Professional Documents

Culture Documents

Module 40 Taxes: Gift and Estate

Uploaded by

Zeyad El-sayedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Module 40 Taxes: Gift and Estate

Uploaded by

Zeyad El-sayedCopyright:

Available Formats

690 MODULE 40 TAXES: GIFT AND ESTATE

/ zations that are listed in Sec. 501 as being exempt from tax. part of a therapeutic program to allow the persons to become

Answer (d) is incorrect because a social club can be an ex- involved with society, assume responsibility, and to exercise

empt organization as long as substantially all its activities business judgment, would be substantially related to the

are for such purposes and no part of its net earnings inures to rehabilitation purposes of the exempt organization.

the benefit of any private shareholder. Answer (c) is incor-

rect because most exempt organizations are permitted speci- 56 .. (c) The operational test requires that an exempt

fied levels of lobbying expenditures, and can even elect to organization be operated exclusively for an exempt purpose.

be subject to a tax equal to 25% of their excess lobbying An organization will be considered to be operated exclu-

expenditures to prevent loss of exempt status. Answer (b) is sively for an exempt purpose only if it engages primarily in

incorrect because foreign corporations can qualify as exempt activities that accomplish its exempt purpose. An organiza-

organizations. tion will not be so regarded if more than an insubstantial part

of its activities is not in furtherance of an exempt purpose.

52. (c) Organizations that can qualify as exempt organi- Thus, an organization that engages in insubstantial nonex-

zations are listed in Sec. 501 of the Internal Revenue Code. empt activities will not fail the operational test. In contrast,

An exempt organization can take the form of a trust or a an organization that operates for the prevention of cruelty to

corporation. In order to receive exempt status, the organiza- animals will fail the operational test if it directly participates

tion must file an application with the Internal Revenue Ser- in any political campaign.

vice. In no event will exempt status be conferred upon an

organization unless the organization is one of those listed in IV.C. Unrelated Business Income (UBI)

the Code. Answer (b) is incorrect because there is no limi- 57. (b) The requirement is to determine the correct

tation on the amount of salary that can be paid an employee. statement with regard to the unrelated business income of an

IV.A.2. Sec. 501(c)(3) Organizations exempt organization. An exempt organization is not taxed

on unrelated business income of less than $1,000. Answer

53. (b) The requirement is to determine which of the (a) is incorrect because the amount of unrelated business

activities is(are) consistent with Hope's tax-exempt status as income will not cause the loss of exempt status. Answer (c)

a religious organization. An exempt organization must be is incorrect because the tax will not apply to a business ac-

operated exclusively for its exempt purpose, and other ac- tivity that is not regularly carried on. Answer (d) is incorrect

tivities not in furtherance of its exempt purpose must be only because a loss from an unrelated trade or business activity is

an insubstantial part of its activities. A religious organiza- allowed in computing unrelated business taxable income.

tion's providing' traditional burial services that maintain the

religious beliefs of its members would be consistent with its 58. (d) The requirement is to determine which one of

tax-exempt status as a religious organization. However, the listed activities will not result in unrelated business in-

conducting recreational functions such as weekend retreats come. Unrelated business income (UBI) is income derived

conducted for business organizations ordinarily would not from any trade or business, the conduct of which is not sub-

be consistent with the tax-exempt status of a religious or- stantially related to the exercise or performance of an or-

ganization unless there were tightly scheduled religious ac- ganization'S exempt purpose. For a trade or business to be

tivities and only limited free time for incidental recreation "related," the conduct of the business activity must have a

activities. causal relationship to the achievement of the exempt pur-

pose. A business activity will be "substantially related" only

54. (a) The requirement is to determine which state- if the causal relationship is a substantial one. Assuming that

ments are correct in regard to the organizational test to qual- the development and improvement of its members is one of

ify a public service charitable entity as tax-exempt. The the purposes for which a trade association is granted an ex-

term "articles of organization" includes the trust instrument, emption, the sale of publications used as course materials for

corporate charter, articles of association, or any other written the association's seminars for its members would be sub-

instruments by which an organization is created. To satisfy stantially related.

the organizational test, the articles of organization (1) must Answer (a) is incorrect because even though a special

limit the organization'S purposes to one or more exempt rule permits an exempt hospital to perform services at cost

purposes described in Sec. 501(c)(3); and, (2) must not ex- for other hospitals with facilities to serve not more than 100

pressly empower the organization to engage in activities that inpatients, the permitted services are limited to data pro-

are not in furtherance of one or more exempt purposes, ex- cessing, purchasing, warehousing, billing and collection,

cept as an insubstantial part of its activities. food, clinical, industrial engineering, laboratory, printing,

communications, record center, and personnel services.

