Professional Documents

Culture Documents

Agent's Servicing Handbook v1.1 - New Business and Underwriting

Uploaded by

AlyssaBerdolagaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Agent's Servicing Handbook v1.1 - New Business and Underwriting

Uploaded by

AlyssaBerdolagaCopyright:

Available Formats

A guide to Life Operations transactions

NE

It is vital for Pru Life UK that its agents, as the frontliners of the Company, be

knowledgeable of the guidelines and requirements of the different transactions that

customers would make throughout the life cycle of their policy.

To be able to provide the customers with the utmost experience, agents can now

communicate with them in simpler and more understandable terms. The Agent’s

Servicing Handbook is created to help strengthen the agents’ understanding of the Life

Operations transactions.

The handbook will be released in different parts:

Part Scope

Agency Licensing and Benefits Administration

1 New Business and Underwriting

Payments Handling

2 After-Sales Servicing

Claims and Policy Benefits

3

Complaints Management

The handbook will help in the delivery of quality customer service.

New Business and Underwriting

New Business Application…………………………………….……………………… 5

New business application…………………………………………………………….. 5

Initial payment…………………………………………………………………………….. 5

Receipt of new business application…………………………………….………… 6

Pre-screening and policy data encoding…………………………………………. 6

Underwriting……………………………………………………..………………………. 11

Policy issuance and releasing………………………………………………………… 15

Refund of Initial Premium………………………………………....................... 16

Turnaround time…………………………………………….………………………….… 17

Frequently asked questions……………………………….......................... 20

List of valid IDs………….............……………………..............………………… 22

Anti-Money Laundering Related Requirements (KYC/CDD)........ 23

Contact us………………........…………….....................………………………… 25

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 3

New business The Customer Contact Management (CCM) department of

New business application Life Operations via the CCM Customer Service

application Representatives welcome queries and assist on new business

applications.

Standard requirements include:

• New Business Application Form

• Quotation Proposal

• Valid IDs

Facilitation of • Initial payment

payments

Mode of Release Form (MRF) is required for Cash Flow

Fund (CFF) applications.

Receipt of new Initial CCM and Payments Services section of the Policy

business payment Administration Department (PAD) processes payments that

application were initially paid by the applicant for the new business, thus

the term new business premium.

Remember the following on your client’s initial

insurance application payment:

Pre-screening and i. If your client requests for pre-underwriting, an initial

policy encoding payment will not be required.

ii. Make sure the modal premium is not less than the

minimum premium required. Refer to Table 1 for the

minimum premium requirements.

iii. When your persistency is below 60%, selling policies

Underwriting on a monthly mode of payment is not allowed.

Monthly

Requirements

mode

Post-dated Cheque (PDC) monthly

Cash/check

agreement form & PDC certification

Policy releasing Credit card CC enrollment form and photocopy

(CC) of credit card

Three (3) duly accomplished ADA

Auto debit

forms (all with original signature)

iv. For quarterly mode, if your persistency is below 60%,

Refund of initial 4 PDCs are required.

premium

v. For eligible third party payor, only PDCs, credit cards

and bank accounts owned by the policy owner's

immediate family shall be accepted.

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 5

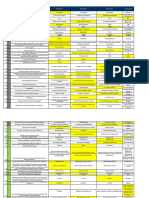

Table 1 Minimum premium requirements (in PhP)

New business

Application Mode RPA RLP XP5 7,10 &15 XLT, XLF LPA

Monthly 1,250 1,500* 3,000 2,750 1,500 1,073

Quarterly 3,750 4,500* 9,000 8,250 4,500 3,135

Semi-annual 5,500 6,000* 18,000 16,500 9,000 5,775

Facilitation of Annual 10,000 12,000* 36,000 33,000 18,000 11,000

payments

P3P and P3D P3L and P3M

PHP

(Band 2) (Band 1)

200,000 TO 100,000 TO

1,000,000 and its

Single premium 999,999 and its 200,000 and its

equivalent USD

equivalent in USD equivalent in USD

Receipt of New

LCAP MLCP

business

application Critical Illness PHP 3,750,000 PHP 5,000,000

plan USD 75,000 USD 100,000

* amount is also the minimum premiums for Pru Shield and Pru Life plans

** Pru Advance and Term 15 plans has no modal minimum amounts

Pre-screening • RPA – PRUlink Assurance Account

and policy • RLP – PRUlink Assurance Account Plus

encoding • XP5,7,10,15 – PRUlink Exact Protector 5, 7,10,15 (respectively)

• XLT – PRUlink Exact Protector 10 Low Premium

• XLF – PRUlink Exact Protector 15 Low Premium

• LPA – Pru Advance 5

• PHP – PRUmillionaire

• P3P / P3D – PRUlink Investor Account Plus Peso/Dollar (Band 1)

• P3L / P3M – PRUlink Investor Account Plus Peso/Dollar (Band 2)

Underwriting

• LCAP – Life Care Advance Plus

• MLCP – Multiple Life Care Plus

Receipt of All applications together with the routine underwriting

new business requirements and complete payment are submitted to the

application CCM Customer Service Representatives of each branch or to

Policy releasing GA Secretaries of general agency.

