Professional Documents

Culture Documents

LMDC

Uploaded by

Pj TignimanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LMDC

Uploaded by

Pj TignimanCopyright:

Available Formats

MR. CHARLES B.

BALACHAWE

Chief Executive Officer

Lagawe Multi-purpose Development Cooperative (LMDC)

Lagawe, Ifugao

WITH ALL DUE RESPECT TO THE HONORABLE OFFICE, the undersigned

most respectfully submits his answer and for this purpose avers that:

1. I am of legal age, married, and a resident of Pob. West, Lagawe, Ifugao;

2. I am currently employed as a Loan Analyst under the Loans Department of the

Lagawe Multi-purpose Development Cooperative (LMDC);

3. A Dep-Ed Loan Application Form was accomplished and submitted by a certain

Lourdes Binwag Bitog on September 30, 2017. The form was received on the

same day it was submitted. As Loan Analyst, it is my duty and responsibility to

ensure the strict implementation of loan policies in coordination with the

Loan Officer for better services to members. To let an applicant sign the

Insurance Contract, is inconsistent with my job description as nothing was

indicated in my Duties and Responsibilities as a Loan Analyst to let the applicant

sign an Insurance Contract. Attached hereto is a copy of my Duties and

Responsiblities as Lan Analyst marked as Annex “A” to form part of the records

hereof;

4. The loan application form submitted by Ms. Lourdes B. Bitog, together with the

supporting documents, will be reviewed by the undersigned. After careful

review of the loan application, the undersigned is of the opinion that it passed

the loan review process, hence, deemed qualified for approval pursuant to

Section 13. Elements of Credit Investigation of the LMDC Credit Management

Policy or otherwise known as the five (5) C’s of credit;

5. Under paragraph A and E, Section 17. Loan Application Stage of the LMDC

Credit Management Policy, to wit:

a. “Loan applications are submitted to the Loan Officer or Loan Analyst

or Field loan personnel together with the supporting

documents that include among others, identification paper,

member’s passbook as well as photocopies of ownership

documents of collateral offered. (Emphasis supplied)

b. Xxx

c. Xxx

d. Xxx

e. “ All loan applications, including DOSRI loan application shall undergo

loan processes, and shall include all documentation required as

follows:

i. Application Form

ii. Amortization Schedule

iii. Sources of Income and Expenditures

iv. Statement of Asset and Liabilities

v. Self-assessment Form” (Emphasis supplied)

It is very clear in the provisions of LMDC Credit Management Policy that no

Insurance Policy was included as a requirement or a supporting document of

the Loan Application before it will be granted. Hence, it is not my job during

the Loan Application Stage to let the applicant sign the insurance.

It is worthy to note that I transmitted the Loan Application of Ms. Lourdes B.

Bitog to the Loan Officer that it passed the review based on the five (5) C’s of

credit and all the documentation aforementioned;

6. Further, the submission of other pertinent documents is during the Loan

Release, after the approval of the loan, found under paragraph 3, Section 21

of the LMDC Credit Management Policy, to wit:

“3. The Cashier disburses the loan proceeds to the borrower upon the

latter’s signing of the voucher and amortization schedule as well as

promissory note and other pertinent documents.” (Emphasis

supplied)

Thus, an Insurance Policy will only be signed by the applicant after the Loan

Application be approved and released. There is no way an Insurance Contract

be signed simultaneously with the Application Form since the Insurance

Contract will only be presented for signing by the applicant after the loan

application has been approved and released;

7. After evaluating the application of Ms. Lourdes, I even handed her a copy of

the Insurance Policy, in advance, for her to read the terms and conditions of

the insurance. She then starts reading the content of the Insurance Policy.

Suddenly, she told me “Nape ta signa’h yaden wahtu’y content na te tu an I

have not been treated nor been told to have cancer yaden agpaysu te an waday

cancer uh ten munkem-kemoha’ pay.” With her comment, she is aware that

she is not qualified for the Insurance Contract and it will be considered void

and not to have taken effect even if she signed it. As proof, she neither sign

nor fill up the Insurance Contract to the cooperative.

Be it a note that concealment, fraud or misrepresentation of the material facts

in an insurance contract will render the contract void and no effect;

8. I am executing this document to attest that I performed my job in accordance

to my duties and responsibilities as a Loan Analyst in order to prevent

discontentment of clients and provide better services to clients.

WHEREFORE, premises considered, it is most respectfully prayed that the

undersigned be exonerated of the allegations against him.

Respectfully submitted this ___ day of _________ 2018.

