Professional Documents

Culture Documents

Common Recruitment Process For RRBs (RRBs - CRP-VII) For Recruitment of Group A-Officers (Scale-II & III) Tax

Uploaded by

Anurag Saxena0 ratings0% found this document useful (0 votes)

22 views1 pagerrb

Original Title

Common Recruitment Process for RRBs (RRBs- CRP-VII) for Recruitment of Group a-Officers (Scale-II & III)Tax

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentrrb

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views1 pageCommon Recruitment Process For RRBs (RRBs - CRP-VII) For Recruitment of Group A-Officers (Scale-II & III) Tax

Uploaded by

Anurag Saxenarrb

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

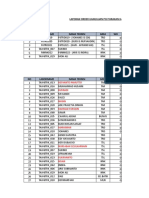

ICICI BANK LIMITED.

TAX FORECASTING FOR MAY 2018

DOB:03/04/1989

EMPLOYEE:(284821) ANURAG SAXENA BRANCH:ALAMPUR_BR GENDER:M PAN:ENTPS0862Q DOJ:15/11/2013 DOS:21/04/2018

-------------------------------------------------------------------------------------------------------------------------------------------------

-------Actual-------|---------------------------------------------Projected----------------------------------------------

PARTICULARS APRIL MAY JUNE JULY AUGUST SEPTEMBER OCTOBER NOVEMBER DECEMBER JANUARY FEBRUARY MARCH TOTAL

-------------------------------------------------------------------------------------------------------------------------------------------------

BASIC 0 8918 0 0 0 0 0 0 0 0 0 0 8918

H.R.A. 0 2450 0 0 0 0 0 0 0 0 0 0 2450

HRA.ADDL 0 3892 0 0 0 0 0 0 0 0 0 0 3892

CONV.ALLW 0 1190 0 0 0 0 0 0 0 0 0 0 1190

LTA(MT) 0 700 0 0 0 0 0 0 0 0 0 0 700

MEDICAL 0 875 0 0 0 0 0 0 0 0 0 0 875

LVE.ENC.TX 0 5866 0 0 0 0 0 0 0 0 0 0 5866

LVE.ENC.EX 0 12700 0 0 0 0 0 0 0 0 0 0 12700

TRNPT.ALL 0 1120 0 0 0 0 0 0 0 0 0 0 1120

SUPER_ANN 0 1338 0 0 0 0 0 0 0 0 0 0 1338

LUNCH.ALL 0 910 0 0 0 0 0 0 0 0 0 0 910

SUPPL.ALL 0 694 0 0 0 0 0 0 0 0 0 0 694

-------------------------------------------------------------------------------------------------------------------------------------------------

TOTAL EARNING 0 40653 0 0 0 0 0 0 0 0 0 0 40653

-------------------------------------------------------------------------------------------------------------------------------------------------

PROFESSIONAL TA 0 208 0 0 0 0 0 0 0 0 0 0 208

PROVIDENT FUND 0 1070 0 0 0 0 0 0 0 0 0 0 1070

-------------------------------------------------------------------------------------------------------------------------------------------------

TAX CALCULATIONS |INVESTMENTS U/S 80C........................... |

================ |PF-DED 1070 |

TOTAL 40653 | |

LESS: REIMBURSEMENTS 12700 | |

ADD : PERKS & OTHERS 0 | |

TOTAL GROSS 27953 | |

| |

LESS: DEDUCTION U/S 10/17 0 | |

LESS: PROFESSION TAX 208 | |

LESS: STANDARD DEDUCTION 40000 | |

NET SALARY 0 | |

| |

LESS: HOUSING LOAN INTEREST 0 | |

LESS: INVEST. U/S 80C 1070 | |

LESS: INVESTMENTS U/S 80(OTH) 0 | |

| |

TAXABLE INCOME 0 | |

| |

TOTAL TAX 0 | |

| |

LESS: TAX DEDUCTED AT SOURCE 0 | |

| |

BALANCE TAX PAYABLE 0 | |

BALANCE NUMBER OF MONTHS 0 | |

MONTHLY TAX 0 | |

You might also like

- People of The Philippines Vs Sandiganbayan and Bienvenido TanDocument2 pagesPeople of The Philippines Vs Sandiganbayan and Bienvenido TanRobyAnneLimbitcoAlbarracin100% (2)

