Professional Documents

Culture Documents

Case 3

Uploaded by

KhalidOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 3

Uploaded by

KhalidCopyright:

Available Formats

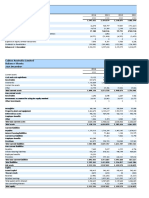

Amount in

Amount in

USD Exchange Rate Foreign

USD

Currency

Year ended December 31, Net change in

Revenue 01/01/15 12/31/15 01/01/15 12/31/15

2015 ($ millions) revenue

Asia, other than China 13,433 0.7543 0.7063 10,132.51 14,346 913

Europe 12,248 0.8266 0.9203 10,124.20 11,001 (1,247)

China 12,556 6.2025 6.4952 77,878.59 11,990 (566)

Middle East 10,846 3.6729 3.6729 39,836.27 10,846 0

Oceania 2,601 3.5046 4.3044 9,115.46 2,118 (483)

Canada 1,870 1.1618 1.3847 2,172.57 1,569 (301)

Africa 1,398 11.5642 15.5159 16,166.75 1,042 (356)

Latin America and Caribbean 1,875 14.7414 17.2494 27,640.13 1,602 (273)

Total non-U.S. revenues 56,827 54,514 (2,313)

United States 39,287 39,287 0

Total revenues 96,114 93,801 (2,313)

1. Convert the revenue @ 01/01/15 to foreign currency (revenue * exchange rate @ 01/01/2015)

2. Convert foreign currency to $US @ 12/31/15 (currency @ 01/01/2015/exchange rate @ 12/31/15)

3. Foreign exchange fluctuations caused a loss of 2,313 (millions) in net income.

4. Fluctuations caused the net income to be decreased by 2,313 (millions)

5. When a company does business in multiple countries, they need to maintain the books in local

currency as well as USD and they need to disclose the exchange rate impact. Based on the GAAP

rules, the company is to prepare its financials based on these principals. As per GAAP regulation G,

public companies are required to disclose non-GAAP financial measure to include a presentation of the

most directly comparable GAAP financial measures and a reconciliation of non-GAAP financial

measures to the most directly comparable GAAP financial measures.

6. One way to treat the foreign exchange rate loss is to frequently hedge their exposures to realized

losses by using financial derivative securities. As an analyst, these losses should be treated as non

operating.

Sources:

https://www.sec.gov/rules/final/33-8176.htm

Easton, P. D., McAnally, M. L., Sommers, G. A., & Zhang, X. “Framework for Analysis and Valuation.”

Financial Statement Analysis & Valuation. 5th edition. Cambridge Business Publishers, 2017.

You might also like

- REA Mock Examination With AnswerDocument36 pagesREA Mock Examination With AnswerKaren Balisacan Segundo Ruiz100% (10)

- A Recommendation For Pre-Paid Legal Services, Inc.: Full ReportDocument26 pagesA Recommendation For Pre-Paid Legal Services, Inc.: Full Reporttheskeptic21No ratings yet

- Supply Chain Finance at Procter & Gamble - 6713-XLS-ENGDocument37 pagesSupply Chain Finance at Procter & Gamble - 6713-XLS-ENGKunal Mehta100% (2)

- Section A - Group DDocument6 pagesSection A - Group DAbhishek Verma100% (1)

- Annual Income Statemen1 Mcdonalds KFCDocument6 pagesAnnual Income Statemen1 Mcdonalds KFCAnwar Ul HaqNo ratings yet

- Financial ReportDocument197 pagesFinancial ReportErnaFitrianaNo ratings yet

- Erro Jaya Rosady - 042024353001Document261 pagesErro Jaya Rosady - 042024353001Erro Jaya RosadyNo ratings yet

- Financial ReportDocument125 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument125 pagesFinancial ReportleeeeNo ratings yet

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Document14 pagesUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufNo ratings yet

- Lesson 2. PolarisDocument19 pagesLesson 2. PolarisMarta DelgadoNo ratings yet

- Niocorp Developments LTD.: (Formerly Quantum Rare Earth Developments Corp.)Document18 pagesNiocorp Developments LTD.: (Formerly Quantum Rare Earth Developments Corp.)niobfNo ratings yet

- Cover Page - Shares Shares in Thousands Entity Information (Line Items)Document101 pagesCover Page - Shares Shares in Thousands Entity Information (Line Items)leeeeNo ratings yet

- Financial ReportDocument101 pagesFinancial ReportleeeeNo ratings yet

- AAPL Financial ReportDocument110 pagesAAPL Financial ReportChuks VincentNo ratings yet

- Financial ReportDocument135 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument135 pagesFinancial ReportleeeeNo ratings yet