55. (d) The requirement is to determine which of two Answer (b) is incorrect because even though an exempt

activities (if any) will result in unrelated business income. senior citizen's center may operate a beauty parlor and bar-

Unrelated business income (UBI) is income derived from a ber shop for its members, selling major appliances to its

trade or business, the conduct of which is not substantially members has been held to generate unrelated business in-

related to the exercise or performance of an organization's come. Answer (c) is incorrect because the performance of

exempt purpose. For a trade or business to be related, the accounting and tax services for its members would be unre-

conduct of the business activity must have a causal relation- lated to the exempt purpose of a lab or union.

ship to the achievement of the organization's exempt pur-

pose. Selling articles made by handicapped persons as part 59. (a) The requirement is to determine the correct

of their rehabilitation would be substantially related to the statement with regard to an exempt organization's unrelated

exempt purpose of an organization exclusively involved in business taxable income when the exempt organization is a

their rehabilitation. Similarly, operating a grocery store corporation. An exempt organization's unrelated business

almost fully staffed by emotionally handicapped persons as income in excess of $1,000 is taxed at regular corporate

You might also like

- Risk Report: Marriott HotelDocument19 pagesRisk Report: Marriott HotelBao Thy Pho100% (1)

- Solution Manual For Advanced Accounting 5th EditioDocument16 pagesSolution Manual For Advanced Accounting 5th EditioSindy AstrinasariNo ratings yet

- HDFC StatementDocument8 pagesHDFC StatementAnonymous 3Mycs5No ratings yet

- ACCT 3326 Tax II Cengage CH 2 199ADocument6 pagesACCT 3326 Tax II Cengage CH 2 199Abarlie3824No ratings yet

- (Digest) CIR v. AlgueDocument2 pages(Digest) CIR v. AlgueHomer SimpsonNo ratings yet

- Microeconomics Midterm Review QuestionsDocument14 pagesMicroeconomics Midterm Review QuestionsRashid AyubiNo ratings yet

- Air BNB Business AnalysisDocument40 pagesAir BNB Business AnalysisAdolf NAibaho100% (1)

- Apics CPIM ModuleDocument2 pagesApics CPIM ModuleAvinash DhoneNo ratings yet

- Working Capital Managment ProjectDocument48 pagesWorking Capital Managment ProjectArun BhardwajNo ratings yet

- Scan 0011Document2 pagesScan 0011Zeyad El-sayedNo ratings yet

- Section 55 of the Income Tax ActDocument4 pagesSection 55 of the Income Tax Actkavi priyaNo ratings yet

- Acw 1000 Assigment 2Document8 pagesAcw 1000 Assigment 2KooKie KeeNo ratings yet

- Types of Organizations Revised Corporation CodeDocument11 pagesTypes of Organizations Revised Corporation CodeNadie LrdNo ratings yet

- Written Report in Income TaxationDocument24 pagesWritten Report in Income TaxationRonron De ChavezNo ratings yet

- Royal AholdDocument5 pagesRoyal AholdRajaSaein0% (1)

- BIR Ruling 322Document1 pageBIR Ruling 322RavenFoxNo ratings yet

- Tax Seatwork #3Document5 pagesTax Seatwork #3irish7erialcNo ratings yet

- CIR v. General FoodsdocxDocument5 pagesCIR v. General FoodsdocxDennis Aran Tupaz AbrilNo ratings yet

- Manila Wine Merchants Inc V CIRDocument6 pagesManila Wine Merchants Inc V CIRAndrew GallardoNo ratings yet

- Corporation Taxpayers 1Document59 pagesCorporation Taxpayers 1Kyla De LunaNo ratings yet

- G.R. No. 202792Document7 pagesG.R. No. 202792zelayneNo ratings yet

- FNSACC514 Amit ChhetriDocument13 pagesFNSACC514 Amit Chhetriamitchettri419No ratings yet

- Guidance Note On CSR Expenditure (My Notes)Document2 pagesGuidance Note On CSR Expenditure (My Notes)maulesh bhattNo ratings yet

- 54 TaxBits August-September2020Document18 pages54 TaxBits August-September2020Pearl Caryl Catantan-CadavisNo ratings yet

