Professional Documents

Culture Documents

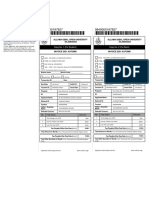

Scan 0089

Uploaded by

Anonymous JqimV1E0 ratings0% found this document useful (0 votes)

12 views2 pagesuyt543weyuh

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentuyt543weyuh

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views2 pagesScan 0089

Uploaded by

Anonymous JqimV1Euyt543weyuh

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

You are on page 1of 2

r-~-------------------'-

-----------,------=-:----------- - - - - - - - - - - -

MODULE 36 TAXES: CORPORATE 629

117. (d) The requirement is to determine the correct H. S Corporations

statement concerning the accumulated earnings tax (AET).

Answer (d), "The accumulated earnings tax can not be im- 124. (c) The requirement is to determine Stahl's basis for

posed on a corporation that has undistributed earnings and his S corporation stock at the end of the year. A share-

profits of less than $150,000," is correct because every cor- holder's basis for S corporation stock is increased by the

poration (even a personal service corporation) is eligible for pass-through of all income items (including tax-exempt in-

an accumulated earnings credit of at least $150,000. An- come) and is decreased by distributions that are excluded

swer (a) is incorrect because the AET is not self-assessing, from the shareholder's gross income, as well as the pass-

but instead is assessed by the IRS after finding a tax avoid- through of all loss and deduction items (including non-

ance intent on the part of the taxpayer. Answer (b) is incor- deductible items). Here, Stahl's beginning stock basis of

rect because the AET may be imposed regardless of the $65,000 is increased by the $6,000 of municipal interest

number of shareholders that a corporation has. Answer (c) income and $4,000 of long-term capital gain, and is de-

is incorrect because the AET cannot be imposed on a corpo- creased by the ordinary loss of $10,000 and short-term

ration for any year in which an S corporation election is in capital loss of $9,000, resulting in a stock basis of $56,000

effect because an S corporation's earnings pass through and at the end of the year.

are taxed to shareholders regardless of whether the earnings 125. (b) The requirement is to determine the amount of

are actually distributed. the $30,000 distribution from an S corporation that is tax-

118. (d) The requirement is to determine the amount on able to Baker. If an S corporation has no accumulated

which Kee Holding Corp.' s liability for personal holding earnings and profits from C years, distributions to share-

company (PHC) tax will be based. To be classified as a holders are generally nontaxable and reduce a shareholder's

personal holding company, a corporation must meet both a stock basis. To the extent that distributions exceed stock

"stock ownership test" and an "income test." The "stock basis, they result in capital gain. A shareholder's basis for S

ownership test" requires that more than 50% of the stock corporation stock is first increased by the pass through of

must be owned (directly or indirectly) by five or fewer indi- income, then reduced by distributions that are excluded from

viduals. Since Kee has eighty unrelated equal shareholders, gross income, and finally reduced by the pass through of

the stock ownership test is not met. Thus, Kee is not a per- losses and deductions. Here, Baker's beginning stock basis

sonal holding company and has no liability for the PHC tax. of $25,000 would first be increased by the pass through of

the $1,000 of ordinary income, to $26,000. Then the

119. (b) The accumulated earnings tax (AET) can be $30,000 cash distribution would be a nontaxable return of

avoided by sufficient dividend distributions. The imposition stock basis to the extent of $26,000, with the remaining

of the AET does not depend on a stock ownership test, nor is $4,000 in excess of stock basis taxable to Baker as capital

it self-assessing requiring. the filing of a separate schedule gain. Baker will not be able to deduct the long-term capital

attached to the regular tax return. The AET cannot be im- loss of $3,000 this year because the cash distribution re-

posed on personal holding companies. duced his stock basis to zero. Instead, the $3,000 loss will

be carried forward and will be available as a deduction when

120. (c) The personal holding company (PHC) tax may

Baker has sufficient basis to absorb the loss.

be imposed if more than 50% of a corporation's stock is

owned by five or fewer individuals. The PHC tax cannot be 126. (d) The requirement is to determine the 'amount of

imposed on partnerships. Additionally, small business in- the $7,200 of health insurance premiums paid by Lane, Inc.

vestment companies licensed by the Small Business Ad- (an S corporation) to be included in gross income by Mill.

ministration are excluded from the tax. If a corporation's Compensation paid by an S corporation includes fringe

gross income arises solely from rents, the rents will not be benefit expenditures made on behalf of officers and employ-