Pre-screening This involves checking the accuracy and completeness of the

and policy new business application including all the routine

encoding of underwriting requirements before it is jet underwritten and

new business forwarded to Head Office. Tables 2 to 4 show these

requirements.

Refund of initial

premium Applications with pending underwriting requirements

depending on the declaration of the client are still

encoded but will remain in Proposal status until

completed.

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 6

Table 2 Financial routine requirements

New business

application Total coverage

Single premium Requirements

(in PhP)

3M - 5M <30M (aggregate) Agent's Confidential Information (ACI)

or APE <3M

5M - <10M ACI & Personal Financial Statement

Facilitation of

payments 10M - <15M ACI & Large Amount Questionnaire

30M & above (LAQ)

(aggregate)

or APE >3M

15M & above ACI, LAQ, AFS (for 2yrs) Income Tax

Return (ITR) and IR

Receipt of new

business Table 3 Medical routine requirements

application

Total

Coverage 0 - 15 16 -40 41 - 45 46 - 50 51 - 60 61 - 65 66 up

(in PhP)

up to 499K FME FME FME FME FME FME FME/MUR

Pre-screening FME/MUR FME/MUR

and policy 500K - 999K FME FME FME FME FME

/ECG BEX/ECG

encoding FME/MUR

FME/MUR FME/MUR

1M - 1.9M FME FME FME FME BEX/ECG

/ECG BEX/ECG

CXR

FME/MUR FME/MUR

FME/ FME/ FME/ FME/MUR

2M - 2.9M FME BEX/ECG BEX/ECG

MUR MUR MUR BEX/ECG

CXR CXR

FME/MUR FME/MUR

FME/MUR FME/MUR FME/MUR FME/MUR

Underwriting 3M - 4.9M FME

/BEX /BEX BEX/ECG BEX/ECG

BEX/ECG BEX/ECG

CXR CXR

FME/MUR FME/MUR FME/MUR

FME/MUR FME/MUR FME/MUR

5M - 7.9M FME BEX/CXR BEX/CXR BEX/CXR

/BEX BEX/ECG BEX/ECG

ECGT ECGT ECGT

FME/MUR FME/MUR FME/MUR FME/MUR FME/MUR

FME/MUR

8M - 9.9M FME BEX/ECG BEX/ECG BEX/CXR BEX/CXR BEX/CXR

BEX/ECG

CXR CXR ECGT ECGT ECGT

Policy releasing FME/MUR FME/MUR FME/MUR FME/MUR FME/MUR FME/MUR

For 10M FME BEX/ECG BEX/CXR BEX/CXR BEX/CXR BEX/CXR BEX/CXR

CXR ECGT ECGT ECGT ECGT ECGT

FME/MUR FME/MUR FME/MUR FME/MUR FME/MUR FME/MUR

For over 10M FME BEX/CXR BEX/CXR BEX/CXR BEX/CXR BEX/CXR BEX/CXR

ECGT ECGT ECGT ECGT ECGT ECGT

i. Total in-force policies within the 24 month period inclusive of all pending

Refund of initial applications

premium ii. Dipstick Urinalysis is done as part of the FME for all Insureds above 10 years

old unless MUR is required.

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 7

iii. Medical Exams

New business • FME – Full Medical Exam

application • MUR – Micro Urinalysis

• ECG – Electro Cardiogram

• CXR – Chest X-ray

• ECGT – Treadmill Stress Test

• BEX – Blood Examination

Components of BEX:

• FBS – Fasting Blood Sugar

Facilitation of • HDL – High Density Lipoprotein

payments

• HBSAg – Hepatitis B Surface Antigen

• GGT – Gamma Glutamyl Transpeptidase

• SGPT – Serum Glutamic Pyruvic Transpeptidase

• HIV Test – Human Immunodeficiency Virus Test

• Triglycerides

• Total Cholesterol

Receipt of new • Uric Acid

business • Creatinine

application

Pre-screening

and policy

encoding

Underwriting

Policy releasing

Refund of initial

premium

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 8

Table 4 Requirements for special and high-risk occupations

New business

application

Occupation Requirements and reminders

Aviation risk Commercial (international and domestic) carriers

(Pilots/Stewards) issued at standard with riders

Routine of Aviation Questionnaire

Facilitation of

Student pilots and non-commercial pilots are

payments

NOT acceptable

Athletes Issued at standard with no riders; Total

Permanent Disability (TPD) at minimum

Boxers and wrestlers are NOT acceptable

Receipt of new

business Entertainers Agent’s Report regarding morals, habits and

application or performers lifestyle

Simplified BEX is required regardless of the

coverage aside from the routine requirements

Expatriates, resident aliens Copy of Alien Certificate Registration

and immigrants Continuous two (2) years of residency in the

Pre-screening Philippines.

