Professional Documents

Culture Documents

Sugar Industry Sector Update April 2018

Uploaded by

Sehar IshtiaqOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sugar Industry Sector Update April 2018

Uploaded by

Sehar IshtiaqCopyright:

Available Formats

SECTOR UPDATE

Sugar Industry April, 2018

Sugar Industry Overview

Sugarcane is one of the most important cash crops of Pakistan; it is a key input for sugar production as well as the paper

and board industry. Pakistan is the 6th largest sugarcane producer, 9th largest by sugar production and 8th largest

sugar consuming country in the world. Over the years, domestic sugar consumption has grown from 0.5 million (m)

metric tons (MeT) in 1975 to 5.1m MeT in 2017 on the back of population growth. Per capita consumption of refined

sugar in Pakistan was estimated at 25.7kg in FY17. Processed food sector which includes candy, ice cream and soft

drink manufactures accounts for almost 60% of total domestic sugar consumption. Furthermore, absence of major

substitutes for sugar makes its demand inelastic.

Refining and Processing Sugar

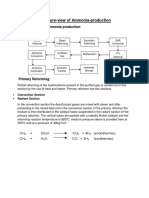

Sugar manufacturing comprises five primary procedures cleaning, slicing, extraction, evaporation and crystallization

which are illustrated in the figure below.

Figure 1: Sugarcane refining process

Major by-products of sugar production are molasses and bagasse fiber. Molasses are used as raw material for ethanol

production. Local sugar mills export molasses, sell it locally or process molasses into ethanol through their own distillery.

Pakistan’s sugar sector has the capacity to produce over 2.5m MeT of molasses. Moreover, sugar manufacturers mainly

utilize bagasse for paper and chip board manufacturing. The same may also be used as a raw material for power

generation.

Sugarcane Plantation Area and Production

Sugarcane has a seasonal production spell for a period of five months from November to March. Sugarcane is a labor-

intensive crop that requires about 134 man-days/hectare. Sugarcane cultivation provides a partial and seasonal

employment to 3.9m people approximately, which is about 12.14% of the total agricultural labor force.

JCR-VIS Credit Rating Company Limited

2

Table 1: Sugarcane Plantation area by province (‘000’s Hectares)

Province FY15 FY16 FY17

Punjab 685 705 778

Sindh 318 313 320

KPK 113 113 119

Total 1,113 1,131 1,217

Total sugarcane production in FY17 amounted to 75.5m MeT (FY16: 65.5m MeT) whereas for FY18, 78.4m MeT has

been forecasted. On a provincial basis, highest sugarcane production was contributed by Punjab followed by Sindh and

KP during FY17.

Table 2: Sugarcane production and yield by province

Sugarcane Production (MeT) Yield (Tons Per Hectare)

Province

FY15 FY16 FY17 FY15 FY16 FY17

Punjab 41.0 41.9 49.6 60.1 59.5 63.8

Sindh 16.6 17.9 20.2 52.4 57.5 63.1

KPK 5.1 5.5 5.6 45.4 48.8 47.5

Total 62.7 65.5 75.5 56.4 57.8 62.0

Source: Provincial Agricultural Departments and FAS/Islamabad

During FY17 yield was healthy in the sugarcane crop specifically in Punjab and upper part of Sindh Province compared

to other parts. Due to scarcity of water, the production of sugar in lower part of Sindh but on an overall basis the total

production was higher than previous year.

Sugar Production

A total of 89 sugar mills are presently operating in the country and are pre-dominantly owned by the private sector. Out

of 89 sugar mills, 45 are located in Punjab, 38 mills in Sindh and remaining mills are located in KP. About 40% (36 sugar

mills) in Pakistan are listed on Pakistan Stock Exchange (PSX).

During FY17, total sugarcane crushed amounted to 70.9m MeT (FY16: 50.0m MeT) while sugar production was reported

at 7.0m MeT (FY16: 5.1m MeT), indicating a recovery rate of about 9.8% (FY16: 10.2%). Sugar production is projected

at 6.6m MeT in FY18.