- Family Monthly Budget PlannerDocument47 pagesFamily Monthly Budget PlannerKaren Odhiambo MilanyaNo ratings yet

- Banking and InsuranceDocument20 pagesBanking and Insurancebeena antuNo ratings yet

- Solar Off-Grid Design ExcelDocument3 pagesSolar Off-Grid Design Excelmurugaraj50% (2)

- 01 Basilan Estate V CIRDocument2 pages01 Basilan Estate V CIRBasil MaguigadNo ratings yet

- 4th Quarter Entrepreneurship FinalsDocument3 pages4th Quarter Entrepreneurship FinalsShen EugenioNo ratings yet

- Itr-3 Coi - F.Y 2021-22 - Ayush BhosleDocument6 pagesItr-3 Coi - F.Y 2021-22 - Ayush Bhosledarshil thakkerNo ratings yet

- BLD-enq 607-R1Document5 pagesBLD-enq 607-R1Rakesh SharmaNo ratings yet

- 882668Document1 page882668chandan singhaniyaNo ratings yet

- FC 101634Document1 pageFC 101634Parth BeriNo ratings yet

- FC1138335Document1 pageFC1138335Abhijeet ZawareNo ratings yet

- 06005965 (8)Document1 page06005965 (8)surisam.rNo ratings yet

- Income Tax CalculatorDocument11 pagesIncome Tax Calculatorsaty_76No ratings yet

- ReportDocument1 pageReportPriyanka DodkeNo ratings yet

- Mohd Naim FNF STDocument2 pagesMohd Naim FNF STMohd NaimNo ratings yet

- ProjectionReport_20240331Document3 pagesProjectionReport_20240331IaM Rajesh RajNo ratings yet

- Acrow MisrDocument63 pagesAcrow MisrAmir MamdouhNo ratings yet

- DR01BDocument1 pageDR01BAzka AldricNo ratings yet

- Tax ComputationDocument2 pagesTax Computationng28No ratings yet

- Acrow MisrDocument66 pagesAcrow MisrAmir MamdouhNo ratings yet

- Mis 01.2019 PDFDocument8 pagesMis 01.2019 PDFKiran DandileNo ratings yet

- Tax Cal - 2020 - 21 MalayDocument8 pagesTax Cal - 2020 - 21 MalayGaming PlazaNo ratings yet

- MCL2125Document3 pagesMCL2125srinivasNo ratings yet

- Tax Calculator FY-2020-21Document12 pagesTax Calculator FY-2020-21Naveen Narasimha MurthyNo ratings yet

- 202112eerDocument3 pages202112eerSSEPWIC DOINo ratings yet

- CL2902201Document268 pagesCL2902201DianaPatriciaChavarroNo ratings yet

- Employee tax statement for Circor Flow Technologies India Pvt LtdDocument1 pageEmployee tax statement for Circor Flow Technologies India Pvt LtdElakkiyaNo ratings yet

- Presupuesto Institucional Por Categoria Programatica, Fuente de Financiamiento Y Organismo FinanciadorDocument3 pagesPresupuesto Institucional Por Categoria Programatica, Fuente de Financiamiento Y Organismo FinanciadorJusn perezNo ratings yet

- New Microsoft Excel WorksheetDocument1 pageNew Microsoft Excel Worksheetm.v.reddyNo ratings yet

- Revised Estimation - FY 2023-24Document1 pageRevised Estimation - FY 2023-24Debojyoti MukherjeeNo ratings yet

- Wa0037.Document1 pageWa0037.Ahsan khanNo ratings yet

- ReportDocument1 pageReportAishwarya KoreNo ratings yet

- Acc May2018Document137 pagesAcc May2018himanshuNo ratings yet

- Branch Pledge Release Growth Intrest New Customer OGLDocument3 pagesBranch Pledge Release Growth Intrest New Customer OGLTML- RAMANPUTHURNo ratings yet