and policy

encoding

Housewives Maximum coverage: PhP 500,000 (whose

husbands do not have insurance coverage)

Issued at Standard and with riders

Keyman insurance Policyowner and Beneficiary is the

Company/Legal Entity

Underwriting Copy of Securities and Exchange Commission

registration

Board resolution or Secretary’s Certificate

authorizing purchase of policy and designating

authorized signatory/ies

Latest General Information Sheet (GIS)

Articles of incorporation and by-laws

Sworn Statement of existence and non-existence

Policy releasing of beneficial owners

Latest Audited Financial Statement

Issued without ADD

Refund of initial

premium

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 9

Table 4 Requirements for special and high-risk occupations

New business (continuation)

application

Occupation Requirements and reminders

Military Max. issue limit: Captain to Major – PhP 1 million;

(and its Philippine Colonel to General – PhP 2 million

Facilitation of National Police Flat extra: PhP 5/thousand; no riders; TPD at minimum

payments counterpart) Counterpart in PNP also acceptable (Senior Inspector to

Chief Superintendent

Critical Illness rider may be granted

Overseas Filipino Executives or clerical work usually issued Standard

Workers (OFW) Skilled workers/Domestic helpers issued with flat extra

Receipt of new A flat extra may be imposed depending on the country

business of assignment

application Issued without Hospital Income and Personal Accident

CI rider may be granted

Politicians Flat extra: Php 5/thousand

Issued without riders; TPD at minimum

Coming from high risk areas would not be acceptable

Pre-screening CI rider may be granted

and policy

encoding Pregnant women Routine: FME, MUR and Pregnancy Questionnaire

Issued without riders/TPD at minimum

Can apply for Life or re-apply for riders: C-Section

(three months after delivery)/Normal delivery: two

months after delivery

Underwriting Seaman Non-officer: PhP 2/thousand | Captains and other

officers: Standard

TPD at minimum and no riders

Simplified BEX for PhP 1 million and above aside from

the routine requirements

Port of Entry must be specified

Security guards, Flat extra: PhP 5/thousand; No riders; TPD at minimum

Policy releasing

messengers, cab/bus/ Tricycle drivers are not acceptable

jeepney drivers

Refund of initial

premium

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 10

Underwriting An insurance policy application will go through an

New business underwriting procedure to evaluate the risks. Underwriting

application could be:

a. straight thru underwriting,

b. medical underwriting,

c. non-medical underwriting, or

d. guaranteed insurability option (GIO).

Facilitation of If an application is not taken up (NTU) then refund in

payments premium has to be made.

Straight Also known as “jet underwriting” is a process wherein New

through Business and Underwriting staff and selected BOA are given

Receipt of new underwriting the authority to approve clean, non-medical cases.

business

application

i. “Clean” is an application that has complete

requirements at the onset.

ii. “Non-medical” is an application which does not

require additional information or routine medical

exams (based on Agent’s NMA).

Pre-screening and

policy encoding

Issuance for clean cases are faster than unclean

applications, thus, it is strongly recommended to submit

clean applications.

Medical Underwriting method where medical refers to applications

Underwriting underwriting accompanied by medical reports and other routine medical

requirements.

i. Medical examiners are appointed only by the

Company.

ii. An authorized physician should accomplish the

medical request form including proposed Insured’s

Policy releasing health history (front) and results of physical

examination (back).

It is the agent’s responsibility to:

1. Arrange for medical and laboratory exams

• List of accredited medical examiners and

Refund of initial laboratories and clinics is available at the branch

premium offices

• Referral slip should be secured from the CCM

Customer Service Representative (CSR)

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 11

Medical Guidelines in arranging medical exam:

New business Underwriting

application 1. Agent should not be present during any part of the

(continuation)

examination.

2. Agent should not request preliminary evaluation of the

physical exam results nor demand that the medical

examiner discuss the medical exam results. The

medical report is sent by the medical examiner in a

sealed envelope directly to the branch office or to

Facilitation of

payments NBU.

3. The agent should not arrange medical exams with a

doctor to whom he has relation by consanguinity or by

affinity or to whom the agent has close business

relationships.

4. The agent should not make any special arrangement

with the medical examiners regarding fees without

Receipt of new authority from Pru Life UK.

business

application

Any expense of examination made in violation to the

Company’s rules will be charged to the agent.

Pre-screening and

policy encoding Non-medical Non-medical Authority (NMA) is given to agents per level.

Authority This means that their clients may not be subjected to routine

medical requirements as long as the age group and

aggregate Sum Assured are satisfied.

Table 5 Agent’s Non-medical Authority

Underwriting

Age group General Premiere Exclusive

0 - 40 1M 4M 6M

41 - 50 750K 2.5M 4M

51 - 60 500K 1M 1.5M

Aggregate of Sum Assured for underwriting should include all

Policy releasing Pru Life UK policies in-force within the two-year contestability

period.

During underwriting, additional medical documents may

be required. Compliance to these requirements will

facilitate the underwriting decision.