- 10 - Sum of Revs, Exp, and FBDocument5 pages10 - Sum of Revs, Exp, and FBFecund StenchNo ratings yet

- Results Continue To Demonstrate Stability of Portfolio and Provide Opportunities For High Quality GrowthDocument35 pagesResults Continue To Demonstrate Stability of Portfolio and Provide Opportunities For High Quality GrowthJavier Montecinos MalebranNo ratings yet

- Att Ar 2012 ManagementDocument35 pagesAtt Ar 2012 ManagementDevandro MahendraNo ratings yet

- 2104040066 Nguyễn Thị Tuyết MaiDocument3 pages2104040066 Nguyễn Thị Tuyết MaiHoàng HuếNo ratings yet

- Trabajo Final DireccionDocument17 pagesTrabajo Final DireccionAnani RomeroNo ratings yet

- Emma Walker s0239551 Ass#3Document23 pagesEmma Walker s0239551 Ass#3Emma WalkerNo ratings yet

- Financial - Report RTNDocument280 pagesFinancial - Report RTNShouib MehreyarNo ratings yet

- 61 10 Shares Dividends AfterDocument10 pages61 10 Shares Dividends Aftermerag76668No ratings yet

- United Bank Limited (UBL) : Balance SheetDocument7 pagesUnited Bank Limited (UBL) : Balance SheetZara ImranNo ratings yet

- Harley-Davidson Motor Co.: Enterprise Software SelectionDocument4 pagesHarley-Davidson Motor Co.: Enterprise Software Selectionjuan guerreroNo ratings yet

- Financial ReportDocument144 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument135 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument135 pagesFinancial ReportleeeeNo ratings yet

- Capital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeDocument13 pagesCapital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeKrunal BhuvaNo ratings yet

- FINM 7044 Group Assignment 终Document4 pagesFINM 7044 Group Assignment 终jimmmmNo ratings yet

- Financial ReportDocument151 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument151 pagesFinancial ReportleeeeNo ratings yet

- EY Cash Flow ForecastingDocument27 pagesEY Cash Flow ForecastingAsbNo ratings yet

- January Meeting InfoDocument7 pagesJanuary Meeting InfoBrendaBrowningNo ratings yet

- HLX 2011arDocument158 pagesHLX 2011arMike MaguireNo ratings yet

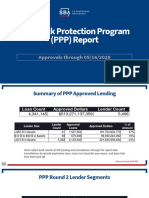

- PPP ReportDocument7 pagesPPP ReportBrittany EtheridgeNo ratings yet

- Financial - Report 2015 LockheedDocument259 pagesFinancial - Report 2015 LockheedShouib MehreyarNo ratings yet

- Case 28 AutozoneDocument39 pagesCase 28 AutozonePatcharanan SattayapongNo ratings yet

- Exchange RateDocument1 pageExchange RateFaisal MahbubNo ratings yet

- Financial ReportDocument190 pagesFinancial ReportThành HoàngNo ratings yet

- Financial ReportDocument137 pagesFinancial ReportleeeeNo ratings yet

- Imt Ceres RJDocument11 pagesImt Ceres RJrjhajharia1997No ratings yet

- Imf Database 2016 061716Document552 pagesImf Database 2016 061716lukeniaNo ratings yet

- Dunkin Brands 2015 CaseDocument24 pagesDunkin Brands 2015 CaseAna rose Arobo100% (2)

- Basic Music TheoryDocument8 pagesBasic Music TheorySam Nyarko-MensahNo ratings yet

- International Flow of Funds (Balance Of: Payments)Document25 pagesInternational Flow of Funds (Balance Of: Payments)Ranu AgrawalNo ratings yet

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiNo ratings yet

- Business PlanDocument2 pagesBusiness PlanJamilexNo ratings yet

- Case 2 - PG Japan The SK-II Globalization Project - SpreadsheetDocument7 pagesCase 2 - PG Japan The SK-II Globalization Project - SpreadsheetCAI DongningNo ratings yet

- Financial ReportDocument143 pagesFinancial ReportleeeeNo ratings yet

- Financial Analysis of National Underground Railroad Freedom Center, IncDocument6 pagesFinancial Analysis of National Underground Railroad Freedom Center, IncCOASTNo ratings yet

- Financial Statements and Financial AnalysisDocument42 pagesFinancial Statements and Financial AnalysisAhmad Ridhuwan AbdullahNo ratings yet

- HYUNDAI Motors Balance SheetDocument4 pagesHYUNDAI Motors Balance Sheetsarmistha guduliNo ratings yet

- FY 2012 Audited Financial StatementsDocument0 pagesFY 2012 Audited Financial StatementsmontalvoartsNo ratings yet