- Earnings Deductions: Mth./Yr Code Pay Items INS Hrs/Dy ASO Rs - P Mth./Yr Code Pay Items INS Hrs/Dy ASO Rs - PDocument1 pageEarnings Deductions: Mth./Yr Code Pay Items INS Hrs/Dy ASO Rs - P Mth./Yr Code Pay Items INS Hrs/Dy ASO Rs - PRishav JhaNo ratings yet

- Fye 06 Trial BalanceDocument307 pagesFye 06 Trial BalanceAnn Arbor Government DocumentsNo ratings yet

- Ahmedabad Municipal Corporation Mahanagar Sewa SadanDocument1 pageAhmedabad Municipal Corporation Mahanagar Sewa SadanNeil RathodNo ratings yet

- October2019 PDFDocument1 pageOctober2019 PDFmohammed dastageerNo ratings yet

- YBALAGEGRPDocument38 pagesYBALAGEGRPAdil EssmaaliNo ratings yet

- InvoiceDocument2 pagesInvoicebhavanush2008No ratings yet

- Preference Shares - October 31 2019Document1 pagePreference Shares - October 31 2019Lisle Daverin BlythNo ratings yet

- Software Modulo de FacturacionDocument1 pageSoftware Modulo de FacturacionMaria Luisa Cantillo DuranNo ratings yet

- Registro de ComprasDocument1 pageRegistro de ComprasmarinaNo ratings yet

- GeneratePdftax AspxDocument2 pagesGeneratePdftax AspxShiva KumarNo ratings yet

- September 2022Document1 pageSeptember 2022amitdesai92No ratings yet

- Route A CashflowDocument1 pageRoute A CashflowJessamy KellyNo ratings yet

- ComputationDocument1 pageComputationbirpal singhNo ratings yet

- Tax computation for FY 2020-21Document2 pagesTax computation for FY 2020-21mainsicklinetataNo ratings yet

- Waster PropertyDocument1 pageWaster PropertySolanki AshokNo ratings yet

- Preference Shares - November 5 2019Document1 pagePreference Shares - November 5 2019Lisle Daverin BlythNo ratings yet

- Rep ShowDocument1 pageRep Showprabu sNo ratings yet

- Sep - Oct 2017Document1 pageSep - Oct 2017sce mduNo ratings yet

- Boston FinanceDocument2 pagesBoston Financeapi-460825358No ratings yet

- Folha de Salário Referente Ao Mês de Mdezembro de 2018 Organzações RFDocument3 pagesFolha de Salário Referente Ao Mês de Mdezembro de 2018 Organzações RFErivaldo Dos SantosNo ratings yet

- IGA61306 SalSlipWithTaxDetailsMiscDocument1 pageIGA61306 SalSlipWithTaxDetailsMiscSanthoshNo ratings yet

- Año - Mes Categoria Linea MarcaDocument4 pagesAño - Mes Categoria Linea MarcaVictor Elvis Castro GarayNo ratings yet

- Fee - 919010028988911 (Aadas 1447 H) : Store - 919010028989419Document5 pagesFee - 919010028988911 (Aadas 1447 H) : Store - 919010028989419Ssunnel kumarNo ratings yet

- Computation Sheet 2022-11Document4 pagesComputation Sheet 2022-11Harsha KumarNo ratings yet

- Byh001654 SGDocument1 pageByh001654 SGMuni RajuNo ratings yet

- Salary Slip (1) - Samarpreet SinghDocument1 pageSalary Slip (1) - Samarpreet Singhayush.guptaNo ratings yet

- Trial Balance: Margaria - Keziasulistio - 5150111005Document3 pagesTrial Balance: Margaria - Keziasulistio - 5150111005Kezia SulistioNo ratings yet

- It Projection Pdf2023-2024Document3 pagesIt Projection Pdf2023-2024Sumit SanjanNo ratings yet