Refund of initial

premium

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 12

New business Table 6 Requirements for NMA eligibility

application

Level Requirements

General 1. Completed Basic Training Course (BTC)

2. Passed NMA validation exam conducted by

Distribution Training and Development

Facilitation of Premiere 1. Unit Manager/Branch Manager

payments 2. Agent

• NAP: 750,000*

• Case count: 20**

• Persistency: 85%

Exclusive 1. Area Manager/District Manager

2. Branch Manager

Receipt of new

• at least 20 million branch NAP (previous year)

business

application • 85% branch persistency (previous year)

3. Unit Manager

• at least 7 million unit NAP (previous year

• 85 % unit persistency (previous year)

4. Agent

• at least Achiever’s Club CEO Circle member

Pre-screening and

*NAP is reckoned on past 12-months performance

policy encoding

**Case count requirement is exclusive of PA and Single Pay products; case count is

reckoned from date of appointment.

Guaranteed Products with GIO feature are considered automatic issue

insurability policy and do not require medical requirements. However,

offer (GIO) financial requirements should be complied.

Underwriting

Rated A Quotation Proposal (QP) evaluated with findings are

applications adjusted to a rated QP accompanied with an Information on

Ratings (IOR) which must be reviewed and signed by the

applicant.

Policy releasing An Amendment of Application (AOA) shall be

accomplished if rating will affect premiums, Sum Assured

and riders.

Refund of initial

premium

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 13

New business Beneficiaries Immediate family members or somebody who has insurable

application interest with the policy life Insured (PLI). For irrevocable

beneficiaries, a separate irrevocable form should be signed.

Beneficiary

The following are accepted by the Company as eligible beneficiaries:

Facilitation of Legal spouse

payments Children (natural or legally-adopted)

Parents and siblings

Grandparents (countersignature of either parent is required)

Creditors

Business partners

Company or corporation (keyman insurance)

Receipt of new Fiancé or fiancée (indicate place and date of marriage)

business

application i. Erasures on the Beneficiary portion should be counter-signed by the

policyowner/PLI.

ii. Cousins, for example, do not qualify as beneficiaries by reason of

relationship alone.

Pre-screening and

policy encoding

Underwriting

Policy releasing

Refund of initial

premium

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 14

Validity NBU forms and documents are valid only at certain period.

New business period of

application forms

Table 7 NBU forms validity period

Documents Standard Substandard

Application Form 3 months

KYC and ID 1 year

Facilitation of

payments FME 1 year 6 months

MUR 6 months

BEX 6 months

ECG and CXR 1 year 6 months

Receipt of new

business

application Proposal's validity is generally three (3) months, however,

if a new version is released, the old version is still valid for

one (1) month from the new version's release date.

Policy After issuance in the system, the policy is assembled in the

Pre-screening and issuance and following manner:

policy encoding releasing

1. Application forms (pages 1-14 for PRUlink Insurance and

pages 1-14 for Traditional Insurance) and medical or non-

medical forms are photocopied.

2. All the policy forms, including copies of the application

and medical form are collated into a policy contract.

3. Contract is forwarded to an authorized personnel for

Underwriting

checking and countersignature.

4. Policy contract is released and/or sent to the branches.

New Business NBPDF serves as proof that clients receives the policy and

Policy confirms accuracy of policy information including product and

Policy releasing personal details. It is attached to the policy contract delivered

Delivery Form

to the branch.

(NBPDF)

Make sure the NBPDF is filled out completely by your

client and submit it to the branch. Release of commission is

dependent on the Company’s receipt of the NBPDF.

Refund of initial

premium

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 15

Figure 1 Guaranteed PRUlink Production Cycle*

New business

application

Facilitation of

payments

Receipt of new

business

application * Based on NBU turnaround time on Table 8 with or without Transaction

Confirmation Advice (TCA) applicable to PRUlink Investment Account,

PRUmillionaire, PruExact Protector 5, 7 and 10 plans.

** Only applicable to contracts with units

Pre-screening and

policy encoding Refund of Refund of initial premium is only made on cancelled or Not

initial Taken Up (NTU) policies.

premium

An application will be automatically cancelled in the system if

the underwriting requirements (e.g. FATCA-related and

financial documents) are not submitted within thirty (30) days

from receipt of application form. It may also be cancelled upon

Underwriting client’s request provided that a letter is sent to the Underwriting

Department.

Not Taken Up means that the application form submitted to

NBU was not able to reach an in force status due to non-

compliance to underwriting requirements. The following are the

NTU categories but are not limited to:

1. Auto cancelled

Policy releasing 2. Withdrawn

3. Postponed

4. Declined

Excess In cases of excess payments, the excess amount will remain in

payments suspense.

Refund of initial

premium If a refund is requested by your client (proposed Insured

and/or applicant), then excess payment refund shall be

made.