Table 3: Province-wise break up of sugarcane crushed,

sugar production and recovery rate in FY17.

Sugarcane Sugar

Recovery

Province Crushed Production

Rate

(MeT) (MeT)

Punjab 44.1 4.3 9.8%

Sindh 21.9 2.2 10.2%

KPK 4.8 0.5 9.4%

Total 70.9 7.0 9.9%

Recovery rate of sugar is primarily dependent upon favorable weather, availability of water, type of sugarcane seed

and soil conditions. Variation in sucrose recovery rate from sugarcane across the country has a direct impact on cost of

manufacturing and profit margins amongst different producers. As a result, mills operating in high recovery area have a

competitive advantage over others. Moreover, per hectare yield of sugarcane in Pakistan is significantly lower vis-à-vis

global averages. Recovery rate has also ranged between 9-10.5% over past couple of years compared to other major

sugar producing countries where average recovery rate is over 10.2%.

JCR-VIS Credit Rating Company Limited

3

Given the rise in output levels, domestic surplus situation in sugar is expected to continue with domestic consumption

of 5.1m MeT in FY17 During the outgoing year FY17, sugarcane production was higher vis-à-vis the previous period,

as well as the consumption thereby leading to surplus. Furthermore, bumper sugarcane crop is expected to resurface

during next year FY18 due to favorable climatic conditions, intensifying supply glut in the sector.

Figure 2: Domestic sugar production, consumption and surplus (MeT)

Domestic Prices

Government actively controls the support prices of sugarcane. The sugarcane retail average price per 40 Kg stands at

Rs. 180.6 (FY17: Rs. 180.6) in FY18. However, the sugar average retail price per kg stands at Rs 53.0 (FY17: Rs. 61.4) in

9MFY18.

Table 4: Comparison of sugarcane procurement

Sugarcane Indicative Price (Rs.) Avg. Sugar Retail

Year

Punjab* Sindh* KP* price/Kg**

FY14 170 172 170 54.8

FY15 180 182 180 58.9

FY16 180 172 180 63.8

FY17 180 182 180 61.4

FY18 180 182 180 53.0***

*Price is per 40kg, **Average prices of period (Oct-Sep), Source: Pakistan Bureau Statistics

Over the past four years, sugarcane prices have remained stable and increased slightly by Cumulative Average Growth

Rate (CAGR) of 1.4% whereas, the sugar average retail price has shown improvement and increased by CAGR of 3.8%.

Figure 3 depicts the comparison in average retail prices of sugarcane and sugar.

Figure 3: Sugarcane indicative price (Rs./40 Kg.)

JCR-VIS Credit Rating Company Limited

4

Given that sugarcane prices are fixed by the government and sugar prices are determined by market forces, which is

exhibiting a declining trend, the same may result in a cost-price mismatch, whereby change in retail sugar prices may

not correspond with the change in raw material costs including other overheads as well. Some players in this sector

are diversifying their revenue base by undertaking other ventures like power production, Medium Density Fiber (MDF)

board and ethanol production. Trend analysis of sugar retail prices is presented below:

Figure 4: Sugar average monthly retail price (Rs./Kg.)

The steady rise in sugarcane procurement prices has made it difficult for mills to profitably produce sugar, but the

industry is currently protected by a 40 percent import tariff designed to boost domestic sugar sector and protect the

local industry from imports.

Government intervenes in imposing trade controls over import and export of sugar by buying and selling sugar.

Moreover, in order to support the export market of sugar government extends the export rebates to the mill owners

every year. Additionally, government set the export quotas to keep the domestic prices stable. The quota is approved

and monitored by the State Bank of Pakistan (SBP) on a first come first serve basis. Trend comparison of sugar monthly

domestic and international prices is presented below:

Figure 5: Monthly average sugar prices (Rs./Kg.)- domestic vs. international (FY17)

During FY17, total sugar exports allowed by Economic Coordination Committee of Pakistan (ECC) amounted to 1.2m

MeT. 0.7m MeT out of total exports was at no subsidy however, remaining 0.5m MeT of sugar was exported at a

subsidy of Rs. 10.7 per Kg. In view of the availability of surplus sugar, 1.5m MeT of exports was allowed by ECC on end-

Nov 2017.

