Professional Documents

Culture Documents

Perrt 8 Debt Investment

Uploaded by

Vidya IntaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Perrt 8 Debt Investment

Uploaded by

Vidya IntaniCopyright:

Available Formats

INTERMEDIATE ACCOUNTING 2

CHAPTER 17

INVESTMENTS

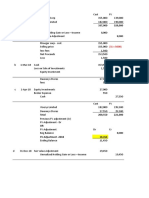

SOAL 1 DEBT INVESTMENTS (FVOCI)

On January 1, 2017, Ellison Company purchased 12% bonds, having a maturity value of

$800,000, for $860,652. The bonds provide the bondholders with a 10% yield. They are dated

January 1, 2017, and mature January 1, 2023, with interest receivable December 31 of each

year. Ellison’s business model is to hold these bonds to collect contractual cash flows and

selling the bonds.

Instructions

a) Prepare a bond amortization schedule through 2019.

b) Prepare the journal entry at the date of the bond purchase.

c) Prepare the journal entry to record the interest received and the amortization for 2017.

d) Prepare any entries necessary at December 31, 2017, assuming the fair value of the

bonds is $860,000.

e) Prepare any entries necessary at December 31, 2018, assuming the fair value of the

bonds is $840,000.

f) Prepare any entries necessary at March 1, 2019, if Ellison sold the Watson bonds for

$850,000.

SOAL 2 DEBT INVESTMENTS (Amortised Cost)

On July 1, 2017, Kirmer Corp. purchased $450,000 of 6% bonds, interest payable on January 1

and July 1, for $428,800 (a 7% effective interest rate). The bonds mature on July 1, 2023.

Amortization is recorded when interest is received by the effective-interest method (round to the

nearest dollar). Kirmer Corp’s business model is to hold these bonds to collect contractual cash

flows.

Instructions

a) Prepare a bond amortization schedule through 2018.

b) Prepare the journal entry at the date of the bond purchase.

c) Prepare the journal entry to record the interest received and the amortization for 2017

d) Prepare the journal entry to record the interest received on January 1, 2018

e) Prepare the journal entry if the bonds are sold on October 1, 2018 for $427,000 plus

accrued interest.

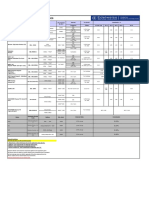

SOAL 3 DEBT INVESTMENTS

Presented below is an amortization schedule related to PT Maju Bersama’s 5-year, $100,000

bond with a 7% interest rate and a 5% yield, purchased on December 31, 2017, for $108,660.

Date Cash received Interest Bond Premium Carrying

Revenue Amortization Amount of

Bonds

12/31/17 $108,660

12/31/18 $7,000 $5,433 $1,567 107,093

12/31/19 7,000 5,354 1,646 105,447

12/31/20 7,000 5,272 1,728 103,719

12/31/21 7,000 5,186 1,814 101,905

12/31/22 7,000 5,095 1,905 100,000

The following schedule presents a comparison of the amortized cost and fair value of the bonds

at year-end:

12/31/18 12/31/19 12/31/20 12/31/21 12/31/22

Amortized $107,093 $105,447 $103,719 $101,905 $100,000

Cost

Fair Value 106,500 107,500 105,650 103,000 100,000

Instructions

Assuming the bonds classified as amortised cost.

a. Prepare the journal entry to record the purchase of these bonds on December 31, 2017

b. Prepare the journal entry(ies) for 2018.

c. Prepare the journal entry(ies) for 2020.

Assuming the bonds classified as FVTPL

a. Prepare the journal entry(ies) to record the purchase of these bonds

b. Prepare the journal entry(ies) for 2018.

c. Prepare the journal entry(ies) for 2020.

