Professional Documents

Culture Documents

Credit Ho 5 PDF

Uploaded by

limra chnOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Credit Ho 5 PDF

Uploaded by

limra chnCopyright:

Available Formats

STAYING ON GOOD TERMS: CREDIT AND DEBT

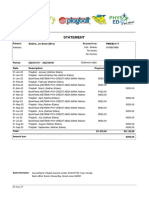

Sample Credit Card Statement

http://www.federalreserve.gov/creditcard/ Credit_HO#5 June 2010

http://www.federalreserve.gov/creditcard/ Credit_HO#5 June 2010

The following describes the important aspects

of your credit card statement.

1) Summary of account activity

A summary of the transactions on your account--your payments, credits, purchases, balance transfers,

cash advances, fees, interest charges, and amounts past due. It will also show your new balance,

available credit (your credit limit minus the amount you owe), and the last day of the billing period

(payments or charges after this day will show up on your next bill).

2) Payment information

Your total new balance, the minimum payment amount (the least amount you should pay), and the date

your payment is due. A payment generally is considered on time if received by 5 p.m. on the day it is

due. If mailed payments are not accepted on a due date (for example, if the due date is on a weekend or

holiday), the payment is considered on time if it arrives by 5 p.m. on the next business day.

Example: If your bill is due on July 4th and the credit card company does not receive mail that

day, your payment will be on time if it arrives by mail by 5 p.m. on July 5th.

3) Late payment warning

This section states any additional fees and the higher interest rate that may be charged if your payment

is late.

4) Minimum payment warning

An estimate of how long it can take to pay off your credit card balance if you make only the minimum

payment each month, and an estimate of how much you likely will pay, including interest, in order to

pay off your bill in three years (assuming you have no additional charges). For other estimates of

payments and timeframes, see the Credit Card Repayment Calculator.

5) Notice of changes to your interest rates

If you trigger the penalty rate (for example, by going over your credit limit or paying your bill late), your

credit card company may notify you that your rates will be increasing. The credit card company must tell

you at least 45 days before your rates change.

6) Other changes to your account terms

If your credit card company is going to raise interest rates or fees or make other significant changes to

your account, it must notify you at least 45 days before the changes take effect.

7) Transactions

A list of all the transactions that have occurred since your last statement (purchases, payments, credits,

cash advances, and balance transfers). Some credit card companies group them by type of transactions.

Others list them by date of transaction or by user, if there are different users on the account. Review the

list carefully to make sure that you recognize all of the transactions. This is the section of your statement

where you can check for unauthorized transactions or other problems.

8) Fees and interest charges

Credit card companies must list the fees and interest charges separately on your monthly bill. Interest

charges must be listed by type of transaction (for example, you may be charged a different interest rate

for purchases than for cash advances).

http://www.federalreserve.gov/creditcard/ Credit_HO#5 June 2010 p. 3

9) Year-to-date totals

The total that you have paid in fees and interest charges for the current year. You can avoid some fees,

such as over-the-limit fees, by managing how much you charge, and by paying on time to avoid late

payment fees.

10) Interest charge calculation

A summary of the interest rates on the different types of transactions, account balances, the amount of

each, and the interest charged for each type of transaction.

http://www.federalreserve.gov/creditcard/ Credit_HO#5 June 2010 p. 4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- India Fintech Report 2021: Economic Impact of COVID-19 and Future Growth DriversDocument29 pagesIndia Fintech Report 2021: Economic Impact of COVID-19 and Future Growth Driversdevang bohraNo ratings yet

- Factors Influencing Credit PolicyDocument5 pagesFactors Influencing Credit PolicyMrDj Khan75% (4)

- 4-CONSUMER CREDIT (PART 1) (Introduction To Consumer Credit)Document31 pages4-CONSUMER CREDIT (PART 1) (Introduction To Consumer Credit)Nur DinieNo ratings yet

- Msi Owner Occupancy AffidavitDocument1 pageMsi Owner Occupancy AffidavitbatinatorNo ratings yet

- Finance Notes # 2Document12 pagesFinance Notes # 2Bai NiloNo ratings yet

- Ratio Analysis of Co-Operative Bank of Surat: Manisha D. PatelDocument11 pagesRatio Analysis of Co-Operative Bank of Surat: Manisha D. Patels.muthuNo ratings yet

