Professional Documents

Culture Documents

Joseph Cochingyan Vs R

Uploaded by

Junpyo ArkinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Joseph Cochingyan Vs R

Uploaded by

Junpyo ArkinCopyright:

Available Formats

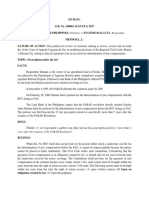

JOSEPH COCHINGYAN VS R&B SURETY

In November 1963, Pacific Agricultural Suppliers, Inc. (PAGRICO)

was granted an increase in its line of credit from P400,000.00 to

P800,000.00 (the “Principal Obligation”), with the Philippine

National Bank (PNB).

PAGRICO submitted Surety Bond No. 4765, issued by respondent

R&B Surety and Insurance Co., (R&B Surety) in the amount of

P400,000.00 in favor of the PNB. In consideration of R & B Surety's

issuance of the Surety Bond, two identical indemnity agreements

were entered into with R & B Surety executed by the Catholic

Church Mart (CCM) and by petitioner Joseph Cochingyan, Jr, and

(b) another agreement dated 24 December 1963 was executed by

PAGRICO.

Under both indemnity agreements, the indemnitors bound

themselves jointly and severally to R & B Surety to pay an annual

premium of P5,103.05 and "for the faithful compliance of the terms

and conditions set forth in said SURETY BOND for a period

beginning ... until the same is CANCELLED and/or DISCHARGED."

When PAGRICO failed to comply with its Principal Obligation to the

PNB, the PNB demanded payment from R & B Surety of the sum of

P400,000.00, the full amount of the Principal Obligation. R & B

Surety made a series of payments to PNB by virtue of that demand

totalling P70,000.00 evidenced by detailed vouchers and receipts.

R & B Surety in turn sent formal demand letters to petitioners

Joseph Cochingyan, Jr. and Jose K. Villanueva for reimbursement

of the payments made by it to the PNB and for a discharge of its

liability to the PNB under the Surety Bond. When petitioners failed

to heed its demands, R & B Surety brought suit against Joseph

Cochingyan, Jr., Jose K. Villanueva and Liu Tua Ben.

The lower court rendered a decision in favor of R & B Surety,

ordering the Cochingyan and Villanueva to pay the plaintiff, jointly

and severally, the total amount of their liability on Surety Bond No.

4765, at the interest rate of 6% per annum.Bond.

Not satisfied with the decisions of trial court. The petitioners appeal

to the CA

ISSUE: WON the filing of this complaint was premature since the

PNB had not yet filed a suit against R & B Surety for the forfeiture

of its Surety Bond.

HELD: NO. The Indemnity Agreements are contracts of

indemnification not only against actual loss but against liability as

well. While in a contract of indemnity against loss as indemnitor

will not be liable

until the person to be indemnified makes payment or sustains loss,

in a contract of indemnity against liability, as in

this case, the indemnitor's liability arises as soon as the

liability of the person to be indemnified has arisen without

regard to whether or not he has suffered actual loss. Accordingly, R

& B Surety was entitled to proceed against

petitioners not only for the partial payments already made but for

the full amount owed by PAGRICO to the PNB.

Diño vs. Court of Appeals (1992)

Facts: In 1977, Uy Tiam Enterprises and Freight Services (UTEFS),

thru its representative Uy Tiam, applied for and obtained credit

accommodations from Metrobank in the sum of Php700,000. This

was secured by Continuing Suretyships separately executed by

petitioners Norberto Uy (who agreed to pay Php300,000) and

Jacinto Diño (who bound himself liable up to Php800,000). Uy Tiam

paid the obligation under this letter of credit in 1977. UTEFS

obtained another credit accommodation in 1978, which was

likewise settled before he applied and obtained another in 1979 in

the sum of Php 815,600. This sum covered UTEFS’ purchase of

fertilizers from Planters Producst. Uy and Diño did not sign the

application for this credit and were not asked to execute suretyship

or guarantee. UTEFS executed a trust receipt whereby it agreed to

deliver to Metrobank the goods in the event of non-sale, and if sold,

the proceeds will be delivered to Metrobank. However, UTEFS did

not comply with its obligation. As a result, Metrobank demanded

payment from UTEFS and the sureties, Uy & Diño. The sureties

refused to pay on the ground that the obligation for which they

executed the continuing suretyship agreement has been paid

RTC- dismissing the complaint against Petitioner Dino and UY

-found that there was no sufficient showing that the petitioner were

fully informed of the continuing suretyship that they are securing

all future obligation which Uy Tiam may contract with the plaintiff.