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 16

Table 8 New Business Underwriting turnaround time (TAT)

TRANSACTION

TRANSACTION TAT/FREQUENCY

CATEGORY

Receiving of new business

applications with complete --- Daily receiving of complete applications

routine requirements

Pre-screening and policy

One (1) – two (2) days from receipt of complete

encoding of complete new ---

application

business applications

Straight through One (1) – two (2) days from encoding of complete

---

underwriting application

Three (3) – five (5) days from encoding of application/

Medical Underwriting ---

receipt of complete underwriting requirements

One (1) – two (2) days from system issuance (for contract

without units)

Without policy delivery Three (3) – four (4) days from system issuance (for

requirement contracts with units)

Additional one (1) day transmittal time for provincial

branches

Without policy alteration (without changes in contract

inserts):

Policy releasing One (1) day from receipt of delivery requirement

With minor alteration (contracts without units; with

changes in contract inserts e.g. PDP/TCA details,

Upon completion of correction in name or address):

policy delivery Two (2) days from receipt of delivery requirement

requirement

With major alteration (contracts with units):

Three (3) days from receipt of delivery requirement

Additional one (1) day transmittal time for provincial

branches

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 17

Table 8 New Business Underwriting turnaround time (continuation)

TRANSACTION

TRANSACTION TAT/FREQUENCY

CATEGORY

Facilitate Medical Referral

--- One (1) day from receipt of request

Form request

Refund of Initial Premium

For PIA, 15 days from

Proposal Receipt Date

Auto-Cancelled

For PAA and Exact, 31

Three (3) – five (5) days processing of refund cheque

requests

days from Proposal

Receipt Date

Upon receipt of written

Withdrawn

request from client

Once decision has been

Postponed/Declined One (1) – two (2) days once decision has been rendered

rendered

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 18

NE

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 19

New Business and How long is a new business application

Underwriting form valid?

The new business application form is valid for

three (3) months from date of its submission.

Kindly refer to Table 7 of the New Business and

Underwriting Process section for a complete list

of form validity.

My client works overseas, does this mean

they are not allowed to purchase a life

insurance?

An OFW may be considered as Rated due to

occupation or country of assignment. You may

refer to Table 4 to know more about these jobs

and their corresponding limitations.

How are you able to determine in straight

thru underwriting that a case is non med

clean?

A new business application is said to be clean if it

has complete requirements and has no adverse

declarations.

What are the high-risk provinces that are

included in the watch list during pre-

screening of application?

The high-risk provinces based on industry and

current events are:

• Basilan

• Maguindanao

• Shariff Kabunsuan

• Sulu

• Tawi-tawi

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 20

New Business and What are the common Policyowner-Insured-

Underwriting Beneficiary relationship approved during

underwriting?

Insurable interest on the life of the Insured is

determined during underwriting. Immediate

family relationships were previously defined in

the New Business and Underwriting section, and

these relationships are assumed to have insurable

interest on the life Insured, thus, these cases are

also basically approved.

Example:

My client Stacy McGary is single and would want

to buy life insurance for her mother Annie

McGary. Stacy thinks she could make herself the

Beneficiary of this insurance application.

Analysis:

Stacy is single and therefore she has immediate

relationship with Annie McGary and is assumed

to have insurable interest on the Life of Annie.

Policyowner-Insured-Beneficiary cases other

than those presented by immediate family

relationships require additional documents

and are subject to underwriting approval.

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 21

Passport

Driver’s license

Professional Regulations Commission (PRC) ID

National Bureau of Investigation (NBI) clearance

Police clearance

Postal ID

Voter’s ID

Photo-bearing barangay ID/Certification

Government Service and Insurance System e-Card

Social Security System (SSS) card

Philhealth card

Senior citizen card

Overseas Workers Welfare Administration ID

OFW ID

Seaman’s book

Alien Certificate of Registration/Immigrant Certificate of Recognition

Government Office ID (e.g. AFP, Home Development Mutual Fund,

Department of Education IDs) and IDs issued by the government

instrumentalities

Photo-Bearing ID/Certification from the National Council for the Welfare of

Disabled Persons

Department of Social Welfare and Development photo-bearing

ID/Certification

Firearms license

ID issued by the Bureau of Internal Revenue

Photo-bearing credit card

Photo-bearing health card issued by health

maintenance organizations

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 22

Submission of As an agent, you must ensure that all new business, after-sales, and claims

complete document requirements are complete, accurate, and duly signed upon

requirements submission to the branches or Head Office. The requirements below are

mandatory upon submission without any exemptions.

AMLA AMLA-related requirements (Anti-Money Laundering Act)

Requirements

a) Valid IDs

• Clear copies of one (1) valid ID each of the applicant-owner

and Insured (if proposed Insured is not the applicant-owner)

must be submitted together with the transaction forms (Refer

to Appendix A for the list of valid IDs).

The agent should sign on the copies and certify the accurate

reproductions of the original IDs by indicating “Original Seen; Copy

Certified” on the copies.

b) Tax Identification Number (TIN) or Social Security System (SSS)

Number or Government Services Insurance System (GSIS)

Number

• TIN or SSS or GSIS numbers should be provided in the

application form.