Molasses and ethyl alcohol are the two major by-products of sugar that are also exported. Over the past two years,

Ethyl Alcohol (Ethanol) exports have been of higher value than sugar exports. There has been no or very little import

in the sugar market. During FY17, a total of 8,923 tons of refined sugar was imported while no raw sugar has been

imported since past five years.

JCR-VIS Credit Rating Company Limited

3

Trend in sugar exports over past eight years is presented below:

Figure 6: Sugar exports (MeT)

Financial Analysis of Industry

The excess supply of sugar in the market has kept the sector under pressure and weakened the financial profile of the

industry. Due to lower selling price, players in the industry delayed selling of inventory, thereby, resulting in higher

short-term borrowings for longer periods. This resulted in higher leverage levels as well as finance cost.

Profitability and resulting cash flows were considerably lower due to lower margins and higher finance cost as explained

above. However, the competitive advantage of low-cost production has favored large players as well as companies that

have diversified their business to other products categories such as ethanol and MDF by utilization of by-products of

sugar.

Outlook

Government subsidy for export of sugar for local companies has helped companies to reduce inventory levels at the

beginning of crushing season, thereby, avoiding a significant downturn. However, given that Pakistan will experience

a bumper crop next year, which will increase sugar supply further; financial profile of sugar companies is expected to

deteriorate, going forward.

Analysts Contacts

Jazib Ahmed, CFA

Senior Manager

jazib.ahmed@jcrvis.com.pk

Muhammad Tabish

Assistant Manager

muhammad.tabish@jcrvis.com.pk

JCR-VIS Credit Rating Company Limited

You might also like

- Sugar Annual: Report NameDocument9 pagesSugar Annual: Report Namenusrat jehanNo ratings yet

- Agriculture: OutlookDocument16 pagesAgriculture: OutlookMuhammadTanveerNo ratings yet

- Sugar: Sweetness FadingDocument6 pagesSugar: Sweetness FadingPradeep MotaparthyNo ratings yet

- India Sugar SectorDocument4 pagesIndia Sugar SectorsonysajanNo ratings yet

- GAIN Report: Pakistan Sugar Annual 2008 2008Document8 pagesGAIN Report: Pakistan Sugar Annual 2008 2008mirzayounus1000No ratings yet

- Sugar Profile July 2019Document9 pagesSugar Profile July 2019Ahmed OuhniniNo ratings yet

- Sugar Annual - Guangzhou ATO - China - People's Republic of - CH2022-0049Document11 pagesSugar Annual - Guangzhou ATO - China - People's Republic of - CH2022-0049kennethNo ratings yet

- Dhampur Sugars - LKP Sec - 30 11 09Document3 pagesDhampur Sugars - LKP Sec - 30 11 09api-19978586No ratings yet

- ReportDocument16 pagesReportasnashNo ratings yet

- Pakistan's Agricultural Sector Driven by SugarcaneDocument9 pagesPakistan's Agricultural Sector Driven by SugarcaneUsama QayyumNo ratings yet

- IDirect Sugar SectorUpdate Jun22Document6 pagesIDirect Sugar SectorUpdate Jun22fojoyi2683No ratings yet

- GAIN Report: Pakistan Sugar Annual 2009 2009Document7 pagesGAIN Report: Pakistan Sugar Annual 2009 2009AftabahmedrashidNo ratings yet

- USDA - Good - Oilseeds and Products Annual - Islamabad - Pakistan - 4!3!2017Document21 pagesUSDA - Good - Oilseeds and Products Annual - Islamabad - Pakistan - 4!3!2017Malik MussadiqueNo ratings yet

- Sugar Sector Analysis: Background and Measures Taken by Govt in Sugar Season 2017-18Document3 pagesSugar Sector Analysis: Background and Measures Taken by Govt in Sugar Season 2017-18Achal MeenaNo ratings yet

- Indian Sugar Sector Embracing Clean Energy FutureDocument26 pagesIndian Sugar Sector Embracing Clean Energy FutureEquity Nest100% (1)