CA- Reverse and set aside the decision of the lower court.

-continuing suretyship agreement separately executed by the

petitioner in 1977 were guarantee to payment of UY Tiam’s

outstanding as well as future obligation; It remain in full force and

effect until Metrobank would have been notified of its revocation.

ISSUE: Whether petitioners are liable as sureties for the 1979

obligations of Uy Tiam to METROBANK by virtue of the Continuing

Suretyship Agreements they separately signed in 1977?

HELD: YES. Article 2053 provides a guaranty may also be given as

security of future debts, the amount of which is not yet known;

In this case based on the stipulation unequivocally reveal that

the suretyship agreement are continuing in nature. Petitioner did

not deny this; in fact he admitted it. Because the purpose of the the

continuing suretyship was to induce appellant to grant application

for credit accommodation UTEFS may desire to obtain from

appellant bank.

PACIONARIA C. BAYLON VS CA AND LEONILA TOMACRUZ

facts: Petitioner Baylon introduced private respondent Leonila

Tomacruz to Rosita luanzon. The petitioner assured that luanzon

have been engage in business as contractor for 20yrs. which case

the respondent lend money to luanzon with 5% /mo. Interest to be

used for the latters business. Luanzon issued and signed a PN and

petitioner affixing her signature under the word guarantor.Private

respondent made a written deman upon petitioner for payment.

Which petitioner did not heed

May 8 1989 private respondent file a case for the collection of a sum

of money with RTC. Impleading the petitioners husband. However

summons was never served upon luanzon.

- In her answer petitioner denied having guaranteed the

payment of PN. She claimed that respondent gave luanzon the

money not as a loan but rather as an investment in luanzons

business.

- -not exhausted the property of the principal debtor.

RTC- in favor of private respondent.

-the court found that contract executed was clearly a loan with 5%

interest.

CA- affirmed the decision of trial court.

ISSUE: WON the petitioner, can invoke the benefit of excussion?

HELD: YES art 2058 of the civil code provides the guarantor cannot

be compelled to pay the creditor unless the latter exhausted all the

property of the debtor and resorted to all the legal remedies against

the debtor.

Thus, the creditor may hold the guarantor liable only after

judgment has been obtained against the principal debtor and the

latter unable to pay for the exhaustion of the principal’s property.

In this case no judgment was first obtain against the principal

debtor Rosita Luanzon. It is premature to speak of guarantor when

no debtor has been held liable for the obligation which allegedly

secured by the such guarantee. Although the principal debtor

luanzon was impleade as defendant , there is nothing in the records

show that summon was served upon her. Hence the trial court

never acquired jurisdiction over the her.

You might also like

- CS Form No. 212 Personal Data Sheet RevisedDocument4 pagesCS Form No. 212 Personal Data Sheet RevisedJean Castro76% (106)

- Civil Procedure TANDocument119 pagesCivil Procedure TANFely Desembrana100% (7)

- The 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsFrom EverandThe 5 Elements of the Highly Effective Debt Collector: How to Become a Top Performing Debt Collector in Less Than 30 Days!!! the Powerful Training System for Developing Efficient, Effective & Top Performing Debt CollectorsRating: 5 out of 5 stars5/5 (1)

- Manila Banking Corporation v. Teodoro JR., G.R. No. 53955, January 13, 1989 DIGESTDocument3 pagesManila Banking Corporation v. Teodoro JR., G.R. No. 53955, January 13, 1989 DIGESTAprilNo ratings yet

- Case Digest in Guarranty and Suretyship 2Document5 pagesCase Digest in Guarranty and Suretyship 2Icee Genio100% (2)

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersFrom EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersRating: 3 out of 5 stars3/5 (1)