- 10 Juli 2017 TSL-TRD-NNKDocument22 pages10 Juli 2017 TSL-TRD-NNKAnonymous wKNxe4No ratings yet

- Preference Shares - November 6 2019Document1 pagePreference Shares - November 6 2019Tiso Blackstar GroupNo ratings yet

- Review ArticleDocument20 pagesReview ArticleVira ImranNo ratings yet

- Collection of HC and SC DecisionsDocument63 pagesCollection of HC and SC DecisionsDayavantiNo ratings yet

- Uno Minda RameezDocument139 pagesUno Minda RameezRameez TkNo ratings yet

- Chapter-5: Equity ValuationDocument30 pagesChapter-5: Equity ValuationNati YalewNo ratings yet

- Bajaj Auto Annual Report - Secc - grp6Document11 pagesBajaj Auto Annual Report - Secc - grp6Varun KumarNo ratings yet

- Equifax Credit Report - A New Credit Score in IndiaDocument4 pagesEquifax Credit Report - A New Credit Score in IndiaVyas Maharshi GarigipatiNo ratings yet

- Finance Act 2021 - PWC Insight Series and Sector Analysis Interactive 2Document25 pagesFinance Act 2021 - PWC Insight Series and Sector Analysis Interactive 2Oyeleye TofunmiNo ratings yet

- BITS Pilani Course Handout on Fundamentals of Finance & AccountingDocument2 pagesBITS Pilani Course Handout on Fundamentals of Finance & Accountingbijesh9784No ratings yet

- 25dairy Cow ModuleDocument47 pages25dairy Cow ModulericoliwanagNo ratings yet

- ISOM 5510 Data Analysis Group Project 14 - 3Document7 pagesISOM 5510 Data Analysis Group Project 14 - 3Ameya PanditNo ratings yet

- Combining PCR With IV Is A Clever Way of Viewing ItDocument17 pagesCombining PCR With IV Is A Clever Way of Viewing ItKamNo ratings yet

- Dunong Consultancy Services Income Statement For The Month of July 2020Document4 pagesDunong Consultancy Services Income Statement For The Month of July 2020Denise MoralesNo ratings yet

- Macroeconomic Effects of Banking TaxesDocument35 pagesMacroeconomic Effects of Banking TaxesAlan Dennis Martínez SotoNo ratings yet

- Principles and Methods for Improving CollectionsDocument7 pagesPrinciples and Methods for Improving Collectionsrosalyn mauricioNo ratings yet

- Project Finance in Developing Countries ExplainedDocument8 pagesProject Finance in Developing Countries Explained'Daniel So-fly OramaliNo ratings yet

- Analysis and Correction of Errors WorksheetDocument3 pagesAnalysis and Correction of Errors WorksheetDaphneNo ratings yet

- Flame I - Jaideep FinalDocument23 pagesFlame I - Jaideep FinalShreya TalujaNo ratings yet

- AgreementDocument16 pagesAgreementarun_cool816No ratings yet

- ICICI ProjectDocument55 pagesICICI ProjectRamana GNo ratings yet

- 2026 SyllabusDocument28 pages2026 Syllabussatkargulia601No ratings yet

- Cmfas M 9: OduleDocument23 pagesCmfas M 9: Odulezihan.pohNo ratings yet

- ACC 450 - Chapter No. 02 - Professional Standards - Auditing & Assurance Services - UpdatedDocument34 pagesACC 450 - Chapter No. 02 - Professional Standards - Auditing & Assurance Services - Updatedfrozan s naderiNo ratings yet

- INV2001082Document1 pageINV2001082Bisi AgomoNo ratings yet

- تجربة الأردن في العمل المصرفي الإسلامي من حيث كفاءة أداء البنوك الإسلامية -دراسة حالة بنكDocument11 pagesتجربة الأردن في العمل المصرفي الإسلامي من حيث كفاءة أداء البنوك الإسلامية -دراسة حالة بنكMortaza AlbadriNo ratings yet