Professional Documents

Culture Documents

Zimbabwe Revenue Authority: Pay As You Earn (Paye) Forex Tables For January To December 2018

Uploaded by

Nyasha Chihungwa0 ratings0% found this document useful (0 votes)

37 views2 pagestaxx

Original Title

2018 Tax Tables(1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenttaxx

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

37 views2 pagesZimbabwe Revenue Authority: Pay As You Earn (Paye) Forex Tables For January To December 2018

Uploaded by

Nyasha Chihungwataxx

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

ZIMBABWE REVENUE AUTHORITY

PAY AS YOU EARN ( PAYE) FOREX TABLES FOR JANUARY TO DECEMBER 2018

DAILY TABLE Example

Rates If an employee earns

from - to 9.86multiply by 0% Deduct - $10 per day

from 9.87 to 49.32multiply by 20% Deduct 1.97 The tax will be calculated thus:

from 49.33 to 98.63multiply by 25% Deduct 4.44

from 98.64 to 164.38multiply by 30% Deduct 9.37 $10 x 20% -$1.97 =

from 164.39 to 328.77multiply by 35% Deduct 17.59 $0.03

from 328.78 to 493.15multiply by 40% Deduct 34.03

from 493.16 to 657.53multiply by 45% Deduct 58.68

from 657.54 and above multiply by 50% Deduct 91.56

WEEK LY TABLE Example

Rates If an employee earns

from - to 69.23

multiply by 0% Deduct - $300 per week

from 69.24 to 346.15

multiply by 20% Deduct 13.85 The tax will be calculated thus:

from 346.16 to 692.31

multiply by 25% Deduct 31.15

from 692.32 to 1,153.85

multiply by 30% Deduct 65.77 $300 x 20% -$13.85 =

from 1,153.86 to 2,307.69

multiply by 35% Deduct 123.46 $46.15 per week

from 2,307.70 to 3,461.54

multiply by 40% Deduct 238.85

from 3,461.55 to 4,615.38

multiply by 45% Deduct 411.92

from 4,615.39 and above multiply by 50.0% Deduct 642.69

FORTNIGHTLY TABLE Example

Rates If an employee earns

from - to 138.46 multiply by 0% Deduct - $1 000 per fortnight

from 138.47 to 692.31 multiply by 20% Deduct 27.69 The tax will be calculated thus:

from 692.32 to 1,384.62 multiply by 25% Deduct 62.31

from 1,384.63 to 2,307.69 multiply by 30% Deduct 131.54 $1 000 x 25%- $62.31

from 2,307.70 to 4,615.38 multiply by 35% Deduct 246.92 $187.69 per fortnight

from 4,615.39 to 6,923.08 multiply by 40% Deduct 477.69

from 6,923.09 to 9,230.77 multiply by 45% Deduct 823.85

from 9,230.78 and above multiply by 50% Deduct 1,285.38

MONTHLY TABLE Example

Rates If an employee earns

from - to 300.00

multiply by 0% - $6 000 per month

from 300.01 to 1,500.00

multiply by 20% Deduct 60.00 The tax will be calculated thus:

from 1,500.01 to 3,000.00

multiply by 25% Deduct 135.00

from 3,000.01 to 5,000.00

multiply by 30% Deduct 285.00 $6 000 x 35% -$535 =

from 5,000.01 to 10,000.00

multiply by 35% Deduct 535.00 $1 565.00 per month

from 10,000.01 to 15,000.00

multiply by 40% Deduct 1,035.00

from 15,000.01 to 20,000.00

multiply by 45% Deduct 1,785.00

from 20,000.01 and above multiply by 50% Deduct 2,785.00

ANNU AL TABLE Example 1

Rates If an employee earns

from 0 to 3,600.00 multiply by 0% Deduct - $150 000 per year

from 3,601 to 18,000.00 multiply by 20% Deduct 720 The tax will be calculated thus:

from 18,001 to 36,000.00 multiply by 25% Deduct 1,620

from 36,001 to 60,000.00 multiply by 30% Deduct 3,420 $150 000 x 40%-$12 420

from 60,001 to 120,000.00 multiply by 35% Deduct 6,420 $47,580.00 per annum

from 120,001 to 180,000.00 multiply by 40% Deduct 12,420

from 180,001 to 240,000.00 multiply by 45% Deduct 21,420

from 240,001 and above multiply by 50% Deduct 33,420

Aids Levy is 3% of the Individuals' Tax payable

CONTACT YOUR NEAREST ZIMRA OFFICE FOR QUERIES

You might also like

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- August To December 2019 RTGS Tax TablesDocument1 pageAugust To December 2019 RTGS Tax TablesAlton MadyaraNo ratings yet

