds - May 7 2020Lisle Daverin BlythNo ratings yet

- Bonds - May 6 2020Document3 pagesBonds - May 6 2020Lisle Daverin BlythNo ratings yet

- Bonds - May 14 2019Document3 pagesBonds - May 14 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 18 2019Document3 pagesBonds - March 18 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 17 2019Document3 pagesBonds - March 17 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 24 2019Document3 pagesBonds - March 24 2019Anonymous 7A1d7fjj3No ratings yet

- Bonds - February 13 2019Document3 pagesBonds - February 13 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - January 15 2019Document3 pagesBonds - January 15 2019Tiso Blackstar GroupNo ratings yet

- Bonds - April 11 2019Document3 pagesBonds - April 11 2019Tiso Blackstar GroupNo ratings yet

- Bonds - April 3 2019Document3 pagesBonds - April 3 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 26 2019Document3 pagesBonds - March 26 2019Tiso Blackstar GroupNo ratings yet

- Bonds - September 5 2022Document3 pagesBonds - September 5 2022Lisle Daverin BlythNo ratings yet

- Bonds - March 27 2019Document3 pagesBonds - March 27 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 6 2019Document6 pagesBonds - May 6 2019Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - September 27 2018Document3 pagesBonds - September 27 2018Tiso Blackstar GroupNo ratings yet

- Bonds - April 10 2019Document3 pagesBonds - April 10 2019Tiso Blackstar GroupNo ratings yet

- Bonds - February 26 2019Document3 pagesBonds - February 26 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 3 2019Document6 pagesBonds - May 3 2019Lisle Daverin BlythNo ratings yet

- Bonds - November 8 2018Document6 pagesBonds - November 8 2018Tiso Blackstar GroupNo ratings yet

- Bonds - November 7 2018Document6 pagesBonds - November 7 2018Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 28 2019Document6 pagesBonds - February 28 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 3 2019Document3 pagesBonds - March 3 2019Anonymous 7A1d7fjj3No ratings yet

- Bonds - April 22 2019Document3 pagesBonds - April 22 2019Lisle Daverin BlythNo ratings yet

- Bonds - March 11 2019Document3 pagesBonds - March 11 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 12 2019Document3 pagesBonds - March 12 2019Tiso Blackstar GroupNo ratings yet

- Bonds - July 16 2020Document3 pagesBonds - July 16 2020Lisle Daverin BlythNo ratings yet

- Bonds - April 20 2018Document6 pagesBonds - April 20 2018Tiso Blackstar GroupNo ratings yet

- Bonds - May 21 2019Document3 pagesBonds - May 21 2019Tiso Blackstar GroupNo ratings yet

- Bonds - July 13 2018Document6 pagesBonds - July 13 2018Tiso Blackstar GroupNo ratings yet

- Bonds - May 9 2019Document3 pagesBonds - May 9 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 5 2019Document3 pagesBonds - March 5 2019Tiso Blackstar GroupNo ratings yet

- Bonds - July 4 2021Document3 pagesBonds - July 4 2021Lisle Daverin BlythNo ratings yet

- Bonds - May 11 2020Document3 pagesBonds - May 11 2020Lisle Daverin BlythNo ratings yet

- Bonds - May 16 2019Document3 pagesBonds - May 16 2019Tiso Blackstar GroupNo ratings yet

- Bonds - March 8 2019Document6 pagesBonds - March 8 2019Anonymous 7A1d7fjj3No ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsAnonymous 7A1d7fjj3No ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 7 2019Document3 pagesBonds - February 7 2019Tiso Blackstar GroupNo ratings yet

- Bonds - February 21 2019Document3 pagesBonds - February 21 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 13 2019Document3 pagesBonds - May 13 2019Lisle Daverin BlythNo ratings yet

- Bonds - April 17 2019Document3 pagesBonds - April 17 2019Tiso Blackstar GroupNo ratings yet

- Bonds - May 15 2019Document3 pagesBonds - May 15 2019Lisle Daverin BlythNo ratings yet