- PNB vs. Luzon Surety and CA ruling on surety liability for interestDocument5 pagesPNB vs. Luzon Surety and CA ruling on surety liability for interestTrem GallenteNo ratings yet

- Case #141 Conchingyan Vs RB Surety and Insurance - Torres, Loida CDocument3 pagesCase #141 Conchingyan Vs RB Surety and Insurance - Torres, Loida CMark SakayNo ratings yet

- RCBC V Arro To PBTC v. TambutingDocument5 pagesRCBC V Arro To PBTC v. TambutingPeng ManiegoNo ratings yet

- Guaranty Extinguishment CaseDocument2 pagesGuaranty Extinguishment CaseNica09_foreverNo ratings yet

- PhilGuarantee liable to indemnify guarantor despite waiver of excussionDocument44 pagesPhilGuarantee liable to indemnify guarantor despite waiver of excussionJereca Ubando JubaNo ratings yet

- PNB Vs Luzon SuretyDocument5 pagesPNB Vs Luzon SuretyRossRaiderNo ratings yet

- Guarantor rights and obligations between debtor and creditorDocument10 pagesGuarantor rights and obligations between debtor and creditormichaelargabiosoNo ratings yet

- Batch 6 DigestsDocument10 pagesBatch 6 DigestsHaze Q.No ratings yet

- Atok Finance Corporation vs. Court of Appeals FactsDocument4 pagesAtok Finance Corporation vs. Court of Appeals FactsasdfghjkattNo ratings yet

- Cochingyan - Mercantile Page 11Document3 pagesCochingyan - Mercantile Page 11MichyLGNo ratings yet

- Credit 2Document9 pagesCredit 2Mythl Eunice DaroyNo ratings yet

- Philippine Supreme Court Rules on Indemnity AgreementDocument2 pagesPhilippine Supreme Court Rules on Indemnity AgreementAr LineNo ratings yet

- CREDIT TRANS - Syllabus-Guaranty-Surety - With CasesDocument10 pagesCREDIT TRANS - Syllabus-Guaranty-Surety - With CasesSarah Zabala-AtienzaNo ratings yet

- Mercantile Insurance Co Vs PDFDocument3 pagesMercantile Insurance Co Vs PDFXtian HernandezNo ratings yet

- Credit Transactions June 23Document5 pagesCredit Transactions June 23Trent ChimingchoiNo ratings yet

- Part 5 Guaranty and SuretyshipDocument19 pagesPart 5 Guaranty and SuretyshipJan. ReyNo ratings yet

- Obligations and Contracts HWDocument22 pagesObligations and Contracts HWJessamyn DimalibotNo ratings yet

- Petitioners RespondentDocument10 pagesPetitioners RespondentNicorobin RobinNo ratings yet

- Personal Liability of Corporate Officers Under Trust ReceiptsDocument7 pagesPersonal Liability of Corporate Officers Under Trust ReceiptsTrem GallenteNo ratings yet

- Bonnevie vs. Ca 3. Rosepacking Co. vs. Ca 4.bpi Investment Corp. vs. CaDocument4 pagesBonnevie vs. Ca 3. Rosepacking Co. vs. Ca 4.bpi Investment Corp. vs. CaLea Angelica RiofloridoNo ratings yet

- When There Is No Agreement That The First Debtor Shall Be Released From Responsibility, Does Not Constitute A Novation, and The Creditor Can Still Enforce The Obligation Against The Original Debtor."Document4 pagesWhen There Is No Agreement That The First Debtor Shall Be Released From Responsibility, Does Not Constitute A Novation, and The Creditor Can Still Enforce The Obligation Against The Original Debtor."Jlyne TrlsNo ratings yet

- Carolyn M. Garcia - Vs-Rica Marie S. Thio GR No. 154878, 16 March 2007 FactsDocument8 pagesCarolyn M. Garcia - Vs-Rica Marie S. Thio GR No. 154878, 16 March 2007 FactskathNo ratings yet

- 111 Cochingyan v. R & B SuretyDocument5 pages111 Cochingyan v. R & B Suretyalnurtanondong2No ratings yet

- Mercantile Insurance Co VsDocument3 pagesMercantile Insurance Co VsBuenavista Mae BautistaNo ratings yet