- PC - Sugar Sector Update - Feb 2021 20210227004214Document16 pagesPC - Sugar Sector Update - Feb 2021 20210227004214VINAYAK AGARWALNo ratings yet

- Centrum Flash Note On Sugar Industry Sugar Production This YearDocument3 pagesCentrum Flash Note On Sugar Industry Sugar Production This YearmisfitmedicoNo ratings yet

- Inbound Supply Chain Modeling in Sugar IndustryDocument10 pagesInbound Supply Chain Modeling in Sugar Industryrsdeshmukh0% (1)

- Sugar - Profile - July - 2019 ImportentDocument10 pagesSugar - Profile - July - 2019 ImportentMohit SharmaNo ratings yet

- Sugar Sector ReportDocument14 pagesSugar Sector ReportsarvanbalajiNo ratings yet

- Problems of Sugar IndustryDocument3 pagesProblems of Sugar IndustrySumit GuptaNo ratings yet

- Sugar Annual New Delhi India 4-19-2018Document12 pagesSugar Annual New Delhi India 4-19-2018rAHULNo ratings yet

- Pakistan Overview 2002Document18 pagesPakistan Overview 2002ShahidNo ratings yet

- Sugar Sector by Icici DirectDocument24 pagesSugar Sector by Icici DirectpradeepthiteNo ratings yet

- April 2013 1365498623 f0fc1 89Document4 pagesApril 2013 1365498623 f0fc1 89Sv KhanNo ratings yet

- SKP Sec-Balrampur (Init Cov) - 2012Document12 pagesSKP Sec-Balrampur (Init Cov) - 2012rchawdhry123No ratings yet

- Textile Industry May23Document19 pagesTextile Industry May23udayansari786No ratings yet

- Hard Candy Manufacturing Rs 11.61 Million May-2019Document31 pagesHard Candy Manufacturing Rs 11.61 Million May-2019Waqas AtharNo ratings yet

- Sugar Industry Market Research & ROCOL ProductsDocument30 pagesSugar Industry Market Research & ROCOL ProductsROCOL EGYPTNo ratings yet

- A Business Plan On: "Stevia"Document34 pagesA Business Plan On: "Stevia"Sikandar HameedNo ratings yet

- Financial Profitability of White Sugar Production in PakistanDocument8 pagesFinancial Profitability of White Sugar Production in PakistanMohammad Sameed ZaheerNo ratings yet

- Lower Production Sweet For Sugar CompaniesDocument3 pagesLower Production Sweet For Sugar Companiessanghvi21No ratings yet

- Economic Sector Accomplishment Report 2017Document26 pagesEconomic Sector Accomplishment Report 2017marjorie reponteNo ratings yet

- Performance of Kharif Crops in 2019-2020Document4 pagesPerformance of Kharif Crops in 2019-2020UswaTariqNo ratings yet

- MargarineDocument25 pagesMargarineyenealem AbebeNo ratings yet

- SSRI (PARC) Ayub Agricultural Research Institute Faisalabad. 2019-20Document12 pagesSSRI (PARC) Ayub Agricultural Research Institute Faisalabad. 2019-20Muzaffar Abbas SipraNo ratings yet

- Economics Notes Year 3rdDocument69 pagesEconomics Notes Year 3rdSuhail MahesaniNo ratings yet

- Dalmia Cement (DALCEM) : Higher Expenditure Dents MarginDocument6 pagesDalmia Cement (DALCEM) : Higher Expenditure Dents Marginjass200910No ratings yet

- Should We Believe The Sugar DaddiesDocument3 pagesShould We Believe The Sugar DaddiesindrajoshiNo ratings yet

- KRBL LTD: Q3FY18: Flattish Domestic Performance Due To GST, Iran Resumes ImportsDocument4 pagesKRBL LTD: Q3FY18: Flattish Domestic Performance Due To GST, Iran Resumes Importssaran21No ratings yet

- Indian Sugar Industry UpdateDocument4 pagesIndian Sugar Industry UpdateUpendra KumarNo ratings yet