- Bonds - August 10 2020Document3 pagesBonds - August 10 2020Lisle Daverin BlythNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument3 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - February 14 2019Document3 pagesBonds - February 14 2019Tiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Total Market Turnover StatisticsDocument6 pagesMarkets and Commodity Figures: Total Market Turnover StatisticsTiso Blackstar GroupNo ratings yet

- Bonds - May 13 2020Document3 pagesBonds - May 13 2020Lisle Daverin BlythNo ratings yet

- Bonds - April 20 2020Document3 pagesBonds - April 20 2020Lisle Daverin BlythNo ratings yet

- Modern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondFrom EverandModern Pricing of Interest-Rate Derivatives: The LIBOR Market Model and BeyondRating: 4 out of 5 stars4/5 (2)

- Arena Holdings Pty LTD - BBBEE Certificate - 2023Document2 pagesArena Holdings Pty LTD - BBBEE Certificate - 2023Tiso Blackstar GroupNo ratings yet

- Anti Corruption Working GuideDocument44 pagesAnti Corruption Working GuideTiso Blackstar GroupNo ratings yet

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupNo ratings yet

- Shoprite Food Index 2023Document19 pagesShoprite Food Index 2023Tiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Collective InsightDocument10 pagesCollective InsightTiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Ramaphosa's Letter To MkhwebaneDocument1 pageRamaphosa's Letter To MkhwebaneTiso Blackstar GroupNo ratings yet

- Open Letter To President Ramaphosa - FinalDocument3 pagesOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupNo ratings yet

- Statement From The SA Tourism BoardDocument1 pageStatement From The SA Tourism BoardTiso Blackstar GroupNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- Letter From Reuel Khoza Chairman of The Eskom Board 1999Document2 pagesLetter From Reuel Khoza Chairman of The Eskom Board 1999Tiso Blackstar GroupNo ratings yet

- JudgmentDocument30 pagesJudgmentTiso Blackstar GroupNo ratings yet

- JP Verster's Letter To African PhoenixDocument2 pagesJP Verster's Letter To African PhoenixTiso Blackstar GroupNo ratings yet

- Tobacco Bill - Cabinet Approved VersionDocument41 pagesTobacco Bill - Cabinet Approved VersionTiso Blackstar GroupNo ratings yet

- Collective Insight September 2022Document14 pagesCollective Insight September 2022Tiso Blackstar GroupNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- LibertyDocument1 pageLibertyTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - August 6 2020Document2 pagesSanlam Stratus Funds - August 6 2020Lisle Daverin BlythNo ratings yet

- FairbairnDocument2 pagesFairbairnTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - July 15 2020Document2 pagesSanlam Stratus Funds - July 15 2020Lisle Daverin BlythNo ratings yet

- LibertyDocument1 pageLibertyTiso Blackstar GroupNo ratings yet

- BondsDocument3 pagesBondsTiso Blackstar GroupNo ratings yet

- Sanlam Stratus Funds - June 1 2021Document2 pagesSanlam Stratus Funds - June 1 2021Lisle Daverin BlythNo ratings yet

- FuelPricesDocument1 pageFuelPricesTiso Blackstar GroupNo ratings yet

- Critical Skills List - Government GazetteDocument24 pagesCritical Skills List - Government GazetteTiso Blackstar GroupNo ratings yet

- The ANC's New InfluencersDocument1 pageThe ANC's New InfluencersTiso Blackstar GroupNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- Bonds - June 8 2022Document3 pagesBonds - June 8 2022Lisle Daverin BlythNo ratings yet

- Financial Crisis Among UTHM StudentsDocument7 pagesFinancial Crisis Among UTHM StudentsPravin PeriasamyNo ratings yet

- Effects of Alcohol, Tobacco, and Marijuana - PR 1Document11 pagesEffects of Alcohol, Tobacco, and Marijuana - PR 1Mark Andris GempisawNo ratings yet

- Radiography Safety ProcedureDocument9 pagesRadiography Safety ProcedureأحمدآلزهوNo ratings yet

- Debus Medical RenaissanceDocument3 pagesDebus Medical RenaissanceMarijaNo ratings yet