PHC income (even though no services are rendered to les- ees owning more than 2% ofthe S corporation' stock. Since

sees) and thus, the PHC tax cannot be imposed. Mill is a 10% shareholder-employee, Mill's compensation

income reported on his W-2 from Lane must include the

121. (d) A net capital loss for the current year is allowed

$7,200 of health insurance premiums paid by Lane for health

as a deduction in determining accumulated taxable income

insurance covering Mill, his spouse, and dependents. Note

for purposes of the accumulated earnings tax. A capital loss

that Mill may qualify to deduct 100% of the $7,200 for AGI

carry over from a prior year, a dividends received deduction,

as a self-employed health insurance deduction.

and a net operating loss deduction would all be added back

to taxable income in arriving at accumulated taxable income. 127. (b) The requirement is to determine Lazur's tax

basis for the Beck Corp. stock after the distribution. A

122. (d) The minimum accumulated earnings credit is

shareholder's basis for stock of an S corporation is increased

$250,000 for non service corporations; $150,000 for service

by the pass-through of all income items (including tax-

corporations.

exempt income) and is decreased by distributions that are

123. (a) The requirement is to determine Daystar's al- excluded from the shareholder's gross income. Here,

lowable accumulated earnings credit for 2009. The credit is Lazur's beginning basis of $12,000 is increased by his 50%

the greater of (1) the earnings and profits of the tax year share of Beck's ordinary business income ($40,500) and tax-

retained for reasonable business needs of $20,000; or exempt income ($5,000) and is decreased by the $51,000

(2) $150,000 less the accumulated earnings and profits at the cash distribution excluded from his gross income, resulting

end of the preceding year of $45,000. Thus, the credit is in a stock basis of $6,500.

$150,000 - $45,000 = $105,000.

128. (d) The requirement is to determine the amount of

income from Graphite Corp. (an S corporation) that should

be included in Smith's 2009 adjusted gross income. An S

You might also like

- Module 36 Taxes: Corporate: RationDocument2 pagesModule 36 Taxes: Corporate: RationAnonymous JqimV1ENo ratings yet

- 622 Axes: ATE: Module 36 T CorporDocument1 page622 Axes: ATE: Module 36 T CorporEl-Sayed MohammedNo ratings yet

- Taxes: Corporate: F F@. e 'LDocument1 pageTaxes: Corporate: F F@. e 'LZeyad El-sayedNo ratings yet

- Module 36 Taxes: CorporateDocument1 pageModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- MOD L S: Corporat: U E AXE EDocument2 pagesMOD L S: Corporat: U E AXE EAnonymous JqimV1ENo ratings yet

- S I Ssa: Module 33 Taxes: IndividualDocument1 pageS I Ssa: Module 33 Taxes: IndividualZeyad El-sayedNo ratings yet

- Taxes: Corporate: Sec. S OcDocument2 pagesTaxes: Corporate: Sec. S OcAnonymous JqimV1ENo ratings yet

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Document2 pagesTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1ENo ratings yet

- M U Taxes IND Vidual: OD LE: IDocument1 pageM U Taxes IND Vidual: OD LE: IZeyad El-sayedNo ratings yet

- M ULE Taxes: A TNE SHI S: R N L Ul L HDocument3 pagesM ULE Taxes: A TNE SHI S: R N L Ul L HZeyad El-sayedNo ratings yet

- Tionfees Include Thecosts Connected With The Issuing And: Taxes: PartnershipsDocument2 pagesTionfees Include Thecosts Connected With The Issuing And: Taxes: PartnershipsZeyad El-sayedNo ratings yet

- Taxes: Corporate: Sio ZSCDocument2 pagesTaxes: Corporate: Sio ZSCAnonymous JqimV1ENo ratings yet

- Module 36 Taxes: CorporateDocument2 pagesModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- Taxes: Corporate: But D N LDocument2 pagesTaxes: Corporate: But D N LZeyad El-sayedNo ratings yet

- Module 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOODocument1 pageModule 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOOAnonymous JqimV1ENo ratings yet

- Module 36 Taxes: CorporateDocument3 pagesModule 36 Taxes: CorporateEl-Sayed MohammedNo ratings yet

- Module 35 Taxes: PartnershipsDocument3 pagesModule 35 Taxes: PartnershipsAnonymous JqimV1ENo ratings yet

- Principles of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions ManualDocument23 pagesPrinciples of Taxation For Business and Investment Planning 2015 18th Edition Jones Solutions Manualbosomdegerml971yf100% (19)

- Module 36 Taxes: Corporate: 75 Hares 5 H Res X 2 X 2 X 365 Day X 40 Days 54 750 2.000 56 750Document1 pageModule 36 Taxes: Corporate: 75 Hares 5 H Res X 2 X 2 X 365 Day X 40 Days 54 750 2.000 56 750Zeyad El-sayedNo ratings yet