- Producing Peanut Butter ProfitablyDocument27 pagesProducing Peanut Butter Profitablyyenealem AbebeNo ratings yet

- Assured Price & Stable Market Report 2018Document75 pagesAssured Price & Stable Market Report 2018Manjunath DavaskarNo ratings yet

- Soybean Monitor March 2018Document9 pagesSoybean Monitor March 2018harjiNo ratings yet

- IDirect Sugar SectorUpdate Aug21Document4 pagesIDirect Sugar SectorUpdate Aug21Bharti PuratanNo ratings yet

- 578 30120641 Sugar IndustryDocument8 pages578 30120641 Sugar Industryshankar gosaviNo ratings yet

- Sugar Industry in Pakistan (17-UGLC-650)Document16 pagesSugar Industry in Pakistan (17-UGLC-650)Waqar IbrahimNo ratings yet

- Sugar MarketDocument20 pagesSugar Marketashajain0706No ratings yet

- India's rice production, exports and global market outlookDocument10 pagesIndia's rice production, exports and global market outlooksatyanarayana markandeyaNo ratings yet

- Sugar Semi-Annual - New Delhi - India - IN2023-0069Document10 pagesSugar Semi-Annual - New Delhi - India - IN2023-0069fojoyi2683No ratings yet

- Dairy-Industry Outlook April 2023Document5 pagesDairy-Industry Outlook April 2023Adarsh ChamariaNo ratings yet

- Cotton Profile May 2019Document10 pagesCotton Profile May 2019Jahanvi KhannaNo ratings yet

- 13th January, 2022 Daily Global Regional Local Rice E-NewsletterDocument56 pages13th January, 2022 Daily Global Regional Local Rice E-NewsletterMujahid AliNo ratings yet

- Research Publication On: A Joint StudyDocument27 pagesResearch Publication On: A Joint StudyAtif RehmanNo ratings yet

- Prabhu Sugars ReportDocument27 pagesPrabhu Sugars ReportPrajwal UtturNo ratings yet

- KMF GenlDocument21 pagesKMF GenlMANAGEMENT INFORMATION SYSTEMNo ratings yet

- Sugar Industries of PakistanDocument19 pagesSugar Industries of Pakistanhelperforeu50% (2)

- A Presentation On " Indian Sugar Industry"Document38 pagesA Presentation On " Indian Sugar Industry"Nimesh PatelNo ratings yet

- Improving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentFrom EverandImproving Rice Production and Commercialization in Cambodia: Findings from a Farm Investment Climate AssessmentRating: 5 out of 5 stars5/5 (1)

- Food Outlook: Biannual Report on Global Food Markets July 2018From EverandFood Outlook: Biannual Report on Global Food Markets July 2018No ratings yet

- Heat Exchanger Cost AnalysisDocument50 pagesHeat Exchanger Cost AnalysisSehar IshtiaqNo ratings yet

- Plant II - Final Draft 2Document125 pagesPlant II - Final Draft 2Sehar IshtiaqNo ratings yet

- Dow Fire and Explosion Index Study: Name Date of SubmissionDocument6 pagesDow Fire and Explosion Index Study: Name Date of SubmissionSehar IshtiaqNo ratings yet

- Heat Exchanger Cost AnalysisDocument50 pagesHeat Exchanger Cost AnalysisSehar IshtiaqNo ratings yet

- Practise Questions 2019Document8 pagesPractise Questions 2019Sehar IshtiaqNo ratings yet

- CapacityDocument8 pagesCapacitySehar IshtiaqNo ratings yet

- Report OlefinsDocument7 pagesReport OlefinsSehar IshtiaqNo ratings yet

- Levicky Fluid Kinematics PDFDocument15 pagesLevicky Fluid Kinematics PDFivana83No ratings yet

- Block Diagram of Ammonia ProductionDocument22 pagesBlock Diagram of Ammonia ProductionSehar IshtiaqNo ratings yet

- Asa - Injection Mould Component Cost EstimationDocument7 pagesAsa - Injection Mould Component Cost EstimationVenkateswaran venkateswaranNo ratings yet