You might also like

- PROBLEMSDocument19 pagesPROBLEMSlalalalaNo ratings yet

- Cpa Review School of The Philippines ManilaDocument3 pagesCpa Review School of The Philippines ManilaAljur Salameda100% (1)

- PQ3 BondsDocument2 pagesPQ3 BondsElla Mae MagbatoNo ratings yet

- CH 6 (WWW - Jamaa Bzu - Com)Document8 pagesCH 6 (WWW - Jamaa Bzu - Com)Bayan Sharif100% (2)

- ch3 Not EditedDocument14 pagesch3 Not EditedDM MontefalcoNo ratings yet

- This Study Resource Was: Multiple ChoiceDocument6 pagesThis Study Resource Was: Multiple ChoiceNicah AcojonNo ratings yet

- Module 5 - Assessment ActivitiesDocument4 pagesModule 5 - Assessment Activitiesaj dumpNo ratings yet

- Far Review - Notes and Receivable AssessmentDocument6 pagesFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNo ratings yet

- Mahusay Acc227 Module 4Document4 pagesMahusay Acc227 Module 4Jeth MahusayNo ratings yet

- CH 5 LS Practice HW QUIZDocument25 pagesCH 5 LS Practice HW QUIZDenise Jane RoqueNo ratings yet

- LatihanDocument12 pagesLatihanSurameto HariyadiNo ratings yet

- Investment in Equity SecuritiesDocument3 pagesInvestment in Equity SecuritiesNicole Galnayon100% (1)

- FAR EASTERN UNIVERSITY HANDOUT ON PROVISIONS AND CONTINGENCIESDocument8 pagesFAR EASTERN UNIVERSITY HANDOUT ON PROVISIONS AND CONTINGENCIESCharlyn Jewel OlaesNo ratings yet

- Manufacturing Costing Concepts and Techniques MCQDocument3 pagesManufacturing Costing Concepts and Techniques MCQCarlo ParasNo ratings yet

- MAS.07 Drill Balanced Scorecard and Responsibility AccountingDocument6 pagesMAS.07 Drill Balanced Scorecard and Responsibility Accountingace ender zeroNo ratings yet

- Quiz in AE 09 (Current Liabilities)Document2 pagesQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Chap 8Document13 pagesChap 8MichelleLeeNo ratings yet

- Accounting for Debt InstrumentsDocument4 pagesAccounting for Debt InstrumentsKeahlyn Boticario CapinaNo ratings yet

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFDocument4 pagesFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhNo ratings yet

- Audit of Liabilities: Audit Program For Accounts Payable Audit ObjectivesDocument18 pagesAudit of Liabilities: Audit Program For Accounts Payable Audit ObjectivesSarah PuspawatiNo ratings yet

- AccntngDocument3 pagesAccntngChristine Dela Rosa CarolinoNo ratings yet

- Handouts 04.04 - Part 3Document3 pagesHandouts 04.04 - Part 3John Ray RonaNo ratings yet

- 2.6. Retained EarningsDocument5 pages2.6. Retained EarningsKPoPNyx Edits100% (1)

- CH 15Document46 pagesCH 15Indah SucitraNo ratings yet

- Fin Mkts3practiceDocument3 pagesFin Mkts3practiceMon RamNo ratings yet

- Business Combination1Document5 pagesBusiness Combination1Mae Ciarie YangcoNo ratings yet

- Pamantasan ng Cabuyao Midterm Exam Covers Financial Accounting 3 ProblemsDocument3 pagesPamantasan ng Cabuyao Midterm Exam Covers Financial Accounting 3 Problemsjoevitt delfinadoNo ratings yet

- IntAcc Quiz 1 PDFDocument9 pagesIntAcc Quiz 1 PDFMyles Ninon LazoNo ratings yet

- ACCT203 LeaseDocument4 pagesACCT203 LeaseSweet Emme100% (1)

- Notes Payable Problem SolutionDocument1 pageNotes Payable Problem SolutionMa Teresa B. CerezoNo ratings yet

- International Accounting Problems and SolutionsDocument2 pagesInternational Accounting Problems and SolutionsRafael Capunpon VallejosNo ratings yet