Note that guidelines for TIN, SSS and GSIS are updated or revised as

needed.

BIR application for TIN can now be done online. Simply access:

www.BIR.gov.ph and go to e-reg (for online application of TIN). Fill-out

the online application and the TIN number can be provided immediately.

c) Know Your Customer (KYC) forms

• KYC forms should be completely filled-out.

Ownership Requirements

For Corporations:

Board Resolution

SEC Registration

Third Party Payor General Information Sheet (GIS)

For Individuals:

KYC Form

Valid ID

Sole Proprietorship or partnership DTI Registration

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 23

Quotation Applications with incomplete, inaccurate, or unsigned QPs will not be accepted

Proposals

(QP)/Sales

Illustration A complete and accurate QP should:

a) Contain details of the applicant-owner and proposed Insured that

match the details indicated in the application form for insurance (i.e.

include the name, gender and age);

b) Have the signature of the applicant-owner and the proposed Insured

on ALL the pages of the QP;

c) Have the same serial number in all pages

d) Latest version of EQuotes

Alterations and All alterations and corrections in the forms and QPs must be counter-signed by

corrections the applicant-owner.

As an agent, you cannot alter or counter-sign any information contained in the

forms and QPs in behalf of your clients.

Policy delivery The approval to submit additional requirements after policy issuance is based on

requirements the discretion of the Chief Underwriter and does not include the requirements

cited from sections Submission of complete requirements to Alterations and

Corrections must be countersigned.

Requests coming from you that have any pending cases with ‘policy delivery

requirements’ will not be permitted.

Utilization of the Submission of documents, transaction inquiries and requests should be coursed

decentralized through the proper channels.

offices for

frontline We have nationwide branch offices, and a call center to handle these

transactions. Decentralized offices are open and on extended time during month-

services

end cut offs to provide the same level of service to you and the clients.

Visit of agents to Head Office/Life Operations area, specifically New Business

and Underwriting Department, is strictly discouraged.

This is to enable us to have ample time for to concentrate on the task at hand

and to protect the privacy and confidentiality of documents. However, on your

behalf, your BMs, AMs, DMs may conduct follow-ups.

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 24

Pru Life UK Customer Action Team

1 800 10 PRULINK

(632) 887 LIFE

contact.us@prulifeuk.com.ph

Pru Life UK Head Office

(632) 683 9000

Uptown Place Tower 1, 1 East 11th Drive, Uptown Bonifacio,

1634 Taguig City, Philippines

AGENT’S SERVICING HANDBOOK – New Business and Underwriting 25

You might also like

- NTUC Wealth SolitaireDocument36 pagesNTUC Wealth SolitaireGaryNo ratings yet

- Banking Allied ServicesDocument30 pagesBanking Allied ServicesSrinivasula Reddy P50% (2)

- Sun Acceler8Document7 pagesSun Acceler8Princessa Lopez Masangkay100% (1)

- FWD Producst: Products For AllDocument44 pagesFWD Producst: Products For AllCharish DanaoNo ratings yet

- Citibank in Zaire CaseDocument19 pagesCitibank in Zaire CaseMike Stephen TanNo ratings yet

- Auto InsuranceDocument5 pagesAuto InsuranceAkshay AggarwalNo ratings yet

- 25M AXA HealthMax 20P 1.2M (Trad)Document19 pages25M AXA HealthMax 20P 1.2M (Trad)Aljes ReyesNo ratings yet

- FWD Set For Life Variable Unit-Linked Plan BrochureDocument7 pagesFWD Set For Life Variable Unit-Linked Plan Brochuremock examNo ratings yet

- Fire & Consequential Loss Insurance 57Document15 pagesFire & Consequential Loss Insurance 57surjith rNo ratings yet

- Sun Maxilink PrimeDocument9 pagesSun Maxilink PrimeGracie Sugatan PlacinoNo ratings yet

- Product Primer PaaplusDocument9 pagesProduct Primer PaaplusHeddy RoaringNo ratings yet

- 200 IC 33 Test QuestionsDocument36 pages200 IC 33 Test QuestionsDinesh KatochNo ratings yet

- Insurance & Risk Management JUNE 2022Document11 pagesInsurance & Risk Management JUNE 2022Rajni KumariNo ratings yet

- Insurance Manual Ver 1Document82 pagesInsurance Manual Ver 1api-3743824No ratings yet

- Presented By: Mr. Rashmi Ranjan PanigrahiDocument35 pagesPresented By: Mr. Rashmi Ranjan PanigrahiRashmi Ranjan PanigrahiNo ratings yet

- HMO Proposal For Individual Family Account REGULAR-UPDATED AS OF JULY 2...Document11 pagesHMO Proposal For Individual Family Account REGULAR-UPDATED AS OF JULY 2...Arron BuenavistaNo ratings yet

