Professional Documents

Culture Documents

EC Letters

Uploaded by

The Wire0 ratings0% found this document useful (0 votes)

15K views9 pagesA copy of the letters sent by the Election Commission to the Centre in early 2017.

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentA copy of the letters sent by the Election Commission to the Centre in early 2017.

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

15K views9 pagesEC Letters

Uploaded by

The WireA copy of the letters sent by the Election Commission to the Centre in early 2017.

Copyright:

© All Rights Reserved

You are on page 1of 9

66

ANNEXURE-C/3

ELECTION COMMISSION

NIRVACHAN SADAN, ASHOKA ROAD, NEW ELM eoo0,

No. 3/ER/LET/ECIFUNC/JUD/SDR/Vol.! 2017

ra Dated:15" march, 2017.

The secretary to the Govt. of India.

Ministry of Law & Justice,

Legislative Department,

Shastri Bhavan,

New Delhi.

Subject: Amendment of provisions related to funding of political

i parties and Candidates regarding.

ir,

__ Lam directed to state that the Commission has reviewed the

various provisions relating to funding of political parties and

candidates. The commission proposes that the following amendments

may be made in the Income Tax Act 1961 and relevant provisions of

Representation of the People Act, 1951.

Proposal for amendments in the |.T. Act, 1964

4). Amendment to Section 13A ‘of the Income Tax Act, 1961

in 2003, Sections 29B and 29C were inserted in the Representa-

tion of the People Act, 1951 making provisions regarding receiving of

donations/ contributions by the political from individuals and companies

(other than Govt., companies). Section 29C provides that for

contribution in excess of Rs. 20,000/- in a year, the treasure!

authorized person of the party shall prepare a report of such

contributions. The contribution report is required to be submitted in

Form 24A appended to the Conduct of Elections Rules, 1961 on an

annual basis to the Commission before the due date for furnishing the

return of its income, and failure to do so would render a party ineligible

for any tax relief under Income Tax notwithstanding any provision

therein.

Ithas been observed that many political parties have been

64

Teporting a major portion of the donations received as being less than

the prescribed limit of Rs. 20,000 for which details regarding name,

address & PAN of the donors are not maintained. In the interest of

transparency of funding of politcal paries, the Commission is

Proposing the following amendments to the existing laws:

()__Amendment to Income Tax Act.

Existing provisions of IT Act

Proposed changes

Section 13A of the Income Tax

Act, 1961 confers tax

exemption to political parties

for Income from house property

income by way of voluntary

contribution income — from

capital gains and income from

other sources. Political parties

registered with the Election

Commission of India are

exempt from paying Income

Tax under section 13A of

Income Tax Act, 1961 as along

as the political parties comply

with the proviso to section

13A, that is, if they file their

Income Tax Return every

Assessment Year along with

their audited accounts, Income/

To only grant Income tax

exemption, us 13A, in

Fespect of —_ voluntary

contrioutions, as under:

').100% exemption in respect

of voluntary contributions

received by political parties

through cheque/e-transfer.

li)in respect of voluntary

contributions in cash, their

tax exemption may be

restricted to an amount of

Rs.20 Crores or 20% of the

total contribution received by

a political party, whichever Is

less; and

ili, No exemption for

anonymous/ cash donations

above _Rs.2000_(Rs._Two

n

68

1951 Section 29C of the RP.

Expenditure detaile and | Thous:

balance sheet. a

(il) Amendment to the Repres:

> 1951, should al

amended to prohibit anonymous donations above Rs, 7000, re

entation of the people Ac

en People Act,

Existing provisions of the

RP. Act, 1954

Proposed changes

No recording’ reporting of

names, addresses, PANs of

donors of sums upto Rs.

20,000/-

1). Anonymous Donations!

Cash Donations Exceeding

Rs. 2000 May Be Prohibited

Accordingly, The Words

“Twenty Thousand Rupees”

In Section 28C may be

substituted by * two thousand

tupees”,

il) a new proviso may be

added under Section 298 to

provide that a party shall not

receive contribution in cash

for amount, exceeding Rs

20 Crores or 20% of the total

contribution, received by the

party, whichever is less, in

the Financial Year.

. Specific date of furnishing of Return of Political Parties

The due date of furnishing the contribution Report by the

Political parties under the existing law is before the due date for

furnishing the Return of Income of that Financial Year u/s 139 of

the IT Act. However, there is no specific due date for submission

of return by political parties as per Sec. 139(1) of the IT Act,

1961. Therefore, it is proposed that “due date" may be

Prescribed in the said Act, as under:

Existing provisions of IT Act

Proposed changes

No specific “due date” for

Political Parties and they file on

30" September —_under

Explanation 2(a)(i) of Sec

39(1) of the IT Act. 1961.