CLARENCE D. LUMIDAO

Loan Analyst

LMDC

You might also like

- BOE Bonded TemplateDocument2 pagesBOE Bonded TemplateSuzanne Cristantiello100% (6)

- Foreclosure DefenseDocument76 pagesForeclosure Defenseluke17100% (9)

- Student Loan Forgiveness For Frontline Health WorkersDocument20 pagesStudent Loan Forgiveness For Frontline Health WorkersKyle SpinnerNo ratings yet

- Dealers Borrowed Vehicle AgreementDocument2 pagesDealers Borrowed Vehicle AgreementIrina GafitaNo ratings yet

- Motion For ReinvestigationDocument2 pagesMotion For ReinvestigationPj Tigniman80% (5)

- 1.deped Provident Form 2023Document6 pages1.deped Provident Form 2023BTS EDITSNo ratings yet

- FIDIC Capacity BuildingDocument11 pagesFIDIC Capacity Buildingepurice5022No ratings yet

- Sample Lease AgreementDocument14 pagesSample Lease Agreementapi-390255872No ratings yet

- Borrower in Custody Aka BICDocument16 pagesBorrower in Custody Aka BICMichael FociaNo ratings yet

- Solution Manual For Accounting Text andDocument17 pagesSolution Manual For Accounting Text andanon_995783707No ratings yet

- Assertion and CounterclaimsDocument28 pagesAssertion and CounterclaimsDank SelNo ratings yet

- Petrozuata CaseDocument10 pagesPetrozuata CaseBiranchi Prasad SahooNo ratings yet

- Special Power of Attorney (SPA, HQP-HLF-064, V02)Document2 pagesSpecial Power of Attorney (SPA, HQP-HLF-064, V02)Rpadc CauayanNo ratings yet

- Career Guidance CaravanDocument19 pagesCareer Guidance CaravanRosana Cañon100% (1)

- Formal Offer of EvidenceDocument4 pagesFormal Offer of EvidencePj TignimanNo ratings yet

- Approval SheetDocument9 pagesApproval SheetMay Valenzuela MaigueNo ratings yet

- Fact or Opinion Lesson PlanDocument4 pagesFact or Opinion Lesson PlanSusie CruzNo ratings yet

- Consolidated Digest of Case Laws Jan 2013 March 2013Document179 pagesConsolidated Digest of Case Laws Jan 2013 March 2013Ankit DamaniNo ratings yet

- Justification ON LOCAL TRAVELDocument2 pagesJustification ON LOCAL TRAVELRIZA Y. LABUSTRONo ratings yet

- Approval Sheet Outline DefenseDocument2 pagesApproval Sheet Outline DefenseMaestro LazaroNo ratings yet

- Motion To Withdraw Formal Offer of EvidenceDocument3 pagesMotion To Withdraw Formal Offer of EvidencePj TignimanNo ratings yet

- Employee Handbook Final SmallDocument66 pagesEmployee Handbook Final SmallCricket KheloNo ratings yet

- Paculio Case AnnulmentDocument5 pagesPaculio Case AnnulmentPj TignimanNo ratings yet

- Course Guide - Purposive CommunicationDocument4 pagesCourse Guide - Purposive CommunicationShaira GrafilNo ratings yet

- Gradball Consent FormDocument1 pageGradball Consent FormKlent Ivan ValdezNo ratings yet

- Case No. 9 Republic v. GrijaldoDocument2 pagesCase No. 9 Republic v. GrijaldoAnjela Ching50% (2)

- Counter - Affidavit: MODESTO C. MAHICON, of Legal Age, Filipino Citizen and ADocument5 pagesCounter - Affidavit: MODESTO C. MAHICON, of Legal Age, Filipino Citizen and APj TignimanNo ratings yet

- DLP-january 24, 2018 Reading and Writing SkillsDocument3 pagesDLP-january 24, 2018 Reading and Writing SkillsJomar SolivaNo ratings yet

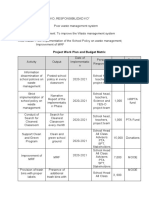

- Project Work Plan and Budget MatrixDocument2 pagesProject Work Plan and Budget MatrixMa. Rosary Amor EstradaNo ratings yet

- Her. What Approach Is Used in The Statement?Document2 pagesHer. What Approach Is Used in The Statement?Jaasiel Isaguirre GarciaNo ratings yet

- Examiner'S Handbook: Computer-Based English Proficiency TestDocument16 pagesExaminer'S Handbook: Computer-Based English Proficiency TestAngelica MandingNo ratings yet

- Fact and Opinion Lesson PlanDocument2 pagesFact and Opinion Lesson Planapi-247211131100% (1)

- MechanicsDocument2 pagesMechanicsjessa clarinoNo ratings yet

- Campus JournalismDocument5 pagesCampus JournalismxirrienannNo ratings yet

- Commonly Confused Words - Worksheet 1Document2 pagesCommonly Confused Words - Worksheet 1Santanaaa10No ratings yet