- Exhibit 99.1 Message To ShareholdersDocument8 pagesExhibit 99.1 Message To ShareholdersWilliam HarrisNo ratings yet

- 14-Copy of NURFC Financial AnalysisDocument9 pages14-Copy of NURFC Financial AnalysisCOASTNo ratings yet

- Financial Statement Analysis (Practicum)Document8 pagesFinancial Statement Analysis (Practicum)evlin mrgNo ratings yet

- Financial Analysis Project Segement 1and 2.edited Final 2Document15 pagesFinancial Analysis Project Segement 1and 2.edited Final 2chris waltersNo ratings yet

- Nim - Nama - Group L - Planning 6-9Document12 pagesNim - Nama - Group L - Planning 6-9willyNo ratings yet

- Valuation - ScriptDocument2 pagesValuation - ScriptBhaveek OstwalNo ratings yet

- Pitch Deck MistakesDocument10 pagesPitch Deck MistakesHala Khaled ArarNo ratings yet

- Instant Download Ebook PDF Forensic Accounting and Fraud Examination 2nd Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Forensic Accounting and Fraud Examination 2nd Edition PDF Scribdmichael.cahill319100% (41)

- The Future of Common Stocks Benjamin GrahamDocument8 pagesThe Future of Common Stocks Benjamin GrahambogatishankarNo ratings yet

- SS19 Ethics Reading 71 Version B&W Septembre 2022 PDFDocument35 pagesSS19 Ethics Reading 71 Version B&W Septembre 2022 PDFkallista1999No ratings yet

- Expectation InvestingDocument35 pagesExpectation InvestingThanh Tuấn100% (2)

- Master Thesis in Quantitative FinanceDocument8 pagesMaster Thesis in Quantitative Financeokxyghxff100% (2)

- Constant Growth ModelDocument6 pagesConstant Growth ModelmosesNo ratings yet

- Case Study - PatniDocument19 pagesCase Study - PatniYagneshwar BandlamudiNo ratings yet

- Volatility - Index - 75 - Macfibonacci - Trading StrategyDocument5 pagesVolatility - Index - 75 - Macfibonacci - Trading StrategyRàví nikezim 100No ratings yet

- Economic PaperDocument3 pagesEconomic PaperAbdullah AlhuraniNo ratings yet

- Ey Value of Health Care Data v20 FinalDocument36 pagesEy Value of Health Care Data v20 FinalScott FanNo ratings yet

- CH 14 Long-Term LiabilitiesDocument69 pagesCH 14 Long-Term LiabilitiesSamiHadadNo ratings yet

- Condensed Combined Interim Financial Statements Cpsa and Related Cos September 30 2015Document42 pagesCondensed Combined Interim Financial Statements Cpsa and Related Cos September 30 2015api-307565920No ratings yet

- FinShastra - Internship Edition PDFDocument24 pagesFinShastra - Internship Edition PDFrakeshNo ratings yet

- Mod 4 - Credit Risk Analysis and InterpretationDocument45 pagesMod 4 - Credit Risk Analysis and InterpretationbobdoleNo ratings yet

- Jntu Mba SyllabusDocument77 pagesJntu Mba SyllabusyepurunaiduNo ratings yet

- Toa 2022 Q1 PDFDocument6 pagesToa 2022 Q1 PDFNiña Yna Franchesca PantallaNo ratings yet

- Candle Sheds More Light Than The MACD - InvestopediaDocument5 pagesCandle Sheds More Light Than The MACD - InvestopediadubeypmNo ratings yet

- CBRT 07 DyArch 20 10 2019 ANDocument17 pagesCBRT 07 DyArch 20 10 2019 ANSadaf HussainNo ratings yet

- Property ValuationDocument13 pagesProperty ValuationAmulie JarjuseyNo ratings yet

- Reliance Capital: Reliance Home Finance: A Deep Dive Into Business ModelDocument15 pagesReliance Capital: Reliance Home Finance: A Deep Dive Into Business Modelsharkl123No ratings yet

- Bonds Payable SlidesDocument53 pagesBonds Payable Slidesayesha125865No ratings yet

- ERA On LupinDocument14 pagesERA On LupinRohan AgrawalNo ratings yet

- European Indices: Technically SpeakingDocument22 pagesEuropean Indices: Technically SpeakingmanuNo ratings yet

- Research Paper - PriyaDocument9 pagesResearch Paper - PriyaUrvee SanganiNo ratings yet

- Complete ITF NOTESDocument14 pagesComplete ITF NOTESNouman BaigNo ratings yet

- PitchBook For Corporate Development - EbookDocument20 pagesPitchBook For Corporate Development - EbookHun Yao ChongNo ratings yet