Professional Documents

Culture Documents

Unilever Annual Report and Accounts 2016 Tcm244 498880 en

Uploaded by

Muntasir Alam EmsonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unilever Annual Report and Accounts 2016 Tcm244 498880 en

Uploaded by

Muntasir Alam EmsonCopyright:

Available Formats

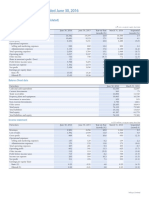

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

UNILEVER GROUP CONTINUED

2. SEGMENT INFORMATION CONTINUED

ADDITIONAL INFORMATION BY GEOGRAPHIES

Although the Group’s operations are managed by product area, we provide additional information based on geographies. The analysis of turnover

by geographical area is stated on the basis of origin.

€ million € million € million € million

Asia/ The

AMET/RUB(d) Americas Europe Total

2016

Turnover 22,445 17,105 13,163 52,713

Operating profit 3,275 2,504 2,022 7,801

Non-core items 19 222 4 245

Core operating profit 3,294 2,726 2,026 8,046

Share of net profit/(loss) of joint ventures and associates (2) 108 21 127

2015

Turnover 22,425 17,294 13,553 53,272

Operating profit 3,019 2,273 2,223 7,515

Non-core items 16 244 90 350

Core operating profit 3,035 2,517 2,313 7,865

Share of net profit/(loss) of joint ventures and associates (1) 96 12 107

2014

Turnover 19,703 15,514 13,219 48,436

Operating profit 2,626 3,233 2,121 7,980

Non-core items (15) (959) 14 (960)

Core operating profit 2,611 2,274 2,135 7,020

Share of net profit/(loss) of joint ventures and associates - 68 30 98

(d) Refers to Asia, Africa, Middle East, Turkey, Russia, Ukraine and Belarus.

Transactions between the Unilever Group’s geographical regions are immaterial and are carried out on an arm’s length basis.

3. GROSS PROFIT AND OPERATING COSTS

RESEARCH AND MARKET SUPPORT COSTS

Expenditure on research and market support, such as advertising, is charged to the income statement as incurred.

NON-CORE ITEMS

Disclosed on the face of the income statement are costs and revenues relating to business disposals, acquisition and disposal-related costs,

impairments and other one-off items, which we collectively term non-core items due to their nature and/or frequency of occurrence. These

items are material in terms of nature and/or amount and are relevant to an understanding of our financial performance.

Business disposals generate both gains and losses which are not reflective of underlying performance. Acquisition and disposal-related costs are

charges directly attributable to the acquisition or disposal of group companies.

€ million € million € million

2016 2015 2014

Turnover 52,713 53,272 48,436

Cost of sales (30,229) (30,808) (28,387)

of which: Distribution costs (3,246) (3,358) (3,079)

Gross profit 22,484 22,464 20,049

Selling and administrative expenses (14,683) (14,949) (12,069)

of which: Brand and Marketing Investment (7,731) (8,003) (7,166)

Research and Development (978) (1,005) (955)

Operating profit 7,801 7,515 7,980

92 Financial Statements Unilever Annual Report and Accounts 2016

You might also like

- Consolidated Financial Statements As of December 31 2020Document86 pagesConsolidated Financial Statements As of December 31 2020Raka AryawanNo ratings yet

- CR AssignmentDocument16 pagesCR AssignmentWaleed KhalidNo ratings yet

- Q1 2023 Puma Energy Results ReportDocument11 pagesQ1 2023 Puma Energy Results ReportKA-11 Єфіменко ІванNo ratings yet

- Deleum Q2 2019Document43 pagesDeleum Q2 2019DiLungBanNo ratings yet

- KPIs Bharti Airtel 04022020Document13 pagesKPIs Bharti Airtel 04022020laksikaNo ratings yet

- FIN 422-Midterm AssDocument43 pagesFIN 422-Midterm AssTakibul HasanNo ratings yet