It may be prescribed in Sec.

199(1) of the IT Act, that

Political Parties will be

required to file their returns

within 6 months from the end

of relevant Financial Year.

Correspondence changes

may also be made in sub-

Section 29C of the Representation of the People Act, 1951,

You might also like

- Letter to ECI 17500Document768 pagesLetter to ECI 17500The WireNo ratings yet

- Positive Narrative On Citizenship Amendment Act, 2019Document2 pagesPositive Narrative On Citizenship Amendment Act, 2019Siddharth Varadarajan100% (1)

- SBI (D&TB) Responses Dated 22-03-2024 On 02 Separate RTIsDocument3 pagesSBI (D&TB) Responses Dated 22-03-2024 On 02 Separate RTIsThe Wire100% (2)

- IKS IITKGP Calendar 2024-2Document25 pagesIKS IITKGP Calendar 2024-2abhay desai100% (1)

- Manish Kumar Peace EducationDocument23 pagesManish Kumar Peace EducationThe WireNo ratings yet

- BJP Second List Lok Sabha Polls 2024Document7 pagesBJP Second List Lok Sabha Polls 2024Abhinav BhattNo ratings yet

- E Gazette 11032024Document39 pagesE Gazette 11032024Rishabh Sharma100% (1)

- I&B Ministry's Order On LokshahiDocument6 pagesI&B Ministry's Order On LokshahiThe WireNo ratings yet

- July 25 Reply by Ministry of Rural Development On MGNREGS DeletionsDocument3 pagesJuly 25 Reply by Ministry of Rural Development On MGNREGS DeletionsThe WireNo ratings yet

- Women's Reservation Bill, 2023Document6 pagesWomen's Reservation Bill, 2023The WireNo ratings yet

- NH-2018.03.23-Standards For Lane Width of NHs and Roads Developed Under CSS in Hilly and Mountainous Terrains PDFDocument3 pagesNH-2018.03.23-Standards For Lane Width of NHs and Roads Developed Under CSS in Hilly and Mountainous Terrains PDFMamilla NageshNo ratings yet

- Supreme Court Order On Vernon Gonsalves and Arun FerrieraDocument54 pagesSupreme Court Order On Vernon Gonsalves and Arun FerrieraThe WireNo ratings yet

- VHP's StatementDocument1 pageVHP's StatementThe WireNo ratings yet

- Mahesh Raut Bail OrderDocument23 pagesMahesh Raut Bail OrderThe WireNo ratings yet

- Report of The Fact-Finding Mission On Media's Reportage of The Ethnic Violence in ManipurDocument24 pagesReport of The Fact-Finding Mission On Media's Reportage of The Ethnic Violence in ManipurThe WireNo ratings yet

- Kenapara Site ManualDocument4 pagesKenapara Site ManualThe WireNo ratings yet

- Cases Before Constitution BenchesDocument6 pagesCases Before Constitution BenchesThe WireNo ratings yet

- Clause by Clause Comments of Ministry With Circulation LetterDocument32 pagesClause by Clause Comments of Ministry With Circulation LetterThe Wire100% (1)

- Complaint To Thane Police On The Sakal Hindu SamajDocument10 pagesComplaint To Thane Police On The Sakal Hindu SamajThe WireNo ratings yet

- Support To Sandip K. LuisDocument5 pagesSupport To Sandip K. LuisThe Wire100% (1)

- Letter To SAARC Foreign MinistersDocument20 pagesLetter To SAARC Foreign MinistersThe WireNo ratings yet

- SC Judgment On EC AppointmentsDocument378 pagesSC Judgment On EC AppointmentsThe WireNo ratings yet

- List of SignatoriesDocument15 pagesList of SignatoriesThe WireNo ratings yet

- FIR Lodged by A Police Outpost Sub-Inspector at Heingang Police Station On May 4, 2023Document3 pagesFIR Lodged by A Police Outpost Sub-Inspector at Heingang Police Station On May 4, 2023The WireNo ratings yet

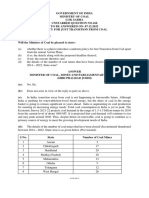

- Ministry of Coal Data On Mine Closure, Tabled in ParliamentDocument1 pageMinistry of Coal Data On Mine Closure, Tabled in ParliamentThe WireNo ratings yet

- Congress BookletDocument31 pagesCongress BookletThe Wire100% (1)

- Bahutva Karnataka EC ComplaintDocument3 pagesBahutva Karnataka EC ComplaintThe WireNo ratings yet

- CRIP DataDocument62 pagesCRIP DataThe WireNo ratings yet

- The Morbi Admin's Notification Asking Migrant Labourers To Be Registered With PoliceDocument3 pagesThe Morbi Admin's Notification Asking Migrant Labourers To Be Registered With PoliceThe Wire100% (1)