- What Is InsuranceDocument3 pagesWhat Is InsuranceAgarwal SumitNo ratings yet

- Mock TestDocument11 pagesMock TestSnehil SinghNo ratings yet

- IC 33 Mock TestDocument66 pagesIC 33 Mock TestAnkur K ZaverriNo ratings yet

- Sample Term Sheet PDFDocument4 pagesSample Term Sheet PDFrajiveacharyaNo ratings yet

- Assgmt 1 ReinsuranceDocument44 pagesAssgmt 1 ReinsuranceThevantharen MuniandyNo ratings yet

- RR 22-2020 (Notice of Discrepancy) PDFDocument3 pagesRR 22-2020 (Notice of Discrepancy) PDFilovelawschoolNo ratings yet

- Consequential Loss PolicyDocument34 pagesConsequential Loss PolicyAnmol GulatiNo ratings yet

- Introduction To InsuranceDocument15 pagesIntroduction To InsuranceInza NsaNo ratings yet

- Life Insurance PowerpointDocument34 pagesLife Insurance PowerpointDennis Villarta0% (1)

- PRUlife Ready Audrey Valeria 2015aug28 1440740115072 PDFDocument21 pagesPRUlife Ready Audrey Valeria 2015aug28 1440740115072 PDFPhilip JuniorNo ratings yet

- Manulife Health Flex Product BrochureDocument8 pagesManulife Health Flex Product BrochureKhalila ReyesNo ratings yet

- INS 22 Chapter 11Document26 pagesINS 22 Chapter 11dona007No ratings yet

- Prulink Assurance Account Plus: Applicant-OwnerDocument8 pagesPrulink Assurance Account Plus: Applicant-OwnerAlexanderNo ratings yet

- Innofold Modular Acoustic Panel PricelistsDocument2 pagesInnofold Modular Acoustic Panel PricelistsDAP Ysabelle Marie FuentesNo ratings yet

- Risk and InsuranceDocument62 pagesRisk and InsurancegauravNo ratings yet

- Types of Life InsuranceDocument5 pagesTypes of Life InsuranceFatema KhambatiNo ratings yet

- ALC AG Ver10 17 2011Document134 pagesALC AG Ver10 17 2011jonathandacumosNo ratings yet

- Key Success Factors Insurance IndustryDocument15 pagesKey Success Factors Insurance IndustryEverson BoyDayz PetersNo ratings yet

- VUL Mock Exam Reviewer Set 2 For ACE With Answers 2Document11 pagesVUL Mock Exam Reviewer Set 2 For ACE With Answers 2Theo AgustinoNo ratings yet

- M5 V1.5 Combined 1 Oct 2022Document717 pagesM5 V1.5 Combined 1 Oct 2022AshNo ratings yet

- Ic33 Print Out 660 English PDFDocument54 pagesIc33 Print Out 660 English PDFumesh100% (1)

- Charlote Rep. FINANCIAL RISK MANAGEMENTDocument18 pagesCharlote Rep. FINANCIAL RISK MANAGEMENTJeanette FormenteraNo ratings yet

- Credit Risk ManagementDocument14 pagesCredit Risk ManagementSandy XavierNo ratings yet

- Variable IC Mock Exam Version 2 10022023Document16 pagesVariable IC Mock Exam Version 2 10022023Jayr Purisima100% (1)

- A-Plus HospitalIncome and HospitalIncome Extra Brochure 201306 v2Document8 pagesA-Plus HospitalIncome and HospitalIncome Extra Brochure 201306 v2nusthe2745No ratings yet

- Joven CampuganDocument8 pagesJoven CampuganJovenNo ratings yet

- Reinsurance Principle and Practice CPCUDocument9 pagesReinsurance Principle and Practice CPCUNguyen Quoc HuyNo ratings yet

- Miscellaneous Manual 1Document507 pagesMiscellaneous Manual 1shrey12467% (3)

- Risk and InsuranceDocument29 pagesRisk and InsuranceFaheemNo ratings yet

- Crime Insurance and Surety BondsDocument17 pagesCrime Insurance and Surety Bondsmannajoe7No ratings yet

- Term Insurance (Life Insurance)Document2 pagesTerm Insurance (Life Insurance)Roxanne Quing Quing RoscoNo ratings yet

- A. Basic Insurance Concepts and PrinciplesDocument6 pagesA. Basic Insurance Concepts and PrinciplesSHAURYA MAHAJANNo ratings yet

- 2014 Ilp Mock ExamDocument10 pages2014 Ilp Mock ExamVMendoza MjNo ratings yet

- Steve Albrecht Service TriangleDocument3 pagesSteve Albrecht Service Trianglejared soNo ratings yet

- F - UnderwritingDocument15 pagesF - UnderwritingRavid Villa Arya100% (5)

- Pru TermDocument6 pagesPru TermJaboh LabohNo ratings yet

- Functions and Characteristics of InstrumentsDocument29 pagesFunctions and Characteristics of InstrumentsMarion AlyssaNo ratings yet

- Updated SME Luxe Proposal For Triforce GlobalDocument21 pagesUpdated SME Luxe Proposal For Triforce GlobalallangreslyNo ratings yet