- (A) Nature of Business of Cepatwawasan Group BerhadDocument16 pages(A) Nature of Business of Cepatwawasan Group BerhadTan Rou YingNo ratings yet

- Statement of OperationsDocument1 pageStatement of Operations227230No ratings yet

- Report For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)Document7 pagesReport For The Quarter Ended June 30, 2016: Select Financial Data - IFRS (Consolidated)ashokdb2kNo ratings yet

- Net Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsDocument1 pageNet Revenue $ 15,301 $ 16,883 $ 14,950 Operating Expenses: Consolidated Statement of OperationsMaanvee JaiswalNo ratings yet

- Dilip BuildconDocument59 pagesDilip BuildconNishant SharmaNo ratings yet

- Orascom - Interim Financial Report Q1 2020 FinalDocument28 pagesOrascom - Interim Financial Report Q1 2020 FinalTawfeeg AwadNo ratings yet

- Beg A Cheese 2016Document4 pagesBeg A Cheese 2016杨子偏No ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Financials 9Document4 pagesFinancials 9Sagar ChaurasiaNo ratings yet

- Bangladesh q3 Report 2020 Tcm244 556009 enDocument8 pagesBangladesh q3 Report 2020 Tcm244 556009 entdebnath_3No ratings yet

- Microsoft Corporation Financial Statements and Supplementary DataDocument43 pagesMicrosoft Corporation Financial Statements and Supplementary DataDylan MakroNo ratings yet

- Airbus SN Q3-2020Document21 pagesAirbus SN Q3-2020paulouisvergnesNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- FY2023 SGX Format-FINALDocument35 pagesFY2023 SGX Format-FINALjonathan.zy95No ratings yet

- Financial Analysis DataSheet KECDocument22 pagesFinancial Analysis DataSheet KECSuraj DasNo ratings yet

- Quarterly Analysis: Analysis of Variation in Interim Results and Final AccountsDocument1 pageQuarterly Analysis: Analysis of Variation in Interim Results and Final Accounts.No ratings yet

- National Stock Exchange of India LimitedDocument2 pagesNational Stock Exchange of India LimitedAnonymous DfSizzc4lNo ratings yet

- PSO StatementDocument1 pagePSO StatementNaseeb Ullah TareenNo ratings yet

- Financial Report Q1 2021Document21 pagesFinancial Report Q1 2021FiestaNo ratings yet

- Bata Shoe Company (Bangladesh) LimitedDocument1 pageBata Shoe Company (Bangladesh) LimitedMutasin FouadNo ratings yet

- Airasia Quarter ReportDocument34 pagesAirasia Quarter ReportChee Meng TeowNo ratings yet

- KPI Q1 FY24 June2023Document12 pagesKPI Q1 FY24 June2023tapas.patel1No ratings yet

- Financial Statements Notes On The Financial StatementsDocument95 pagesFinancial Statements Notes On The Financial StatementsEvariste GaloisNo ratings yet

- Case StudyDocument14 pagesCase StudyViren DeshpandeNo ratings yet

- Amazon Vs WallmartDocument13 pagesAmazon Vs WallmartHammad AhmedNo ratings yet

- FY Financial Report 2022Document107 pagesFY Financial Report 2022satkiratd24No ratings yet

- Financial Statement ACIFL 31 March 2015 ConsolidatedDocument16 pagesFinancial Statement ACIFL 31 March 2015 ConsolidatedNurhan JaigirdarNo ratings yet

- National Central Cooling Company PJSCDocument24 pagesNational Central Cooling Company PJSCMohamed NaieemNo ratings yet

- Consolidated Statement of Profit and LossDocument1 pageConsolidated Statement of Profit and LossSukhmanNo ratings yet

- Generali YE20 Supplementary Financial InformationDocument31 pagesGenerali YE20 Supplementary Financial InformationMislav GudeljNo ratings yet

- Adventa Sofp & Sopl 2021Document3 pagesAdventa Sofp & Sopl 2021ariash mohdNo ratings yet