- Open Letter To MoRD, NREGA Sangharsh Morcha (English)Document2 pagesOpen Letter To MoRD, NREGA Sangharsh Morcha (English)The WireNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- GoI Act 1919 introduced diarchy and federalismDocument2 pagesGoI Act 1919 introduced diarchy and federalismAziz0346No ratings yet

- English 9: Making Cultural Content Connections ProjectDocument5 pagesEnglish 9: Making Cultural Content Connections ProjectAntonette Padilla100% (1)

- PrefaceDocument54 pagesPrefaceNafees ShaikNo ratings yet

- Ge 4 MMW Week 6 7Document79 pagesGe 4 MMW Week 6 7JOHN DAVE BANTAYANNo ratings yet

- Informative Speech: Smart VotersDocument2 pagesInformative Speech: Smart VotersPrinces Macale BoritoNo ratings yet

- Primaries StudentDocsDocument9 pagesPrimaries StudentDocsKawan BorbaNo ratings yet

- Armenia Country Profile - BBC News PDFDocument4 pagesArmenia Country Profile - BBC News PDFRabbiNo ratings yet

- Real Estate Principles A Value Approach 3rd Edition Ling Test BankDocument35 pagesReal Estate Principles A Value Approach 3rd Edition Ling Test Bankelegiastepauleturc7u100% (21)

- The Most Dangerous Man in The WorldDocument2 pagesThe Most Dangerous Man in The WorldJames Artre100% (2)

- Newsweek International 04 September 2020Document54 pagesNewsweek International 04 September 2020Zoltan KapitanyNo ratings yet

- Lanot vs. ComelecDocument23 pagesLanot vs. ComelecjennydabNo ratings yet

- Curling v. Raffensperger Transcript, Volume 11Document322 pagesCurling v. Raffensperger Transcript, Volume 11The FederalistNo ratings yet

- I Smell A RatDocument2 pagesI Smell A RatPaula MatthewsNo ratings yet

- Supreme Court PetitionDocument54 pagesSupreme Court PetitionWWMTNo ratings yet

- StandardDocument80 pagesStandardJustin LuuNo ratings yet

- FEC Complaint - Tipirneni and Postcards To VotersDocument38 pagesFEC Complaint - Tipirneni and Postcards To VotersAZPublicIntegrityNo ratings yet

- PartySysteminIndia PushpaSinghDocument19 pagesPartySysteminIndia PushpaSinghyyyyyyyyyyNo ratings yet

- Kentucky Primary Ballot Sample 2019Document2 pagesKentucky Primary Ballot Sample 2019Courier Journal100% (1)

- Bias in TurnoutDocument2 pagesBias in TurnoutDardo CurtiNo ratings yet

- Financing Corruption Affects 70% of Philippine PoliticsDocument21 pagesFinancing Corruption Affects 70% of Philippine PoliticsNikki SiaNo ratings yet

- Sir Baba Khail 01Document60 pagesSir Baba Khail 01me Mn khanNo ratings yet

- D&A: 25092019 Patent Assignment 050500/0236 Security AgreementDocument3 pagesD&A: 25092019 Patent Assignment 050500/0236 Security AgreementD&A Investigations, Inc.No ratings yet

- DANC344 Presentation 6Document6 pagesDANC344 Presentation 6Jerric AbreraNo ratings yet

- Exposed ALEC's Influence in Missouri 2015 UpdatedDocument122 pagesExposed ALEC's Influence in Missouri 2015 UpdatedProgress MissouriNo ratings yet

- COMELEC Ruling on Substitution of Disqualified Mayoralty Candidate UpheldDocument1 pageCOMELEC Ruling on Substitution of Disqualified Mayoralty Candidate Upheldglobeth berbanoNo ratings yet

- LABO V COMELECDocument1 pageLABO V COMELECLEVI ACKERMANNNo ratings yet

- Does Bernard Ponsonby KnowDocument44 pagesDoes Bernard Ponsonby KnowRoss 'Teddy' CraigNo ratings yet

- Important Points Class: X Sub: History & Civics Ls. 1 The Union ParliamentDocument4 pagesImportant Points Class: X Sub: History & Civics Ls. 1 The Union ParliamentAvangapuram JyothiNo ratings yet

- IMELDA ROMUALDEZ-MARCOS v. COMELECDocument2 pagesIMELDA ROMUALDEZ-MARCOS v. COMELECMMAC100% (1)

- ThompsonMR - Off The Endangered List Philippine Democratization in Comparative PerspectiveDocument28 pagesThompsonMR - Off The Endangered List Philippine Democratization in Comparative PerspectiveJ. O. M. SalazarNo ratings yet