- Tax Tables RTGS 2020Document1 pageTax Tables RTGS 2020Mai CarolNo ratings yet

- Aug - Dec 2020 Tax Tables RTGSDocument1 pageAug - Dec 2020 Tax Tables RTGSTanaka MachanaNo ratings yet

- RTGS 2022 August-December 2022 Tax TablesDocument1 pageRTGS 2022 August-December 2022 Tax TablesGodfrey MakurumureNo ratings yet

- Tax Tables RTGS 2021 Jan - DecDocument1 pageTax Tables RTGS 2021 Jan - DecTanaka MachanaNo ratings yet

- Tax Tables 2021 Jan - DecDocument1 pageTax Tables 2021 Jan - DecGeanie TawodzeraNo ratings yet

- JANUARY To DECEMBER 2022 USD Tax TablesDocument1 pageJANUARY To DECEMBER 2022 USD Tax TablesAndrew MusarurwaNo ratings yet

- RTGS Tax Tables 2022Document1 pageRTGS Tax Tables 2022Godfrey MakurumureNo ratings yet

- USD Tax Tables 2022Document1 pageUSD Tax Tables 2022Godfrey MakurumureNo ratings yet

- Jan To Jul 2022 Tax TablesDocument1 pageJan To Jul 2022 Tax Tablesgracia murevanemweNo ratings yet

- 2014 Tax TablesDocument1 page2014 Tax Tableszimbo2No ratings yet

- RTGS 2022 August-December 2022 Tax TablesDocument1 pageRTGS 2022 August-December 2022 Tax TablesTinovimba MawoyoNo ratings yet

- Aug To Dec 2022 Tax TablesDocument1 pageAug To Dec 2022 Tax TablesGodfrey MakurumureNo ratings yet

- Jan-July 2023 ZWL Tax TablesDocument1 pageJan-July 2023 ZWL Tax TablesTawanda BlackwatchNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- FIT-Percentage Method ChartsDocument4 pagesFIT-Percentage Method ChartsMary67% (3)

- Net Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsDocument8 pagesNet Income Before Tax Less - Exempstions Personal Exemption 50,000.00 Additional ExemptionsGeromil HernandezNo ratings yet

- Tax Reform Acceleration and InclusionDocument28 pagesTax Reform Acceleration and InclusionWilliam Alexander Matsuhara AlegreNo ratings yet

- Zimra 2016 Tax Tables PDFDocument2 pagesZimra 2016 Tax Tables PDFKathryn BrownNo ratings yet

- TAX LIABILITY PDF) OkDocument7 pagesTAX LIABILITY PDF) OksaeNo ratings yet

- Tax TablesDocument6 pagesTax TablesGeromil HernandezNo ratings yet

- Department of Finance and Administration: Withholding TaxDocument3 pagesDepartment of Finance and Administration: Withholding TaxJuan Daniel Garcia VeigaNo ratings yet

- Percentages Increase DecreaseDocument15 pagesPercentages Increase DecreasedipanajnNo ratings yet

- Income TAX: Particular Case 1 Case 2Document15 pagesIncome TAX: Particular Case 1 Case 2Shekh SalmanNo ratings yet

- Canada Government Tax BenefitsDocument38 pagesCanada Government Tax BenefitsRitesh singhaniaNo ratings yet

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDocument5 pagesProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNo ratings yet

- Lab Assignment A8.2 IRS: BackgroundDocument1 pageLab Assignment A8.2 IRS: BackgroundArnav LondheNo ratings yet

- Teste 4 - Geovana Gabriela LettninDocument13 pagesTeste 4 - Geovana Gabriela LettninGeovana LettninNo ratings yet

- House Bill 5636 - Package 1Document63 pagesHouse Bill 5636 - Package 1Denise MarambaNo ratings yet