- Sofp, Sopl Adventa&uem 20-21Document14 pagesSofp, Sopl Adventa&uem 20-21ariash mohdNo ratings yet

- UBL Annual Report 2018-76Document1 pageUBL Annual Report 2018-76IFRS LabNo ratings yet

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Document15 pagesATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoNo ratings yet

- Plaquette Annuelle 31 Decembre 2022 EN VdefsDocument80 pagesPlaquette Annuelle 31 Decembre 2022 EN VdefsAbdcNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- 7B20N001Document21 pages7B20N001pbNo ratings yet

- 2011 MAS Annual 2Document9 pages2011 MAS Annual 2Thaw ZinNo ratings yet

- LVMH 2020 Consolidated Financial StatementDocument99 pagesLVMH 2020 Consolidated Financial StatementGEETIKA PATRANo ratings yet

- Financial Overview and Regulation G Disclosure Q2 2014Document10 pagesFinancial Overview and Regulation G Disclosure Q2 2014Christopher TownsendNo ratings yet

- Eum Edgenta Sofp& Sopl 2021Document4 pagesEum Edgenta Sofp& Sopl 2021ariash mohdNo ratings yet

- Financial Statement 7EDocument9 pagesFinancial Statement 7ENurin SyazarinNo ratings yet

- Apple Financial StatementsDocument3 pagesApple Financial StatementsNadine Felicia MugliaNo ratings yet

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaNo ratings yet

- (In Thousands, Except Per Share Amounts) : Snap Inc. Consolidated Statements of OperationsDocument2 pages(In Thousands, Except Per Share Amounts) : Snap Inc. Consolidated Statements of OperationsPhan DuyetNo ratings yet

- Group Income StatementDocument1 pageGroup Income StatementAJNAZ PACIFICNo ratings yet

- Consolidated Income Statement For The Year Ended December 31, 2018Document1 pageConsolidated Income Statement For The Year Ended December 31, 2018Cresilda DelgadoNo ratings yet

- Annual Report 2018 PDFDocument288 pagesAnnual Report 2018 PDFАндрей СилаевNo ratings yet

- Quarterly - Report - 2q2021-Segment ReportDocument2 pagesQuarterly - Report - 2q2021-Segment ReporthannacuteNo ratings yet

- 8167-W 2017 PPB IsDocument3 pages8167-W 2017 PPB IsVijay KumarNo ratings yet

- The WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Document4 pagesThe WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Mohammad Abram MaulanaNo ratings yet

- Consolidated Financial Statements For Past Five Quarters - Bharti Airtel Limited (As Per International Financial Reporting Standards (Ifrs) )Document13 pagesConsolidated Financial Statements For Past Five Quarters - Bharti Airtel Limited (As Per International Financial Reporting Standards (Ifrs) )Amit Kumar SinghNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Net ConsDocument6 pagesNet ConsTitas KhanNo ratings yet

- LM - Beton Er Sleep Tazin Mam Er Jonno - 08 Oct 2020 PDFDocument1 pageLM - Beton Er Sleep Tazin Mam Er Jonno - 08 Oct 2020 PDFMuntasir Alam EmsonNo ratings yet

- Product Life Cycles - Issues in Manufacturing Strategy..Document3 pagesProduct Life Cycles - Issues in Manufacturing Strategy..Muntasir Alam EmsonNo ratings yet

- Profile 2020 - TM Assets LTD - R PDFDocument72 pagesProfile 2020 - TM Assets LTD - R PDFMuntasir Alam EmsonNo ratings yet

- Product Life Cycles - Issues in Manufacturing Strategy..Document3 pagesProduct Life Cycles - Issues in Manufacturing Strategy..Muntasir Alam EmsonNo ratings yet

- Schedule January PDFDocument1 pageSchedule January PDFMuntasir Alam EmsonNo ratings yet