- Module 4 Companies SlidesDocument77 pagesModule 4 Companies SlidesChua Rui TingNo ratings yet

- INCOMEDocument12 pagesINCOMEaviralmittuNo ratings yet

- Declaration and Payment of Dividend-Compliance RequirementsDocument8 pagesDeclaration and Payment of Dividend-Compliance RequirementsSherin BabuNo ratings yet

- FNSACC514 Amit ChhetriDocument16 pagesFNSACC514 Amit Chhetriamitchettri419No ratings yet

- Chapter 13-B (Asenjo, Inso, Jacomilla)Document31 pagesChapter 13-B (Asenjo, Inso, Jacomilla)Gwyneth Inso100% (1)

- Compliance Guide For Public CharitiesDocument28 pagesCompliance Guide For Public CharitiesPov TsheejNo ratings yet

- Auditing Ethics IssuesDocument5 pagesAuditing Ethics IssuesFalak EnayatNo ratings yet

- Income TaxDocument39 pagesIncome TaxNadine LumanogNo ratings yet

- CCI - Guidelines For ValuationDocument13 pagesCCI - Guidelines For Valuationsujit0577No ratings yet

- Term Paper - LLCDocument9 pagesTerm Paper - LLCapi-115328034No ratings yet

- Module 36 Taxes: CorporateDocument2 pagesModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- Accounting for Non-Profits (NPOsDocument15 pagesAccounting for Non-Profits (NPOsDieter DyNo ratings yet

- 2-6int 2002 Dec ADocument14 pages2-6int 2002 Dec AJay ChenNo ratings yet

- Fringe Benefits in The PhilippinesDocument4 pagesFringe Benefits in The PhilippinesMarivie Uy100% (1)

- Corporations: Introduction and Operating RulesDocument2 pagesCorporations: Introduction and Operating RulesjackNo ratings yet

- 01 CIR V FilinvestDocument3 pages01 CIR V Filinvestmblopez1No ratings yet

- M Ule 40 Taxes: G F AN Esta E: OD I T D TDocument4 pagesM Ule 40 Taxes: G F AN Esta E: OD I T D TZeyad El-sayedNo ratings yet

- Valuation of Goodwill Cost AssignmentDocument12 pagesValuation of Goodwill Cost AssignmentShubashPoojari100% (1)

- Chapter AnswersDocument20 pagesChapter Answerslynn_mach_1100% (3)

- Abellera and LachicaDocument30 pagesAbellera and Lachicadave_88opNo ratings yet

- Cyanamid Philippines, Inc. vs. Ca G.R. No. 108067 - January 20, 2000 DoctrineDocument3 pagesCyanamid Philippines, Inc. vs. Ca G.R. No. 108067 - January 20, 2000 DoctrineBryan Jay NuiqueNo ratings yet

- United Way of AmericaDocument2 pagesUnited Way of AmericaSajala Pandey100% (3)

- Week 7Document16 pagesWeek 7Hannah Rae ChingNo ratings yet

- SMChap 006Document66 pagesSMChap 006testbank100% (1)

- Acc 702 Assignment 4Document8 pagesAcc 702 Assignment 4laukkeasNo ratings yet

- Wassim Zhani Income Taxation of Corporations (Chapter 1)Document36 pagesWassim Zhani Income Taxation of Corporations (Chapter 1)wassim zhaniNo ratings yet

- Comm. of Customs vs. PH Phosphate FertilizerDocument3 pagesComm. of Customs vs. PH Phosphate FertilizerMara VinluanNo ratings yet

- chapter 10_20240408_103855_0000Document23 pageschapter 10_20240408_103855_0000marilyntuyan16No ratings yet

- Tax Seatwork #4Document4 pagesTax Seatwork #4irish7erialcNo ratings yet

- Assignment 2Document3 pagesAssignment 2nnazninNo ratings yet

- On Holding Co.Document62 pagesOn Holding Co.Rahul SinhaNo ratings yet

- What Are The Corporations Exempt From Taxation?Document3 pagesWhat Are The Corporations Exempt From Taxation?ANGEL MAE LINABAN GONGOBNo ratings yet

- CH 01Document36 pagesCH 01Seulki Roni LeeNo ratings yet

- AdvancedDocument8 pagesAdvancedvaloruroNo ratings yet

- Winding Up (Liquidation) DraftDocument55 pagesWinding Up (Liquidation) DraftZainab BillaNo ratings yet