- New Rekening Koran Online 216801010479506 2023-03-01 2023-03-31 00313019Document11 pagesNew Rekening Koran Online 216801010479506 2023-03-01 2023-03-31 00313019dodimaryono22No ratings yet

- Private Bank Credit Risk Management Policy With Bangladesh BankDocument60 pagesPrivate Bank Credit Risk Management Policy With Bangladesh Bankgalib8323No ratings yet

- Discuss The Role of Banking System in Economic Growth and Development of IndiaDocument5 pagesDiscuss The Role of Banking System in Economic Growth and Development of IndiaNaruChoudharyNo ratings yet

- Farmers Suicides in India: Dr. Vandana Shiva Kunwar JaleesDocument54 pagesFarmers Suicides in India: Dr. Vandana Shiva Kunwar JaleesTanya RawalNo ratings yet

- Raphael LTD Is A Small Engineering Business Which Has AnnualDocument2 pagesRaphael LTD Is A Small Engineering Business Which Has AnnualAmit PandeyNo ratings yet

- BANGKO SENTRAL NG PILIPINAS Vs LIBO-ON 173864Document8 pagesBANGKO SENTRAL NG PILIPINAS Vs LIBO-ON 173864Kimberly Sheen Quisado TabadaNo ratings yet

- 11 Chapter 3Document10 pages11 Chapter 3Anbarasan SivarajanNo ratings yet

- Lesson No 4 Banking: 1. Which of The Following Banking Services Does The Customer Normally Have To Pay For?Document4 pagesLesson No 4 Banking: 1. Which of The Following Banking Services Does The Customer Normally Have To Pay For?Gamers CannabitNo ratings yet

- BSP MORFXT Appendix 1.3 (Cir1030 - 2019)Document4 pagesBSP MORFXT Appendix 1.3 (Cir1030 - 2019)Bianca VillaramaNo ratings yet

- Economics of Money and BankingDocument12 pagesEconomics of Money and BankingGhazal HussainNo ratings yet

- Module 1 - Philippine Deposit Insurance CorporationDocument10 pagesModule 1 - Philippine Deposit Insurance CorporationRoylyn Joy CarlosNo ratings yet

- CMU20123: How Fintech is Developing and Impacting Banks in Developing CountriesDocument16 pagesCMU20123: How Fintech is Developing and Impacting Banks in Developing CountriesHương GiangNo ratings yet

- FM Eco Marathon Notes by CA Namit Arora SirDocument257 pagesFM Eco Marathon Notes by CA Namit Arora SirahmedNo ratings yet

- What We Have Learned From The Mortgage Crisis About Transferring Mortgage LoansDocument69 pagesWhat We Have Learned From The Mortgage Crisis About Transferring Mortgage LoansAnonymous v3dT7UFNo ratings yet

- Women's Economic Empowerment Through Financial Inclusion: A Review of Existing Evidence and Remaining Knowledge GapsDocument12 pagesWomen's Economic Empowerment Through Financial Inclusion: A Review of Existing Evidence and Remaining Knowledge GapsRabaa DooriiNo ratings yet

- Tanzania Agri Research ReportDocument42 pagesTanzania Agri Research ReportSrinivas Rao100% (1)

- Strategic Finance Assignment ChallengesDocument18 pagesStrategic Finance Assignment ChallengesArchana SarmaNo ratings yet

- Ratio Problems 2Document7 pagesRatio Problems 2Vivek Mathi100% (1)

- Aishwarya Precision Works GECLSDocument7 pagesAishwarya Precision Works GECLSchandan bhatiNo ratings yet

- How the Big Short exposed flaws in the US mortgage marketDocument2 pagesHow the Big Short exposed flaws in the US mortgage marketPedro HacheNo ratings yet

- Chelsea Nicole Bitera - Module 11Document6 pagesChelsea Nicole Bitera - Module 11Chelsea NicoleNo ratings yet

- Current Liabilities Management Quiz: Accounts Payable, Cash Discounts & Short-Term FinancingDocument24 pagesCurrent Liabilities Management Quiz: Accounts Payable, Cash Discounts & Short-Term FinancingRodNo ratings yet

- MGT 201 All Solved Quiz 2 in One FileDocument77 pagesMGT 201 All Solved Quiz 2 in One FilenargisNo ratings yet

- Billings & HalsteadDocument1 pageBillings & HalsteadJo anne Jo anneNo ratings yet