- ABAKADADocument20 pagesABAKADAYuan Leoj M. AsuncionNo ratings yet

- Photo Contest MechanicsDocument4 pagesPhoto Contest MechanicsNic Satur jrNo ratings yet

- Arachne Lesson PlanDocument5 pagesArachne Lesson PlanAnjenneth Castillo-Teñoso FontamillasNo ratings yet

- Infomercial ActivityDocument1 pageInfomercial ActivityPamy ManDemNo ratings yet

- Quarter 1 - English 10 Summative TestDocument4 pagesQuarter 1 - English 10 Summative Testanalisa monteroNo ratings yet

- Lesson 3:: Filipino Family Values and CultureDocument16 pagesLesson 3:: Filipino Family Values and CultureRyle DavidNo ratings yet

- Certificate of Appearance Title DefenseDocument1 pageCertificate of Appearance Title Defensecristito inovalNo ratings yet

- Guimaras State College: Graduate SchoolDocument7 pagesGuimaras State College: Graduate SchoolJanet AlmenanaNo ratings yet

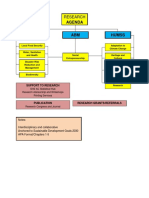

- SHS Research AgendaDocument1 pageSHS Research AgendaFJ MacaleNo ratings yet

- EAPPDocument24 pagesEAPPErika Mae Narvaez100% (1)

- Literary Criticism: Questions For A Variety of ApproachesDocument2 pagesLiterary Criticism: Questions For A Variety of ApproachesAly Swift100% (1)

- RPMS Tool For Teacher I-III (Proficient Teacher) : Position and Competency ProfileDocument31 pagesRPMS Tool For Teacher I-III (Proficient Teacher) : Position and Competency ProfileLawrence CruzNo ratings yet

- Ocean Pollution Advocacy Campaign RubricDocument1 pageOcean Pollution Advocacy Campaign Rubricapi-398397642100% (1)

- Lesson 9 ModuleDocument2 pagesLesson 9 ModuleDaniella May CallejaNo ratings yet

- Noting DetailsDocument2 pagesNoting DetailsQueeny Mae Cantre ReutaNo ratings yet

- POEM 10 (1942) by Jose Garcia VillaDocument3 pagesPOEM 10 (1942) by Jose Garcia VillaJared Darren S. OngNo ratings yet

- Sensory Images QuizDocument2 pagesSensory Images QuizCharity Anne Camille PenalozaNo ratings yet

- Omnibus Certification of Authenticity and Veracity of DocumentsDocument2 pagesOmnibus Certification of Authenticity and Veracity of DocumentsLimar Anasco EscasoNo ratings yet

- ADM LR Standards v.11 083019 PDFDocument53 pagesADM LR Standards v.11 083019 PDFCrisanto P. Uberita0% (2)

- Students Day Proposal 2021Document12 pagesStudents Day Proposal 2021Leika TarazonaNo ratings yet

- SSG Bylaws and ConstitutionDocument16 pagesSSG Bylaws and ConstitutionDan Lhery Susano GregoriousNo ratings yet

- Continuous Improvement - Our Role Our ResponsibilityDocument2 pagesContinuous Improvement - Our Role Our ResponsibilityYeshua Yesha100% (1)

- Developmental Reading (Drill)Document3 pagesDevelopmental Reading (Drill)Rommel BansaleNo ratings yet

- Invitation Letter Workshops PetaDocument4 pagesInvitation Letter Workshops PetaGiles DayaNo ratings yet

- Rubric For State of The Nation Address (SONA) : Excellent (4) Good (3) Satisfactory (2) Needs Improvement (1) ScoreDocument1 pageRubric For State of The Nation Address (SONA) : Excellent (4) Good (3) Satisfactory (2) Needs Improvement (1) ScoreFritzie100% (1)

- Certificate of RecognitionDocument5 pagesCertificate of RecognitionCharles Yves Damayo MillanNo ratings yet

- Subject: English Grade Level: 10 Quarter: 1 Academic Year: 2021-2022Document2 pagesSubject: English Grade Level: 10 Quarter: 1 Academic Year: 2021-2022Katherine Pagas Galupo100% (2)

- NEMSU-GS Concept Note TemplateDocument6 pagesNEMSU-GS Concept Note TemplateKim Calisquis, LPTNo ratings yet

- Extemporaneous Speech and Essay Set-Up and OutlineDocument5 pagesExtemporaneous Speech and Essay Set-Up and OutlinemariahneuNo ratings yet

- Sample Narrative Report On SeminarDocument3 pagesSample Narrative Report On SeminarRellie CastroNo ratings yet

- CSC Form No. 1 Position Description Forms - LANGDocument2 pagesCSC Form No. 1 Position Description Forms - LANGAbegail PanangNo ratings yet

- Second Periodical Test in English 10Document7 pagesSecond Periodical Test in English 10Jennefer AranillaNo ratings yet