- Internship Report On Kazi Farms KitchenDocument30 pagesInternship Report On Kazi Farms KitchenMuntasir Alam Emson100% (1)

- Learningcurve 121123105005 Phpapp02Document20 pagesLearningcurve 121123105005 Phpapp02Muntasir Alam EmsonNo ratings yet

- Operations Management - Ebook - MZM PDFDocument341 pagesOperations Management - Ebook - MZM PDFMuntasir Alam Emson100% (2)

- Globaldieselginsetmarket 180130053303Document24 pagesGlobaldieselginsetmarket 180130053303Muntasir Alam EmsonNo ratings yet

- Internship Report On Business Procedures of Corporate Sales in IGLOO Ice-CreamDocument51 pagesInternship Report On Business Procedures of Corporate Sales in IGLOO Ice-CreamshaziaNo ratings yet

- Cummins CCEC Marine Engine K19Document2 pagesCummins CCEC Marine Engine K19Muntasir Alam Emson100% (1)

- Operations Management - Ebook - MZM PDFDocument341 pagesOperations Management - Ebook - MZM PDFMuntasir Alam Emson100% (2)

- Analysis of The Sri Lanka Diesel Genset Market: Rising Opportunities From Hospitality and Infrastructure SectorsDocument12 pagesAnalysis of The Sri Lanka Diesel Genset Market: Rising Opportunities From Hospitality and Infrastructure SectorsMuntasir Alam EmsonNo ratings yet

- TJ1400PE5ADocument1 pageTJ1400PE5AMuntasir Alam EmsonNo ratings yet

- Internship Report On Kazi Farms KitchenDocument30 pagesInternship Report On Kazi Farms KitchenMuntasir Alam Emson100% (1)

- GHAIL Annual Report 2016Document1 pageGHAIL Annual Report 2016Muntasir Alam EmsonNo ratings yet

- TJ1005PE5SDocument1 pageTJ1005PE5SMuntasir Alam EmsonNo ratings yet

- Doosan Daewoo Engine P180LE CDocument2 pagesDoosan Daewoo Engine P180LE CMuntasir Alam Emson100% (2)

- LECTURE 11 August 2013Document51 pagesLECTURE 11 August 2013Muntasir Alam EmsonNo ratings yet

- Alternator DescriptionDocument4 pagesAlternator DescriptionMuntasir Alam EmsonNo ratings yet

- Kta19-M Ccec SSDocument2 pagesKta19-M Ccec SSMuntasir Alam Emson100% (1)

- TJ1005PE5SDocument1 pageTJ1005PE5SMuntasir Alam EmsonNo ratings yet

- GCC Presentation LatestDocument33 pagesGCC Presentation LatestMuntasir Alam Emson0% (1)

- LV Eaton Common Single Line DiagramDocument1 pageLV Eaton Common Single Line DiagramMuntasir Alam EmsonNo ratings yet

- 204-009 Acronyms and Abbreviations: General InformationDocument3 pages204-009 Acronyms and Abbreviations: General InformationMuntasir Alam EmsonNo ratings yet

- 204-009 Acronyms and Abbreviations: General InformationDocument3 pages204-009 Acronyms and Abbreviations: General InformationMuntasir Alam EmsonNo ratings yet

- D23 MX 1 - DSDocument2 pagesD23 MX 1 - DSMuntasir Alam EmsonNo ratings yet

- Flying StartDocument5 pagesFlying StartMuntasir Alam EmsonNo ratings yet

- Kroger Vendor General Parcel Air LTL TL Routing InstructionsDocument4 pagesKroger Vendor General Parcel Air LTL TL Routing InstructionsReetika ChoudharyNo ratings yet

- POM Assignment On Pepsi...Document15 pagesPOM Assignment On Pepsi...Muhammad Shahzad67% (3)

- Marriott Hotels, Resorts, and SuitesDocument5 pagesMarriott Hotels, Resorts, and Suitesjuttgee0% (1)