- Chapter 34Document17 pagesChapter 34Mike SerafinoNo ratings yet

- Intercompany Plant Asset TransactionsDocument11 pagesIntercompany Plant Asset TransactionsRo-Anne LozadaNo ratings yet

- Accounting Test Bank - Bank ReconciliationDocument2 pagesAccounting Test Bank - Bank ReconciliationAyesha RGNo ratings yet

- Jawaban Soal No.1Document2 pagesJawaban Soal No.1Enci UnsriyaniNo ratings yet

- CompExam D AcceptedDocument10 pagesCompExam D Acceptedrahul shahNo ratings yet

- On January 1 2012 Perry Company Purchased 80 of SelbyDocument1 pageOn January 1 2012 Perry Company Purchased 80 of SelbyMuhammad ShahidNo ratings yet

- Ia Shareholder's Equity Practice ProblemsDocument5 pagesIa Shareholder's Equity Practice ProblemsMary Jescho Vidal AmpilNo ratings yet

- Chapter 14, Modern Advanced Accounting-Review Q & ExrDocument18 pagesChapter 14, Modern Advanced Accounting-Review Q & Exrrlg4814100% (4)

- Sinking Fund and DerivativesDocument4 pagesSinking Fund and DerivativesCharice Anne VillamarinNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- ICare First Preboard Examination-MSDocument14 pagesICare First Preboard Examination-MSLeo M. SalibioNo ratings yet

- Auditing Problems SolvedDocument9 pagesAuditing Problems SolvedGlizette SamaniegoNo ratings yet

- Unit II CFS Intercompany TransactionsDocument17 pagesUnit II CFS Intercompany TransactionsDaisy TañoteNo ratings yet

- HW 2. Problems Cash and Cash Equivalents - StudentDocument2 pagesHW 2. Problems Cash and Cash Equivalents - StudentAngelo TipaneroNo ratings yet

- Group of 5: Key Accounting Rules for LeasesDocument3 pagesGroup of 5: Key Accounting Rules for LeasesGarp BarrocaNo ratings yet

- Philippine Deposit Insurance Corporation (PDIC) Law SummaryDocument11 pagesPhilippine Deposit Insurance Corporation (PDIC) Law SummaryElmer JuanNo ratings yet

- Ia3 BSDocument5 pagesIa3 BSMary Joy CabilNo ratings yet

- Defined Benefit Plan-Midnight CompanyDocument2 pagesDefined Benefit Plan-Midnight CompanyDyenNo ratings yet

- Answers To Exercises Fs AnalysisDocument8 pagesAnswers To Exercises Fs AnalysisGrace RoqueNo ratings yet

- Module 13 Other Professional ServicesDocument18 pagesModule 13 Other Professional ServicesYeobo DarlingNo ratings yet

- Intermediate Accounting - Petty Cash Journal EntriesDocument2 pagesIntermediate Accounting - Petty Cash Journal EntriesSean Lester S. NombradoNo ratings yet

- Year Sales Actual Warranty ExpendituresDocument5 pagesYear Sales Actual Warranty ExpendituresMinie KimNo ratings yet

- AP-300 (Audit of Liabilities)Document10 pagesAP-300 (Audit of Liabilities)Pearl Mae De VeasNo ratings yet

- Final Examination in Auditing Principles and Application 1Document8 pagesFinal Examination in Auditing Principles and Application 1Anie Martinez0% (1)

- Pq-Cash and Cash EquivalentsDocument3 pagesPq-Cash and Cash EquivalentsJanella PatriziaNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- Pert 8 - Debt InvestmentDocument2 pagesPert 8 - Debt InvestmentJordan SiahaanNo ratings yet

- Tutorial 8 (Exercise)Document2 pagesTutorial 8 (Exercise)Vidya Intani100% (1)

- 5 Hospitality UI PresentationDocument23 pages5 Hospitality UI PresentationVidya IntaniNo ratings yet

- Daftar LombaDocument1 pageDaftar LombaVidya IntaniNo ratings yet

- AVB Porter's 5 Forces PT Air Asia IndonesiaDocument24 pagesAVB Porter's 5 Forces PT Air Asia IndonesiaVidya Intani100% (1)