- Court upholds P75K promotional fees deductionDocument3 pagesCourt upholds P75K promotional fees deductionannamariepagtabunanNo ratings yet

- Starting A Business Los AngelesDocument14 pagesStarting A Business Los AngelesCompany Counsel PCNo ratings yet

- 19 127210-1995-Philippine Duplicators Inc. v. NationalDocument9 pages19 127210-1995-Philippine Duplicators Inc. v. NationalAngela AquinoNo ratings yet

- Taxation of Business IncomeDocument17 pagesTaxation of Business Incomeomoding benjaminNo ratings yet

- Scan 0013Document2 pagesScan 0013Zeyad El-sayedNo ratings yet

- Scan 0010Document3 pagesScan 0010Zeyad El-sayedNo ratings yet

- 1st Sec LowoodDocument1 page1st Sec LowoodZeyad El-sayedNo ratings yet

- Fede Al Securities Acts: OvervieDocument2 pagesFede Al Securities Acts: OvervieZeyad El-sayedNo ratings yet

- Corporate Taxes: Consolidated Returns and Controlled GroupsDocument2 pagesCorporate Taxes: Consolidated Returns and Controlled GroupsZeyad El-sayedNo ratings yet

- Corporate Tax Module on Receipts, AMT Exemption, and Organizational ExpendituresDocument3 pagesCorporate Tax Module on Receipts, AMT Exemption, and Organizational ExpendituresZeyad El-sayedNo ratings yet

- Scan 0001Document2 pagesScan 0001Zeyad El-sayedNo ratings yet

- Consent Dividends: Module 36 Taxes: CorporateDocument2 pagesConsent Dividends: Module 36 Taxes: CorporateEl-Sayed MohammedNo ratings yet

- Corporate Tax Rules for Transfers and Stock IssuanceDocument2 pagesCorporate Tax Rules for Transfers and Stock IssuanceZeyad El-sayedNo ratings yet

- I y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateDocument2 pagesI y I - D - S I - (E o - T, L: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- P N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEDocument3 pagesP N 0 TH H T - T o H T: Module 36 Taxes: Co O ATEZeyad El-sayedNo ratings yet

- Scan 0012Document2 pagesScan 0012Zeyad El-sayedNo ratings yet

- Se Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossDocument3 pagesSe Tion 1244 Small Business Corporation (SBC) Stock Ordinary LossZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Document2 pagesModule 36 Taxes: Corporate:, - S, V e C, - ,, % S 'Zeyad El-sayedNo ratings yet

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDocument2 pages80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDocument2 pagesModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNo ratings yet

- AMTs - Individual vs. CorporationDocument3 pagesAMTs - Individual vs. CorporationZeyad El-sayedNo ratings yet

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDocument2 pagesModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNo ratings yet

- Bankruptcy:: y y S e S Owed SDocument3 pagesBankruptcy:: y y S e S Owed SZeyad El-sayedNo ratings yet

- B Nkruptcy: Discharge of A BankruptDocument2 pagesB Nkruptcy: Discharge of A BankruptZeyad El-sayedNo ratings yet

- Taxable As A Dividend: 'Ss o %,, 'S eDocument2 pagesTaxable As A Dividend: 'Ss o %,, 'S eEl-Sayed MohammedNo ratings yet

- Module 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CDocument3 pagesModule 36 Taxes: Corporate: - G, - , - C C,, S, A, I - . Es T, R, CZeyad El-sayedNo ratings yet

- Carryover of Tax Attributes NOL: S (,, S R S, T-I, C) A S V A I y I S T X Yea F e SDocument2 pagesCarryover of Tax Attributes NOL: S (,, S R S, T-I, C) A S V A I y I S T X Yea F e SEl-Sayed MohammedNo ratings yet

- Revocation of Discharge: 2M Module27 BankruptcyDocument2 pagesRevocation of Discharge: 2M Module27 BankruptcyZeyad El-sayedNo ratings yet

- The Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Document2 pagesThe Bankruptcy Abuse Prevention and Consumer Protection Act of 2005Zeyad El-sayedNo ratings yet

- Bankruptcy Chapter 11 Reorganization Plan Key ElementsDocument2 pagesBankruptcy Chapter 11 Reorganization Plan Key ElementsZeyad El-sayedNo ratings yet

- Tax Planning and Strategic ManagDocument2 pagesTax Planning and Strategic ManagEl-Sayed MohammedNo ratings yet