- Chapter 13Document56 pagesChapter 13Dyllan Holmes0% (1)

- CH 12 NotesDocument23 pagesCH 12 NotesBec barronNo ratings yet

- Scan 0022Document2 pagesScan 0022El-Sayed MohammedNo ratings yet

- 80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateDocument2 pages80 de Cei Du T o D P A e ST Li D T BL N: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Scan 0015Document2 pagesScan 0015El-Sayed MohammedNo ratings yet

- Principles of Taxation For Business and Investment Planning 2013 16th Edition Jones Solutions ManualDocument18 pagesPrinciples of Taxation For Business and Investment Planning 2013 16th Edition Jones Solutions Manualfenderpracticpii5h100% (26)

- Principles of Taxation For Business and Investment Planning 2013 16Th Edition Jones Solutions Manual Full Chapter PDFDocument39 pagesPrinciples of Taxation For Business and Investment Planning 2013 16Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (9)

- Module 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZDocument2 pagesModule 36 Taxes: Corporate:: C % Es C, E, E, We, %, C, O, W e e G, Z C C e S V e C C S C ZZeyad El-sayedNo ratings yet

- Chapter 10 PDFDocument22 pagesChapter 10 PDFJay BrockNo ratings yet

- Principles of Taxation For Business and Investment Planning 14th Edition Jones Solutions ManualDocument18 pagesPrinciples of Taxation For Business and Investment Planning 14th Edition Jones Solutions Manualelmerthuy6ns76100% (26)

- Principles of Taxation For Business and Investment Planning 2014 17th Edition Jones Solutions ManualDocument21 pagesPrinciples of Taxation For Business and Investment Planning 2014 17th Edition Jones Solutions Manualfenderpracticpii5h100% (19)

- Principles of Taxation For Business and Investment Planning 2014 17Th Edition Jones Solutions Manual Full Chapter PDFDocument42 pagesPrinciples of Taxation For Business and Investment Planning 2014 17Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (9)

- ACC 430 Chapter 10Document20 pagesACC 430 Chapter 10vikkiNo ratings yet

- Scan 0090Document2 pagesScan 0090Anonymous JqimV1ENo ratings yet

- Scan 0084Document2 pagesScan 0084Anonymous JqimV1ENo ratings yet

- 4561 Lecture 10 Notes Part 3 November 23, 2022Document6 pages4561 Lecture 10 Notes Part 3 November 23, 2022moshe1.bendayanNo ratings yet

- Taxation of Business Entities 2019 Edition 10th Edition Spilker Solutions ManualDocument30 pagesTaxation of Business Entities 2019 Edition 10th Edition Spilker Solutions Manualfuturelydotardly1ivv100% (23)

- Setoff Carry Forward - UnlockedDocument30 pagesSetoff Carry Forward - Unlockedsohamdivekar9867No ratings yet

- Aggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToDocument31 pagesAggregation of Income, Set Off or Carry Forward of Losses: After Studying This Chapter, You Would Be Able ToSivasankariNo ratings yet

- Scan 0010Document3 pagesScan 0010Zeyad El-sayedNo ratings yet

- Scan 0093Document3 pagesScan 0093Zeyad El-sayedNo ratings yet

- Aggregation of IncomeDocument30 pagesAggregation of Incomeraja naiduNo ratings yet

- Chapter 09, Modern Advanced Accounting-Review Q & ExrDocument28 pagesChapter 09, Modern Advanced Accounting-Review Q & Exrrlg481467% (3)

- Tax Planning Relating To Capital Structure Decision: S.G.T Collage BallariDocument9 pagesTax Planning Relating To Capital Structure Decision: S.G.T Collage BallariVijay KumarNo ratings yet

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1ENo ratings yet

- Accounting Canadian Volume II 2nd Edition Warren Solutions ManualDocument26 pagesAccounting Canadian Volume II 2nd Edition Warren Solutions ManualJessicaMitchelleokj100% (51)

- Acct 557Document5 pagesAcct 557kihumbae100% (4)

- Principles of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFDocument21 pagesPrinciples of Taxation For Business and Investment Planning 2016 19Th Edition Jones Solutions Manual Full Chapter PDFrosyseedorff100% (8)

- Taxes: Individual: Di Dend W Es AGI Xempt On Std. D D Tion Ta Ab e Income 70 00 5 400 2 000Document1 pageTaxes: Individual: Di Dend W Es AGI Xempt On Std. D D Tion Ta Ab e Income 70 00 5 400 2 000Zeyad El-sayedNo ratings yet

- Earnings and Profits Is As FollowsDocument3 pagesEarnings and Profits Is As Followscmau08No ratings yet