- EX01. Annual Report Sahid 2018Document173 pagesEX01. Annual Report Sahid 2018Vidya IntaniNo ratings yet

- Tutorial 11 (Exercise)Document2 pagesTutorial 11 (Exercise)Vidya IntaniNo ratings yet

- Internal Auditings Role in Corporate Governance (IIA)Document4 pagesInternal Auditings Role in Corporate Governance (IIA)Vidya IntaniNo ratings yet

- Company Performance Report - NorskDocument1 pageCompany Performance Report - NorskVidya IntaniNo ratings yet

- Audit Committee Effectiveness, What Works Best (PWC)Document162 pagesAudit Committee Effectiveness, What Works Best (PWC)Vidya IntaniNo ratings yet

- Ringkasan CGDocument121 pagesRingkasan CGblackraidenNo ratings yet

- Unilever Future Leaders ProgrammeDocument8 pagesUnilever Future Leaders ProgrammeVidya IntaniNo ratings yet

- Guidance On Board Effectiveness (FRC 2018)Document50 pagesGuidance On Board Effectiveness (FRC 2018)Vidya IntaniNo ratings yet

- Tutorial 12 (Exercise)Document1 pageTutorial 12 (Exercise)Vidya IntaniNo ratings yet

- Guidance On Audit Committees (FRC April 2016)Document20 pagesGuidance On Audit Committees (FRC April 2016)Vidya IntaniNo ratings yet

- Mallin - Corporate-Governance PDFDocument407 pagesMallin - Corporate-Governance PDFSharron Shatil88% (17)

- Kafein Soal 1Document22 pagesKafein Soal 1Vidya IntaniNo ratings yet

- Penn's Internal Control FrameworkDocument18 pagesPenn's Internal Control FrameworkVidya IntaniNo ratings yet

- Tutorial 10 (Exercise)Document1 pageTutorial 10 (Exercise)Vidya IntaniNo ratings yet

- Tutorial 13 & 14 (Answer)Document11 pagesTutorial 13 & 14 (Answer)Vidya IntaniNo ratings yet

- Tutorial 12 (Answer)Document6 pagesTutorial 12 (Answer)Vidya IntaniNo ratings yet

- Pert 9 - Equity InvestmentDocument12 pagesPert 9 - Equity InvestmentVidya IntaniNo ratings yet

- Record operating lease expense for SageDocument4 pagesRecord operating lease expense for SageVidya IntaniNo ratings yet

- Tutorial 13 & 14 (Exercise)Document2 pagesTutorial 13 & 14 (Exercise)Vidya IntaniNo ratings yet

- Tutorial 11 (Answer)Document7 pagesTutorial 11 (Answer)Vidya IntaniNo ratings yet

- Tutorial 8 (Exercise)Document2 pagesTutorial 8 (Exercise)Vidya Intani100% (1)

- Pert 9 - Equity InvestmentDocument2 pagesPert 9 - Equity InvestmentVidya IntaniNo ratings yet

- Record Bond TransactionsDocument8 pagesRecord Bond TransactionsVidya IntaniNo ratings yet

- Week 10 - Leasing (Part 1)Document1 pageWeek 10 - Leasing (Part 1)Vidya IntaniNo ratings yet

- Tutorial 11Document2 pagesTutorial 11Vidya IntaniNo ratings yet

- Solution Meet 11Document7 pagesSolution Meet 11Vidya IntaniNo ratings yet

- 2019 Vol 1 CH 5 AnswersDocument23 pages2019 Vol 1 CH 5 AnswersDummy Number 2No ratings yet

- IR Spectrum Table: Quick Reference for Functional Group IdentificationDocument5 pagesIR Spectrum Table: Quick Reference for Functional Group IdentificationMike Dinh100% (3)

- Bond Pricing Formula ExplainedDocument46 pagesBond Pricing Formula ExplainedSmita100% (1)