- Professional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsDocument2 pagesProfessional Responsibilities: S S S A o S e C I A o Ir Par S o C Ie To A A State-O,, S Ss y G S, C e S. R I S of AsZeyad El-sayedNo ratings yet

- Scan 0018Document1 pageScan 0018Zeyad El-sayedNo ratings yet

- Article I Responsibilities. Article Il-The Public InterestDocument2 pagesArticle I Responsibilities. Article Il-The Public InterestZeyad El-sayedNo ratings yet

- NTPC Limited: Korba Super Thermal Power StationDocument9 pagesNTPC Limited: Korba Super Thermal Power StationSAURAV KUMARNo ratings yet

- Universidad de Lima Study Session 5 Questions and AnswersDocument36 pagesUniversidad de Lima Study Session 5 Questions and Answersjzedano95No ratings yet

- Arizona Exemptions 7-20-11Document1 pageArizona Exemptions 7-20-11DDrain5376No ratings yet

- Average Due Date and Account CurrentDocument80 pagesAverage Due Date and Account CurrentShynaNo ratings yet

- Concurrent Engineering Development and Practices For Aircraft Design at AirbusDocument9 pagesConcurrent Engineering Development and Practices For Aircraft Design at Airbusanon_658728459No ratings yet

- Sally Yoshizaki Vs Joy Training Case DigestDocument5 pagesSally Yoshizaki Vs Joy Training Case DigestPebs DrlieNo ratings yet

- Del Monte Philippines, Inc. vs. AragoneDocument1 pageDel Monte Philippines, Inc. vs. AragoneLeizle Funa-FernandezNo ratings yet

- Wilchez Cromatógrafo A Gás 370xa Rosemount PT 5373460Document140 pagesWilchez Cromatógrafo A Gás 370xa Rosemount PT 5373460Mantenimiento CoinogasNo ratings yet

- IAQG Standards Register Tracking Matrix February 01 2021Document4 pagesIAQG Standards Register Tracking Matrix February 01 2021sudar1477No ratings yet

- AR JBN JANUARY 03 and JANUARY 10, 2023Document1 pageAR JBN JANUARY 03 and JANUARY 10, 2023h3ro007No ratings yet

- BT India Factsheet - NewDocument2 pagesBT India Factsheet - NewsunguntNo ratings yet

- Diluted Earnings Per ShareDocument15 pagesDiluted Earnings Per ShareHarvey Dienne Quiambao100% (1)

- Ikea 6Document39 pagesIkea 6My PhamNo ratings yet

- HBO - Change Process, Managing ConflictDocument12 pagesHBO - Change Process, Managing ConflictHazel JumaquioNo ratings yet

- Vinati Organics Ltd financial analysis and key metrics from 2011 to 2020Document30 pagesVinati Organics Ltd financial analysis and key metrics from 2011 to 2020nhariNo ratings yet

- Capital Market: Unit II: PrimaryDocument55 pagesCapital Market: Unit II: PrimaryROHIT CHHUGANI 1823160No ratings yet

- Management Development ProgrammeDocument4 pagesManagement Development ProgrammeDebi GhoshNo ratings yet

- Organization Development and Change: Chapter Twenty: Organization TransformationDocument16 pagesOrganization Development and Change: Chapter Twenty: Organization TransformationGiovanna SuralimNo ratings yet

- City Gas Distribution Projects: 8 Petro IndiaDocument22 pagesCity Gas Distribution Projects: 8 Petro Indiavijay240483No ratings yet

- Forbes Insights Study - Customer EngagementDocument12 pagesForbes Insights Study - Customer EngagementMegan BlanchardNo ratings yet

- Scope and Methods of EconomicsDocument4 pagesScope and Methods of EconomicsBalasingam PrahalathanNo ratings yet

- Project Proposal: ESC472 - Electrical and Computer Capstone Design Division of Engineering ScienceDocument19 pagesProject Proposal: ESC472 - Electrical and Computer Capstone Design Division of Engineering Scienceapi-140137201No ratings yet

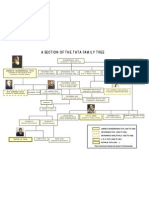

- TATA Family TreeDocument1 pageTATA Family Treemehulchauhan_9950% (2)

- Reeengineering MethodologyDocument87 pagesReeengineering MethodologyMumbi NjorogeNo ratings yet