- Cochingyan v. R&B SuretyDocument10 pagesCochingyan v. R&B SuretyHaniyyah FtmNo ratings yet

- Cochingyan v. R & B Surety, 151 SCRA 339Document14 pagesCochingyan v. R & B Surety, 151 SCRA 339BernsNo ratings yet

- OBLICON Case DigestsDocument56 pagesOBLICON Case Digestsglaize587No ratings yet

- Reviewer in Credit Transactions - Cases On GuarantyDocument17 pagesReviewer in Credit Transactions - Cases On GuarantyGuiller C. MagsumbolNo ratings yet

- Diño's Continuing Suretyship LiabilityDocument11 pagesDiño's Continuing Suretyship LiabilityKayeNo ratings yet

- Conchingyan Vs R&B SuretyDocument3 pagesConchingyan Vs R&B SuretyAyanna Noelle VillanuevaNo ratings yet

- SC Affirms PhilGuarantee's Right to Reimbursement from DebtorDocument4 pagesSC Affirms PhilGuarantee's Right to Reimbursement from DebtorKMNo ratings yet

- 140157-1975-Philippine National Bank v. Luzon Surety Co.20190212-5466-Kz2in5 PDFDocument7 pages140157-1975-Philippine National Bank v. Luzon Surety Co.20190212-5466-Kz2in5 PDFJoffrey UrianNo ratings yet

- Credit Guaranty 7 8 9Document5 pagesCredit Guaranty 7 8 9Shiela CarbonellNo ratings yet

- Case Digests 1st Meeting Credit TransDocument16 pagesCase Digests 1st Meeting Credit Transmichael jan de celisNo ratings yet

- Debt Prescription Waived by New PromiseDocument9 pagesDebt Prescription Waived by New PromiseMitchayNo ratings yet

- Oblicon CasesDocument11 pagesOblicon CasesCess LazagaNo ratings yet

- UntitledDocument3 pagesUntitledSheila Mae LlandelarNo ratings yet

- Credit Transactions DigestDocument5 pagesCredit Transactions DigestMarcus J. ValdezNo ratings yet

- Case Digest - IntroductionDocument10 pagesCase Digest - IntroductionAnonymous b4ycWuoIcNo ratings yet

- 4a - Bar Q and A - Credit Transactions and Torts and DamagesDocument76 pages4a - Bar Q and A - Credit Transactions and Torts and Damagesnbragas100% (3)

- Credit CasesDocument42 pagesCredit CasesTess LimNo ratings yet

- Credit 1st SetDocument8 pagesCredit 1st SetRhena SaranzaNo ratings yet

- Suretyship LiabilityDocument44 pagesSuretyship LiabilityJoel ElunaNo ratings yet

- 13 Chieng V Sps SantosDocument2 pages13 Chieng V Sps SantosArtemisTzyNo ratings yet

- Nego - Inciong Vs CADocument1 pageNego - Inciong Vs CAKTNo ratings yet

- Compiled DigestDocument7 pagesCompiled DigestAbi GailNo ratings yet

- Credit and Transactions DigestDocument28 pagesCredit and Transactions DigestAngela P. SenoraNo ratings yet

- Guaranty and Suretyship SummaryDocument12 pagesGuaranty and Suretyship SummaryBenn DegusmanNo ratings yet

- Inciong v. CADocument1 pageInciong v. CAMaicko PhilNo ratings yet

- Spouses Gregorio and Josefa Yu vs. Ngo Yet Te (Di Ko Ganung Naintindihan)Document4 pagesSpouses Gregorio and Josefa Yu vs. Ngo Yet Te (Di Ko Ganung Naintindihan)Trem GallenteNo ratings yet

- Credit DigestDocument38 pagesCredit DigestKelvin ZabatNo ratings yet

- Spouses Paray Vs Rodriguez Case DigestDocument4 pagesSpouses Paray Vs Rodriguez Case DigestLei Ann FernandezNo ratings yet

- Case Digests - Cred Trans - Atty. Sarona (2013)Document43 pagesCase Digests - Cred Trans - Atty. Sarona (2013)JanJan ClarosNo ratings yet