- 02 RebatesDocument53 pages02 RebatesughaniNo ratings yet

- Salary Tax Calculator Pak-2019-20Document2 pagesSalary Tax Calculator Pak-2019-20Usman HabibNo ratings yet

- S Corp vs. Sole Prop - LLC Tax Savings CalculatorDocument1 pageS Corp vs. Sole Prop - LLC Tax Savings CalculatorsomdivaNo ratings yet

- Technical Note: DisclaimerDocument13 pagesTechnical Note: DisclaimerNicquainCTNo ratings yet

- Standard Pay CalculationDocument16 pagesStandard Pay Calculationnaresh86chNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6Document3 pagesRevised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6GwenNo ratings yet

- 1.1.1 Tax On Income From Employment / Personal Income Tax: Direct TaxesDocument6 pages1.1.1 Tax On Income From Employment / Personal Income Tax: Direct TaxesGetu WeyessaNo ratings yet

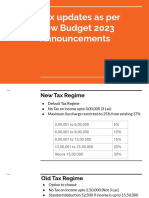

- Budget 2023 2024Document12 pagesBudget 2023 2024finance bnbmNo ratings yet

- Econ Math ProjectDocument14 pagesEcon Math ProjectAndy ChiuNo ratings yet

- Budget Updates 2023 PDFDocument4 pagesBudget Updates 2023 PDFmohit PathakNo ratings yet

- Income Tax Calculator 2023Document50 pagesIncome Tax Calculator 2023Pani NiNo ratings yet

- Forex Compounding CalculatorDocument8 pagesForex Compounding CalculatorMye RakNo ratings yet

- ExtraTaxProblem-TY2020 Student - SUSANDocument6 pagesExtraTaxProblem-TY2020 Student - SUSANhhunter530No ratings yet

- You Exec - Budgeting Model CompleteDocument66 pagesYou Exec - Budgeting Model CompleteJihane Jihane TupperwareNo ratings yet

- TAX RATE PowerpointDocument8 pagesTAX RATE PowerpointAngelo Gade LeysaNo ratings yet

- Akuntansi Keuangan Lanjutan IIDocument6 pagesAkuntansi Keuangan Lanjutan IIlistianiNo ratings yet

- 2007 Tax RatesDocument3 pages2007 Tax RatesmobiletaxboysNo ratings yet

- Mrs Incidence Report 2011Document2 pagesMrs Incidence Report 2011Melinda JoyceNo ratings yet

- 1.1 Simple Interest: StarterDocument37 pages1.1 Simple Interest: Starterzhu qingNo ratings yet

- Self Employed Tax ContributionDocument4 pagesSelf Employed Tax ContributionLe-Noi AndersonNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- Financial Planning and Forecasting Brigham SolutionDocument29 pagesFinancial Planning and Forecasting Brigham SolutionShahid Mehmood100% (6)

- Cost of Revenue Operating Expenses Research & Development Sales, General and Admin Add Income/expense ItemsDocument1 pageCost of Revenue Operating Expenses Research & Development Sales, General and Admin Add Income/expense ItemsMerlene CastilloNo ratings yet

- Income TaxationDocument41 pagesIncome TaxationErlindss Ilustrisimo GadainganNo ratings yet

- Calculo IrDocument5 pagesCalculo IrLesbia Reyes MontesNo ratings yet

- Month Net Taxable Income Tax Slabs Tax RateDocument2 pagesMonth Net Taxable Income Tax Slabs Tax RateBhargav ChintalapatiNo ratings yet

- Income Tax Calculator 2023Document50 pagesIncome Tax Calculator 2023TARUN PRASADNo ratings yet

- International Tax ComparisonsDocument23 pagesInternational Tax ComparisonsJahnavi BadlaniNo ratings yet

- In Small Independent Businesses: Women Are Like Cats—Men Are Like DogsFrom EverandIn Small Independent Businesses: Women Are Like Cats—Men Are Like DogsNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- Trading Time in ZimDocument1 pageTrading Time in ZimNyasha ChihungwaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Power ToolsDocument1 pagePower ToolsNyasha ChihungwaNo ratings yet