- 9 Micro Ch17 Presentation7e Chap09Document41 pages9 Micro Ch17 Presentation7e Chap09Nguyễn Lê KhánhNo ratings yet

- Edible OilDocument51 pagesEdible Oilashish100% (3)

- DCF Valuation Modeling Presentation - 2Document76 pagesDCF Valuation Modeling Presentation - 2amr aboulmaatyNo ratings yet

- Service Pricing and The Financial and Economic Effect of ServiceDocument25 pagesService Pricing and The Financial and Economic Effect of ServicePietro BertolucciNo ratings yet

- Ultratech Cement ReportDocument19 pagesUltratech Cement Reportkishor waghmareNo ratings yet

- Markowitz Portfolio TheoryRDocument9 pagesMarkowitz Portfolio TheoryRShafiq KhanNo ratings yet

- MEFADocument363 pagesMEFALaxminarayanaMurthy100% (1)

- Group 1 LenovoDocument17 pagesGroup 1 LenovoGULAM GOUSHNo ratings yet

- SAP MM OverviewDocument113 pagesSAP MM OverviewPatil MGNo ratings yet

- Chapter-2 Concept of DerivativesDocument50 pagesChapter-2 Concept of Derivativesamrin banuNo ratings yet

- Shaheen Air Ticket - 19Y6PKO7Document1 pageShaheen Air Ticket - 19Y6PKO7Khalid MehmoodNo ratings yet

- Summative Ex 2 Repaired)Document13 pagesSummative Ex 2 Repaired)Red0123No ratings yet

- Ch.+17 Supply Chain ManagementDocument22 pagesCh.+17 Supply Chain ManagementKash SinghNo ratings yet

- IndiGo Q2 FY22 Earnings CallDocument16 pagesIndiGo Q2 FY22 Earnings CallBhav Bhagwan HaiNo ratings yet

- Audit 3 Midterm Exam (CH 17,18,19,20 Cabrera)Document3 pagesAudit 3 Midterm Exam (CH 17,18,19,20 Cabrera)Roldan Hiano ManganipNo ratings yet

- Project Report On Portfolio ManagementDocument118 pagesProject Report On Portfolio ManagementMohan Chakradhar100% (1)

- XI Accountancy T-IIDocument5 pagesXI Accountancy T-IIBaluNo ratings yet

- Capital Budteting JainDocument56 pagesCapital Budteting JainShivam VermaNo ratings yet

- Exchange Rates and The Foreign Exchange Market: An Asset ApproachDocument44 pagesExchange Rates and The Foreign Exchange Market: An Asset ApproachJohanne Rhielle OpridoNo ratings yet

- Oil Refineries (USA, Canada, Mexico)Document10 pagesOil Refineries (USA, Canada, Mexico)Margaret Carney100% (1)

- Investor Behaviour MatrixDocument23 pagesInvestor Behaviour Matrixabhishek sharmaNo ratings yet

- The Dune Group Internationalising PresentationDocument18 pagesThe Dune Group Internationalising Presentationgemmahagan92No ratings yet

- Itc WaccDocument185 pagesItc WaccvATSALANo ratings yet

- Shapiro Chapter 16 SolutionsDocument12 pagesShapiro Chapter 16 SolutionsRuiting ChenNo ratings yet

- CH 1 Cost Volume Profit Analysis Absorption CostingDocument21 pagesCH 1 Cost Volume Profit Analysis Absorption CostingNigussie BerhanuNo ratings yet

- Texas Pacific Land Trust: Shareholder PresentationDocument37 pagesTexas Pacific Land Trust: Shareholder PresentationTodd Sullivan100% (1)

- Economics Higher Level Paper 3: Instructions To CandidatesDocument6 pagesEconomics Higher Level Paper 3: Instructions To CandidatesAndres Krauss100% (1)

- Ces Weber Lect1Document43 pagesCes Weber Lect1이찬호No ratings yet

- Case Study 2 - EbayDocument12 pagesCase Study 2 - EbayMihir MehtaNo ratings yet