- Upon The Parties, But The Commodatum or Simple Loan Itself Shall Not Be Perfected Until Delivery of The Object of The ContractDocument9 pagesUpon The Parties, But The Commodatum or Simple Loan Itself Shall Not Be Perfected Until Delivery of The Object of The ContractChrizllerNo ratings yet

- Guaranty - DigestDocument2 pagesGuaranty - DigestAngelica PulidoNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Wer Form Formatasterzen Blank Copy BDocument1 pageWer Form Formatasterzen Blank Copy BJunpyo ArkinNo ratings yet

- Philippine Supreme Court Rules on State Immunity from Suit and Political DynastiesDocument107 pagesPhilippine Supreme Court Rules on State Immunity from Suit and Political DynastiesJunpyo ArkinNo ratings yet

- Wer Form Formatasterzen Blank Copy BDocument1 pageWer Form Formatasterzen Blank Copy BJunpyo ArkinNo ratings yet

- Hilton Vs GuyotDocument1 pageHilton Vs GuyotJunpyo ArkinNo ratings yet

- July 21Document1 pageJuly 21Junpyo ArkinNo ratings yet

- 026 Philex Mining Co. Vs CIRDocument3 pages026 Philex Mining Co. Vs CIRkeith105No ratings yet

- Antibullyingact 150712205707 Lva1 App6891Document19 pagesAntibullyingact 150712205707 Lva1 App6891Junpyo ArkinNo ratings yet

- UP-Revised Ortega Lecture Notes IDocument130 pagesUP-Revised Ortega Lecture Notes IIKENo ratings yet

- Practice CourtDocument2 pagesPractice CourtJunpyo ArkinNo ratings yet

- Fort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012Document3 pagesFort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012GraceNo ratings yet

- JA SecretaryDocument4 pagesJA SecretaryJunpyo ArkinNo ratings yet

- Win10 ActivatorDocument1 pageWin10 ActivatorJunpyo ArkinNo ratings yet

- TAX 2 Full Cases May 7 2021Document61 pagesTAX 2 Full Cases May 7 2021Junpyo ArkinNo ratings yet

- Credit Transactions Q & ADocument14 pagesCredit Transactions Q & AJunpyo ArkinNo ratings yet

- TAXDEC6Document45 pagesTAXDEC6Junpyo ArkinNo ratings yet

- Conde Vs IacDocument3 pagesConde Vs IacJunpyo ArkinNo ratings yet

- PROPERTY (Case Digest Compilation)Document34 pagesPROPERTY (Case Digest Compilation)marizfuster17100% (1)

- Metro VSNWPCDocument11 pagesMetro VSNWPCJunpyo ArkinNo ratings yet

- Table of ContentsDocument7 pagesTable of ContentsJunpyo ArkinNo ratings yet

- Property Digested CasesDocument10 pagesProperty Digested CasesJunpyo ArkinNo ratings yet

- Reviewer Property San Beda PDFDocument27 pagesReviewer Property San Beda PDFSheena Valenzuela100% (1)

- Pre Trial DigestDocument3 pagesPre Trial DigestJei Essa AlmiasNo ratings yet

- Looyuko Vs CADocument13 pagesLooyuko Vs CAJunpyo ArkinNo ratings yet

- Maritime Delimitation and Territorial Questions (Qatar v. Bahrain)Document1 pageMaritime Delimitation and Territorial Questions (Qatar v. Bahrain)Junpyo ArkinNo ratings yet

- G.R. No. L-47369 CAse3Document5 pagesG.R. No. L-47369 CAse3Rio PortoNo ratings yet

- G.R. No. L-47369 CAse3Document4 pagesG.R. No. L-47369 CAse3Junpyo ArkinNo ratings yet

- REMEDIAL LAW BAR EXAMINATION QUESTIONSDocument11 pagesREMEDIAL LAW BAR EXAMINATION QUESTIONSAubrey Caballero100% (1)

- Assignement 3 - 20 Mobilia Products Inc v. DemecilioDocument1 pageAssignement 3 - 20 Mobilia Products Inc v. DemeciliopatrickNo ratings yet