- I Wonder Lonely As A Cloud by W. Words WorthDocument6 pagesI Wonder Lonely As A Cloud by W. Words WorthGreen Bergen100% (1)

- Mathematicaleconomics PDFDocument84 pagesMathematicaleconomics PDFSayyid JifriNo ratings yet

- New Document (116) New Document (115) New Document (1Document9 pagesNew Document (116) New Document (115) New Document (1Manav PARMARNo ratings yet

- Endocrine System Unit ExamDocument3 pagesEndocrine System Unit ExamCHRISTINE JULIANENo ratings yet

- The Machine StopsDocument14 pagesThe Machine StopsMICHAEL HARRIS USITANo ratings yet

- Arif Dirlik - The Origins of Chinese Communism-Oxford University Press, USA (1989)Document335 pagesArif Dirlik - The Origins of Chinese Communism-Oxford University Press, USA (1989)Denisa FeisalNo ratings yet

- Chan Sophia ResumeDocument1 pageChan Sophia Resumeapi-568119902No ratings yet

- Danculos - M1 - L3 - Activity TasksDocument2 pagesDanculos - M1 - L3 - Activity TasksAUDREY DANCULOSNo ratings yet

- Boden 2015 Mass Media Playground of StereotypingDocument16 pagesBoden 2015 Mass Media Playground of StereotypingMiguel CuevaNo ratings yet

- Practice Makes Perfect Basic Spanish Premium Third Edition Dorothy Richmond All ChapterDocument67 pagesPractice Makes Perfect Basic Spanish Premium Third Edition Dorothy Richmond All Chaptereric.temple792100% (3)

- Thesis Committee MeetingDocument7 pagesThesis Committee Meetingafknojbcf100% (2)

- Oleracea Contain 13.2% Dry Matter, 15.7% Crude Protein, 5.4% Ether ExtractionDocument47 pagesOleracea Contain 13.2% Dry Matter, 15.7% Crude Protein, 5.4% Ether ExtractionJakin Aia TapanganNo ratings yet

- Articles 62 & 63: Presented By: Muhammad Saad Umar FROM: BS (ACF) - B 2K20Document10 pagesArticles 62 & 63: Presented By: Muhammad Saad Umar FROM: BS (ACF) - B 2K20Muhammad Saad UmarNo ratings yet

- The Role of Financial System in DevelopmentDocument5 pagesThe Role of Financial System in DevelopmentCritical ThinkerNo ratings yet

- Class 12 Accountancy HHDocument58 pagesClass 12 Accountancy HHkomal barotNo ratings yet

- AmplifierDocument20 pagesAmplifierValerie StraussNo ratings yet

- Final Paper IN MAJOR 14 EL 116 Life and Death: Fear Reflected in John Green's The Fault in Our StarsDocument12 pagesFinal Paper IN MAJOR 14 EL 116 Life and Death: Fear Reflected in John Green's The Fault in Our StarsMary Rose FragaNo ratings yet

- E 18 - 02 - Rte4ltay PDFDocument16 pagesE 18 - 02 - Rte4ltay PDFvinoth kumar SanthanamNo ratings yet

- CURRICULUM VITAE Kham Khan Suan Hausing, PHDDocument8 pagesCURRICULUM VITAE Kham Khan Suan Hausing, PHDCinpu ZomiNo ratings yet

- Full Moon RitualsDocument22 pagesFull Moon RitualsJP83% (6)

- Tamil Ilakkanam Books For TNPSCDocument113 pagesTamil Ilakkanam Books For TNPSCkk_kamalakkannan100% (1)

- Cofee Table Book - Hayyan - Alef GroupDocument58 pagesCofee Table Book - Hayyan - Alef GroupMustafa GelenovNo ratings yet

- Geriatric AnaesthesiaDocument24 pagesGeriatric Anaesthesiakarl abiaad100% (2)

- Congental Abdominal Wall DefectsDocument38 pagesCongental Abdominal Wall DefectsAhmad Abu KushNo ratings yet

- Scipaper 7Document2 pagesScipaper 7JL Serioso BalesNo ratings yet

- Jesus Christ Was A HinduDocument168 pagesJesus Christ Was A Hinduhbk22198783% (12)