- Dialnet LaMedicionDeLaProductividadDelValorAgregado 4808514 PDFDocument9 pagesDialnet LaMedicionDeLaProductividadDelValorAgregado 4808514 PDFVásquezRamosCarmenJannethNo ratings yet

- 969c4824-5909-4c92-b584-7db17876a664Document6 pages969c4824-5909-4c92-b584-7db17876a664Swamy Dhas DhasNo ratings yet

- Sheets Giggles Resume Template 01af0a6f 45d0 4e38 8a97 b98357247fb2Document2 pagesSheets Giggles Resume Template 01af0a6f 45d0 4e38 8a97 b98357247fb2fomiro3054No ratings yet

- Country Evaluation and SelectionDocument10 pagesCountry Evaluation and Selectionvishesh_2211_1257207100% (1)

- Econ 110: Principles of Microeconomics: Problem SetDocument8 pagesEcon 110: Principles of Microeconomics: Problem SetJoe OstingNo ratings yet

- Usage of MSPO LogoDocument5 pagesUsage of MSPO LogoShazaley AbdullahNo ratings yet

- Social Advertising Strategic Outlook 2012-2020 Russia, 2012Document4 pagesSocial Advertising Strategic Outlook 2012-2020 Russia, 2012HnyB InsightsNo ratings yet

- RanbaxyDocument24 pagesRanbaxydnyanni100% (1)

- Building Your Personal BrandDocument37 pagesBuilding Your Personal BrandVicente EspinozaNo ratings yet

- Using GT To Model Competition - Sridhar MoorthyDocument22 pagesUsing GT To Model Competition - Sridhar MoorthyJaime PereyraNo ratings yet

- Case 11F Einschmecker SauceDocument2 pagesCase 11F Einschmecker SauceDexter LiboonNo ratings yet

- TCCDocument48 pagesTCCMahin ShaNo ratings yet

- SMEDA Fast Food RestaurantDocument30 pagesSMEDA Fast Food Restaurantengagedsword100% (9)

- Natura CaseDocument3 pagesNatura CaseVietNo ratings yet

- Equity of Care Supplier DiversityDocument19 pagesEquity of Care Supplier DiversityiggybauNo ratings yet

- Comm - Socail Media Final PaperDocument4 pagesComm - Socail Media Final PaperDaniel CollinsNo ratings yet

- Psychological Factors That Affects Online CustomersDocument4 pagesPsychological Factors That Affects Online CustomerskelvinjhleeNo ratings yet

- Green Marketing Definition: Green Marketing Refers To The Process of Selling Products And/or Services BasedDocument4 pagesGreen Marketing Definition: Green Marketing Refers To The Process of Selling Products And/or Services BasedInigoraniNo ratings yet

- Borjan Retail Management PlanDocument18 pagesBorjan Retail Management PlandilawaysNo ratings yet

- Operations Management of Logistics and Supply Chain: Issues and DirectionsDocument16 pagesOperations Management of Logistics and Supply Chain: Issues and DirectionsAnurag Gupta100% (1)

- 2 Strategic Role of Operations ManagementDocument13 pages2 Strategic Role of Operations Managementseling97No ratings yet

- Importacia Del Branding Sesion 5 - Lectura en InglésDocument5 pagesImportacia Del Branding Sesion 5 - Lectura en InglésCARLOS ANTONIO ANGULO CORCUERANo ratings yet

- Supply Chain Assignment 4Document3 pagesSupply Chain Assignment 4TAYYABA AMJAD L1F16MBAM0221No ratings yet

- Trend Lines and PatternsDocument6 pagesTrend Lines and PatternsUpasara WulungNo ratings yet

- Marketing MixDocument6 pagesMarketing MixelianaNo ratings yet

- Robi Intern ReportDocument98 pagesRobi Intern ReportTanvir HashemNo ratings yet

- Selling GreenDocument5 pagesSelling GreenlibertadmasNo ratings yet