- SSS v. DavacDocument7 pagesSSS v. DavacIhna Alyssa Marie SantosNo ratings yet

- Romualdez Vs SandiganbayanDocument4 pagesRomualdez Vs SandiganbayanRyomaNo ratings yet

- The New Residential Free Patent Act (Republic Act 10023)Document17 pagesThe New Residential Free Patent Act (Republic Act 10023)Memphis RainsNo ratings yet

- United States v. Lerone Martin, 4th Cir. (2015)Document4 pagesUnited States v. Lerone Martin, 4th Cir. (2015)Scribd Government DocsNo ratings yet

- Court Affirms Right of Private Prosecutor in Perjury CaseDocument6 pagesCourt Affirms Right of Private Prosecutor in Perjury CaseAkoo Si EarlNo ratings yet

- Indian Trusts Act 1882Document3 pagesIndian Trusts Act 1882Sunil ChoudhariNo ratings yet

- The Prevention of MoneyDocument67 pagesThe Prevention of Moneyvikram270693No ratings yet

- Federal Investigation Agency - ActDocument10 pagesFederal Investigation Agency - ActHasan BilalNo ratings yet

- MAGELLAN v. ZOSADocument8 pagesMAGELLAN v. ZOSAJustin CebrianNo ratings yet

- Civil ProcedureDocument77 pagesCivil ProcedureTiofilo VillanuevaNo ratings yet

- Intro To Criminology Maodule 2Document6 pagesIntro To Criminology Maodule 2Clark RefuerzoNo ratings yet

- Legal Latin Maxims and PhrasesDocument30 pagesLegal Latin Maxims and PhrasesTyrelle CastilloNo ratings yet

- La Naval Drug Corporation Vs CA (Digest)Document2 pagesLa Naval Drug Corporation Vs CA (Digest)Rikki BanggatNo ratings yet

- Francia vs. IAC G.R. L-67649 June 28, 1988Document4 pagesFrancia vs. IAC G.R. L-67649 June 28, 1988eunice demaclidNo ratings yet

- Disputed inheritance of Eugenio's estateDocument10 pagesDisputed inheritance of Eugenio's estateDi CanNo ratings yet

- Mens ReaDocument21 pagesMens ReaSyarlynna Sarawak100% (2)

- Zaldivar vs. EstenzoDocument2 pagesZaldivar vs. EstenzoTinersNo ratings yet

- Supreme Court upholds conviction of man for illegal recruitment and estafaDocument4 pagesSupreme Court upholds conviction of man for illegal recruitment and estafaKaiNo ratings yet

- Republic Vs GimenezDocument3 pagesRepublic Vs GimenezBarrrMaidenNo ratings yet

- Leung vs. O'Brien, 28 Phil. 182 G.R. No. L-13602 April 6, 1918Document2 pagesLeung vs. O'Brien, 28 Phil. 182 G.R. No. L-13602 April 6, 1918Lu CasNo ratings yet

- Case DigestDocument21 pagesCase Digestzimm potNo ratings yet

- Court of Appeal Dismisses RSPCA's Bid to Strike Out Malicious Prosecution ClaimDocument15 pagesCourt of Appeal Dismisses RSPCA's Bid to Strike Out Malicious Prosecution ClaimLiamNo ratings yet

- Drimal's Motion To Suppress WiretapsDocument16 pagesDrimal's Motion To Suppress WiretapsDealBookNo ratings yet

- Civ2 1st Half 2017 CasesDocument160 pagesCiv2 1st Half 2017 CasesAudreyNo ratings yet

- De Leon Vs SorianoDocument1 pageDe Leon Vs SorianoGaizeAngelPagaduanNo ratings yet

- Chillicothe Police Reports For April 11th, 2013Document26 pagesChillicothe Police Reports For April 11th, 2013Andrew AB BurgoonNo ratings yet

- MarrySuanNotes SALES CaseDigest2015Document64 pagesMarrySuanNotes SALES CaseDigest2015Angel DeiparineNo ratings yet

- Central Bank V CA ObliCon Case DIGESTDocument1 pageCentral Bank V CA ObliCon Case DIGESTCharlyn ReyesNo ratings yet