- Saturated SolutionDocument21 pagesSaturated SolutionsuyashNo ratings yet

- Stocks Bonds: Bonds and Stocks Are Both Financial Securities With Respective Risks and RewardsDocument2 pagesStocks Bonds: Bonds and Stocks Are Both Financial Securities With Respective Risks and RewardsAndrea TahilNo ratings yet

- 3.6.A. Ruble WorkDocument2 pages3.6.A. Ruble WorkMalith De SilvaNo ratings yet

- Luzon Surety v Quebrar DigestDocument2 pagesLuzon Surety v Quebrar DigestKazper Vic V. BermejoNo ratings yet

- Quiz 2Document2 pagesQuiz 2JNo ratings yet

- Peptidomimetics FINAL PDFDocument21 pagesPeptidomimetics FINAL PDFVissarapu NagalakshmiNo ratings yet

- Fin701 - Module2 9.18Document15 pagesFin701 - Module2 9.18Krista CataldoNo ratings yet

- Take Test: Online Quiz 2: Questi On 1Document3 pagesTake Test: Online Quiz 2: Questi On 1jonNo ratings yet

- BP202TP PDFDocument2 pagesBP202TP PDFVINOD CHOUDHARYNo ratings yet

- Comparing Government Agency and Local Government NotesDocument3 pagesComparing Government Agency and Local Government NotesCLINT SHEEN CABIASNo ratings yet

- Idx Monthly March 2020 PDFDocument128 pagesIdx Monthly March 2020 PDFWiwik SetyaningsihNo ratings yet

- Request For Bonding And/Or Cancellation of Bond of Accountable Officials and Employees of The Republic of The PhilippinesDocument3 pagesRequest For Bonding And/Or Cancellation of Bond of Accountable Officials and Employees of The Republic of The Philippinesjanila garnicaNo ratings yet

- CH 28Document7 pagesCH 28Yusuf Ats-TsiqohNo ratings yet

- Answers For Lecture 1nDocument1 pageAnswers For Lecture 1n低調用戶929No ratings yet

- Case 2 You Are Interested in Purchasing The Common Stock of Azure Corporation The Firm RecentlyDocument3 pagesCase 2 You Are Interested in Purchasing The Common Stock of Azure Corporation The Firm RecentlyDoreen0% (1)

- Chapter 12 Organic Chemistry Some Basic Principles and TechniquesDocument21 pagesChapter 12 Organic Chemistry Some Basic Principles and TechniquesNitish MehraNo ratings yet

- JB CI 13.1 HalogenoalkanesDocument6 pagesJB CI 13.1 HalogenoalkanesOCRChemistrySaltersNo ratings yet

- IPPTChap 003Document35 pagesIPPTChap 003Ghita RochdiNo ratings yet

- Chapter 1 Valence Bond TheoryDocument10 pagesChapter 1 Valence Bond Theoryaremyrah AzlanNo ratings yet

- Discovery and Structure of Aromatic CompoundsDocument108 pagesDiscovery and Structure of Aromatic Compoundsdzenita100% (1)

- Chapter 19. Aldehydes and Ketones: Nucleophilic Addition ReactionsDocument45 pagesChapter 19. Aldehydes and Ketones: Nucleophilic Addition ReactionsPra YogaNo ratings yet

- Audit Fot Liability Problem #11Document2 pagesAudit Fot Liability Problem #11Ma Teresa B. CerezoNo ratings yet

- Alkenes and Alkynes CHM456Document93 pagesAlkenes and Alkynes CHM456nanaNo ratings yet

- FD & Bond Brokerage July 20Document1 pageFD & Bond Brokerage July 20Yash SoniNo ratings yet

- Exam 3 Answer Key ChemDocument5 pagesExam 3 Answer Key Chemalbert jeffersonNo ratings yet

- The Black-Derman-Toy (BDT) TreeDocument4 pagesThe Black-Derman-Toy (BDT) TreeJohn SnowNo ratings yet

- CH 2Document9 pagesCH 2Myk AbayaNo ratings yet