- S Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateDocument3 pagesS Y, S Ys) - Ss - ' S: Module 36 Taxes: CorporateZeyad El-sayedNo ratings yet

- Iaet Section 29 NIRCDocument1 pageIaet Section 29 NIRCregine rose bantilanNo ratings yet

- Chapter - 7 Income From Other SourcesDocument31 pagesChapter - 7 Income From Other SourcesAnonymous duzV27Mx3No ratings yet

- 05 Fischer10e SM Ch05 FinalDocument195 pages05 Fischer10e SM Ch05 FinalJohan Wahyu AsthoqofiNo ratings yet

- Vi K. Credit For The E E Yandthed Sab Ed: M Ule Taxes: Ind Vi UalDocument3 pagesVi K. Credit For The E E Yandthed Sab Ed: M Ule Taxes: Ind Vi UalZeyad El-sayedNo ratings yet

- 2009 R-3 Class Notes PDFDocument5 pages2009 R-3 Class Notes PDFAgayatak Sa ManenNo ratings yet

- Chapter 6Document13 pagesChapter 6vitbau98100% (1)

- Tax On Cash GiftsDocument31 pagesTax On Cash GiftsA.YOGAGURUNo ratings yet

- Taxes: Gift and Estate: S A Dard DeductioDocument2 pagesTaxes: Gift and Estate: S A Dard DeductioZeyad El-sayedNo ratings yet

- CH 13 NotesDocument19 pagesCH 13 NotesBec barron100% (1)

- Module 36 Taxes: CorporateDocument2 pagesModule 36 Taxes: CorporateAnonymous JqimV1ENo ratings yet

- Scan 0084Document2 pagesScan 0084Anonymous JqimV1ENo ratings yet

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Document2 pagesTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1ENo ratings yet

- Scan 0090Document2 pagesScan 0090Anonymous JqimV1ENo ratings yet

- Taxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Document2 pagesTaxes: Corporate: G in e Ogni Di T Ibution PR P RT Di T Ibuti N Li Bilit TD Re N P B R 1 5Anonymous JqimV1ENo ratings yet

- Taxes: Corporate: Sio ZSCDocument2 pagesTaxes: Corporate: Sio ZSCAnonymous JqimV1ENo ratings yet

- Taxes: Corporate: Sec. S OcDocument2 pagesTaxes: Corporate: Sec. S OcAnonymous JqimV1ENo ratings yet

- Taxes: Corporate: Sec. S OcDocument2 pagesTaxes: Corporate: Sec. S OcAnonymous JqimV1ENo ratings yet

- Module 35 Taxes: PartnershipsDocument3 pagesModule 35 Taxes: PartnershipsAnonymous JqimV1ENo ratings yet

- U I T U: Module 33 Taxes I Divi UALDocument1 pageU I T U: Module 33 Taxes I Divi UALAnonymous JqimV1ENo ratings yet

- Module 36 Taxes Corporat: Multipl - HOI E RSDocument2 pagesModule 36 Taxes Corporat: Multipl - HOI E RSAnonymous JqimV1ENo ratings yet

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1ENo ratings yet

- Module 33 Taxes: I Dividual: I F e R C ADocument2 pagesModule 33 Taxes: I Dividual: I F e R C AAnonymous JqimV1ENo ratings yet

- I.C. Items To Be Included in Gross Income: ( (. y - , V A Ed SDocument1 pageI.C. Items To Be Included in Gross Income: ( (. y - , V A Ed SAnonymous JqimV1ENo ratings yet

- K. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsDocument2 pagesK. Pro Rata Distributions From Partnership: Module 35 Taxes: PartnershipsAnonymous JqimV1ENo ratings yet

- Scan 0054Document2 pagesScan 0054Anonymous JqimV1ENo ratings yet

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1ENo ratings yet

- Taxes: Individual: S S, S A - , CDocument2 pagesTaxes: Individual: S S, S A - , CAnonymous JqimV1ENo ratings yet

- Module 33 Taxes: IndividualDocument2 pagesModule 33 Taxes: IndividualAnonymous JqimV1ENo ratings yet

- M ULE Taxes Individual: Multiple CHO Ce Answers'Document3 pagesM ULE Taxes Individual: Multiple CHO Ce Answers'Anonymous JqimV1ENo ratings yet

- B 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceDocument1 pageB 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceAnonymous JqimV1ENo ratings yet

- Module 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOODocument1 pageModule 33 Taxes: I DI Idual: S Ary $ 0 0 0 o S 1 $6Q OOOAnonymous JqimV1ENo ratings yet