- Seven Things My Ompany Should DoDocument1 pageSeven Things My Ompany Should DoNyasha ChihungwaNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- New 1Document11 pagesNew 1Nyasha ChihungwaNo ratings yet

- Free InternetDocument1 pageFree InternetNyasha Chihungwa100% (2)

- Impact of Taxes On Economic Development BackgroundDocument5 pagesImpact of Taxes On Economic Development BackgroundAbdullahiNo ratings yet

- Itemized DeductionsDocument23 pagesItemized DeductionsAbhishek JaiswalNo ratings yet

- MCQ Income Taxation Chapter 13docx PDF FreeDocument14 pagesMCQ Income Taxation Chapter 13docx PDF FreeMichael Brian TorresNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)glenniesamuelNo ratings yet

- DonorsDocument11 pagesDonorsboniglai50% (1)

- Boat 235V2 Fast Charging Bluetooth Headset: Grand Total 1199.00Document1 pageBoat 235V2 Fast Charging Bluetooth Headset: Grand Total 1199.00AjayNo ratings yet

- Models of GSTDocument16 pagesModels of GSTGs AbhilashNo ratings yet

- Quotation Quotation: Al Kindy Safety Eqpt Sales & Maint EstDocument1 pageQuotation Quotation: Al Kindy Safety Eqpt Sales & Maint EstEmmanuel ToretaNo ratings yet

- Quiz 3-Part 3Document1 pageQuiz 3-Part 3JCNo ratings yet

- BLR 903 PDFDocument1 pageBLR 903 PDFAthahNo ratings yet

- Usha Cooler Invoice 1Document1 pageUsha Cooler Invoice 1Arun Prakash SinghNo ratings yet

- Tax II OutlineDocument68 pagesTax II OutlineEdmond MenchavezNo ratings yet

- US Involuntary Deds White PaperDocument37 pagesUS Involuntary Deds White PaperSubramanianNo ratings yet

- Annual Premium Statement: Nagarajan KDocument1 pageAnnual Premium Statement: Nagarajan KRajanNo ratings yet

- TE1HPHDocument2 pagesTE1HPHKarthikeya MandavaNo ratings yet

- SMART Pensions Booklet 2021-2022Document6 pagesSMART Pensions Booklet 2021-2022Julian Tierno MagroNo ratings yet

- INCOME AND BUSINESS TAXATION FinalsDocument21 pagesINCOME AND BUSINESS TAXATION FinalsAbegail BlancoNo ratings yet

- NLPC IRS Complaint Against Alianza Americas July 10, 2023Document9 pagesNLPC IRS Complaint Against Alianza Americas July 10, 2023Gabe KaminskyNo ratings yet

- Pha 066 Module 9 SGDocument14 pagesPha 066 Module 9 SGHannah yssa seguerraNo ratings yet

- Apple Watch InvoiceDocument1 pageApple Watch InvoiceawesumaditisinghalNo ratings yet

- Ey Thailand Tax Measures To Support Sez and Industry 4 0Document3 pagesEy Thailand Tax Measures To Support Sez and Industry 4 0harryNo ratings yet

- UNIFEEDS TaxDocument64 pagesUNIFEEDS TaxRheneir MoraNo ratings yet

- 2021 Carter AssessmentDocument1 page2021 Carter AssessmentMary LandersNo ratings yet

- Emp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANDocument1 pageEmp Code Emp Name Department Cost Center PF No. Location Designation Esi No. Date of Birth Bank A/c No Pan No. Date of Joining Gender Eps No. UANGanesh PrasadNo ratings yet

- Tax Management and Make - Buy DecisionsDocument12 pagesTax Management and Make - Buy DecisionsYash MittalNo ratings yet

- Invoice OD211629772102222000Document1 pageInvoice OD211629772102222000Faruk PatelNo ratings yet

- Correction of ErrorDocument1 pageCorrection of ErrorElmer JuanNo ratings yet

- Application For Lottery Prize ClaimDocument3 pagesApplication For Lottery Prize ClaimAMit PrasadNo ratings yet

- View CertificateDocument1 pageView CertificateGopal PenjarlaNo ratings yet

- Vendor Registration FormDocument3 pagesVendor Registration FormSourabh ShrivastavaNo ratings yet