- (Draft/test Only) Statement of The ProblemDocument4 pages(Draft/test Only) Statement of The ProblemCarlo PeraltaNo ratings yet

- Division of Lapu-Lapu City Lesson Plan in Science 10Document3 pagesDivision of Lapu-Lapu City Lesson Plan in Science 10Khang KhangNo ratings yet

- School Learning Action Cell Session "Produce Quality Outputs and Learners Ready and Fully Equipped"Document6 pagesSchool Learning Action Cell Session "Produce Quality Outputs and Learners Ready and Fully Equipped"Anthonette Calimpong Bermoy-BurgosNo ratings yet

- Legal IssuesDocument3 pagesLegal IssuesElijah James LegaspiNo ratings yet

- CS Form No. 212 Attachment - Work Experience SheetDocument2 pagesCS Form No. 212 Attachment - Work Experience SheetThess Cahigas - NavaltaNo ratings yet

- 7 Maintenance-Of-Quality-EducationDocument26 pages7 Maintenance-Of-Quality-EducationChristine Comia CorderoNo ratings yet

- LMDCDocument2 pagesLMDCPj TignimanNo ratings yet

- RETCRD Module II CH 4 Documentation - 3Document13 pagesRETCRD Module II CH 4 Documentation - 3somesh5907No ratings yet

- Credit AgreementDocument2 pagesCredit AgreementLeonard PaduaNo ratings yet

- Affidavit - CabbigatDocument2 pagesAffidavit - CabbigatPj TignimanNo ratings yet

- Affidavit - GapuzDocument1 pageAffidavit - GapuzPj TignimanNo ratings yet

- Pao Form 1-BDocument2 pagesPao Form 1-BPj TignimanNo ratings yet

- SketchDocument1 pageSketchPj TignimanNo ratings yet

- PPC MinutesDocument5 pagesPPC MinutesPj TignimanNo ratings yet

- Procedure in ExtraDocument6 pagesProcedure in ExtraPj TignimanNo ratings yet

- SandeshDocument21 pagesSandeshhiteshvavaiya0% (1)

- Third Amended Complaint From PacerDocument48 pagesThird Amended Complaint From Pacerapi-32750214No ratings yet

- ECGC Export Credit Guarantee Corp of India Summer TrainingDocument24 pagesECGC Export Credit Guarantee Corp of India Summer TrainingPhxx619No ratings yet

- Chapter 9 SolutionsDocument5 pagesChapter 9 SolutionsRivaldi SembiringNo ratings yet

- Equifax Credit Report With Score: Consumer Name: ANKIT KDocument13 pagesEquifax Credit Report With Score: Consumer Name: ANKIT KAnkit ShawNo ratings yet

- GRP Bricks Located at Kaliyur at Survey No VILLAGE: Kaliyur, TALUKA - T. Narasipura, DIST: MysoreDocument19 pagesGRP Bricks Located at Kaliyur at Survey No VILLAGE: Kaliyur, TALUKA - T. Narasipura, DIST: MysoredevakiNo ratings yet

- Payless Bankruptcy FilingDocument62 pagesPayless Bankruptcy FilingkmccoynycNo ratings yet

- Market Report On Working Capital Management in FMCG SectorDocument12 pagesMarket Report On Working Capital Management in FMCG SectorSweta HansariaNo ratings yet

- Rent-to-Own FlyerDocument1 pageRent-to-Own FlyerCj AlfieNo ratings yet

- Suggested Answer Guide To Exam Revision Practice Questions 1Document7 pagesSuggested Answer Guide To Exam Revision Practice Questions 1Yashrajsing LuckkanaNo ratings yet

- Cashless Society - The Future of Money or A Utopia?: Nikola FabrisDocument14 pagesCashless Society - The Future of Money or A Utopia?: Nikola FabrisDominika VitárNo ratings yet

- Gippslander Dec 2014 V1Document20 pagesGippslander Dec 2014 V1Local Extra NewspaperNo ratings yet

- 02 Receivable Lec PDFDocument7 pages02 Receivable Lec PDFRyan CornistaNo ratings yet

- EXIM INDIA BlockchainDocument18 pagesEXIM INDIA BlockchainKrish GopalakrishnanNo ratings yet

- Regulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachiDocument25 pagesRegulation & Financial Market: Prudential Regulations For Small & Medium Enterprises Financing Fall 2021 IBA - KarachialiNo ratings yet

- Table 3.1: Loan Amortization Table 3.2: Tax Shaving On Depreciation & InterestDocument9 pagesTable 3.1: Loan Amortization Table 3.2: Tax Shaving On Depreciation & InterestdasamrishNo ratings yet

- My Car Loan PDF WorksheetDocument5 pagesMy Car Loan PDF Worksheetapi-62785081No ratings yet