- Micro InsuranceDocument17 pagesMicro InsurancerishipathNo ratings yet

- Reinsurance Glossary 3Document68 pagesReinsurance Glossary 3أبو أنس - اليمنNo ratings yet

- Axa PhilippinesDocument3 pagesAxa Philippinesaccounting probNo ratings yet

- BancassuranceDocument11 pagesBancassuranceAndrea LimuacoNo ratings yet

- Credit Policy Version 1.2Document157 pagesCredit Policy Version 1.2Amit SinghNo ratings yet

- 9new - 471233 - Learning Material - SMEDocument28 pages9new - 471233 - Learning Material - SMERavi KumarNo ratings yet

- ICB Structure and CodesDocument11 pagesICB Structure and CodesSuhailNo ratings yet

- Precision Market The Trading BibleDocument46 pagesPrecision Market The Trading Biblepaulo silvaNo ratings yet

- Grade 8 & 9 Maths SchemesDocument17 pagesGrade 8 & 9 Maths SchemesJustin MusondaNo ratings yet

- Richard Age 35 Owns An Ordinary Life Insurance Policy inDocument1 pageRichard Age 35 Owns An Ordinary Life Insurance Policy inAmit PandeyNo ratings yet

- 2010 Bar QuestionsDocument40 pages2010 Bar QuestionsLawfriends2012No ratings yet

- FMDS1303Document34 pagesFMDS1303Jack WeaverNo ratings yet

- Proc 559 Vehicle Insurance AgainstDocument15 pagesProc 559 Vehicle Insurance Againstkafala lalimaNo ratings yet

- Zprmrnot 21163309 8704721Document1 pageZprmrnot 21163309 8704721Arnav MishraNo ratings yet

- Agnes Koomson PDFDocument74 pagesAgnes Koomson PDFGodsonNo ratings yet

- Services Sectoral Classification ListDocument7 pagesServices Sectoral Classification ListMinh Luu Vu AnNo ratings yet

- 6QQMN970 Tutorial 6 SolutionsDocument12 pages6QQMN970 Tutorial 6 SolutionsyuvrajwilsonNo ratings yet

- New Dem ACA Letter To Congressional LeadershipDocument4 pagesNew Dem ACA Letter To Congressional LeadershipSahil KapurNo ratings yet

- Group Life Covid 19 Mortality 03 2022 Report - Society of Actuaries Research InstituteDocument56 pagesGroup Life Covid 19 Mortality 03 2022 Report - Society of Actuaries Research InstituteCFHeatherNo ratings yet

- Agent/ Intermediary Name and Code:POLICYBAZAAR INSURANCE BROKERS PRIVATE LIMITED BRC0000434Document5 pagesAgent/ Intermediary Name and Code:POLICYBAZAAR INSURANCE BROKERS PRIVATE LIMITED BRC0000434hiteshmohakar15No ratings yet

- Country Bankers Insurance Corporation Vs Antonio LagmanDocument3 pagesCountry Bankers Insurance Corporation Vs Antonio LagmanJhon Anthony BrionesNo ratings yet

- Madhusoodhan - FTC E-CardDocument2 pagesMadhusoodhan - FTC E-CardMadhusudhan ReddyNo ratings yet

- Liberty Secure Future Connect Group Policy Enrollment FormDocument2 pagesLiberty Secure Future Connect Group Policy Enrollment FormAbcNo ratings yet

- Insurance DigestDocument3 pagesInsurance DigestIshNo ratings yet

- What Day Care Procedure Is Covered in Health Insurance?Document6 pagesWhat Day Care Procedure Is Covered in Health Insurance?AdityaNo ratings yet

- Professional ConductDocument8 pagesProfessional Conductpkgarg_iitkgpNo ratings yet

- SBI Car Loan Application FormDocument6 pagesSBI Car Loan Application FormKarthik Gunasekaran100% (2)

- Science Gentics EssayDocument2 pagesScience Gentics EssayLuigi AriasNo ratings yet

- Investsec Strategy Middle ClassDocument43 pagesInvestsec Strategy Middle ClassDeepul WadhwaNo ratings yet

- ACT AprilDocument64 pagesACT AprildingdongbellsNo ratings yet

- Chapter 2. PITDocument77 pagesChapter 2. PITKhuất Thanh HuếNo ratings yet

- ICICI LombardDocument2 pagesICICI LombardPiyushKumarNo ratings yet

- Cbcs (Final)Document72 pagesCbcs (Final)Bikash Kumar NayakNo ratings yet

- Policy Fund Withdrawal Form v2Document2 pagesPolicy Fund Withdrawal Form v2Julius Harvey Prieto BalbasNo ratings yet

- 542 Supreme Court Reports Annotated Bank of The Philippine Islands vs. LaingoDocument11 pages542 Supreme Court Reports Annotated Bank of The Philippine Islands vs. LaingodanexrainierNo ratings yet

- Deepak InsDocument3 pagesDeepak InsNaveen Kumar E ( Brand Champion )No ratings yet