- Scan 0049Document2 pagesScan 0049Anonymous JqimV1ENo ratings yet

- B 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceDocument1 pageB 6. Insurable Intere T E.6 Coinsurance Cla Se: InsuranceAnonymous JqimV1ENo ratings yet

- 7 Bank Marketing Strategies To Increase DepositsDocument10 pages7 Bank Marketing Strategies To Increase DepositsBalwinder SinghNo ratings yet

- Packers Amp Movers ProjectDocument57 pagesPackers Amp Movers Projectabdullah100% (2)

- Comprehensive Exam BDocument14 pagesComprehensive Exam Bjdiaz_646247No ratings yet

- Financial Statement and The Reporting Entity.Document8 pagesFinancial Statement and The Reporting Entity.Mikki Miks AkbarNo ratings yet

- List of IasDocument4 pagesList of IasRakib AhmedNo ratings yet

- Cambridge IGCSE™: Accounting 0452/21 May/June 2020Document18 pagesCambridge IGCSE™: Accounting 0452/21 May/June 2020Israa MostafaNo ratings yet

- Chapter 3 The Machinery of Government MMLSDocument32 pagesChapter 3 The Machinery of Government MMLSpremsuwaatiiNo ratings yet

- Super ProjectDocument2 pagesSuper ProjectQiang ChenNo ratings yet

- Corporate Office: No. 27A, Developed Industrial Estate, Guindy, Chennai - 600032, Tel: (044) 3925 2525, Fax: 044-39252553Document2 pagesCorporate Office: No. 27A, Developed Industrial Estate, Guindy, Chennai - 600032, Tel: (044) 3925 2525, Fax: 044-39252553RaghulNo ratings yet

- Symfonie Angel Ventures AML 20130715Document13 pagesSymfonie Angel Ventures AML 20130715Symfonie CapitalNo ratings yet

- E-Commerce MCQ 2nd Sem by Anu OjhaDocument3 pagesE-Commerce MCQ 2nd Sem by Anu OjhaNikhil PimpareNo ratings yet

- Enterpernurship NotesDocument85 pagesEnterpernurship NotesSaaid ArifNo ratings yet

- General Banking Law of 2000Document25 pagesGeneral Banking Law of 2000John Rey Bantay RodriguezNo ratings yet

- Module 1 - Fundamentals of Auditing and Assurance ServicesDocument29 pagesModule 1 - Fundamentals of Auditing and Assurance ServicesEnya ViscoNo ratings yet

- Lanbank vs. FastechDocument14 pagesLanbank vs. FastechDANICA ECHAGUENo ratings yet

- Employee Benefits: Accounting Standard (AS) 15Document67 pagesEmployee Benefits: Accounting Standard (AS) 15hanumanthaiahgowdaNo ratings yet

- Skans Schools of Accountancy CAF-8: Product Units RsDocument2 pagesSkans Schools of Accountancy CAF-8: Product Units RsmaryNo ratings yet

- ASJ #1 September 2011Document72 pagesASJ #1 September 2011Alex SellNo ratings yet

- CertificatesDocument21 pagesCertificatesJed AbadNo ratings yet

- E-Way Bill - 7Document2 pagesE-Way Bill - 7AshishTrivediNo ratings yet

- Digital Assets GuideDocument22 pagesDigital Assets GuideProject Erch64No ratings yet

- Form Dispute FormDocument1 pageForm Dispute Formramnik20098676No ratings yet

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDocument1 pageImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadMuhammad Sohail0% (1)

- 1601-FQ Final Jan 2018 Rev DPADocument2 pages1601-FQ Final Jan 2018 Rev DPAMarvin AmparadoNo ratings yet

- Pacifico Renewables Yield AG 2021H1 enDocument50 pagesPacifico Renewables Yield AG 2021H1 enLegonNo ratings yet

- English HKSI LE Paper 2 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 2 Pass Paper Question Bank (QB)Tsz Ngong Ko0% (1)

- Module 34 Share-Based Compensation ProblemDocument1 pageModule 34 Share-Based Compensation ProblemThalia UyNo ratings yet

- Genmath LoansDocument22 pagesGenmath LoansninjarkNo ratings yet

- Analisis Kinerja Keuangan PT - Bank Mandiri Syariah, TBK Periode 2016-2020 Menggunakan Metode Du Pont SystemDocument7 pagesAnalisis Kinerja Keuangan PT - Bank Mandiri Syariah, TBK Periode 2016-2020 Menggunakan Metode Du Pont SystemJasika Jurnal Sistem Informasi AkuntansiNo ratings yet

- DragonpayDocument3 pagesDragonpayJamel YusophNo ratings yet